中国抑制资本外流怎么会造成比特币价格暴跌 ?

|

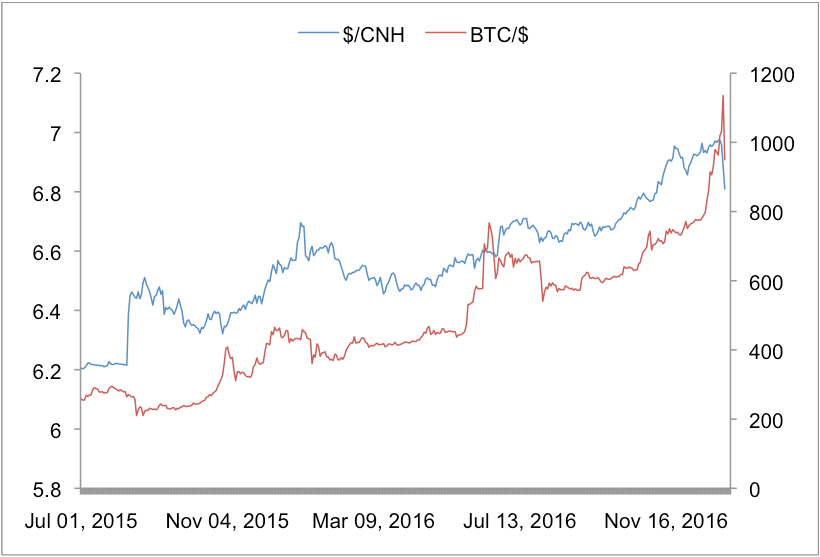

上周四比特币崩盘。截至正午(美国东部时间),比特币兑美元汇率在短短两个小时的疯狂交易中共下跌20%。 近些天的火热行情给比特币带来的涨幅几乎损失殆尽,原因看来是人们担心中国将采取新的措施来抑制资金外流。中国占比特币公开交易的90%以上,约70%的比特币“挖矿”活动(通过创建区块链来生产比特币,区块链是比特币的底层技术基础)都集中在中国。因此,最近比特币剧烈波动的源头不太可能在其他地方。 虽然不可能锁定比特币飙升的确切源头和动力,但有足够迹象说明影响比特币走势的终极因素就是人民币。2016年11月以来人民币汇率急剧下滑,但最近两天出现反弹,原因是中国央行大力轧空让投机者产生了些许恐惧。 上周一美元汇率逼近7元人民币。周四,人民币反弹逾2.5%,香港离岸市场美元/人民币报6.81。比特币市场的流动性和透明度远不如汇市,它将人民币汇率的猛然反转放大了许多倍。 正如分析师们所说,大家都意识到比特币“将要回落”。2016年12月21日以来,比特币兑美元上升了45%;2015年9月至今的增幅更是达到了令人侧目的521%。在此期间,美元兑其他货币几乎全线走强,这让比特币的走势显得更加震撼。 问题在于,这样的行情会引发回调吗?为了让人民币放缓下行脚步,政府部门就新资本管制措施发出的提醒和暗示看来就是答案。 新年到来之际,中国人民银行宣布,将金融机构大额现金交易报备门槛从20万元人民币下调至5万元人民币(7100美元)。央行表示,此举只是为了加大对洗钱、偷逃税等犯罪活动的监测和打击力度。同时,外管局细化了个人外汇信息申报内容,个人购汇(每年每人额度为5万美元)时需说明购汇理由以及所购外汇的使用地点与使用方式。 虽然一年半以来一直允许人民币贬值,但中国政府不愿意看到局势陷入混乱,因为这既有可能在国内引发恐慌,也有可能造成美国新任总统再次指责中国操纵货币。 实际上,在这一年半时间里中国一直在推动人民币升值,而非压低其汇率。2016年1-10月中国资本外流规模猛增至5300亿美元,中国外汇储备则从2014年初略低于4万亿美元的高点下降近25%。分析师估算,仅11月份,中国央行就动用了超过340亿美元外汇储备来支撑人民币汇率。同时,预计外管局本周公布的数据将表明,中国外储自2011年以来首次跌至3万亿美元以下。 2015年8月人民币兑美元贬值2%,这是中国几年来首次调整汇率,随后中国政府下在人民币上的赌注就像雪球一样越滚越大。同时,如下图所示,人民币和比特币兑美元的汇率也越发紧密地联系在了一起(只是按百分比计算,比特币的增幅当然要大得多)。 |

The value of the cryptocurrency bitcoin is melting down Thursday, having dropped 20% against the dollar by midday Eastern Time in only two hours of frantic trading. The move reversed an almost equally feverish rise in recent days that had appeared to be driven by concerns that China will introduce new measures to stop its citizens moving money out of the country. China accounts for over 90% of reported bitcoin trades and around 70% of bitcoin "mining" (the production of new bitcoins through the building of blockchain that makes up the currency's infrastructure). So it's unlikely that the source of recent volatility lies anywhere else. While it's impossible to pin down the exact source and motive for the bitcoin rally, there are plenty of signs that what's going on with bitcoin is, ultimately, driven by what's going on with China's official currency, the renminbi (also known as the yuan). The renminbi has fallen sharply since November but rallied over the last two days thanks to a brutal short squeeze engineered by China's central bank to put a bit of fear into speculators. After nearly touching 7 to the dollar on Monday, the renminbi rallied over 2.5% Thursday to reach 6.81 in the offshore Hong Kong market. That abrupt reversal was magnified many times over in a bitcoin market that doesn't have anything like the same liquidity or transparency as the market for official currencies. By anyone's reckoning, bitcoin was, as the analysts say, "due a correction." It had risen by 45% against the dollar since Dec. 21, and by an eye-watering 521% since September 2015. Those moves are all the more striking because the dollar has strengthened against virtually every other national currency in the world in that time. The question was, what would trigger the correction? The answer appears to have been a series of nudges and winks from the authorities about the introduction of new capital controls to slow the renminbi's decline. Over the new year, the People's Bank of China, China's central bank, said that banks will be required to notify it of all cash transactions over 50,000 yuan ($7,100), down from a current ceiling of 200,000 yuan. It said the move was merely aimed at improving the monitoring of money-laundering and tax fraud. Meanwhile, the State Administration for Foreign Exchange (SAFE) imposed onerous new reporting requirements requiring people to explain why, where and how they intend to use their annual quota of foreign currency (which is capped at $50,000 per person). While Beijing has allowed the renminbi to weaken over the last 18 months, it doesn't want a disorderly rout that would both trigger panic at home and invite fresh accusations of currency manipulation from the new U.S. President. The fact is, such manipulating as Beijing has done over the last 18 months has been to support the renminbi rather than weaken it. Capital outflows from China in the first 10 months of 2016 rocketed to an estimated $530 billion, while the country's stash of foreign reserves has fallen nearly 25% from a peak of just under $4 trillion in early 2014. Analysts estimate that the PBOC spent over $34 billion in November alone to prop up the currency, and figures expected next week from SAFE are expected to show reserves dropping below $3 trillion for the first time since 2011. Chinese bets against the renminbi have snowballed since Beijing let it fall by 2% against the dollar in August 2015, the first revaluation in years. And, as this chart shows, the renminbi and the bitcoin rate to the dollar have become increasingly closely correlated (though bitcoin's rise, in percentage terms, has of course been far more dramatic). |

美元/人民币汇率(蓝色)和比特币/美元汇率(红色)

|

现在,这种关联性再一次戏剧性地得到了证实。如果中国真的打算为了资本管制而切断比特币交易,由此产生的结果就确实非常令人期待。(财富中文网) 作者:Geoffrey Smith 译者:Charlie 审校:詹妮 |

Today, once again, that correlation was affirmed, dramatically. If ever China actually tries to close down bitcoin exchanges as a form of capital control, the fallout will be truly exciting to watch. |