这家药企靠一款药跻身世界500强,但死不降价引争议

|

你可能没有得过需要修美乐(Humira)治的病,但可能听说过这种药。 修美乐是艾伯维的旗舰药品,主治关节炎、银屑病、克罗恩病和溃疡性结肠炎等多种疾病,也是全世界最畅销的药。仅去年一年,全球销售额就达近200亿美元。正如2月一场药物价格听证会上美国一位参议员指出,修美乐(如果是一家独立的公司)庞大的销售额已经能够跻身《财富》美国500强。 乍一看,似乎很难找到更完美的药品成功故事。2013年雅培公司将旗下著名的制药部门剥离为独立的公司,即艾伯维。2002年12月31日艾伯维获得了美国食品与药品管理局首份批文,修美乐获准上市。两年多后,该款注射药的全球销售额超过10亿美元,在制药行业里迈入传统意义上“重磅”地位的门槛。在如此短的时间内实现这一成就,堪称惊人壮举。2006年修美乐销售额达到20亿美元,短短两年内就翻了一番。到2013年,修美乐已经成为全世界最畅销的药,在60多个市场上的销售额达到107亿美元,尽管看起来机会渺茫,但之后五年庞大的销售数字几乎又翻了一番。 重要的一点是,修美乐确实有效,也改变了不少病人的生活。药物用预装药品的注射器皮下注射,说是药,严格来说是人体抗体(下文将介绍更多的细节),通过抑制炎症的核心蛋白,经过许多病理过程从而起效。临床试验中,罹患类风湿关节炎(导致关节疼痛和进行性肿胀的自身免疫性疾病)的患者活动能力迅速改善,关节退化速度明显减缓。美国有超过800万人患有皮肤病银屑病,研究发现修美乐能够在几个月内清除75%到90%的疼痛和瘙痒皮疹。中度到重度克罗恩病(导致人体衰弱的肠道疾病,需要住院治疗甚至做手术)方面,使用该药治疗可以降低对深入治疗的需求,同时促进“粘膜愈合”,即炎症性肠病可能缓解的迹象。 所以你可能会想,既然修美乐能够帮助数百万身患重病痛苦挣扎的人们,赚上数十亿美元有什么不对?制药行业不就应该做这些吗? 答案就像制药行业有很多方面一样,在于一系列副作用,而且通常写在小字说明里。修美乐的故事也有阴暗的一面,体现在数十亿美元不必要的药品成本,以及现代药物开发关键领域的竞争中。尽管看起来像科学创新和营销成功的典型,但修美乐变成全球畅销药其实是行业缓慢失败的案例,可以看出制药公司越来越放弃投资研发新药,更倾向于从外部购买(支付溢价)。该模式提高了患者、政府支付、保险公司,甚至是制药公司股东的成本。 事实上,跳过惊人的销售数字,艾伯维每年200亿美元销售额的现象级热门药更像对大型制药公司和消费者的警告。 想了解各种原因,最好先了解修美乐是什么,以及从何而来。 |

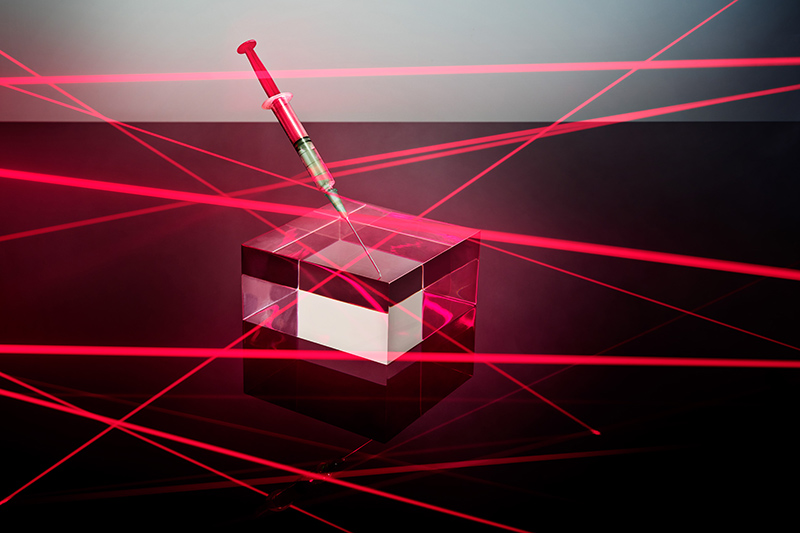

You may not have any of the conditions Humira treats. But chances are, you’ve heard of it. AbbVie’s flagship therapy, a medicine used to treat a slew of conditions from arthritis to psoriasis to Crohn’s disease and ulcerative colitis, is the bestselling drug in the world, bringing in nearly $20 billion in global sales last year alone. As one U.S. senator noted at a hearing on drug prices in February, that titanic sales figure would be enough to put Humira (were it a company unto itself) on the Fortune 500 list. And on first glance, it’s hard to conceive of a more perfect archetype for drug success. Abbott Laboratories—which spun off its branded pharmaceuticals unit as a separate company, AbbVie, in 2013—received its first FDA approval to market the medicine on Dec. 31, 2002. A little more than two years later, the injectable drug surpassed the billion-dollar mark in global sales, traditionally the threshold for “blockbuster” status in the pharmaceutical industry—a stunning feat in such a brief span. By 2006, sales had reached $2 billion, a number that would more than double in just two years’ time. By 2013, Humira was the world’s bestselling drug, with $10.7 billion in sales across more than 60 markets, and as improbable as it seems, even that colossal sales figure has nearly doubled again in the half-decade since. Humira is also, importantly, an effective medicine—and for some people, a life-changer. Injected under the skin by way of a prefilled syringe, the drug—technically, a human antibody (more on that detail soon)—works by inhibiting a key protein that’s central to inflammation, a process that’s implicated in a number of pathologies. In clinical trials, patients with rheumatoid arthritis, an autoimmune disease that leads to painful and progressive swelling of the joints, have experienced rapid improvement in movement and a marked slowing of joint deterioration. In the skin condition psoriasis, which afflicts more than 8 million Americans, studies found the drug could clear up painful and itchy rashes by 75% to 90% in months. In ¬moderate-to-severe forms of Crohn’s disease, a gut disorder that can prove debilitating and require hospitalization or even surgery, the treatment has been able to cut the need for drastic medical action while boosting “mucosal healing”—a possible sign that an inflammatory bowel disease is in remission. So, you might wonder, what’s not to like about a medicine that helps millions of people suffering from serious and painful conditions and that has made its owners billions of dollars in the process? Isn’t that what the pharmaceutical industry is supposed to do? The answer, like so many aspects of the drug industry, lies in the litany of side effects that are spelled out in the fine print. For the Humira tale has a dark side too—one that’s reflected in many billions of dollars in unnecessary drug costs for consumers and in stymied competition in a critical area of modern drug development. As much as it might look like the quintessential example of scientific innovation and marketing success, the story of how Humira became the world’s bestselling drug is a case study of an industry in slow-motion failure—of a corporate model that is increasingly forsaking investing in research and discovery in favor of purchasing it (at a premium) from the outside. That model is driving up costs for everybody—patients, government payers, insurers, and, yes, even drug company shareholders. Indeed, read past those striking sales figures, and AbbVie’s $20 billion-a-year drug phenom might well look like a black-box warning for Big Pharma and consumers alike. To understand why, it helps to understand what Humira is and where it came from. |

****

|

修美乐并不算“药”,实际上是名叫单克隆抗体或mAb的生物实体。简单地说,单克隆抗体是通过诱导特定免疫反应而产生的蛋白质。实验室造出的抗体结合到有害因子的特定抗原上,从而阻滞其产生作用。 1986年,美国食品与药品管理局批准了第一种单克隆抗体,是用于器官移植患者的免疫抑制药物。从那时起,已经有超70多款单克隆抗体药物获批,其中大多数针对各种癌症和免疫疾病。不过修美乐与其他药在关键方面不同,修美乐是“全人源”抗体,而不是来自于老鼠的抗体。全人源单克隆抗体引发副作用的可能性较小。修美乐的名字就在纪念该项开创性科学,英文名Humira是“类风湿关节炎人类单克隆抗体”的缩写,类风湿关节炎也是首个获准治疗的疾病。 尽管科学原理很酷,但修美乐并不是艾伯维研发的,也不是来自于艾伯维的前身雅培公司。2001年,雅培从德国巴斯夫化学公司收购了诺尔制药公司。诺尔剑桥抗体技术(名字起得不错)获得了抗体技术许可,而剑桥抗体技术又从英国医学研究委员会获得了该技术(大部分)许可,该委员会根据格雷戈里·温特爵士的研究开发,后来温特爵士因为该项研究而分享了2018年诺贝尔化学奖。 |

Humira isn’t a “drug,” technically speaking—it’s a biological entity known as a monoclonal antibody, or mAb. Put simply, mAbs are proteins created by inducing a specific immune response; these lab-created antibodies then bind to specific antigens on the surface of biological adversaries and work to neutralize the offenders. The FDA approved the first mAb, an immunosuppressive drug for organ transplant patients, in 1986. More than six dozen have been approved since then, with most targeting various cancers and immune diseases. But Humira was different in one key way from those that preceded it—it was a “fully human” antibody, as opposed to one derived from a mouse. Fully human mAbs are less likely to cause adverse side effects. Humira’s name is itself a tribute to this pioneering science—it stands for “human monoclonal antibody in rheumatoid arthritis,” the first disease it was approved to treat. As cool as that science is, it didn’t come from AbbVie—or even from its progenitor, Abbott. Abbott picked up the biologic in 2001 when it purchased the Knoll Pharmaceutical unit from German chemical company BASF. Knoll, in turn, had licensed the antibody technology from a company called (appropriately) Cambridge Antibody Technology—which, in turn, had licensed it (in large part) from Britain’s Medical Research Council, where it was developed from the research of Sir Gregory Winter, who would eventually share in the 2018 Nobel Prize in Chemistry for that very same science. |

|

然而2002年,雅培公司第一次获得美国食品与药品管理局对修美乐的批准。雅培的研究人员很明智地测试了该药对炎症性疾病的疗效,随后不断取得临床试验成功和新许可。2005年,雅培获准推广使用该药治疗银屑病关节炎;2006年可以治疗影响脊柱的关节炎、强直性脊柱炎;2007年获准治疗克罗恩病;2008年拓展到斑块型银屑病(最常见的皮肤瘙痒症状)和一种幼年关节炎;2012年增加了溃疡性结肠炎。2013年雅培剥离艾伯维后,艾伯维仍然在针对新疾病采取临床试验,并在数十个市场上申请监管批准。 更多适应症意味着要治疗更多患者,销售量也更大,正因如此,制药公司获得美国食品与药品管理局针对某一市场的批准后,总会尽力增加药物治疗范围。 不过在修美乐身上,艾伯维宣传起来也毫不吝啬。据Kantar Media报道,仅去年一年,艾伯维宣传这款明星产品就花了近4.9亿美元,位列2018年医药广告支出榜首。相比之下,辉瑞公司斥资2.72亿美元宣传止痛药普瑞巴林(Lyrica)广告费仅居第二。艾伯维也在社交媒体广告上投入大量资金,未算在上述推广费用内。今年1月1日以来,修美乐的电视广告已经播放4.6万次。 当然,积极的市场营销必然伴随着价格上涨。在美国,制药公司可以为药品自由定价。修美乐制造者也确实这么做了。美国AARP公共政策研究所和明尼苏达大学的PRIME研究所数据显示,2006年到2017年间,美国治疗类风湿性关节炎的标准40毫克修美乐注射笔标价涨到三倍多,一年供应价格从16636美元飙升至58612美元。年复合增长率超过12%。 |

It was Abbott, however, that received the first FDA approval for Humira, in 2002. Researchers there had the good sense to try it against other manifestations of inflammatory disease—and new clinical successes and approvals kept coming: In 2005, Abbott got permission to market the antibody for the treatment of psoriatic arthritis; then ankylosing spondylitis, a form of arthritis affecting the spine, in 2006; Crohn’s disease in 2007; plaque psoriasis (the most common type of the itchy skin condition) and a form of juvenile arthritis in 2008; and ulcerative colitis in 2012. After Abbott spun off AbbVie in 2013, the latter continued recruiting clinical trials in new disease settings and petitioning for regulatory approval across dozens of markets. More indications mean a larger pool of patients to treat and, consequently, more sales—which is why drug companies do their best to increase the therapeutic reach of their drugs once they’ve gotten a single marketing approval from the FDA. But in the case of Humira, its owners didn’t take any chances getting the word out. Last year alone, AbbVie spent just shy of $490 million to hawk its superstar product, topping the list of 2018 pharmaceutical ad spending, according to Kantar Media. By comparison, Pfizer’s $272 million on advertising for the pain drug Lyrica came in second. AbbVie also spent significantly on social media advertising, not included in the figure above. And television ads for Humira have aired more than 46,000 times since Jan. 1 of this year. Along with the über-aggressive marketing, naturally, came price hikes. In the U.S., pharma companies can charge whatever they want for their products. And the makers of Humira did just that. The U.S. list price of the standard 40 mg Humira injectable pen, used in the treatment of rheumatoid arthritis, more than tripled from 2006 to 2017, with the price for a one-year supply soaring from $16,636 to $58,612, according to the AARP Public Policy Institute and the University of Minnesota’s PRIME Institute. That’s a compound annual growth rate of over 12%. |

|

制药公司经常辩称,标价具有误导性,无法反映与福利经理、保险公司和援助计划的私人安排,而种种安排其实可以大幅降低患者支付的成本。 今年3月,纽约大型食品店工人工会UFCW Local 1500 福利基金针对艾伯维的诉讼中显示,即便考虑各种因素,修美乐的价格仍在飙升。诉讼称,与各种医疗保健中间商协商了折扣后,修美乐在美国的平均售价从2012年的每年约19000美元翻了一番,到2018年年初超过38000美元。艾伯维拒绝就定价策略置评。 |

Drug companies often argue that such list prices are misleading because they don’t reflect private arrangements with benefits managers, insurance companies, and assistance programs that can significantly reduce out-of-pocket costs for patients. But even with such factors considered, Humira’s price kept soaring, as documented in a March lawsuit against ¬Abb¬Vie filed by UFCW Local 1500 Welfare Fund, a large New York grocery workers’ union. After the rebates and discounts negotiated with various health care middlemen, the suit alleges, Humira’s average price in the U.S. doubled from about $19,000 per year per patient in 2012 to more than $38,000 in early 2018. AbbVie declined to comment on the record about its pricing strategy. |

****

|

一款药治疗多种疾病的效果令人震惊。艾伯维的收入从2013年,也就是成为独立公司第一年的18.8亿美元,增长到2018年的328亿美元,在今年的世界500强榜单中排名第381位,比去年增长41位。期间艾伯维在各家大型制药公司当中收入增长率最高。 但现金奶牛也有问题:要继续挤奶。要知道,修美乐不仅是艾伯维旗下最畅销的药物,也是重要支柱,2018年占公司收入60%以上。还有另一个问题:修美乐最初的美国成分专利于2016年12月到期,距离进入美国市场已经13年。(公司在欧洲的一项并行专利已经于去年10月到期。) 面对专利难题,艾伯维为了保证修美乐的市场霸主地位采取了最后一招,没准也是最强力的一招:起诉追赶的同行。“艾伯维不仅是医疗领域的先驱,也是法律保护领域的先驱。”加州大学黑斯廷斯法学院教授,也是《药品、金钱和秘密勾结》(Drugs, Money, and Secret Handshakes)一书作者罗宾·费尔德曼告诉《财富》杂志。 根据宣传和药物监督组织无障碍药物协会的数据,最初专利于2016年到期前三年里,艾伯维申请并获得了75项与修美乐有关的专利。艾伯维的首席执行官理查德·冈萨雷斯表示,目前公司拥有约136项与修美乐相关的专利。 艾伯维如何在一个产品上获得如此多专利?主要还是因为修美乐属于“生物制剂”药物。与化学合成药物不同,生物制剂来源于实际的生物材料,比标准化学药物更复杂。费尔德曼解释说,这就是艾伯维知识产权战略的关键所在。举例来说,公司可以为生产制造过程中模糊的步骤或剂量调整申请专利。 这正是艾伯维的操作。艾伯维在电邮声明中称,美国专利商标局(USPTO)已经授予该公司30多项与药物管理方式相关的专利;超过25项药物配方的专利;50多项与修美乐生产工艺相关的专利;以及患者用来注射药物装置的约20项专利。 Goodwin Procter事务所的律师罗伯特·瑟温斯基解释说,制造单克隆抗体当然并不容易。“制造阿达木单抗(修美乐的学名)主要靠发酵过程,涉及到经过基因工程改造的细胞株,由15000升的生物反应器中生长的巨大细胞中分泌出大量阿达木单抗。”他告诉《财富》杂志。 之后的流程比较复杂。处理时必须净化,去除不必要的副产品,为不同疾病针对性调整剂量,以及各种微调。瑟温斯基表示,在所有程序中,“艾伯维这样的著名制造商有很多机会声称,制造流程中即便很小的改进也可以算作创新,而且可以受到专利保护。” 这对想靠生物仿制品打入市场的公司来说是个挑战。(生物仿制药即生物药品的仿制药,通常比著名制造商生产的药品便宜得多。)他说,后来者“必须自行研发制造流程”。“过程就是产品。” 瑟温斯基专攻生命科学领域的专利侵权诉讼已经20多年,其中也包括与修美乐等单克隆抗体有关的诉讼。他还参与了改革美国专利制度,目前美国专利制度不仅允许而且鼓励艾伯维之类制药商打造所谓的专利丛林。 |

The combined effect of these efforts for a single drug has been stunning. AbbVie’s revenue grew from $18.8 billion in 2013, its first year as an independent company, to $32.8 billion in 2018, putting the company at No. 381 on this year’s Global 500, a rise of 41 spots from last year. Over that span, AbbVie has been the best in its peer group of big pharma companies in percentage revenue growth. But with this cash cow has come a problem: the need to keep milking it. You see, Humira isn’t just AbbVie’s bestselling drug, it is its everything-drug—accounting for more than 60% of the company’s 2018 revenues. And there is another catch: The initial U.S. composition patent for Humira expired in December 2016, 13 years after it first hit the American market. (A parallel patent in Europe expired this past October.) That conundrum brings up the last, and perhaps most potent, weapon in AbbVie’s campaign for market dominance with Humira: Sue anybody who comes close. “I think of AbbVie as a pioneer—not just in medical treatments but also in legal protections,” Robin Feldman, a professor at the UC Hastings College of the Law and author of Drugs, Money, and Secret Handshakes, tells Fortune. According to advocacy and drug watchdog group Association for Accessible Medicines, the company applied for and won 75 Humira patents in the three years before its initial patent expired in 2016. AbbVie CEO Richard Gonzalez has said the company now holds approximately 136 Humira patents. How was the company able to rack up so many patents on a single product? Much of it has to do with the type of drug that Humira is—a “biologic.” Unlike chemically synthesized drugs, biologics derive from actual biological material, making them significantly more complex than standard chemical medicines. And therein lies the key to AbbVie’s IP strategy, explains Feldman. For instance, a company may be able to file patents on obscure steps in the production and manufacturing process, or adjustments in dosing. And that’s precisely what AbbVie has done. AbbVie, in an emailed statement, says the U.S. Patent and Trademark Office (USPTO) has granted the company more than 30 patents on the ways in which the drug is administered; more than 25 patents on various formulations of the drug; more than 50 patents related to Humira’s manufacturing processes; and about 20 patents on the delivery devices that customers use to take the medicine. To be sure, creating a monoclonal antibody isn’t easy work, explains Goodwin Procter attorney Robert Cerwinski. “The manufacture of adalimumab [Humira’s scientific name] occurs through a process called fermentation, and it involves a cell line that’s genetically engineered to secrete large amounts of adalimumab from a huge vat of cells growing in, like, a 15,000-liter bioreactor,” he tells Fortune. Then things get even more complicated. Afterward, the treatment must go through purification processes to take out unnecessary by-products, modifications in dosage for different diseases, and all sorts of incremental tweaks. Amid all these procedures, Cerwinski says, “branded product sponsors like ¬AbbVie have found many more opportunities to conclude that little wrinkles in the manufacturing process are innovative and can be protected by patents.” That presents a challenge for companies that want to enter the market with biosimilar copycats. (Biosimilars are generic versions of biologic medicines and are usually far cheaper than the brand-name medicines they imitate.) Those challengers “have to come up with their own process,” he says. “The process is the product.” Cerwinski has been litigating patent infringement with a focus on the life sciences for more than two decades, including litigation concerning monoclonal antibodies like Humira. He’s also been involved in efforts to reform the U.S. patent system, which currently not only allows but also incentivizes manufacturers like AbbVie to build these so-called patent thickets. |

|

“艾伯维为修美乐申请和保护专利的多重方式无可厚非。”瑟温斯基说。另一位专利专家,纽约法学院教授雅各布·舍尔科夫也表达了类似看法。“他们只是充分利用了现行法律规定。”他表示。 但瑟温斯基也指出,其他生物制药商可没有雇佣十几个,甚至40人的团队专门负责专利申请。艾伯维使用专利丛林狙击竞争对手方面做得有些过分。2017年一场诉讼中,艾伯维列举了德国勃林格殷格翰公司以及修美乐仿制药Cyltezo的74项专利侵权。刚开始,勃林格在法庭上还击。但等到5月,勃林格成了第九家与艾伯维就修美乐仿制药进行专利和解的公司。 “由于诉讼固有的不可预测性、漫长而复杂的法律程序所需巨大成本以及对正常业务的持续干扰,我们得出的结论是,和解是最好的解决方案。”公司发言人在电子邮件中说。 三家获得美国食品与药品管理局批准的修美乐生物仿制药的公司——安进、勃林格和诺华旗下的山德士子公司都达成了类似协议,推迟药品上市时间,2023年再进入。事实上,各家已经同意向艾伯维支付许可费,以推销自家仿制药。 不管是专利丛林,还是艾伯维与竞争对手达成的专利协议,都是食品店工人工会针对指控艾伯维和其他七家签订协议公司的主要内容。诉讼在勃林格和解前提交。“如果艾伯维不从事反竞争行为,原告们就能够用更低的价格在美国购买修美乐生物仿制药。”3月的集体诉讼投诉中写道。 |

“There’s nothing unusual about the multilayered way ¬AbbVie has sought to patent and protect Humira,” Cerwinski says. Another patent expert, New York Law School professor Jacob Sherkow, echoes the sentiment. “They’re just taking advantage of existing law,” he says. But Cerwinski points out that other biologic drugmakers fending off competition have employed anywhere from a handful to, perhaps, 40 patent claims in litigation. AbbVie has gone much further—using its patent thicket against rivals with vigor. In a 2017 lawsuit, AbbVie cited 74 alleged instances of patent infringement against Boehringer Ingelheim and its Humira copycat Cyltezo. At first, Boehringer fought back in court. But, in May, it became the ninth company to settle patent litigation with AbbVie over a Humira biosimilar. “With the inherent unpredictability of litigation, the substantial costs of what would have been a long and complicated legal process and ongoing distraction to our business, we have concluded that this settlement is the best solution,” says a company spokesperson in an email. All three companies with FDA-approved Humira biosimilars—Amgen, Boehringer, and Novartis’s Sandoz unit—have reached such deals to delay their products’ market entry until 2023. In fact, they have agreed to pay AbbVie licensing royalties in order to market their copycats. The patent thicket and AbbVie’s arrangements with rivals is a major part of the grocers union’s lawsuit against the company and seven other firms it has struck such deals with. It was filed before Boehringer’s settlement. “Had AbbVie not engaged in anticompetitive conduct, the plaintiffs would have been able to purchase Humira biosimilars in the U.S … at significantly lower prices,” reads the March class action complaint. |

|

虽然艾伯维拒绝就价格上涨置评,但还是为专利战略辩护。“修美乐的创新专利在法律诉讼中屡遭挑战。”艾伯维的首席法律顾问劳拉·舒马赫表示。“我们的专利和解中并不涉及艾伯维支付任何款项,主要为了保护在创新方面的投资,而且声明修美乐最后一项专利到期10年后即允许生物仿制药上市,诉讼中的指控并无根据。” 专利丛林最近也受到立法者抨击。2月的参议院财政委员会药物价格听证会上,得克萨斯州的共和党参议员约翰·科宁就该问题向艾伯维的首席执行官冈萨雷斯提出质疑。“专利制度目的是保护投入大量资金研发的独家药品,这我理解。”他表示。“但过了特定时间,专利必须终止,独家保护必须终止,这样病人才能够以更便宜的成本使用药物。” 冈萨雷斯称,由于修美乐针对多项病症获得了多项批准,不应该被视为一种药物,应该算作多种药物,他在听证会上为艾伯维的策略极力辩护。“随着修美乐的功效不断拓展,专利组合也不断扩大。”他表示。 即便修美乐仿制药上市,也很难说美国人能够省下多少钱。在欧洲,较便宜的竞争药品已经开始抢占艾伯维的份额,好几个国家的修美乐价格出现下跌。事实上,由于“生物仿制药”在海外销售,2019年一季度全球修美乐销量下降了5.6%,这也是该药收入首次出现全球下滑。但费尔德曼表示,从整个行业来看,生物仿制药的引入可以为消费者和其他支付方节省大量开支。她指出,兰德公司研究发现,生物仿制药通常可以在10年内节省54亿美元的医疗费用。 “这可是你我口袋里一大笔钱。”她说。 |

While AbbVie declined to comment on the record regarding price hikes, it did defend its patent strategy. “Humira’s innovative patents have repeatedly withstood challenges in legal proceedings,” says AbbVie’s chief legal officer Laura Schumacher. “Our patent settlements, which do not include any payments by AbbVie, balance protecting our investment in innovation with access to biosimilars 10 years before our last Humira patent expires and the allegations in the lawsuit are without merit.” Patent thickets have recently come under fire from lawmakers as well. Sen. John Cornyn, a Texas Republican, challenged AbbVie CEO Gonzalez on the issue during a Senate Finance Committee drug-price hearing in February. “I get the idea that that’s the purpose of the patent system, which is to protect the exclusivity of that drug that you’ve sunk a lot of money into,” he says. “But at some point, that patent has to end, that exclusivity has to end, so that the patients can get access to those drugs at a much cheaper cost.” Gonzalez, who argues that Humira shouldn’t be considered just one drug but rather multiple ones, given its approvals for various conditions, vigorously defended AbbVie’s tactics at the hearing. “That patent portfolio evolved as we discovered and learned new things about Humira,” he said. It’s hard to tell just how much money Americans would save had Humira copycats already been on the market. In Europe, where cheaper rivals have already begun gaining on AbbVie, Humira prices have fallen in several countries. Indeed, global Humira sales dropped 5.6% in the first quarter of 2019—the first-ever worldwide slide in the drug’s earnings—thanks to “biosimilar” copycats sold abroad. But across the industry, Feldman, says, the introduction of biosimilars could produce dramatic savings for consumers and other payers. She notes one Rand Corporation study that found that biosimilars, generally, could save the U.S. $54 billion in health spending over 10 years. “It’s a big chunk of change coming out of your pocket and mine,” she says. |

****

|

尽管修美乐在商业和科学上都取得了巨大成功,却让人们不由得关注传统制药行业到底出了什么问题。艾伯维靠着错综复杂的专利网络和其他策略,让潜在的竞争对手在2023年前都无法进入美国市场。这意味着如果消费者想找更便宜的替代药,只会发现选择更少而且成本更高。 这就是“重磅”药物模式引发的后果,该模式里公司依赖一两款关键药品,每年赚数十亿美元。市场营销和构建法律壁垒花费数亿美元,然而处于生物制药行业核心地位的创新和科学发现通常从外部引进,比如从规模更小也确实将重点放在创新上的生物技术公司获得许可。 当畅销产品最终不可避免面临“专利悬崖”,也就是之后更便宜的仿制药可进入市场,该战略就会推动大型制药公司之间积极交易。举个例子:就看艾伯维,6月便宣布打算斥资630亿美元收购艾尔建。艾伯维的冈萨雷斯解释为何要收购时表示,修美乐面临的竞争迫在眉睫,艾尔建也在积极保护药妆保妥适和干眼药等畅销产品的专利。 “这是制药公司进行财务交易的案例,跟科学无关;100%跟金融工程有关。”专注研究癌症免疫疗法的生物技术投资者布莱德·隆卡尔表示。“美国人为修美乐支付高价已经很长时间。公司用收益做了什么?做了笔大型财务交易,要收购美容用的肉毒素保妥适。” 并不是说近期艾伯维一点成绩也没有。4月,美国食品与药品管理局批准了具有巨大销售潜力的免疫系统新药Skyrizi,可以治疗中度到重度斑块型银屑病。这是艾伯维急需的胜利,公司相信到2023年该药年销售额将达到50亿美元。而2023年正是修美乐竞争对手将进入美国市场的时间。2018年艾伯维旗下的Orilissa也获得美国食品与药品管理局放行,该药是第一种获准治疗子宫内膜异位引发疾病的药物。 但业内一些资深人士表示,新疗法无法弥补其他渠道出现的问题。安娜丽莎·詹金斯负责制药巨头如百时美施贵宝和德国默克雪兰诺的主要研发部门,20世纪90年代和2000年代两家公司推出了Yervoy等开创性的癌症免疫疗法。如今她进入了生物技术初创企业的世界,感觉科学更令人兴奋,也更具创造性。 根据业内丰富的经验,詹金斯对艾伯维和全行业创新困境提出了自己的看法。“艾伯维的问题在于运气不好。有些选择做错了。”她说。“他们没有积极寻找替代产品,行动迟缓。” 错误的选择包括最近受医疗行业嘲笑的一项收购。2016年,艾伯维预付58亿美元的现金和股票,抢下了总部位于旧金山的生物科技公司 Stemcentrx。该公司正研究潜在利润丰厚的Stemcentrx肺癌治疗方案,方案叫Rova T。三年后,Rova T在临床试验阶段遭遇不少挫折,艾伯维最终叫停。今年1月艾伯维宣布,将为Stemcentrx交易记下约40亿美元减值损失。 |

For all its commercial and scientific success, Humira offers a sharply focused lens on what’s wrong with the legacy drug industry at large. AbbVie’s convoluted web of patents and other strategies will keep would-be competitors off the U.S. market until 2023. That means fewer choices—and higher costs—for consumers who might otherwise pursue cheaper options. This is a consequence of the “blockbuster” drug model, wherein a company relies on one or two key products that ring in billions annually. Hundreds of millions go to marketing and legal-fortress building, while innovation and scientific discovery—ostensibly the beating heart of the biopharmaceutical industry—is often imported from the outside: in-licensed, for instance, from leaner biotechs that actually do place an emphasis on innovation. The strategy can also drive aggressive dealmaking among large pharma companies when their blockbusters finally do face the inevitable “patent cliff,” the point after which cheaper generic competitors can enter the market. Case in point: AbbVie itself, which announced a proposed $63 billion megadeal to buy Allergan in June. AbbVie’s Gonzalez cited impending Humira competition—and Allergan’s own aggressive approach to protecting patents on bestsellers like the cosmetic drug Botox and the dry-eye treatment Restasis—as a rationale for the deal. “This is an example of a pharma company doing a financial transaction—it has nothing to do with science; it has 100% to do with financial engineering,” says Brad Loncar, a biotechnology investor focused on cancer immunotherapy. “People have been overpaying for Humira for a long time in the United States. And what has the company done with the proceeds of that? They’ve done a major financial deal for, of all things, Botox.” This isn’t to say AbbVie hasn’t had any recent success. In April, the FDA approved its new therapy Skyrizi, an immune system drug with blockbuster sales potential, to treat moderate-to-severe plaque psoriasis. It was a much-needed victory for the company, which believes the drug will reach $5 billion in annual sales by 2023—the very year Humira rivals will launch in the U.S. AbbVie also won a 2018 FDA green light for Orilissa, the first drug approved to treat pain associated with the uterine disorder endometriosis. But some industry veterans say these new therapies aren’t nearly enough to compensate for other failures in AbbVie’s pipeline. Annalisa Jenkins led major R&D divisions at drug giants like Bristol-Myers Squibb and Germany’s Merck Serono as they pumped out pioneering new treatments such as the cancer immunotherapy Yervoy, among others, in the 1990s and 2000s. But now she’s gone over to the world of biotech startups, where she feels the science is more exciting and inventive. The wide-ranging experience paints Jenkins’s views on AbbVie’s and the broader industry’s innovation woes. “Part of the problem for AbbVie was just being unlucky. There were some bad picks,” she says. “They didn’t aggressively pursue the replenishment of their pipeline. They were slow.” Those unfortunate picks include one of the more derided acquisitions in recent health care history. In 2016, AbbVie snatched up the San Francisco–based biotech Stemcentrx for $5.8 billion in upfront cash and stock. The company was eyeing a potentially lucrative Stemcentrx lung cancer treatment called Rova T. Three years later, Rova-T has faced multiple clinical trial setbacks, and AbbVie has nixed the program. In January, AbbVie announced it would record an estimated $4 billion impairment charge on the Stemcentrx deal. |

|

艾伯维旗下另一款颇有希望的药,是治疗血癌多发性骨髓瘤的venetoclax,正在接受检测,临床试验结果令人失望。投资者也发现了进展不顺,过去12个月艾伯维股价暴跌超过27%,表现比大多数同行都差。 “看起来大型制药公司花钱也不一定能买到创新。”生命科学咨询公司IDEA Pharma的首席执行官迈克·利亚告诉《财富》杂志。“像艾伯维一样靠一款药或单一治疗领域发展壮大的公司都在挣扎……进入(新)市场时并未表现出有新的洞察力。” 调研机构EvaluatePharma称,全球12家大型生物制药公司中,艾伯维的研发支出水平较低。2010年至2018年研发支出实际上翻了一番,去年仍然只有51亿美元,而全球收入达328亿美元。 |

Another AbbVie hopeful, venetoclax, being tested for the blood cancer multiple myeloma, has also disappointed in clinical trials. Investors have noticed the struggles—AbbVie’s stock has plunged more than 27% in the past 12 months, underperforming most of its peers. “These big drug companies can’t even seem to buy their way into innovation,” Mike Rea, CEO of the life sciences consulting firm IDEA Pharma, tells Fortune. “Companies that have grown large with one drug or in one therapeutic area, such as AbbVie, have struggled … They haven’t shown that new insight when it comes to a [new] market.” AbbVie’s spending on R&D is on the lower end among the 12 big, global biopharma companies, according to EvaluatePharma. The company actually doubled its reported R&D spend between 2010 and 2018—but it was still just $5.1 billion last year, compared with $32.8 billion in global revenues. |

****

|

生命科学游说团体并不认同创新停滞的观点。“我就不同意。”制药行业贸易集团美国制药研究与生产商(PhRMA)的公共事务主管安德鲁·波瓦莱尼说。“从生物制药的角度来看,当前的创新力度前所未有。”波瓦莱尼指出,约7000种药物正在开发,仅在美国就有4000种。 但深入研究数字,会发现更加微妙的故事。德勤称,通过对比公司将后期药品投放市场的预期成本与药品预期销售额可知,12家大型生物制药公司研发投资的预计回报率下降至可怜的1.9%。EvaluatePharma预测称,前20大制药公司的研发支出将从2017年的20.9%下降到2024年的16.9%。 去年,美国食品与药品管理局创纪录地批准了59种新药,均采用新分子实体或生物实体。但分析公司 IQVIA称,大型制药公司仅获得其中四分之一专利,而“新兴生物制药公司”(每年研发支出不到2亿美元或收入不到5亿美元的公司)则获得了近三分之二的专利。“大制药公司获得美国食品与药品管理局的批准比以前少得多。”德勤生命科学部合伙人科林·特里表示。 如今,面临着产品线失败和紧迫的竞争压力,传统企业正在努力挑选更精简也更注重科学的小团队,希望能够选中下一款大热门产品(艾伯维向Rova-T下注失败的案例显示,并非每笔投资都能够成功)。“这些公司就像大唱片公司:靠人才猎头出去寻找新艺术家。”SVB Leerink的分析师杰弗里·波吉斯说。(就在本期杂志出版之前,艾伯维宣布将在名单里新增一位“艺术家”,即癌症免疫治疗初创公司Mavupharma,交易金额尚未公布。) 行业研发审查员詹金斯表示,长期以来各种扭曲的激励措施,还有很多公司没有跟上新技术和新商业模式导致了现状。“制药公司的做法就是墨守过去20年的陈规。”她表示。“药企只关注短期。要么看季度环比,要么看年度同比。这可不是鼓励创新的好方式。” 从根本上说,对股东也不好。过去五年里,纽约证交所Arca制药指数的年回报率为5.2%,而同期标准普尔500指数年回报率为10%。“没有人才,没有技术,大型制药公司指挥将越来越多资金投入到原有研发中。成败与否就看能不能研发出热门药。”詹金斯补充道。 不幸的是,如果艾伯维之类的大型制药公司继续赢下去,美国患者将承担巨大的成本。(财富中文网) 本文另一版本登载于《财富》杂志2019年8月刊,标题为《拼尽全力的专利保护战》。 译者:Feb |

The life science lobby takes exception to the idea it’s in an innovation rut. “I happen to disagree,” says Andrew Powaleny, public affairs director at the Pharmaceutical Research and Manufacturers of America (PhRMA), the industry’s trade group. “From the biopharma perspective, we’re at the most exciting time we’ve ever been.” Powaleny points to some 7,000 medicines currently in development, including 4,000 in the U.S. alone. But a deeper dive into the numbers tells a more nuanced story. Projected returns on R&D investment among the top 12 large-cap biopharmaceutical companies—measured by comparing the expected cost of bringing a drug in a company’s late-stage pipeline to market versus an estimate of expected sales of those drugs—plummeted to a dismal 1.9% in 2018, according to Deloitte, compared with 10.1% in 2010. EvaluatePharma projects that the top 20 pharma companies will drop their R&D spending from 20.9% of top-line revenues in 2017 to 16.9% by 2024. The FDA approved a record 59 novel drugs—those derived from entirely new molecular entities or biological entities—last year. But big pharma companies patented just one-quarter of those treatments, according to analytics firm IQVIA, while “emerging biopharma companies” (organizations that spend less than $200 million per year in R&D or bring in less than $500 million in revenue) patented nearly two-thirds. “Large-cap pharma’s Food and Drug Administration approvals have been way lower than usual,” says Colin Terry, a partner at Deloitte’s life sciences division. Now facing the specter of dilapidated pipelines and imminent competition, legacy firms are looking to insource the Next Big Thing from leaner, science-driven outfits (with varying degrees of success, as AbbVie’s failed Rova-T gamble shows). “These companies became like great big record labels: reliant on talent spotters going out and finding new artists,” says SVB Leerink analyst Geoffrey Porges. (Indeed, just before this issue went to press, AbbVie announced that it was adding another “artist” to its roster, cancer immunotherapy startup Mavupharma, for an undisclosed price.) Jenkins, the industry R&D vet, says a long history of misaligned incentives—including many companies’ failure to adopt new technologies and business models—has led to the current status quo. “What pharma did was what it’s always done over the past 20 years,” she says. “They’re entirely short-term focused. Quarter to quarter, year to year. That’s not the best way to leverage innovation.” It’s also, fundamentally, not good for shareholders. The NYSE ARCA Pharmaceutical Index has delivered a total return of 5.2% annually over the past five years, compared with 10% for the S&P 500.“Without access to talent, without access to technologies, big pharma companies are just pouring more and more money into the same old R&D. All they’re judged on is one big win,” Jenkins adds. Unfortunately, if big pharma companies like AbbVie keep winning like this, the cost to American patients will be ¬immense. A version of this article appears in the August 2019 issue of Fortune with the headline “Protect at All Costs.” |