在Facebook大变脸的背后,都发生了什么?

|

马克·扎克伯格想聊聊Facebook的变化。

今年2月初,在Facebook最新建成的大厦里,34岁的首席执行官扎克伯格坐在会议室的沙发上概括了Facebook未来调整方向。新大厦是设计师弗兰克·格里的作品,屋顶有占地3.6英亩的花园,还栽了40英尺高的红杉。据扎克伯格介绍,调整聚焦在“四个主要领域”。过去两年多,Facebook正是因为相关领域而饱受公众指责,过得相当艰难。其中之一是“内容监管,要平衡自由表达和安全。”第二个领域是“数据隐私,所有人都在分享大量信息的当今世界里,如何采取一些正确的方式来保护隐私信息,向人们提供掌控权。”另外两项调整是关于“数字健康和福祉”,他希望解决设备数量激增和屏幕使用时间过长的问题,还有“保护选举公正,避免干扰选举过程。”

此前因为Facebook惹下不少麻烦,扎克伯格各处奔走致歉,本次也是其中之一。扎克伯格搭建了5000亿美元的网络帝国Facebook,连接了无数新老朋友,也在不经意间变成了争议的中心,从仇恨言论到数据入侵,各种负面效应纷纷出现。扎克伯格想要证明他明白这一点。他说:“未来Facebook将从被动应付转为搭建完善的系统,提前预防问题。”

道歉一个月后,很明显扎克伯格只不过在背稿子,这位科技大佬就像开麦夜(酒吧或咖啡馆里举行的卡拉OK晚会,任何人都可以登场演唱和演奏——译者注)练台词的喜剧演员。3月初Facebook就发表过一篇颇有预告涵义的公告,文中扎克伯格宣布将打造全新的“保护隐私通讯产品”,由此前的“广场”变成更类似于“客厅谈话”。“人们应该享受简单亲密的角落,要能明确控制谁可以加入交流,还要确信分享的内容不会被第三方抓取。”他写道。换句话说,用户需要跟原来的Facebook完全不一样的交流空间。

对Facebook来说,改变是个复杂的话题。一方面Facebook确实在做大量工作解决问题,比如招聘数万名员工监管内容。然而另一方面,在可预见的未来,Facebook与过去十年相比不会发生本质变化,而且仍然会保持高速发展。也就是说,Facebook还是一个发布平台,收集23亿用户的数据提供给推广客户,去年正是这些客户帮助Facebook实现了560亿美元的收入。Facebook可能确实在改变,但其目标是在找到替代方案之前维持原状。毕竟调整太猛可能危害很大。 |

Mark Zuckerberg wants to talk about how Facebook is changing.

It is early February, and the 34-year-old CEO sits on a couch in his glass-walled conference room in Facebook’s newest complex, a Frank Gehry–designed structure that features a 3.6-acre rooftop garden and 40-foot redwoods. Zuckerberg summarizes Facebook’s changes around “four big categories that we’ve focused on,” all with the subtext of the immense criticism his company has faced over more than two incredibly difficult years. One category, he says, is “content governance, helping to balance free expression and safety.” He continues, “Another is principles around data privacy and, in a world where everyone is sharing a lot of information, what are the right ways to go about protecting that and giving people control.” Zuckerberg’s last two categories are “digital health and well-being,” a nod to device proliferation and screen-time overload, and “election integrity and preventing interference.”

The talking points amount to Zuckerberg’s apology tour for all the damage Facebook has wrought. On the way to building an empire worth half-a-trillion dollars, he and his company have connected friends old and new, sure, but they have also inadvertently found themselves in the middle of controversies from hate speech to data breaches. Zuckerberg wants to show that he gets it. Facebook, he says, “is moving from a reactive model of how we’re handling this stuff to one where we are building systems to get out ahead.”

A month later it becomes apparent that Zuckerberg has been rehearsing his lines, the tech-mogul equivalent of a comedian trying out material at open-mic night. In a much-heralded post on Facebook in early March, Zuckerberg announced his company would build new privacy-friendly messaging products, moving from a “town square” approach to one more akin to a living room conversation. “People should have simple, intimate places where they have clear control over who can communicate with them and confidence that no one else can access what they share,” he wrote. In other words, they should have a place to communicate that is nothing like Facebook.

Change is a complicated topic for Facebook. On the one hand, it certainly is doing a ton to address its problems, like hiring tens of thousands of workers to police its content. Yet on the other hand, for the foreseeable future, Facebook will remain exactly what it has been over the past decade-plus of its meteoric rise: a publishing platform that gathers data on its 2.3 billion users for the benefit of its marketer customers, who helped Facebook record $56 billion in revenues last year. Facebook may be changing, but it aims to preserve what it’s got until it figures out a way to replace the business too much change would jeopardize. |

|

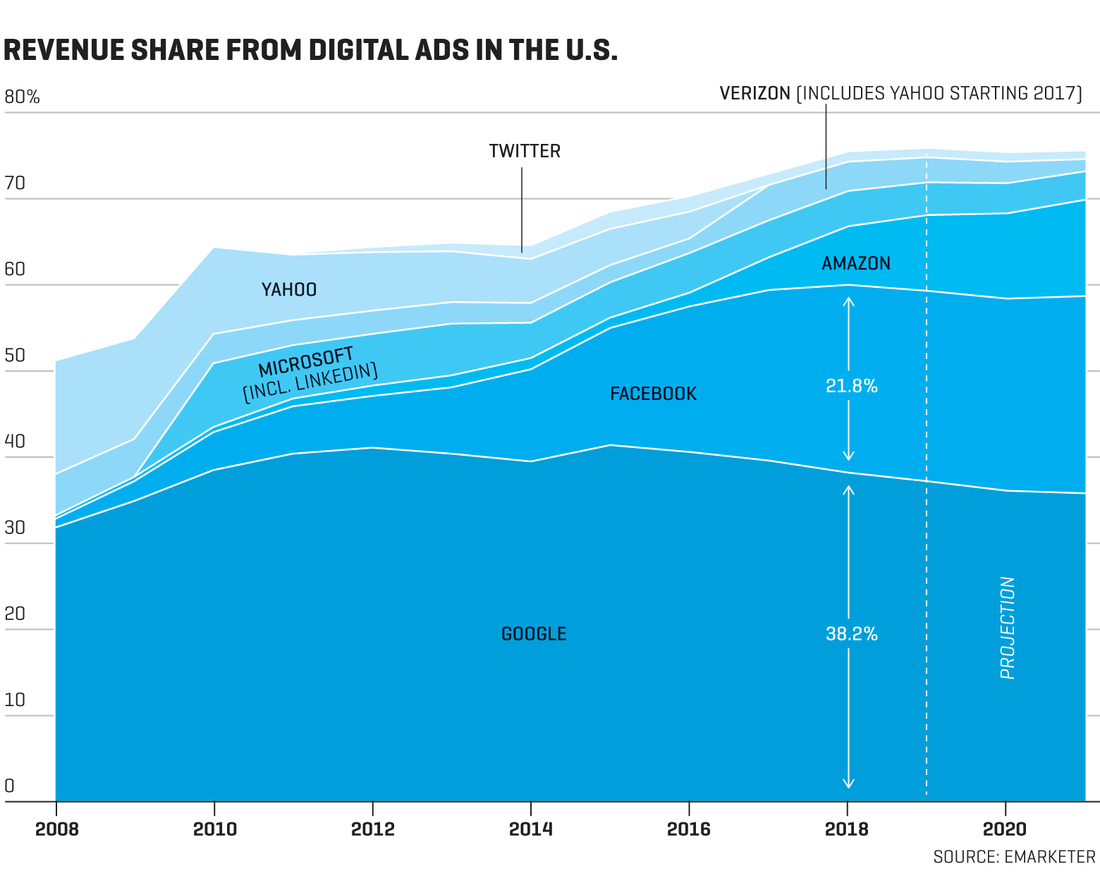

Facebook调整商业模式也比很多人想象中更紧迫,不仅仅是应付审查。Facebook的核心业务增速大幅放缓,还要迎来有可能“剥皮抽筋”式的监管,还有强劲的竞争对手追赶。公司的旗舰产品也就是主平台Facebook Blue的人气逐渐流失,尤其是在年轻用户群体中。富裕国家向来是其利润的主要来源,用户增长有所放缓。当然了,相较于巨头的体量,2018年Facebook的营收增速仍然惊人,达到37%。但增速下滑明显,2016年还有54%,2017年为47%。S&P Global预计,未来两年其营收增速将继续下降,今年降至23%,2020年降到21%。

扎克伯格并未直接评论Facebook营收增长放缓,转而表示将分两条路走:一是继续维护Facebook现有产品,另一条则是通过支付和电商等服务找新的赢利点。“我们努力提供每个人都能使用的服务。”他说,并表示实现的最佳方法是让产品“价格低廉,最好免费”,由此争取广告收入,也是现有的业务模式。当被问到保护隐私和小团体交流的构想如何落实为业务时,他比较躲闪,或许因为不知道,也许是不打算透露。(3月Facebook发布的公告里也语焉不详。)他表示,“用户想要知道,也有权知道自己的信息如何使用,以及如何掌控”,Facebook将提供相应产品实现控制。扎克伯格说:“我们一定要做到。” |

Facebook’s fiddling with its business model is also more pressing than many realize—and not merely a response to the scrutiny the company faces. Facebook’s core business is slowing dramatically, even as a combination of potentially hamstringing regulation and rejuvenated competition looms. Its flagship product, widely known as Facebook Blue, is losing popularity, especially among younger audiences. And user growth has slowed in the rich countries where the company makes the bulk of its money. Sure, Facebook’s 2018 revenues grew at a torrid pace for a company its size, gaining 37%. But that reflects a rapidly declining growth rate, from 54% in 2016 and 47% in 2017. Wall Street projects continued deceleration, to 23% this year and 21% in 2020, according to S&P Global.

Zuckerberg, without commenting directly on the deceleration in Facebook’s revenue growth, says he aims to chart a dual course, one that protects Facebook’s current offerings and another that finds new ways to make money, through services like payments and e-commerce. “We are trying to build services that everyone can use,” he says, adding that the best way to do this is to keep them “affordable and ideally free” and thus funded by advertising, Facebook’s existing business. Asked how his new interest in privacy and smaller-group communication will become a business, he is tough to pin down, either because he doesn’t yet know or isn’t ready to say. (His March manifesto is no more specific.) Users, he says, “want to and rightfully should be able to understand how their information is used and have control,” and Facebook will build them products to give them that control. Says Zuckerberg: “We need to go do that.” |

****

|

“两张图片哪个是西蓝花,哪个是大麻?“

Facebook的首席技术官迈克·斯科罗普夫指着笔记本电脑上两张并排的图片,让我区分“好”与“坏”。答案并不明显。两张照片都挺像大麻,绿芽浓密,顶上有毛发状突起,也可能是霉。最后我连蒙带猜了一个:“左边的是大麻?”斯科罗普夫点了点头。

这次演示是为了解释Facebook如何利用技术,特别是人工智能来清理平台有害信息。斯科罗普夫表示,人工智能比人类更准确。据他介绍,Facebook的人工智能系统对左侧照片为大麻的确信度为93.77%,对右侧照片为西蓝花的确信度为88.39%。人工智能比人类快得多。“你判断用了一秒多,”他说。而人工智能系统“可以在百分之一毫秒内完成,一天可判断数十亿次。” |

“Which one of these is broccoli and which one is marijuana?”

Mike Schroepfer, Facebook’s chief technology officer, is pointing to two side-by-side images on his laptop, asking me to identify the “good” from the “bad.” The answer isn’t obvious. Both pictures look convincingly cannabis-like—dense, leafy-green buds that are coated with miniature, hair-like growths, or perhaps mold. Finally, I make a semi-educated guess: “The one on the left is marijuana?” Schroepfer nods approvingly.

The demo is an illustration of how Facebook is using technology, specifically artificial intelligence, to clean up its act. A.I., says Schroep¬fer, is more accurate than humans. He says Facebook’s A.I. system was 93.77% sure the picture on the left was marijuana and 88.39% sure that the picture on the right was broccoli. And it’s faster by far than a human. “It took you more than a second,” he says. The company’s technology “can do this in hundredths of milliseconds, billions of times a day.” |

|

与计算机一样,人类员工也是Facebook解决问题的重要力量。2017年至今,Facebook的内容审核员工人数增至三倍,从1万人增加到现在的3万人。公司高层也加强招聘力度,安排专家解决用户信息流里出现的问题。前法律副总顾问莫莉·卡特勒目前负责领导“战略响应”团队,每周都跟首席运营官谢丽尔·桑德伯格开会。公民参与负责人萨米德·查克拉巴蒂的工作重心也发生变化,从投票人注册转向防止选举受干扰。Facebook还将此前单独的“安全”工程师团队打散,安排到每个产品开发团队里。

尽管各项措施都很实在,但最终目的还是改进业务,而不是彻底调整。从平台上清除恐怖主义宣传很容易取悦大众,Loup Ventures的著名分析师吉恩·蒙斯特表示,尤其是跟更棘手的问题相比,比如Facebook究竟应该怎样处理用户数据。“Facebook喜欢谈内容监管,因为相关问题都能解决。”他表示。

事实上,Facebook宣称,除了不小心让坏人进入平台之外,并没有什么问题要解决。Facebook认为,只要其广告模式更为人理解,尤其是大众更理解之后,质疑就会消失。“广告是我们业务的核心。” 桑德伯格在列举Facebook的三大业务核心,即用户数据、广告主支付和免费内容时表示。“三项业务里,广告业务最难解释。”

桑德伯格与扎克伯格在同一座大厦办公,她的会议室名字是:“只有好消息”(Only Good News)。起这么个名字可能有两种含义:一是她希望来访者只有好消息,第二种可能则生动诠释了Facebook内部对平台内容的幻想。她与扎克伯格都极力否认Facebook将用户数据“出售”给广告商。Facebook的实际做法是代表广告商精准锁定匿名用户数据,如此一来Facebook和付费客户均可利用数据获得收入。“实际的内生业务模式非常坚实,也比其它业务模式都要好。” 桑德伯格在解释为何不愿也不能放弃现有业务模式时表示。另外,Facebook认为其业务模式是一种双赢。“广告比收会员费好,因为只有富人才能负担得起会员费。如果收费,根本无法获得27亿用户。对很多Facebook用户来说,即便只收1美元也超出了负担能力。”

无论大众能否负担付费线上服务,毫无疑问Facebook正在面临富裕/贫穷世界之间的矛盾。用户增长的主阵地在欠发达市场,营收却主要来自于发达市场。去年Facebook用户总数增长了9%,大部分都来自于非成熟市场。据Facebook透露,在美国和加拿大市场上,每个用户每个季度能为公司贡献35美元收入,达到亚太地区10倍以上。至少从财务角度来看,用户增长的地区出现了错位。“我们预计,未来用户增长将主要集中在平均每个用户贡献营收相对较低的地区。” 今年1月,Facebook在10-K年度报告中指出。桑德伯格声称并不关注该趋势。“我们不会因为变现机会有差异,对不同国家和不同市场上用户增长策略区别对待。”她表示。“我们希望连接每个人。” |

People are as much a part of Facebook’s solutions to its problems as computers. It has tripled its number of content moderators, contractors it hires to monitor postings in Facebook’s News Feed section, from 10,000 in 2017 to 30,000 today. At the higher end of the organizational chart, Facebook also has beefed up the hiring and redeploying of experts who address specific issues with the information its users see. Molly Cutler, Facebook’s former associate general counsel, now leads a “strategic response” team that meets weekly with chief operating officer Sheryl Sandberg. Samidh Chakrabarti, the company’s head of civic engagement, has shifted his focus from voter registration to preventing election interference. Facebook has reassigned engineers in its once separate “safety and security” group to be embedded in individual product teams.

Such fixes are real, yet they are designed to improve Facebook, not to fundamentally change it. Removing terrorist propaganda is a crowd pleaser, argues Gene Munster, a veteran analyst with Loup Ventures, especially compared with the thornier issue of what Facebook does with its users’ data. “They like talking about that because it’s fixable,” he says.

In fact, Facebook argues that beyond the bad actors it unintentionally allowed onto its network, it doesn’t even have a problem to fix. Instead, it maintains that if only its advertising model were better understood, particularly by the public, its problems would be diminished. “It is core to our business,” says Sandberg, of Facebook’s holy trinity of user data, advertiser payments, and free content. “And it is the hardest to explain.”

Sandberg works in the same building as Zuckerberg, and her conference room has a name: “Only Good News.” It is either a wry joke about what she expects to hear from visitors or the greatest example ever of corporate wishful thinking. She and Zuckerberg vigorously push back on the notion that Facebook “sells” user data to marketers. What Facebook allows is the hypertargeting of anonymized users on behalf of marketers so that Facebook and its paying customers can profit from that data. “The actual inherent business model is really strong and much better than any other,” she says by way of explaining why Facebook won’t—¬indeed, cannot—give it up. What’s more, Facebook sees its business model as a win-win. “It’s much better than selling subscriptions, which only rich people can afford. You cannot have 2.7 billion people on a service if you charge. For a lot of the people who use our services, even a dollar would be out of range.”

Whether or not the masses can pay to use online services, Facebook undeniably faces a rich world/poor world conundrum. Its growth is in the latter, but its profitability lies in the former. Last year the number of overall users grew 9%, much of the growth coming from outside its mature markets. Facebook said it makes an average of nearly $35 quarterly on each user in the U.S. and Canada, more than 10 times what it collects in the Asia Pacific region. From a financial perspective, at least, the growth is in the wrong part of the world. “We expect that user growth in the future will be primarily concentrated in those regions where [average per-user revenue] is relatively lower,” the company said in its 10-K annual report, filed in January. Sandberg professes to be unconcerned about the trend. “We don’t ¬really prioritize countries and user growth based on monetization opportunities,” she says. “We want to connect everyone.” |

|

用户地区分布复杂只是从宏观层面影响Facebook业务发展的问题。Facebook新收购的公司,包括Instagram(2012年以10亿美元收购)和WhatsApp(2014年以220亿美元收购)都没有实现大规模盈利,尽管Instagram的增速一直很快。WhatsApp方面,业务在全球拓展得很广,截至目前有15亿用户,但到现在还没有找到清晰的业务模式。Facebook的大本营Facebook.com发展也陷入停滞。 “Facebook主要的增长来自于Instagram,明年某一时间段Facebook核心营收可能只有个位数增长。” Stifel的分析师斯科特·德威特对客户表示。他认为其他互联网公司更值得投资。 |

The geographic mix is just one macro issue buffeting Facebook’s business. Its newer enterprises, including Instagram (purchased in 2012 for $1 billion) and WhatsApp (acquired for $22 billion in 2014) haven’t yet translated into big revenue opportunities, though ¬Instagram has been growing rapidly. Whats¬App, in particular, has huge global reach—it has 1.5 billion users worldwide but no obvious business model. What began as Facebook.com, the original Facebook, has become positively becalmed. “The majority of growth is coming from Instagram, with core Facebook revenue growth likely to hit high single digits sometime next year,” Stifel analyst Scott Devitt writes to clients. He says other Internet companies make for better investments. |

****

|

2012年,乌萨马·法亚德雄心勃勃地启动了一个项目,还招募了两名法国博士。任务是根据成长中的硅谷公司Facebook提供的数据,弄清楚公司对个人用户购买行为的判断有多准确。当时Facebook的用户数约为10亿。法亚德自己就是研究的对象。

法亚德并不算随机用户。约十年前,当时如日中天的互联网公司雅虎收购了他创办的数据挖掘创业公司DMX Group,之后法亚德加入雅虎成为第一任首席数据官。法亚德在任期间,雅虎的广告业务从2000万美元增长到5亿美元,开创了定向用户行为的做法。测试时,法亚德在移动设备个性化购物应用Blue Kangaroo担任首席技术官,此举目的是评估Facebook广告的有效性。(剧透一下:不管是以前还是现在,Facebook的广告都很有效。)

身为业内人士,法亚德对在网上过多分享个人数据非常谨慎,留在Facebook上的数字足迹很有限。2006年,Facebook对非大学生用户开放注册不久,法亚德便迅速注册了账号。但他主页上介绍的详细信息很少,没有加入任何群,也没有在别人帖子下发表评论。虽然账号加了数千个“好友”,但大部分都经常见的熟人。然而,Facebook对法亚德“熟人”的习惯已经非常了解,足以推测出法亚德可能做出的购物决定。“推给我的购物‘建议’都很有诱惑力。”他说,“原因很简单,你的好友喜欢,很有可能你也会喜欢。”

法亚德研究之后几年里,随着数据来源增加,Facebook定位用户的能力也不断加强。大部分补充数据来自于Facebook本身,主要通过新功能比如视频流媒体服务Facebook Live或Reactions。“Reactions”是点赞按钮的升级版,用户可以对平台上的内容表达“热爱”、“悲伤”、“生气”等情绪反馈。(通过用户观看的视频类型和对各种内容的反应,广告商可以大致判断出身份喜好等。)但在此过程中,Facebook也积攒了各种其他数据,不少第三方供应商希望分一杯羹。事实证明,Facebook无法控制第三方信息与平台自身数据混合使用,比如政治研究公司剑桥分析滥用其用户信息后,Facebook声称该行为违反了公司规定。

之后的风暴削弱了Facebook的可信度,连在平台上投放广告且获益匪浅的广告商也开始离开。Facebook在决定切断与第三方数据供应商的联系时,受损的还不仅仅是声誉。“简直是搬石头砸自己的脚。”在线广告咨询公司WordStream的营销专家艾伦·芬恩表示,“剑桥分析丑闻之后,他们的广告定位能力也削弱了。”

种种变化已经伤害到Facebook的广告,但并未削弱其效果,因为一些聪明的广告技术专家总有办法将Facebook的数据与第三方数据结合起来。“随着各种变化出现,我们也不得不重新调整。” 在线零售商TechStyle Fashion Group的首席媒体官劳拉·霍克夫斯基说。

Facebook认为,提高用户信任的方法之一是让用户更了解Facebook。该理论认为,如果消费者了解广告的运作方式,就会继续当成积极的Facebook体验。“消费者并不了解数字广告如何运作,这也不是他们的错。” 全球营销解决方案副总裁卡罗琳·埃弗森表示。Facebook努力介绍其广告模式的一个办法是让用户点击单个广告后,了解为何该广告会出现在自己面前。但是,“为什么我会看到这条广告?”的按钮介绍不太详细,仅提供粗略的信息,比如有家零售商希望触达特定区域特定年龄段的用户。Facebook表示,仍在研究“为什么我会看到这条广告?” 功能细节,将提升透明度,加强用户对数据的掌控。举例来说,Facebook宣布将“清除历史记录”按钮,方便用户删除活动记录,比较类似于多年来网络浏览器软件提供的功能。

种种调整加起来也不过是点到为止,只能证明Facebook正在调整,只不过幅度非常小。 |

In 2012, Usama Fayyad enlisted two French Ph.D.s in an ambitious project. Their task was to figure out just how accurately Facebook could determine an individual user’s purchasing behavior, based on the data available to the growing Silicon Valley company, which had about a billion users at the time. He made himself the subject of the study.

Fayyad was no random sample. Nearly a decade earlier, he had been Yahoo’s first chief data officer after the then-booming Internet company acquired his data-mining startup, DMX Group. Yahoo grew its ad business from $20 million to $500 million during Fayyad’s time there, pioneering the use of behavioral targeting of users. Now, as the chief technology officer of Blue Kangaroo, a personalized shopping app for mobile devices, he was trying to assess the effectiveness of Facebook’s ads. (Spoiler alert: They were, and are, extremely effective.)

Because of his insider’s wariness of sharing too much personal data online, Fayyad’s own digital footprint on Facebook was limited. He had created a Facebook account soon after non–college students were allowed to, in 2006, but he had very few defining details on his page. Fayyad hadn’t joined any groups and didn’t comment on other people’s posts. And while he had accrued several thousand “friends,” the vast majority weren’t people he regularly interacted with. As it turned out, Facebook’s knowledge of the habits of Fayyad’s acquaintances was more than enough to guess the kinds of purchasing decisions he was likely to make. “The shopping ‘signal’ for me was pretty strong,” he says. “Your friends are very likely to like what you like.”

In the years since Fayyad’s study, Facebook’s ability to target customers has only improved as its data sources have grown. Much of that additional data has come from Facebook itself, via new features like Facebook Live, its live-streaming video service, or the launch of Reactions, a more nuanced version of the Like button that allows users to express love, sadness, anger, and other emotional responses to content on the platform. (The videos that users watch and their reactions to all sorts of content can tell marketers a lot about who they are.) But the company also accumulated all sorts of other data sources from third-party providers eager to share the spoils. Facebook proved unable to control how the mix of third-party information and its own data got used, such as when political researcher Cambridge Analytica violated Facebook’s rules, the company says, to harvest and act on Facebook user profiles.

The ensuing firestorm began to chip away at Facebook’s credibility—even with the marketers who get so much value from the ads they buy on its platform. Facebook then hurt more than its reputation when it decided to cut off the third-party data providers. “They really shot themselves in the foot,” says Allen Finn, a marketing specialist with online advertising consultancy WordStream. “They’ve dampened the ability to do ad targeting following Cambridge Analytica.”

The changes have hurt¬¬¬¬—but have not crippled—the effectiveness of Facebook’s ads because there are ways clever ad-tech specialists can combine Facebook’s data with third-party data. “As these changes took place, we had to renavigate a little bit,” says Laura Joukovski, chief media officer at TechStyle Fashion Group, an online retailer.

Facebook believes one way to improve trust on the part of users is to help them better understand Facebook itself. The theory is that if consumers understand how ads work, they’ll continue to view them as a positive aspect of the Facebook experience. “Consumers—and it’s not their fault—do not understand how digital advertising works,” says Carolyn Everson, vice president of global marketing solutions. One of the ways Facebook is trying to shed light on its advertising model is by letting users click on individual ads to find out why they’re being put in front of them. But the “Why am I seeing this?” button doesn’t go into much detail, providing cursory information such as suggesting a retailer wants to reach people of a certain age in a given location. Facebook says it is still working out the kinks to the “Why am I seeing this?” feature and is in the process of allowing for much greater transparency and data controls. For example, it has announced it will offer a Clear History button that gives users the ability to erase their activity, much as web browser software has allowed for years.

The tweaks add up to just enough changes, more grist for the argument that Facebook is adapting—but only as little as possible. |

****

|

即便Facebook采取更为彻底的调整措施,也是因为迫不得已,并非心甘情愿。2020年,加州有史以来第一部州级别的数据隐私法将生效,除非美国国会赶在前面通过全国性的隐私法案。人称《加利福尼亚州消费者隐私法案》(CCPA)里囊括了最严格的规定,可能对Facebook等公司采取前所未有的限制。该法案将给消费者更高的个人数据控制权,允许查看与自己有关的哪些数据正在被收集,以及数据使用方式。消费者还将可以点击删除在线信息,类似于“清除历史记录”按钮,不过针对的是整个互联网。

面临如此严格的标准,显然科技业很不愿接受。加州州长盖文·纽森还希望更进一步。“感谢加州议会去年通过了国内第一部数字隐私法。”2月中旬他首次发表州情咨文演讲时说。“但加州消费者还应该从个人数据创造的财富中分得属于自己的一部分。”

纽森的提议是“数据红利”思路,即要求互联网公司为使用用户信息支付费用,他并不是唯一持此观点的人。民主党2020年总统候选人伊丽莎白·沃伦等人呼吁,应该拆分Facebook等巨头。此时此刻,Facebook只能希望是联邦法律比州法律更快出台,因为互联网行业预期联邦法律会宽松一点。

不管怎样,即将到来的法律限制将对Facebook产生深远的影响。公司已经充分体会到欧盟的《通用数据保护条例》(GDPR)带来的影响。新法律下,欧洲消费者对在线数据掌握更大的控制权,互联网公司利用某些类型的数据之前必须先征得用户同意。任何违反该规定的公司可面临年收入4%的处罚,如果Facebook出问题,罚金会超过20亿美元。更糟糕的是,该法律还会削弱Facebook销售定向广告的能力。“《通用数据保护条例》出台后,”桑德伯格说,“欧洲有些人已经撤回某些类型的定向广告。欧洲广告的重要性会降低。”换句话说,包括Facebook在内的整个互联网行业财务上都已经受到影响。

监管政策变化也会产生累积效应。过去广告主选择Facebook是因为其“覆盖面广,又具有极精准的定向能力”,研究公司eMarketer的首席分析师黛波拉·阿霍·威廉姆森表示。“毫无疑问,随着欧盟法案出台,相关广告的定向能力将逐渐削弱。”随着未来全球各地(包括华盛顿特区)陆续采取类似措施,广告定向能力还会加速减弱,Stifel的斯科特·戴维特表示,“Facebook的管理团队树敌太多,政客、监管机构、技术领袖、消费者和员工等等,公司业务难以承受长期负面针对。”

监管政策不会在一夜之间落实,但已经有竞争对手开始利用Facebook的弱点。有史以来第一次,大对头谷歌之外的其它对手也能跟Facebook一较高下。比如,亚马逊也攒起了海量消费者购买行为数据。抖音国际版音乐应用TikTok最近下载量突破了10亿,许多用户都比Facebook上逐渐老去的用户年轻得多。(不过太受年轻人欢迎也惹了麻烦:近日联邦贸易委员会因TikTok违反儿童隐私法罚款570万美元。)各种新现象对Facebook来说都像个陌生的世界,其增长缓慢又赚钱的核心产品遭遇了史上最严厉的审查,快速创新的道路上又面临着前所未有的阻碍。 |

If Facebook does change in more fundamental ways, it will be because it has to, not because it wants to. In 2020, the first-ever state data-privacy law will take effect in California, unless Congress can hurriedly pass a law to preempt it nationwide. The so-called California Consumer Privacy Act (CCPA) is one of the most stringent sets of rules that could soon put unprecedented restrictions on Facebook and companies like it. The law would give consumers much more control over their data, allowing them to see what online information is being collected on them and how it’s being used. They’ll also be able to hit “delete” on their online information—a kind of Clear History button but for the entire Internet.

It’s a high bar that pretty much no one in the tech industry wants to meet. California Governor Gavin Newsom wants to take it a step further. “I applaud this legislature for passing the first-in-the-nation digital privacy law last year,” he said in his first State of the State Address in mid-February. “But California’s consumers should also be able to share in the wealth that is created from their data.”

Newsom’s proposal is a “data dividend” that would require Internet companies to pay users for use of their information, and he’s not the only one supporting it. Some, like Democratic 2020 presidential candidate Elizabeth Warren, are calling for companies like Facebook to be broken up. At this point, Facebook’s best hope is that federal regulations come together faster than state-led laws, as the Internet industry hopes the fed rules will end up being more lenient.

Either way, the upcoming restrictions will have a lasting impact on Facebook. The company is already seeing the repercussions of the European Union’s General Data Protection Regulation (GDPR). The new laws aim to give European consumers more control over their online information, requiring companies to gain consent from users before utilizing certain types of data. Failure to comply can result in fines up to 4% of a company’s annual revenue—more than $2 billion, in Facebook’s case. Even worse, the laws can cut into the company’s ability to sell targeted ads. “With GDPR,” says Sandberg, “there’s a percentage of people in Europe that have opted out of certain kinds of targeting. Those ads are going to be less relevant.” In other words, the Internet industry, including Facebook, already is taking a financial hit there.

The regulatory changes promise to have a cumulative effect. Historically, what advertisers use Facebook for is its broad reach and extremely specific targeting capabilities,” says Debra Aho Williamson, principal analyst with researcher eMarketer. “It is true that those targeting capabilities are starting to be chipped away from GDPR.” It’s a process that could accelerate with similar moves around the world, including in Washington, D.C. Says Stifel’s Scott Devitt: “Facebook’s management team has created too many adversaries—politicians, regulators, tech leaders, consumers, and employees—to not experience long-term negative ramifications on its business.”

Regulation won’t kick in overnight, but already competitors are capitalizing on Facebook’s vulnerabilities. For the first time, it has viable rivals in addition to arch-nemesis Google. There’s Amazon, which has incomparable purchasing behavior data on its customers, and TikTok, the music-video app that recently passed 1 billion downloads, many by customers much younger than Facebook’s ¬aging users. (Popularity with youngsters brings baggage: The Federal Trade Commission recently fined TikTok $5.7 million for violating child privacy laws.) All of this adds up to a strange new world for Facebook: There is unprecedented scrutiny on its slowing yet money-making core product and more obstacles than ever before to innovating quickly. |

****

|

讨论起Facebook面临的阵痛,不由得让人联想到公司过去的困境,以及马克·扎克伯格如何一次次表现出超越年龄的老练。扎克伯格曾经坚持拒绝出售公司。(2006年雅虎曾经提出以10亿美元收购Facebook。)他挺过了用户对各种设计调整的怒火。2012年,他成功地把Facebook从基于PC桌面的网页程序转型为移动应用,该举措需要全面调整开发过程。

Facebook在全球不断挖掘新用户。毕竟,利润最丰厚的市场日趋饱和,要寻找其它利润增长点。如果未来是私密通信或阅后自动删除信息的天下,Facebook也希望参与其中。“我总是希望这样管理公司,宁愿付出些成本,或是收入低一点……也要努力打造能经得起时间考验的好产品。”扎克伯格说,暗示了公司新产品将经历痛苦的蜕变,“但我认为,随着时间推移,不断寻找合适的模式可以构建更强大的社区。”别搞错了,扎克伯格口中的更强大显然不是指用户、社会或议员,他的意思是打造更强大的Facebook。(财富中文网)

本文首发于2019年4月出版的《财富》杂志,标题为《Facebook大变脸》。 译者:冯丰 审校:夏林 |

The discussion of Facebook’s travails often toggles back to its past travails and what a canny, wise-beyond-his-years operator Mark Zuckerberg repeatedly has proved to be. He resisted early calls to sell his company. (Yahoo offered $1 billion in 2006.) He weathered user outrage over various design changes. In 2012 he successfully converted Facebook from a desktop-PC web program to a mobile app, a feat that required a complete retooling of its development process.

Facebook has already circled the globe looking for users. It has saturated the markets that are most profitable for the company, and now it needs to turn to additional ways of making money. If the future is in private messages or pictures that auto-delete, then Facebook wants to be there too. “I’ve always tried to run the company in a way that we’re willing to take on more costs or lower revenue … in order to get to what I think will be the better thing over time,” he says, previewing the painful changes the company’s new products will require. “But I just think getting to the right model over time is going to help build a stronger community.” Make no mistake. Zuckerberg doesn’t just mean stronger for users, or society, or lawmakers. He means stronger for Facebook.

This article originally appeared in the April 2019 issue of Fortune with the headline “About Face”. |