贝宝CEO谈Venmo:别浪费它的“特殊魔力”

|

直到不久前,贝宝首席执行官丹·舒尔曼在硅谷最响的名头还是新泽西来的新人,喜欢穿牛仔靴。而今,让他更为人所知的是对这家经典支付公司的领导。贝宝是少数几家不仅生存下来而且蓬勃发展的互联网宠儿之一(2002年上市后不久贝宝成为eBay的子公司,2015年又被剥离了出来)。 在获得独立的贝宝担任掌门人之前,舒尔曼曾先后在美国运通和Sprint任职,还创立了Virgin Mobile,并担任CEO。进入贝宝后,他做出了一些精明决策。实际情况证明,开放贝宝平台以便Facebook等大公司打造自己的支付软件是个明智之举,这让更多消费者把贝宝设为他们的默认支付渠道。在他的领导下,舒尔曼上任前收购的公司也有了令人瞩目的成长。特别是很受80、90后欢迎的P2P支付应用软件Venmo,它已经逐步实现了业绩承诺。舒尔曼最近披露了把Venmo推广给数百万商家的计划。这很重要,原因是Venmo的大约1000万长期用户都不用支付手续费,而商家是需要支付费用的,这样贝宝就能把Venmo的普及性转化为新增收入。 舒尔曼说,所有这些因素将会进一步加深人们对贝宝增长速度的深刻印象。上一个财务年度中,贝宝实现收入108亿美元,同比增长17%。考虑到有那么多新的金融科技公司和这家老牌支付企业竞争,这样的业绩显得尤为出色。 |

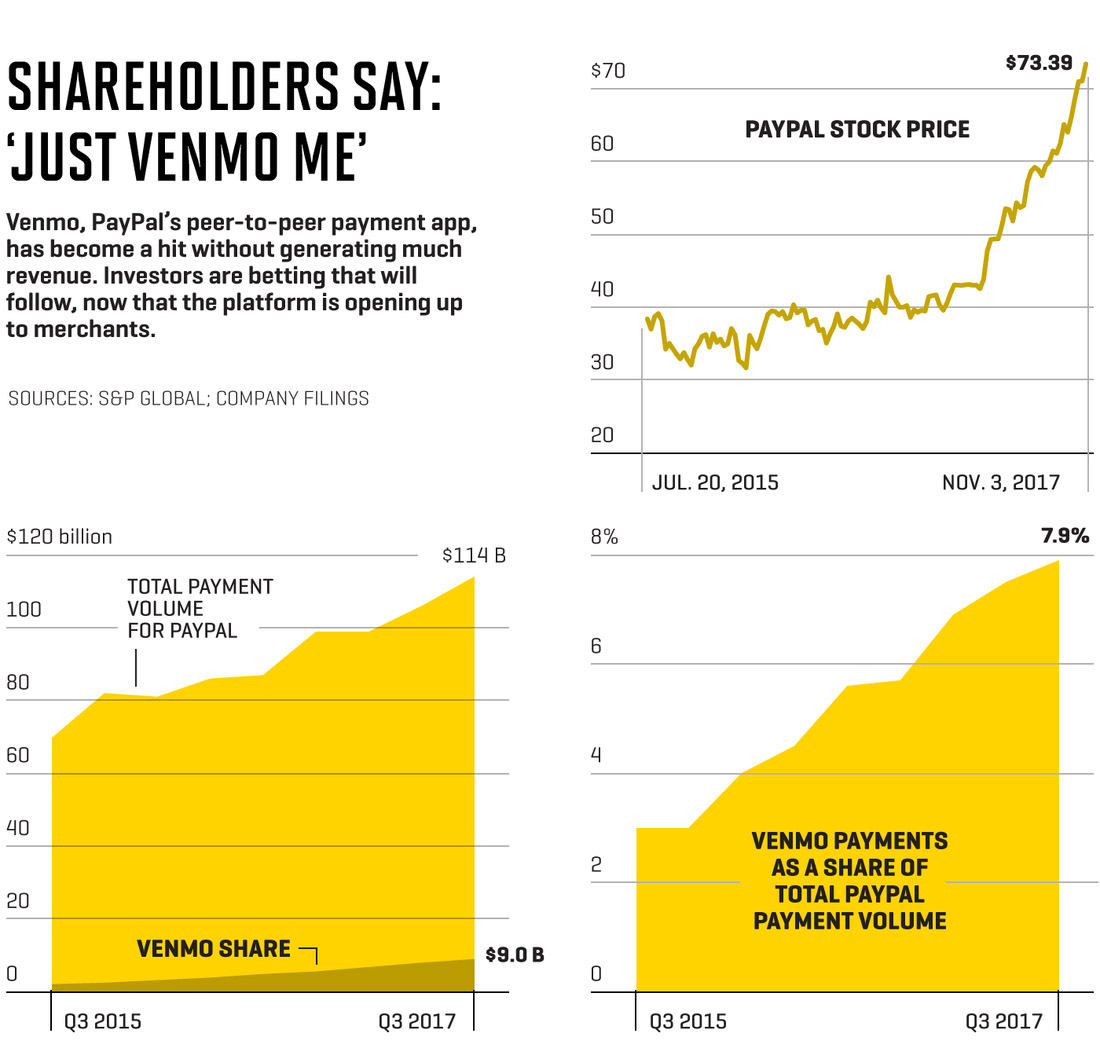

Until recently, PayPal CEO Dan Schulman was best known in Silicon Valley as the New Jersey newcomer who liked to wear cowboy boots. These days he’s more renowned for his leadership of the iconic payments company—one of few dotcom-era darlings that not only survived but flourished. (Shortly after going public in 2002, PayPal became a subsidiary of eBay; in 2015 it was spun back out.) Since coming on board to run the newly independent company, after stints at American Express, Sprint, and Virgin Mobile—where he was the founding CEO—Schulman has made some shrewd bets. Opening up PayPal’s platform so that other big players, like Facebook, can build upon its payments software has proved to be a savvy move, enabling more consumers to make PayPal their default payment option. And acquisitions that predate Schulman’s arrival are also showing impressive growth under his guidance. In particular, Venmo, a peer-to-peer payments app popular with millennials, is starting to deliver on its -promise. Schulman recently announced plans to roll it out to millions of merchants. That’s important because most of Venmo’s estimated 10 million regular ¬users don’t pay transaction fees—but merchants will, so PayPal can convert its popularity into more revenue. Schulman says all of these factors will help ¬PayPal build on its already impressive growth: Last fiscal year, the ¬company’s revenue came in at $10.8 billion, up 17% from the year before. That’s especially remarkable when you consider the crowd of new fintech players competing with this incumbent. |

丹·舒尔曼 在2017年年度商业人物榜上排名第8位 | 由Robyn Twomey为《财富》杂志拍摄

|

《财富》杂志资深撰稿人米甲·勒维-拉姆采访了舒尔曼(没错,他穿着牛仔靴),以更多地了解贝宝的业绩增长动力以及他对这家支付行业代表企业有何计划。以下是经过编辑的采访内容: 让我们从Venmo开始。我觉得很多人仍然想知道它怎么赚钱? 让我用最简单的方法描述一下:贝宝刚开始是一家P2P服务商,随后被eBay收购,成为eBay的支付渠道。后来eBay又把它剥离了出来。现在我们87%的业务量来自eBay以外的商家服务。 Venmo[也]从P2P服务开始,或者说实际上更像是一种社交支付“体验”,因为所有人都会给他们的东西加上标签,写下简短的注释和表情符号——90%[的交易]都[在Venmo的推送消息中]得到了分享。 哇,你是说Venmo上90%的交易都是公开的? 对,这确实是一种社交体验。人们会在Venmo上看自己的朋友们在干什么,去了哪里,跟谁一起出去玩。大多数评论都相当精彩和有趣。我自己也会这样看Venmo上的推送消息。 接下来开放Venmo就变得合情合理,让它具备更多功能。也就是说,如果现在用它的话,你会发现自己可以轻松地分东西,可以付房租。但如果还能用Venmo买东西,然后跟别人分一下,或者把买了什么告诉自己的朋友,那不是很好吗? 因此,我们现在把这项功能推广给了美国的200万商家,让他们接受Venmo。我们就是这样通过贝宝变现的,对Venmo我们也准备这样做。顺便说一下,商家对此非常兴奋,因为从他们那儿买的东西会得到推送,而且人们可能会说:“嘿,我买了个很酷的东西。”商家就喜欢这样的宣传。 Venmo的社交性会打开其他收入渠道吗,比如广告? 有可能。Venmo有特殊的魔力。我们基本上不在上面打广告。它的增长完全来自传播。眼下出现了网络效应,原因是它已经变得非常有吸引力,大家都想让别人加入进来,这样就可以给他们转账了。 我觉得应该非常谨慎的对待这样的体验。我想这样的体验需要和Venmo的哲学保持一致,而且对用户来说要非常愉快。通过给Venmo用户创造更多价值来变现对我而言极为合理。但对于其他更具有干扰性的变现方式,比如广告什么的,我真的还在考虑之中。 有这么多交易得到共享让你感到意外吗?它反映了Venmo用户群体的哪些情况? 想想80、90后,他们成长的时代和我截然不同[舒尔曼59岁]。私人和公开的界限要模糊得多。他们想跟朋友们分享一切并不让我感到意外。 Venmo不[光]是一种支付工具,它更多的是一种体验,这就是它的秘方。许多人都说:“噢,现在有很多种P2P服务。”确实如此,而且这个市场正在飞速增长。但本质上,Venmo的社交属性要强得多。人们在Venmo上看推送消息的时间超过了真正进行支付的时间。 既然支付领域有这么多的参与者,你怎么保持Venmo和贝宝的位置呢? 我觉得有三点很重要。第一是数字支付才刚刚起步。目前的P2P规模介于350-400亿美元,预计5-10年后将达到3500亿美元。所有这不是一个赢家通吃的市场。 其次,我们的平台已经同时向品牌服务和非品牌服务开放。那些被外界普遍视为我们竞争对手的人现在是我们非常密切的合作伙伴。比如Facebook,他们的许多支付活动都是通过我们的平台进行的,Apple Pay也有一半的交易通过我们的平台。大型银行正在向他们的用户推荐贝宝。这样,竞争环境对我们来说就会逐渐变得有利起来,而不是压迫我们。 第三,支付其实很困难。首先,你[需要]像变魔术那样让一个双向网络变得有规模,因为如果一项服务只有几百万用户,就没有商家会有时间做整合以及编码工作。如果只有一百万左右的商家在使用,也不会有消费者去了解这种新的支付途径。所以需要上规模。一旦有了规模,就像Venmo和贝宝,就会出现网络效应。我们有1700万商家,2.18亿用户。我们的新用户同比净增速度接近90%。 |

Fortune’s Michal Lev-Ram caught up with Schulman (yes, he was wearing the boots) to find out more about what’s driving PayPal’s performance and what his plans are for the payments icon. An edited transcript follows: Let’s start with Venmo. I think a lot of people still wonder, “How does it make money?” I’ll give you the simplest analog: PayPal in its early days was a peer-to-peer service. Then it was bought by eBay, and it became a payment method for eBay. And then it started moving off eBay, and now 87% of our volume is merchant services outside of eBay. Venmo [also] started as a peer-to-peer service, or really more of a social payments “experience,” because everyone tags their stuff and puts in little notes and emojis—90% of [transactions] are shared [on Venmo’s news feed]. Wow, did you just say 90% of Venmo transactions are public? Yes, it’s really a social experience. People open the app to see what their friends are doing, where they’re going, who they’re hanging out with. Most of the comments are pretty amusing and fun. I open the feed to do that myself. The next step logically is to open up the application to more functionality. So if you use it today, you know that you can split things easily, you can pay your rent. But wouldn’t it be nice to be able to use your Venmo to buy things, too, and then to split that purchase or to tell your friends about it? So we have now opened the ability for 2 million merchants in the U.S. to accept Venmo. That’s exactly how we monetized PayPal, and that’s exactly what we’re going to do with Venmo. And by the way, the merchants are so excited about it because the purchase gets to go into your feed, and you can say, “Hey, I bought this cool thing.” They love that. Does the social aspect of Venmo open the door to other revenue streams, like advertising? Possibly. There’s a special magic to Venmo. We do pretty much no advertising around it. Its growth is all viral. There’s a network effect right now because it’s so big that you just want people to be a part of it so you can send them money. I want to be very careful with the experience. I think the experience needs to be in keeping with the Venmo philosophy, and it’s got to be fully delightful for those who are using it. Monetizing by creating more value for a Venmo user makes a ton of sense to me. But other forms of monetization that are more intrusive, like in advertising or something like that, the jury is really still out for me. Does the fact that so many of the transactions are shared surprise you? What does it say about Venmo’s user base? If you think about the millennial generation, they grew up in a very different era than I did. [Schulman is 59.] The boundaries between private and public are much more blurred. And it’s not surprising to me that they want to share with all of their friends. It is the secret sauce of Venmo that it isn’t [just] a payment; it’s more of an experience. A lot of people say, “Oh, there are a lot of peer-to-peer services out there.” There are, and it’s an exploding market. But Venmo is much more social in its nature. The app is opened more times to look at feeds than it is to do an actual payment. How do you maintain your position, both with Venmo and PayPal, now that there are so many other players in payments? I think there are three important things. One is that we’re in the infancy of digital payments. Peer-to-peer is between $35 billion and $40 billion today, and in five or 10 years it’s supposed to go to $350 billion. So this isn’t going to be a winner-take-all market. Second, we’ve opened up our platform to give both branded and unbranded services. And people who everyone thought would compete with us are now very close partners. Like Facebook—many of their payment ¬initiatives are done through our platform, and 50% of Apple Pay comes through our platform. The big banks are marketing PayPal to their subscribers. So over time the competitive environment has become more benign for us than aggressive. Third, payments are just really hard. First of all, you magically [need to] make a two-sided network to appear at scale, because no merchant’s going to take the time to do integration and coding when there’s only a couple million users, if that, on a service. And no consumer is going to learn a new payment methodology if only a million or so merchants are using that payment. So you need to have scale. And once you have scale, like Venmo and PayPal do, you get a network effect. We have 17 million merchants. We have 218 million consumers. Our net new accounts are growing by nearly 90% year over year. |

|

你们的另一项业务是Xoom,它让用户实现跨境支付。这个市场有多大,你是否担心它会受到政治气候的影响? 这个市场非常大,规模达到6000亿美元。对许多发展中国家的GDP来说,它都难以置信地重要。现在,各种各样的中间人平均收取汇款额的8%-10%。如果完全以电子方式进行,这个数字也许能降到3%-4%。而且你仍有可能获得巨大的利润,同时节省300亿美元资金,这笔钱有可能让数千万人摆脱贫困。 所以我们[2015年]推出Xoom的原因之一就是这个市场非常大。另一个原因则是我们的效率要高得多,而且更安全、更快、价格更低。这对消费者来说是一种非常棒的价值主张。而且我们觉得颠覆这个市场的时机已经成熟。 那么在政治层面,有理由担心资金流向其他国家会遇到某种监管障碍吗? 政治环境非常难以预测。我觉得企业不能只是作壁上观。我觉得对于我们相信的价值,我们得成为它的一股力量。我们需要和政府以及监管机构合作。同时我们需要把自己的资源用于应对公共部门无法单独对付的情况和问题。 许多人都说我是维权型CEO。我只是觉得我是负责人的企业领导者。北卡罗莱纳州颁布HB2法案[禁止变性者根据自己认同的性别选择公共洗手间和更衣室]后,我们是第一家退出该州的公司。这让我受到了很多人身威胁。所以我觉得站出来表示反对并不容易,而且这个环境的政治色彩很浓。但我认为我们不能抛弃自己的责任。 我们的使命具有非常大的包容性。我们要让金融服务民主化。管理和转移资金应该是所有民众的权利,而不是富人的特权。它属于所有民众,属于所有种类的人。也就是说,这个世界应该容不得以任何理由来歧视任何人的行为。(财富中文网) 本文将作为我们年度商业人物特辑的一部分刊登在2017年12月1日出版的《财富》杂志上。 译者:Charlie 审校:夏林 |

Another piece of your business is Xoom, which enables people to send payments back home to other countries. How big of a market is that, and do you worry it could be impacted by the political climate? It’s a very large market: $600 billion. And it’s an incredibly important part of the GDP of many developing countries. On average today, between 8% and 10% of the remittance is taken by various middlemen. If you can do it all electronically, you can do that at maybe 3% to 4%. And you could still make a great profit on it, but save $30 billion, which could lift tens of millions of people out of poverty. So the reason we bought Xoom [in 2015] is, one, it’s a very large market. But, two, we can do things much more efficiently, more secure, faster, less expensive. That’s a great value proposition to a consumer. And we feel it’s a market that’s ripe for disruption. And on the political part of the question, is there any reason for concern that there will be some kind of regulatory hurdles put in place for money flowing out to other countries? It’s so hard to predict the political environment. I think that business can’t sit on the sidelines and just watch. I think we need to be a force for the values that we believe in. We need to partner with government and regulators. But we need to bring our resources to bear against issues and problems that the public sector won’t be able to do by itself. A lot of people say that I’m an activist CEO. I just think I’m a responsible leader of a business. When HB2 [a law that prevents transgender people from using bathrooms corresponding to the gender with which they identify] was introduced in North Carolina, we were the first business to pull out. I received a lot of personal threats as a result of it. So I think it’s not easy to stand up, and the environment is very politically charged. But I don’t think we can abdicate our responsibility. Our mission is a very inclusive one. It’s to democratize financial services. Managing and moving money should be a right for all citizens, not a privilege for the affluent. It’s all citizens, all types. Which means that there should be no room in the world for discrimination against anybody for any reason. A version of this article appears in the Dec. 1, 2017 issue of Fortune as part of our Businessperson of the Year package. |