善用高科技,高端连锁健身房这样吸引回头客

|

瑜伽课结束,美国健身连锁品牌Equinox的首席执行官尼基·利昂达基斯闭眼端坐,深呼吸,双手合十向老师致意:Namaste。利昂达基斯从头到脚都是运动品牌露露柠檬,身材好得让人羡慕,看起来跟纽约曼哈顿下城蜂拥上瑜伽班的人们没什么两样。身旁一起练习瑜伽的人们很难想象,不久之前她还坐在楼上的会议室,讨论这家健身房的公司未来发展,因为行业即将迎来技术革新的洗礼。 |

Equinox CEO Niki Leondakis sits with her eyes closed, breathing deeply, hands folded together. She bows to the teacher: Namaste. Clad head-to-toe in Lululemon and enviably fit, Leondakis looks like any other gym-goer in the crowded yoga class in downtown Manhattan. There’s no reason to suspect—and indeed no one around her does—that moments ago she was sitting in the boardroom upstairs, discussing the future of the company that operates this gym, whose industry teeters on the brink of technological disruption. |

|

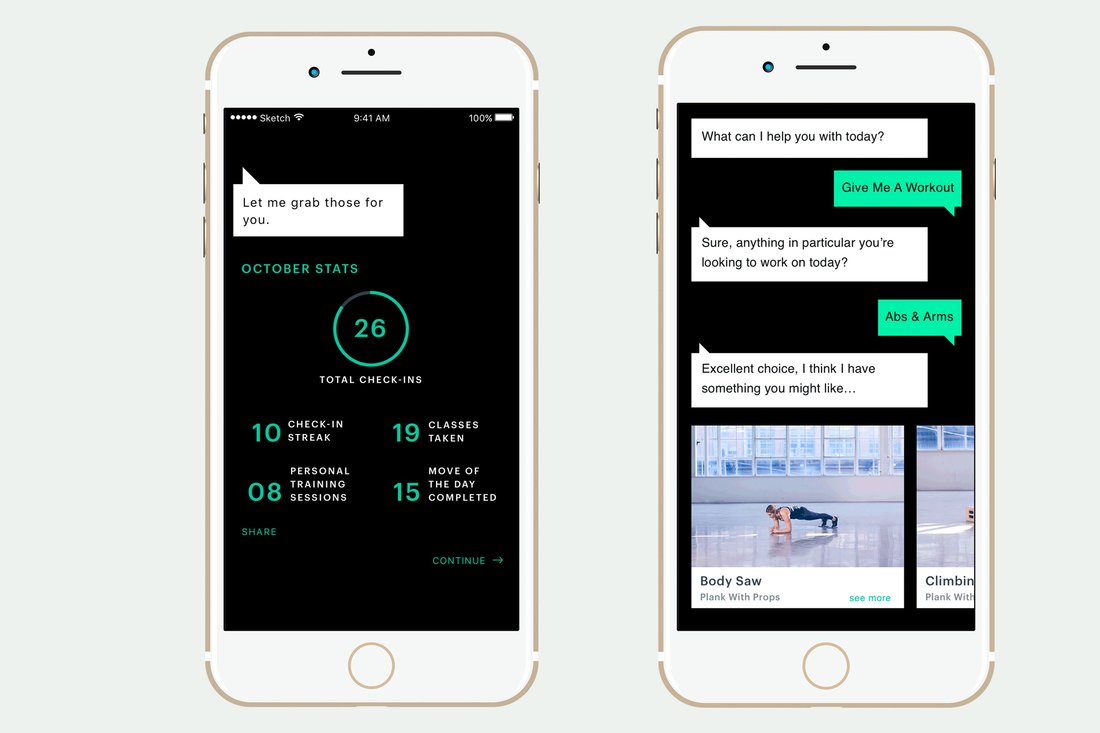

利昂达基斯担任Equinox的首席执行官并没有多久,任职刚一年。在此之前,她在酒店业工作超过30年。在执掌Euqinox以前,她在美国科罗拉多州一家精品连锁酒店Two Roads Hospitality任首席执行官。(利昂达基斯接手后,她的前任哈维·斯派瓦克升任Equinox母公司的执行董事长,目前母公司旗下还有高端健身俱乐部SoulCycle、瑜伽中心Pure Yoga和评价健身品牌Blink Fitness等。)某种意义上说,利昂达基斯跳槽的时机非常好。她接掌Equinox时,正赶上健身业爆发性增长。非营利贸易组织国际健康、网球及体育俱乐部协会(IHRSA)的数据显示,2009年到2016年,美国的健身俱乐部会员人数增长了26%。仅2016年就有200万美国人成为健身房的会员,其中经常健身者估计达5730万人。Equinox开有92家俱乐部,今年准备至少再开八家,明年年初还要开设首家酒店。毕竟,健身已成为一种生活方式。 然而,乐观的数据却掩盖了健身业发展不均衡的现状,高端的奢侈品牌和低端的口碑品牌状况良好,中端俱乐部则境况不佳。Equinox与Orangetheory、Flywheel和Rumble等高端连锁健身房积极扩张,Planet Fitness之类每月会员费才10美元的平价连锁健身房也吸引了不少新会员。然而,在美国西北部经营中端健身俱乐部的Town Sports International刚刚从破产边缘挣脱,市值约为十年前的四分之一。 现代人比过去更热爱健身,高端客户更注重专属服务的体验。因此,健身业的公司也开始利用高科技。单车健身房Flywheel的首席执行官、曾于2012年到2016年任Equinox总裁的莎拉·罗伯·奥哈根解释说:“通过科技手段可以让人更投入健身。”当然,关键要鼓励现有客户坚持锻炼。据IHRSA统计,健身俱乐部运营商每获得一个新会员,投入的销售和市场营销成本中位值是118.65美元。而老会员每年为健身房收入贡献的中位值是793.4美元。 吸引会员经常光顾健身房的一个方法是鼓励其对自己身体责任。为此,多家健身房推出了收集会员详细数据的系统。比如在单车健身房里,系统会追踪会员的骑行速度和消耗的热量。而在Orangetheory等高强度健身为主的精品健身房里,系统主要监控会员的心率数据。Orangetheory的首席执行官戴夫·隆表示,会员对收集的健身数据很“着迷”。 科技也能帮助健身房了解会员,有时确实能了解得很深入。Flywheel的会员就能“互粉”,像玩Twitter一样关注彼此的健身情况。Equinox则是在移动应用中植入一个了解会员健身活动和目标的程序,在为期六个月的试点项目中,使用“数字教练”程序的会员活跃率比不使用的会员高40%以上。Equinox还为参与个人训练项目Tier X的会员提供人工智能初创公司Halo Neuroscience的耳机,据称可以从神经层面“调节”大脑,从而刺激肌肉更快适应训练。 |

Leondakis hasn’t been Equinox CEO for very long. She took on the role a year ago after spending three decades in the hotel business, most recently as chief of Two Roads Hospitality, a boutique hotel chain based in Colorado. (Harvey Spevak previously led Equinox before ascending to executive chairman of its parent company, which now includes SoulCycle, Pure Yoga, and Blink Fitness.) In one sense, her timing couldn’t be better. Leondakis took the reins at Equinox at a time of warp-speed growth for the fitness industry. Health club memberships in the U.S. grew by 26% from 2009 to 2016, according to data from the International Health, Racquet & Sportsclub Association (IHRSA), an industry trade group. In 2016 alone, 2 million Americans joined gyms, bringing the estimated number of regular gym-goers to 57.3 million. Equinox has 92 locations and is preparing to open at least eight more in 2018, as well as its first-ever hotel—fitness is a lifestyle, after all—in early 2019. But those cheery statistics belie the fact that a fitness industry carve-out is underway, allowing high-touch luxury brands and low-touch value brands to flourish as middle-market clubs suffer. Equinox and upscale workout studio chains like Orangetheory, Flywheel, and Rumble are expanding aggressively as bare-bones gym chains like Planet Fitness, which starts at $10 a month, rack up new memberships. Meanwhile, Town Sports International, owner of mid-market clubs in the Northeast (New York Sports Clubs, et al.), just clawed its way out of the brink of bankruptcy with a market capitalization of about a quarter of what it was a decade ago. People are working out more than ever—and at the high end, they want an exclusive experience. So companies are turning to tech. “Technology is a route to making people even more engaged in fitness,” explains Sarah Robb O’Hagan, CEO of cycling studio chain Flywheel and Equinox’s president from 2012 to 2016. Engagement of existing customers, of course, is key. According to IHRSA, club operators spend a median of $118.65 in sales and marketing costs for each new membership account. But existing members generate a median $793.40 in annual revenue. One way to keep customers coming back is keeping them accountable. Several fitness companies have introduced systems that gather detailed data about their customers. In the case of cycling studios, that means tracking things like speed and calories, while clients at Orangetheory, a boutique gym that offers a high-intensity workout, receive monitors to track their heart rates. People “get hooked on” results, says Orangetheory CEO Dave Long. Technology is also helping fitness companies get into customers’ heads—sometimes literally. Flywheelers can “follow” each other’s performance in a Twitter-like fashion. And Equinox saw users of its “digital coach”—a bot embedded in its mobile app that “learns” from a customer’s activities and goals—check in 40% more than nonusers during a six-month pilot program. The chain has also given Halo Neuroscience headsets, which claim to neurologically “prime” the brain and help muscles adapt more quickly, to members of its Tier X personal training program. |

|

利昂达基斯相信,Equinox很快就能吸引大批数字技术用户。(无独有偶,人气跑步与单车应用Strava标榜打造运动员社区,已经确实圈到不少用户。)目前Equinox在十家健身房分店的器材上安装了自带定位的“标记”。通过收集的数据,Equinox能够了解会员属于哪类健身人士(比如喜欢跑步还是喜欢卧推),然后向会员提供有针对性的建议。 数字服务也能帮助连锁健身房获得线下客户,听起来可能不合常理,但事实如此。谁说健身房一定要开实体店?2012年,一家高端单车健身公司Peloton开创了新商业模式,用户跟着实时播放的视频学习,在家中就可以健身。Peloton的竞争对手纷纷仿效。视频健身教学班的利润比不超过50人的实体健身房开班利润还高(Peloton可以同时开数千个实时视频教学班)。在丰厚利润的吸引下,Flywheel和ClassPass最近几个月也推出了类似的平台。该模式资金投入有限,理论上却可以无限增加开班数,的确很有吸引力。 利昂达基斯倒并不太担心健身业大量应用数字技术。她预计,人们还是会去实体健身房,健身不是因为有新型聊天机器人或者酷炫的耳机,而是因为人们希望“尽可能享受健康精彩的生活”。现在人们上网时间越来越多,健身房增加网络投入也合情合理。(财富中文网) 本文首发于2018年3月期《财富》杂志,原文标题为《经历数字技术的阵痛,终有收获。》 注:本文已更新,澄清了Town Sports International虽然曾面临严重的财务问题,但并未破产。 译者:Pessy 审校:夏林 |

Leondakis says she believes Equinox will soon enjoy a flourishing digital community. (Not unlike, say, the one created by Strava, a popular running and cycling app that markets itself as a social network for athletes.) Armed with the data from geolocating “beacons” installed in the chain’s facilities—there are 10 such locations to date—Equinox is able to know what kind of exerciser you are (Runner? Bench presser?) and nudge you toward certain activities. Counterintuitively, fitness chains’ forays into digital services are helping them build analog communities. But who says you need a physical location at all? In 2012 Peloton, a pricey exercise bike company, pioneered a business model based on at-home workout experiences using live-streaming video. Competitors have since caught on. In recent months Flywheel and ClassPass launched similar platforms, attracted by profit margins that are magnitudes larger for a streamed class (which for Peloton might serve thousands of living rooms at a time) than a physical one with 50 people or fewer. Limited capital requirements, theoretically infinite scalability—it’s an attractive business to be in. Leondakis isn’t particularly concerned about the influx of technology into the fitness business. People are still going to gyms, and it isn’t because of chatbots or fancy headphones. They come back because of the promise, as the Equinox CEO puts it, “that they can live their best lives.” As people spend more of those lives online, it only makes sense that fitness companies join them there. A version of this article appears in the March 2018 issue of Fortune with the headline “Through Digital Pain, Gain.” Note: This story was updated to clarify that Town Sports International never entered into bankruptcy despite serious financial troubles. |