国债超过21万亿,特朗普该怎么办?

|

唐纳德·特朗普宣称,也只有唐纳德·特朗普能够如是宣称,美国经济的强劲复苏正在推动美国走向新的辉煌,而他正是这一切的促成者。这位总统在最近一篇具有代表性的推文中断言,“如今,我们的经济一片繁荣,而且,得益于我所做的一切,美国经济定会扶摇直上……美国即将再次立于不败之地!” 虽然“繁荣”一词是特朗普式的夸耀之词,但不可否认的是,从众多方面来看,这位总统的政策事实上取得了巨大的成功。在特朗普入主白宫整整三个季度之际,美国GDP增速仅仅略低于他所承诺的3%的目标。按照近些年的标准来衡量,这一成绩实属惊艳。股市市值自特朗普当选之后增长了四分之一,相当于5万亿美元的献礼。这一欣欣向荣的前景也重振了企业领袖的扩张野心:在其1月对中小企业的调查中,美国独立企业联合会发现,32%的企业认为当前是“扩张的好时机”。这一比例可谓是创下了新的记录,同时也较2016年底翻了三番。 我不日将前往瑞士达沃斯,向全世界宣扬美国的伟大之处,以及美国的近况。如今,我们的经济一片繁荣,而且,得益于我所做的一切,美国经济定会扶摇直上……美国即将再次立于不败之地! 特朗普标志性的立法成就——《减税与就业法案》——更是为这一政绩锦上添花。该法案将企业所得税率从35%减为21%。新法案让企业领袖喜出望外,包括美国航空、沃尔玛和Verizon在内的各大公司均预测这一举措将使公司未来的盈利大增。大型企业首席执行官,从摩根大通的杰米·戴蒙到波音的丹尼斯·穆伦伯格,一致称赞其是美国竞争力的强效补剂。即将到来的利润激增已促使200多家《财富》500强企业提升其最低薪酬(美国银行、哈门那等公司),或向员工发放一次性奖金(家得宝、迪士尼等公司),或两者兼而有之。 然而,特朗普令人目眩神迷的经济补剂将掩盖那些错误的政策,从而让这些企业在一时的欢愉之后出现严重的后遗症。美国政府大量不断增长的预算赤字已成为了一个庞然大物,足以威胁伟大的美国增长机器。同时,特朗普到目前为止祭出的大幅税收削减和开支剧增的组合政策,将大幅扩大收支之间不可持续的鸿沟,并缩短财政定时炸弹的导火索。按照当前的态势,等待我们的将是充斥着惩罚性税收、增长乏力和工人薪资停滞不前的乱摊子,与特朗普所宣称的未来恰恰相反。 到2028年,美国政府债务负担可能会从今年的15.5万亿美元激增至33万亿美元,对比特朗普的减税法案未得到通过的未来债务水平,增幅超过了20%。到那时,利息支出将消耗超过20%的联邦收入,政府也就无力促进经济发展,并控制私营领域。与总统和其支持者的声称背道而驰的是,美国经济的增速还达不到摆脱这一债务负担的水平;不但如此,特朗普在移民和贸易方面的举措看起来可能会对经济增长起反作用。(下文会详细说明。)穆迪分析的首席经济师马克·赞迪表示,“此举就像是气候变化一样。短时间内看不到什么影响,但一旦那一天真的来临,人们才能真正认识到这些政策的弊端。” 由于没有采取果断、迅速的行动来应对这一滞后型危机,未来几年内最乐观的情形是,美国将成为一个风险颇高的经商地。大量的债务将限制美国保持经济平衡发展的可用手段。哈佛大学经济学家肯尼斯·罗格夫表示,“债台高筑的国家对于经济下行不会采取激进的应对措施。”如果美国陷入衰退,我们将失去减税或提升基础设施建设投入的机会,例如,将其作为重振增长的工具。而且随着债务负担的加重,美联储刺激经济的降息举措更有可能会让通胀失去控制。“那时,投资者将抛售美国国债”,胡佛研究所经济学家约翰·柯克兰说道,“这会导致利率大涨,同时让预算问题更加严重。” 刚退休的霍尼韦尔首席执行官大卫·科特指出,华盛顿方面到如今依然对这一即将到来的灾难视而不见,这一现象将让企业领导者感到异常担忧。2010年,科特曾供职于辛普森-鲍勒斯委员会,它是一个由18名成员组成的部门,受命为美国寻找可持续的财政出路。虽然委员会平台未能在国会中存活下来,但其在提升营收以及医疗和社保改革方面的平衡举措得到了人们的称赞。科特称,即便这一问题在如今已经无比严重,但决策者们却在自掘更深的坟墓。科特对《财富》说,“我们在辛普森-鲍勒斯委员会中花了颇大的气力才与两党谈妥社会福利改革和增税问题。”他还提到,在大萧条之前,美国债务占GDP的比重为35%。今冬,美国的债务增长了一倍多,科特感慨道,“特朗普总统和国会同意减税并提升开支。我害怕这只是一种破罐子破摔的行为。” |

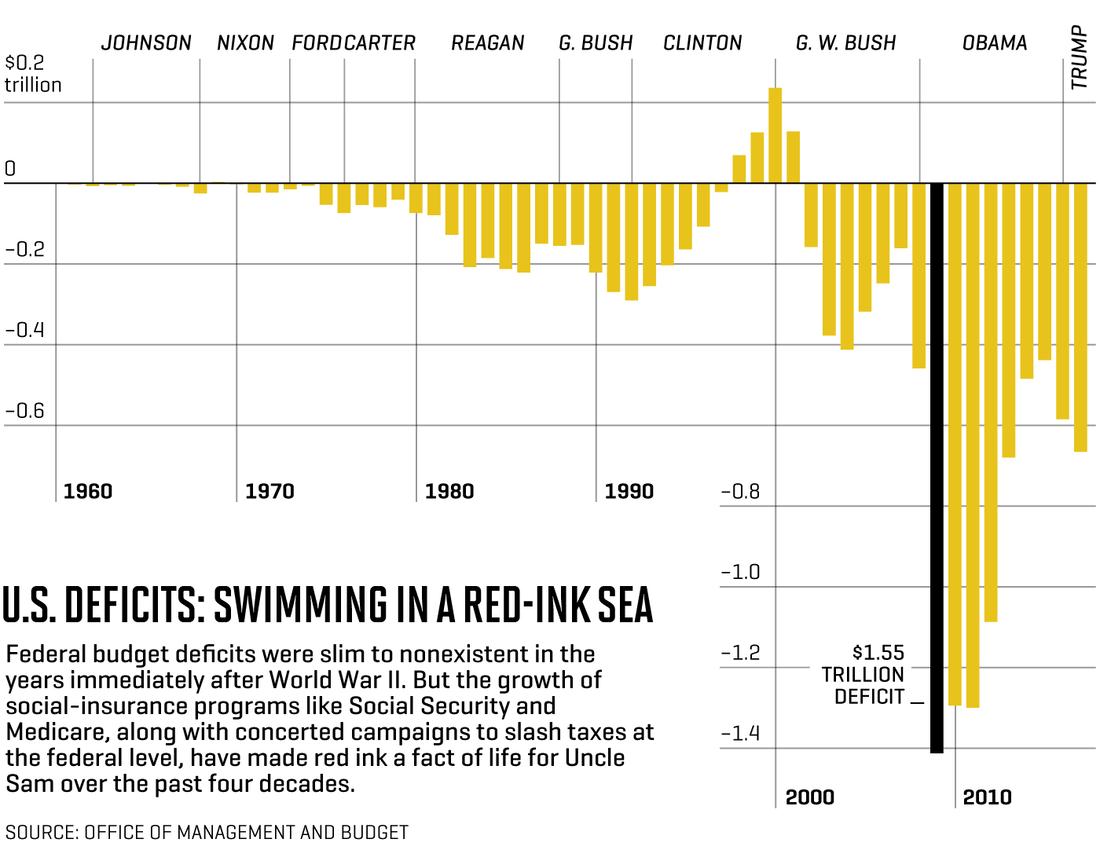

Donald Trump is pitching, as only Donald Trump can pitch, that a major economic revival is energizing America for a new run at greatness, and that he’s the straw stirring the elixir. In one representative recent tweet, the President declared, “Our economy is now booming and with all I am doing, will only get better … Our country is WINNING again!” Though “booming” is Trumpian overstatement, it’s undeniable that by many criteria, the President’s agenda is proving remarkably successful. In Trump’s first three full quarters in the White House, GDP clocked growth just shy of his vaunted goal of 3%, a performance that by recent standards looks stellar. The stock market has added a quarter to its value since the election, a $5 trillion vote of confidence. The jaunty outlook is recharging animal spirits in corner offices: In its January survey of small companies, the National Federation of Independent Business found that 32% of the enterprises rated the present climate “a good time to expand”; that was a record high and a threefold increase from late 2016. Donald J. Trump✔@realDonaldTrump Will soon be heading to Davos, Switzerland, to tell the world how great America is and is doing. Our economy is now booming and with all I am doing, will only get better...Our country is finally WINNING again! 8:27 AM - Jan 25, 2018 Fueling the giddiness is the President’s signature legislative achievement: the Tax Cuts and Jobs Act, which slashed rates for corporations from 35% to 21%. The new law is a runaway hit with business leaders. Companies as varied as American Airlines , Walmart , and Verizon predict that the measure will swell their earnings for years to come, and marquee CEOs from JPMorgan Chase’s Jamie Dimon to Boeing’s Dennis Muilenburg laud it as a powerful tonic for American competitiveness. The looming profit surge has prompted more than 200 Fortune 500 companies to raise their minimum pay (U.S. Bancorp, Humana), issue one-time bonuses to employees (Home Depot, Walt Disney), or both. Trump’s heady economic potion, however, is masking misguided policies that could leave those same businesses with a severe hangover from today’s celebration. The U.S. government’s huge and growing budget deficits have become gargantuan enough to threaten the great American growth machine. And Trump’s policies to date—a combination of deep tax cuts and sharp spending increases—are shortening the fuse on that fiscal time bomb, by dramatically widening the already unsustainable gap between revenues and outlays. On our current course, we’re headed for a morass of punitive taxes, puny growth, and stagnant incomes for workers—a future that’s the precise opposite of what Trump champions. By 2028, America’s government debt burden could explode from this year’s $15.5 trillion to a staggering $33 trillion—more than 20% bigger than it would have been had Trump’s agenda not passed. At that point, interest payments would absorb more than $1 in $5 of federal revenue, crippling the government’s ¬capacity to bolster the economy, and constraining the private sector too. Contrary to the claims of the President and his supporters, the U.S. can’t grow fast enough to shed this burden; indeed, Trump’s agenda on immigration and trade looks likely to stunt that growth. (More on that later.) “This is almost like climate change,” says Mark Zandi, chief economist at Moody’s Analytics. “It doesn’t do you in this year, or next year, but you’ll see the ill effects in a day of reckoning.” In the absence of decisive, quick action to tackle this slow-motion crisis, the best-case scenario for the next few years is that America becomes a much riskier place to do business. A high debt load will limit our flexibility to keep the economy on an even course. “Countries with high debt don’t respond aggressively to downturns,” says Harvard economist Kenneth Rogoff. If the U.S. slips into recession, we’ll lack the option of lowering taxes or increasing spending on infrastructure, for example, as tools to revive growth. And as the debt load grows, efforts by the Federal Reserve to stimulate the economy with lower rates would be more likely to feed runaway inflation. “Then, investors will dump Treasuries,” says John Cochrane, an economist at the Hoover Institution. “That will drive rates far higher, and make the budget picture even worse.” For now Washington is neglecting the coming crunch, and that should make business leaders plenty worried, says David Cote, the recently retired CEO of Honeywell (HON, +0.44%). In 2010, Cote served on the Simpson-Bowles Commission, an 18-member group charged with finding ways to put America on a sustainable fiscal path. Though the commission’s platform died in Congress, it drew praise for its balanced approach to raising revenues and reforming Medicare and Social Security. Cote says that even though the problem is far more dire today, policymakers are digging a deeper hole. “We made a grand, bipartisan bargain in Simpson-Bowles to reform entitlements and raise taxes,” Cote tells Fortune, noting that prior to the Great Recession, the ratio of debt to GDP was 35%. This winter, with debt more than twice as high, marvels Cote, “President Trump and Congress agreed to reduce taxes and raise spending. I’m afraid that people are just giving up.” |

|

科特警告说,首席执行官们不应庆祝,而是应针对风险超高的未来做好规划,届时不断恶化的金融环境可能会让其利润受到严重打击。其中一个危险在于,因债务剧增和控制举措缺失而有所警觉的外国投资者可能会抛售美国债券,进而推高利率。科特说:“利率每升高1个百分点,债务每年就会增加2000亿美元。”收益率的激增也会提升门槛,届时新投资会获利,这将迫使公司紧缩开支。 企业高管可能还会担心,解决债务问题的唯一办法就是提高税率。科特说:“此举会对企业对投资环境的看法带来巨大的影响。各大企业将变得忧心忡忡,并撤回投资,转而观望。”但他认为,观望会导致增长停滞和恶化。这种停滞不前会让特朗普第一年的经济改观转瞬即逝。 当然,美国财政格局远在特朗普上任之前便失去了其可持续性。不过,真正令人感到震惊的是,特朗普的税收削减和开支增加政策竟会让这一格局的前景变得如此的暗淡,而且是如此地迅速。 此举对经济增长的威胁来自于两个方面。首先,美国一直以来对于老年人颇为照顾,而且对穷人亦是不吝帮扶,福利模式与欧洲相当,但美国却通过举债来资助这些项目,而不是采取欧洲式的高税收政策。此举可谓是政路亨通:在去年4月的民调中,皮尤研究中心询问选民是否支持14个特定预算领域的开支削减。大多数民主党人士反对对任何预算进行削减,而共和党人士同意削减其中的一项,即“向全球受难民众提供协助。” 这一点也引出了第二个方面。与财政改革完全相悖的两个法案既得到了特朗普的支持,也得到了国会的批准。 国会的税务联合委员会称,即便12月签署的税收削减法案会提振增长和收入,但它也会让美国的预期财政收入在未来10年内减少1万亿美元,也就是每年1000亿美元。得出这一结果的前提是,大多数个人所得税削减将在8年内到期,而且资本设备费用化减税将在2023年逐渐停止。保守派曼哈顿研究生的布莱恩·瑞德尔表示,“这些减税非常有可能得以延期。”他预测,在减税延期有望的环境下,这项减税法案将导致财政收入在接下来的10年中减少1600亿美元。 同时,2月份的联邦预算议案显示,可自由支配开支项下的两个门类——国防和联邦支出(从外国援助到房屋补贴)——的费用均出现了12%的增长,也就是2018年、2019年每年增长1500亿美元,这是史无前例的。它基本上取消了2011年预算控制法案所设定的两党开支上限,而这一法案也让近期赤字多少受到了一些控制。上述开支增长在国会中受到了两党的热烈欢迎,而且几乎必然会开启一个新的预算开支平台,未来开支在此基础上必然会有所增加。 瑞德尔估计,税收削减和开支增加每年将带来共计约3750亿美元的赤字,包括新增的利息。财政方面的应对举措本应是寻找提振收入的手段,并减少其他预算领域的开支,以弥补这一缺口。然而,尽管法案提到了一些抵消手段,但这些手段在铺天盖地的减税面前却又是那么微不足道。 去年6月,国会预算办公室预测,赤字将在2022年达到1万亿美元。非党派机构负责人联邦预算委员会称,由于新税收法案的出台,如果当前的税收和开支政策继续得以延续,美国赤字突破这一门槛的时间将大幅提前至2019年。即便经济繁荣发展,那些可能出现的资金缺口将继续扩大。根据国会预算办公室的预测,如果没有减税法案,赤字将在2028年达到约1.6万亿美元。如今,联邦预算委员会预测会出现2.4万亿美元的缺口。美国在接下来的10年中所支出的三分之一资金都将是借来的,这在很大程度上归咎于上述扩大赤字的举措。如果开支和收入如以前那样没有什么变化,那么这一比例将变成四分之一。 10年后,联邦债务水平将达到触目惊心的33万亿美元,相当于GDP的113%,较税收削减法案出台之前国会预算办公室预测的数字高出了6万亿美元。美国借贷的利息也将成为联邦预算中增速最快的开支项目,它的增幅将超过2倍,每年接近1.1万亿美元。到那时,债务持有成本将相当于医疗支出的一半。如果通胀或利率超过了国会预算办公室所预测的相对较低的门槛值,利息账单甚至会变得更加触目惊心。联邦预算委员会的高级政策理事马克·戈尔德文指出,“这一增幅就是美国扔掉的钱,相当于占用了可用于医疗、军事等众多项目的资金。” 这种占用会带来切实的影响。偿还飙升债务所需的成本会给政府带来巨大的压力,迫使政府取消可用于刺激经济增长的投资。在过去,用于修缮高速公路、公交系统或用于改善高等教育的开支曾提升了美国劳动力的生产力。这些开支提升了民众收入,推高了储蓄率,刺激了消费支出,并增加了可用于私人投资的储蓄。迅速增长的债务所带来的利息负担会将这一良性循环变成一个难以维继的海市蜃楼。 政府是否会在财政危机或远超警戒线的赤字增幅发生之前采取纠正性对策,这一点我们无法断言。穆迪投资者服务的高级副总裁萨拉·卡尔森表示,可以肯定的是,“我们等的时间越长,福利削减和税收增加的举措就越难开展。” 然而,正如科特所提到的那样,决策者并没有意愿采取那些不怎么受欢迎而且可能十分激进的举措,并借此重塑美国财政平衡。2月9日,参议院就提升可自由支配开支进行了投票,期间,共和党预算鹰派(像肯塔基州兰德·保尔和犹他州麦克·李)的反对之声被34名共和党参议员和上院36名民主党参议员所淹没,最终通过了这一助长赤字的议案。这一迹象表明,国会已经将审慎财政政策抛之脑后。特朗普也不大可能去填补这一财政责任深坑:这位总统在其5866字的国情咨文中对财政“赤字”或“债务”只字未提。 有一种方法可以让美国继续保持现状,那就是继续肆无忌惮地向世界各国借钱。美国之所以一直能够挥霍度日,原因在于外国借贷者对美国政府和企业债务有着浓厚的兴趣。在当前美国的15.5万亿美元的债券中,他们如今持有其中的6万亿美元。 对于大多数国家来说,这类大规模借贷会推高利率,因为政府将与企业竞争有限的借贷资金池。但是几十年以来,美国并未出现这样的情况:来自于全球各地,包括中国、日本和其他海外投资者的大量资金抑制了利率的增长。如今,美国是全球最强大的多元化企业经济体,而且在全球经济不景气的环境下,资金会涌入最安全的安全港——美国。唯一得到大萧条证实的一条理论是:“我们向世界输出了金融危机,而世界却向我们提供了资金。”(出自于加州大学伯克利分校经济学家阿兰·欧拉巴克)。 这位总统在其5866字的国情咨文中对“赤字”或“债务”只字未提。 但据此设想世界会对美国的挥霍无度继续听之任之将会是一个高风险赌注,同时,如果国会依然对未来十年应采取的痛苦抉择视而不见,其风险会变得更高。发生2010年希腊式的全面崩溃——经济放缓,惩罚性利率,迫使当局采取改革措施——的可能性到是不大。更为可能的情形是,年度债务数字变得异常糟糕,并引起了世界各国的关注,然后即将到来的赤字悬崖再次成为了一个重大的政治问题。美国人可能会因为巨大的预算赤字而变得愤怒不已:上个世纪80年代的过度赤字所产生的赤字焦虑促使两党达成共识——在1990年布什总统首次入主白宫时提升税收并缩减赤字。 周期的下行,股价的大幅下跌或由多疑的海外投资者所引发的始料未及的真实利率大幅上升,或许会成为促使立法者开始认真对待赤字的催化剂。上述现象不会带来灾难,但是通过降低财政收入或扩大已经触目惊心的赤字,它会引导人们聚焦可能成为现实的灾难性未来。戈尔德文说:“决策者们将制定一些在眼下不需要大量资金、但却能够逐渐显现成效的方案。”换句话说,他们会让美国进入下滑通道,以重拾市场信心。 |

Rather than celebrating, Cote warns, CEOs should be planning for an ultra-risky future where the worsening financial climate could cut deep into their profits. One danger is that foreign investors, alarmed both by our crushing debt and the absence of plans to tame it, could dump our Treasuries, pushing interest rates higher. “A one point rise in rates adds $200 billion every year to the debt,” says Cote. A jump in yields would also raise the threshold at which new investments become profitable, forcing companies to retrench. Corporate leaders may also fret that the only solution to our debt woes is a jolting rise in taxes. “That would have a huge impact on how businesses view the investment climate,” Cote says. “Companies will get worried and pull back on investment and wait and see.” But to wait and see, he predicts, is to court stagnation and deterioration. That kind of stasis would turn the good economic news of President Trump’s first year into a short story. Of course, America’s fiscal picture was becoming unsustainable well before Trump took office. What’s astounding is how much worse his tax cuts and spending increases have rendered the outlook, and how quickly. The causes of this menace to prosperity are twofold. First, the U.S. has long chosen to lavish seniors, and to a lesser extent support the poor, with European-style benefits, while borrowing to fund those programs rather than levying European-style taxes. It’s a politically popular path: In a poll released last April, the Pew Research Center asked voters whether they supported spending reductions to 14 specific budget areas. A majority of Democrats opposed cuts to any, while Republicans endorsed shrinking just one, “assistance to needy people around the world.” That brings us to the second point. Trump has championed, and Congress has enacted, two laws that go in the opposite direction of fiscal reform. According to Congress’s Joint Committee on Taxation, the Tax Cuts act, signed in December, will decrease expected revenues by a total of $1 trillion over the next 10 years, an average of $100 billion annually, even after any boost to growth and incomes from lower taxes. That number assumes that most of the personal income-tax reductions expire in eight years, and a break for expensing capital equipment starts phasing out in 2023. “Those breaks are extremely likely to be renewed,” says Brian Riedl of the conservative Manhattan Institute—and in that more likely scenario, he projects, the tax plan will lower revenues by $160 billion over the following decade. The February federal budget deal, meanwhile, hikes outlays in both of the two categories of “discretionary” spending, defense and federal programs from foreign aid to housing subsidies, by an unprecedented 12%, or $150 billion a year in 2018 and 2019. It essentially obliterates bipartisan spending caps established in the Budget Control Act of 2011 that had kept recent deficits partially in check. These spending increases are so popular on both sides of the congressional aisle that they’re almost certain to establish a new floor for discretionary spending, from which future expenditures will rise. All told, the tax cuts and increased spending will raise deficits by roughly $375 billion annually, by Riedl’s estimates, including additional interest. The fiscally responsible path would have been to enact revenue-raisers and spending curbs elsewhere in the budget to fill the gaps. But although the tax bill included some offsets, they were swamped by the sweeping reduction in taxes. Last June, the Congressional Budget Office (CBO) forecast that deficits would reach $1 trillion in 2022. Because of the new laws, America will exceed the $1 trillion mark much earlier, in 2019, assuming current tax and spending policies are extended, according to the nonpartisan Committee for a Responsible Federal Budget (CRFB). Those probable shortfalls will keep ballooning even if the economy thrives. Under the CBO’s forecast, deficits would have reached roughly $1.6 trillion in 2028 without the new laws. Now, the CRFB predicts a shortfall of $2.4 trillion. Largely owing to the deficit-widening measures, the U.S. in a decade will borrow $1 in every $3 it spends, vs. $1 in $4 if outlays and revenues had remained on their prior path. In a decade, federal debt will reach an overwhelming $33 trillion, the equivalent of 113% of GDP—and $6 trillion higher than the CBO had forecast before the Trump agenda passed. Interest on U.S. borrowings would become the fastest-growing item in the federal budget, more than tripling to almost $1.1 trillion annually. At that point, carrying costs would equal one-half of spending on Medicare, and if inflation or interest rates exceeded the relatively low thresholds in the CBO’s forecasts, the interest bill would soar even higher. “That increase represents money the U.S. is just throwing away—that’s crowding out the funding on everything from health care to the military,” says Marc Goldwein, the CRFB’s senior policy director. That crowding out has real consequences. The cost of servicing the exploding debt would exert tremendous pressure on the government to eliminate investments that could fuel growth. In the past, spending that modernized highways and mass-transit systems or enhanced higher education has boosted the productivity of America’s workers. That raises incomes, boosts savings rates, lifts consumer spending, and swells savings that fund private investment. The interest burden generated by the mushrooming debt threatens to turn this virtuous cycle into an unaffordable luxury. It’s impossible to say whether a fiscal crisis, or growing outrage over the alarming numbers, might prompt corrective action before that happens. What’s certain, says Sarah Carlson, a senior vice president at Moody’s Investors Service, is that “the longer we wait, the tougher the choices on benefits cuts and tax increases become.” Yet as Cote points out, policymakers are showing no willingness to take the unpopular, potentially radical steps needed to restore America’s fiscal balance. A sign of just how far Congress has shifted away from fiscal caution is the Senate vote on Feb. 9 to raise discretionary spending: Opposition from Republican budget hawks such as Rand Paul of Kentucky and Mike Lee of Utah was overwhelmed by the 34 GOP Senators who joined 36 Democrats in the upper chamber to pass the deficit-swelling measure. Nor is Trump likely to fill the fiscal-responsibility vacuum: The President failed to even mention fiscal “deficits” or “debt” a single time in his 5,866-word State of the Union Address. There is one scenario in which the U.S. could stay on its current course, and that’s to keep blithely borrowing from the rest of the world. America has been able to play the spendthrift because foreign lenders have shown a huge appetite for both our government and corporate debt—they now own $6 trillion of our $15.5 trillion in publicly owned Treasuries. For most nations, such colossal borrowings would push interest rates higher as the government competes with business for a limited pool of lendable assets. But for decades, that hasn’t been the case for the U.S.: A worldwide glut of savings from Chinese, Japanese, and other overseas investors holds our rates in check. The U.S. is, for now, the world’s most powerful, well-diversified, and entrepreneurial economy, and in times of global stress, ¬money pours into the safest of all safe havens, the United States. The Great Recession only proved the thesis. “We exported a financial crisis to the rest of the world, and they sent us their money,” says UC–Berkeley economist Alan Auerbach. The president failed to even mention “deficits” or “debt” a single time in his 5,866-word state of the Union address. But assuming that the rest of the world will continue to turn a blind eye to American profligacy is a risky bet, and it will get riskier if Congress keeps skirting the tough choices for the next 10 years. A full-blown Greece-in-2010-style debacle—a slowdown of the economy, coupled with punitive interest rates, that forces major reforms—is faintly possible but unlikely. A more probable plotline involves a scenario in which the annual debt numbers become so bad, and draw so much attention, that our looming fiscal cliff once again becomes a major political issue. Americans can get riled over gigantic budget deficits: Deficit anxiety after the excesses of the 1980s prompted a bipartisan deal to raise taxes and shrink deficits under the first President Bush in 1990. A cyclical downturn, a sharp decline in stock prices, or an unexpectedly steep increase in real interest rates dictated by skeptical overseas investors might be the catalyst that prompts legislators to get serious. It wouldn’t cause catastrophe, but by lowering revenues or widening the already yawning deficits, it would train the spotlight on the potentially disastrous outlook. “Policymakers would form plans that wouldn’t need to raise tons of money right now, but would kick in gradually,” says Goldwein. In other words, they’d shift the U.S. to a glide path that would reassure the markets. |

一场危机引发另一场危机:大萧条期间和之后政府的买单行为和一落千丈的税收为第一财务部长提摩西·哥特内带来了1万亿多美元的赤字。Josua Robert—Bloomberg via Getty Images

|

特朗普政府认为,这类举措并非是当前的重点,因为经济增长会消化掉其中的很多问题。财政部长史蒂芬·姆努钦在去年称,“通过税收改革和放松监管,美国可以获得更高的GDP增速,有助于消除国家的财政赤字。”但外界很少有人认为美国能够实现特朗普和姆努钦所称的3%的增长目标。国会预算委员会、经合组织和世界银行均预测,美国未来10年的增速约为2%。主要原因在于:美国人口的老龄化导致劳动力增速的下降。 此外,有鉴于特朗普在经济政策领域所采取的非常难以预测、非常矛盾的方法,经济增速能否达到2%都是一个问题。特朗普所支持的立法出台后,美国每年的合法移民数量在未来10年内将降低50%。房利美首席经济师道格·邓肯指出,“说到对增长的限制,控制移民可谓是最直接的方式。”邓肯认为,外国劳动力所创办的企业要比美国人多得多,而且美国需要他们来避免出现可能会造成严重后果的行业劳动力短缺,包括农业、建筑和科技。特朗普还在推行他的商业支持者希望其抛弃的手段:利用关税来打压进口。特朗普首先做的便是对外国制造的钢铁和铝制品征收高额关税。穆迪的赞迪说:“关税会拉高美国制造商使用这些材料的价格,并放缓销售和投资。” |

The Trump administration argues that such maneuvers aren’t a high priority, because economic growth will solve a lot of the problem. “Through a combination of tax reform and regulatory relief, this country can return to higher levels of GDP growth, helping to erase our fiscal deficit,” Treasury Secretary Steven Mnuchin declared late last year. But few outside the administration believe that America can expand at the 3% rate that Trump and Mnuchin are targeting. The CBO, Organization for Economic Cooperation and Development (OECD), and World Bank all forecast an average reading of around 2% over the next decade. A major reason: a decline in the rate of workforce growth because of our aging population. What’s more, Trump’s highly unpredictable, and highly contradictory, approach to economic policy makes even 2% growth uncertain. Trump supports legislation that would reduce the annual number of legal immigrants by 50% over 10 years. “There’s no more direct way to cut growth than restricting immigration,” says Doug Duncan, chief economist at Fannie Mae. Duncan notes that foreign workers both start far more businesses than Americans, and that they’re needed to avoid potentially crippling labor shortages in industries from farming to construction to tech. Trump is also delivering on what his business supporters hoped he’d abandon: deploying tariffs to punish imports, starting with heavy duties on foreign-made steel and aluminum. “Tariffs raise prices for U.S. manufacturers using those materials, and slow sales and investment,” says Moody’s Zandi. |

|

虽然特朗普的税收和监管立场在短期内十分亲商,但这些政策是经济增长的杀手。最致命的危险在于,特朗普对传统移民和对外贸易的遏制举措可能会迫使经济进入衰退期,而且情况有可能会更糟,因为经济衰退会促使投资者要求美国对已然触目惊心的债务支付更多的利息。 说得更直白些,联邦预算委员会称,即便GDP增速能够达到特朗普团队所追求的3%的目标值,那么2028年之前所得到的额外收益也只能减少10%的总债务,也就是3万亿美元。科特说:“经济增速增加1%对于解决赤字问题也只是杯水车薪。”为了确保经济的长期稳定发展,决策者将不得不执行在近期看来不可思议的举措,即同时削减开支并提升财政收入。 最近的财政立法让开支和收入发生了负面的结构性变化,也会让控制债务的任务比哪怕一年前都更难以执行。 在特朗普推行税收削减之前,国会预算委员会曾预测联邦税收会出现稳健增长,从占GDP的17.7%到10年后的约18.4%。然而,由于税收削减的出现,2018年财政收入预计仅占GDP的17.2%。政府开支则必然会从2018年占GDP的20.5%升至2027年的23.6%(国会预算委员会并未预测这一日期之后的数据)。但2月的预算方案将引发可自由支配开支从2019年开始大幅下降,导致2027年开支占GDP的整体比重升至24.8%。 财政改革的一个重要政策便是减缓在福利保障方面的失控开支,也就是社保和医疗。简单来说,美国令人生畏的人口结构注定了福利计划会继续占用越来越多的财政收入。美国人口中65岁以上人群数量的增速大大高于劳动力的增速。2017年到2030年,超过2000万婴儿潮年代出生的人群将步入退休年龄,而仅有1400万美国人会加入就业群体。医疗所覆盖的老年群体也在变老,其患病的几率也就更高。大量的高龄美国民众会通过选票来保护其享有的福利。 然而,我们可以采取一些办法来降低福利保障开支的增长。在社保方面,针对未来10年中退休人员预计获得的每1.10美元福利,纳税人应向其信托基金中投放1美元。将福利与通胀挂钩而不是与薪酬挂钩,后者的年增速预计将超出前者1.5个百分点,此举将让福利计划重回平衡,同时不会破坏购买力。在医保方面,政府可通过获得处方药议价权以及重新要求制药商返利来控制成本,后者会为医疗补助计划带来节省,但不适用于医保。国会还可以将医生的门诊费拉低至医生的办公室坐诊费。更加激进的举措包括引入市场机制,让病患成为对成本敏感的消费者。还有一条建议:为老年人发放固定额度的资金,以购买私人保险。 进一步放缓军费和其他可自由支配开支的增幅并不是件容易事,但过去也曾实现过。国会应按照预算控制法案,设立新的开支上限。该法案曾在2013-2017年期间帮助减少了开支占国家财政收入的比重。然而,由于我们观望的时间过长,即便推行重大的开支改革,这个深坑依然存在,只能靠税收来填补。 在拿出解决方案之前观望的时间越长,所需征收的新税率也就会越高。《财富》曾对美国在未来10年之内所需获取的额外财政收入进行过计算,条件包括社保增速降低1个百分点,大幅减少医保、医疗补助和其他医疗开支,并让可自由支配开支的增幅低于GDP(虽然得从新法所确立的更高的基准开始)。为了方便计算,我们假设现任政府不会调高企业税。我们的目标是让债务占GDP比重能够保持在或低于2017年年底76%的水平,从而得出所需的开支削减和财政收入增幅。尽管这一比例大约是过去50年平均值的两倍,但按照国会预算委员会对于未来的低利率环境预测,这个比例还是可承受的。 正常的成本如下。如果我们现在开始改革,包括开支的削减,美国政府需要在2018年底-2028年期间每年获得9000亿美元的企业税增量,也就是将这一期间的联邦税率调高21%-22%。(如果近期赤字增加立法未能推行,而且我们在眼下就进行改革,所需的税率增幅还不到这一数字的一半。)如果我们再等上4年,然后在2023年开始计算未来10年的状况。我们将不得不应对这4年期间债务的大幅增长。如果要让债务占GDP的比重在2032年依然维持在76%的水平,以当前税收为基准线,美国的年均税收增量应达到1.2万亿美元,也就是24%的税率增幅。 一名经济师指出,如果国会希望解决债务危机,“无论他们采取何种举措,这些举措在现在看来都是不可能推行的。” 什么样的税可以带来如此可观的财政收入。里根政府期间国会预算委员会主任鲁道夫·佩勒说:“美国政府可谓是最大程度地利用了个人所得税这颗摇钱树。”他如今担任城市研究所研究员。曼哈顿研究所的瑞德尔认为,将最高的两档个人所得税税率调至70%和74%(从政治上来讲是不可能的事)也只能填补30年中医保和社保所缺资金的五分之一。其他的建议包括对汽油销售征收碳排放税,通过向企业强制推行如今适用于个人的相同税收抵扣上限来限制企业的州税抵扣,以及对雇主提供的高额医疗保险计划征税。 然而,如果依靠现有的税法,这个数字是无法企及的。基本上每一个工业化国家都已采用消费税来补贴其福利系统。平均来看,增值税占到了这些税收的约60%,它与销售税类似,发生在商品经历的每个生产环节,实际上由公司来支付。这类税收平均贡献了约6%的GDP,其通常的税率约为20%。 美国没有增值税或全国性的销售税,但由于此类税种在其他国家会蚕食掉很大一部分的收入,因此我们也就不难理解为什么这一税种会在国会遇冷。然而,由于我们的财政即将陷入绝境,美国可能很快就会发现,政府需要采取一些以前从未考虑过的解决方案。带有自由主义倾向的布鲁金斯研究所的经济师威廉·盖尔说:“特朗普政府和这届国会不会考虑推出增值税,但其呼声将高涨。无论最终采取何种举措,这些举措在现在看来都是不可能推行的。”。 确实,如果美国政客们最终都下定了决心,并尽其所能为美国财政寻找一个坚实的落脚点,那么他们必然会经历难以想象的痛苦。即便可以采用调高税率的办法,他们仍需要从一个高起点出发,因为我们等待的时间已经太久了,他们将以这一起点为基础来调高税率。美国此前从未经历过这种幅度的增税,但这是很有可能发生的。不久之后,消费者可用于汽车、电器、iPhone和度假方面的资金将减少。公司的销售和盈利也将因此而受到冲击。同时,这一可能发生的消费阵痛或许会给政客们带来压力,迫使他们至少撤销某些特朗普尤为引以自豪的公司税削减政策。 大卫·科特回忆道,他在一开始加入辛普森-鲍勒斯委员会时曾力推增值税。“然后,有些人指出,美国政府不需要制造一个新的税收引擎,后来我转而反对增值税,因为它只会继续推高支出。”但不管怎么样,政府支出一直在不断增加,如今,支出增幅更是得到了共和党立法主体和这位民粹总统的支持。在预算事务方面,美国民众热衷于高福利的锐不可当之势与美国民众拒绝高税收的无法撼动之心发生了冲突。就像强尼·莫瑟的那首老歌所唱的那样——“总得付出点代价”。(财富中文网) 本文的一个版本刊登于《财富》2018年4月刊,标题为《深陷债务泥潭》。 译者:Ms |

As business-friendly as Trump’s tax and regulation stances may be in the short term, these policies are growth killers. The overriding danger is that by pushing hard against traditional immigration and open trade, Trump could force the economy into a recession—one that could be made worse because it would prompt investors to ask for higher interest on our already gigantic debt. Perhaps more to the point: Even if GDP did wax at the 3% level that the Trump team seeks, the extra juice would lower total debt by only 10%, or $3 trillion, by 2028, according to the CRFB. “Adding a point to growth won’t come close to solving the problem,” says Cote. To ensure long-term stability, policymakers will have to do something that’s been almost unthinkable in recent memory—simultaneously cut spending and pump up revenue. The recent fiscal legislation caused negative, structural changes on both the spending and revenue fronts—making the task of keeping the debt in check much harder than it would have been even a year ago. Prior to the Trump tax cuts, the CBO was projecting that federal tax revenues would grow robustly, from 17.7% of GDP in 2018 to around 18.4% a decade later. But because of the cuts, revenues in 2018 are projected to be just 17.2% of national income. Government spending, meanwhile, was set to expand from 20.5% of GDP in 2018 to 23.6% in 2027 (the CBO did not project the figure after that date). But the February deal will trigger a huge jump in discretionary spending starting in 2019, raising the overall 2027 figure to 24.8% of GDP. A crucial plank in fiscal reform is slowing runaway spending on entitlements, chiefly Social Security and Medicare. Put simply, the nation’s daunting demographic math dictates that the benefit programs keep absorbing bigger and bigger shares of national income. The cohort of Americans over age 65 is expanding much faster than the workforce; from 2017 to 2030, 20 million more baby boomers will reach retirement age, while only 14 million Americans will begin employment. The pool of seniors on Medicare is also getting older, and as a result, sicker. And older Americans vote, in huge numbers, to protect their privileges. Still, there are ways to slow entitlement growth. In Social Security, taxpayers will contribute about $1 to its trust fund for every $1.10 retirees are projected receive in benefits over the next decade. Indexing benefits to inflation instead of wages, the latter of which are forecast to grow 1.5 percentage points faster annually, would return the program to balance without damaging purchasing power. On Medicare, the government could restrain costs by gaining authority to negotiate prices for prescription drugs, and by reinstating the requirement that drugmakers provide rebates, a policy that generates savings for Medicaid but is barred for Medicare. Congress could also set doctors’ fees for outpatient hospital visits to the lower rates charged for office consultations. Bolder moves include introducing market forces that turn patients into cost-conscious consumers. One prescription: Giving seniors fixed payments to buy private insurance. Getting military and other discretionary spending to grow less slowly won’t be easy, but it has been done in the past. Congress should enact new spending caps along the lines of the Budget Control Act, which helped to shrink outlays as a share of national income from 2013 to 2017. But because we’ve waited so long, even major spending reforms leave a big hole—a chasm that can be filled only by taxes. The longer we wait to enact a solution, the higher the new levies required will need to go. Fortune ran numbers to calculate how much extra revenue the U.S. would need to raise, over the next decade, if it lowered the rate of growth in Social Security by one percentage point, reduced increases in Medicare, Medicaid, and other health care spending by a proportional amount, and held discretionary spending below growth in GDP (albeit from the higher base established by the new laws). For our purposes, we assumed that corporate tax increases are off the table under the current administration. Our goal was to come up with spending cuts and revenue increases that would keep the ratio of debt to GDP at or below where it was at the end of 2017, at 76%. Though that’s around twice the average over the past 50 years, it’s what would be affordable given the CBO’s projections of low interest rates for years to come. So here’s what the cost of sanity looks like. If we start reforms now, including the slowdown in spending, the government would need to phase in noncorporate tax increases averaging $900 billion a year from the end of 2018 through 2028. That would require raising federal tax collections by between 21% and 22% over that period. (That’s more than twice the increase we would have needed if we’d started now, without the recent deficit-ballooning legislation.) What if we wait four years, and begin our 10-year projections at the start of 2023? We’d be coping with four more years of colossal growth in debt. To wrestle the debt-to-GDP ratio back to 76% by 2032, the U.S. would require an average tax increase of $1.2 trillion over today’s baseline. That’s a rise of 24%. If congress hopes to solve the debt crisis, says one economist, “whatever they come up with will be something that seems impossible now.” What kind of taxes could produce that bounty? “We’ve gotten about as much money as we can out of the personal income tax,” says Rudolph Penner, director of the CBO during the Reagan administration and now a fellow at the Urban Institute. Riedl, of the Manhattan Institute, reckons that doubling the top two personal rates to 70% and 74% respectively (politically a near-impossibility) would close just one-fifth of the projected shortfall from Medicare and Social Security over 30 years. Other proposals include a carbon tax on gasoline sales, limiting deductibility of state taxes for businesses by imposing the same caps that now apply to individuals, and taxing generous employer-provided health care plans. But it’s unlikely that anything close to the necessary number can be raised by tinkering with the existing tax code. Virtually every other industrialized country deploys consumption taxes to support their welfare states. On average, around 60% of those levies are value-added taxes, or VATs, which resemble a sales tax but are actually paid by companies as goods go through each stage of production. They raise, on average, about 6% of GDP, at typical rates of roughly 20%. The U.S. doesn’t have a VAT or a national sales tax—and given how enormous a bite such taxes take out of income in other countries, it’s easy to see why they haven’t gained traction in Congress. But our fiscal plight is becoming so desperate that America may soon find itself embracing solutions it never before contemplated. “A VAT won’t happen under this President and this Congress, but its stock will rise,” says William Gale, an economist at the liberal-leaning Brookings Institution. “Whatever they come up with will seem to be something that’s impossible now.” Indeed, if our politicians finally grow a collective backbone and strive to put America’s finances on a firm footing, the pain will be wrenching. Even though tax increases can be phased in, they’ll still need to start at a high plateau because we’ve waited so long, and they’ll rise from there. America has never seen anything like the kind of tax hikes that could be in the cards. Over time, consumers will have less to spend on cars, appliances, iPhones, and vacations. Sales and profits will suffer. And the likely consumer pain might generate political pressure to undo at least some of the corporate tax cuts that Trump is so proud of. Dave Cote recalls that he favored a VAT when he first joined the Simpson-Bowles Commission. “Then someone pointed out that the government doesn’t need a new engine to collect taxes, and I changed to opposing the VAT because it would just keep ratcheting up spending.” But government spending has ratcheted up anyway—now with the blessing of the Republican legislative majority and a populist President. On budget matters, the irresistible force of Americans’ love for rich benefits collides with the immovable object of Americans’ resistance to high taxes. As the old Johnny Mercer song goes, “Something’s Gotta Give.” A version of this article appears in the April 2018 issue of Fortune with the headline “Deep in Debt.” |