戴森的进与退|《财富》独家专访

|

今年9月中旬的一天,英国发明家、企业家、亿万富翁詹姆斯·戴森站在一个小型舞台中间,出席公司在巴黎新开旗舰店的盛大开幕式。旗舰店的空间布局更像是高端的艺术画廊,而不是电器市场:哑光的黑色墙壁和天花板、灰色的瓷砖地板,以及放置在白色底座上像雕塑一样展示的新潮小电器。 现年72岁的戴森,身材瘦长、精神矍铄,戴着一副儒雅的蓝框眼镜,穿着一件古铜色的、长及大腿的夹克,让人联想到狂热科学家的实验服。他操着一口标准的英国口音,正在视察公司的最新产品,包括一款使用循环气流来避免热损伤的吹风机、一种利用空气涡流来包裹卷发的整发器、一台无叶片的椭圆形空气净化器(可以吹热风和冷风)、组合式水龙头和干手器等等。这样的产品不胜枚举。在产品清单最后,毫无意外都以无绳吸尘器收尾,因为这是消费者最熟悉的戴森产品。 尽管戴森以现有产品的设计和技术令人称道,但许多参加开幕式的观众都希望他能对一款备受关注、但尚未上市的产品谈谈看法。果然,这位商界巨头说出了他们渴望听到的那个词语:“汽车”。他展示了一张航拍照片,不是一辆汽车,而是位于英国乡村地区的前英格兰皇家空军基地的照片,他的团队一直在那里秘密设计一款电动汽车。“今晚关于车的话题我就说这么多。”他向观众表示。说到做到,他然后开始滔滔不绝地讲述他47岁的儿子兼继承人杰克设计的一款LED灯。 几个星期后,戴森对汽车项目三缄其口的原因变得很清楚:他已经认为汽车项目注定要失败。事实上,当他大张旗鼓地兜售吸尘器和整发器时,他背后的投资银行家们却没能成功地为戴森的电动汽车项目找到买家。戴森已经为电动汽车项目投入了四年时间、数百名工程师和20亿英镑(25亿美元)的精力和投入。10月10日,戴森表示,他的私人控股公司将终止这个项目,在第一款电动汽车下线之前,他就结束了自己的电动汽车梦想。 |

James Dyson, the billionaire British inventor and entrepreneur, is standing on a small stage at the mid-September gala opening of his new flagship retail store in Paris. The space is more high-end art gallery than appliance mart: matte black walls and ceiling, gray tile floors, and stylish gadgets displayed like sculptures, spotlighted on white-topped plinths. Dyson, spry and lanky at 72 years old, is wearing owlish blue-frame glasses and a copper-toned, thigh-length jacket evocative of a mad scientist’s lab coat. In his cut-glass English accent he’s running through his company’s latest wares: a hair dryer that uses circular airflow to avoid heat damage; a hair styler that wraps curls using a vortex of air; a bladeless oval air purifier that blows hot and cold; a combination water faucet and hand dryer. The list goes on, ending, inevitably, with a cordless vacuum cleaner, the category consumers most closely associate with Dyson’s name. For all the eye-catching design and technological wonder of Dyson’s body of work, many in the audience are hoping he’ll make a pronouncement about the one much-discussed Dyson product that’s not yet for sale. Then the great man utters the words they’ve longed to hear: “the car.” He flicks to an aerial photograph, not of an automobile, but of the former Royal Air Force base in rural England where his team has been working in great secrecy to design an electric vehicle. “That’s about all I’ll say about the car this evening,” he declares. True to his word, he pivots to rhapsodizing about an LED lamp designed by his 47-year-old son and heir apparent, Jake. Within weeks, the reason behind Dyson’s reticence becomes clear: He had already decided the car project was doomed. In fact, while he was exuberantly peddling vacuums and hair stylers, his bankers were unsuccessfully scrambling to find a buyer for the electric vehicle program to which Dyson had committed four years, hundreds of engineers, and 2 billion pounds ($2.5 billion). On Oct. 10, Dyson said his privately held company would cease work on the project, ending his electric car dreams before the first model ever rolled off the assembly line. |

|

对于戴森来说,这是一个勇敢的决定,也是一次罕见的公开受挫。戴森及其家人拥有这家以他的名字命名的公司的全部股份。他把自己的声誉押在了这款汽车上,承诺推出一款“截然不同”的汽车,采用“革命性”的电池技术,同时超越更有经验的竞争对手。他还承诺在2021年前将其交付给客户。对于一家新成立的汽车制造商来说,这是一个非常短的时间。最后,懊恼的戴森将退出项目的决定归结为一个简单的商业考量,“这款车在商业上根本不可行。”他在接受《财富》杂志独家采访时表示。尽管戴森公司的一流汽车团队成功地制造出了一款创新型新车,但他不愿以低于成本价的定价出售——他认为竞争对手正在这么做。“这真是个悲剧,真的,因为我们的工程师干得很出色。” 戴森无法生产出可盈利的汽车,充分说明了电动汽车行业目前面临的危险境地,埃隆·马斯克的特斯拉和中国的初创企业蔚来汽车等公司每年都在烧钱数十亿美元,却看不到任何盈利的迹象。这个勇敢但最终失败的项目也充分展示了戴森的个性。戴森是一位与众不同的高管,能够将不切实际的梦想与坚定的财务纪律做很好的平衡。在每家公司都在谈论创新和颠覆的时候,戴森决定放弃自己的电动汽车。这个典型的案例体现出了一种微妙的平衡行为,即在追求创新的同时必须考虑利润。 |

It was a gutsy decision and a rare public setback for Dyson, who, with his family, owns the entirety of the company that bears his name. He had put his estimable reputation on the line with the car, promising a “radically different” vehicle that would feature “revolutionary” battery technology while outperforming more experienced competitors. And he had promised to have it in customers’ hands by 2021, a dramatically short time frame for a neophyte automaker. In the end, a chagrined Dyson says the decision came down to a simple business proposition. “It just wasn’t commercially viable,” he said, in an exclusive interview with Fortune the day after news broke of the car’s demise. Although Dyson’s crack auto team successfully created an innovative new car, he wasn’t willing to price it below cost, as he believes the competition is doing. “It’s a tragedy, really, because our engineers have done a brilliant job.” Dyson’s inability to produce a profitable automobile speaks volumes about the current perilous state of the electric vehicle industry, in which companies like Elon Musk’s Tesla and Chinese startup Nio are burning through billions of dollars annually with no sign of black ink on the horizon. The story of his audacious but ultimately failed project also says much about Dyson, the rare executive who can combine blue-sky dreaming with steely-eyed financial discipline. At a time when every company speaks about innovation and disruption, Dyson’s decision to kill his electric car is a case study in the delicate balancing act of embracing ingenuity while keeping an eye on profits. |

****

|

尽管看起来有些令人难以置信,但詹姆斯·戴森尝试制造全电动汽车有充分的理由。电气化技术发展为汽车行业带来了百年一遇的机遇,戴森并不是唯一发现这一机遇的人。电动传动系统仅需要约20个活动部件,而内燃机汽车则需要2,000多个活动部件——从理论上讲,这降低了准入门槛。更重要的是,特斯拉已经唤醒了“沉睡”中的全球电动汽车行业。几年前,电动汽车行业看起来似乎还有很大的空间有待更多的进入者填补。例如,有传闻称苹果和谷歌也在研发汽车。“任何人都可以制造电动汽车。”资深汽车分析师玛丽安·凯勒说。“这是一个开放的市场。” 戴森认为他比大多数人有更好的成功概率。他的公司蒸蒸日上,2018年的销售额上升25%,达到创纪录的56亿美元。作为彰显身份的消费品牌,在亚洲市场强劲需求的推动下,戴森公司的税前营业利润首次突破10亿美元。通过生产真空吸尘器,戴森公司已经成为全球电动马达的领导者。通过深耕无绳产品,戴森公司对电池也有很深的了解。气流和温湿度控制等关键电动汽车技术也出现在戴森的现有电器产品中。戴森表示:“当我们几乎是偶然地意识到,我们拥有制造电动汽车的技术时,很自然地就会考虑开发电动汽车。”早在2015年,当他第一次构思电动汽车时,戴森就表示,市场上似乎有足够的空间让他重新思考电动汽车的模样。他表示:“你必须记住,四五年前,只有特斯拉存在。所以那是一个非常不同的环境。” 这位发明家的职业生涯就是不断证明质疑者的错误。从1974年发明的独轮车开始,他成功地重塑了一个又一个普通的家用产品。他通过无袋吸尘器成名并获得大量财富,这种吸尘器利用“旋风”效应从空气中除尘。1993年他推出真空吸尘器,其特点是装有一个透明的垃圾箱,可以让用户看到你到底吸了多少灰尘(值得一提的是,他拒绝了营销专家的建议,后者曾经告诉他,没有人会买一个展示灰尘的真空吸尘器)。新型产品还包括了一些改进,比如对球形把手的改进,以便在狭窄的角落里移动机器。公司通过电动机研究让细长的无绳直立装置得以实现。戴森还善于将自己的专业知识扩展到新的领域,比如Airblade干手器、无叶片风扇和空气净化器。 尽管汽车产品对戴森公司看起来像是一种跨界,但戴森多年来一直致力于设计一款汽车,部分原因是他渴望发明一种针对内燃机排放污染的解决方案。针对柴油发动机的气味和烟雾,他在20世纪80年代末和90年代初基于无袋真空吸尘器技术开发了一种过滤器,用于过滤卡车排放中的颗粒物。但是货运公司拒绝购买,戴森认为原因是他们不想清洗过滤器。他还指责英国和欧洲的监管机构,尽管有大量科学证据证明柴油对健康有害,但他们坚持认为柴油“绿色环保”。戴森表示:“有一种被抛弃的感觉。”他承认自那以后对新技术的探索“一直处于蛰伏状态”。出于某些不确定的原因,他启动了一些大型项目。 詹姆斯·戴森 这位72岁的英国发明家在他成年后一直在创新。他的新发明从园艺行业到发型设计。 发明家 戴森的第一个成功之作出现在1974年,那是一辆经过重新设计的独轮车,用塑料球代替了狭窄的橡胶轮,塑料球可以防止独轮车陷入泥泞的地面。他称之为“球轮手推车”。 然后戴森将注意力转向无袋吸尘器。他花了10年时间来完善他的产品设计,先后做出了5,127个原型机,最终成就了他的名声和财富。 环保主义者 几十年来,戴森一直对污染问题感到担忧,但并非出于对全球变暖的担忧。他讨厌欧洲流行的柴油发动机排放到空气中的废气。“我讨厌那种味道,”他说。“我讨厌黑烟。” 他开发了一种过滤器来过滤柴油发动机的颗粒物,但无法说服卡车运输公司购买。他从来不喜欢使用化石燃料的发动机。 土地所有者、慈善家、爱国者 除了日常工作,戴森还经营着一家盈利的农业企业。他拥有的农田比英国其他任何人都多,包括英国女王伊丽莎白二世。 他的詹姆斯戴森基金会(James Dyson Foundation)在27个国家开展年度奖励计划,评选最具创新性的发明。为了培养更多的英国工程师,他创办了詹姆斯戴森学院(James Dyson Institute),为本科生提供免费的工程学位教育和工作经验。 他还喜欢在位于伦敦以西100英里的威尔特郡农村的公司园区展示其他英国发明家的作品。作为英国脱欧的支持者,戴森将总部迁至新加坡的计划遭到了批评。 秘密守护者 戴森公司是一家拥有14,000名员工的企业,是一家对保护公司机密几乎偏执的企业。这种行为最早可以追溯到与苹果竞争的Ballbarrow(球轮手推车)的设计遭到盗版的时代。它是专利保护的积极诉讼方,曾经与胡佛(Hoover)和三星(Samsung)等公司打过专利官司。员工们在工作中通常只允许了解和自身工作相关的内容,不允许在团队之外讨论项目,包括在公司食堂。 |

Improbable though it seems in retrospect, there were good reasons for James Dyson to attempt to make an all-electric automobile. Electrification presented a once-in-a-century opportunity in the auto industry, one that Dyson was not alone in spotting. Electric powertrains require only about 20 moving parts compared with more than 2,000 for cars with internal combustion engines—a fact that theoretically lowers barriers to entry. What’s more, Tesla had caught the global automotive industry sleeping on EVs, and several years ago, it looked as if there was room for more entrants. Apple was rumored to be working on a car, for example, as was Google. “Anybody can build an electric car,” veteran automotive analyst Maryann Keller says. “It’s an open playing field.” Dyson thought he had a better shot than most. His company was thriving, with 2018 sales jumping 25% to a record $5.6 billion. Pretax operating profits topped $1 billion for the first time, driven by strong demand in Asia, where Dyson is a status-conferring consumer brand. Through its vacuums, Dyson’s company already was a global leader in electric motors. It knew batteries too, thanks to its cordless products. Key EV concepts like airflow and climate control also were present in all of Dyson’s appliances. “When we realized, almost by accident, that we had the technology to build an electric car, it was natural to go into it,” Dyson says. Back in 2015, when he first conceived of it, Dyson says there seemed to be ample room in the market for a chassis-to-moonroof rethink of what an EV should be. “You have to remember that four or five years ago, only Tesla was on the scene,” he says. “So it was a very different sort of environment.” The inventor had made a career of proving skeptics wrong. He’d successfully reimagined one mundane household product after another, starting with an innovative wheelbarrow in 1974. He’d made his name and fortune with the bagless vacuum cleaner, which used a “cyclone” effect to draw dust out of the air. Launched in 1993, the vacuums featured a transparent bin that let you see exactly how much dust you’d sucked up. (He famously overruled marketing experts who told him no one would buy a vacuum that showcased the dirt.) New models included advancements such as ball-like handle attachments for maneuvering into tight corners. Slim cordless uprights were made possible by the company’s electric motor research. Dyson was also adept at extending his expertise into new categories, like the Airblade hand dryer as well as bladeless fans and air purifiers. While a car may have looked like a leap, Dyson had been building up to designing one for years, in part because of a hankering to invent a solution for the pollution-spewing internal combustion engine. Affronted by the smell and smoke from diesel engines, in the late 1980s and early 1990s he developed a filter for the particulate belched by trucks, based on technology used in his bagless vacuum. But trucking companies refused to buy it, he says, because they didn’t want to have to empty the filter. He also blames U.K. and European regulators who insisted that diesel was “green and clean,” despite abundant scientific evidence of ill-health effects. “There was a sort of jilted feeling,” he says, acknowledging his search for new technology “has been lurking” ever since. Grand projects have been started for shakier reasons. James Dyson At 72, the British inventor has been innovating his whole adult life. His contraptions span from gardening to hair styling. Inventor Dyson’s first hit came in 1974, a redesigned wheelbarrow that replaced the typical narrow rubber wheel with a plastic sphere that resisted sinking into muddy ground. He called it the Ballbarrow. Dyson then turned his attention to the bagless vacuum. It took a decade and 5,127 prototypes to perfect his design for the product that ultimately would make his name and fortune. Environmentalist Dyson has been worked up about pollution for decades, but not out of concern for global warming. He loathed the exhaust spewed into the air by diesel-burning engines popular in Europe. “I hated the smell,” he says. “I hated the black smoke.” He developed a filter to capture diesel particulates but couldn’t persuade trucking companies to buy it. His dislike of fossil-fuel burning engines persisted. Landowner, philanthropist, patriot Aside from his day job, Dyson runs a profitable agriculture business. He owns more farmland than anyone else in the U.K., including Queen Elizabeth II. His James Dyson Foundation runs an annual award program in 27 countries, in search of the most innovative inventions. To train more U.K. engineers, he founded the James Dyson Institute, which offers undergraduates free engineering degrees and work experience. He also likes to display the work of other British inventors on the grounds of his company’s corporate campus in rural Wiltshire, 100 miles west of London. A Brexit supporter, Dyson had critics who chafed at his plans to relocate HQ to Singapore. Secret Keeper Dyson is a 14,000-person company whose paranoia for protecting corporate secrets, dating back to piracy of the Ballbarrow’s design, rivals Apple’s. It is an active litigant on its patent portfolio, having tussled with the likes of Hoover and Samsung. Employees generally operate on a “need to know” basis and are expected not to discuss projects outside their teams, including in communal cafeterias. |

****

|

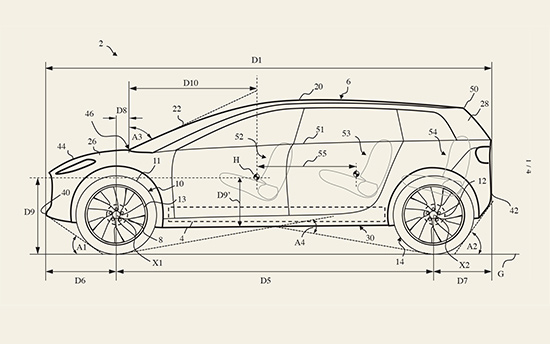

从阿斯顿·马丁和捷豹路虎等汽车公司招募了一批行业资深人士后,戴森公司于2015年正式启动绝密的汽车项目。这家公司习惯于秘密经营。戴森早年作为发明家的痛苦经历(竞争对手窃取了他的独轮车设计),让这位企业家变得谨慎多疑。在产品信息公开之前,公司内部对这款汽车产品只有一个编号(这款失败的汽车的早期版本叫做“N526”)。此外,公司通过指纹扫描仪控制着进入实验室的入口。 但这次秘密泄露了。英国政府在其网上发布的一份产业战略报告中无意中透露了戴森在电动汽车方面的工作,包括已经开展的工作,以及不断扩大的投入——其中包括耗资2亿英镑翻新旧的英国皇家空军机场作为汽车项目的设计和测试中心,并雇佣了数百人——迫使戴森必须做出澄清说明。2017年9月,他在伦敦举行了一场新闻发布会,正式宣布了这个项目,并承诺投入20亿英镑,其中10亿英镑用于在电池技术上取得突破。 汽车专家认为,与打造一款新车所需的成本相比,这个数字微不足道。但这比戴森花在其它新产品研发上的钱要多几个数量级。例如,公司于2016年推出的超音速吹风机耗时四年,开发成本仅为7,100万美元。许多人还怀疑戴森的前提——即把其它产品的技术诀窍转移到电动汽车。“电动汽车不仅仅是一个大吹风机。”美国能源部阿贡国家实验室能源存储研究联合中心主任乔治·克拉布特里说。 戴森并没有因此而感到沮丧。公司致力于从基本原则重新思考汽车,而这一原则是戴森在家用产品领域取得成功的基础。戴森说:“我们想改变一切,而不使用其他人的基础架构。”公司将在内部设计电动汽车的所有组件,从电动机到挡风玻璃雨刷。戴森的技术研究总监安德鲁·克洛西尔说:“如果你看看其他汽车公司的运营方式,就会发现他们把零部件视为黑匣子。”他们从货架上购买零件,然后把它们组装起来。他说,这样做成本更低,速度更快,但却以牺牲创新为代价。戴森将尝试一种完全不同的方法。(特斯拉也设计了自己的电动机、电池组和充电器。) 今年5月公布的专利文件显示,戴森的团队设计的汽车大小和路虎揽胜差不多,但轴距更长,车顶轮廓线更低,车头很短,导致挡风玻璃严重倾斜。戴森说,目前的长轴距对于容纳一个非常大的电池组是必要的,这将使该款汽车比目前市场上的任何电动汽车都具有更长的续航里程。轮胎也比平时更高更窄,这样降低了滚动阻力,留出了更多的内部空间,并且允许更低的轮胎压力,提供了更舒适的乘坐体验。“我们追求的是更高的空气动力学效率、滚动阻力效率、电动机效率和电池效率。”戴森说。 如今,道路上的每辆电动汽车都使用“湿式”锂离子电池。在这种电池中,锂与其他金属(通常是镍、锰和钴)混合制成的阴极通过电解液与石墨阳极分离。这些电池效率高,但充电时间长,而且容易着火。戴森认为,他可以通过使用固态电池来获得优势。这种电池可以用陶瓷材料替代液体电解质,并使用纯锂金属阳极,是电动汽车的理想选择。它们的能量密度更大,这意味着它们将大大扩展汽车的续航里程。它们的充电速度也更快、更安全。 去年,戴森选择新加坡作为他未来的电动汽车工厂的所在地。这家公司已经在邻国马来西亚生产其他产品,并将该地区视为汽车的主要潜在市场。然后,在今年初,戴森宣布将全球公司总部也迁至新加坡。这位创始人在新加坡购置了一套价值5,400万美元的顶级公寓。一些小报视其为背叛行为并对这位企业家进行了谴责,因为他曾经呼吁重振英国工业实力,并且是英国脱欧的重要支持者。戴森指出,他在英国仍有5,000名员工。 |

Work on the top-secret car program began in earnest in 2015, as Dyson recruited auto industry veterans from Aston Martin and Jaguar Land Rover. The company is accustomed to operating clandestinely. Bitter experience from Dyson’s earliest days as an inventor, when he says a competitor pinched his wheelbarrow design, taught the entrepreneur to be paranoid. Products inside the company are known only by a number until they are publicly unveiled. (An early version of the doomed car was called “N526.”) Fingerprint scanners control access to labs. But this time the secret got out. The U.K. government accidentally revealed Dyson’s work on an electric car in an industrial strategy report it published online. That, and the increasing scale of the endeavor—which included a 200-million-pound refurbishment of the old RAF airfield to serve as the design and testing hub for the car and the hiring of hundreds of people—forced Dyson to come clean. In September 2017, he held a press conference in London to officially announce the project, saying he was committing 2 billion pounds to the endeavor, including 1 billion aimed at producing a breakthrough in battery technology. Automotive experts thought the sum was paltry compared with what would be needed to build a car. But it was orders of magnitude bigger than anything Dyson had ever spent on a new product. Its Supersonic hair dryer, for instance, which it launched in 2016, had taken four years and cost $71 million to develop. Many also doubted Dyson’s premise that its technical know-how would transfer to electric cars. “An electric vehicle is not just a big hair dryer,” says George Crabtree, director of the U.S. Department of Energy’s Joint Center for Energy Storage Research at the Argonne National Laboratory. Dyson was undeterred. The company was committed to rethinking the car from first principles—a philosophy that had underpinned Dyson’s success in household products. “We wanted to change everything and not use other people’s architectural layout,” Dyson says. The company would design all its components in-house, from motors to windshield wipers. “If you look at the way other auto companies operate, they treat components as black boxes,” says Andrew Clothier, Dyson’s director of technical research. They buy parts off the shelf and bolt them together. That’s cheaper and faster but comes at the expense of innovation, he says. Dyson would try a completely different approach. (Tesla also designs its own electric motors, battery packs, and chargers.) The car Dyson’s team came up with was about the size of a Range Rover but with a longer wheelbase; a lower roofline; and a short, stubbed nose leading to a dramatically sloped windscreen, according to patent filings made public in May. Dyson says now the long wheelbase was necessary to accommodate a very large battery pack that would have given the car more range than any EV currently on the market. The tires were taller and narrower than usual too. That reduced rolling resistance as well as accommodating more interior space and, by allowing for lower tire pressure, provided a more comfortable ride. “We were after aerodynamic efficiency, rolling resistance efficiency, electric motor efficiency, and battery efficiency,” Dyson says. Every EV on the road today uses “wet” lithium-ion batteries, in which a cathode made of lithium mixed with other metals (usually nickel, manganese, and cobalt) is separated from a graphite anode by an electrolyte solution. These cells are efficient but take time to charge and are prone to catching fire. Dyson thought he could gain an edge by using solid-state batteries instead. Such batteries, which replace the liquid electrolyte with a ceramic material and use a pure lithium metal anode, are the Holy Grail for EVs. They pack more power for their weight, meaning they would vastly extend the car’s range. They also charge far faster and are much safer. Last year, Dyson selected Singapore as the site for his future EV factory. The company already made its other products in neighboring Malaysia, and it saw the region as a key potential market for the car. Then, earlier this year, Dyson announced it would shift its global corporate headquarters to Singapore too. The founder bought a $54 million penthouse apartment in the city-state. Tabloids leveled accusations of betrayal at the entrepreneur, who had called for a revival of British industrial prowess and is a prominent proponent of Brexit, the U.K.’s decision to leave the European Union. Dyson notes he continues to employ 5,000 people in the U.K. |

****

|

一直以来,詹姆斯·戴森都知道这个项目可能比他之前尝试过的任何项目都要困难。那是在通用汽车、大众汽车等知名汽车制造商全力投入电动汽车之前。他知道自己必须花很多钱,而且没有经销商网络,他将不得不依靠数字渠道直接销售,就像特斯拉一样,并找到一种方式来为汽车售后服务提供支持。但他没有想到这项任务会如此艰巨。 最令人生畏的是行业竞争。欧洲和中国的监管机构在未来几十年禁止汽油发动机的举措,成为主要汽车制造商投身电动汽车的催化剂。预计在未来十年中,它们将共同为电动汽车开发注入3,000亿美元。此外,戴森的团队突然面临资金问题,而此时正是在新加坡开始安装制造设备的时候。“从头开始做所有事情可能会增加成本。”戴森反思到。他还说,由于公司无法保证大批量生产,因此无法像在数十年的家用电器行业中那样与供应商达成最佳协议。 而且,在没有透露任何细节的情况下,他承认公司想要使用的电池价格高于行业标准。 戴森一直都知道他的车不便宜。他之前曾经对记者开玩笑说,相较于汽车价格,可能更合适的话题是购买一辆车所需的首付金额。没有最贵,只有更贵。戴森表示,如果他的电动汽车要盈利,就必须进入“高端市场”。虽然他拒绝透公司正在考虑的定价,但特斯拉Model X的起价约为10.4万美元,位于加州的中资初创企业Faraday Future正计划推出一款超豪华SUV,售价可能高达18万美元。戴森表示:“在这个价位上,我们可以卖出一些汽车,但不够数量。” |

All along, James Dyson knew this project was likely to be harder than any he’d attempted previously. And that was before automakers like General Motors, Volkswagen, and others committed wholeheartedly to EVs. He knew that he’d have to spend a lot of money and that without a dealer network, he would have to rely on direct sales through digital channels, much like Tesla, and find a way to support and service the cars in the aftermarket. But he was unprepared for just how tough the task would prove to be. Most daunting was the competition. European and Chinese regulatory moves to ban gas engines in coming decades acted as a catalyst for major automakers. Together, they are expected to pump $300 billion into electric car development in the next decade. Suddenly, Dyson’s team faced a financial reckoning just as it was time to begin installing manufacturing equipment in Singapore. “Doing everything from scratch probably put up the cost,” Dyson reflects. He also says that because the company could not guarantee high volumes, it could not strike the best deals with suppliers, as it had throughout decades of building appliances. And, without revealing any details, he admits the battery that the company wanted to use was more expensive than industry standards. Dyson always knew his car wouldn’t be cheap. He had previously joked to reporters that it might be more appropriate to talk about the size of the down payment required to buy one rather than the sticker price. But there’s expensive, and then there’s exorbitant. If his EV were to turn a profit, it would have to enter the market “right at the top end,” Dyson says. While he declines to reveal the price the company was considering, the Tesla Model X starts at about $104,000, and Faraday Future, a Chinese-backed startup in California, is planning to launch an ultraluxury SUV that may cost as much as $180,000. “It’s a price where we could sell some but not enough,” Dyson says. |

|

不过最后,戴森并没有对已经投资于汽车项目的亏损感到心疼。他说:“这不是一次投资行为,我们对此有心理准备。”在财务上持保守态度的戴森表示,他绝不会为了自己汽车项目而让公司陷入财务危机。截至2018年年底,戴森的债务约为3.68亿英镑(合4.92亿美元),处于可控状态,大部分是长期债务。他拒绝过度杠杆化,或上市,因为这将削弱他的控制权。他说:“我们不能无限地使用股东资金,也没有募集股东资金的潜力。我们是一家家族企业。” 戴森表示,他关注的是汽车的“BAM”——汽车的制造成本和材料成本,因此他必须对汽车定价,以获得可接受的利润率。让戴森担心的不是竞争对手动辄在电动汽车上数十亿美元的投资,而是他们愿意亏本出售汽车。咨询公司Navigant负责跟踪电动车行业的分析师萨姆·阿布萨米德表示,一辆普通电动汽车的盈亏平衡点在8万美元左右。奔驰、宝马和捷豹今年都推出了电动豪华SUV,起价约为7万美元。特斯拉和蔚来汽车正在以这个价格的一半销售面向大众市场的电动汽车(特斯拉2018年的投入达到35亿美元,超过戴森对其整个电动汽车项目的预算)。戴森担心他的电动汽车相比之下会贵得多。 戴森在之前曾经面临过类似的困境。2000年11月,公司推出了一款名为Contrarotator的洗衣机。产品采用了一个巧妙的设计——两个朝相反方向旋转的鼓。但戴森表示,与汽车一样,公司新颖的设计和较低的销量让它在与供应商的竞争中几乎没有优势。他表示:“我发现,它的制造成本至少是传统洗衣机的2.5倍。”最终,戴森以大约1,000英镑(当时约合1,500美元)的价格出售这种洗衣机,至少比竞争对手高出30%。即便如此,每台洗衣机都是赔钱的。最终,在2005年,公司决定停止生产。戴森发誓再也不会以低于成本的价格出售产品。 在决定放弃电动汽车项目之前,戴森聘请投资银行家试图出售项目。“他们接触过‘所有你能想到的人’,戴森说。(英国《金融时报》报道称,捷豹路虎就是其中之一。)但没有一个人愿意接手。“我们没有和任何人达成协议。”他说。9月下旬,戴森做出了最终的决定,放弃该项目。 实际上,扼杀新产品对于戴森来说并不罕见。戴森公司的创意总监斯蒂芬·库特尼说:“这令人心碎。但这是研发工作的本质。”通常,这家低调的公司会在私下里悄无声息接受失败。但在电动汽车项目上,竞争对手、变速器专家、电池专家和财经记者都在密切关注着它的一举一动。“这是我们做过的最艰难的决定。”戴森说。“很多设计师和工程师都为此付出了很多努力,但却没有看到成效。”公司计划为开发这款车的523名员工尽可能地在其他部门找到岗位。但是并没有足够的岗位能够容纳所有人。 |

At the end of the day, Dyson didn’t blink at the “sunk costs” of capital already invested in the car project. “It wasn’t the investment at all,” he says. “We’d already committed that.” Fiscally conservative, Dyson says he would never consider putting his company in financial jeopardy for the sake of his car. At the end of 2018, Dyson’s debt was a manageable 368 million pounds ($492 million), most of it long term. He refused to over leverage Dyson or take it public, which would dilute his control. “We don’t have endless shareholders’ money or the potential to raise shareholders’ money,” he says. “We’re a family business.” Dyson says he focused on “the BAM”—the build and materials cost—of the car and therefore where he’d have to price it to earn an acceptable margin. What worried Dyson wasn’t the billions competitors were investing in EVs; it was their willingness to sell cars at a loss. Sam Abuelsamid, an analyst who tracks the EV sector for the consulting firm Navigant, says the break-even price for a generic electric car is about $80,000. Mercedes, BMW, and Jaguar all have electric luxury SUVs entering the market this year with a starting price of around $70,000. And Tesla and Nio are selling mass-market electric cars at half that price. (Tesla’s burn rate hit an annual pace of $3.5 billion in 2018—more than Dyson had pledged to its entire EV project.) Dyson feared his EV would look even pricier in comparison. Once before, Dyson had faced a similar dilemma. In November 2000, the company unveiled a washing machine called the Contrarotator. The ingenious design had two drums that spun in opposite directions. But, as with the car, Dyson says, the company’s novel design and low volumes gave it little leverage with suppliers. “I worked out it cost at least two-and-half times more to make than a conventional washing machine,” he says. Ultimately, Dyson sold the washers for about 1,000 pounds ($1,500 at the time), at least 30% more than competitors’, and even then it lost money on every one. Eventually, in 2005, the company decided to discontinue it. Dyson vowed never to sell a product below cost again. Before deciding to abandon the car, Dyson hired bankers to try to sell the division. They approached “all the people you might imagine,” says Dyson. (The Financial Times reported Jaguar Land Rover was among them.) No one bit. “We didn’t really get close to anyone,” he says. In late September, Dyson made the fateful decision to pull the plug. Killing fledgling products actually isn’t that unusual for Dyson. “It’s heartbreaking,” says Stephen Courtney, Dyson’s concept director. “But it is sort of the nature of working in research.” Normally, the buttoned-up company fails privately and quietly. With the EV, competitors, gearheads, battery experts, and business journalists were scrutinizing its every move. “It was the hardest decision we’ve ever had to make,” says Dyson. “So many designers and engineers have put so much effort into it, and it hadn’t seen the light of day.” The company plans to find roles elsewhere for as many as possible of the 523 employees who worked on the car. But there won’t be room for all of them. |

****

|

戴森公司位于伦敦西部约100英里处的马姆斯伯里(Malmesbury)企业园区占地67英亩,巧妙的经典工业设计实例在其间随处可见,其中包括亚力克·伊西戈尼斯最初设计的Mini Cooper(它被一分为二,以展示其对室内空间的巧妙利用)、一辆本田Super Cub摩托车以及两架英国战机。总有一天,戴森公司的电动汽车原型会加入它们的行列。与此同时,已经有迹象表明,公司在汽车领域的努力不会白费。 在戴森公司受人关注的镜面玻璃D9研究实验室后面,正在建造一座没有窗户的工业厂房。在那里,公司已经建造了欧洲最大的固态电池先进原型实验室。除了电动汽车,固态电池在从移动电话到消费类电子产品再到飞机等的各个领域里都有潜在的用途。戴森表示,他将继续在这些领域投资。戴森的能源储存产业化主管迈克·伦德尔表示:“我们认为,我们已经取得了突破性和革命性的成果。”名为D9A的新电池原型工厂应该能够让戴森“尽快将固态电池推向市场,”伦德尔说。 公司还在汽车领域以外的机器人领域大举投资。在神秘的D9大楼的一个区域内,一个由65名机器人研究人员组成的团队正在研究机器人,其中大部分隐藏在防水油布下,供记者参观。从有限的几件可视的东西——像那把奇怪的棕色大扶手椅放在一张桌子上,以及桌子上有个大东西藏在一张床单下面——就可以清楚地判断,这并不是现有的机器人吸尘器——戴森360 Eye的改进。戴森的机器人研究主管文森特·克莱克曾经领导过软银的仿人机器人Pepper和Romeo的设计。戴森是在开发一个完全仿人的机器人管家还是女佣?克莱克拒绝透露,尽管他承认公司正致力于让机器人感知三维世界。 在宣布退出汽车项目的第二天,戴森似乎闷闷不乐,但依然很平静,充满哲理。他谈到自己的在研产品时,包括那些可能会从汽车项目研究中得到启发的小电器时说:“目前我们有很多令人兴奋的产品,退出汽车项目的一个好的方面是我们可以专注于这些产品的开发。”戴森可能错过了击败竞争对手亿万富翁埃隆·马斯克的机会。但这位发明家似乎急于回到实验室,把自己的名字写在另一个突破性的产品上。(财富中文网) 本文另一版本登载于《财富》杂志2019年11月刊,标题为《詹姆斯·戴森的电动汽车之殇》。 |

Dyson’s 67-acre corporate campus in Malmesbury, about 100 miles west of London, is sprinkled with iconic examples of ingenious industrial design, among them an original Alec Issigonis–designed Mini Cooper, bisected to show off its clever use of interior space; a Honda Super Cub motorcycle; and two British fighter jets. One day a prototype of Dyson’s electric car may join them. In the meantime, there are already hints that the company’s automotive efforts won’t be wasted. In a windowless industrial shed being constructed behind Dyson’s striking mirrored-glass D9 research lab, the company has built the largest advanced prototyping lab for solid-state batteries in Europe. Beyond EVs, solid-state batteries have potential uses in everything from mobile phones to consumer electronics to aircraft. And Dyson says it will continue its investment in them. “We think we’ve got something that is groundbreaking and revolutionary,” says Mike Rendall, Dyson’s head of energy storage industrialization. Called D9A, the new battery prototyping facility should enable Dyson “to bring solid-state batteries to market as soon as possible,” Rendall says. The company is also investing heavily in robotics with uses beyond automobiles. Inside a section of the secretive D9 building, a team of 65 robotics researchers are working on machinery, much of it hidden under tarps for a journalist’s visit. It is clear from what little is visible—like the big brown armchair, curiously perched on a table, upon which sits something big under a sheet—that it is not simply an evolution of its existing robot vacuum cleaner, the Dyson’s 360 Eye. Dyson’s director of robotics research, Vincent Clerc, previously led SoftBank’s design of its humanoid robots Pepper and Romeo. Is Dyson developing a fully humanoid robot butler or maid? Clerc won’t say, although he allows that the company is focused on getting robots to perceive the world in three dimensions. The day after canceling the car, Dyson seems subdued but philosophical. “There’s lots of exciting stuff,” he says of his product pipeline, including gadgets that may benefit from the automotive research. “And the silver lining of this horrible decision is we can concentrate on those.” Dyson may have missed his chance to beat rival billionaire Elon Musk. But the inventor seems eager to get back to the lab and put his name on yet another breakthrough product. A version of this article appears in the November 2019 issue of Fortune with the headline “James Dyson's Electric Shock.” |