“没人知道该怎么办”:脱欧问题三年迟迟未决对英国商业有何影响?

|

在三年半前,艾玛·希斯科特-詹姆斯曾经打算把业务拓展到英国以外。 当时,她旗下成立11年的Little Soap公司在英国各地的大型超市和药房销售沐浴用品。下一步很明显,从旁边的爱尔兰开始,进入欧洲的其他地区。 随着2016年6月英国举行公投决定退出欧盟,扩张计划戛然而止。由于公投后英镑贬值,精油等进口产品变得更加昂贵,第一个星期就推高了5%的成本。 Little Soap公司想办法抵消了额外支出造成的影响,但海外扩张的计划泡汤了。 “之前跟我们谈的人全都静下来了。”她说。 然而,希斯科特·詹姆斯认为跟其他公司相比,Little Soap的运气已经不错。该公司的总部位于田园风格的科茨沃尔德地区,过去几年已经扩张到国内的新商店,客户和制造业都在英国,从而避免了英国与欧盟未达成贸易协议便脱欧,产品便无法跨越边境送给用户的巨大风险。 但政府缺乏清晰的准备和沟通,没有为脱欧后的英国做好准备,着实令人沮丧。 “小企业需要确定性,我们却陷入了困境。”希斯科特-詹姆斯说。 在全世界排名第五大经济体的英国,退出欧盟导致的政治瘫痪已有三年,而且还在持续。英国仍然在考虑10月31日要不要退出欧盟,以及达成协议再退还是达不成协议也坚决退。 这只是最近一次期限;3月29日的第一个期限被延长,因为议会一直未能就脱欧计划达成一致。经历种种挫折后,前首相特雷莎·梅辞职,新上台的是鲍里斯·约翰逊,他发誓10月底之前带领英国脱离欧盟,即使此举意味着英国可能因为“无协议”脱欧出现崩溃,重新启用世界贸易组织的贸易规则。 |

Three and a half years ago, Emma Heathcote-James was looking to expand her business beyond Britain. Her 11-year-old Little Soap Company was selling bath products through major supermarkets and pharmacies across the U.K. The next step was obvious. Using neighboring Ireland as a starting point, the company would enter the rest of Europe. The vote for Britain to leave the European Union in June 2016 brought those plans to a screeching halt. As the value of the pound plummeted after the referendum, imported products—including essential oils—became more expensive, pushing up costs by 5% in the first week. The Little Soap Company managed to absorb the added expense, but its export expansion plans evaporated. “Everyone we’d been chatting to went quite quiet,” she says. Heathcote-James considers Little Soap lucky compared to others, however. In the years since, the business, headquartered in the idyllic Cotswolds region, has expanded into new stores domestically; and its customers and manufacturing are both based in the U.K., which insulates it from the bigger risk that products won’t be able to cross borders to reach end users if there's no U.K.-EU trade deal after Brexit. But the lack of clarity and communication from the government on how to prepare for a post-Brexit Britain is frustrating. “Small businesses need certainty, and we’ve just been hanging in limbo,” Heathcote-James says. Political paralysis over an exit from the EU has gripped the world’s fifth-largest economy for three years and counting; the U.K. is still figuring out whether it will leave the EU on October 31, and if it will do so with or without a deal. That is only the most recent deadline; the first of March 29 was extended, as Parliament repeatedly failed to agree on a plan for the country’s departure. After those setbacks, former Prime Minister Theresa May resigned and was replaced by Boris Johnson, who has vowed to take Britain out of the EU by the end of October—even if that means the country crashes out with ‘no deal’, reverting to World Trade Organization trade rules. |

|

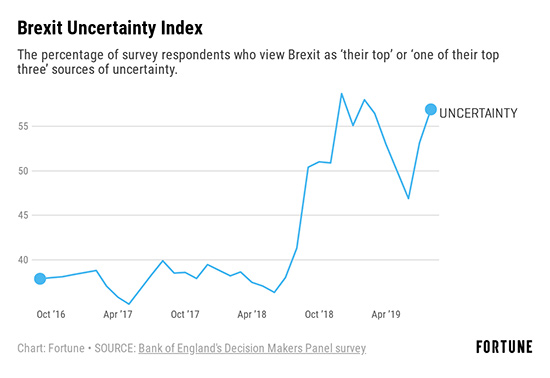

但在约翰逊的领导下,议会只是进一步陷入混乱,随着国会议员排除了“无协议”脱欧的可能,约翰逊暂停了议会,后来英国最高法院宣布非法。 一直以来,脱欧的阴影阻碍了英国企业的运转,因为许多未知数抑制了投资增长,拖累了生产率,也拖延了宝贵的执行时间,原因都是脱欧后英国的前景与公投结果刚出来时一样不明朗。 “没人在做事,因为大家都不知道该做什么。”希斯科特-詹姆斯说。 “脱欧也没有帮助” 说起骇人听闻的经济事件,“脱欧”公投堪称历史性一幕。 不仅脱欧公投出人意料,毕竟民意调查显示三分之二的人预计英国会留在欧盟,由此带来的不确定性持续时间也比预期长,诺丁汉大学的教授保罗·米兹恩表示,他也是2019年8月一项关于脱欧对英国企业影响的研究论文的作者。 “如果想找类似的冲击,唯一真正(可比的)冲击是1929年。”米兹恩说,他在研究中使用了英格兰银行从2016年8月以来收集的企业数据。他表示,1929年的金融危机恰好赶上1930年代大萧条之前的关税和保护主义措施,导致情况加剧。 研究表明,在脱欧公投以来的三年里,投资增长率比起公投结果留在欧盟要低11%。与此同时,生产率下降了多达5%,主要原因是管理者每周都要花几个小时为脱欧做准备。 脱欧并不是罪魁祸首。英国庞大的汽车市场转向柴油车,以及电子商务对传统零售商造成的压力从2016就已经开始加速,导致两个行业的公司收入下降。不过,“脱欧也没有帮助。”米兹恩说。 |

But under Johnson, Parliament has only fallen further into chaos, as Members of Parliament ruled out a ‘no deal’ scenario, and Johnson suspended Parliament—a move the U.K. Supreme Court later declared illegal. All the while, the prospect of Brexit has jammed the gears of British businesses—large and small—as its many unknowns have smothered investment growth, hampered productivity, and sidetracked valuable executive time, all for a vision of post-bloc Britain that's nearly as unclear as it was immediately following the vote. “Nobody’s doing anything, because nobody knows what to do,” Heathcote-James says. “Brexit hasn’t helped” As far as shocking economic events go, the Brexit vote stands out as historic. Not only was the vote to leave the EU largely unexpected—two-thirds of polls predicted Britain would vote to remain—but the uncertainty has lasted longer than anticipated, says Paul Mizen, a University of Nottingham professor and an author of an August 2019 study on the impact of Brexit on British businesses. “If you look at a shock that’s parallel, the only real [comparable] shock is 1929,” says Mizen, whose study used Bank of England data collected from businesses starting in August 2016. The 1929 financial crash was quickly compounded by tariffs and protective measures ahead of the depression of the 1930s, he says. In the three years since the Brexit vote, investment growth was 11% lower than it would have been had voters opted to remain, the study says. Meanwhile, productivity declined as much as 5%, largely due to executives diverting several hours a week to Brexit planning. Brexit isn’t wholly to blame. The shift away from diesel cars in the U.K.’s sizable auto market, as well as pressure from e-commerce on traditional retailers have accelerated since 2016, resulting in falling revenue for companies in both sectors. But “Brexit hasn’t helped,” says Mizen. |

|

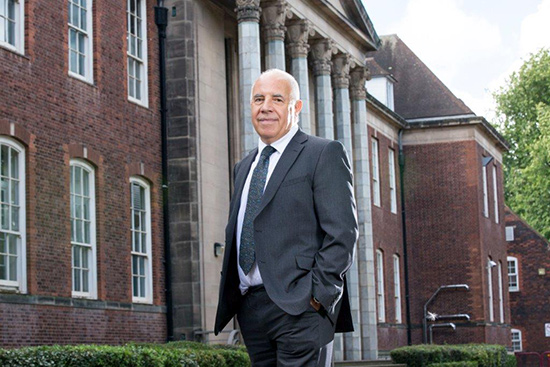

英国与欧盟的分离尚未完成,已然造成了巨额成本,比如在其他国家开设办事处以在欧洲站稳脚跟,还有在3月脱欧截止日期之前囤积库存,即将到来的10月31日截止日期之前还得再囤积。此外,脱欧也影响了投资、工作岗位招聘、扩张计划等,打击了英国企业。 “在某种程度上,还影响了公司与海外竞争对手竞争的能力。”米兹恩说。 “脱欧病” 两年前,收入达2400万英镑的英国材料咨询公司Lucideon开始与其位于特伦特河畔斯托克总部附近的地方政府合作,开设先进的工业陶瓷研究中心。工业陶瓷与装饰陶瓷不同,广泛用于从手机到飞机引擎的各种零部件。 原本该研究中心将涉及4000万英镑的投资,Lucideon打算自己投资1000万英镑。但由于英国没有按计划3月退出欧盟,双方的会议开始很难推进。 “就是无法谈了。”Lucideon的首席执行官托尼·金塞拉表示。“因为几乎每次开会都会出现变化。”脱欧影响了政府的关注点和时间,他说。 |

The U.K.’s split from the EU has yet to be consummated, but it’s already spawned myriad costs for companies, like opening offices in other countries to keep a foothold in Europe, and stockpiling inventory ahead of Brexit’s initial March deadline—and again ahead of the upcoming October 31 cutoff. Plus, it’s hit businesses by way of investments not made, open jobs not filled, and expansions pared back. “To some extent, this is something that’s affecting the firm’s ability to compete with its rivals overseas,” Mizen says. “The Brexit disease” Two years ago, Lucideon—a U.K. materials consultancy with 24 million pounds in revenue—started working with the regional government near its Stoke-on-Trent headquarters to open a research center for advanced technical ceramics. The material, unlike decorative ceramics, is used to make components in everything from mobile phones to airplane engines. The research center was to be a 40 million pound investment, and Lucideon was looking to invest up to 10 million pounds of its own money. But when the U.K. didn’t exit the EU in March 2019 as planned, the meetings started going nowhere. It has “just not happened,” says Lucideon CEO Tony Kinsella. “That’s because almost every meeting gets changed," as Brexit diverts the government’s attention and time, he says. |

|

与此同时,10年前Lucideon有40%的收入来自于欧盟,如今也要调整。自从脱欧公投以来,业务虽然也有所扩张,但主要是在美国和亚洲。现在公司约20%的收入来自于欧洲,远远落后于来自美国的35%。 “脱欧病并没有阻止商业投资,”金塞拉说。“只是在改变资金投向的选择。” 即便如此,目前 Lucideon为脱欧做准备已经花费10万英镑。举例来说,公司在都柏林开设了办事处,作为通往欧盟其他市场的门户。如果出现无协议脱欧的局面,公司将失去欧洲认证机构的证书,进一步打击收入,因为只有获得认证的公司才能够宣布产品符合欧盟规则。 金塞拉乐观地认为,脱欧后的业务发展仍然会保持良好。但持续三年的等候,还有最后期限一再拖延已经让人精疲力竭。 “感觉就像凌迟。”他说。“鉴于议会各种政治闹剧不断,我认为英国希望继续延长(欧盟成员国资格)三、四个月,简直太愚蠢。” 保持沉默 许多大公司向客户和股东保证已经为脱欧做好了准备,但很少有人愿意讨论已经造成的影响。 一家著名的行业协会告诉《财富》杂志,在围绕脱欧高度两极分化的辩论中,许多成员不想因为讨论脱欧潜在的消极影响得罪客户。(协会要求不透露姓名,以便坦率地私下发表观点。) 在《财富》世界500强的17家英国公司中,除一家外,其他公司均拒绝置评,也没有回应《财富》杂志的问询。多家公司表示已经决定不谈论脱欧。(发表评论的只有矿业巨头力拓集团,力拓表示其业务都在英国以外,预计不会受到影响。) 然而,脱欧导致的业务瘫痪迹象比较明显。8月,世界500强排名第90位的汇丰推出10亿美元回购时,首席财务官邵伟信表示,“考虑到脱欧造成的不确定性,回购10亿美元是相当保守之举”,也就是说如果大环境没有那么动荡,回购金额可能更高。2月,世界500强排名第336位的巴克莱表示,已经划拨1.95亿美元应对“硬”脱欧带来的潜在问题,一旦硬脱欧,英国将无法轻易进入欧盟单一市场。 脱欧不确定性的涓流效应之一就是可能影响各种规模的公司,也导致消费者情绪转变。尽管在2016年刚公投之后,英国对产品和服务的需求惊人地强劲,但随后几个月里英国对产品和服务的需求有所下降。 9月,市场研究公司YouGov表示,英国的消费者信心处于六年来的最低点;市场研究机构IHS Markit的报告称,家庭对个人财务的关注度达到了六年来的最高水平;英国工业联合会也表示,8月的零售额下降速度达2008以来最快,此后一直疲软。 “真的值得吗?” 2016年6月,当英国投票决定脱欧时,位于伦敦的汤姆·布朗批发花店的财务总监约翰·戴维森就已经知道,花卉生意将遭逢巨大威胁。 汤姆·布朗花店的收入为1500万英镑,在全国有四家分店,几乎所有花卉都是通过欧盟进口,主要是通过欧洲花卉中心荷兰,进口来源包括南美和非洲。 公投后,随着英镑走软,成本立即飙升。按业内人士的说法,截至今年年底,按枝计算花卉价格上涨了20%。2016年上半年底前,即脱欧公投之前,汤姆·布朗的客户购买的数量较2015年同期增长了6.5%。下半年脱欧公投之后势头急转直下,销售额跌了7.3%。 接下来几年里,花卉销售与英国政治基本保持同步。2017年年底随着脱欧临近销售上涨,2018年继续走强,2019年则变慢。 戴维森表示,伦敦的主店里已经暂时停止招聘。他说最近几个月感觉变得安静,送货速度也有所放缓。 |

Meanwhile, Lucideon—which got 40% of its revenue from the EU ten years ago—was undergoing a shift. Since the Brexit vote, it has expanded, but mostly in the U.S. and Asia. Now, about 20% of its revenue comes from Europe, far behind the U.S.’s 35% share. “The Brexit disease has not stopped the business investing,” Kinsella says. “It’s just shifting where we’ve chosen to put that money.” Even so, preparing for Brexit has cost Lucideon a hundred thousand pounds so far. For instance, it’s opened a Dublin office as a gateway to the rest of the EU market. And in the case of a no-deal Brexit, it would lose its certification as a European Notified Body—a standing that allows it to declare products to be in conformity with EU rules—which would deal another blow to its revenue. Kinsella is optimistic that the business will be fine post-Brexit. But three years of anticipation and deadline delays has been draining. “It’s death by a thousand cuts,” he says. “For all the Westminster political shenanigans, I think the nation wants another three-, four-month extension [to EU membership] like it wants a hole in its head.” Staying mum While many large companies have reassured clients and shareholders that they have prepared for Brexit, few appear willing to discuss the impact it has already had. One prominent trade association told Fortune that, in the highly polarized debate around Brexit, many of its members don't want to run the risk of losing customers by speaking out about potential downsides. (The association asked not to be named in order to candidly express such views, which were spoken in private.) Of the 17 U.K.-based companies on Fortune’s Global 500 list, all but one either declined to comment or did not respond to Fortune's inquiries. Several companies said they had decided not to speak about Brexit at all. (The one company that did comment—mining giant Rio Tinto Group—said its operations are all outside the U.K. and so didn’t expect to be affected.) However, some hints of Brexit paralysis are evident. When HSBC—No. 90 on the Global 500—launched a billion-dollar buyback in August, Chief Financial Officer Ewen Stevenson said the move was “appropriately conservative given Brexit uncertainties”—meaning it might have been bigger if the environment wasn’t so shaky. And in February, Barclays—No. 336—said it had set aside $195 million to cover potential problems arising from a “hard” Brexit, in which the U.K. would lose easy access to the EU’s single market. One trickle-down effect of Brexit uncertainty that’s likely to hit firms of all sizes is the shift in consumer sentiment. Though surprisingly robust immediately after the 2016 vote, British demand for products and services has waned in subsequent months. In September, market researcher YouGov said consumer sentiment in the U.K. was at a six-year low; IHS Markit reported a six-year high in household concern over personal finances; and the Confederation of British Industry said retail sales remained weak, after dropping in August at the fastest pace since 2008. “Is it really worth it?” When Britain voted for Brexit in June 2016, John Davidson, the finance director of London-based Tom Brown Wholesale Florists, knew it would be a major threat to the flower business. With about 15 million pounds in revenue and four locations countrywide, Tom Brown imports almost all of its flowers through the EU—mostly through the Netherlands, Europe’s flower hub, including flowers originally imported from South America and Africa. After the vote, costs immediately jumped as the pound weakened, pushing up the price of flowers—measured in industry parlance by the stem—by as much as 20% by the end of the year. In the first half of 2016—before the Brexit vote—Tom Brown had seen customers buy 6.5% more stems compared to the same period in 2015. Sales in the second half, after the Brexit vote, went in the opposite direction, falling 7.3%. In the following years, flower sales fluctuated alongside British politics: picking up in late 2017 as a Brexit deal seemed imminent, getting stronger in 2018, and then flattening out in 2019. In his key London store location, Davidson says he’s paused hiring for now: in recent months, he says the warehouse feels quieter and deliveries have slowed down. |

|

戴维森说,目前汤姆·布朗店可以在上午11点前从荷兰订购鲜花,12小时后收到,顾客的预期也是如此。脱欧可能导致延迟和额外费用,主要由于脱欧后进口鲜花需要大量文件,而之前只要简单下个订单就行。 “新一代花店越来越少。”他说。“面对种种不确定,老一代花卉商也在想:‘真的值得吗?’” 克服“脱欧疲劳” 其他迹象表明,在过去三年内,招聘、应聘、建筑和房地产方面都付出了代价。 9月,专业人士猎头公司SThree 发布报告称,猎头公司从英国和爱尔兰招聘单位赚取的季度净费用下降了7%,前一季度下降了12%。与此同时,大型合同工机构Staffline发布了盈利警告,称由于需求减少,客户逐渐减少欧盟招纳合同工。 有些公司,特别是科技公司,在招聘时根本找不到求职者。 科技行业协会techUK负责研究脱欧政策的尼尔·罗斯说,作为协会成员之一的一家数据中心运营商最近告诉他,过去两年都没有欧洲大陆的求职者应聘。 “能够招到人才是企业扩张的基础。”罗斯说。 同时,今年9月,建筑和基础设施服务公司Keir Group 警告称,由于客户要等脱欧事项确定,推迟项目关键决策,导致收入持平。 房地产服务公司世邦魏理仕则估计,由于投资者对英国何时脱离欧盟以及退出具体情况心存疑虑,2019年商业地产价值将下跌3.8%。 不过,世邦魏理仕英国研究团队的执行董事迈尔斯·吉布森表示,由于脱欧事项久而未决,一些公司已经决定先采取行动。 “毫无疑问,人们对脱欧都有些厌倦了,只想赶紧做出决定,实在不想再等。”他说。 对于Little Soap公司的希斯科特-詹姆斯来说,只能重新将业务重点放在英国市场,曾经雄心勃勃的海外扩张计划前途未卜。 “先暂停一下吧。”她说。不管怎样,她还是充满希望。毕竟,就算英国退出欧盟,“人们还是要用肥皂的。”(财富中文网) 译者:Charlie 审校:夏林 |

Currently, Tom Brown can order fresh flowers from the Netherlands by 11 a.m. and receive them about 12 hours later—and that’s what customers expect, Davidson says. Brexit could cause delays and additional costs, largely due to reams of paperwork required to import flowers that previously needed only a simple order request. “The newer generation of florists are fewer and far between,” he says. “And some of that uncertainty is making the older generation of florists think, ‘Is it really worth it?’” Fighting off “Brexit fatigue” There are other signs that the last three years have taken a toll, across hiring, recruiting, construction, and real estate. In September, specialist recruiter SThree reported a 7% drop in quarterly net fees—the fees recruiters collect for successful placements—for its U.K. and Ireland unit, after reporting a 12% drop in the previous quarter. Meanwhile Staffline, a major contract-worker agency, issued a profit warning due to reduced demand, noting that its customers were reducing their exposure to temporary labor from the EU. Some companies—especially in tech—simply can’t attract applicants when they want to hire. Neil Ross, the lead on Brexit policy at industry association techUK, said one member of the organization, a data center operator, recently told him it had attracted no job applicants from mainland Europe in the last two years. “Being able to recruit talent is fundamental to companies’ ability to expand,” says Ross. Meanwhile, construction and infrastructure services company Keir Group warned in September of flat revenue due to clients putting off key decisions on projects until they know what’s happening with Brexit. And real estate services company CBRE estimates the value of commercial real estate will fall by 3.8% in 2019 due to investors’ wariness over when Britain will leave the bloc and what the departure will look like. Still, the lengthy duration of the Brexit uncertainty has prompted some companies to move forward regardless, says Miles Gibson, executive director of the U.K. research team at CBRE. “There is no doubt that people are getting a bit of Brexit fatigue, and making decisions anyways, because they can’t wait,” he says. For Heathcote-James of the Little Soap Company, refocusing the business on its existing U.K. market has pushed her once-ambitious export plans into the unknowable future. “That’s on pause for the moment,” she says. Still, she remains hopeful. Even in Brexit Britain, “everyone needs a bar of soap.” |