摩根大通在底特律:美国版的“精准扶贫”故事

|

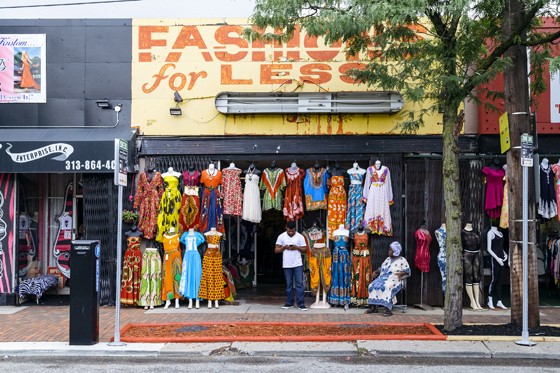

在底特律的西麦克尼克斯路上只有两种店面:一种是关门的,另一种是“它怎么还没关门?”的。道路两旁的一二层铺面要么用褐色的木板封着,要么拉下了烟灰色的卷闸门。星期四上午10点半,十字路口的那家售酒店是唯一有点人流量的地方——当然,如果你没算那起路边的交易。一个开着本田小轿车的大叔将车子停在公交站牌前面,跟一个行人用现金交易一袋用三明治袋子装着的东西,全然不顾一辆30路公交车在后面按喇叭。 对于没有生活在底特律的人来说,他们想象中的底特律,大概就是这个样子了。这也难怪,每当你在报纸上看到底特律的人口已经比二战后减少了60%,或是在网上看到底特律大骚乱50周年的纪念专题时,你脑中肯定会想象出类似的画面。这符合标准的“铁锈地带”的形象——昔日繁华的工业区变成一片废墟,城市一片死气,值得庆幸的无非是这些关张的店面还没有被人打砸抢烧罢了。 然而真正的底特律,以及这条麦克尼克斯路,并非是这样死气沉沉的末日景象。与附近的利沃诺斯大道一样,麦克尼克斯路也是住宅区的一条主干道,它基本上安然无恙地挺过了芝加哥的历次重大风波。在步行所及的范围里,有几千户中等收入家庭。离此不到六个街区,坐落着两座大学和一家医院,这些都是能给出不错的薪水的“铁饭碗”单位。 |

There are two kinds of storefronts on this stretch of Detroit’s West ¬McNichols Road: Boarded-up and “Why isn’t this boarded up?” Most of the one- and two-story buildings are clad in drab painted plywood or the gunmetal gray of security shutters. At 10:30 on a Thursday morning, the liquor store on the corner of San Juan is the only business with noticeable traffic—¬unless you count the one being run out of the Honda coupe idling at a bus stop. The driver is conducting a cash-for--something-in-a-sandwich-bag transaction with a passerby, both of them oblivious to the horn blasts from the westbound Number 30 whose space they occupy. It’s a tableau that epitomizes what people who don’t live in Detroit imagine when they think about Detroit. It’s the picture you might conjure when you read that the city’s population has shrunk by 60% since World War II, or when you see 50th-anniversary remembrances of the riots of 1967. It’s an almost-perfect image of Rust Belt stagnation; the only detail missing from the stereotype is that none of the shuttered stores is actually on fire. But the real Detroit is not a blank canvas for apocalyptic visions of decline—and neither is McNichols Road. Along with nearby Livernois Avenue, McNichols is a main artery of a residential area that has stayed healthy through all of Detroit’s well-publicized woes. It’s within walking distance of thousands of middle-income households—and within six blocks of two college campuses and a hospital, “anchor employers” supporting decent-paying jobs. |

|

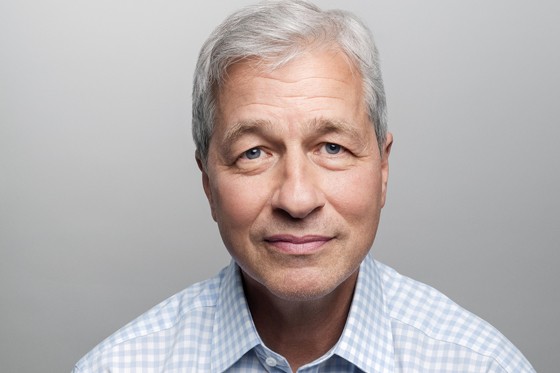

现在,有些底特律人想把这个没什么希望的地方改造成一个经济中心。他们致力于打造一个“20分钟社区”项目,使当地居民只需要步行一会儿,就能在离家不远的地方找到购物、餐饮、娱乐和工作的地方。一位开发商计划收购100余套废弃房屋,然后进行翻新改造,沿着一条连接两个大学校园的“园林路”,建立一个混合居住的居民区。一些非营利组织也在收购临街的空白店面,进行翻新后提供给当地的小企业主,以便给当地居民创造他们一直渴求的就业机会。 梅琳达·克莱蒙斯带我们向北走了几个街区,来到拐角处的一座大型建筑。这里曾是一家B. Siegel百货商店。即便是在有“时尚大道”之称的利沃诺斯大街上,这间百货商店也一度称得上地标性建筑。不过B. Siegel百货商店早在20世纪70年代就关门了。最近租下这个地方的是一间一元店,老板2005年跑路后,这个地方已经空置了十多年。克莱蒙斯负责的一个项目致力于将这个地方改造成一个“迷你社区”——上面是朝阳的两室一厅,一栋10户,下面是一排临街的餐厅和商店。克莱蒙斯的童年就是在这里度过的。她在楼上用手势指点江山,暗示着这里昔日的繁华和如今的潜力:这里是餐厅、这里是假发商店和服装店……她笑着说:“如果你住在这儿,这些就都能拥有了。” 要重建一个城市,就要从一个村子建起。为了底特律的复苏,很多个人和企业都投入了大量心力。不过在利沃诺斯大街和麦克尼克斯大道的规划上,以及在很多其他社区的建设上,有一家企业的名字经常被反复提及,这家公司就是摩根大通。它也是底特律最大的银行,它在底特律个人银行市场上的占有率达到了惊人的65%。2014年以来,摩根大通进一步加大了它对底特律的投入,并且进行了相当大胆的试验,以帮助底特律的中产阶层重新恢复生机。 摩根大通的试验叫做“投资底特律”项目,该项目致力于在最短的时间内,同时振兴当地房地产市场、帮助当地培育小企业,并且对居民进行就业培训。摩根大通CEO杰米·戴蒙在纽约总部接受《财富》采访时表示:“如果你没有工作,你就没有房子。如果你没有房子,你就没法去工作。另一方面,如果人们没有就业技能,他们还是买不了房子。所以必须在这几个方面同时做出进展。” |

That’s why a coalition of Detroiters wants to turn this unlikely tract into an economic hub—part of a “20-¬minute neighborhood” where residents could find shopping, restaurants, recreation, and jobs within a short walk from their homes. A developer plans to take over more than 100 abandoned houses and renovate or replace them, creating mixed-income housing along a “greenway” park that will link the college campuses. And nonprofit groups are acquiring some of these blank-faced storefronts, aiming to remake them to host small businesses owned by local entrepreneurs who would hire locally—creating opportunities where they’ve long been absent. A few blocks north, Melinda Clemons shows off a bigger building on a corner lot. This was once a B. Siegel department store, the centerpiece of a stretch of Livernois known as the Avenue of Fashion. B. Siegel closed in the 1970s; the last tenant, a dollar store, fled in 2005. But Clemons is overseeing a project that could turn this vacant hulk into its own mini-neighborhood: a cluster of 10 sunny two-bedroom lofts, sitting atop a parade of street-level restaurants and boutiques. Clemons, who spent her toddler years nearby, gestures down a scrappy block lined with diners, wig shops, and clothing stores that hint at the neighborhood’s prosperous past and present potential. “You could live here,” she says with a grin, “and you’d have all this.” It takes a village to rebuild a city, and the list of people and businesses collaborating on Detroit’s recovery is long. But the planning underway in Livernois/McNichols, and in a growing roster of other neighborhoods, reflects the expertise and financial clout of one corporation in particular: JPMorgan Chase. CEO Jamie Dimon’s financial powerhouse is the largest bank in Detroit, with a titanic 65% market share in consumer banking. Since 2014, the company has been doubling down on that relationship, in a daring experiment to help revitalize Detroit’s middle-class core. The bank’s effort, called Invested in Detroit, is a ¬neighborhood-by-neighborhood campaign to revive local real estate, launch small businesses, and train residents for in-demand jobs—all at the same time, as quickly as possible. “If you don’t have jobs, you don’t have housing,” ¬Dimon tells Fortune in an interview at JPMorgan Chase’s New York headquarters. “If you don’t have housing, people can’t get to their jobs. If people don’t have skills, people can’t buy homes. You’ve got to make progress on all these fronts.” |

|

要在这些方面取得进展,既离不开一个长袖善舞的牵头者,也需要一群精心挑选的合作伙伴。摩根大通并没有直接掏钱盖公寓或是给新培训的卡车司机发工资,不过正是它的投资才使后续的这些发展成为可能。目前摩根大通已经向该项目投资了1.5亿美元,同时部署了一支轮换团队,帮助底特律的改革派市长麦克·杜根以及当地的非盈利组织决定对哪些社区和产业进行改造升级。决定相关投资去向的也是这些利益相关方和非盈利组织。比如Capital Impact Partners公司的底特律市场总监梅琳达·克莱蒙斯就是摩根大通团队的成员之一。她表示:“我们有一些其他大公司没有的信息。”正是这些信息,使一些本来无法获得投资的当地企业得到了急需的投资——这些企业原本得不到投资的原因可能是多方面的,有经验不足这样的简单原因,也有底特律根深蒂固的种族歧视倾向这种复杂原因。 这个项目虽然帮助了穷人,但它并不是纯粹的慈善事业。摩根大通想培养的企业不仅要能支付得起工人的工资,同时还要付得起投资的利息。摩根大通的企业责任总监彼得·谢尔指出,迄今为止,该公司约有55%的投资是由贷款构成的。给一个女人一条鱼,她一天就吃完了。但如果你教给她如何钓鱼,然后把钱借给她,让她开一家炸鱼薯条店,这就超越了做慈善的范畴——这既是善事,也是一笔好生意。 在戴蒙看来,投资底特律的商业价值也在日益增加。自从金融危机爆发以来,戴蒙就深信,就业技能较低的劳动者与好的就业机会之间的鸿沟,其本身已经成为拖累全美经济发展的一个重要因素。如果能够通过培育小企业和对劳动者提供培训来缩小这种差距,就能建立起一种良性循环,这意味着更多人能获得稳定的收和,从而给地区带来更大的繁荣。这样一来,更多的企业家和购房者将成为有信用的借贷者,摩根大通也自然能够从中获益。在底特律城区,摩根大通拥有200亿美元的存款。戴蒙指出:“我们正在不断获得市场份额,摩根大通是每家每户都会选择的银行。”我们不难想象,如果本地经济得以快速增长,这200亿美元的回报率无疑是惊人的。因此,拿出1.5亿美元进行城市建设,自然并不是搞慈善这么简单。 |

Making progress involves a deft dance with carefully chosen partners. JPMorgan Chase isn’t directly paying for a thicket of new apartments or a cohort of newly trained truck drivers—but it’s putting up the money to make those efforts possible. The bank has committed $150 million to the project, while deploying a rotating team to help Detroit’s reformist mayor, Mike Duggan, and local nonprofits decide which neighborhoods and industries to saturate. It’s those stakeholders who ultimately decide where the money goes. “We have the intelligence that larger organizations may not have,” says Clemons, the Detroit Market Lead at Capital Impact Partners, one of the bank’s teammates. And that intelligence is steering funds to businesses that wouldn’t otherwise qualify for them—for reasons as simple as inexperience, or as complicated as Detroit’s legacy of racial discrimination. The program may lift up the needy, but it isn’t charity. JPMorgan Chase wants to foster businesses with the skills to pay the bills—with interest. Some 55% of the money it has distributed to date has been made up of loans, says Peter Scher, the bank’s head of corporate responsibility. Give a woman a fish, and she’ll eat for a day. Teach her how to fish, and then lend her money to build a fish-and-chips restaurant, and you’ve gone beyond philanthropy—you’re doing good while doing good business. And the business case for investing in Detroit looks increasingly strong to Dimon. Since the financial crisis, the CEO has become convinced that the gap separating lesser-skilled workers from good job opportunities has itself become a drag on economic growth, nationwide. Do more to close that gap—by fostering small businesses and training workers—and you build a virtuous circle, where more people with stable incomes foster greater prosperity. If that means more entrepreneurs and would-be homebuyers become creditworthy borrowers, JPMorgan Chase wins too. In the Detroit metro area, where the bank has $20 billion in deposits, “We’re gaining share,” Dimon notes. “Chase is the home bank.” Imagine the returns that those $20 billion could earn in a faster-growing local economy, and a $150 million investment in city-building becomes more than simple altruism. |

|

2017年夏天,摩根大通给了《财富》一次仔细观察其项目的机会——虽然这是一系列小项目,但它们累积起来的影响是巨大的。据谢尔团队的计算,“投资底特律”项目已经创造或保住了近1700个工作岗位,为大约100家新企业提供了资金,为大约15,000名劳动者提供了培训。在这样一个失业率超过10%的城市,这些数字代表了实打实的进步。更重要的是,它们通过实践证明了摩根大通的理念是可行的。通过底特律的试验,摩根大通相信,这种“全面发力”的底特律模式是可以推广到全国的。在接下来的几个月里,他们就将把底特律模式的一些元素向全美进行推广。 底特律的衰落程度用一组简单的数字就能看出来。现在,底特律大约有67.5万名居民,而1950年这个数字是180万人。早在艾森豪威尔时代,底特律的汽车制造商和国防承包商们已经开始积极采用新技术,以减少对劳动力的依赖。此后,很多制造企业都迁往郊区或是美国的其他州,寻找更大空间建设更新更高效的工厂。随着时间的推移,几万名工人也跟着公司离开了底特律。 底特律深入当地政治体系骨髓的种族歧视,也使那些留下的人深受其害。底特律郊区至今保持着事实上的种族隔离,使黑人员工无法随工作而居。与此同时,当地银行用“划红线”将少数族裔区别对待的做法(即用红线标出少数族裔聚居区,以强调这个地区的借贷风险),也让黑人家庭难以通过房产增值来获得财富,同时也使一些贫困创业者无法获得资本。再加上所谓的“白人大迁移”,更使得底特律成为了一个黑人为主的城市。 上世纪六七十年代的民权运动打破了一些种族藩篱,但这并没有阻止底特律的衰退。在2007年至2009年,底特律做出了一个相当草率的决定,不仅将通用汽车和克莱斯勒逼至破产,也彻底暴露了底特律有多少人欠了次级房贷。据研究机构RealtyTrac的数据称,在2005年到2014年,底特律有14万套房子因房主无力还贷而被银行收回,本已脆弱不堪的纳税人群体又遭到一次暴击,这也进一步加速了底特律的破产。 戴蒙是此次灾难的亲历者之一。他从八十年代起就在这座城市的商界里打拼。戴蒙曾经当过第一银行(Bank One,总部在芝加哥)的CEO,当时的第一银行还是底特律最大的借贷行。后来在戴蒙的主导下,摩根大通于2004年与第一银行合并,并继承了其业务。“我们认为,底特律早已积重难返,这场灾难其实已经酝酿了很多年了。” |

Last summer, JPMorgan Chase gave Fortune a closer look at the work it’s supporting—a string of small projects whose cumulative impact is large. Scher’s team calculates that Invested in Detroit has created or preserved nearly 1,700 jobs, financed about 100 new businesses, and reached some 15,000 people through training programs. In a city with unemployment above 10%, those numbers represent real progress. More important, they’re a proof of concept. Thanks to Detroit, the bank is confident that this full-court-press approach is a blueprint that could work across the country—and in the next few months, they’ll be taking components of the Motown model nationwide. You can frame the magnitude of Detroit’s decline with a single statistical juxtaposition: Today, the city has about 675,000 residents, down from 1.8 million in 1950. By the Eisenhower era, the automakers and defense contractors who had fueled Detroit’s boom were already adopting new technology that enabled them to shrink their workforces. Manufacturers moved to suburbs or other states with ample space for new, more efficient factories, and over time, tens of thousands of workers followed the companies out of town. Racial discrimination, baked into local politics and institutions, burdened those who stayed. Many Detroit suburbs maintained a de facto segregation that kept African-American workers from going where the jobs were. Meanwhile, “redlining” by banks—the practice of classifying minority-dominated neighborhoods as too dangerous for lending—kept black families from building wealth through home equity, and starved entrepreneurs of capital, even as “white flight” made Detroit a majority-black city. Civil rights advances in the 1960s and 1970s lowered some barriers, but the erosion continued. The city took a decisive kick in the teeth from the 2007–09 financial crisis, which not only drove General Motors and Chrysler into bankruptcy, but exposed how many Detroit homeowners held subprime mortgages. Some 140,000 Detroit homes were foreclosed on between 2005 and 2014, according to research firm RealtyTrac, shredding the city’s already decimated tax base and helping precipitate its own bankruptcy. Among those witnessing this train wreck was Dimon, who’s been doing business in the city since the 1980s. When Dimon became CEO of Chicago-based Bank One, that institution was Detroit’s biggest lender. JPMorgan Chase inherited that mantle when Dimon engineered its merger with Bank One, in 2004. “We’ve been watching Detroit be an accident waiting to happen for years,” he says. |

|

戴蒙不光赶上了底特律的衰落,也赶上了它的复兴。2006年,底特律为了承办第40届“超级碗”杯而在市中心修建了福特体育场,这在一定程度上刺激了市区的重新开发。2011年,快速贷款公司(Quicken Loans)的董事长丹·吉尔伯特将公司总部从利沃尼亚市郊搬到了离底特律市政厅只有几步之遥的马修斯公园。自此,快速贷款公司和吉尔伯特的另一家房地产开发公司——底特律Bedrock公司对底特律市中心进行了不少改造,这两家公司斥资25亿美元,收购和开发了100多处地产。Bedrock公司总裁丹·马伦曾这样描述过公司的哲学:“只要在一个地区建立足够的密度,直到它向四周爆炸辐射,然后这密度本身就会带来销路。”还有一些《财富》500强公司,比如汽车座椅生产商Adient和微软等等,也被这里的人流吸引,在底特律市中心开设了办事处,随之而来的是数千名知识工人。 如果你现在到底特律市中心转转,或是坐上快速贷款公司投资建设的有轨电车“Q Line”沿着伍德沃德大道去市中心,一路上你会看见不少都市白领喜欢的高档住宅、品牌专卖店和休闲娱乐场所。John Varvatos和Warby Parker这种时尚潮牌应有尽有。下了公寓楼,走几步便是一片老式的棒球场。当然,这里也少不了能喝鸡尾酒的高档餐厅。 复苏中的底特律虽然忙忙碌碌、灯红酒绿,但这种复苏却是不完整的。在一个只有13%的适龄工作人口拥有学士学位的城市,金融和科技行业工作的涌入对经济的推动毕竟是有限的。市长杜根表示,他不想让城市出现严重的贫富分化。他对《财富》表示:“我曾仔细研究过华盛顿的情况。另外我的女儿生活在纽约的布鲁克林,我也研究过那里的情况。我们采取了一定的战略以避免那种局面发生。”不过你怎样才能把市中心的繁荣延伸到蓝领和粉领阶层呢?底特律的复苏怎样才能不走贫富分化的老路? 就此,杜根和摩根大通有一些想法。 |

But Dimon also had a front-row seat for a revival. ¬Detroit built Ford Field, a downtown stadium, to host Super Bowl XL in 2006. That helped spark some downtown redevelopment, and the movement gained momentum in 2011, when Quicken Loans Chairman Dan Gilbert moved his headquarters from suburban Livonia to Campus Martius Park, steps from city hall. Since then, Quicken and Gilbert’s development company, Bedrock Detroit, have reshaped downtown, spending some $2.5 billion to acquire and develop more than 100 properties. Dan Mullen, president of Bedrock, describes its philosophy as, “Create enough density in one area until it busts at the seams, and then that density sells itself.” Other Fortune 500 companies—from car-seat maker Adient to Microsoft—have been drawn by the critical mass, establishing offices downtown, and several thousand knowledge workers have moved there too. Visit the central city now, or take the Quicken-funded “Q Line” up Woodward Avenue to Midtown, and you’ll see the kinds of homes, brands, and amenities that white-collar hipsters love. John Varvatos? Warby Parker? Got ’em. An old-fashioned ballpark you can walk to from your loft? Check. Restaurants where the cocktails come with a single, huge ice cube? Roger that. This vision of recovery is buzzy, fun—and incomplete. In a city where only 13% of working-age residents have a bachelor’s degree, the benefits of an influx of finance and tech jobs only stretch so far. Mayor Duggan is adamant that he doesn’t want a stratified city. “I’ve studied closely what happened in Washington, D.C.,” he tells Fortune. “My daughter lives in Brooklyn. I’ve studied what happened there. We are adopting strategies so that doesn’t happen.” But how could you spread downtown’s recovery through the city’s sprawl of blue- and pink-collar neighborhoods? How could you keep Detroit’s boom from replicating America’s economic divide? Duggan had some ideas—and so did JPMorgan Chase. |

|

底特律的复苏与摩根大通的捐赠理念的转变几乎是同时发生的。在城市发展上,摩根大通一向是慷慨解囊的。光是2016年,它就向非盈利组织捐赠了2.5亿美元。不过在经济危机后,摩根大通的管理层开始思考如何让这笔资金变得更有意义。在彼得·谢尔的领导下,摩根大通重新制定了自己对抗底特律经济衰退问题的战略,将重点放在了发展小企业、工作技能培训、社区开发和金融咨询上。2012年,摩根大通约40%的企业捐款流向了这“四驾马车”,现在这一比重已经提高到了95%。这一战略恰恰也利用了银行的强项——把资本借给别人,然后建议他们如何投资这笔钱。 在2013年底的时候,这种模式对于摩根大通还很陌生。不过戴蒙和谢尔认为底特律是一个理想的实验室。当时的市长杜根作为一匹黑马刚刚胜选,作为一个精力充沛、风风火火的民主党籍市长,他与共和党籍的密歇根州州长里克·斯奈德的关系反倒是相当和谐。戴蒙回忆道:“他们整天说的都是:‘我们需要工作,我们需要房子,我们需要把这些灯点亮’,而不是纠结于意识形态的纷争。”底特律退出破产程序后,城市得以摆脱了一些债务负担,能够将更多税收花在改善城市环境上。最重要的是,谢尔和杜根发现,他们在社区建设和促进居民自力更生上有许多观点是一致的。到2014年7月,摩根大通已经为“投资底特律”项目投入了1亿美元。 有人可能要问,摩根大通2016年的营收入达到了1060亿美金,这样一家大银行,为什么只拿出这点钱援助底特律?如果它有心,为什么不疯狂地向底特律的企业家放贷呢?简单说来,心急吃不了热豆腐,摩根大通也没办法,因为这些借款人并不一定是银行眼中“有贷款资格”的人。 这也反映了底特律陷入持续衰落的恶性循环背后的经济原理。按照法律规定,大多数银行在贷款时都要保持一定的“贷款价值比”,也就是贷款额与担保物价值的比例,这个比例必须低于一定的门槛——通常是80%。然而底特律大部分地区的房价跌得极惨,大多数房地产项目很容易就会打破这个上限。也就是说,建筑这些房产所花的成本,可能要比它建好后的售价还要高。出于同样的原因,当地企业家们也很难凑够一笔抵押品来申请贷款。不过快速贷款公司(Quicken Loans)并不存在这样的困难,它早期在底特律市中心的几笔投资都是自己掏的腰包。对于底特律的其他大公司来说,要找一家愿意提供贷款的银行也非难事。但小企业和本地的房地产开发公司就没有这么幸运了。 |

Detroit’s reemergence coincided with a philosophical shift at the bank. It’s already a formidable donor: In 2016, it gave $250 million to nonprofits. But after the financial crisis, its leadership began considering how to make that money count for more. Under Peter Scher, it retooled its giving to tackle economic insecurity itself—focusing on small-business expansion, job-skills training, neighborhood development, and financial counseling. In 2012, about 40% of JPMorgan Chase’s corporate giving was devoted to those four pillars, Scher says; today, it’s 95%. It’s an approach that leverages what banks already do well—lending people capital, and giving them advice about how to deploy it. In late 2013, this model was new for the bank. But Dimon and Scher saw in Detroit an ideal laboratory for it. There was rare harmony between Duggan—an energetic, bulldozer Democrat who had just won an election, amazingly, as a write-in candidate—and Michigan Gov. Rick Snyder, a Republican. “All they spoke about was, ‘We need jobs, we need housing, we need to turn the lights on,’ ” Dimon recalls. “Not the ideological yelling and screaming.” Detroit’s exit from bankruptcy enabled the city to shed some of its elephantine debt obligations and dedicate more tax revenue to improving the city. Most important: Scher and Duggan found they shared many beliefs about neighborhood-building and economic empowerment. By July 2014, JPMorgan Chase had put $100 million on the table for Invested in Detroit. It’s fair to ask why JPMorgan Chase, a bank that generated $106 billion in revenue in 2016, wasn’t already lending like crazy to Detroit’s entrepreneurs. The answer was that it essentially couldn’t—because those borrowers weren’t “bankable.” That fact reflects the self-perpetuating math of Detroit’s decline. Most banks are required by law to keep “loan-to-value ratios”—the ratio of the loan amount to the estimated worth of the project it funds—below a certain threshold, typically 80%. But property values in most of Detroit have sunk so far that most real-estate projects easily break that ceiling; by definition, they would cost more to build than they would be worth once completed. For similar reasons, entrepreneurs can seldom scrape together collateral for a loan. Quicken Loans didn’t face this problem—its early downtown investments were self-financed. And Detroit’s big corporations can almost always find lenders. But small businesses and local developers are often stymied. |

|

不过摩根大通找到了绕过这些障碍的方法。美国所谓的“社区发展金融机构”(简称CDFI)专门负责为低收入社区提供贷款。CDFI通常是非营利性组织,财政部也不硬性要求他们遵守一些针对营利性银行的规则。CDFI可以承担更大风险,也能接受更高的贷款价值比,而且贷款条件也相对宽松。他们还可以贷款给那些信用评分不高或是缺乏信用记录的企业家,而其他银行对于这种企业家肯定是敬而远之的。摩根大通由全球慈善副总裁托莎·塔布伦牵头,选择了三家CDFI合作伙伴从事这项工作。塔布伦是个土生土长的底特律人,而且有着丰富的CDFI领域的经验。目前摩根大通已向这三家CDFI提供了5000万美元的贷款和拨款,并任由他们将这些资金分配到正确的地方。 “有色企业家基金”(Entrepreneurs of Color Fund)就是致力于这项工作的组织之一,它是由底特律发展基金会(DDF)创办的。自2015年创立以来,该基金会已经向47名借款人发放了420万美元贷款。DDF理事长雷伊·沃特斯表示:“他们之中的95%通过正常渠道是拿不到银行贷款的。”沃特斯会帮助他们制订商业计划,然后为他们提供会计和营销方面的培训,好将他们的业务做大做久。在这些人中,生意做得最大的一个年收入可达80万美元——虽然这种小生意在银行看来不值一提,但却足以对一个社区产生重大影响了。沃特斯表示:“你开了一家小小的墨西哥餐厅,雇了十个人每天走路来上班。你怎可能说它不好呢?” 沃特斯指出,CDFI贷款的利率通常为7%或8%,而银行贷款的利率一般是4%到5%。这既反映了CDFI提供的额外支持的成本,也充分说明了CDFI贷款面临的高风险——DDF的违约率略高于4%,而普通商业贷款的违约率大约是1.35%,也就是说前者的违约风险是后者的三倍。不过一旦CDFI的受益人做得成功了,他们在银行眼里也就变成了“有资格”的贷款者,他们的违约风险也就小得多。 艾德丽安和A.K.·班尼特母子在城市西北角的一座老楼里开了一家小公司,主要经营水电工服务,取名叫Benkari机械公司。去年,Benkari公司抓住了一个大机会,可以承包小凯撒竞技场——也就是底特律的新冰球场馆的部分水电工程。不过这个工期要持续60到90天才能回款,他们这家母子店一时没有足够的现金给工人发薪水。以这家小公司的条件,也不可能从银行申请到贷款。 有色企业家基金为Benkari公司提供了一笔30万美元的贷款,最终使Benkari公司赢得了竞标。小凯撒竞技场的工程将使Benkari公司在2017年成功赚到第一个100万美金。在证明了自己的实力后,又有很多大项目自动找上了门。如果这一发展势头持续下去,这家小公司会不会在10名员工的基础上再招几个人?艾德丽安答道:“这不是‘如果’的问题,而是‘什么时候’的问题。” “今天是收垃圾的日子。你能在收垃圾日学到很多东西。”戴夫·布拉斯基维茨开着一辆大型SUV,沿着一条居民区的狭窄小路行驶,这里是麦克尼克斯大道以北,离那里的零售区域并不远。对于没有经过训练的人,这排平房的健康状况是很难评估的。有些房子极为老旧,有的已经破坏不堪,有的干脆已经被废弃了。但大多数房子门前都矗立着一个大大的塑料垃圾桶,等待着收垃圾的卡车将它们清走。而这就是社区力量的一个象征。 布拉斯基维茨是一家名叫InvestDetroit的CDFI的理事长。InvestDetroit主要关注房地产和小企业的发展,它也是摩根大通选择的另一个CDFI伙伴。在市中心和城区的复苏中,他坚信“密度就是一切”的信条。他说,即使是在那些看起来很破败的社区里,也有很多被压抑的居民需求,足以使一些小企业蓬勃发展。 |

JPMorgan Chase spotted a way around the obstacle. Community development financial institutions (CDFIs) specialize in lending to lower-income communities. They’re usually nonprofits, and the Treasury Department exempts them from some rules that govern for-profit banks. CDFIs can take greater risks, accepting higher loan-to-value ratios and extending relatively lenient payment terms. They can also lend to entrepreneurs whose credit scores or lack of a track record would drive banks away. Guided by vice president of global philanthropy Tosha Tabron, a Detroit native with extensive CDFI experience, JPMorgan Chase chose three as partners. It has since extended more than $50 million to them through loans and grants—and given them a free hand to get it to the right places. One such group is the Entrepreneurs of Color Fund, an initiative operated by the Detroit Development Fund (DDF). The fund has loaned $4.2 million since its inception in 2015, to 47 borrowers, “95% of whom could not get a bank loan,” according to DDF president Ray Waters. Waters and his partner groups help them develop business plans and train them in accounting and marketing, so they’re able to sustain what they build. The biggest have about $800,000 a year in revenue—too small to get attention from banks, but big enough to make a neighborhood impact. “You open a little taqueria, you’ve got 10 employees who are all walking to work” because they live nearby, Waters says. “How can you feel bad about that?” CDFI loans typically carry interest rates of 7% or 8%, Waters says, compared with 4% to 5% for a bank business loan. That reflects both the costs of the additional support the lenders offer, and the greater risk: Default rates at DDF, at a little over 4%, are almost three times as high as the 1.35% average for commercial loans. But the nonprofits’ most successful protégés can grow large enough to be “bankable”—and look like much less risky bets. Adrienne and A.K. Bennett, mother and son, run their plumbing and HVAC contracting firm, Benkari Mechanical, out of a cluttered cinder-block building on the city’s northwest side. Last year, Benkari got a big opportunity: The chance to work on Little Caesars Arena, Detroit’s new hockey venue. But it didn’t have the cash to cover payroll for the 60-to-90 days between when the job started and when the checks arrived—and it wasn’t well established enough to borrow it from a bank. The Entrepreneurs of Color Fund extended a $300,000 loan to cover the costs—enabling Benkari to win the bid. The arena work has put Benkari on track for its first million-dollar year in 2017. And having proved it can skate with the pros, Benkari is a candidate for some lucrative contracts at federal buildings downtown. If the momentum continues, will the Bennetts expand their 10-person staff? “If?” retorts Adrienne. “It’s not ‘if.’ It’s ‘when.’ ” "Oh, nice, it’s trash day," says Dave Blaszkiewicz. “You learn a lot on trash day.” He’s piloting an enormous SUV down a narrow residential street, just north of the McNichols retail strip. To the untrained eye, the health of this block of brick bungalows might be hard to gauge. Some homes are pristine, some are run-down, some are abandoned “broken teeth.” But most have big plastic trash bins waiting for pickup in their driveways—and that’s a sign of neighborhood strength. Blaszkiewicz is the president and CEO of InvestDetroit, a CDFI with a focus on real estate and small-business development; it’s another JPMorgan Chase partner. Working on the downtown and midtown revivals converted him to the “density is everything” mantra. Even in neighborhoods that look blighted, he says, there’s often enough pent-up demand among residents to kindle a small-business boom. |

|

摩根大通已经向底特律的几家非营利性基金投资了3000万美元,以寻找那些有可能“冒尖”的社区,从而推动小企业的增长。现在的问题是,在底特律的大多数地区,老百姓的钱袋子还不够深,因此无论多少投资都无法吸引出走的企业回流——至少现在是这样。正如杜根所说的:“我不能告诉那些开鞋店、杂货店和咖啡店的应该去哪里开店。” 底特律的这几家CDFI最迫切的愿望是建立一个数据库,从而帮助他们预测哪些社区最能从他们的推动中获益。为了建立这样的数据库,摩根大通从全国各地请来了四名员工,以展示他们强大的数据分析能力。研究小组收集了任何能够量化的关于社区健康的数据,包括附近的餐馆、交通设施和当地学校的质量等等。他们还分析了信用卡交易数据,研究了当地人的消费模式。另外他们还参加了几十次社区会议,以了解当地居民最想要什么样的企业。摩根大通企业与投资银行部全球研究总监乔伊斯·张表示:“这就像在投行一样,你会把各种机会按‘绿色’、‘琥珀色’和‘红色’进行评级。” 最终,他们成功建立了一个可以有效辅助投资决策的灵活的数据库。布拉斯基维茨表示:“他们一个月就做了其他人半年才能做到的事。”“投资底特律”项目瞄准的前三个“微商区”的各种资产类型都能在数据库中显示出来,包括前文提到的利沃诺斯大道和麦克尼克斯大道。比如相对比较荒凉的麦克尼克斯路,在步行可达的范围内,就有两块比较繁荣的商区、舍伍德林区和大学区,居民平均年收入达到8万美元左右。向北不远就是时尚大道。这里的鞋店和服装店都有些年头了,有时会给人一种时空穿梭的错乱感,很多牌子都是汽车城时代的遗产,不过他们的生意还算兴隆,他们的势头也能带动附近街区的增长。 摩根大通的塔布伦表示:“我没有见过这个城市的全盛时期。”塔布伦是在大学区长大的。不过她表示,这里和一些社区依然保持着旺盛的商业脉搏。“现在我们已经有了扩展它的模板。” 这种“模板”的建筑特色,便是“商住混用”,即上层是住宅、下层是商铺的地产项目。这些项目可以成为区域经济的“瑞士军刀”,促进多种商业的发展。另外它们可以吸引许多富裕的租户,同时房价也能让普通居民负担得起。按照现在的计划,“投资底特律”项目瞄准的每个“微街区”至少要有两个这样的“商住混用”小区。 克莱蒙斯所在的CDFI就是专门从事这种项目的。利沃诺斯大道上的B. Siegel项目就是一个这样的项目。在一个炎热的下午,克莱蒙斯和他的同事又带我去了另一个项目“the Coe at West Village”的工地。该项目预计于去年11月开盘。旁边的街区有两家深受当地人喜爱的老店,一家是理发店Heavyweight Cuts,一家是烘培店Sister Pie。项目开发商克里夫·布朗带着我们四处参观。他的体型相当健硕,安全帽在他头顶小得有些滑稽。这是他作为开发商接手的第一个项目。若不是CDFI的资助,他几乎肯定申请不到传统贷款。该项目耗资约400万美元,其中差不多有一半的资金来自摩根大通。 |

JPMorgan Chase has invested some $30 million in Detroit-based funds that fuel that kind of growth by spotting neighborhoods that could be about to “tip.” The problem: In much of Detroit, the pockets of strength aren’t big enough, and no amount of investment can lure business back, at least right now. As Duggan puts it, “I can’t tell the shoe store or grocery store or the coffee shop where to go.” High on the wish list for Detroit’s CDFIs was a database that could help them predict which neighborhoods could best take advantage of a push. To build one, JPMorgan Chase brought in four employees from around the country to flex their data-science muscles. The team gathered anything they could quantify about neighborhood health—number of sit-down restaurants, transit availability, quality of local schools. They looked at credit card transaction data, gleaning insights about spending patterns. And they went to dozens of neighborhood meetings to learn what kinds of businesses residents wanted. “It’s like in investment banking, where you rank an opportunity ‘green,’ ‘amber,’ or ‘red,’ ” says Joyce Chang, the bank’s New York–based global head of research for corporate and investment banking, who mentored the team. The result was a flexible, user-friendly database that could shape decision-making. “They did in a month what would have taken someone else six,” says Blaszkiewicz. The kinds of assets that the database is designed to detect are on display in the first three eight-to-15-block “micro¬districts” targeted by Invested in Detroit—including Livernois/McNichols. Within walking distance of the desolate part of McNichols Road, for example, are two prosperous tracts, Sherwood Forest and the University District, where household incomes average around $80,000. A short distance north is the Avenue of Fashion. The shoe stores and dress shops on those blocks have a time-capsule air about them—many of the signs are of Motown vintage—but they do brisk business, and the momentum they generate could help nearby blocks grow too. “I didn’t witness the heyday of the city,” says JPMorgan Chase’s Tabron, who grew up in the University District. But neighborhoods like hers have sustained a commercial pulse, she says, and “now we’ve got this template to expand it.” If that template has an architectural signature, it’s the “mixed-use” building—boxy new construction that combines residential units with ground-floor retail. These projects can be a Swiss Army knife for development: They can host multiple businesses; they’re well suited to loft spaces that attract affluent renters; and they can accommodate affordable housing. Under current plans, each of the microdistricts targeted by Invested in Detroit’s partners will have at least two new mixed-use hubs. Capital Impact, Clemons’s CDFI, specializes in these projects. The B. Siegel project on Livernois is one, and on a hot afternoon, Clemons and a colleague take me to another. We pull into a site due to open in November as “the Coe at West Village.” It sits about a block from two beloved “anchors” of the West Village neighborhood: a barbershop, Heavyweight Cuts, and a bakery, Sister Pie. Cliff Brown, a broad-shouldered man on whom a construction helmet looks comically small, shows us around. It’s one of his first projects as a developer, and he almost certainly couldn’t have financed it with a traditional loan; just under half of the $4 million cost is coming from funds backed by JPMorgan Chase. |

|

布朗表示,该项目目前还处于毛墙毛地的阶段,不过在12个单元已经有7个租出去了。另外有一家动感单车健身房的老板也瞄准了这里的商业空间。随后,布朗为我们展示了一套平价住房的空间布局,这套房子的月租金是944美元。这套房子有巨大的落地窗,还有一个阳台,和旁边高档住宅楼里的房子没什么区别。布朗说:“我小时候住在一个很破旧的小区。等我进入建筑行业以后,我经常想:‘如果我能为我的朋友们建一套房子,它会是什么样的?’这就是我的理念的具体化。” 当然,对于很多底特律人来说,要拿出944美元的月租也是很吃力的。要知道,底特律的中位家庭收入只有不到26000美元,还不到全国平均水平的一半。确保更多底特律人有工作,从而掏得起更高的租金,则是摆在昌西·列侬面前的难题。列侬是摩根大通的劳动力计划总监,他的部门主要负责将没有大学学历的工人匹配到中等薪水的“中等技能”工作上——这些工作经常由于人才短缺而招不到人。列侬表示:“很多家庭都有‘不上大学就挣不到钱’的心态。这种心态不能说完全是错的,但它不能帮助人们做出最好的选择。” 列侬的团队针对底特律的就业市场进行了一项调查,以确定就业市场上供给与需求的差距。为了弥补这种差距,迄今为止,摩根大通已经投入了1500万美元。列侬的部门帮助20所公立高中设计了职业主题课程,并且组织了部分企业以学徒或实习的形式聘用学生从事水管工或医院护工等工作。 摩根大通还资助了像“Focus: HOPE”这样的非营利组织。Focus: HOPE是一个职业性的学习中心,学生可以在这里通过“整合先进制造”课程,学习如何操作工厂中常见的机器人工具。去年5月,杜根和谢尔在新闻发布会上宣布,摩根大通将向“投资底特律”项目追加投资5000万美元,使项目总投资达到1.5亿美元。Focus: HOPE就是他们选择的投资渠道之一。学员们有时要竖起耳朵才能听见彼此的说话声,因为课堂里到处都是金属撞击的叮叮当当声。 重建底特律是一项长期而艰巨的工程。光是前三个“微商区”就要到2021年才能全部建成。底特律希望到2026年前建成10个这样的“微商区”。要想培养足够的工作岗位以保持这些微商区的发展势头,也需要同样长的时间。我们尽可以想象届时到利沃诺斯大道和麦克尼可斯大道购物的情形,但短期内,这里还是不值得专程来一趟。 虽然需要漫长的等待,但摩根大通的领导层却并不灰心。谢尔表示:“一个政治家在台上只有四年时间,但一个银行家却有20年可以施展抱负。”不过到目前为止,摩根大通的投资已经初步见到了成效。它向CDFI提供的贷款已经有了回报,迄今偿还额已达890万美元,这笔钱又重钱投入到了“投资底特律”项目。谢尔指出,该项目迄今还没出现任何一例违约。 该项目也为摩根大通培养和保留了很多顶尖人才。迄今已有80多名员工在摩根大通的“底特律服务团”进行了轮岗和培训。而且“底特律服务团”的竞争还是相当激烈的,经常出现好几名员工同时竞争一个机会的情况。“它很容易让二十多岁的年轻人产生共鸣。”曾经做过社区记分卡工作的乔伊斯·张说。 最重要的是,“投资底特律”项目经过三年的实践,戴蒙和摩根大通的领导团队相信,他们已经找到了让美国各大城市重新焕发生心机的良方。到去年年底,他们就将把“定点扶贫”的底特律模式推广到密歇根州以外的地方。 去年8月,摩根大通宣布,将在芝加哥南区投资建设BSD职业中心,它就是以底特律的Focus: HOPE为蓝本建立的。9月晚些时候,摩根大通还将在其他三个城市启动社区支持项目,项目所用的拨款均来自摩根大通的“社区支持基金”(Pro Neighborhoods Fund)。大约就在同一时间,摩根大通还将在旧金山湾区设立一个新的“有色企业家基金”。另外,也是在去年秋天,摩根大通将对另一个美国大城市启动全套的“底特律模式”——即对小企业发展、住宅开发和就业培训进行大量投资,从而重建当地的中产阶层。 戴蒙表示:“我们不能在每个地方都采用底特律模式,但我们每年可以底特律模式推广到三四个地方,然后在另外十个地方采用‘简化版的底特律模式’。”至于怎样推广,以及在哪里推广,“我们已经有名单了。”他说。(财富中文网) 译者:Min |

Construction is still in the drywall stage, but seven of the 12 units are leased, Brown says, and the owner of a spinning gym is eyeing the retail space. He shows off the shell of an affordable-housing unit that will rent for $944 a month. The studio has huge picture windows and a balcony, just like its bigger neighbors in the complex. “I grew up with kids who lived in beat-up housing projects,” Brown says. “When I got into construction, I thought, ‘What kind of house would I build for our friends?’ This is that idea in action .” Of course, $944 a month is a stretch for many in Detroit. Median household income in the city is under $26,000—less than half the national average. Making sure that more Detroiters have jobs that can keep up with higher rents is a job for Chauncy Lennon. Lennon is JPMorgan Chase’s head of workforce initiatives, and his group’s mandate includes steering workers without college degrees toward “middle skill” jobs that pay middle-class salaries—jobs that often go unfilled because of talent shortages. “A lot of families and educators have a ‘B.A.-or-bust’ mentality,” Lennon says. “That’s not wrong as far as it goes, but its not helping people make the best choices.” In Detroit, Lennon’s team helped spearhead a survey of the job market, to identify the gaps between demand and supply. To date, JPMorgan Chase has invested $15 million in filling those gaps. Lennon’s group is helping design career-themed curriculums at 20 public high schools—and organizing businesses to hire students for apprenticeships and internships in fields like plumbing and hospital work. The bank is also funding nonprofits like Focus: HOPE, a vocational center where students in an “integrated advanced manufacturing” course work with the kind of robotics tools used in today’s factories. When Duggan and Scher hosted a press conference in May to announce that ¬JPMorgan Chase was steering another $50 million to Invested in Detroit, bringing the total to $150 million, they chose Focus: HOPE as the venue. Audience members sometimes had to strain to hear them; they were competing with the metal-on-metal clangor from the shop-class floor. Rebuilding Detroit’s neighborhoods is nothing if not a long game. The projects in the first three microdistricts should be finished by 2021; the city hopes to build out 10 neighborhoods by 2026. Cultivating jobs to sustain those neighborhoods will take just as long. Fantasize about a shopping trip to Livernois/McNichols, in other words, but don’t book it any time soon. JPMorgan Chase’s leaders aren’t fazed by the wait. “A politician has a four-year horizon,” Scher says. “A banker can have a 20-year horizon.” But so far, the bank’s bet is paying off. Its loans to CDFIs have already reaped returns, with $8.9 million to date repaid and cycled back into Invested in Detroit projects; Scher says there hasn’t been a single default. The project is also helping the bank retain and develop top talent. JPMorgan Chase has cycled more than 80 employees through its Detroit Service Corps to provide advice and training for a few weeks at time. Those postings are competitive, with multiple candidates applying for each opening. “It’s so much more in touch with what people in their twenties want to do,” says Chang, the executive who worked on the neighborhood scorecard. But most important, three years of progress with Invested in Detroit has convinced Dimon and his leadership team that they’ve assembled the right tool kit for revitalizing American cities. And by the end of the year they’ll have planted the flag beyond Michigan. In August, JPMorgan Chase announced an investment in BSD, a vocational center on Chicago’s South Side modeled after Focus: HOPE. Later in September, the bank will unveil its support for neighborhood-building projects in three more cities, to be financed by grants from its Pro Neighborhoods Fund. Around the same time, the bank will launch a new Entrepreneurs of Color fund in the San Francisco Bay Area. And another major metro area, to be announced this fall, will be the next to get the full Motor City treatment¬—a multipronged blitz of funding for small businesses, residential development, and job-skills work that could help rebuild its middle class. “We can’t do Detroit everywhere,” Dimon says. “But we could do Detroit in three or four places a year, and we could do a ‘Detroit lite’ in another 10.” Figuring out how, and where? “It’s on the list,” he says. |