这家公司想让药店变成医生

|

在休斯顿的郊外,一家看上去很普通也有些陈旧的CVS药店门口,翻腾的蓝色横幅上写着“健康中心来了!”药房看门杰西·冈萨雷斯站在门口迎接众人,用他的话说,“引导”人们前往目标通道或者找医生。睡眠呼吸暂停?冈萨雷斯会指导打鼾严重的人去找呼吸科医生,医生建议家庭检测疗法,如果方便的话再推荐购买持续正压呼吸机(CPAP)治疗。因为过劳和体重增加而烦恼?他会让你去看护士,抽血检查甲状腺是否异常,如果确有异常,护士会给你开激素疗法的药物,药房柜台就能购买。 今年4月的一天早晨,我跟着冈萨雷斯走过弯曲的木地板小路,走进重新粉刷后为社区服务的新医疗中心的新前门。这家店位于休斯顿市中心以北的斯普林社区,周围居民以工人居多。店内改建了曾经卖拖把和贺卡等商品的通道,现在四分之一的面积都用于医疗保健。整个左边的特色产品区都是为了实现新目标,从被认为是健康食品的姜黄粉奶昔到各种移动设备,比如经常在仓储店卖的淋浴椅。 稍远处的健康中心跟平常典型的免预约步入式诊所完全不一样。这里可以检测并治疗慢性病,有四间会诊室,内有医疗椅和视网膜摄像头用于糖尿病筛查。屏幕上显示着热门服务价格:今日糖尿病视网膜病变成像收费100美元,胆固醇筛查收费89美元。得克萨斯州交通部的员工可以享受全面体检。在健康中心隔壁药房里,药剂师亚历克斯·伊巴拉在私人办公室为病人提供咨询,也是新型高接触实践。之前一天,她向一位需要协助测量6种糖尿病药物对血糖影响的老年人解释了一小时。杰奎琳·海恩斯前往健康中心,想变得更健康。护士给她验血检测高血压,医生开了处方,然后去药房开降压药奈必洛尔。海恩斯称赞全职营养师帮她从今年1月以来帮助减掉了72磅体重。“现在我的体重降到了167.7磅。”海恩斯说,她经常去CVS周二的“舒缓瑜伽”课。“我对鳄梨和巧克力上瘾了。营养师帮我安排了健康的饮食,还教我想吃糖果的时候用低卡可可豆代替。” |

Over the entrance of what looks like a regular, aging CVS drugstore outside Houston, a billowing blue banner announces “HealthHUB Come Inside!” Greeting folks at the door is Jesse Gonzalez, the care concierge who, in his words, “navigates” folks to the right aisle or therapist. Sleep apnea problems? Gonzalez dispatches the heavy snorers to the respiratory therapist, who can suggest a home-testing regimen and, if appropriate, recommend a CPAP mask that’s in stock to stop the honking. Fretting over excessive fatigue and weight gain? He’ll guide you to a nurse practitioner who’ll draw blood to test for thyroid disorder and, if that’s the finding, prescribe a hormone therapy you can pick up at the pharmacy counter. On an April morning, I followed Gonzalez down a curving parquet pathway, through this stucco box that’s been repurposed as health care’s new front door for America’s communities. This store in Spring, a working-class neighborhood north of central Houston, has eliminated aisles that once offered the likes of mops and greeting cards so that a full one-fourth of its footprint is now devoted to wellness. The entire left side features products supporting the new mission, from health food—think turmeric powder shakes—to mobile equipment, such as shower chairs, usually found in warehouse stores. The HealthHUB section at the far end goes far beyond what you’d find at a typical walk-in clinic. They offer testing and treatment for chronic conditions, and boast four consultation rooms equipped with exam chairs and retinal cameras for diabetes screening. Video screens display prices for popular services: Today’s rates are $100 for diabetic retinopathy imaging and $89 for a cholesterol screening. Employees from the Texas Department of Transportation get full physicals here. At the pharmacy adjacent to the HealthHUB, pharmacist Alex Ybarra counsels patients in a private office as part of the new high-touch approach; the previous day, she spent an hour advising a senior who needed help measuring the effect of his six diabetes medications on his blood sugar. The HealthHUB is Jacqueline Haynes’s destination for wellness. She was given a blood test for hypertension by a nurse practitioner, who wrote a prescription for beta-blocker Bystolic that Haynes filled at the pharmacy, steps away. She credits the full-time dietitian with helping her shed 72 pounds since January. “That brings my weight to 167.7,” says Haynes, who frequents a CVS “gentle yoga” class on Tuesdays. “I was addicted to avocados and chocolate. He got me eating healthy by doing things like substituting low-cal cacao nibs when I craved candy bars.” |

|

健康中心的概念标志着医疗改革的飞跃,即通过紧急医疗网店、门诊手术中心和药店的快速护理中心,将原本要去大型医院,找极其难约的医生看病需求疏导至社区。CVS Health称此举立足本地,又可以提供全面的服务。 为了支持该策略,过去十年CVS一直在建立步入式诊所,提供疫苗接种和流感疫苗注射等简单治疗,也刚刚成为第一家与保险公司合并的大型药品零售商。去年11月底,CVS斥巨资700亿美元收购了美国第三大保险公司安泰,由此成为全世界最大的医疗上市公司,然而注意到这点的人还不多。目前《财富》美国500强排行榜上CVS名列第8位,明年排名可能会跳升几位。如果算上安泰全年收入,而不是像去年一样仅加上CVS收购后安泰一个月的收入,合并后公司销售额将达到2560亿美元,跃升至仅次于沃尔玛、埃克森美孚和苹果之后的第4位。 CVS收购安泰是2018年最大一起并购案,也超越了医疗领域里程碑,即信诺保险以544亿美元收购快捷药方公司。但该笔大交易与通常的石油、移动通信或媒体巨头合并完全不同,因为石油之类行业为客户提供类似的产品和服务。CVS与安泰的合并则联合了医疗领域里两个截然不同且迄今为止独立的业务。一家公司精通IT业务,部署机器学习和人工智能预测大量客户下一步举措,另一家则是老牌实体店,通过展示、促销和优惠券吸引人们购买药品到化妆品之类的营销高手。在医疗行业的大型并购案中,此次相当于下注大数据和邻家药店的联姻可以令美国更加健康,无疑是最大胆也最危险之举。 |

The HealthHUB concept marks a forward leap in what’s already a revolution in health care: bringing treatment once dominated by giant hospitals and overbooked doctors’ offices to America’s neighborhoods via urgent care outlets, outpatient surgery centers, and quick care outlets in pharmacies. CVS Health claims to be both the most local and the most comprehensive. To bolster that strategy, CVS—which has been building its own walk-in clinics for over a decade, providing simple treatments like vaccinations and flu shots—just became the first major drug retailer to combine with an insurer. In late November, CVS bought Aetna, America’s third-largest insurance carrier, in a $70 billion megadeal that made the new CVS the world’s largest publicly traded health care company, a distinction that, until now, had gone largely unnoticed. CVS ranks eighth on the Fortune 500 list, but look for it to make a big jump on next year’s roster. Had Aetna’s revenues been included for the entire year, instead of just the one month it was owned by CVS, the combined company would have posted sales of $256 billion and catapulted to fourth place behind Walmart, Exxon Mobil, and Apple. The CVS purchase of Aetna was the largest merger of 2018, edging another health care milestone, Cigna’s $54.4 billion acquisition of Express Scripts. But this big deal is totally unlike the usual combinations of oil, mobile communications, or media giants that provide their customers with similar products and services. The CVS-Aetna union brings together two distinct, and heretofore separate, fields of health care: an insurer that’s a master of IT, deploying machine learning and A.I. to predict the next step for a vast population of enrollees; and an old-line, brick-and-mortar merchant, a marketing machine that uses displays, promotions, and coupons to get people to buy everything from drugs to cosmetics. Of all the big health care mergers, this bet that marrying big data and neighborhood drugstores will create a healthier America is the most daring—and the riskiest. |

|

总体规划是结合安泰公司的索赔数据和分析,确定在2200万会员里哪些人有患糖尿病或心脏病的风险,然后CVS发挥能力,指导相关会员前往药房或健康中心做体检或接受治疗。这种方案的目标是限制再入院率并敦促患者遵守药物治疗方案,从而节省巨额成本。第二阶段包括召集CVS最大的客户,主要是其他保险公司,采取全新模式后确保CVS获得部分收益,因为CVS通过店内诊所提供咨询和筛查服务实现巨大节省,病人不必再去手术室和急诊室。 然而投资者认为,CVS才应该好好体检一下。该公司的股价曾经长期保持优异,但在过去三年里出现逆转,股价急剧下滑。截至2015年的十年里,CVS实现年度总回报率15.3%,是标准普尔500指数回报率的两倍。2016年春跌势初现,2017年10月宣布收购安泰后加速下滑。CVS股价走低以来已下跌28%,从76美元跌至56美元。 问题主要有两个层面。首先,华尔街认为CVS收购安泰时出价过高。合并传言传播时,两家公司市值加起来还有1280亿美元,如今只有720亿美元,意味着多达560亿美元(占总市值的44%)已经消失。问题在于,CVS为安泰支付了32%的溢价,而且过程中其财务报表上增加了780亿美元的资本。 其次,CVS在收购时,自身的核心业务出现恶化。因此到目前为止,其收购安泰增加的额外资本仅获得了微薄回报。判断业绩下降程度有个很好的指标便是经济增加值,也是研究公司ISS EVA使用的工具,ISS EVA隶属于公司治理顾问——机构股东服务(ISS)。EVA主要判断公司有没有在赚取“资本成本”,也是回报投资者的最低要求。合并前一年,CVS的税后净营业利润(NOPAT)为77亿美元,安泰保险为33亿美元,总计110亿美元,两个数字都轻松超过了5.4%的资本成本,尽管当时CVS的业绩已经在下滑。机构股东服务高级顾问贝内特·斯图尔特认为,合并后的CVS要多赚11亿美元,或者说121亿美元才能补上收购安泰支付的巨额溢价。但合并后的公司利润比起2018年并没有增加,反而在减少。至于2019年,由于市场上对CVS业绩预期普遍负面,分析师预测今年的税后营业收入仅为1050亿美元,比2018年低5亿美元,比收购安泰后实现足够回报所需的金额少了16亿美元。 听起来很糟糕。但请注意,投资者已经大幅减持了CVS股票。所以现在重要的是,与跌跌不休的股价相比未来收益会怎样。“预期实在太低,如果CVS能够实现降低到105亿美元的预期并有所改善,模型显示其股价低估了多达80%。”斯图尔特表示。将CVS估值调整为720亿美元后,投资者预测最终其业绩也只是一般水平。 但CVS团队的野心不止于此。 |

Today the master plan is to combine Aetna’s claims data and analytics that identify which of its 22 million members are at risk for, say, developing diabetes or cardiac disease, with CVS’s capacity to guide them to testing and treatment before the disease progresses, at the pharmacies and HealthHUBs. That formula is targeted to generate big savings by curbing readmissions to hospitals and getting patients to adhere to their drug regimens. Phase 2 consists of recruiting CVS’s biggest customers, mostly other insurers, to adopt a fresh model that gives CVS a share of the potentially giant savings to come from counseling and screenings at their corner clinics that keep patients out of operating and emergency rooms. Investors, however, think it’s CVS that could use a checkup. Its stock’s steep slide over the past three years is a reversal from a long history of outperformance. Over the decade through 2015, CVS delivered total annual returns of 15.3%, double the trend for the S&P 500. The cratering started in the spring of 2016, then accelerated after reports of an Aetna deal surfaced in October of 2017. Since CVS’s decline began, its stock price has dropped 28%, from $76 to $56. The problem is twofold. First, Wall Street is judging that CVS way overpaid for the insurer. When rumors of a merger spread, the companies’ combined market caps stood at $128 billion. Today that figure is $72 billion, meaning that a staggering $56 billion, or 44% of the total, has vanished. The rub is that CVS paid a 32% premium for Aetna and, in the process, loaded an additional $78 billion in capital on its books. Second, CVS did this deal just when its own core businesses were deteriorating. Hence, it’s so far generating weak returns on all the extra capital added by purchasing Aetna. A good measure of how far the performance has declined is Economic Value Added, a tool deployed by research firm ISS EVA, a branch of governance adviser Institutional Shareholder Services. EVA measures whether companies are earning their “cost of capital,” the minimum requirement for rewarding investors. In the year prior to the merger, CVS had net operating profit after tax (NOPAT) of $7.7 billion, and Aetna achieved $3.3 billion, for a total of $11 billion, numbers that both easily beat their 5.4% cost of capital, though the CVS figure was already sliding. Bennett Stewart, a senior adviser to ISS, reckons that the new CVS would have needed to earn $1.1 billion more, or $12.1 billion, just to break even on the big premium paid for Aetna. The rub is that the combined enterprise is making not more, but less now than in 2018 when the deal closed. For 2019, based on CVS’s generally negative guidance, analysts predict that it will earn just $10.5 billion in after-tax operating income for this year, $500 million below 2018, and $1.6 billion less than the amount needed to achieve an adequate return on the Aetna deal. Sounds bad. But keep in mind that investors have radically marked down CVS stock. So what matters now is how its future earnings compare with its beaten-down price. “The expectations are so low that if CVS meets that reduced $10.5 billion forecast and improves from there, our models show that its stock is undervalued by as much as 80%,” says Stewart. By valuing CVS at a lowly $72 billion, investors are forecasting that it merely achieves mediocrity. But the team at CVS had much bigger aspirations in mind. |

****

|

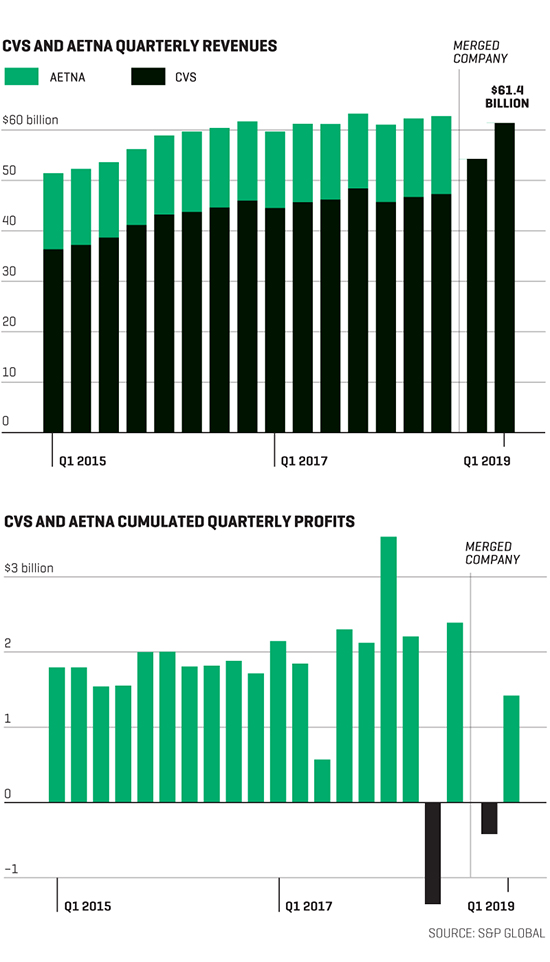

不完全为了利润的合并 在斥资700亿美元与安泰合并后,CVS跃升为全球最大的医疗公司,预计2019年收入将达到2500亿美元。但目前为止还未见成效。2019年第一季度,CVS公布的利润数字比一年前两家公司分别赚取的利润低三分之一。整合计划目标是节省7.5亿美元,将有助于提高盈利能力。 |

A merger that has not equaled profits The $70 billion merger with Aetna made CVS the world’s biggest health care company, with projected revenues of $250 billion in 2019. But so far it hasn’t paid off. In the first quarter of 2019, the new CVS posted profits one-third lower than the amount the two companies had earned separately a year earlier. An integration plan targeting $750 million in savings should help lift profitability. |

****

****

|

在生活节奏缓慢的罗德岛文索基特,CVS类似校园的总部里,首席执行官拉里·梅洛给出了自己的理由。他认为,收购安泰支付的巨额价格是值得的,因为结合之后将为医疗保健创立全新模式。“我们认为并没有花冤枉钱。”梅洛表示。他气质纯朴,留着胡子,之前是药剂师,最出名的是2014年禁止烟草制品进店销售。“这是改变医疗体验的绝好机会,把社区当成治疗中心。”确实,今年5月1日的一次电话会议上,CVS宣布实际效果好于预期,梅洛谈到了将健康中心当成新的CVS业务核心的计划。投资者很赞同。随后股价大涨5.4%,市值增加了近40亿美元。 CVS的便利店式医疗要想成功,主要靠两大支柱。首先是分布广泛。目前CVS旗下有9900家药店,与美国最大的连锁药店沃尔格林基本持平。80%的美国家庭要找CVS药房只需步行或驾车10英里以内。目前CVS已经在运营1100个“一分钟诊所”,提供流感疫苗和带状疱疹疫苗等基本服务,是沃尔格林店里的步入式诊所数量的两倍多。沃尔玛是第三大药房,只在三个州有少数几家店内诊所。5月初,CVS称计划将休斯顿的三家健康中心增加到20家,城区每七家店里便有一处,并承诺6月将宣布更大规模的推广计划。如果CVS将现有的一分钟诊所扩建为健康中心,并且在全国范围保持一分钟诊所覆盖比例,分析师认为可能性很高。那么根据《财富》杂志计算,可能美国四分之三的家庭附近10英里以内就能有一家健康中心。 第二大支柱是大型保险公司的影响力。新的CVS加安泰是结合制药行业三个主要领域的巨头:零售店、保险和药品福利管理(或简称PBM,主要负责管理处方药计划)。美国最大的保险公司联合健康集团经营着一家药品福利管理、医生诊所,还有大约200家步入式诊所,但没有零售店。沃尔格林与药品福利管理合作但旗下没有保险公司,排名第五的保险公司信诺最近收购了最大的药品福利管理快捷药房,运营健康维护组织但没有社区诊所。合并后的CVS关注重点是利润在哪,即慢性疾病管理。成年人里50%到60%的人患有五大疾病中的一种或多种:糖尿病、高血压、心脏病、抑郁症和哮喘。相关疾病占美国每年3.5万亿美元医疗支出的80%。 新模式的核心在于将安泰客户的每个健康细节(包括住院、实验室检测和医生诊断)数据交给药剂师和健康专家,这些专家会经常与客户面对面交流,比客户生活中的医疗人员更频繁。安泰利用人工智能分析后,也会告诉健康中心的一线人员,从遗传学和病史来看哪些人可能罹患疾病。“一般成年人每年看医生1.6次。”梅洛说。“人们拿处方药的次数比看医生多多了。” |

In his office at CVS’s campus-like headquarters in the sleepy town of Woonsocket, R.I., CEO Larry Merlo is making his case: namely, that the big price for Aetna was deserved because the combination will establish a new paradigm for health care. “We don’t look at this as overpaying,” says Merlo, a folksy, mustachioed former pharmacist who famously banished tobacco products from his stores in 2014. “It’s a tremendous opportunity to transform the health care experience, to put the community at the center of care.” Indeed, on a May 1 conference call in which CVS announced better-than-expected results, Merlo discussed plans to make HealthHUBs the cornerstone of the new CVS. Investors liked what they heard. Shares surged 5.4%, adding almost $4 billion in value. CVS is relying on two pillars to make its convenience-store approach to health care a success. The first is its giant footprint. It operates 9,900 drugstores, standing in a virtual tie with Walgreens as the nation’s largest drugstore owner. Eighty percent of America’s families need to walk or drive 10 miles or less to reach a CVS. Today, it’s already running 1,100 MinuteClinics, which provide such basics as flu shots and shingles vaccinations, more than twice the number of walk-in outlets in Walgreens stores. Walmart, the No. 3 pharmacy owner, has just a smattering of in-store clinics in three states. In early May, CVS unveiled plans to grow its three Houston HealthHUBs to 20, or one for every seven stores in the metro area, and pledged to announce a bigger rollout plan in June. If CVS applies the same “hub-and-spoke” ratio nationwide that it now uses for the MinuteClinics by expanding the existing MinuteClinics into HealthHUBs—and analysts think that’s likely—a HealthHUB, by Fortune’s calculations, could be within 10 miles of three-quarters of America’s homes. The second mainstay is the clout of a giant insurer. The new CVS-Aetna is a colossus that combines the pharmacy industry’s three major areas: retail stores, insurance, and a pharmacy benefit manager (or PBM, which manages prescription drug plans). America’s largest insurer, UnitedHealth Group, operates a PBM, physicians’ practices, and about 200 walk-in clinics, but no retail stores. Walgreens partners with a PBM but doesn’t own an insurer, and fifth-ranking insurer Cigna recently acquired the largest PBM—Express Scripts—and runs HMOs but doesn’t operate neighborhood clinics. The new CVS is focusing on where the money is: managing chronic conditions. Between 50% and 60% of all adults suffer from one or more of the top five: diabetes, hypertension, cardiac disease, depression, and asthma. Those conditions account for 80% of America’s $3.5 trillion in annual health care spending. The new model’s Rx is to hand Aetna’s data on every detail of its members’ health—including hospitalizations, lab tests, and doctors’ diagnoses—to the pharmacists and wellness specialists who encounter those folks in person far more often than anyone else in their health care orbit. Aetna’s analytics, deploying artificial intelligence, also tell the HealthHUBs’ front line who, from genetics and medical history, is more likely to contract the conditions. “The average adult visits the doctor 1.6 times a year,” says Merlo. “People pick up prescriptions a lot more often than they see a physician.” |

|

尽管如此,CVS必须谨慎行事,避免跨越消费者隐私的法律界限,或让消费者感觉公司太了解自己。很多州和地方法律规定,只有直接参与提供或评估患者治疗的员工才能查看病史,也就是安泰的营销团队无法在CVS查看处方历史。法规还限制了哪些人能开处方和做检测,限制了艾滋病和精神健康患者的数据共享。隐私权倡导者已经开始关注保险和零售历史的结合。“这种模式就是诱导患者购买更加昂贵的药品从而增收,因为CVS了解患者的所有信息。”狄波拉·皮尔博士表示。他是一位精神病学家,也是游说团体患者隐私权的主席。 很明显,如果在药店里加入许多初级保健功能,可以提高效率。但梅洛还有一个更宏大的想法,他希望保险公司和保健组织向CVS付费,让人们保持健康。 |

Still, CVS must proceed cautiously to avoid either crossing legal boundaries governing consumer privacy or provoking customers’ perception that it knows too much about them. A thicket of state and local laws mandate that only employees directly involved in providing or assessing patient care can view medical histories—meaning marketing teams at Aetna can’t review prescription histories from CVS. Regulations also limit who is able to prescribe and perform tests, and restrict data-sharing for HIV and mental health patients. Privacy advocates are already raising concerns about mixing insurance and retail histories. “It’s a way to leverage more revenue from patients by steering them to their own more expensive pharmacies because CVS will know everything about them,” says Dr. Deborah Peel, a psychiatrist who is president of the advocacy group Patient Privacy Rights. It’s clear there are efficiencies to be gained from bringing many of those primary-care functions to the local drugstore. But Merlo has another, bigger idea: He wants insurers and HMOs to pay CVS to keep people healthy. |

****

|

“目前在药房业务中,并没有节约成本的分配机制。”CVS内部掌管830亿美元零售药房业务的主管凯文·霍利肯表示。CVS如何采取对策改变?“我们将在安泰内部开展工作,先证明能做,再推广到其他大型保险公司。”霍利肯指出,每年700万例再入院病例中有四分之一可以预防,大多数都是因为患者不服用慢性病药物或服药不当。通过健康中心提供的咨询服务,平均花费14000美元的复诊费用可能会大幅削减。“如果我们的服务能让琼斯女士不用回医院奔波就解决病痛,为保险公司节省1万美元,那么我希望得到节省费用里的X%。” 霍利肯说。 分成非常关键,因为CVS有块重要业务正在下降:费用报销。“按计划趋势应该是,‘去年付给你10美元,明年会付给你9美元。’”霍利肯说。结果是,利润率不断承受压力。反过来,这也是各种因素共同作用。新的仿制药报销金额往往是品牌药品的三倍。但近几年仿制药流通速度有所放缓,部分原因是仿制药在处方总量中的占比已经飙升至90%左右。药店也面临向“特殊”药物转移的痛苦,每年花费10000美元以上,主要治疗类风湿性关节炎和丙型肝炎等复杂疾病,通常在单独的药房或邮递分发。 各地的药品福利管理也发生了重大变化。而且由于2007年收购Caremark并在集团下保持快速增长后,CVS变成了主要参与者。2012年以来,Caremark的营业利润增长了75%,达到47亿美元,咨询公司Grand View Research预计,到2026年药品福利管理行业规模将翻番,收入达到7500亿美元。 不过Caremark和药品福利管理行业面临着严重威胁,可能影响预期达成。拟议中的法规将限制最擅长的模式,压低药品价格。Caremark为保险公司和健康维护组织管理处方药计划,为药店分发的药品付费。因此,实际上Caremark一直引导大部分保险公司用户前往接受最低报销额度的连锁店,导致CVS药房和沃尔格林之类的公司都很痛苦。 Caremark在为赞助商提供大幅折扣方面的效率又非常高,其赞助商包括安泰保险和数十家其他大型保险公司以及健康维护组织,给CVS的零售利润造成压力。以下是具体流程,Caremark编制“处方集”,也就是基于成本的推荐药物列表,而且健康计划里都覆盖。处方集指导医生、护士和医院开处方,也建议患者选择同类药中疗效相同但价格最低的品类。举个例子,只要能选择,CVS总是将新出仿制药换成品牌药。药品福利管理则会比较同类药物,最终选择实价最低的种类。 过去三年里,CVS已经获得了大约1400亿美元折扣,并通过争取折扣将品牌药品的实价上涨保持个位数较低水平。去年,CVS用礼来新获批的生物仿制药Basaglar代替了赛诺菲出品特别昂贵的处方药来得时。来得时的30天处方药花费是340美元,而Basaglar的花费是235美元。在27000名受影响的患者中,四分之三的人选择了Basaglar和其他低成本的替代品,为Caremark的计划节省了大笔资金。 情况很复杂,但在卫生和公众服务部提出新规则并应用于医疗保险和医疗药品计划里之后,对药品福利管理形成了威胁。在目前的制度下,Caremark和同行获得的折扣几乎全部归保险公司所有,保险公司则用这些钱降低保费(患者的共同支付和免赔额仍然基于官方“清单”价格)。大制药公司支持的拟议规定将把大部分折扣从保险公司转移出去,转而降低患者在药房的共同支付金额。整个生态都要随之变化。“如今大笔用于降低保费的资金将用于降低共同支付和免赔额。”美国企业研究所的经济学家约瑟夫·安托斯表示。 现在,竞争计划通过提供最低保费吸引老年人。如果提议或通过,药品福利管理节省下来从而帮保险公司降低保费的资金也会减少。正如安托斯指出,这才是老年人最关心的事。如此一来,以低保费获取大批新客户的能力将削弱,药品福利管理对该计划的价值降低,费用也可能下调。“大制药公司普遍支持某项提议时,一定要加倍注意。”梅洛说。确实,相关规定可能会削弱CVS最大的盈利来源。 那么,有什么替代方案呢? |

In the pharmacy business, no mechanism now exists for sharing savings,” says Kevin Hourican, chief of the $83 billion retail pharmacy business at CVS. The company’s game plan to change that? “We’ll do it internally with Aetna to prove we can do it ourselves, then bring it to the other big insurers.” Hourican notes that a quarter of the 7 million hospital readmissions each year are preventable, and that most are caused by patients who either don’t take their chronic-care medications or take them incorrectly. The return visits, costing $14,000 on average, could be sharply reduced through the type of counseling offered at the HealthHUBs. “If I can save an insurer $10,000 by preventing Ms. Jones from going back to the hospital, I want to share x percent of the savings,” says Hourican. That’s key, because an important part of CVS’s business is in decline: reimbursements. “The trend from the plans is, ‘Last year we paid you $10—next year we’ll pay you $9,’ ” says Hourican. Result: unremitting pressures on margins. That, in turn, is due to a convergence of factors. New generic drugs are typically reimbursed at three times the rate of branded drugs. But the flow of generics has slowed in recent years, in part because their share of total prescriptions has already soared to around 90%. Drugstores are also suffering from a shift to “specialty” drugs that cost $10,000-plus a year, treat such complex diseases as rheumatoid arthritis and hepatitis C, and are typically dispensed at separate pharmacies or by mail. But there are also significant changes happening in the PBM, or pharmacy benefit manager, world. And it’s a world where CVS is a major player, thanks to its 2007 acquisition of Caremark, which has grown fast under CVS’s ownership. Since 2012, Caremark’s operating profits jumped by 75% to $4.7 billion, and consulting firm Grand View Research predicts that the PBM industry will double in size to $750 billion in revenues by 2026. But Caremark and the PBM industry face a major threat that could undermine that forecast: proposed regulations that would limit what they do best, hold down drug prices. Caremark manages prescription drug plans for insurers and HMOs that pay for the drugs dispensed by pharmacies. So, in effect, Caremark tortures its own CVS drugstores, as well as the likes of Walgreens, by directing the lion’s share of their insurers’ members to the chains that accept the lowest reimbursements. Caremark has been extremely effective in driving deep discounts for its sponsors, a group that encompasses the premerger Aetna and dozens of other big insurers and HMOs, thereby putting pressure on CVS’s retail margins. Here’s how it works: Caremark establishes “formularies,” or lists of preferred medications based on cost, that your health plan agrees to cover. The formularies guide physicians, nurses, and hospitals to prescribe—and patients to request—the least expensive drugs in any category shown to be medically equivalent. CVS, for example, always substitutes new generics identical to branded names when they become available. The PBMs pit those me-too drugs against one another, choosing the one that offers the lowest net price. In the past three years, CVS has secured around $140 billion in rebates and held net branded drug price increases in the low single digits by wresting these bargains. Last year it replaced Sanofi’s super-expensive Lantus on its formulary with a newly approved biosimilar, ¬Basaglar from Eli Lilly. Lantus was priced at $340 for a 30-day prescription, versus $235 for Basaglar. Three-quarters of the 27,000 affected patients switched to Basaglar and other low-cost alternatives, producing big savings for Caremark’s plans. It’s complicated, but the new rules that threaten the PBMs, advanced by the Department of Health and Human Services, apply to Medicare and Medicaid drug plans. Under the current system, the discounts won by Caremark and its peers go almost entirely back to the insurance companies, which use the money to reduce premiums (patients’ co-pays and deductibles are still based on official “list” prices). The proposed regulations, backed by big drugmakers, would shift a large share of the discounts away from insurers and instead lower co-pays at the pharmacy counter. That would change the dynamic of this whole ecosystem. “A lot of the money that now goes to lowering premiums would go to [lowering] co-pays and deductibles,” says Joseph Antos, an economist at the American Enterprise Institute. Today, competing plans attract seniors by offering the lowest premiums. If the proposed regulation goes through, the insurers would have less of those PBM-generated savings to put toward lowering insurance premiums, which, as Antos points out, is what seniors care most about. That would weaken the ability of the plans to gain hordes of new customers with low premiums, hence the value of the PBMs to the plans would diminish, and their fees could shift downward. “When Big Pharma universally backs a proposal, your antenna goes up,” says Merlo. Indeed, the regulations could undermine what’s been CVS’s best profit engine. So, what could take its place? |

****

|

“每天有1万人满65岁。”56岁的安泰公司总裁凯伦·林奇说。“新客户很难找到更好的选择。”在CVS收购安泰时,也将林奇纳入麾下。她负责的医保优惠专营(可替代医保的私人管理计划)是合并后公司的业务增长引擎。 林奇在安泰时,优惠专营业务成员从2013年的96.8万增加到如今的220万,她现在除了继续负责该业务,也负责CVS旗下SilverScript部门的联邦医疗保险处方药物计划(向老年人提供的私人管理补充处方药计划)。安泰是率先提供前往医院和诊所交通服务的公司之一,也是第一批向老年人提供紧急护理服务不额外收费的公司。林奇母亲自杀时她才12岁,在她的领导下,安泰提供了最慷慨的行为健康计划之一。 现在优惠计划已经发展成为规模超过200亿美元的业务,占安泰销售额的三分之一,不过CVS还有很大发展空间。其医保优惠专营规模仍然远小于两家行业领导者UnitedHealth和Humana。增速确实很快。第一季度新成员数激增了14万人,增加了27%,也是大型医保优惠计划里增速最快的。 对CVS来说,从“让人们恢复健康”的药店连锁到打造前所未见的组合,可以说是巨大的战略延伸,可能会改变医疗保健的未来。CVS与安泰的交易在未知领域取得突破,结果很难预测。可以比作开拓性的治疗方法,可能拯救数百万人的生命,但尚未经过检测。为了进一步推动,CVS需要通晓两方面业务的领导者,也需要能够打通两块业务的新思路。 林奇就是个好例子。之前董事会选择她接替退休的安泰首席执行官马克·贝托里尼,也是接替63岁梅洛的热门人选。为了利用好零售商与保险公司的联姻,她在应用CVS称之为“盒内恢复”的概念。“出现问题最好的时机是病人第一次出院时。”她表示。比如某个病人刚做过膝关节手术。根据“盒内恢复”概念,安泰保险的护理经理会通知健康中心的护理看门人或药剂师,安排从医院回家的交通,送给病人一个大包裹,其中包括新处方、膝盖踏板车、沐浴椅和头几天里的健康膳食。“目前的非定期护理系统下,人们只在出现问题时才去治病,今后取而代之的是在生活购物的地方获得服务。我们是医疗的新大门。”她说。这一愿景诞生于休斯顿商业街的瑜伽工作室和筛查室。 但很快你身边的角落也会出现。(财富中文网) 本文另一版本登载于《财富》杂志2019年6月刊,标题为《现在药店会照看你了》。 译者:冯丰 审校:夏林 |

Ten thousand people turn 65 every day,” says Aetna president Karen Lynch, 56. “It’s hard to imagine a better place for new customers.” CVS brought Lynch into the fold as part of the Aetna acquisition. And her Medicare Advantage franchise (the privately managed plans that are an alternative to Medicare) is a leading growth engine for the combined enterprise. At Aetna, Lynch expanded the Advantage ranks from 968,000 in 2013 to 2.2 million today, and she now oversees that in addition to CVS’s giant SilverScript Medicare Part D program (the privately managed supplemental prescription drug program for seniors). Aetna was among the pioneers in providing transportation to hospitals and clinics, and it was one of the first to grant seniors acute-care service at no extra charge when they travel outside their service area. Under Lynch, who was just 12 years old when her mother committed suicide, Aetna also offered one of the most generous behavioral health programs. Advantage is now a $20 billion–plus business and represents one-third of Aetna’s sales, yet CVS has lots of headroom. Its Advantage franchise is far smaller than those at the two leaders, UnitedHealth and Humana. But it’s gaining fast: In the first quarter, enrollment surged by 140,000, or 27%, the largest percentage increase of any big Medicare Advantage plan. It was a big strategic stretch for CVS to go from a let’s-get-healthy drugstore chain to a never-before-seen combination that could change the future of health care. The CVS-Aetna deal is breaking ground in territory so uncharted that the results are as hard to predict. You could liken it to a trailblazing medical procedure that could save millions of lives but has yet to be tested. And to make it work, CVS will need leaders with a mastery of both sides of the business—and new ideas that bridge these two diverse disciplines. Lynch is a case in point. She was the board’s choice to follow now-retired Aetna CEO Mark Bertolini, and she is a favorite to succeed Merlo, who’s 63. To exploit the union of a retailer and an insurer, she’s employing a concept CVS calls “Recovery in a Box.” “The prime time for things to go wrong is when people are first discharged from the hospital,” she says. Take a patient who’s just had knee surgery. Under Recovery in a Box, an Aetna care manager would message a care concierge at HealthHUB or a pharmacist to arrange transportation home from the hospital and deliver a big package containing new prescriptions, a knee scooter, a shower chair, and healthy meals for the first few days. “The current system of episodic care, where people seek care when something goes wrong, is being replaced by service where you live and shop. We’re the new front door for health care,” she says. It’s a vision born in the yoga studios and screening suites at a Houston strip mall. But it’s coming soon to a corner near you. A version of this article appears in the June 2019 issue of Fortune with the headline “Your Drugstore Will See You Now.” |