这家机构曾是硅谷风投大鳄,如今已经连续亏损20年,到底怎么回事?

|

大约五年前,弗拉基米尔·特内夫和拜朱·巴特创办了一家名为Robinhood,不收佣金的股票经纪公司,并着手为这家刚刚起步的硅谷公司筹措资金。他们寻求获得相对较少的1300万美元投资——其创意的估值由此将达到6100万美元。这两位曾经的斯坦福大学同学当时即将过30岁生日。他们做了一件企业家们几十年来一直在做的事情:恳请历史悠久的风险投资公司凯鹏华盈(Kleiner Perkins Caufield & Byers)提供支持。 在硅谷沙丘路,凯鹏华盈的名号就像奥普拉在好莱坞那般响亮。尽管这家风投大鳄看到了Robinhood的潜力,它并没有选择出手。然后,在2015年年中,当Robinhood寻求以2.5亿美元的估值再融资5000万美元时,凯鹏华盈又一次置身事外。2017年寻求另一笔1.1亿美元投资时,这家硅谷初创公司已经以13亿美元的估值,华丽演变为一只“独角兽”。但这一次遭到冷落的,是凯鹏华盈:它被排除在参与融资的风投公司名单之外。 根据交易撮合者的说法,直到去年年初,Robinhood和凯鹏华盈才最终携手。到那时,这家新锐公司已经在经纪行业引发巨大震荡,以至于富达、TD Ameritrade和嘉信理财等业界巨头不得不削减费用,以回应Robinhood提供的零佣金服务。在华尔街著名分析师玛丽·米克的斡旋下,此前多次错失投资机会的凯鹏华盈现在参与了这一轮总额为3.63亿美元的融资——这笔融资对Robinhood的估值高达56亿美元。自2011年以来,米克一直担任凯鹏华盈合伙人。 对于这家曾经名满天下的公司来说,无法参与一家热门初创企业的首轮融资,随后不得不以昂贵得多的代价入股,现在已经变得司空见惯。凯鹏华盈此前已经错失了整整一代技术投资,即本世纪初那批所谓的Web 2.0公司,其典型代表当属Facebook。现如今,在2010年代,它又一次未能对当下最受欢迎的初创公司进行早期投资,尽管这是风险资本投资的传统主业。但这一次,它出现了一个反常的转折:凯鹏华盈以米克为核心的新战略取得了巨大成功。她在公司内部管理着一只单独的基金,专注于投资更加成熟、需要资本来增长的私人公司,而不是那些仅仅想站稳脚跟的初创公司。 相较于“风险”投资,面向更成熟企业的“增长型”投资应该更安全一些,回报率也会相应较低。然而,米克投资团队的表现却超过了长期担任凯鹏华盈领导者的约翰·多尔所监管的风险投资团队。多年来,一批不太知名的投资家相继加入,随后离开多尔的团队。成功入股这个时代最有前途公司(比如Slack、DocuSign、Spotify和Uber)的,是米克领导的团队,而不是凯鹏华盈的风投部门。这种状况引发了怨恨情绪——毕竟,谁获得称赞,更重要的是,谁获得报酬,是一个与投资业务同样古老的冲突焦点。 更糟糕的是,凯鹏华盈内部形成了一个阶级体系。在外部世界,尤其是那些考虑接受凯鹏华盈资金的企业家看来,这一点非常明显:米克团队堪称业界翘楚,而风投部门充其量也不过是二流机构。专门研究风险资本的斯坦福大学金融学教授伊利亚·斯特拉耶夫表示:“20年前,凯鹏华盈处于风险资本世界的顶峰。如今,它只是众多参与者中的普遍一员。” 接下来发生的是商界另一个古老的故事。它讲述了一个曾经骄傲的业界领导者如何发现自己变得无关紧要。它表明,接班计划有多么重要,没有充分培养合适继任者将产生多么严重的后果。它也提醒我们,即使历经40多年的实践,从一群想要成功的企业中找出早期成功者,仍然是一件难以捉摸、难于上青天的事情。对于凯鹏华盈在过去几年中发生的事情,无论是该公司的合伙人,还是以守口如瓶著称的风投圈子,都没有兴趣讨论,至少不愿公开讨论。多尔、米克和凯鹏华盈的其他负责人都拒绝接受本文采访或发表评论。但20多名现任和前任员工、凯鹏华盈基金的投资者、企业家和其他行业观察人士确实谈到了问题所在,以及如果可能的话,凯鹏华盈如何才能重拾昔日魔力。 |

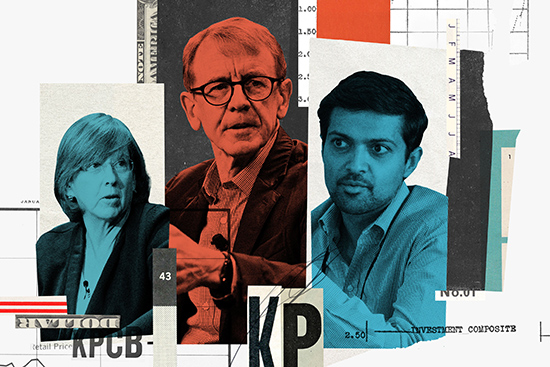

Some five years ago Vladimir Tenev and Baiju Bhatt, founders of a potentially disruptive no-fee stock brokerage startup called Robinhood, set out to raise capital for their fledgling Silicon Valley outfit. They sought a relatively small amount, $13 million, that would value their idea at $61 million. The former Stanford classmates, both within spitting distance of their 30th birthdays at the time, did what entrepreneurs have been doing for decades: They asked the venerable venture capital firm Kleiner Perkins Caufield & Byers to back them. Kleiner—its singular name is as sufficient on Sand Hill Road as Oprah is in Hollywood—was interested. The firm sees lots of opportunities, however, and it chose not to bite. Then, in mid-2015, when Robinhood was looking for another $50 million at a valuation of $250 million, Kleiner passed again. By 2017, when Robinhood became a “unicorn” valued at $1.3 billion as it raised an additional $110 million, it was the startup doing the snubbing: It excluded Kleiner from the list of venture firms that participated in its funding. It wasn’t until early last year that Robinhood and Kleiner finally connected, according to accounts from dealmakers on both sides. By then Robinhood had made such a splash in the brokerage world that Fidelity, TD Ameritrade, and Charles Schwab had cut fees in response to the upstart’s zero-commission offering. Under the sponsorship of famed Wall Street analyst Mary Meeker, a Kleiner partner since 2011, the firm that had failed repeatedly to invest at increasing levels now participated in the $363 million funding round, valuing Robinhood at $5.6 billion. The inability to get in on a hot startup’s ground floor, only to subsequently pay a far richer price, was all too common for the once-storied firm. Kleiner had sat out on another generation of technology investments, the crop of so-called Web 2.0 companies, including Facebook in the 2000s. Now, in the 2010s, it was failing again to make early-stage investments—the traditional meat of venture capital investing—in the most sought-after startups of the day. But this time its whiffs came with a perverse twist: Kleiner was succeeding wildly with a new strategy centered around Meeker, who ran a separate fund within the firm focused on more mature private companies that required capital to grow as opposed to merely establish themselves. “Growth” investing, with its more developed companies, should be somewhat safer than “venture” investing and would also earn commensurately lower returns. Yet Meeker’s investment team outperformed the venture group overseen by longtime Kleiner leader John Doerr and a rotating ensemble of lesser-known investors who joined and left him over the years. Meeker, not the venture capital investing unit, was landing stakes in the era’s most promising companies, including Slack, DocuSign, Spotify, and Uber, breeding resentment over tension points as old as the investing business: Who gets the credit and, more important, who gets paid. Worse, a class system developed inside Kleiner, evident to the outside world as well, notably among entrepreneurs mulling accepting Kleiner’s money: Team Meeker was a top-tier operation while the venture unit was B-list at best. Says Ilya Strebulaev, a Stanford finance professor who studies venture capital: “Twenty years ago, Kleiner Perkins was at the pinnacle of venture capital. These days it’s just one of many firms trying to compete.” What happened next is another age-old tale in the business world, of how a once-proud stalwart found itself on the edge of irrelevance. It’s about just how much succession planning matters and the ramifications of not adequately grooming the right successors. And it’s a reminder that something as elusive as identifying early-stage winners from the pack of wannabes doesn’t get easier, even after more than four decades of practice. The story of what happened in the past handful of years at Kleiner is also one neither the firm’s partners nor the notoriously tight-lipped VC industry around it are interested in discussing, at least on the record. Doerr, Meeker, and other Kleiner principals all declined to be interviewed for this article or to comment. But more than 20 current and former employees, investors in Kleiner’s funds, entrepreneurs, and other industry observers did talk about what went wrong and how, if possible, the firm can ever regain that old Kleiner magic. |

****

|

从1972年成立到1999年对谷歌投资1180万美元,在凯鹏华盈的黄金岁月,你很难相信这家风投大鳄必须得费尽周折才能入股一家前景光明的初创公司。彼时,凯鹏华盈进行了一系列富有传奇色彩的投资,诸如Tandem Computers、基因泰克、太阳微系统、电子艺界、网景和亚马逊等业界标杆的背后都有它的身影。像任何一家风投公司一样(接受早期阶段投资的初创公司往往没有一分钱收入),凯鹏华盈当然品尝过失败的滋味。但它的整体投资业绩令人惊叹。例如,一只20世纪90年代中期的基金每投资1美元,就能获得32美元的回报。它在沙丘路上的权势是毋庸置疑的。“再也没有比获得凯鹏华盈的投资更好的事情了。”硅谷历史学家莱斯利·伯林这样说道。“这是最高级别的认可标志。这对企业家来说意味着一切。” 20年来,这家公司最有能力的投资者非约翰·多尔莫属,尽管他的名字没有出现在信笺上。多尔曾经是英特尔的销售人员,于1980年加入凯鹏华盈,并逐渐成为该公司事实上的领导者。多尔取得了一连串的成功——网景、亚马逊和谷歌,是他的经典投资案例。在一些最令人兴奋的科技公司中,他是一位活跃而有影响力的董事会成员。在互联网时代,他还是一位杰出的硅谷啦啦队队长。 实际上,多尔是如此强势,以至于他能够推动凯鹏华盈将全部精力从互联网转移到他最新的激情项目上:他笃信,可再生能源公司将成为下一波重要的科技投资浪潮。多尔是一位杰出的民主党筹款人,也是前美国副总统阿尔·戈尔的朋友——多尔让他成为一位凯鹏华盈合伙人。从2004年到2009年,该公司在54家“清洁技术”公司共投资了6.3亿美元。在22位凯鹏华盈合伙人中,有12位将部分或全部时间用于所谓的绿色投资。 凯鹏华盈的初衷也许是好的,但它的投资失败了。其中一些投资对象破产了,比如电动汽车制造商Fisker Automotive。其他一些投资对象,比如燃料电池制造商Bloom Energy,在2002年获得凯鹏华盈投资之后,足足花了16年时间才上市。就这样,当凯鹏华盈的竞争对手们纷纷在数字经济中斩获投资佳绩的时候,这个金字招牌却蒙上了一层阴影。例如,Accel Partners是Facebook的早期支持者。合广投资是第一批投资推特的公司之一。通过投资eBay在web1.0时代取得成功的Benchmark Capital,成为Uber的早期投资者。 多尔将凯鹏华盈推入了一个不幸的投资类别,他也未能组建起一支可以带领公司走出困境的投资家团队。一方面,凯鹏华盈倾向于招揽那些没有投资经验,或者没有在困难时期坚持下来的知名人士。前美国国务卿科林·鲍威尔是一位“战略顾问”。戈尔是一位全身心参与的投资家。太阳微系统公司的联合创始人、杰出的技术专家比尔·乔伊在凯鹏华盈做了9年的合伙人。太阳微系统的另一位联合创始人维诺德·科斯拉,是多尔招揽的最接近投资同行的团队成员。但科斯拉在2004年挂印而去,自立门户。现如今,他的公司已经成为沙丘路上一股不可小觑的力量。 凯鹏华盈也因其拥有众多血统纯正的年轻投资家而闻名。在供职数年之后,这些青年才俊往往因为没有获得晋升至高层的机会而黯然离去。其中许多人成为风险投资界的下一代领导者——但他们所领导的,不是凯鹏华盈。例如,史蒂夫·安德森在21世纪初曾经在凯鹏华盈待了4年。他独自创业,后来成为Instagram的首位投资者。Instagram最终以10亿美元的价格卖给了Facebook。以创造“独角兽”(意指曾经罕见的估值达10亿美元的初创公司)一词而著称的艾琳·李,现在执掌风投公司Cowboy Ventures。特雷·瓦萨罗是凯鹏华盈在那个时代最成功的投资案例之一(即恒温器制造商Nest)的关键人物。她后来创办了专注于早期阶段投资的风投公司Defy。 无休止的人才外流造成了两个问题:企业家们不确定谁会留在凯鹏华盈指引他们前行,多尔也不知道他退休后谁将领导这家公司。这个问题并非凯鹏华盈独有,但对于该公司来说,这确实是一个极其严峻的问题。“接班向来是风险投资公司面临的一大挑战,因为这些公司往往跟某个大人物紧密相连。”《创意资本》(Creative Capital)一书的作者斯宾塞·安特这样说道。“有些人比其他人更善于放权。”就多尔的例子而言,他似乎无法找到一位兼具潜力和名望的接班人。“我认为问题出在约翰,以及他对超级英雄的迷恋上面。”一位前凯鹏华盈投资者说,“如果你在加入时还不是超级英雄,你就不会在凯鹏华盈成为超级英雄。” 多尔需要一个新策略,以及一个与他相称的大人物来辅佐自己,他找到了两者。他在2010年筹集了凯鹏华盈首只“增长型”基金,当时的假设是,如果凯鹏华盈无法捕捉早期的初创明星企业,它至少可以在这些明星企业崛起之后将其揽入怀中。为了管理这只新的10亿美元基金,他在2011年说服该公司的老朋友,摩根士丹利分析师玛丽·米克搬到西海岸,在其职业生涯中首次成为一位投资家。这一进展在一定程度上挽救了凯鹏华盈,并最终导致它一分为二。 |

Having to sweat to get into a promising startup would have been unthinkable during Kleiner’s golden years, from its founding in 1972 through its $11.8 million investment in Google in 1999. The firm made legendary investments in startup icons including Tandem Computers, Genentech, Sun Microsystems, Electronic Arts, Netscape, and Amazon.com. Like any venture firm, which invests so early in a company’s existence that it often has no revenue yet, Kleiner had its share of stinkers. But Kleiner’s overall investment results were staggering: A mid-90s fund, for example, returned $32 for every dollar invested. Its power on Sand Hill Road was unquestioned. “You could not do better than a Kleiner deal,” says Silicon Valley historian Leslie Berlin. “It was a sign of approval from the very highest level. And it meant everything to entrepreneurs.” The firm’s ablest investor for two decades, though his name wasn’t on the letterhead, was John Doerr. A former Intel salesman, Doerr joined Kleiner in 1980 and over time became its de facto leader. Doerr scored a string of hits—Netscape, Amazon, and Google—becoming an active and forceful board member at the tech industry’s most exciting companies. He also was a prominent cheerleader for Silicon Valley in the age of the Internet. Doerr was so powerful, in fact, that he was able to pivot Kleiner’s entire thrust away from the Internet and toward his latest passion project: renewable energy companies he believed would be the next important wave of tech investing. Doerr was a prominent Democratic fundraiser and pal of former Vice President Al Gore, whom Doerr made a Kleiner partner. Between 2004 and 2009, the firm had invested $630 million across 54 “clean tech” companies, and 12 of its 22 partners spent some or all of their time on so-called green investments. The firm’s heart may have been in the right place, but its investments flopped. Some, like electric-car maker Fisker Automotive, went bankrupt. Others, like fuel-cell manufacturer Bloom Energy, took 16 years from Kleiner’s investment in 2002 to go public. The result was a tarnished brand at a time Kleiner’s competitors were killing it with investments in the digital economy. Accel Partners, for example, was the early backer of Facebook. Union Square Ventures was among the first to put money into Twitter. And Benchmark Capital, which scored in the web’s first era by investing in eBay, staked Uber in its early days. Doerr had pushed Kleiner into an unfortunate investment category, and he also failed to assemble a team of investors that could lead the firm past its troubles. On the one hand, Kleiner had a penchant for collecting famous names who nevertheless had no investing experience—or didn’t stick around through troubled times. Former Secretary of State Colin Powell was a “strategic adviser.” Gore was a full-on investor. Bill Joy, a cofounder of Sun Microsystems and by acclaim a brilliant technologist, was a Kleiner partner for nine years. Vinod Khosla, another Sun cofounder and the closest Doerr had to an investing peer, jumped ship in 2004 to set up his own shop, a formidable power on Sand Hill Road today. Kleiner also became known as a firm full of highly pedigreed young investors who stayed for a number of years but left without being given a shot at ascending to the top ranks. Many constitute the next generation of leadership in the venture capital world—but not at Kleiner. Steve Anderson, for example, did a four-year stint in the early 2000s. He went out on his own and later became the first investor in Instagram, which sold itself to Facebook for $1 billion. Aileen Lee, famous for coining the expression “unicorn” for the once-rare billion-dollar startup, now runs Cowboy Ventures. Trae Vassallo, key to one of Kleiner’s biggest successes of the era, thermostat maker Nest, started her own early-stage-focused firm, called Defy. The endless outflow created two problems. Entrepreneurs couldn’t be sure who would be around at Kleiner to help guide them, and Doerr didn’t know who would lead the firm when he retired. It wasn’t a problem unique to Kleiner, but it was an acute one. “Succession has always been a challenge with venture capital firms because they tend to be so tied to specific, large personalities,” says Spencer Ante, author of Creative Capital, a history of the industry. “Some people are better at giving up control than others.” In Doerr’s case, he couldn’t seem to alight on the right mix of promise and stature. “I think the answer lies in John and his superhero fixation,” says one ex-Kleiner investor. “If you weren’t already a superhero coming in, you weren’t going to become a superhero at Kleiner.” In need of a new strategy and a high-wattage personality to match his own, Doerr found both. He raised Kleiner’s first “growth” fund in 2010 on the assumption that if Kleiner couldn’t catch early-stage stars, at least it could get them before their ascent was complete. To run the new billion-dollar fund, in 2011 he persuaded a longtime friend of the firm, Morgan Stanley’s Mary Meeker, to move west and become an investor for the first time in her career. It was a development that would partly resuscitate Kleiner—and eventually lead to its being cleaved in half. |

****

|

在硅谷,米克已经是一位传奇人物,尽管她的整个职业生涯都在纽约从事研究分析工作。她是在一个分析师与投行家密切合作的时代成长起来的。米克对网景、亚马逊和谷歌等公司的热情支持(上述公司都在凯鹏华盈的投资组合中),帮助摩根士丹利赢得了这些公司的IPO承销权。新规则禁止投资银行奖励研究相关交易的分析师,因此多尔邀请米克运营新基金的提议给了她一个改头换面的机会。“我一直想参与投资事务。”她在2012年告诉《连线》杂志。“十年来,凯鹏华盈团队一直在和我讨论加入的问题。我想,如果我现在不加入,我就永远也不会加入了。” 她深厚的人脉和发现技术趋势的能力几乎立刻得到了回报。凯鹏华盈的新增长基金相继投资了Facebook、LendingClub、DocuSign、Snapchat和Slack等公司。是的,所有这些公司都是其他风险投资家培育起来的,但当米克投资时,它们仍然拥有很大的上升空间。就其类别而言,回报率非常高。凯鹏华盈向投资者提供的数据显示,截至去年年底,该公司增长型基金的投资增值了2.4倍。这一业绩超过了凯鹏华盈同期筹集的一只风险基金,尽管后期投资的风险要低得多。 当米克斩获一连串胜利的时候,凯鹏华盈的早期阶段风投业务仍旧停滞不前,尤其是同竞争对手和它辉煌的过去相比。成功的案例还是有的。比如,长期合伙人特德·施莱因投资了一系列安全软件公司,并取得了不错的收益。兰迪·科米萨和特雷·瓦萨罗对Nest进行了早期投资,后者在2014年被谷歌以32亿美元收购。但这些成功还不够,凯鹏华盈继续错失一些更大的机会。它在2010年筹集的基金增值了一倍。但与类似年份成立的一只Benchmark基金相比,这一业绩就相形见绌了。拜它对Uber和Snapchat的投资所赐,Benchmark增值了25倍。 毫无助益的是,凯鹏华盈还面临无数令人分心的事情。即使它的替代能源投资宣告失败或陷入绝境,多尔仍然试图通过收购另一家公司来解决早期投资业务的领导问题。他主动接洽以直言不讳著称的Facebook前高管查马斯·帕利哈皮蒂亚,后者是当时计划筹集第三只基金的Social Capital的幕后推手。多尔曾经以私人身份投资Social Capital(对于沙丘路上的大佬来说,这种做法并不罕见)。他认为,帕利哈皮蒂亚的果敢和人脉关系,或许有助于解决凯鹏华盈面临的种种问题。 然而,关于帕利哈皮蒂亚将拥有凯鹏华盈多大控制权的谈判最终破裂。帕利哈皮蒂亚拒绝接受本文采访。大约在同一时间,凯鹏华盈正在打一场激烈的官司——多尔的门生鲍康如起诉该公司性别歧视。尽管凯鹏华盈最终胜诉,但这场官司让其声誉严重受损。多尔继续寻找新的人才。他和长期合伙人施莱因在多尔此前尝试过的一个地方,找到了一位领导人选:他们招募Social Capital的另一位联合创始人马蒙·哈米德负责早期投资业务。此君曾经领导Social Capital成功入股Slack。2017年,也就是在多尔成为董事长(在风投公司,这一职位往往带有荣誉退休的意味)一年之后,哈米德加入凯鹏华盈。多尔将他奉为凯鹏华盈的新领导人,这一举动将使这位新人与米克产生冲突,因为她已经在很大程度上扮演着该公司领导者的角色。 |

Meeker was already a legend in Silicon Valley, despite having spent all of her career as a New York City–based research analyst. She came of age in an era when analysts worked hand in glove with investment bankers, and her enthusiastic support for companies like Netscape, Amazon, and Google—all in Kleiner’s portfolio—helped Morgan Stanley win the mandate to underwrite their IPOs. New rules prohibited investment banks from rewarding analysts on deals, so Doerr’s offer to have Meeker run the new fund afforded her the opportunity to repot herself. “I always wanted to invest,” she told Wired in 2012. “The Kleiner team had been talking to me for a decade about joining, and I thought that if I didn’t do it now, I never would.” Her deep network and ability to spot tech trends paid off almost immediately. Kleiner’s new growth fund invested in the likes of Facebook, LendingClub, DocuSign, Snapchat, and Slack—all companies seeded by other venture capitalists that nevertheless had plenty of upside left when Meeker invested. The returns were stellar for its category. Kleiner’s growth fund grew investments by 2.4 times as of late last year, according to data the firm supplied to its investors. That performance bested a Kleiner venture fund raised at a similar time, even though later-stage investments are designed to be considerably less risky. And as Meeker was racking up victories, Kleiner’s early-stage practice continued to stumble—especially compared with the competition and its own illustrious past. There were successes. Longtime partner Ted Schlein, for example, invested in a series of security-software companies that were purchased for healthy gains. Randy Komisar and Trae Vassallo invested early in Nest, acquired in 2014 by Google for $3.2 billion. But the wins weren’t enough, and Kleiner continued to miss bigger opportunities. The fund it raised in 2010 doubled its money. But that paled in comparison to a Benchmark fund of a similar vintage that multiplied investors’ capital by 25 times, thanks to investments in Uber and Snapchat. It didn’t help that Kleiner faced a myriad of distractions. Even as its alternative-energy investments were blowing up or otherwise foundering, Doerr set out in 2014 to solve the early-stage leadership problem by trying to buy another firm. He approached Chamath Palihapitiya, an outspoken former Facebook executive who was the driving force behind Social Capital, which at the time was planning to raise its third fund. Doerr had personally invested in Social Capital, a not-uncommon practice for the bigwigs of Sand Hill Road, and he thought Palihapitiya’s brashness and connections could be the answer to Kleiner’s problems. Talks eventually broke down, however, over how much control Palihapitiya, who declined to comment for this article, would have over all of Kleiner. Around the same time, Kleiner was fighting a bruising court battle, a gender discrimination suit filed by Ellen Pao, a Doerr protégé. Kleiner emerged victorious but bloodied from the litigation, and Doerr continued his hunt for new talent. He and Schlein, who helped manage the firm, found it at the same place Doerr tried before, Social Capital, by recruiting another cofounder, Mamoon Hamid, to head up early-stage investing. Hamid, who had led Social Capital’s investment in Slack, joined Kleiner in 2017, a year after Doerr became chairman, a role that connotes something like emeritus status at a venture firm. Doerr presented Hamid as the new leader of Kleiner—a move that would put the newcomer in conflict with Meeker, who already was providing plenty of leadership of her own. |

****

|

加入凯鹏华盈后不久,现年41岁的哈米德就向公司员工分发了一份调查问卷,询问他们对公司免费食物的看法。他在一封电子邮件中写道:“我们希望提供高品质的零食,让每个人都开心。”对美食的关注即使在经济上不重要,也是文化上的重要改变。毕竟,他是带着扭转乾坤的重任加入凯鹏华盈的。几个月后,凯鹏华盈把它的年度假日派对从坐落于郊区,因循守旧的门罗马戏团俱乐部,搬到了旧金山覆有沙砾的Tenderloin社区,哈米德坚决要求不再提供姓名标签。他认为这是一种不够酷的老派做法。 抱怨终于来了。哈米德对自身权威的行使,不只局限于世代礼仪,以及早就应该重新设计的公司官网。他还将注意力转向了整个公司的运营方面,包括增长型基金。哈米德开始参加增长团队会议,就投资理念发表意见,帮助寻找投资交易。他想模糊哪些类型的投资适合哪些基金的界限。这意味着,他设想早期基金将持有更大股份,而这恰恰是增长型基金的领域。凯鹏华盈的内部人士表示,哈米德认为自己在帮忙,而米克的团队将哈米德的提议视为横加干涉。 这两只基金之间的关系变得更加困难,因为凯鹏华盈的合伙人有权分享彼此的投资成果。事实证明,米克基金的成功也是其他合伙人的一大福音。但围绕这个好处究竟该有多大所做的决定,很快就引起争议。该公司鼓励投资家在交易中展开合作,但并没有明确具体的回报公式。一位前凯鹏华盈投资家表示:“突然间,米克规模庞大的增长型基金开始产生收益,有很多人公开邀功,并寻求分一杯羹,说什么‘我做了这件事’,‘ 我帮了那个忙’等等。”据一位接近增长团队的人士透露,该团队的成员开始问:“为什么我们要把这么大一块收入分给那些啥都没干的人?” 双方不只是在报酬方面存在分歧。哈米德此前从另一家公司招募了一位同代人,即Index Ventures风投公司的伊利亚·富什曼,提议两人合伙创建一家公司——尽管凯鹏华盈已经存在了几十年。他们的目标之一是能够向企业家们保证,凯鹏华盈的增长型基金将为他们公司的后续投资提供资金。不过,米克并不愿意做出这样的保证。在一些行政问题上,比如基金管理、招聘方式和投资委员会的结构方面,双方也持有不同意见。 到了去年,凯鹏华盈内部的氛围进一步恶化,不仅自尊心受挫,许多人也心生怨恨。在各种顶级风投家排名中,凯鹏华盈合伙人的位置一落千丈;在CB Insights最近公布的全球前20名风险投资家榜单中,位列第8位的米克是唯一一个与凯鹏华盈有关的名字。一位前内部人士表示:“坦白地讲,凯鹏华盈的每个人都很在意这些排名。”另一位前内部人士宣称:“从外部空降加入的哈米德认为,他是这个地方的新老大,而米克一直认为自己是老大。她为什么不离开呢?” 去年9月,米克就这样做了。她宣布将退出凯鹏华盈,成立一家名为Bond的公司,仍然专注于投资处于后期阶段的私人企业。与米克一起出走的,还包括她在凯鹏华盈领导的团队。这些人包括她的长期合伙伙伴穆德·罗汉尼、华平创投的老兵诺亚·克瑙夫,以及自2001年以来一直在凯鹏华盈工作的朱丽叶·德·博比尼。他们离开后,哈米德、富什曼和剩下的一些凯鹏华盈投资家将不得不重建该公司的声誉。 |

Not long after Hamid, who is 41, joined Kleiner, he circulated a poll to the firm’s staff with questions about the free food provided in the office. “We’d like to have a high-quality selection of snacks that makes everyone happy,” he wrote in an email. The focus on noshing was culturally if not financially significant. He’d been brought in to shake things up, after all. A few months later, when Kleiner moved its annual holiday party from the fusty Menlo Circus Club in the suburbs to a hipster venue in San Francisco’s gritty Tenderloin neighborhood, Hamid insisted on skipping the uncool practice of providing name tags. Cue the grumbling. Hamid’s assertion of authority extended beyond generational etiquette and a long overdue redesign of the firm’s website. He also turned his attention to the operations of the entire firm, including the growth fund. Hamid began attending growth team meetings, for example, and giving input on investment ideas, offering to help source deals. He wanted to blur the lines of what types of investments were appropriate for which funds, meaning he envisioned the early-stage fund taking bigger stakes, the province of the growth fund. Hamid, say Kleiner insiders, saw himself as helping; Meeker’s team viewed Hamid’s offers as meddling. The relationship between the two funds was made more difficult because Kleiner partners shared in the spoils of one another’s investments. The success of Meeker’s fund had proved to be a boon to other partners. But deciding how much of a boon quickly became contentious. The firm incentivized investors to work together on deals but wasn’t clear on what the rewards formula was. “All of a sudden, [Meeker’s] monster growth fund starts working, and there was a lot of credit-seeking and lobbying for their share, claiming, ‘I did this,’ and ‘I helped with that,’ ” says a former Kleiner investor. According to someone close to the growth team, its members began to ask: “Why do we want to give such a big portion of the money we earn to people who aren’t contributing anything?” The two sides disagreed about more than compensation. Hamid had recruited a contemporary from another firm, Ilya Fushman of Index Ventures, with the suggestion the two could build a firm together. Never mind that Kleiner had been around for decades. One of their goals was to be able to assure entrepreneurs that Kleiner’s growth outfit would be able to fund later investment rounds in their companies. Meeker wasn’t willing to make those assurances though. The two sides disagreed on a number of administrative issues too, like fund governance, hiring practices, and the way investment committees would be structured. By last year the mood inside Kleiner devolved into one of bruised egos and general resentment. Rankings of top VCs routinely pushed Kleiner partners far down the list; of the world’s top 20 venture capitalists published recently by CB Insights, Meeker’s was the only name associated with Kleiner, at No. 8. “Let’s be perfectly honest. Everyone at Kleiner cares about that stuff,” says a former insider. Says another: “Mamoon comes in and thinks he’s the new sheriff in a place where Mary thinks she’s the sheriff. Why wouldn’t she leave?” In September, Meeker did just that. She announced she would exit Kleiner to set up a firm called Bond, still focused on late-stage private companies, and would take her Kleiner team along for the ride. These included her longtime partner Mood Rowghani, Warburg Pincus veteran Noah Knauf, and Juliet de Baubigny, who had been with Kleiner since 2001. They would leave behind Hamid, Fushman, and a small group of other Kleiner investors to try to rebuild the firm’s reputation. |

****

|

风险投资公司的拆分与婚姻的破裂并没有多大不同。现年59岁的米克还没有完成Bond的筹资工作,她一直在照顾凯鹏华盈的“孩子们”,也就是那些她在该公司工作期间投资的公司。就像离婚的配偶还没有整理好离婚文件一样,双方仍在同居。他们仍然共用位于旧金山的South Park社区,以及凯鹏华盈大本营(即那栋坐落于门洛帕克沙丘路的综合大楼)的办公空间。 现年67岁的约翰·多尔仍然是凯鹏华盈的董事长。他不再积极参与投资事务,但仍然会尽其所能地提供帮助。他最近出版了一本名为《衡量什么是重要的》(Measure What Matters)的著作。在这本书中,他分享了自己在谷歌和其他公司通过“目标和关键结果”(简称OKR)进行管理的经验。今年2月,多尔获得了国家风险投资协会颁发的终身成就奖。在一场有许多凯鹏华盈“校友”参加的庆祝活动上,米克郑重介绍他登台亮相,以表明两人其实并无隔阂。多尔称自己是“一位不可救药的乐观主义者,”并提醒现场观众:“创意很容易产生。执行才是最重要的环节。你需要一支团队来赢得胜利。” 多尔在凯鹏华盈的继任者们仍然在努力寻找硅谷的“下一件大事”。他们已经投资的公司包括员工管理软件Rippling、致力于开发自动驾驶汽车模拟软件的Applied Intuition,以及食品券管理应用Propel。此外,在如何传递共享的价值观这一问题上,他们在很大程度上听从了董事长的指示。 这家风投公司的合伙人们最近召开了一场务虚会议,并提出一个口号:“一个团队,一个梦想”。这显然是在反省该公司此前四分五裂的运营方式。新领导层还开始召开每季度一次的“全员”会议,以提高公司业绩的透明度。正如多尔在书中所恳求的那样,他们试图衡量对现在来说最重要的事情,而不是评价跌宕起伏的往事。 |

The splitting up of a venture capital firm isn’t so different from the dissolution of a marriage. Meeker, who is 59, hasn’t completed raising money for Bond, and she has continued to look after Kleiner’s “children,” the companies she invested in during her time there. Like divorcing spouses who haven’t yet sorted out the paperwork, the two sides are still cohabitating. They continue to share office space in San Francisco’s South Park neighborhood as well as in Kleiner’s longtime complex on Sand Hill Road in Menlo Park. John Doerr, now 67 years old, remains Kleiner’s chairman. He’s no longer actively investing the firm’s funds, but he lends a hand where he can. He recently published a book, Measure What Matters, in which he shares his experiences from Google and other companies with managing by “objectives and key results,” or OKRs. And in February, Doerr received a lifetime achievement award from the National Venture Capital Association. Demonstrating that there are no hard feelings, Meeker introduced him at the gala event, attended by many Kleiner alumni. Doerr, calling himself “a hopeless optimist,” reminded his audience that “ideas are easy. It’s execution that’s everything. And it takes a team to win.” Doerr’s successors at what remains of Kleiner continue the work of trying to find Silicon Valley’s next big thing. They have invested in companies like Rippling, an employee-management software concern; Applied Intuition, which makes software for self-driving-car simulations; and Propel, an app for managing food stamps. And they are very much taking their chairman’s cue in how they communicate their shared values. The venture capital partners recently held a retreat and came up with the slogan, “One team, one dream,” a nod to the firm’s formerly fractured approach. The new leadership also has begun quarterly “all-hands” meetings in an effort to be more transparent about the firm’s performance. As Doerr implores in his book, they’re trying to measure what matters now—not what happened in the past. |

凯鹏华盈大事记

1972年

凯鹏华盈的前身成立。

1976年

凯鹏华盈投资10万美元,孵化生物技术企业基因泰克。30年后,这家公司以470亿美元的价格售出。

1980年

此前在半导体制造商英特尔从事销售工作的约翰·多尔加入凯鹏华盈,成为一名投资家。

1994年

凯鹏华盈投资500万美元,获得了首款商业网络浏览器网景25%的股份。当该公司第二年上市时,这笔投资获得了高达4亿美元的回报。

1996年6月

凯鹏华盈投资800万美元获得亚马逊股份,后者于次年上市。

1999年6月

凯鹏华盈与竞争对手红杉资本一起,斥资1180万美元获得谷歌的股份,这也是有史以来规模最大的风险投资之一。

2004年2月

在凯鹏华盈工作18年之后,普通合伙人维诺德·科斯拉离职创办了自己的公司Khosla Ventures。

2006年2月

凯鹏华盈成立了规模达2亿美元,专注于预防传染病大流行的“流行病和生物防御基金”。

2008年5月

凯鹏华盈推出了一只5亿美元的基金,专注于后期的“清洁技术”投资。获得凯鹏华盈其他投资工具融资的电动汽车制造商Fisker Automotive后来破产。

2010年11月

玛丽·米克宣布将离开摩根士丹利和华尔街,加入凯鹏华盈,领导一只10亿美元的数字增长基金。

2012年5月

鲍康如起诉凯鹏华盈性别歧视。虽然她后来输掉了官司,但凯鹏华盈的声誉在这样一场公开审判中严重受损。

2016年3月

多尔成为凯鹏华盈董事长。

2016年6月

凯鹏华盈为其第三只增长基金筹集了10亿美元。

2017年8月

来自于Social Capital的马蒙·哈米德加入凯鹏华盈。

2018年9月

早期基金和增长期基金宣布分拆。

2019年1月

离开凯鹏华盈后,米克创立新公司Bond,其首只基金准备筹措12.5亿美元。(财富中文网)

|

本文另一版本发表于《财富》杂志2019年5月刊,标题为《凯鹏华盈:失落帝国》。 译者:任文科 |

A version of this article appears in the May 2019 issue of Fortune with the headline “Kleiner Perkins: A Fallen Empire.” |