英国脱欧之后,这座城市将取代伦敦

|

2016年6月24日,周五,夏日的伦敦阳光灿烂,足以让人浮想联翩。然而从清晨开始,整个城市都因为脱欧公投结果而弥漫着焦虑与痛苦的气息。在加入欧盟43年之后,超过1,700万的英国人(占投票者的近52%)投票决定离开这个全球最大的单一市场。 瑞安·拉文斯克劳福特律师供职于总部位于美国的债券交易平台MarketAxess,她有充足的时间考虑接下来的计划。从位于郊区的住所到伦敦巴比肯区的公司欧洲总部有一个小时的车程,怀着七个月的身孕的瑞安显得心烦意乱。到公司时,她已经拿定了主意。作为一名土生土长的英国人,瑞安说:“我是第一个要求(公司)搬迁的人。” 三年后,在10月一个阳光灿烂的清晨,我又一次遇见了瑞安。只是地点换成了MarketAxess欧盟区新总部,这是一座修建在阿姆斯特丹运河边的百年古屋,与伦敦窗外嘈杂的车流声不同,这里时而会听到河船经过时激起的水声。瑞安是公司的高级法律顾问,在伦敦工作时需要乘火车通勤,每天花费32美元。而现在,她可以骑着自行车送3岁的女儿塞伦去附近的幼儿园,再把自行车和婴儿车锁在办公室外。前后只需5分钟,也不用花钱。36岁的瑞安说,这样的改变以前想都不敢想,“生活质量提升很大,不必每天花3个小时上下班,可以把更多的时间投入到工作上。” 受英国脱欧影响,瑞安的生活发生了翻天覆地的变化,但这绝非个例。是否脱欧、何时脱欧的问题将英国的政治、经济搅得一团乱麻。12月12日,英国将举行大选,明年1月31日则是脱欧协议的最后期限,两个事件将是英国的脱欧大剧的下一幕好戏,届时英国是走是留也将一见分晓。但许多企业已经决定不再等待。自2016年公投以来,为了避免英国脱欧后与欧盟法规发生冲突,已经有数百家企业将其业务完全撤出英国,或将关键部门转移至其他27个欧盟国家,一同离开的还有数以千计的员工。 |

Friday, June 24, 2016, was the kind of spark¬ling summer’s day that usually inspires giddy buoyancy in London. On that morning, however, anxiety and distress fell on the city like a lead weight, as the results of the previous day’s Brexit referendum rolled in. More than 17 million Brits, nearly 52% of those who cast a ballot, had voted to leave the European Union, after 43 years in the world’s biggest single market. For Rhian Ravenscroft, an attorney for U.S.-based bond-trading platform Market¬Axess, there was plenty of time to consider her next move. Seven months pregnant and deeply upset, she had an hour-long journey from her suburban home to the company’s European headquarters in London’s Barbican district. By the time she reached the office, she knew what she would do. “I was the first one to ask to move,” says Ravenscroft, who is British. When I meet Ravenscroft in October, more than three years later, it is on another sparkling, sunny morning. But now she is sitting in a centuries-old canal-side house in Amsterdam—¬MarketAxess’s new EU headquarters. The sound outside the picture windows is not London traffic but rather the lapping of water from riverboats gliding by. In London, Ravenscroft, now the company’s senior legal counsel, had a $32 roundtrip train commute. Today, she has dropped off her 3-year-old daughter, Seren, by bicycle at a kindergarten nearby, then locked her bike with its infant buggy outside the office. Total commuting time: five minutes. Total cost: zero. “The quality of life has totally changed,” says Ravenscroft, 36, still stunned by the shift. “Not having to commute up to three hours a day frees up a lot of time to concentrate on your job.” Ravenscroft is hardly alone in having her life radically upturned by Brexit. The question of whether or when the U.K. will leave the EU has dragged Britain’s economy and political apparatus into dysfunction. A U.K. general election on Dec. 12 and a Jan. 31 deadline for an exit deal are the next plot twists in this long-running drama that could cement the country’s departure—or not. But much of the corporate world has decided it can’t wait any longer to see the final episode. Since the votes were counted in 2016, hundreds of businesses have pulled their operations entirely out of Britain, or relocated key segments to the other 27 EU countries, uprooting thousands of employees to avoid running afoul of European regulations. |

|

英国脱欧的最终破坏力难以估量,其全面影响需要数年时间才会明朗。而对于阿姆斯特丹而言,影响已经很明显,从这座井然有序的小城我们可以一窥英国脱欧后欧洲的景象。经济事务部下属的荷兰外商投资局(NFIA)称,受英国脱欧影响,约有100余家在英国开展业务的公司已经在荷兰开设办事处。尽管仅有80万人口的阿姆斯特丹无法与拥有900万人口的伦敦相提并论,但仍然有至少65家企业的荷兰办事处选择设在这座小城。市政官员表示,这些企业将在未来三年内创造约3500个工作岗位。而与未来的企业迁入潮相比,现在的数字也许根本不值一提。NFIA的局长倪景润表示,该机构正在与其他近350家公司就搬迁事宜进行谈判,去年1月才80家,只能用“进展神速”来形容。 多家主流媒体以及大型生命科学公司最近也将其业务扩展到了阿姆斯特丹。而在金融服务业,变化则更为明显。几十年来,欧洲金融业一直以伦敦金融城方圆一平方英里的区域为中心,其它地区显得无足轻重。然而现在已经是今非昔比,自英国脱欧公投以来,金融机构纷纷向欧洲大陆伸出触角,随之而来的影响将会更为深远。 企业迁入对阿姆斯特丹无疑是一大利好。但是对于城市中的许多人来说,现在庆祝未免有些为时过早。新居民的加入会给供应短缺的经适房市场带来新的压力,而且很难说脱欧对荷兰一定是利大于弊。荷兰约有22.5万个工作岗位与对英贸易相关。仅出口一项,每年的产值就有约255亿欧元(283亿美元),而这一经济动脉目前正在面临英国脱欧带来的风险。阿姆斯特丹负责经济事务的副市长西蒙妮·库肯海姆坚称,该市从未想过趁虚而入,夺取伦敦商业枢纽的地位。她说:“这是企业界对英国脱欧的反应,而不是我们说‘我们想从中谋求什么好处。’英国脱欧是件让人非常难过的事情。”话虽如此,但痛苦只是理论上的,英国脱欧给荷兰带来的好处却是实实在在的。 |

The disruption of a final Brexit is impossible to calculate, and its full dimensions will take years to become clear. Even so, in tiny, orderly Amsterdam, it is already possible to glimpse what post-Brexit Europe might look like—because it is already here. About 100 companies with operations in Britain have opened offices in the Netherlands because of Brexit, according to the Netherlands Foreign Investment Agency (NFIA), part of the Ministry of Economic Affairs. Of those, at least 65 are in Amsterdam, a city with a population of 800,000—a sliver of London’s 9 million. City officials say the influx will create about 3,500 jobs in the next three years. And that could be a trickle compared with a future flood. NFIA commissioner Jeroen Nijland says the agency is in talks with almost 350 other companies—up from 80 last January—about possible moves. “This is developing fast,” he says. Major media entities and big life-sciences companies have recently expanded into Amsterdam. But nowhere is this change felt as sharply as in the financial services industry. For decades, finance’s European identity has centered on one square mile of London called simply The City, as though there were none other. That is no longer the case. Since the Brexit referendum, the industry has splintered across the Continent, in a shift that could ultimately be profound and permanent. For Amsterdam, the migration has been an undeniable boon. But for many in the city, celebration feels premature. New residents are straining a market where affordable housing is in short supply. And it’s hardly certain that the Dutch will gain more than they lose from Brexit. About 225,000 jobs in the Netherlands are related to trade with Britain. Exports alone are worth about 25.5 billion euros ($28.3 billion) a year—an economic artery now at risk. Simone Kukenheim, Amsterdam’s deputy mayor for economic affairs, insists the corporate-hub windfall is one the city never chased. “This is a reaction to Brexit, not us saying, ‘Hah, let us see what we can get out of this,’ ” she says. “There is deep sadness over Britain leaving.” Still, for now, the heartache is theoretical; the benefits are real. |

****

|

长期以来,荷兰对商界人士一直持欢迎态度。NFIA的数据显示,自20世纪70年代以来,已经有约4,000家外国公司落户荷兰,其中约有一半是美国公司。阿姆斯特丹巨大的国际机场是一个全球性的交通枢纽,从这里飞往伦敦只需1小时。英语是通用语言,超高速互联网服务更是无处不在。企业所得税的税率为25%,虽然高于英国或爱尔兰,但低于德、法两个欧洲大国。 而且,英国脱欧日期的临近更是放大了这些优势。多数人认为英国脱欧带来的问题主要在商品贸易方面,想想要对法国葡萄酒和德国汽车征收关税或者边境上大排长龙的车队就让人头疼。事实上,服务业面临的障碍同样巨大,甚至可能超出人们的想象。从英国脱欧开始的那一刻起,总部位于英国的任何一家公司,无论国籍,都要重新申办新的监管许可才能够在欧盟的其他地区开展业务,同时还需要与地处欧盟的客户重新签订合同。 现实问题迫在眉睫,金融业不得不早早迈出撤离英国的脚步。据英国智库New Financial的数据显示,截至目前,已经有332家金融公司将其核心业务迁出伦敦。而最终离开英国的金融机构数量或将更多。据安永发布的《英国脱欧追踪》报告估计,在不久的未来,伦敦将流失大约7,000个金融工作岗位,以及大约1万亿英镑(1.29万亿美元)的银行资产。 |

The Netherlands has long been welcoming to business outsiders. Some 4,000 foreign companies, about half of them American, have set up in the country since the 1970s, according to NFIA. Amsterdam’s vast international airport is a global hub, an hour’s flight time from London. English is widely spoken; ultrafast Internet service has long been ubiquitous. And the 25% corporate income-tax rate, while higher than in the U.K. or Ireland, is lower than those of continental giants France and Germany. Britain’s looming departure is amplifying these advantages. Most people think of Brexit headaches in terms of trade in goods, imagining tariffs on French wine and German cars, or 10-mile truck backups at the borders. But the hurdles for service industries are just as big, if not bigger. From the moment Brexit begins, every company now based in Britain, regardless of its nationality, will need new regulatory licenses to do business in the rest of the EU, along with new contracts for EU clients. This looming reality has spurred the financial industry to mount an early Brexodus. So far, 332 financial companies have moved core elements out of London, according to U.K. think tank New Financial. Those numbers may understate the eventual departures: Accounting firm EY’s Brexit Tracker estimates that about 7,000 financial jobs will leave London in the near future, and that about a trillion British pounds ($1.29 trillion) in banking assets could also leave. |

|

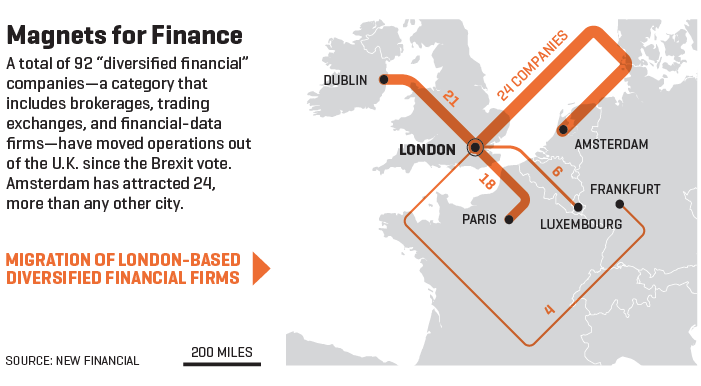

花旗银行和摩根大通各自斥资1亿多美元,将其欧盟业务中心迁出伦敦。美国银行也将约125名员工迁至位于都柏林的新欧盟区总部,另有400名员工将迁至巴黎。此前,欧盟银行业管理局已经从伦敦迁至巴黎。 而阿姆斯特丹则更被金融数据公司、券商、交易所及其他交易基础设施提供商等“多元化金融”公司所青睐。据New Financial统计,落地阿姆斯特丹的大多数金融总部都属于此类企业,而且从英国吸引到此的类似企业比其他欧盟城市都多。受益于此,荷兰或将华丽蜕变,而伦敦则是元气大伤。NFIA的倪景润表示:“对于首次在欧洲投资的投资者来说,英国将不再是其首选。” 对于已经将业务迁出英国的公司而言,脱欧之争已经不再是他们关心的问题。保险评级机构AM Best总部位于新泽西州奥尔德威克,该公司的市场开发董事总经理尼克·查特里斯·布莱克表示:“我们无法干等着政客达成共识。”去年,AM Best将其欧盟总部从伦敦搬到了阿姆斯特丹南部的泽伊达斯金融中心,从这里乘火车前往史基浦国际机场仅需要10分钟。在公司位于NoMa House办公楼的咖啡厅里,AM Best的阿姆斯特丹经理安琪拉·伊奥一边啜饮着精酿意式咖啡,一边说:“公司约有三分之一的业务已经从伦敦迁出。”她将NoMA描述为“英国脱欧难民营”;卡夫亨氏是NoMa的主要租户,去年在此开设了拥有450名员工的全球“卓越中心”。 完全撤出英国的金融机构屈指可数,多数金融机构的大部分欧洲员工依然在英国办公。MarketAxess和AM Best在阿姆斯特丹分别有10名和12名员工,而在伦敦的员工数量分别是120名和70名。但一旦英国正式脱欧,来自阿姆斯特丹的业务将可能增多,随着业务中心的转移,人员结构的平衡也将进一步调整。 |

Already, Citibank and JPMorgan Chase have each spent more than $100 million moving their EU hubs out of London. Bank of America relocated about 125 people to new EU headquarters in Dublin and will have another 400 in Paris, where EU banking regulators have moved from London. Amsterdam, for its part, has become a magnet for “diversified financial” firms—a category that includes financial-data companies, brokerages, and providers of exchanges and other trading infrastructure. Most of the city’s financial headquarters belong to this category, according to New Financial, and Amsterdam has lured more such firms from Britain than any other EU city. That gives the Netherlands critical mass—likely at London’s expense. “For investors who invest for the first time in Europe, Britain will be less often on the short list,” says NFIA’s Nijland. For firms that have moved operations out of Britain, the Brexit argument has long since been settled. “None of us could hang around waiting for politicians to agree on what to do,” says Nick Charteris-Black, managing director of market development for AM Best, the insurance rating agency headquartered in Oldwick, N.J. Last year, AM Best moved its EU headquarters from London to Amsterdam, taking space in the high-rise Zuidas financial center on the southern edge of the city, a 10-minute train ride from Schiphol Airport. “About one-third of our business has moved from London,” says Amsterdam manager Angela Yeo, as she sips a fine-brewed espresso in the lobby café of cutting-edge NoMA House, the company’s new digs. She describes NoMA as a hub for “Brexit refugees”; its anchor tenant is Kraft Heinz, which opened a “center of excellence” last year with 450 people. Few financial firms have abandoned Britain entirely, and many keep most of their European staff there. MarketAxess has 10 staffers in Amsterdam, while 120 remain in London. AM Best has 70 people in London and about a dozen in Amsterdam. But if and when Brexit becomes official, more of their business will likely emanate from Amsterdam, and the staffing balance could eventually shift further—along with the industry’s center of gravity. |

****

|

阿姆斯特丹的支持者坚称,他们在吸引新企业方面还可以做得更好。荷兰人并没有为那些感兴趣的企业修改法律或税法。例如,许多银行之所以选择迁往巴黎、都柏林和法兰克福而不是荷兰,部分原因是荷兰法律规定银行家的奖金上限为基本年薪的20%,而这一数字在伦敦为200%,在其他欧盟国家为100%。阿姆斯特丹负责外商投资事务的高级经理雨果·尼岑表示,法兰克福与巴黎等城市都针对常驻伦敦的高管开展了大规模的城市推广活动,而阿姆斯特丹的市政领导则认为开展这种活动不合时宜。他表示:“说竞争对手的坏话不会显得我们就好。” 不过,至少有一个机构让荷兰下足了功夫。2016年英国脱欧公投后的第二天清晨,在伦敦刚从睡梦中醒来的诺约尔·瓦西翁有理由比大多数人都着急。瓦西翁是欧洲药品管理局(EMA)的副执行董事,该局职能类似于美国食品与药品监督管理局,从1995年开始总部就一直设在伦敦。由于EMA为欧盟实体而非私人公司,因此在英国脱欧的背景下,EMA必须完全迁出英国。作为一个在伦敦生活了20年的比利时人,瓦西翁回忆说,当时员工们都“崩溃了”。“他们的生活都在英国。” 脱欧公投迫使EMA不得不关闭其位于伦敦的总部,由此引发了最大规模单一机构工作岗位迁出行动,EMA因此而蒙受的租金损失高达6.5亿美元。而对于欧洲其他地区而言,EMA则成为了他们竞相争取的香饽饽。无论哪个城市获胜,都将从伦敦接手超过900名的高收入新市民。同时,获胜城市还将迎来大批制药与生物技术企业,这些企业为了完成药物审批事宜必须与EMA紧密合作。 |

Still, for at least one organization, the Dutch turned on the charm. The morning after the 2016 Brexit vote, Noël Wathion woke up in London with more reason than most to be anxious. Wathion is deputy executive director of the European Medicines Agency (EMA), a bureau analogous to the U.S. Food and Drug Administration that had been headquartered in London since 1995. Because it’s an EU entity rather than a private company, under Brexit, the EMA would have to leave Britain entirely. Staffers “were devastated,” recalls Wathion, a Belgian who had lived in London for 20 years. “They had built their lives in the U.K.” The Brexit vote effectively forced the EMA to shut down its headquarters—triggering what became the single biggest job-related move resulting from Brexit. (It also cost the agency $650 million on its London lease.) For the rest of Europe, the EMA was a giant prize to be fought over. Whichever city won could inherit more than 900 high-earning newcomers. It would also have the chance to lure an influx of pharmaceutical and biotech companies, which must work closely with the EMA to get drugs approved. |

|

这次荷兰可谓全力以赴。政府为EMA提供的新总部位于泽伊达斯,建筑价值3.3亿美元,完全按照EMA的要求建造。同时,荷兰政府还指出,作为旅游城市,阿姆斯特丹拥有完善的酒店配套,可供大批造访专家居住。在宣传片中,荷兰儿童用流畅的英语向观众致敬,介绍者则风趣地向伦敦EMA的工作人员保证,“毕竟,我们(与伦敦)没有什么不同。我们也有一位喜欢炸鱼、薯条,同样时尚的女王。” 2017年,在欧盟外交部长们的最终投票中,阿姆斯特丹和米兰打成平手,EMA花落谁家最终由抽签决定。让意大利人生气的是,抽签选中的是遍布运河的荷兰。 今年3月,EMA正式启用了阿姆斯特丹的办事处,它的到来让荷兰受益颇多。阿姆斯特丹的官员表示,包括日本生物技术公司乐天医疗在内的8家医疗保健或生命科学公司已经于去年在该市开设办事处。据推测,这些公司选址多在EMA附近,能够创造数百个工作岗位。杜邦、英国医疗技术公司Aparito和总部位于南非的Synexa Life Sciences等企业都将其欧洲总部设在了莱顿,距EMA也只有很短的火车车程。 当你在阿姆斯特丹散步或骑行时,很容易理解为什么“英国脱欧难民”会选择此地作为庇护所。这里安谧的城市氛围与欧洲大部分地区、尤其是伦敦截然不同。夜间时分,骑行在郊区小道上时,你会看到公园里到处都是入夜后还在踢球的孩子。芝加哥期权交易所(CBOE)的欧洲区总裁亚当·埃德斯是该机构搬迁选址负责人。他说,在阿姆斯特丹、法兰克福、都柏林、巴黎和马德里等城市中,他最终选择了阿姆斯特丹。CBOE的欧盟区新总部位于泽伊达斯,与AM Best同处一座大楼。埃德斯表示,因为妻子、子女还都在伦敦的缘故,他每周都会往返于两地之间。但是“(阿姆斯特丹)比(伦敦)平静得多。”他说。 |

The Netherlands threw itself into an all-out fight. The government offered a $330 million headquarters in Zuidas, built to EMA’s specs. It noted that tourist-friendly Amsterdam had hotel space for the hordes of specialists who would visit. It produced a video in which Dutch children greeted viewers in flawless English, while a narrator reassured EMA staff in London that “after all, we are not that different. We also have a very stylish queen and enjoy fish and chips.” In 2017, the final vote by EU foreign ministers resulted in a tie between Amsterdam and Milan. To the fury of Italian politicians, the winning city was drawn out of a bowl—and had lots of canals. The EMA officially set up shop in Amsterdam this March, and its arrival has already paid off for the Netherlands. Eight health care or life-sciences companies, including Japanese biotech firm Rakuten Medical, opened offices in the city last year, Amsterdam officials say, presumably to be in proximity to the EMA, bringing with them hundreds of jobs. DuPont, British med-tech company Aparito, and South Africa–based Synexa Life Sciences have all opened European headquarters in Leiden, a short train ride away. Walk—or cycle—around Amsterdam, and it’s easy to see why “Brexit refugees” would choose it as their sanctuary. Its calm atmosphere is in striking contrast to much of Europe, especially London. On a nighttime bike ride through the suburbs, I see parks filled with children playing soccer long after dark. Adam Eades, president of the European unit of the Chicago Board Options Exchange (CBOE), had the job of deciding where it would relocate. Amsterdam, he says, beat out Frankfurt, Dublin, Paris, and Madrid. Eades shuttles weekly from London, where his wife and child still live, to CBOE’s new EU headquarters in the same Zuidas building as AM Best. “It is much less frantic here,” he says. |

|

合理的房价是埃德斯选择新总部时的另外一个标准。事实证明,这要难得多。乌得勒支住宅投资顾问公司Capital Value称,自英国脱欧公投以来,阿姆斯特丹的房地产价格已经上涨约36%。800平方英尺(约75平米)的公寓每月租金约1,800欧元(2,000美元),购买费用约500,000欧元(550,000美元)。前提还是你得能够找到卖家。许多限价房屋的租房排队表已经排到了13年之后。AM Best公司的伊奥表示,为了应对不断飙升的居住成本,公司被迫上调了新员工的薪水。 瑞银(UBS)最近的一份报告显示,伦敦房价已经下跌,而阿姆斯特丹的房价则已经出现泡沫,房价已经成了时代变迁的标志。Expat Help是一家专业搬家公司,该公司的房产经理艾格·德·维尔表示,他们已经为700多名EMA员工提供了搬家服务。其中许多人选择在阿姆斯特丹租房居住,同时持有自己在伦敦的房产,希望等到英镑复苏时再出手。德·维尔说:“大家都没有什么头绪,都在等英国脱欧的结果。” |

Eades had one more criterion: reasonably priced housing. That has proved far more elusive. Amsterdam’s property values have shot up about 36% since the Brexit vote, according to Capital Value, residential investment advisers in Utrecht. An 800-square-foot apartment costs about 1,800 euros a month ($2,000) to rent, or about 500,000 euros ($550,000) to buy. And that’s if you can find one. Many units are rent-controlled, with 13-year waiting lists. Yeo, of AM Best, says her company was forced to revise upwards its offers to new recruits, to account for soaring housing costs. In a sign of changing times, London home prices have sunk, while Amsterdam’s have hit bubble-risk territory, according to a recent UBS report. Eeg De Veer, housing manager for relocation experts Expat Help, says his company has helped resettle more than 700 EMA staffers. Many are keeping their London homes while renting in Amsterdam, waiting for the British pound to recover before they commit to selling and reinvesting. “Everyone is in a vacuum,” De Veer says, “waiting to see what will happen with Brexit.” |

****

|

乘公交从泽伊达斯出发,驶出不远就能够看到高楼大厦逐渐退去,取而代之的则是流向北海的运河,以及沿河而建的低矮仓库,在运河尽头就是阿姆斯特丹港。数个世纪以前,从这里出发的荷兰商人将荷兰变成了一个商业巨人,他们帮助开辟了海上丝绸之路,可以说是全球贸易的开创者。阿姆斯特丹港也是全球最大的可可豆加工场,星巴克的大型仓库就坐落于此。来这里参观那天,我老远就能够闻到浓烈的巧克力味。 由于担心英国脱欧会带来剧烈动荡,阿姆斯特丹港和更大、更繁忙的鹿特丹港的港务当局提前几个月就已经在着手准备应对措施。如果英国脱欧成功,那么所有进出英国的货物都必须进行海关申报,而这一机制已经有近30年没有启用过。荷兰估计,截至2030年,受英国脱欧影响,荷兰每年的损失将高达其GDP的1.2%,相当于每年约100亿欧元。(据估计,英国将遭受更大的损失。) |

A short bus ride from from Zuidas, office towers give way to low-rise warehouses along a blustery channel feeding into the North Sea: the port of Amsterdam. From here, centuries ago, Dutch merchants turned the Netherlands into a commercial giant, helping to open the Silk Road and virtually invent global trade. Starbucks’ mammoth warehouses are here, and the port is the world’s biggest processor of cocoa beans; a strong smell of chocolate wafted over the terminal on the day I visited. Port authorities in Amsterdam and larger, busier Rotterdam have spent months preparing for Brexit, fearing total upheaval. If the U.K. leaves the union, all British imports and exports will require customs declarations—a regime that has not existed for 30 years. The Netherlands estimates Brexit could reduce its GDP by up to 1.2%, or about 10 billion euros annually, by 2030. (Britain, by most estimates, will suffer much greater damage.) |

|

TMA物流的总经理迈克尔·范·托莱多表示:“进出口商的成本肯定会增加,” TMA物流旗下每周有六艘次集装箱船往返于英国和荷兰之间。前往英国的船只上会载满食物和其他商品。荷兰向英国出口大量的鱼、切块土豆和蛋黄酱,都是制作炸鱼薯条的基本原料,英国自己只生产很少一部分这类食材。运回阿姆斯特丹的是什么呢?主要是垃圾,真正的垃圾。范·托莱多解释说,部分伦敦人家里的垃圾被当作燃料为阿姆斯特丹40,000户家庭提供电力。 颇为讽刺的是,如今这样的生活已经如同烧掉的垃圾一样成了过眼云烟。而且,随着英国脱欧闹剧继续上演,新来者正在考虑他们此前未曾想过的选项:成为荷兰人。 MarketAxess荷兰业务主管乔佛里·范德·林登在伦敦工作了12年,现在搬到了阿姆斯特丹生活。在《财富》杂志12月刊出版之际,他正期待着自己第一个孩子——一个荷兰男孩的降生。他的同事瑞安·拉夫斯克劳福特告诉我,她的孩子塞伦现在能够说一口流利的荷兰语,“甚至刚参加了她生命中的第一场自行车比赛!”现年35岁的托恩是瑞安的丈夫,担任M&C Saatchi体育娱乐公司的经营合伙人,因为公司将在阿姆斯特丹开设新的欧盟总部,不久他也将从伦敦搬来这里。目前尚不清楚这对夫妇是否还会返回伦敦。瑞安表示,无论英国脱欧结果如何,“阿姆斯特丹都是一个很适合养家的好地方。”(财富中文网) 本文另一版本登载于《财富》杂志2019年12月刊,标题为《英国脱欧惠及荷兰》。 译者:梁宇 审校:夏林 |

“Exporters and importers will have increased costs for sure,” says Michael van Toledo, general manager of TMA Logistics. TMA oversees six container-ship crossings per week between Britain and the Netherlands. The vessels headed to Britain are laden with food and other goods. (The Netherlands sends vast quantities of fish, cut potatoes, and mayonnaise, basics for fish-and-chips meals; Britain produces little of its own.) Those arriving in Amsterdam? Most are filled with trash—¬literally. Some of Londoners’ household waste, van Toledo explains, is incinerated and turned into electricity for 40,000 Amsterdam homes. It’s intriguing to imagine London’s garbage lighting the homes of former residents whose old lives, like the trash, have gone up in smoke. Now, as the Brexit wrangling continues, the newcomers are considering a future they could not have predicted before: becoming Dutch. Geoffroy Vander Linden, head of MarketAxess’s Netherlands business, is now living in Amsterdam after 12 years in London. He was expecting his first child—a baby boy to be born in Holland—as Fortune went to press. His colleague, Rhian Ravenscroft, says her toddler, Seren, is now fluent in Dutch: “She even competed in her first bike race!” Rhian’s husband, Toan, 35, will soon move from London to be management partner of M&C Saatchi Sports and Entertainment, which will open its new EU headquarters in Amsterdam. It is not clear the couple will ever return to London. However Brexit plays out, Rhian says, “this is a lovely place to raise a family.” A version of this article appears in the December 2019 issue of Fortune with the headline “Brexit Goes Dutch.” |