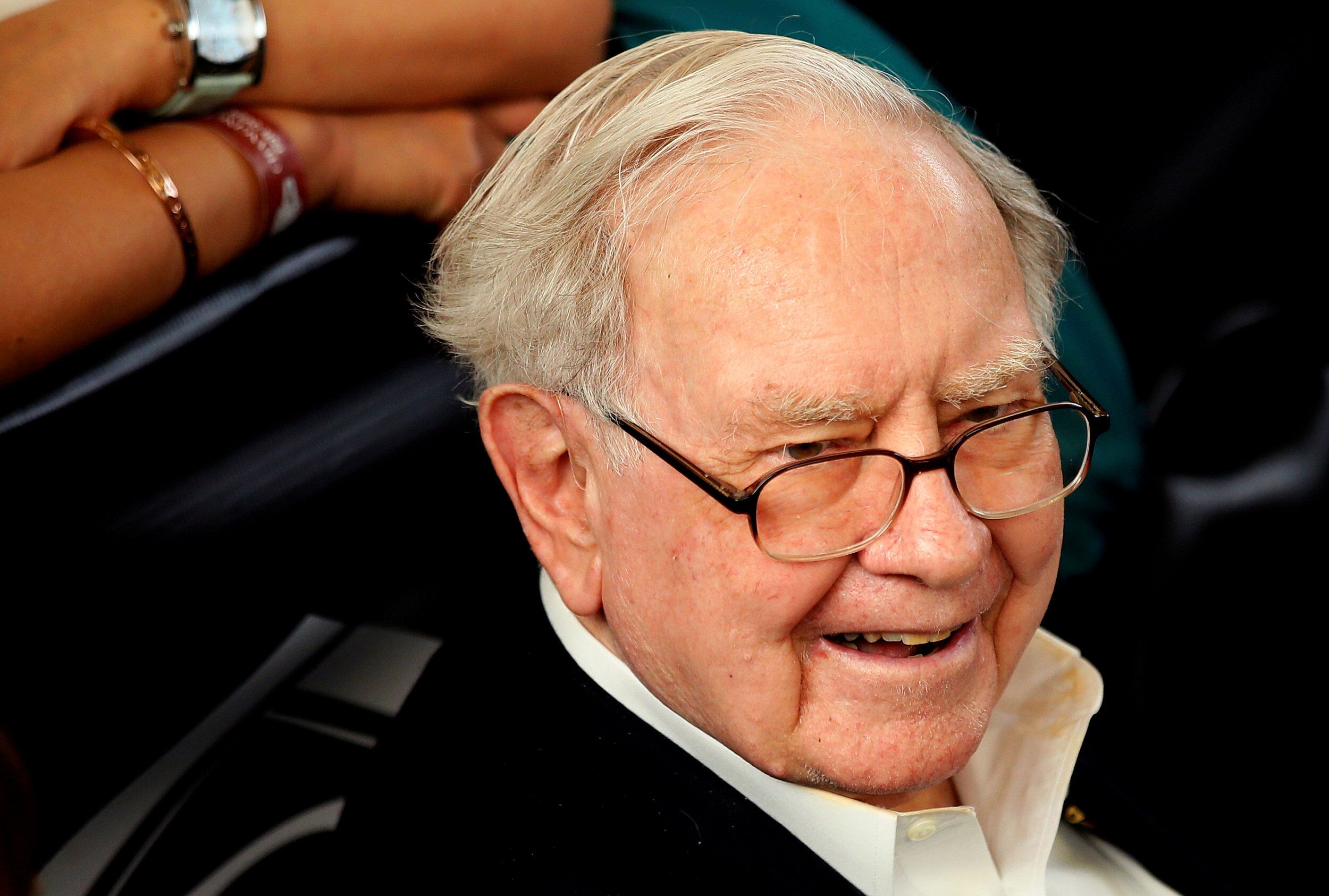

巴菲特在公司年度会议上的精彩语录

|

在伯克希尔·哈撒韦公司(Berkshire Hathaway)的年度会议上,沃伦·巴菲特和他的商业伙伴查理·芒格会针对股东提出的任何问题,提供观点和建议。 2017年的年度会议于上周六在奥马哈举行,涉及的内容五花八门,包括谷歌(Google)和亚马逊(Amazon)的股价、富国银行(Wells Fargo)、人工智能、共和党医疗法案,以及伯克希尔·哈撒韦的股票是否进行分红。 不过年度会议上最值得关注的,是86岁的巴菲特和93岁的芒格如何把对复杂技术问题的回答提炼成意味深长、简洁有力的智慧结晶,甚至让新手投资者也能理解。 为此,我们编辑了2017年伯克希尔·哈撒韦年度会议上巴菲特对于热门话题的经典语录。毕竟,他被称作奥马哈的先知不是没有道理的。 关于富国银行的虚假账户丑闻 “富国银行犯了三个严重的错误,其中一个比其他的更加糟糕……主要问题在于他们知道以后没有采取行动……如果存在严重的问题,首席执行官总会得到风声。那就是关键点了,首席执行官必须采取措施。如果他们了解情况的话,就会发现这是个极其巨大的错误,而且我肯定他们得到了一些消息,但是他们忽略了这些,把它们扔回给下级去处理了。” 关于人工智能和自动驾驶汽车 “我要说,自动驾驶卡车给北伯灵顿(Burlington Northern)带来的威胁要比机遇更多。而且如果无人驾驶卡车普及开来,那只可能是因为它们更加安全,也就是说汽车导致的损失给整体经济带来的代价会降低,这也会导致Geico的保险收入减少。所以总结起来就是:无人汽车的普及会伤害我们,如果这种普及蔓延到了卡车,那还会伤害我们的汽车保险业务。” 关于可口可乐和节食减肥 “我想说,我这一辈子都在吃自己喜欢的东西。可口可乐,这种12盎司装的可口可乐,我一天要喝五罐。其中大概有1.2盎司的糖。去看看别人如何摄取糖类和卡路里,你会发现来源各不一样。我认为我喜欢从可乐中获取卡路里,我喜欢这样……如果你告诉我,只吃西蓝花或芦笋或其他什么东西,就能比摄取我喜欢的可口可乐、牛排、土豆煎饼等多活一年的话(而且我也不认为这样就能多活),那我宁愿选择吃我喜欢的,享受吃的过程,而不是再多活一年。” “而且我确实认为选择权应该在我。也许糖类有害,也许你想呼吁政府禁止糖类……但我认为可口可乐对于美国和世界都有正面的影响。而且我真的不希望有人说我不能喝可乐。我觉得活得高兴也是长寿的因素之一。” 关于IBM和苹果 “六年前我购买IBM股票,是认为他们在这些年会有更好的表现。说到IBM和苹果(Apple),我认为这两家是很不一样的公司……我在前一家公司上看走了眼,之后大家可以看看我对后一家公司的做法是否正确。不过我并不认为他们是一种类型的公司,当然也不认为他们风马牛不相及。他们的关系在这两种之间。” 关于共和党的医疗法案和税务 “医疗费用是影响经济竞争力的寄生虫。但税务系统没有损害伯克希尔在全球的竞争力,或是导致类似的问题。我们的医疗费用出现了惊人的增长,而且还会提高许多……这个问题正在给社会带来很多麻烦,未来麻烦还会更多,无论是哪一个党派执政都是如此。” “至于几天前通过的新法案和奥巴马政府的(可支付医保)法案,这很有趣。我能告诉你的就是,新法案对个人的影响会体现在税费上,如果法案得到实施,我去年的联邦所得税就会降低17%。所以对于我这样的人来说,新法案大大减少了税费。” 关于亚马逊和首席执行官杰夫·贝佐斯 “他在公司的两大业务几乎同时从零开始时,就担任首席执行官了。英特尔(Intel)的安迪·格鲁夫曾经说过,如果你有一颗银色子弹,射出去就能消灭掉一个竞争者,那你会选谁?我认为,云计算和零售领域都会有很多人会选择向他射出这颗银色子弹……我们完全错过了他。我们从来没有持有过亚马逊的股份……我太迟钝了,没有意识到在发生什么。我欣赏杰夫,但我没想到他能取得这么大的成功,我甚至没有去想他在云服务上做到这些的可能性。我从来没有考虑过持有亚马逊的股份。” “如果你以前问我,在他经营零售业的时候,还能不能做些事情来颠覆科技行业,我会认为这个成功率不大。我确实低估了他们出色的执行力。有梦想是一回事,能做好是另一回事……(亚马逊的股价)看起来总是很高,我真的也没想到他能做到这一切。他真的很棒,不过在三年、五年、八年前,我不认为他能达到如今这样的地位。” 关于美联航和航空业 “我们实际上是四大航空公司最大的股东,这件事更多是这个行业的警笛……我们购买美国运通(American Express)、美国联合航空(United Airlines)或可口可乐的股份,并不是因为我们认为他们绝对不会遭遇问题,也不会有竞争……你列出了一系列导致糟糕业绩的因素。这是个竞争激烈的行业,问题是它是否像过去一样,竞争是趋向于自杀性的。我的意思是,当你发现所有大型运营商和几十家小型运营商都开始走向破产,那你可能投资了一个错误的行业……老实说,我认为他们可能会在未来五至十年中提高载客量,而不是推出历史新低的折扣,让所有运营商都走向破产。他们是否会继续在票价上自取灭亡,还有待观察……在未来十年内,整个行业的价格敏感性要比过去100年更高,这并不是一件易事,不过这方面的情况已经有所改善……不过这与收购See’s Candies不一样。” “我喜欢这种情况。显然,购买四家航空公司的股票,表明我们很难辨别谁会做得最好……会有低成本的竞争者加入,比如国际上的Spirits和美国的捷蓝(JetBlues)等,不过我猜测拥有所有这四家公司的股票,会让我们有更高的收入。问题在于他们的营业比率——利润越高,他们的净发股票就会越少。所以即便他们的实际价值就和现在的市值一样,我们也能挣到相当多的钱。不过长期来看这并不容易。” 关于伯克希尔·哈撒韦的未来 “我认为如果我今晚去世了,明天股价就会上涨。” 关于裁员和联手3G收购卡夫·亨氏 “我们一点都不享受提高生产率的过程。因为这让人很不愉快……在一家裁员的公司,不如在一家扩大招聘的公司那么有趣。所以查理和我会避免让伯克希尔收购那些主要盈利点在于员工更少的公司。” “不过我认为,提高生产率的想法是利于社会的,而且3G的员工在这方面做得很好……当卡夫·亨氏(Kraft Heinz)发现他们可以用更少的人做成事情时,就像美国公司做了几百年的那样去裁员了。老实说我不喜欢那样……不过改变就是痛苦的。我认为提高生产率对于美国来说是必要的,因为只有你的人均生产率提升了,人均消费才可能提升。” 查理·芒格:“我没觉得提高生产率有什么问题。另一方面,关于反生产率的宣传也不少。你做对了,也并不代表你得一直去那么做……对于经历裁员的人来说,这实在是非常不愉快。那么为什么要陷入这种反复让我们进行裁员的公司呢?我们之前在情非得已时有过裁员。我认为3G没有任何道德错误,不过我确实看到了它引发的政治反应,这对任何人都没有好处。”(财富中文网) 译者:严匡正 |

Every year at the Berkshire Hathawayannual meeting, Warren Buffett and his business partner, Charlie Munger, deliver their views and advice on just about any subject their shareholders ask about. The 2017 meeting, which took place in Omaha Saturday, covered topics as diverse as Google and Amazonstock, Wells Fargo, artificial intelligence, the Republican health care bill, and whether Berkshire Hathaway stock will ever pay a dividend. But what is most remarkable about the annual meeting is the way Buffett, 86, and Munger, 93, distill their responses to complex, technical questions into eloquent and pithy nuggets of wisdom that even novice investors can understand. To that end, we've compiled the best Buffett quotes on the hottest topics from the Berkshire Hathaway annual meeting 2017. After all, they don't call Buffett the Oracle of Omaha for nothing. On Wells Fargo's Fake Accounts Scandal "At Wells Fargo (wfc, -0.13%) there were three very significant mistakes, but there was one that was worse than all the others ... The main problem was that they didn’t act when they learned about it ... at some point if there's a major problem, the CEO will get wind of it. And at that moment, that’s the key to everything, because the CEO has to act. It was a huge, huge, huge error if they were getting, and I'm sure they were getting, some communications and they ignored them or they just sent them back down to somebody down below." On Artificial Intelligence and Self-Driving Cars "I would say that driverless trucks are a lot more of a threat than an opportunity to the Burlington Northern. And I would say that if driverless trucks became pervasive, it would only be because they are safer, and that would mean that the overall economic cost of auto-related losses had gone down, and that would drive down the premium income of Geico. So I would say both of those: Autonomous vehicles widespread would hurt us, if they spread to trucks, and they would hurt our auto insurance business." On Coca-Cola and Dieting "I would say I've been eating things I like to eat all my life. And Coca-Cola(ko, +0.46%), this Coca-Cola 12 ounces, I drink about five a day. It has about 1.2 ounces of sugar in it. And if you look at what different people get their sugar and calories from, they get them from all kinds of things. I happen to believe I like to get my calories from this, I enjoy it ... If you told me that I would live one year longer—and I don’t think I would—if I'd live one year longer if I ate only broccoli or asparagus or whatever, or if I eat what I like including Coca-Colas and steak and hash browns, I'd rather eat what I like and enjoy eating what I like than eat something I don't and live another year. "And I do think that choice should be mine. Maybe sugar is harmful and maybe you'd encourage the government to ban sugar ... But I think Coca-Cola has been a very positive factor in the country and the world. And I really don’t want anyone telling me I can’t drink it. I think there’s something in longevity of feeling happy about your life." On IBM and Apple "When I bought IBM(ibm, -0.34%) six years ago, I thought it would do better in the six years that have elapsed than it has. In terms of IBM and Apple(aapl, +2.72%), I regard them as being quite different businesses ... I was wrong on the first one, and we’ll find out whether I'm right or wrong on the second. But I don’t regard them as apples and apples, and I don't quite regard them as apples and oranges. It's somewhere in between on that." On the Republican Health Care Bill and Taxes "Medical costs are the tapeworm of economic competitiveness. But the tax system is not crippling Berkshire’s competitiveness around the world or anything of the sort. Our health costs have gone up incredibly and will go up a lot more ... And that is a problem that society is having trouble with and is going to have more trouble with, regardless of which party is in power, or anything of the sort. "In terms of the new act which was passed a couple days ago, vs. the Obama administration [Affordable Care] act, it’s a very interesting thing. All I can tell you is the net effect of that act on one person is that my taxes, my federal income taxes, would have gone down 17% last year if what was proposed went into effect. So it is a huge tax cut for guys like me." On Amazon and CEO Jeff Bezos "He has been the CEO almost simultaneously of two businesses starting from scratch. Andy Grove at Intel (intc, -0.76%) used to say if you had a silver bullet and you could shoot it and get rid of one of your competitors who would it be? I think that both in the cloud and in retail, there are a lot of people who would aim the silver bullet at Jeff ... And we missed it entirely. We never owned a share of Amazon (amzn, +1.44%) ... I was too dumb to realize what was going to happen. I admired Jeff, but I did not think he’d succeed on the scale that he has, and I didn’t even think of the possibility that he’d do the things with the cloud services. I never even considered buying Amazon. "If you asked me if while he was building up the retail operation he’d also be doing something that would disrupt the tech industry, that would have been a long shot for me. I really underestimated the brilliance of the execution. It's one thing to dream about, it's another thing to do it ... [Amazon stock] always looked expensive, and I really never thought he would do what he did today. I thought he was really brilliant, but I didn't think he'd be where he is today when I looked at it three, five, eight years ago anyway." On United Airlines and the Industry "We actually are the largest holder of the four largest airlines, and that is much more of an industry call ... We did not buy American Express or United Airlines or Coca-Cola with the idea they would never have problems or never have competition ... And you’ve named a number of factors that just make for a terrible economics. It’s a fiercely competitive industry, the question is whether it's a suicidally competitive industry, which it used to be. I mean, when you get virtually every one of the major carriers and dozens and dozens and dozens of minor carriers going bankrupt, there ought to come a point you find that maybe you're in the wrong industry ... I think it's fair to say they will operate at higher degrees of capacity over the next five or 10 years than the historical rates which caused all of them to go broke. Whether they will do suicidal things in terms of pricing remains to be seen ... It is no cinch that the industry will have some more pricing sensibility in the next 10 years than they had in the last 100 years, but the conditions have improved for that ... But it's not like buying See’s Candies. I like the position. Obviously by buying all four it means it’s very hard to distinguish who will do the best ... There will be low-cost people who come in, the Spirits of the world and JetBlues, whatever it may be, but my guess is that all four of the companies we have will have higher revenues. The question is what their operating ratio is—they will have fewer shares outstanding by a significant margin. So even if they're worth what they're worth today, we could make a fair amount of money. But it is no cinch, by a long shot." On the Future of Berkshire Hathaway "If I died tonight, I think the stock would go up tomorrow." On Layoffs and Partnering with 3G on Kraft Heinz "We don’t enjoy the process at all of getting more productive. Because it’s unpleasant ... It's just not as much fun to be in a business that cuts job as one that adds jobs. So Charlie and I would avoid personally having Berkshire buy businesses where the main benefits are actually having fewer workers. "But I think it’s pro-social to think in terms of improving productivity, and I think the people at 3G do a very good job of that ... When Kraft Heinz(khc, -0.17%) finds whatever amount of business they can do, and they can do it with fewer people, they’re doing what American businesses have done for a couple hundred years and why we live so well. But they do it very fast. They don’t want to have two people doing the job that one could do. I frankly don’t like going through that ... But change is painful. I think it's absolutely essential to America that we become more productive because that is the only way you have more consumption per capita, more productivity per capita." Charlie Munger: "I don’t see anything wrong with increasing productivity. On the other hand, there’s a lot of counterproductive publicity to doing it. Just because you’re right doesn’t mean you should always do it ... It’s terribly unpleasant for the people that have to go through it. And why would we want to get into the business of doing that over and over ourselves? We did it in the past where we had to. I don't see any moral fault in 3G at all, but I do see there is some political reaction that doesn’t do anybody any good." |