中国电动汽车的发展,离不开这个非洲穷国

|

本文撰写过程中曾获普利策灾难报道中心协助。 凌晨5点,刚果民主共和国南部地区一个小村庄里,邻居大多还在睡梦中,15岁的路卡萨已经起身。他轻手轻脚离开家里的土砖房,开始了一天12小时的奔波劳作,每周他要工作六天。路卡萨身体瘦削,椭圆脸,眼神锐利。步行两小时后,他从小村到达一处国有矿区。(为了保护路卡萨和其他孩子,《财富》隐去了村名。)下矿井就要开始干活,路卡萨窝在坑里挖矿8小时,矿石里是现代生活不可缺少的钴。 下午3点,卢卡萨的袋子装满了22磅矿石,他背在背上,背不动就在地上拖,走一个小时才送到交易仓库。“我卖给中国人,”他说的是控制当地市场的中国商品贸易公司买家。星期天,路卡萨终于休息了一天,他穿着胸口印有“Prada”字样的T恤,坐在村里的树荫下介绍自己的日常生活。他挺自豪地说:“如果运气好一天能赚到15,000法郎。”约合9美元。 身处世界上最贫穷国家之一的卢卡萨不知道,他每年辛苦300天从地下挖出的灰色金属是数十亿美元资本争夺的对象。路卡萨说,他最近开始意识到自己挖钴矿赚的钱非常少,尤其跟交易商在全球市场上赚到的钱相比。但对于居住在刚果钴业中心科卢韦齐附近的人们来说,钴矿交易还是很难理解。想让路卡萨之类赤贫的挖矿者明白供求关系影响价格的道理更是困难,目前市场上对钴矿需求激增,矿石价格上涨约400%,从2016年的每磅约10美元涨到今年4月高点,每磅44美元。 钴矿的需求之所以飙升,主要原因是当今电子设备驱动的科技经济:钴是锂电池的关键组成部分,为成百上千万台智能手机、电脑和平板电脑供电。钴元素比较稳定,而且储能密度很高,可使电池安全运行更长时间。如果没有钴,当今数字生活,至少目前模式下的设备几乎都会瘫痪。 虽然钴矿价值很高,人们刚刚开始意识到其关键的作用。一个世纪以来最大规模的能源转型,即全球转向可再生能源,在很大程度上取决于未来几年里钴矿的供应,以及生产和精炼的成本。现在世界各地的许多政府开始推行气候变化目标以遏制碳排放,当然除了美国政府,汽车制造商也大力增加电动汽车的生产。举个例子,通用汽车表示在规划全电动化的未来。大众汽车的目标是,到2025年四分之一产能分配给电动汽车。 |

This story was produced with support from the Pulitzer Center on Crisis Reporting. MOST OF HIS NEIGHBORS are still sound asleep at 5 a.m., when Lukasa rises to begin his 12-hour workday. The slender 15-year-old, with an oval face and piercing stare, slips out of his family’s mud-brick home before dawn six days a week. Then he makes the two-hour walk from his tiny village in the southern region of the Democratic Republic of the Congo to a government-owned mining site. (Fortune is withholding the name of the village in order to protect Lukasa and other children.) Once at the mine, Lukasa spends eight hours hacking away in a hole to accumulate chunks of a mineral that is crucial to keeping our modern lives moving: cobalt. By about 3 p.m., Lukasa has filled a sack with his day’s haul. He hoists the load, which can weigh up to 22 pounds, on his back and lugs it for an hour by foot to a trading depot. “I sell it to Chinese people,” he says, referring to the buyers from Chinese commodity trading companies who dominate the market in the area. Lukasa is wearing a T-shirt with “Prada” written on the front and sitting under a shade tree in his village on a recent Sunday, his one day off, as he explains his routine. With a hint of pride he says, “On good days I can earn 15,000 francs.” That adds up to about $9. From his vantage point in one of the poorest countries in the world, Lukasa has little awareness that a multibillion-dollar scramble is underway for the grayish metal he digs out of the ground some 300 days a year. Lukasa has, he says, recently begun to grasp that his cobalt mining earnings are a pittance compared with the sums that traders make selling it on the world market. But that business is hard to fathom for those living near Kolwezi, the hardscrabble center of the cobalt industry in Congo. It’s more difficult still for diggers living in poverty, like Lukasa, to understand a surge in demand for the mineral that has sent the price of cobalt on commodities markets rocketing up some 400%, from about $10 a pound in 2016 to a peak of about $44 in April. That soaring appetite for cobalt is a product of today’s device-driven tech economy: The metal is a key component in the lithium-ion batteries that power countless millions of smartphones, computers, and tablets. Cobalt provides a stability and high energy density that allows batteries to operate safely and for longer periods. Without it, our digital lives—at least for the moment—would be unable to function as they do. And yet, as valuable as cobalt is today, its crucial role is only now coming into focus. The global transition to renewables—the biggest energy shift in a century—could depend in good measure on how readily cobalt will be available over the next several years, and how expensive it will be to produce and refine. As many governments around the world—if not the one in Washington, D.C.—begin rolling out their climate-change targets to curb carbon emissions, so automakers are hugely ramping up production of electric vehicles. General Motors, for example, says it is planning for an all-electric future. And Volkswagen aims to have one-quarter of its production devoted to electric vehicles by 2025. |

|

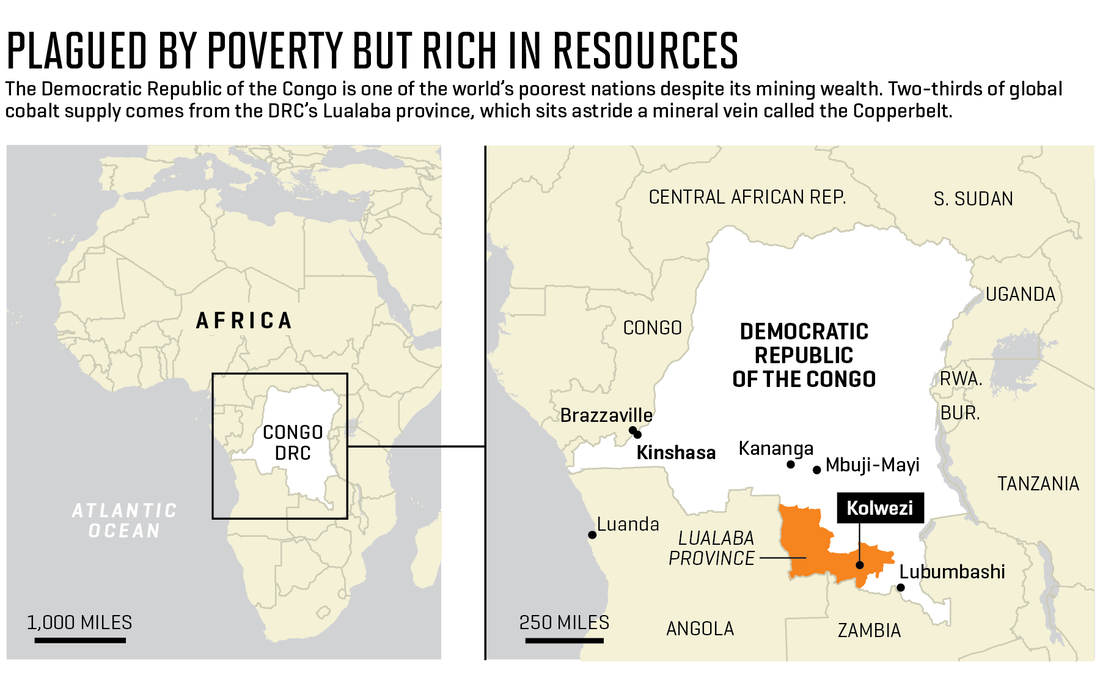

如果电池技术没有突破性发明,每块电动汽车电池需要大约18磅的钴,比起需要四分之一盎司钴的智能手机电池多出1000倍。大众汽车公司预计,十年内将建造六座巨型电池工厂供应其电动汽车。 这意味着钴价飙升可能刚刚开始。总部位于伦敦的钴贸易公司Darton Commodities分析,到2025年锂离子电池对钴的需求将增加两倍,然后再翻一倍,到2030年达到每年约357,000吨,几乎是目前产量的七倍。刚果开采钴矿的热情已接近狂热。“如果未来10年想成为世界之王,就必须拥有钴,”我在科卢韦齐与让-卢克·卡哈巴·库肯基交谈时他表示,他在中国紫金矿业集团旗下刚果矿山Commus Global担任副总经理。“未来10年钴就是一切。” 严重依赖单一原材料并不是什么新鲜事:汽车工业存在就依靠地底抽出的原油。但是,一个世纪前的汽车革命与当下的电动汽车革命相比,存在着重要区别。石油储备分布在数十个国家,各大洋均有油田。然而到现在钴矿一直集中在小块土地上。更糟糕的是,该处是深陷冲突、腐败、贫困且十分混乱的国家:刚果民主共和国,简称DRC,之前曾是比利时殖民地。不管是电池技术、汽车还是采矿公司,都要面对紧迫的道德难题,如果问题不解决,相关公司想利用清洁能源争取数百万消费者就会受影响。 全世界约三分之二的钴产自刚果民主共和国东南部省份卢阿拉巴,靠近赞比亚边境。该地区位于一条名为铜带省的超级富矿矿脉上,钴主要伴生于铜和镍。采矿业占刚果收入80%左右。几十年来,占据非洲中部的刚果几乎是“资源诅咒”的现实缩影。尽管锡,金,镍,铜和钴矿藏丰富,但普通人年收入仅为700美元。 数百万刚果人家里没有自来水也没有电,生活艰难。2015年,刚果在联合国人类发展指数中排名接近垫底,在188个国家中排第176位。在非政府组织透明国际的反腐败指数方面也好不到哪去,指数特别提到执政近18年的总统约瑟夫·卡比拉领导下的腐败猖獗。12月的选举中,卡比拉挑选了一个亲密的盟友接替自己,可能引发暴动。 |

Absent a breakthrough invention in battery technology, each electric-vehicle battery will need about 18 pounds of cobalt—over 1,000 times as much as the quarter-ounce of cobalt in a smartphone. Volkswagen, for example, expects it will need to build six giant battery factories within a decade simply to supply its electric-car plants. That means the spike in cobalt may have only just begun. Demand for cobalt for lithium-ion batteries alone could triple by 2025, and then double again, reaching about 357,000 tons a year by 2030—nearly seven times the current level, according to the London-based cobalt-trading company Darton Commodities. On the ground in Congo, the pressure to produce cobalt has reached a fever pitch. “If you want to be king of the world in the next 10 years, you have to have cobalt,” says Jean-Luc Kahamba Kukenge, deputy general manager of the Congolese mine Commus Global, which is owned by the China’s Zijin Mining Group, when I meet him in Kolwezi. “In the next 10 years, it will be everything.” The reliance on a single raw material is nothing new, of course: The auto industry owes its very existence to pumping crude oil out of the earth. But there is a key difference between the car revolution that began a century ago and the electric-vehicle revolution that is just beginning. Oil reserves are tapped in dozens of countries and under every ocean. By contrast, cobalt has until now been heavily concentrated in one sliver of territory. Worse still, that territory is within a country beset by conflict, corruption, poverty, and dysfunction: the Democratic Republic of the Congo, or DRC, as the former Belgian colony is known. That reality poses urgent ethical conundrums for the technology, automotive, and mining companies that need cobalt—problems that, if not resolved, could threaten the very ability of those companies to win over millions of consumers to cleaner energy. ROUGHLY TWO-THIRDS of the world’s cobalt is produced in the DRC’s southeastern province of Lualaba, near the border with Zambia. The region sits atop a dizzyingly rich mineral vein known as the Copperbelt—and cobalt is mostly a by-product of copper and nickel extraction. Mining accounts for about 80% of the DRC’s earnings. Stretching across Africa’s broad midsection, the DRC has for decades epitomized the term “resource curse.” Despite giant riches of tin, gold, nickel, copper, and now cobalt, the average person there earns just $700 a year. Life is grindingly difficult for the millions of Congolese who have no running water or electricity at home; the average life expectancy is about 60. The DRC ranked near the bottom on the UN’s Human Development Index in 2015, at 176th out of 188 countries. And it fares little better on the anti-corruption index of the NGO Transparency International, which cites rampant patronage among a small elite, headed by President Joseph Kabila, who has held power for nearly 18 years. Kabila has picked a close ally to succeed him, in December elections, which could spark violence. |

|

7月中旬一个寒冷的下午,我们的小型飞机在卢瓦尔巴省省会小城科卢韦齐的简易机场停下,一点也看不出周围是全世界钴矿最丰富之处。只有一座煤渣块形状的建筑,上面写着“科卢韦齐国家机场”,潦草得仿佛手写。 2016年,我乘坐由瑞士大宗商品巨头嘉能可租赁的八座飞机去过该地,当时也是为《财富》杂志撰稿。嘉能可的代表带我前往世界上最大的钴生产设施Mutanda Mining,该设施光线明亮,装有空调,技术相当先进,企业管理系统也非常精细,与门外的混乱星系相比简直像外星球。Mutanda首席执行官佩德罗·金特罗斯是一位经验丰富的秘鲁工程师,他告诉我,刚果铜矿带的矿物浓度非常高,“职业生涯里从未遇过。”现在我回过头,看到了故事的另一面。嘉能可开采钴的产量仍然超过其他公司,还表示计划在未来两年内将产量翻番,因为全球供应短缺迫在眉睫。 在科卢韦齐,传统的独立矿工聚集在该地区开采钴,通常工具很原始。挖矿者包括不少15岁左右的儿童,人数不详,这些孩子徒手挖钴矿石,卖给中间人,用赚来的钱养家,买家几乎都是中国人;科卢韦齐附近一个小村庄里的孩子们看到我们就用中文“你好!”打招呼,因为大多数外来者都是中国人。 未成年矿工人数尚未统计,但努力遏止童工现象的刚果活动人士表示,贫困导致童工人数居高不下。“由于经济危机蔓延,童工约有1万人,”海伦娜·卡耶克萨·慕斯沙卡说道,她负责协调政府去年在科卢韦齐启动的监控计划,主要内容是阻止儿童开采钴。慕斯沙卡表示,长期以来很多贫困家庭让孩子去挖矿补贴家用,所以对政府禁令抵制强烈。“他们相信靠着手工采矿也有机会达到中产,” 慕斯沙卡说。 在科卢韦齐,这几乎是不可能的梦想。 7月一个早晨,在距离科卢韦齐约8英里的手工采矿区Kingiamiyambo附近,我们遇见了11岁的小男孩丹尼尔,他满身灰尘,背着一袋钴矿石从挖掘点爬上山坡,准备卖给中国商人。他说自己没上过学。如今的全球钴矿石市场中,正是无数丹尼尔一样的孩子在最底层挣扎劳作。而很多家庭就指望孩子挖矿挣来的一点可怜收入维持生活,基本没有改善的希望。然而,强令孩子们停止采矿似乎同样困难,因为钴就是现成的收入来源。“(如果不挖矿)让他们干什么,孩子们留在家里不工作?”让·皮埃尔·穆特巴问道,他是个老铜矿工人,现在负责刚果民主共和国南部一个名叫New Dynamics的组织,负责监督采矿业。“他们总要想办法生存。在这还有什么活路?“他说。“答案很明显:去隔壁矿井挖矿。” |

When our small plane bumps to a halt one wintry afternoon in mid-July on the airstrip in Kolwezi, the small provincial capital of Lualaba, there is nothing to suggest we have landed in the epicenter of the world’s cobalt wealth. A small cinder-block structure serves as the “Aéroport National de Kolwezi,” as the hand-painted sign names it. In 2016, I had landed in the same spot, on assignment for Fortune, traveling in an eight-seater aircraft leased by the Switzerland-based commodities giant Glencore. On that trip, the company’s representatives whisked me off to the bright-lit, air-conditioned complex of Mutanda Mining, the world’s biggest cobalt production facility, with state-of-the-art technology and a meticulous corporate management system that felt like an alien planet amid the chaotic galaxy beyond the gates. Mutanda’s CEO Pedro Quinteros, a seasoned Peruvian engineer, told me then that the mineral concentration in Congo’s Copperbelt was so high that he had “never seen anything like it in my career.” Now I was back to see the other side of the story. Glencore still mines and exports more cobalt than any company in the world, and it says it is planning to double its production over the next two years in expectation of a looming global shortfall in supply. Kolwezi—traditional, independent diggers who have converged on the area to search for cobalt, often with primitive tools. The diggers include an unknown number of children like 15-year-old Lukasa, who support their families by digging small quantities of cobalt by hand, then selling them to middlemen, virtually all Chinese; children in a small village near Kolwezi greet us in Chinese with “Ni hao!” since the only non-Africans most have ever seen are from China. While it is impossible to know how many underage miners there are, Congolese activists working to end child labor say poverty has driven up the numbers. “Because of the economic crisis, there are about 10,000 of them,” says Hélène Kayekeza Mutshaka, who coordinates a monitoring program in Kolwezi that the government began last year, to try to stop children from mining cobalt. Mutshaka says she faces strong resistance from poor families, who have long sent their children to dig for minerals in order to supplement their meager earnings. “They believe they can try to make it into the middle class if they work as artisanal miners,” Mutshaka says. Around Kolwezi, that seems an almost impossible dream. One morning in July, on the edge of an artisanal mine called Kingiamiyambo, about eight miles outside of Kolwezi, we meet 11-year-old Daniel, a small boy walking up the hill from the digging site, caked in dust and carrying a load of cobalt on his back, on his way to sell it to Chinese traders; he tells us he has never attended school. Children like Daniel toil at the very bottom of the global cobalt market. For their families, many of whom depend on the tiny sums their children bring home, there seems little hope of actual life improvement. Yet asking them to stop mining seems equally difficult, so long as cobalt appears a ready source of income. “What do they do then, these children you keep at home, without work?” asks Jean Pierre Muteba, a veteran copper miner who heads an organization in southern DRC called New Dynamics, which monitors the mining sector. “They will seek survival. And what is survival here?” he says. “It is obvious: a mine next door.” |

|

尽管条件艰苦,但孩子们还是愿意继续挖矿。许多人每天只赚2美元,像骡子一样帮钴矿挖掘者运矿石。“如果孩子们不上学,就会去矿井工作,”负责苹果资助项目的弗兰克·曼德说,该项目主要培训挖矿童工新技能。“他们从14岁、15岁、16岁就开始工作了,有的甚至10岁就开始挖矿,”曼德说。 刚果当局表示,正努力禁止儿童开采钴矿石,但要完全杜绝基本不可能。他们指出,手工采矿者开采量仅占该国钴产量的20%,矿工大部分是成年人。 对于从刚果采购钴的公司来说,手工采矿者的存在也引发另一个问题:几乎不可能向iPad、智能手机或电动车的消费者保证,制造相关产品过程中没有儿童参与钴矿的挖掘、粉碎、清洗或运输。事实上,对于一些公司来说,直接停止向手工采矿者收购似乎更为简单,但非政府组织和刚果官员表示,一旦这么做会让数百万以此谋生的人蒙受致命打击。 2016年企业界就已开始关注,大赦国际发布了一份深入研究的报告,点名二十多家电子和汽车公司。大赦国际认为,相关公司尽职调查做得不够,钴供应链里存在童工手工采矿现象。该报告引发了一场风暴,之后一些公司尽可能避免从刚果收购钴。随着刚果钴矿的争论日渐激烈,问题关键在于企业找到替代供应之前该国能否彻底整改童工采矿。在一个几十年来社会混乱腐败横行的国家,很难想象深入监管能迅速见效。 要负责任的还不只是刚果官员。大赦国际也抨击西方科技巨头完全忽视童工和腐败的问题,因为消费者忙着购买各种科技设备,却没人质疑行业的黑暗面。“数百万人享受新技术带来的便利,但很少关心制造的过程,”当时该组织表示。 情况终于有些改变。因为最近电视里开始报道,讲述丹尼尔和卢卡萨之类儿童矿工在艰难条件下挖掘钴的情况。经济合作与发展组织驻巴黎的高级法律顾问泰勒·吉拉德协助矿产供应链里的公司起草了尽职调查指南,他说:“我们已面临转折点,不遵守良好的标准代价会很高。”“公司会发现品牌价值受到严重威胁,”他说。“消费者会不会要求无童工,无腐败的电动汽车?我认为会的。” |

Despite the grueling conditions, the temptation for children to keep working is strong. Many earn just $2 per day, often acting as human mules for cobalt diggers. “When kids are not in school, they all go work in the mines,” says Franck Mande, who oversees a project funded by Apple that aims to teach child miners new skills. “They work from 14, 15, 16 years—even from 10 years old,” Mande says. Congolese authorities say that they are trying hard to stop children from mining cobalt, but that it is almost impossible to end child labor completely. And they point out that artisanal miners—the vast majority of them adults—account for just 20% of the country’s cobalt output. But for companies sourcing cobalt from the DRC, the existence of artisanal miners creates another headache: It is virtually impossible to assure consumers of iPads, smartphones, or electric vehicles that no children have dug, crushed, washed, or transported the cobalt inside their devices. For some companies, it has seemed simpler, in fact, to end all business with artisanal miners—a decision that NGOs and Congolese officials say devastates millions of people who depend on the work. CORPORATE CONCERNS have risen sharply since 2016, when Amnesty International issued a deeply researched report naming more than two dozen electronics and automotive companies that, Amnesty concluded, had failed to do enough due diligence to ensure that their supply chains didn’t include cobalt produced with child labor at artisanal mines. The report caused a firestorm—and set some companies scrambling to find ways to avoid the DRC altogether. As the debate over Congo’s cobalt rages on, the question is whether the country can overhaul its mining practices before global businesses succeed in going elsewhere. In a country where dysfunction and corruption have endured for decades, the prospect for far-reaching, rapid change seems hard to imagine. Congolese officials are not the only ones at fault, however. Amnesty blasted Western tech giants for blithely ignoring the problems surrounding child labor and corruption—in large part because consumers had rushed to buy tech devices, without asking questions about the industry’s darker side. “Millions of people enjoy the benefits of new technologies, but rarely ask how they are made,” the organization said at the time. But that is finally changing. The shift has come after recent TV reports have depicted child miners like Daniel and Lukasa, digging for cobalt under tough conditions. “We have reached a tipping point where it’s become more expensive not to abide by good standards,” says Tyler Gillard, senior legal adviser to the Organization for Economic Cooperation and Development, or OECD, in Paris, who helped draft due-diligence guidelines for corporations on mineral supply chains. “Companies see this as a major threat to brand value,” he says. “Are consumers going to demand child-labor-free, corruption-free electric vehicles? I think it is coming.” |

|

由于童工的负面报道可能引起消费者对刚果钴业的愤怒,我们报道本文时,刚果官员态度有些怀疑,还有些明显的敌意。 尽管事先从刚果首都金沙萨的中央政府获得了媒体认证,但摄影师兼电影制片人塞巴斯蒂安·迈耶和我到达科卢韦齐后,还是得找卢阿拉巴省省长理查德·穆耶申请采访,不然就是拘留甚至驱逐出境。我们坐在穆耶的办公室里列出想要采访的地点。省长穆耶用法语说了好几遍作为回应,“On a rien à cacher” ——我们没有什么可隐瞒的。 但我们在科卢韦齐采访一周的经历与省长的承诺截然不同。省矿业部和警方只允许我们采访一个矿场,其他严禁进入,还告诉我们未经许可禁止独立报道。一些采访是在警方的监视下进行的。 我们唯一获官方许可采访的钴矿是卡苏洛,在武装警察护送下省矿业部门官员带我们匆匆看了下,还告诉我们安保措施是为了防止矿工骚扰。尽管此前我们早跟Pact约好,申请再次前往卡苏洛采访时遭到拒绝,Pact是一家总部在美国华盛顿特区的非政府组织,经政府批准在卡苏洛解决矿山童工问题。 我们在刚果最后一个早上,我问省长穆耶,为什么警察和当地官员每次都阻止我们。“人们总是带着偏见而来,”他说,还举了最近写科卢韦齐儿童钴矿工的记者当例子。“他们只看坏的一面,不看好的一面。” 自2016年大赦国际发布报告以来,刚果政府确实尝试整改钴矿开采,但这是一项艰巨的任务,也可以说有些自相矛盾,因为多年来政府高层一直从不透明的采矿交易攫取利益。 政府新措施之一,就是卢阿拉巴采矿部分将卡苏洛评为“模范矿”。卡苏洛矿位于科卢韦齐以北,2012年开始开采,占地420英亩,附近居民挖出的矿石钴浓度高达14%。后来成千上万的人蜂拥而至,人人都在拼命挖钴。 为应付人权组织强烈抗议,去年卢阿拉巴省政府将卡苏洛矿区围起来,只开放一个出入口,还安排武装保安人员驻守。入口旁有法语和斯瓦希里语的手绘标志,写着18岁以下的儿童和孕妇禁止进入,携带酒水也禁止进入。 |

The prospect that bad publicity about child labor could provoke growing consumer anger toward the Congolese cobalt industry might explain why we faced suspicion and some outward hostility from DRC officials in reporting this story. Despite obtaining media accreditation in advance from the central government in the national capital of Kinshasa, once photographer and filmmaker Sebastian Meyer and I arrived in Kolwezi, we had to seek permission from Lualaba’s provincial governor, Richard Muyej, to conduct interviews without being detained or ordered out of the country. Sitting in Muyej’s office, we listed sites we wanted to visit. In response, the governor told us several times, in French, “On a rien à cacher”—we have nothing to hide. But our experience during one week in Kolwezi suggested a very different picture. The provincial Ministry of Mines and the police refused us entry into all but one mine site, telling us that we were forbidden to do any independent reporting without their permission. Some of our interviews were conducted under surveillance by police. At the only cobalt mine to which we were granted official access—Kasulo, owned by the government—provincial mining officials rushed us around the site under the escort of armed police, telling us that the security presence was to protect us from harassment by miners. They refused our request to return to Kasulo a second time, despite the fact that we had an appointment there with Pact, the Washington, D.C.–based NGO working in Kasulo, with government approval, to end child labor in the mines. On our last morning in the country, I asked Governor Muyej why his police and local officials had blocked us at virtually every turn. “People come with prejudices,” he said, citing journalists who have recently described child cobalt miners in Kolwezi. “They see all the bad, not the good.” SINCE AMNESTY’S DAMNING REPORT in 2016, the government has indeed made attempts to clean up cobalt production—a task that is dauntingly difficult, if not paradoxical, given that top officials have benefited for years from opaque mining deals. As an example of its new efforts, Lualaba’s mining authorities point to its “model mine” of Kasulo. The sprawling 420-acre site sits north of Kolwezi and began in 2012, when locals living on the land struck reserves containing cobalt with an extraordinary 14% mineral concentration; thousands of people poured in, sparking a free-for-all hunt for cobalt. In response to the human-rights outcry, the provincial authorities last year fenced off Kasulo, creating a single entrance and exit to the site, at which it posted armed security guards. Next to the entrance are now hand-painted signs proclaiming in French and Swahili that children under 18 and pregnant women are banned from entering, as is anyone with alcohol. |

|

现在,每天大约有14,000名挖矿者在卡苏洛结成小团队努力开采钴,傍晚再分配当天收入。该矿的钴产量占刚果手工矿的四分之一,钴矿专有权属于中国的刚果东方国际矿业有限公司,简称CDM,该公司是华友钴业全资子公司。大赦国际2016年的报告中抨击该公司大肆收购手工开采的钴,却毫不关心对劳动条件。华友则表示,2016年开始已对卡苏洛的矿工培训由Pact提供的安全教程,还向当地人解释为什么儿童不能挖矿。目前尚不清楚如何检查矿工的年龄或怀孕状况。“你看到有小孩了吗?没有,“该省矿业部总干事埃里克·齐索拉·卡希鲁说,他带我们参观了卡苏洛矿,说话时正站在数百名正辛苦挖矿的矿工中间。“更没有婴儿。” 我去科卢韦齐三个月前,曾在巴黎参加一场由经济合作与发展组织举办的矿产供应链论坛,会上刚果曾用卡苏洛矿当正面典型。刚果官员散发一本印制精美的10页小册子,宣称卡苏洛矿是“merveille émergente”,意思是新兴奇迹。但是卡苏洛的奇迹一点也不像当代采矿企业,更像19世纪50年代美国加州淘金热的疯狂场景。矿坑里,数百男人没有工作服,没有头盔,也没有任何防护装备,在深深的矿洞和露天矿坑里挖矿,只用长钢筋之类最基本的工具凿开表层,再用长长的绳索把矿石拉出洞坑。 下午4时左右,男人们把一袋袋钴矿石放在快散架的自行车或摩托车上,推下坡卖给刚果东方国际矿业,收矿石的人就在卡苏洛矿大门里,在露天棚准备好称重收矿石。买家使用小型数字仪器Metorex检测矿石里的钴浓度,确定收购的价格。手写的价格都列在露天棚墙上。在封闭矿区里,中国商人拿出一大堆刚果法郎,付给疲惫不堪的矿工。尽管有数字仪器测量,但几位矿工告诉我们,怀疑买家经常降低钴浓度数据以克扣工资。他们的怀疑并无实证。但人人抢着采矿似乎已经引发冲突。我就亲眼见过六名矿工在卡苏洛挖矿下班之后,站在矿坑中间坑坑洼洼的路上争论当天赚的钱该怎么分。这群人当天一共赚了60,000法郎,仅为37美元。 相对正规的卡苏洛矿之外,还有成千上万人在挖野矿,他们主要的交易中心是Musompo采钴贸易市场,市场里约有50个露天仓库,沿着科卢韦齐的东西向主路延伸半英里左右。Musompo看起来跟一般出售食品或家庭用品的村庄市场没什么两样,却是大量钴矿石进入巨大出口市场的关键渠道。会说基本斯瓦希里语的中国掮客忙着检测挖矿者送来矿石的浓度,每天大约有8小时交易活跃。“我最近刚从尼日利亚过来,”30岁的刘旭斌(音)说,他来自中国河北,现在在Musompo市场边上经营“刘老板”仓库。刘旭斌坐在用钉子钉起的小木桌旁,桌上盖着粗麻布,他说收矿石最麻烦的就是讨价还价。 据官方口径,华友旗下的刚果东方国际矿业已不再从Musompo市场收购钴。但我们想采访Musompo的一位中国买家时,他说要得到“老板”批准,他的老板是刚果东方国际矿业驻科卢韦齐的管理人员。苹果、三星和其他科技公司表示,很难证明Musompo的钴与童工无关,也没法证明主要来自韩国和中国的电池制造商收购钴的矿场没有童工。 |

Now, about 14,000 diggers converge on Kasulo every day to find cobalt, organizing themselves into small teams, then dividing their day’s earnings at sundown. The mine accounts for one-quarter of the cobalt from the DRC’s artisanal mines, and the exclusive rights to the ore are held by China’s Congo Dongfang International Mining, or CDM, a wholly owned subsidiary of Huayou Cobalt, which Amnesty’s 2016 report assailed for purchasing artisanal cobalt with little knowledge of labor conditions; Huayou says it has since implemented programs for Kasulo’s miners, run by Pact, to teach safety and explain why children should not mine. It remains unclear how people’s ages or pregnancy status are checked. “Do you see any child? No, none,” says Erick Tshisola Kahilu, director general of the province’s Ministry of Mines, standing amid hundreds of miners digging in the ground, as he guides us around the site. “And no babies either.” Three months before I landed in Kolwezi, I had listened to DRC mining officials espouse their efforts in Kasulo, at a conference on mineral supply chains in Paris, hosted by the OECD. Congolese officials distributed a glossy 10-page brochure, proclaiming Kasulo as a “merveille émergente,” or emerging wonder. But the wonder inside Kasulo’s gates more closely resembles a frenzied scene from the California gold rush of the 1850s, rather than a current-day mining enterprise. Several hundred men chip away in deep holes and open pits without overalls, helmets, or any other protective gear, using basic hand tools like lengths of rebar to hack away at the surface, and hauling up rocks with handmade lengths of rope. Around 4 p.m., the men load sacks of cobalt atop rickety bicycles or motorbikes, and roll them downhill to CDM traders, who stand ready to weigh the day’s output in an open-air hangar inside the gates of Kasulo. The buyers check the cobalt concentration of the rocks, which determines the price they will pay, using a small digital instrument called a Metorex. The prices are marked on handwritten lists tacked to the walls of the hangar. Inside caged areas, Chinese traders pass wads of Congolese francs to weary miners. Despite the digital measurements, several miners told us they suspected that the buyers routinely lowered the cobalt concentration figures in order to decrease the pay. There is no proof their suspicions are correct. But the free-for-all atmosphere seems primed for conflict. As the digging day in Kasulo ended, I witnessed a fierce argument among six miners standing on one rutted path amid the pits over how to split the day’s proceeds. The group’s total sum: 60,000 francs, or just $37. For thousands of diggers working outside the more formal structure of Kasulo, the main trading hub is Musompo cobalt market, a cluster of about 50 open-air depots stretching a half-mile or so along the main east-west road out of Kolwezi. Musompo looks like the kind of village market that typically sells food or housewares. But for many tons of cobalt, this is a key gateway to the huge export market. Chinese middlemen, who speak rudimentary Swahili, test the concentration of cobalt brought in by diggers, and for about eight hours each day conduct a brisk trade in the metal. “I arrived recently from Nigeria,” says Xu Bin Liu, 30, from Hebei province, China, who runs the “Boss Liu” depot on the edge of the Musompo market. Seated at a small wooden table knocked together with nails and covered in burlap, Xu says the job involves tough haggling over prices. Officially, Huayou’s CDM no longer buys cobalt from the Musompo market. But when we asked a Chinese buyer in Musompo for an interview, he said he needed the approval of his “boss,” a CDM official in Kolwezi. Tech companies like Apple, Samsung, and others have said that it is exceedingly difficult to prove that Musompo’s cobalt is free of child labor, and that the battery manufacturers that supply them—largely in South Korea and China—source the metal from child-labor-free mines. |

|

这种情况下,一些公司面临艰难的选择:例如停止向手工采矿者收购矿石,甚至暂停从刚果收购钴,这两种选择可能让刚果经济遭受严重打击。“如果大家遇到困难就逃走,可能会让孩子和家庭更受冲击,”非政府组织Pact的本·卡茨说。“逃避不会减少伤害,只会导致更大的伤害。“ 在各大公司内部也在暗自竞争,努力减少电动车电池里的钴含量,从目前的10%左右降至5%或更低。目前的技术条件下,钴对于制造高性能电池至关重要。特斯拉首席执行官埃隆·马斯克曾表示,将为下一代特斯拉汽车制造不含钴的电池。与此同时,大众汽车与圣何塞的初创公司QuantumScape合作,发明了一种不含钴的固态电池取代锂电池,但获得成果估计不会很快。“研究还处于非常早期的阶段,”大众汽车研究主管阿克塞尔·海因里希说。“现在还没法说哪一年能研发出完全不含钴的电池。” 由于iPad和iPhone中都可能使用有童工参与开采的钴,苹果表示已确认钴供应链里每个冶炼厂,确保定期接受独立第三方审核。去年,苹果已宣布停止从刚果非正规矿场采购钴,但并不赞同完全退出刚果。“在刚果民主共和国,手工开采钴确实存在挑战,”苹果发给《财富》杂志的一封电子邮件中称。“但我们深信,退出市场并不能改善当地人生活,于环保也无益处。” |

The situation has prompted companies to make some tough choices: cut all artisanal miners out of their supply chain, for example, or halt purchases of DRC cobalt—either option potentially an economic disaster for the country. “If everybody simply runs, that can put children and families in a more vulnerable position,” says Ben Katz of the NGO Pact. “That is not reducing harm. It’s causing more harm.” Among companies, a race is underway to decrease the cobalt in electric-vehicle batteries, from the current 10% or so to 5% or less. Under current technology, cobalt is essential in making high-performing batteries. But Tesla CEO Elon Musk has said he intends to produce non-cobalt batteries for the next generation of Tesla vehicles. Likewise, Volkswagen has partnered with QuantumScape, a startup in San Jose, to invent a cobalt-free, solidstate battery to replace the lithium-ion version—but they do not expect quick results. “We are at a very early research stage,” VW’s research director Axel Heinrich says. “I cannot tell you which year we will have batteries with no cobalt.” Shaken by the possibility that children might be mining cobalt used in iPads and iPhones, Apple says that it has identified every smelter providing cobalt in its supply chain, and that they are regularly audited by independent third parties. Last year, the company announced that it would stop sourcing all cobalt from informal mines in the DRC, but that it did not agree with those pushing to pull out of Congo altogether. “There are real challenges with artisanal mining of cobalt in the Democratic Republic of Congo,” the company said in an email to Fortune. “But we believe deeply that walking away would do nothing to improve conditions for people or the environment.” |

|

为了降低对刚果的依赖,一些公司也在投资开发新的钴矿;目前在澳大利亚、巴布亚新几内亚、加拿大,美国蒙大拿州和爱达荷州的勘探项目都在进行中。一方面人们也越来越担心中国垄断钴矿石资源。今年3月,嘉能可同意将未来三年三分之一的钴卖给深圳的电池回收公司GEM。中国生产了世界上80%的硫酸钴,即锂电池中使用的化合物。总部位于伦敦的研究机构基准矿业情报提供数据显示,到2020年,中国制造的锂电池可能占总产量56%。 然而,只要钴需求持续上升,就很难完全离开刚果。距大规模生产不含钴电池可能还要数年,而刚果之外的新矿可能也要多年才能补上供给缺口。“对于制造锂电池来说,刚果至关重要,”基准矿业情报的电池技术分析师卡斯帕·洛里斯表示。“没有刚果就没有足够的钴。这点毋庸置疑。” 科卢韦齐北部是被称为UCK的小村庄(之前铜矿名字的法语缩写,发音为“oo-say-kah”)。在当地少年足球的泥泞小道上,能看到硅谷吸引用户的同时如何努力解决童工问题。 7月一个早晨,村中后巷一个小房子的后院里,三个十几岁的男孩正弯着腰学习修理面包车。这是苹果公司资助的计划,去年年底启动,由Pact在刚果当局批准后运作。项目的目标是培训儿童放弃采矿寻找其他谋生手段。现在科卢韦齐周围的村庄里,约有100名青少年正学习缝纫、手机维修、美发、木工,餐饮和其他技能。 然而,并非所有家庭都欣然接受苹果的帮助。有些人担心会失去迫切需要的糊口收入。“爸妈问我为什么要放弃挖矿,”16岁的托马斯·穆亚姆巴细声细语地说,他帮着修好了UCK村的车。他说自己12岁开始挖钴,每天赚3.50美元到9美元,对家庭来说是重要一笔收入。他还说上学基本不可能,因为家里负担不起学费。所以他劝母亲说,当汽车修理工能更好地养家。“我告诉爸妈,学技术在手,未来才有保障,”他说。 |

In an effort to lessen their dependence on the DRC, some companies are instead investing to develop new cobalt reserves; exploration projects are underway in Australia, Papua New Guinea, Canada, and Montana and Idaho in the U.S. That is partly because of rising anxiety that China is locking up most of the world’s cobalt supplies; in March, Glencore agreed to dedicate one-third of its entire cobalt production during the next three years to GEM, the Shenzhen-based battery recycling company. China produces a whopping 80% of the world’s cobalt sulfate—the compound used in lithium-ion batteries. And by 2020, China will likely produce 56% of those batteries, according to Benchmark Mineral Intelligence in London. Yet leaving the DRC entirely is hard to manage so long as cobalt demand keeps soaring. Cobalt-free batteries are likely years away from mass production, and new mines outside Congo could take years to come on line. “The DRC is absolutely critical to the production of lithium-ion batteries,” says Caspar Rawles, Benchmark’s analyst on battery technology. “Without the DRC, we are not going to have enough cobalt. There is no question about that.” NORTH OF KOLWEZI IS THE TINY VILLAGE known as UCK (pronounced “oo-say-kah” for the French acronym of its original copper mine). There, amid the dirt paths where children kick battered soccer balls, is one sign of how Silicon Valley is trying to grapple with child labor without alienating consumers. In the backyard of a small house down a side lane in the village one morning in July, three teenage boys were bent over a van, learning how to repair it. They were participants in an Apple-funded program that began late last year, operated by Pact with the approval of Congolese authorities. The idea is to switch children from mining to new moneymaking skills. Today, about 100 teenagers are being taught sewing, cell phone repair, hairdressing, carpentry, catering, and other skills in villages around Kolwezi. Not all families have welcomed Apple’s efforts, however. Some fear they will lose the income they desperately need to survive. “My parents asked me why I would abandon the mine,” says Thomas Muyamba, a soft-spoken 16-year-old helping to fix the vehicle in UCK village. He says he began digging for cobalt at age 12, and earned between $3.50 and $9 a day—crucial support for his family. Attending school is not an option, he says, since his family cannot afford school fees. So he convinced his mother that being an auto mechanic would ultimately serve the family best. “I tell them it will guarantee my future,” he says. |

|

托马斯家里对15岁的妹妹蕾切尔抱有同样的期望,蕾切尔脸颊圆圆的,浓密的辫子像天线一样勾勒出脸型。加入苹果资助项目几个月之前,蕾切尔跟其他10个女孩的工作是在科卢韦齐河的尾矿里清洗钴,非政府组织认为该工作对儿童肺部会造成极大毒害。如今在科卢韦齐五英里外一个棚子里,女孩们坐在辛格缝纫机前接受培训,按客户的订单缝补衣物赚取佣金。 杜绝钴矿开采滥用劳工的计划还有几项,苹果的资助计划只是其中之一。去年,中国五矿化工进出口商会启动了负责任开采钴矿行动,召集了同意遵守经合组织尽职调查规则的公司参与,尽力消除供应链里的童工现象。参与方包括苹果、三星SDI、惠普和索尼。另外一项计划里,华友和其他炼油厂、矿业公司和汽车制造商加入了更健康的钴项目,该项目由RCS Global今年3月启动,RCS Global总部位于伦敦,主要负责跟踪和审核自然资源供应链。该组织声称要鉴定符合“最高全球标准”的钴,监督重点是童工和侵犯人权。在科卢韦齐的Chemaf大型矿场,大型商品交易商托克已开始为12,000余名手工钴矿工注册,实施健康和安全标准,并建立合作社组织。托克称矿工们因此收入提升。 除了消费者可能强烈反对,公司也越来越担心潜在的法律责任,如果有侵犯人权行为可能遭投资者起诉。伦敦金属交易所7月宣布,从明年1月开始,从刚果手工矿场采购矿石占总量四分之一以上的公司都要接受独立审计。未达到人权标准的企业可能会禁止在伦敦金属交易所交易。4月,几位重要投资者建了一个非正式的WhatsApp小组,与当地人交流有关刚果钴行业虐待矿工的消息。伦敦Hermes投资管理公司董事克里斯汀·周表示:“如果存在违规行为且本地出现诉讼,索赔可扩大至国际层面,针对在伦敦证券交易所交易的公司。”“我可不愿意用制造过程跟4岁童工有关的手机。” 虽然公司和投资者做出种种努力,但各项目仍有很强的局限性,只要数百万刚果人贫困状况没有改善,问题还是很难解决。 只要去科卢韦齐的挖掘点几英里外的地方走一走,就会立刻明白。与托马斯和蕾切尔·穆亚巴见面后的第二天,我们就在他们的家乡再次遇上。(《财富》隐去村名,担心当局可能会针对仍在挖钴矿,未经许可与记者交谈的孩子们。) 我们坐在托马斯和蕾切尔与家人居住的泥砖小房子外,显然很难说服他们母亲和祖父同意不挖矿,加入苹果公司培训计划。孩子们现在的收入远比不上挖矿,家里的生活很窘迫。 |

The family has the same hope for Thomas’s sister Rachel, 15, whose bushy pigtails frame her round cheeks like antennae. Rachel is one of about 10 girls who, until joining an Apple-funded project a few months ago, washed cobalt in the tailings in the river in Kolwezi—low-paid work that NGOs believe is particularly toxic for young lungs. Now, as part of the training program, the girls are seated at Singer sewing machines in a shed about five miles from Kolwezi, taking orders for clothes from clients and working on commission. But the Apple program is not the only one trying to root out labor abuses in cobalt mining. Last year, China’s Chamber of Commerce of Metals, Minerals & Chemicals Importers & Exporters launched the Responsible Cobalt Initiative, bringing together companies that agree to follow the OECD’s due-diligence rules by trying to eliminate child labor from their supply chains. The group includes Apple, Samsung SDI, HP, and Sony. In a separate program, Huayou and other refiners, miners, and carmakers have joined the Better Cobalt project, launched in March by RCS Global, a London-based organization that tracks and audits supply chains of natural resources. The group claims it will be able to identify cobalt that meets “the highest global standards,” focusing on child labor and human rights abuses. And the large commodities trader Trafigura has begun registering some 12,000 artisanal cobalt miners at the large Chemaf mine in Kolwezi, implementing health and safety standards and organizing them into cooperatives. Trafigura claims miners are earning dramatically more money as a result. Besides the threat of a consumer backlash, companies also increasingly worry about potential legal liabilities, perhaps from an investor lawsuit, should they violate human rights. In July, the London Metal Exchange said that starting in January it would require every company that sources more than a quarter of its metals from Congo’s artisanal mines to be audited independently. Those that fail to meet human-rights standards risk being banned from trading on the LME. And in April, an informal WhatsApp group began among major investors, to share information with locals about abuses in the DRC’s cobalt industry. “If there are violations and there are lawsuits on a local level, the claims can be brought back to an international level, to a company traded on London Stock Exchange,” says Christine Chow, director of Hermes Investment Management in London. “I do not want to use a phone that has been put together by a 4-year-old.” FOR ALL THE EFFORTS of companies and investors, the projects nonetheless have strong limitations—so long as grinding poverty persists for millions of Congolese. That much is clear when you travel just a few miles away from the digging sites in Kolwezi. The day after meeting the teenagers Thomas and Rachel Muyamba, we meet them again, by happenstance, in their home village. (Again, Fortune has not named the community, for fear authorities might target those children in the village still mining cobalt for talking to journalists without permission.) Sitting outside the tiny, mud-brick dwelling where Thomas and Rachel live with their family, it is clear that their mother and grandfather’s decision to allow them to join Apple’s training programs, and stop mining cobalt, has been difficult. The teenagers still earn just a fraction of what they made in the mines, putting a squeeze on the family. |

|

我们谈话时人群聚集在周围,我问哪些孩子还在挖钴。几只手举起来,其中包括15岁的路卡萨,这孩子早晨5点就得起床,然后离开村子去工作,一天奔波忙碌12小时。 尽管有越来越多企业支持项目鼓励孩子们放弃挖矿,但对童工来说,每天挖钴矿繁重是繁重,赚的钱相对还是多一些。如果运气好,路卡萨一天能赚9美元,远远高于接受苹果资助当实习汽车修理工的薪水,蕾切尔也得做一星期的缝纫工才能赚到。蕾切尔说,希望几年后能当女裁缝。“我要自己开店,”她说。 如果蕾切尔能实现梦想,对整日拼命挖钴矿的刚果童工来说将是极其难得的榜样。科技和汽车公司都希望,其他成千上万的孩子们摆脱矿井找到出路。如此一来,即便科技公司继续利用刚果土地下丰富的矿藏制造电池,消费者也不会再出离愤怒。(财富中文网) 本文首发于2018年9月1日的《财富》杂志。 译者:Pessy 审校:夏林

|

As a crowd gathers around us while we talk, I ask which children are still digging for cobalt. Several hands shoot up—including that of 15-year-old Lukasa, the boy whose 12-hour day begins at 5 a.m. in this village. For these child miners, the daily task of digging for cobalt still seems worth the backbreaking work—despite the growing number of business-backed programs urging them to quit. Lukasa’s earnings—$9 on good days—are far higher than Thomas’s pay from his Apple-funded job as a trainee auto mechanic, and match what Rachel makes for an entire week of sewing. Rachel says she expects to earn a solid living as a seamstress after a few years. “I will have my own shop,” she says. If Rachel succeeds in her plans, it will be a rare chance indeed for one of Congo’s child miners to rise above the bare-bones survival gleaned from cobalt. Tech and auto companies are hoping thousands of other children find their way out of the mines too—allowing the technology industry to ward off consumer anger even as it continues tapping Congo’s giant wealth to give us the batteries we demand. This article originally appeared in the September 1, 2018 issue of Fortune. |