商业信心缘何急剧缩水?混乱局面是元凶

|

近日里,我们很难再看到一个乐观主义者。 |

It’s hard to find an optimist these days. |

|

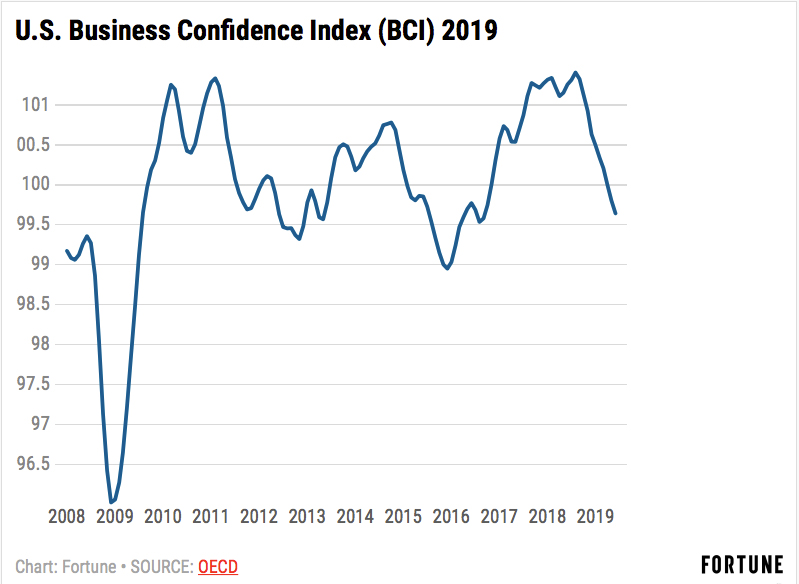

由商业信心指数(Business Confidence Index, BCI)衡量的商业信心在今年6月同比下滑1.3%。当月的信心指数仅有99.82,低于100的基准线,表明企业对未来抱有悲观情绪。 这些数值表明贸易对支出和供应链动态的影响导致了不确定性。Pacific Life Fund Advisors的资产分配主管马克思·高克曼在照会中对《财富》杂志表示,对于贸易的担忧是“商业信心低迷的关键”,如果放任情况恶化,恐怕会“加剧经济衰退”。 担忧的原因主要包括以下几个方面。 美国服务业的增长率在今年7月跌至三年来的最低点,许多人从整体经济中感受到了日益强大的焦虑,这在业务订单中得到了体现。更糟的是,制造业的增速放缓已经影响了非制造行业。供应管理协会(Institute for Supply Management, ISM)在8月5日发布的报告显示,美国非制造业指数从6月的55.1下滑至7月的53.7(这是2016年8月以来的最低值),而7月的非制造业商业活动较之上月也有5.1%的减少。 BMO Capital Markets的美国利率策略主管伊恩·林根在照会中写道:“对于一个严重依赖服务行业的经济体而言,现在公布的数据令人尤其不安。” 林根没有说错——美国经济有70%由服务业构成,服务业的增长放缓,表明企业对贸易状况感到担忧,并会在面临中国的不确定性时继续保持谨慎。此外,富国银行投资研究所(Wells Fargo Investment Institute)的投资战略分析师彼得·唐尼萨努在给《财富》杂志的照会中指出:“尽管服务业的采购经理人指数(PMI)直到近期还有上扬,但它未来的疲软预示着美国经济有进一步下行的风险。” 罪魁祸首在于不确定性 克莱顿大学(Creighton University)海德商学院(Heider College of Business)的金融学教授罗伯特·约翰逊表示:“混乱局面让商业计划难以确定。”他在照会中对《财富》杂志表示,这是招聘岗位减少、支出降低的原因。他还认为关税“对公司盈利造成了压力,公司业绩不景气的可能性也有所提高”。 尽管美国的就业数据依旧相对强劲,但去年起员工薪水的增长已经有所放缓,许多专家认为这可能也是贸易问题所致。 SLC Management投资策略主管迪克·穆拉基对《财富》杂志表示:“如果你接触过那些担忧未来走向何处的公司,他们会在招聘时保持谨慎,这会导致失业率提升,消费者也会开始退却。” 此外,标普全球评级(S&P Global Ratings)的全球企业资本支出调查显示,资本支出在去年涨幅仅为2%,预计在2019年的涨幅也仅有3%。标普全球评级的加雷斯·威廉姆斯写道,疲弱的资本支出“在多年的刺激之后已经瘫软无力,这意味着资本支出在维持现有经济循环上提供不了太大帮助”。SLC的穆拉基认为在中美关系有着更明晰的道路之前,公司不会在资本支出上进行投入。 此外,摩根士丹利(Morgan Stanley)认为,由于最近一轮加征关税的商品中有三分之二都是日用消费品,新关税可能“比起之前几次,会给美国带来更加显著的影响”。摩根士丹利的首席经济学家查坦·阿亚在给投资者的照会中如此说道:“贸易紧张推动着企业信心和全球增长走向多年来的最低水平。”根据最近一篇报告,摩根士丹利认为商业信心衰减已经给经济增长和业绩疲软造成了影响。“” Bankrate.com的首席经济分析师马克·哈姆里克对《财富》杂志表示,他认为随着企业开始权衡如何行动,最近的贸易战升级“改变了消费者承担的张力点”。 不过,尽管经济增长放缓,但美国经济整体仍然处于扩张态势(相关指标都还处于50以上)。虽然出现了紧张迹象,但伴随着勉强超过50基准线(53.7)的服务业增长指数,经济扩张仍在继续。(财富中文网) 译者:严匡正 |

Business confidence, measured by the Business Confidence Index (BCI), decreased some 1.3% in June from the same month last year. And according to the index, June’s 99.82 reading is just below the 100-mark, indicating a pessimistic bent. Those numbers reflect uncertainty over how trade may affect expenditures and supply chain dynamics. Max Gokhman, head of asset allocation at Pacific Life Fund Advisors, told Fortune in a note that trade concerns are “paramount to souring business confidence,” and could “hasten the downturn” if they escalate. There are a few main causes for concern. Growth in the U.S. services sector slowed to three-year lows for July, as business orders reflect the anxiety many are increasingly feeling toward the overall economy. And to make matters worse, slowing manufacturing growth has bled into non-manufacturing sectors as well. According to the Institute for Supply Management’s (ISM) report released on August 5, July U.S. non-manufacturing index growth decreased from 55.1 in June to 53.7 (the lowest reading since August 2016), and non-manufacturing business activity also decreased by 5.1% from June readings. “For an economy that is so heavily dependent on the service sector, this is a particularly troubling release,” Ian Lyngen, head of U.S. interest rates strategy at BMO Capital Markets, wrote in a note. And Lyngen is right—the services sector comprises 70% of the U.S. economy, and slowed growth signals corporations are concerned about trade and could continue being cautious in the face of China uncertainty. And “while buoyant until recently, further weakness in services sector PMI readings could yet portend further downside risks to the U.S. economy,” Peter Donisanu, investment strategy analyst at Wells Fargo Investment Institute, told Fortune in a note. The culprit: uncertainty The “chaotic environment makes planning for businesses problematic,” according to Robert Johnson, professor of finance at Heider College of Business, Creighton University. He told Fortune in a note that’s what leading to lower hiring numbers and less spending. He also suggests that the tariffs “put pressure on corporate earnings and the likelihood of a corporate earnings recession has also increased.” While employment data is still relatively strong, payroll gains have slowed since last year, and many experts suggest it may be due to questions over trade. “If you’ve got companies that get concerned about where the future is leading, they’ll get cautious on their hiring plans, and that will lead to a rise in unemployment and consumers will start to pull back,” Dec Mullarkey, head of investment strategy for SLC Management, tells Fortune. To boot, capital expenditures (or capex), grew only 2% last year and is expected to grow only 3% in 2019, according to the S&P Global Ratings’ Global Corporate Capex Survey. These weaker expenditures are “thin gruel after years of stimulus and means that capex will not offer much help in sustaining the current economic cycle,” writes S&P Global’s Gareth Williams. And SLC’s Mullarkey believes companies aren’t going to spend on capex until there is a clearer path forward with China. Additionally, Morgan Stanley suggests that, since two-thirds of the goods to be tariffed in the latest levy are consumer goods, the new tariffs could “lead to a more pronounced impact on the US as compared to earlier tranches,” Morgan Stanley chief economist Chetan Ahya said in a note to investors. “Trade tensions have pushed corporate confidence and global growth to multi-year lows.” And according to a recent report, Morgan Stanley suggests economic growth and weak earnings are already being impacted by waning business confidence. As corporations weigh how to act, Bankrate.com’s chief economic analyst Mark Hamrick believes the latest trade escalation “shifts the point of strain ... on the shoulders of the consumer,” Hamrick told Fortune. However, while growth is slowing, it is still considered expansionary (as any reading above 50 indicates). With services sector growth just barely above that 50-level mark at 53.7, the expansion continues...albeit showing signs of strain. |