这些大企业去年没纳一分钱税,却一点事没有

|

纳税日来临,美国的许多大公司都发出了一个强烈的信号:我们不会有事。

根据税收和经济政策研究所(ITEP)于4月11日发布的分析显示,在已经申报了2018年税收的《财富》美国500强企业中,有60家盈利企业一分钱联邦所得税都没交。根据该研究所的报告,这60家美国公司包括亚马逊、雪佛龙、通用汽车、达美航空、哈里伯顿、IBM等,它们的美国总营收超过790亿美元,有效税率却为-5%。平均下来还得到了退税。

税收和经济政策研究所之前对2008年至2015年间每年均实现盈利的258家《财富》美国500强企业进行的研究表明,其中18家公司在此期间没有缴纳任何联邦所得税。该研究所的数据显示,2018年是历年来企业所得税减免值第二高的一年,仅低于2009年。

目前在这个问题上最受关注的对象是亚马逊,该公司由于2017年和2018年均没有缴纳联邦所得税,最近受到了舆论的压力。尽管《财富》杂志对公开财务数据的分析显示,该公司上市22年来积累的净收入总额为578亿美元。但亚马逊发给《财富》杂志的公司声明中表示,“亚马逊支付了在美国和世界各国经营需要支付的所有税款。”

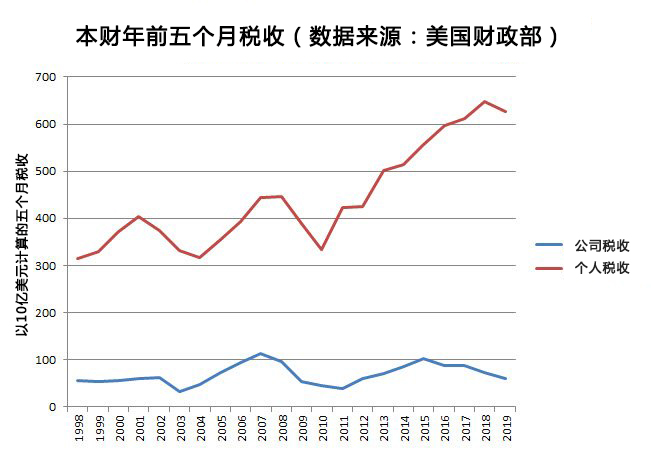

但亚马逊和其他59家零纳税公司显然不是“孤军奋战”。虽然最高公司税率已经从35%降至21%,各大公司仍然花大价钱聘请税务专家想方设法地——通常是通过创造性的错综复杂的方法——帮它们尽可能少交税。这意味着公司赋税和个人税赋之间的差距大大增加。下面,就让我们看看各大公司绕过山姆大叔的三种主要方式。 |

When it comes to tax day, many big American corporations have a powerful message: We’ll pass.

Of the Fortune 500 companies that have already filed their 2018 taxes, 60 were profitable and yet avoided all federal income tax, according to an ITEP analysis released on April 11. The total U.S. income of the 60—which ITEP reports included such names as Amazon, Chevron, General Motors, Delta, Halliburton, and IBM—was more than $79 billion and the effective tax rate was -5%. On the average, they got tax refunds.

In a previous ITEF study of 258 Fortune 500 companies that were profitable in every year from 2008 to 2015, 18 of them paid no federal income in any of those years. According to ITEP, 2018 saw the second-largest corporate income tax reduction, with only 2009 showing a bigger fall.

The current public face of this issue has been Amazon, which has taken heat of late for not paying Federal income tax in 2017 or 2018. That’s despite an analysis of public financial data by Fortune which showed that since going public, the company has amassed a total net income over 22 years of $57.8 billion. A company statement sent to Fortune said in part, “Amazon pays all the taxes we are required to pay in the U.S. and every country where we operate.”

But Amazon and the other 59 on the no-taxes list are certainly not alone. Even with top corporate rate down from 35% to 21%, companies are still throwing massive sums at tax experts who help them find ways—often creative and convoluted—to pay as little as possible. That has meant a dramatically widening gap between what corporations pay and what individuals pay. Below, we looked at the three main ways corporations are skirting Uncle Sam. |

|

全球转移

“使用这种方法的主要是美国的跨国公司,它们通过在全球范围内转移利润来避免或减少向美国政府缴纳税务。”北佛罗里达大学的会计和财务专业讲师、研究工业税收战略35年的资深人士杰弗里·戈特利布向《财富》杂志表示。跨国公司通过将收入进行地理转移,将公司收入放在低税收地区,从而将其缴纳的美国税收降至最低。

人们原以为2018年生效的新税收政策可以终止这种把戏,但它充其量只能够算是引起了些许改变。“跨国公司仍然在大规模地使用这种方法。”戈特利布说,“也许比之前略有减少,但大量收入仍然在被转移。”

合法避税

会计、审计和税务咨询公司EisnerAmper的国际税务服务部门主管肖恩·卡森说:“假设一家美国跨国公司决定以10亿美元的价格在英国购买一家连锁超市。”这家母公司在英国创建了一个分部,但告诉美国国税局,这个新成立的实体实际上是国内公司的一部分。但英国将把它视为一家单独的公司。母公司向新部门提供10亿美元购买连锁超市。新部门买了连锁超市并开始经营,之后连本带利地将10亿美元还给了母公司。由于所谓的打钩选择,在美国,这个新部门被视作为同一家美国公司的一部分,因此所还贷款不属于企业收入。但该部门在英国纳税时,可以将利息从中扣除,利润也可以保留在海外。

另一种机制是将知识产权——指的是包括专利、版权、商标、商业流程和商业秘密在内的广义上的知识产权——转移到位于低税收国家的子公司。尽管这些知识产权的大部分或全部开发工作均由母公司完成,但母公司需要向子公司支付使用费才能拥有其使用权,而这些知识产权涵盖了公司日常运营最基础的方方面面。2017年的税法原本应该可以减少这种做法,但律师事务所Fenwick and West注意到,将这种知识产权带回国内对许多公司来说都不合理,因为美国对海外知识产权的税率约为10.5%,对本国知识产权的税率更高。

知识产权转移的一个典型例子出自于2015年的星巴克。欧盟委员会对该公司的做法反应强烈。“星巴克过去常常从瑞士那家著名的咖啡生产商采购咖啡豆。”初创分析公司Quantexa的反洗钱部负责人亚历克森·贝尔说。从技术上讲,根据欧盟委员会的说法,该公司欧洲的主要分支正在以“过高的价格向总部位于瑞士的星巴克咖啡贸易有限责任公司(Starbucks Coffee Trading SARL)购买生咖啡豆。”它还向星巴克旗下的英国公司Alki支付特许权使用费,获取“关于咖啡豆烘焙的技术知识”。当时(2015年10月),据《纽约时报》(New York Times)报道,星巴克发表声明称其遵守了相关的税收规则、法律和指导方针,该公司在2008年至2014年间在世界各国共支付了30亿美元的税收。

税收抵免

除了转移利润外,企业还一直在寻找增加账面开支甚至亏损的方法。“在美国,公司少纳税甚至不纳税的方法包括利用前几年的经营亏损。”Fuerst Ittleman David&Joseph公司的税务律师及合伙人珍妮弗·科雷亚·利埃拉说。

选择各种税收抵免也是种常用的办法,这个办法得到了美国国会的背书。举个例子,常用的一种税收抵免是研发(R&D)费用。正常情况下,公司可以将研发费用作为支出的一部分扣除,这意味着应税收入会变少。实际上,这样能够节约21%的税,因为美国公司税率为21%。

然而,按照研发抵免税收的政策,研发费用并非在计算应缴税款前从公司收入中扣除。事实上,所有符合条件的研发费用——包括用于开发新产品、新技术、新软件流程或新技术的支出——将直接从算出的总税额中扣除。也就是说,减少的总税款不是研发费用的21%,而是全部研发费用。

利用这项优惠可以省很多钱。讽刺的点在于,如今的公司如果想要有竞争力,无论如何都必须进行创新和改进。凭借研发抵免政策,公司可以利用它本来就要做的工作进一步降低了赋税。税务观察员还举例称,一些公司因为建了新大楼而获得了税收抵免,而这本来就是公司经营最基本的成本开支之一。

有些怀念以前缴税的方式了。(财富中文网) 译者:Agatha |

A global shuffle

“The primary area is really the US multinational companies who avoid or minimize their US tax by moving their profits around the world,” Jeffrey Gottlieb, an accounting and finance instructor at the University of North Florida and 35-year veteran of industrial tax strategies, told Fortune. By shifting income geographically and choosing to house it in low-tax areas, a multinational can minimize the U.S. taxes it pays.

New taxes that came into effect in 2018 were supposed to stop the juggling, but at most it only made a dent. “The game is still being played in a big way,” Gottlieb said. “Maybe slightly less than before, but there’s still a lot of income shifting going on.”

Check-the-box for savings

“Say a U.S. multinational decides to buy a supermarket chain in the U.K. for $1 billion,” said Shawn Carson, a director in the international tax services group of accounting, audit, and tax consulting firm EisnerAmper. The parent corporation creates a U.K. division but tells the IRS that the new entity is really part of the domestic company. But the U.K. will treat it as a separate company. The parent lends the new division $1 billion to buy the chain. The division does so, runs the business, and pays back the $1 billion, with interest, to the parent. Because of the so-called check-the-box choice, to the U.S. it’s all an American company and so the loan payments aren’t income. But the division gets to deduct the interest part from U.K. taxes and the profits are kept overseas.

Another mechanism has been to shift intellectual property—a broad category that includes patents, copyrights, trademarks, business processes, and trade secrets—to foreign subsidiaries in low-tax countries. The parent pays royalties to use these foundational aspects of how they do business to the subsidiaries, even though the parent did most or all of the development. The 2017 tax laws were supposed to discourage the practice, but law firm Fenwick and West has noted that bringing such IP back home won’t make sense for many companies because the U.S. tax rate on IP kept overseas will be about 10.5%, while IP owned in the U.S. is taxed at a higher rate.

A classic example of IP shifting was Starbucks in 2015. The European Commission came down hard on the company. “Starbucks used to buy their coffee beans from that well-known coffee producer, Switzerland,” says Alexon Bell, head of anti-money laundering at analytics startup Quantexa. Technically, according to the European Commission, the company’s major European division was paying “an inflated price for green coffee beans to Switzerland-based Starbucks Coffee Trading SARL.” It also paid a royalty to Alki, a Starbucks-owned U.K.-based company, “for coffee-roasting know-how.” At the time—Oct. 2015—Starbucks issued a statement that it complied with relevant tax rules, laws, and guidelines and had paid $3 billion in global taxes from 2008 to 2014, as the New York Times reported then.

Tax credits

In addition to shifting profits, corporations are also always on the hunt for ways to increase paper expenses and even losses. “Some of the ways that corporations pay very little to no tax in the United States is by using operating losses that they generated from prior years,” said Jennifer Correa Riera, a tax attorney and partner in the firm Fuerst Ittleman David & Joseph.

Opting for various tax credits is a popular strategy and one made possible by Congress. An example is a popular credit for research and development, or R&D. Companies normally deduct R&D costs as expenses, which means they reduce taxable income. Effectively, the tax savings is 21%—the new U.S. corporate tax rate—of the expenses.

Under the R&D credit, these expenses aren’t deducted from corporate revenue before calculating tax. Instead, all qualified research and development spending—which can mean working on new products, technologies, software processes, or techniques—is subtracted directly from the total calculated tax. Instead of reducing the total tax by 21% of the R&D expenses, the company gets to reduce taxes by 100% of the expenses.

It’s a bonus that can save a lot. The irony is that modern companies that wish to be competitive must innovate and improve anyway. With the credit, a company further lowers its their taxes by doing something it might have done anyway. Tax observers also point to credits some companies get for putting up new buildings as an example of rewarding a behavior that is a fundamental cost of doing business.

Kind of like paying taxes used to be. |