为什么在特朗普执政期间,高盛将成为华尔街的最大赢家

|

劳埃德·布兰克芬总是容易焦虑。在哈佛读书的时候,未来的高盛CEO担心自己没有预科学校的学生聪明,因为他们的见识与一个来自纽约市外区的小子相比,简直是天壤之别。他曾经对我说:“我当时眼光非常狭窄,虽然我来自布鲁克林,但我的视野也只局限在布鲁克林。”他在哈佛法学院的时候很焦虑。他在Donovan Leisure律师事务所从事税务律师期间也很焦虑。他担心在J. Aron & Company的工作。1981年,这家大宗商品交易商被高盛收购,一年后他加入该公司从事黄金交易,但他在这方面的经验少得可怜。 从2006年6月汉克·保尔森成为美国财政部长之后,现年62岁的布兰克芬便一直担任高盛的董事长兼首席执行官,现在他依旧很焦虑。他希望税务和监管改革能够帮助高盛重新成为华尔街盈利效率最高的银行——如果改革能在华盛顿的动荡中得以推行的话。但与往常一样,他并不能预见未来,所以他依旧焦虑。他说道:“唉,真希望我不会在五年后回首往事的时候说:‘过去十年是黄金时代。’那样会很糟糕。但谁知道呢?神降下了40天的洪水,而在第三天的时候,人们说:‘天哪,雨太大了!肯定不会持续太长时间。’结果谁知道呢?” 过去十年,对于高盛和布兰克芬自己来说,都是混乱不安的十年。原因当然少不了2008年的金融危机和随后的监管清算——包括多德-弗兰克改革法案和沃尔克规则等,它们严重抑制了高利润的自营交易。而一直以来,高盛的自营交易始终都领先于所有竞争对手。《滚石》杂志曾经嘲讽高盛是“一只巨大的吸血乌贼,无情地将触角缠绕在人类的脸上。”这番描述让人记忆深刻。布兰克芬曾打趣说高盛和它的同行们在做“上帝的工作”,结果因此遭到了无情的讽刺挖苦。最近,布兰克芬陷入了一场严重的健康危机:他在2015年被诊断出患有淋巴癌,并接受了几个月的成功治疗。医生告诉他,病情已经得到缓解。 职业和个人危机可能已经消退,但现在又有新的事情让布兰克芬感到焦虑。 首先,他的长期搭档寇恩离开了公司,前往华盛顿担任特朗普总统的国家经济顾问,使高盛不得不面临10年来规模最大的一次管理层调整。摩根大通、美国银行和富国银行等规模更大、资本金更充足的银行业竞争对手,纷纷实现了创纪录或接近纪录的利润,而在当前的监管环境下,高盛却仍在努力寻找立足点。目前的监管偏向于减少风险承担,使高盛的风险承受能力得不到充分利用。但华尔街有许多人预计,寇恩和高盛系的另一位代表财政部长史蒂夫·姆努钦,会想方设法放松监管。 与此同时,高盛的老对手摩根·士丹利赢得了行业分析师的赞扬,他们认为摩根·士丹利收购美邦,进军更稳定的收费投资管理业务,是明智之举。而此时,高盛仍然认为,投资银行与交易业务,将在华尔街重现辉煌。在华尔街担任研究分析师数十年的盖伊·莫什科夫斯基解释称:“高盛的策略就像是:‘我们只要耐心等待,世界总会变成我们想要的样子,’而摩根·士丹利的策略则是:‘我们要果断行动,不畏艰难。’”莫什科夫斯基现任自主研究的主理合伙人兼研究总监。 其次,金融科技行业的威胁日益加剧。越来越多的硅谷金融公司开始通过互联网,将华尔街数个世纪以来一直做得很好的工作去中介化:将手里有资金并且想要对外借贷或投资的人与需要借款或想利用贷款创业或发展公司的人建立直接联系。目前这种威胁仍无足轻重,因为初创公司主要选择的是信用卡和助学贷款市场这些容易实现的目标。但距离金融科技公司承销股票和债券以及发放公司贷款的日子可能不会太久,这将威胁到华尔街的切身利益。 今年4月,高盛公布的2017年第一季度业绩令人失望,进一步放大了这些问题。在高盛预期将占据统治地位的债券交易市场,其公布的收入增长(1%),与主要银行业竞争对手强劲的两位数增长相比,显得黯淡无光,令人震惊。这也让华尔街不禁担忧:投资者和分析师们纷纷猜测,当其他银行都在连续的特朗普行情中赚得盆满钵满的时候,强大的高盛为什么会犯下如此严重的错误?到底发生了什么?高盛股价在3月份达到接近每股253美元的历史最高价,但在6月初跌至约212美元。 不过现在开始唱衰高盛仍为时尚早。布兰克芬领导的高盛在2016年收入377亿美元,在今年的《财富》500强中排在第78位。利润74亿美元,年比增长了22%。高盛依旧是全球市场中一股强大的力量。另外,寇恩和姆努钦均在特朗普政府中身居要职,另一位高盛人迪娜·鲍威尔担任特朗普的副国家安全顾问,负责战略问题,因此,在外界许多人看来,“高盛政府”依旧统治着世界。 |

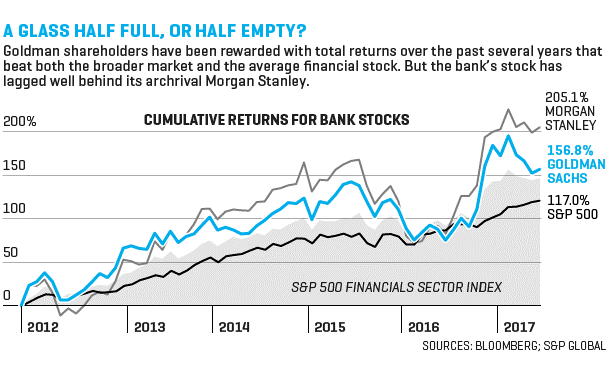

Lloyd Blankfein has always been a big worrier. At Harvard, the future CEO of Goldman Sachs worried that he wouldn’t be able to match wits with the prep-school students who seemed light-years more savvy than a little kid from an outer borough of New York City. “I was as provincial as you could be,” he once told me, “albeit from Brooklyn, the province of Brooklyn.” He worried at Harvard Law School. He worried at Donovan Leisure, the law firm where he worked as a tax lawyer. And he worried at J. Aron & Company, the commodities dealer Goldman Sachs had bought in 1981, the year before he joined it to trade gold—a task for which he had very few qualifications. Blankfein, 62, has been the chairman and chief executive of Goldman since June 2006, when Hank Paulson left to become Treasury secretary, and he’s still worrying. He is hopeful that tax and regulatory reform—if it can be achieved amid the immense turmoil in Washington—will help propel Goldman back to its customary place as Wall Street’s most ruthlessly efficient profitmaker. But as usual he doesn’t know for sure what will happen, and so he worries. “Gee, I hope I don’t look back five years from now and say, ‘The last 10 years were the Golden Age,’ ” he says. “That would be bad. But who knows? When they had the 40-day flood, on the third day, they said, ‘Boy, that’s a lot of rain! It can’t last much longer.’ So who knows?” It has certainly been a tumultuous decade or so, both for Goldman and for Blankfein himself. There was the financial crisis of 2008, of course, and the regulatory reckoning that came after—including the Dodd-Frank reform bill and the Volcker Rule, which greatly inhibited the highly profitable proprietary trading that Goldman had always seemed to do better than anyone else. The investment bank was memorably derided by Rolling Stone as a “great vampire squid wrapped around the face of humanity.” And Blankfein himself was relentlessly pilloried for a quip that Goldman and its peers were doing “God’s work.” More recently, Blankfein has faced a serious health scare: He was diagnosed with lymphoma in 2015 and spent months undergoing successful treatment. His doctors say the disease is in remission. The professional and personal crises may have receded. But Blankfein now has a whole new set of reasons for anxiety. To begin with, his longtime No. 2, Gary Cohn, recently left the firm to go to Washington as President Trump’s national economic adviser, necessitating the most significant management reorganization at Goldman in a decade. Goldman’s bigger and better capitalized banking competitors, such as JPMorgan Chase, Bank of America, and Wells Fargo, are churning out record or near-record profits, while Goldman Sachs is still trying to find its footing in a regulatory environment that has favored less risk taking than Blankfein’s company is designed to accommodate. More than a few people on Wall Street, however, expect that Cohn and Treasury Secretary Steve Mnuchin, another Goldman alum, will find a way to ease back on the regulations. Meanwhile, Goldman’s longtime rival, Morgan Stanley, is winning the plaudits of industry analysts who view its acquisition of Smith Barney as a savvy move into the less volatile fee-based money-management business. This even as Goldman is still betting that investment banking and trading will once again return to prominence on Wall Street. “Unlike Goldman, whose strategy has been a little bit, ‘Let’s just wait it out and the world will come to where we want it to be over time,’ Morgan Stanley’s strategy has been, ‘Let’s take the bull by the horns,’ ” explains Guy Moszkowski, who has been a Wall Street research analyst for decades and now is the managing partner and director of research at Autonomous Research. Then there’s the rising threat from the so-called fintech industry, the growing number of Silicon Valley–based financial businesses that are using the Internet to disintermediate the work that Wall Street has done spectacularly well for centuries: putting people who have money and want to lend it or invest it in direct contact with the people who need to borrow it or want to use it to start or grow businesses. The threat remains a marginal one for now, as the startups are primarily picking off low-hanging fruit in credit card and student-loan markets. But the days of fintech companies underwriting stocks and bonds and making corporate loans—the bread and butter of Wall Street—may not be too far away. These concerns were magnified in April by current events, when Goldman announced disappointing results for its first quarter of 2017. In bond trading—an area where it expects to rule—it reported shockingly anemic revenue growth (1%) compared with strong double-digit gains by its major banking rivals. That got Wall Street worrying too: How had mighty Goldman managed to fumble so badly, investors and analysts wondered, when all of the other banks were raking in profits thanks to the long-running Trump rally? What happened? After reaching an all-time high of nearly $253 a share in March, Goldman’s stock fell to around $212 at the beginning of June. It’s beyond premature to begin writing off Goldman Sachs. With $37.7 billion in revenues for 2016, Blankfein’s company ranks No. 78 on this year’s Fortune 500. The bank earned $7.4 billion in profits on those sales, a 22% gain over the year before. Goldman remains a formidable force in global markets. And with Cohn and Mnuchin in positions of considerable power in the Trump administration—as well as Dina Powell, another Goldmanite who is serving as Trump’s deputy national security adviser for strategy—it appears to many on the outside that “Government Sachs” still effectively rules the world. |

|

但我们有理由质疑,在规模更大的传统银行和更灵活的初创公司的双重包夹之下,高盛是否已经为应对当前华尔街的现实做好了准备。这家因为总是能够率先预见下一笔大交易而闻名的银行,是否依旧具备成功的必要条件? 至少有一位精明的投资者呼吁要在混乱的形势下保持冷静。这位投资者目前持有价值25亿美元的高盛股份。来自奥马哈的伯克希尔·哈撒韦CEO沃伦·巴菲特在电子邮件中写道:“我对预测没有太大兴趣,但有一点我几乎可以百分百确定 — 不论监管、技术和市场有怎样的变化,高盛都能成功应对。我已经关注了它几十年的时间。” 这在华尔街引起了巨大反响。2015年9月,布兰克芬宣布他罹患“治愈可能性极高的”淋巴癌的消息后,华尔街出现了一些可以理解的担忧,人们不仅关心CEO本人的健康,也在担心高盛的未来。高盛是否会有新的领导人?寇恩是否会如所有人设想的那样,接替他的职位?或者高盛董事会是否会深入挖掘一名更年轻的领导者,就像当年董事会选择了布兰克芬接替保尔森担任CEO,而不是保尔森表面上指定的继任者约翰·塞恩和约翰·桑顿那样?这在2016年的大部分时间都是华尔街最热门的话题。 最近,布兰克芬在俯瞰纽约海湾的41层办公室里接受了笔者的采访。他表示,在2015年“很长时间里”,他都感觉不是很好,“事后想来”,他给当时出现的症状找了各种理由。他开玩笑说:“只要能找到理由,我就会搪塞过去。” 例如,他的体重不断下降。他说道:“但是我一直在努力减肥。我只是以为我的减肥特别成功。”他说,实际上他以为自己偶然发现了一种新的减肥食谱。他开始向其他人传授经验。“我开始给别人提供减肥建议,因为我减肥成功了。” 后来他开始咳嗽。他说:“当时是在夏天。我以为我过敏了。”后来出现了疼痛症状。他说:“我正在锻炼,”所以以为只是出现了肌肉酸痛而已。“这些症状纷纷出现,然后在我身体里慢慢积累。”他记得与别人一起散步的时候,经常让他们走慢一点。他说:“他们会说:‘不,劳埃德,是你走得太慢了,而且你这样子走路已经很长时间了。’事情就是这样。”他去看医生,医生告诉他,如果再过两周,他可能就再也无法走路了。他身体里有75颗肿瘤,而且还在不断扩大。 他预定在9月16日接受活组织检查。这种手术通常要在早上进行。但他之前已经答应了要前往曼哈顿中城区的皮埃尔酒店,在《华尔街日报》的活动上讲话。当天他在接受《纽约时报》记者杰勒德·贝克采访时,脸色苍白,面容憔悴,但头脑还很清醒。他在采访中回答了许多问题,包括对唐纳德·特朗普的支持率不断上升的看法。作为民主党人和希拉里·克林顿的长期支持者,布兰克芬表示,特朗普的某些言论是“疯话”,一想到特朗普“会掌控核武按钮,就让我心神不宁。”布兰克芬几乎最早将特朗普与安德鲁·杰克森进行对比,现在特朗普也喜欢这样比较。(特朗普在椭圆形办公室里挂了一副杰克森的肖像。) 医生拿到活检结果的时候,布兰克芬正在医院里。他对布兰克芬说:“你必须马上接受化疗。”在医生为他植入PICC导管时,布兰克芬把诊断结果告知了高盛董事会。然后他安排与管理团队进行通话。在通话的时候,医生正在进行非常痛苦的骨髓活检。他说:“我太投入[通话]了,根本没注意到。” 之后,高盛发布了一则关于布兰克芬病情的声明,宣布他将接受几个月的化疗,但依旧能够领导公司,只是时间上会有所减少。在化疗期间,他并没有感到严重不适。他回忆称:“那一周过得非常糟糕。” 如果有人跟我说我应该离开了,我能理解。但没有人辞退我。— 布兰克芬 他更担心可能会致命的感染。结束化疗几天之后,他的白细胞数量下降到接近零。他在办公室里要随身携带体温计,因为反复量体温是迅速确定他是否被感染的最佳方法。他说道:“如果体温超过100.4度,必须要去医院。”已经基本秃顶的布兰克芬,眉毛也掉光了。他说:“可以给你看看我的照片。看起来有些怪异。我就像是冬天快结束时的莱克斯·卢瑟。”在确诊后,有人曾告诉他,他有很长时间看起来都不太好。他反问他们:“你们为什么不早告诉我呢?” 化疗很成功。布兰克芬说他的癌症已经得到缓解。他开玩笑说:“我想我已经没事了。问题在于,当我确认自己没事的时候,我却变老了许多,这又成了我的新问题。所以,就好像在这件事上我不会有安宁的时候。” 他的眉毛又长了出来。肚腩也开始显现出来。(在采访过程中,他喝了一瓶斯图尔特的甜橙苏打水,这在曼哈顿可不常见。)他的幽默感还是一如既往地讽刺而又犀利。谈完他的病情之后,他对我说:“对了,你真应该同情我。” 现在可以确定,布兰克芬在短期内不会离开高盛,就像摩根大通董事长兼CEO杰米·戴蒙一样。两年前成功接受了咽喉癌治疗之后,戴蒙的领导地位似乎变得更加稳固。事实上,布兰克芬是目前华尔街任职时间最长的现任CEO。(在高盛辉煌的历史上,他的任职时间在所有领导者当中排在第二位,排在第一位的是商业传奇西德尼·温博格,他领导高盛35年,1969年在任上去世。) 恢复健康、保持专注的布兰克芬,似乎决定带领高盛,度过行业内即将出现的一个重要拐点:经济增长更强劲,失业率很低,利率依旧很低。假设华盛顿放松监管,华尔街应该迎来繁荣。 不出所料,布兰克芬对高盛的未来愿景,并没有脱离那些让全世界几乎所有金融机构都对高盛艳羡不已的业务。他希望高盛能成为客户首选的金融中介机构,尤其是在处理复杂问题的时候。他希望高盛未来仍是华尔街领先的投资银行。 他解释说:“我们是一家咨询公司,我并不认为提供咨询已经过时。我们是战略咨询公司。我们通过私募股权和资产管理业务,为我们的客户管理高风险资产。我们还是一家融资公司,而且是一流的融资公司。融资状况越复杂、越困难,我们就越有可能得到客户的青睐。” 他相信,未来不仅美国国内将继续存在对这些复杂融资解决方案的需求,在中国、印度等发展中国家,对高盛服务的需求也将不断增长。“我们在这些市场都有很好的开局,我很看好未来的前景。” |

But it is certainly fair to wonder if Goldman is well positioned for the realities of today’s Wall Street—flanked as it is on one side by much larger traditional banks and on the other by nimbler startups. Does the bank known for always being first to see the next big trade still have what it takes? At least one savvy investor, who owns some $2.5 billion worth of Goldman stock, urges calm amid the roiling seas. “I’m not much for prognostications,” emails Berkshire Hathaway CEO Warren Buffett from Omaha, “but one thing I’m close to 100% sure about—whatever the twists and turns there may be in regulation, technology, and markets, Goldman will successfully adapt. I’ve watched them do it for decades.” The news reverberated around Wall Street. When, in September 2015, Blankfein announced he had a “highly curable” form of lymphoma, there was understandable concern—not just for the CEO himself but also for the future of the bank. Would Goldman soon have a new leader? Would Cohn be his successor, as everyone assumed? Or would the Goldman board of directors reach deeper down to find a younger leader, as it did when the board selected Blankfein to succeed CEO Paulson instead of Paulson’s seemingly designated successors John Thain and John Thornton? For much of 2016, it was Wall Street’s favorite parlor game . In a recent interview in his 41st-floor office, overlooking New York Harbor, Blankfein tells me that for a “long time” during 2015 he wasn’t feeling well and that “in hindsight” he had symptoms he could “explain away.” Then he jokes, “And anything I can explain away, I do.” For instance, he was losing weight. “But I’m always trying to lose weight,” he says. “I just thought I was unusually successful.” In fact, he says, he thought he had hit upon a new diet. He began proselytizing. “I started giving people advice on how to lose weight, because I was so successful at it.” Then he developed a cough. “It was in the summer,” he says. “I thought I had allergies.” Then came the aches and pains. “I was exercising,” he says, and he thought he was just sore. “I just had these things, and then they started accumulating.” He remembers how he’d been walking with some people and told them to slow down. “And they said, ‘No, Lloyd, you’re walking slow, and you’ve been walking slow for a long time,’ ” he says. “Literally, that’s what happened.” He went to the doctor, who told him that in two more weeks he wouldn’t have been able to walk anymore. He had 75 tumors, and they were growing. He scheduled a biopsy for Sept. 16. Usually such surgeries are done first thing in the morning. But Blankfein had already committed to speak at a Wall Street Journal event at the Pierre Hotel in Midtown Manhattan. In his interview that day with Gerard Baker, the editor of the Journal, Blankfein looked wan and a bit peaked but was otherwise lucid. He was asked, among other things, about the growing popularity of Donald Trump. Blankfein, a Democrat and a longtime supporter of Hillary Clinton, said that some of Trump’s statements were “wacky” and the thought of Trump “with his finger on the button blows my mind.” Before nearly anyone else, Blankfein drew a parallel between Trump and Andrew Jackson, a comparison that Trump now makes himself. (Trump has put Jackson’s portrait in the Oval Office.) Blankfein was in the hospital when his doctor got the biopsy results. “You’re going right up to chemo,” he told Blankfein. While the PICC line was in, Blankfein informed the Goldman board of directors of his diagnosis. And then he arranged for a call with his management team. While those calls were being made, the doctors were performing a painful bone-marrow biopsy. “But I was so involved [with the calls],” he says, “I didn’t even notice it.” Goldman released a statement about Blankfein’s illness. It said he would undergo months of chemotherapy but still be able to lead the firm, albeit on a reduced schedule. During chemotherapy, he didn’t feel that sick. “I had one bad week,” he remembers. If somebody said to me that it's time to leave, I would understand that. Nobody's fired me yet. —Blankfein He was more concerned about getting an infection that might kill him. In the days after the chemo, his white blood cell count fell to nearly zero. He walked around the office carrying a thermometer, because taking his temperature repeatedly was the best way to figure out quickly if he’d become infected. “If your temperature goes over 100.4, you’ve got to go to the hospital,” he says. Already mostly bald, Blankfein lost his eyebrows. “I can show you pictures,” he says. “It looks weird. I looked like Lex Luthor at the end of winter.” People told him after he was diagnosed that he hadn’t looked so great for a while. “Well, why didn’t you tell me?” he asked them. The chemotherapy worked. Blankfein says his cancer is now in remission. “I think I’m okay,” he jokes. “The problem is, by the time I’m sure I’m okay, I’ll be so much older that I’ll have that as a problem. So it’s like, there’s not going to be any peace in this, for me.” His eyebrows have grown back. And so has a little bit of his paunch. (As we spoke, he finished off a bottle of Stewart’s sweet orange soda, not the easiest thing to find in Manhattan.) His sense of humor is as wry and acute as ever. “You should really be sympathetic, by the way,” he tells me after we get done talking about his illness. It is clear now that Blankfein is not going anywhere soon, just as Jamie Dimon, the chairman and CEO of JPMorgan Chase, seems more entrenched than ever following his successful bout with throat cancer two years ago. Indeed, Blankfein is now the longest-serving CEO on Wall Street. (And the second-longest-serving leader in Goldman’s illustrious history, behind only the legendary Sidney Weinberg, who died in office in 1969 after 35 years at the top.) Healthy and focused, Blankfein seems determined to steer Goldman through what is shaping up to be an important inflection point in the industry: The economy is growing stronger, unemployment is low, and interest rates remain low. Assuming that Washington pulls back on regulation, Wall Street should be poised for boom times. Blankfein’s vision for the future of Goldman, not surprisingly, does not stray far from what has made the firm the envy of nearly every financial institution on the planet. He still wants Goldman to be the financial intermediary of choice, especially when the problems are complex. And he expects that it will still be Wall Street’s leading investment bank. “We’re an adviser,” he explains. “I don’t think advice has gone out of style. We’re a strategic adviser. We manage risky assets for our clients in private equity and in our asset-management business. And we’re a financier, and usually a financier of choice. The more complex and difficult a financing situation becomes, the more likely we’ll get the call to work on it.” He believes that not only will there continue to be demand for these complicated financing solutions domestically, but that there’s also a growing need for Goldman’s services in developing economies such as those of China and India. “And we’ve always had a very good foot in the door in those places, so I feel good about that.” |

|

随着投资者从主动管理型投资向被动式投资转移,在服务费方面会面临越来越大的压力,但布兰克芬对高盛资产管理的发展似乎很满意。按照高盛的说法,其“受托管理”的资产规模从一年前的1.275万亿美元,增加到了1.375万亿美元。 布兰克芬称,高盛近几年的问题在于,其业务“依旧与增长相关联”,而当除中国以外,全世界都陷入了长期经济放缓时,华尔街却要忍受“相对严厉的”新监管制度执行方式。 布兰克芬认为,近几年许多银行都减少了承担风险,因为人们担心赔钱。或者他们担心会被指控违反沃尔克规则,或以被禁止的方式使用资本。他说道:“有人会说:‘你不应该承担这种风险。’有许多层面的因素让人们变得非常谨慎,非常厌恶风险。” 他说高盛的挑战是如何用其控制的工具盈利。他想知道:“增长点在哪里?你如何实现更高的增长?” 具有讽刺意味的是,目前高盛给出的一个答案似乎是向消费者和中小企业提供贷款 — 这不由让人回想起19世纪60年代,马库斯·高曼从华尔街周围的商人打折收购应收账款的时代。高盛在2月份告诉《华尔街日报》:“我们是一家银行,就应该向银行一样开展业务。” |

Despite increasing pressure on fees as investors move away from actively managed accounts to passive investing, Blankfein also seems pleased with the progress being made at Goldman Sachs Asset Management, where assets under “supervision,” as Goldman calls it, have increased to $1.375 trillion, from $1.275 trillion a year ago. Goldman’s problem in recent years, Blankfein says, is that its businesses “still correlate with growth,” and the world—China aside—has been in an extended slowdown at the same time that Wall Street has endured the “relatively heavy-handed” way that new regulations have been implemented. There has been a lot less risk taking in recent years, says Blankfein, because people are afraid of losing money. Or they’re worried they’ll be accused of violating the Volcker Rule or otherwise using capital in a prohibited way. “Somebody will say, ‘This was a risk that you shouldn’t have been taking,’ ” he says. “There are layers and layers of stuff that made people very, very cautious and very, very risk averse.” He says Goldman’s challenge is how to make money with the tools in its control. “Where is growth?” he wonders. “What are you going to do to get higher growth?” Ironically, at the moment, one answer for Goldman seems to be in lending money to consumers and small businesses—an activity that harks back to the days when Marcus Goldman bought receivables at a discount from the vendors around Wall Street in the 1860s. “We’re a bank, we should act like one,” Goldman told the Wall Street Journal in February. |

|

于是,148年之后,高盛开始以自己的方式,提供过去大部分时间都在回避的贷款业务。“我们有机会建立利润更高的贷款业务,因为我们的竞争对手,并不是那些在账簿里已经持有了2万亿美元贷款的传统银行,”他说道。“如果我们有业内最好的贷款业务,并能递增到1,000亿美元的规模,这将给我们目前所做的事情带来增值效应。但我们不需要这样做,因为没有人认为这是我们的核心业务。” 为了实现这个目标,高盛甚至开始向金融科技方向转变。2016年,高盛推出了新在线零售银行服务Macrus,向希望通过高盛的小额低成本贷款对高信用卡债务进行再融资的个人发放无额外费用的贷款,最高额度30,000美元。Marcus以创始人的名字命名,前六个月已发放贷款总计约10亿美元。布兰克芬认为,由于高盛并没有传统的消费者业务或银行分支,因此可以通过专业技术针对个别需求量身定制产品。他表示,因为这些贷款不需要抵押也不会向投资者出售,所以“我们可以将其设计成定制型产品。”这意味着借款人可以选择贷款期限、每月还款额以及开始还款的时间。 另外,高盛在盐湖城的小型商业银行,也就是高盛美国银行,突然开始对吸收存款产生了兴趣,当然同样是通过互联网。为此,该银行为存款用户提供了1.05%的利率,这是摩根大通和美国银行等竞争对手存款利率的四倍甚至更高。高盛的商业银行现有存款1,250亿美元,虽然相比摩根大通1.4万亿美元显得微不足道,但与高盛2008年的280亿美元相比却已大幅增加。 如果“试水”消费者借贷效果不错,布兰克芬预计高盛还会进行更多尝试。他表示,通过专业技术,“利用数字途径吸引消费者”是高盛的优势所在。他说:“假如说消费者经验是我们的一个短板,那我们的长处就是技术 — 如数字平台、算法交易和风险管理等。” 曾经高盛是华尔街最大的全功能投资银行,但经历过毁灭了贝尔斯登和雷曼兄弟的金融危机之后,如今高盛却变成了规模最小的一家。其资产负债表中的资产(并非管理的资产)规模约9,500亿美元。美国银行收购了美林;摩根大通收购了奄奄一息的贝尔斯登,最终将其彻底吞并;富国银行收购了美联银行,这三家公司的资产规模是高盛的近三倍。高盛的主要竞争对手摩根·士丹利因为从花旗集团收购了美邦,以及大力发展经纪业务,员工人数达到了100,000人。而高盛并没有经纪业务,员工仅有约35,000人。 布兰克芬并不准备让高盛更深入地开发传统的商业银行和消费者银行业务。他说:“高盛不像其他许多公司,我们并没有那种功能单纯的普通银行业务。我们不会这样做,否则就会改变公司,我们的规模可能会膨胀到225,000人。我们得设立分支,要有现金管理。那时候的高盛将完全不同。也许它会变得更好,但这并不是我们一直所坚持的或者我们所期望的样子。在危机中,规模更大,开展多种经营,拥有多元化的产品,是否更好?是的。但那时候我们所管理的将是一家截然不同的公司。公司文化也会发生变化。” 布兰克芬也是凡人,所以在一定程度上,他同样渴望能像摩根大通一样,年年创造250亿美元年净收入。但他更关注的是高盛的业务组合能够实现的股权收益率,而不是用绝对金额计算的盈利能力。布兰克芬表示,例如在我们过去几年经历的低增长环境中,像摩根大通一样拥有庞大的贷款产品组合,确实能保持稳定: “但在大部分时间,事实上是绝大部分时间里,我们的股权收益始终高于竞争对手。如果我们也开展那些业务,一定会拉低我们的股权收益。所以,这取决于你位于循环周期的哪个部分。” 他哀叹道,目前高盛的股权收益率为10%,确实低于他的期望,但更接近规模更大的商业银行应该为投资者实现的股权收益率水平。 布兰克芬指出,提高高盛股权收益率的一个方法是,降低对大银行的资本要求。而且 — 剧透警告! — 他认为目前的资本要求过高。他说:“如果我们经营同一家公司,但资本要求降低25%,我们的股权收益率将提高三分之一。” 过去六年里华尔街事实上的首席监管员、美联储理事丹尼尔·塔鲁洛在四月份离职,让布兰克芬看到了规则调整的希望。金融危机之后,塔鲁洛是主张对银行施行更严格的资本规定的主要倡议者。华尔街的共识是,不论特朗普总统任命谁来接替塔鲁洛,新的人选一定更能理解银行的立场。 史蒂夫·艾斯曼便坚信这一点。资深投资者艾斯曼是迈克·刘易斯的小说《大空头》中的原型之一,在同名电影中由史蒂夫·卡瑞尔饰演的角色给观众留下了深刻印象。他很看好金融股,包括高盛。他认为,在特朗普执政期间,监管机构会“按照不同的曲线”对银行的安全网进行分级,并将放宽沃尔克规则。银行可以回购更多股份,慢慢承担更多风险。他说道:“银行可以使用更多杠杆,股权收益率也会随之大幅提高。高盛将从中获得巨大的收益。” 目前,布兰克芬把大部分精力用于组建新领导团队。寇恩的离职使高盛不得不进行大规模结构调整。该银行任命了新上任的联席总裁和联席首席运营官戴维·索洛蒙和哈维·施瓦茨接替寇恩。格雷格·莱考姆和马克·纳奇曼被任命为投资银行业务共同负责人,接替索洛蒙。R. 马丁·查韦斯接替施瓦茨担任首席财务官。来自拉丁美洲的查韦斯已经公开出柜,并且在胳膊上纹有日语纹身。对他的任命可以看做是高盛与时俱进的标志。 布兰克芬称,他并不认为特朗普选择寇恩、姆努钦和鲍威尔只是因为他们在高盛的工作经历,但他依旧将这看做是对高盛的赞誉。他说道:“我认为这是对高盛的认可。这让我感觉很好,因为我和特朗普在这些人身上看到了相同的品质。 布兰克芬说,有高盛人在华盛顿任职,实际上会有负面影响,这种说法肯定会让他的民主党朋友们翻白眼。他说:“我给杰克·卢[前财政部长]打电话,要比给史蒂夫·姆努钦打电话简单得多。我要时刻提醒自己小心谨慎,尽量少打电话。”在金融危机期间,与保尔森打电话聊聊是一回事,而且他当时也确实经常与保尔森通话,但现在,“我要更加敏感,因为人人都会计较得失。” 从管理的角度,失去寇恩和鲍威尔“让有些事情变得更难,也让有些事情变得更简单,”他说道。 “因为以前每天都有寇恩的下属想要一展身手。我当然不希望[他离开],我跟寇恩是好朋友,这里许多事情都是围绕着寇恩的优势组织的,比如他擅长什么,他喜欢做什么,以及他建立的长期关系等。现在这一切都要重新调整和更改。” |

So after shunning the public for most of the past 148 years, Goldman is embracing the loan business—in its own way. “We have the opportunity to build a higher-margin lending business because we’re not competing in the league tables where people already have $2 trillion worth of loans on their books,” he says. “If we got an incremental $100 billion of the best kind of lending business out there, it would be accretive to what we’re doing. We don’t need to do it, because nobody thinks that’s our core business.” To make it happen, Goldman is even getting a little fintech-y. In 2016 the firm created Marcus, a part of its new online retail banking service, which makes no-fee loans of up to $30,000 to individuals seeking to refinance their high-priced credit card debt with a small, lower-cost loan from Goldman. So far Marcus—named after the firm’s founder—has made loans totaling about $1 billion in its first six months. Blankfein says that because Goldman doesn’t have a legacy consumer business or bank branches, its technological expertise allows it to tailor its products to individual needs. Since the loans aren’t being securitized and sold off to investors, he said, “We can make it almost bespoke.” That means borrowers can pick the term of the loan, the monthly payment amount, and when they start making payments. Furthermore, Goldman’s diminutive Salt Lake City–based commercial bank, known as Goldman Sachs Bank USA, is now suddenly eager to get your money, also through the Internet. To do so, the bank is offering depositors an interest rate of 1.05%, some four times or more what rivals JPMorgan Chase and Bank of America are offering. Goldman’s commercial bank now has deposits of around $125 billion—a mere fraction of Chase’s $1.4 trillion, but up considerably from Goldman’s $28 billion in 2008. If Goldman’s “toe dip” into the waters of consumer lending works out well, Blankfein expects the firm will do more of it. “Reaching a consumer digitally” through technological expertise plays to Goldman’s strengths, he says. “If I assume that consumer experience is a weakness of ours, I’d say a strength of ours has been technology—digital platforms, algorithmic trading, and risk management,” he says. Whereas once upon a time Goldman was the largest full-service investment bank on Wall Street, in the wake of the financial crisis—which immolated Bear Stearns and Lehman Brothers—it has now become the smallest. It has assets on its balance sheet (as opposed to under management) of around $950 billion. Bank of America, which owns Merrill Lynch; JPMorgan Chase, which bought the lifeless Bear Stearns and ultimately folded it; and Wells Fargo, which bought Wachovia, each have nearly three times as much in assets as Goldman does. Its principal rival, Morgan Stanley, has around 100,000 employees, thanks to its acquisition of Smith Barney from Citigroup and its aggressive push into the brokerage business. Goldman has no brokerage business to speak of and has only around 35,000 employees. Blankfein does not see Goldman making a further move into traditional commercial- and consumer-banking businesses. “We don’t have a kind of regular vanilla banking business like a lot of firms do,” he says. “We don’t do that. And it would change the firm if we did, because then we’d be 225,000 people. We’d have branches. We would have cash management. It would be a different firm. Now, maybe it’d be a better firm, but that’s not the firm that we historically have been or have aspired to. In a crisis, is it better to be bigger and have those activities and those diversified strains? Yes. But it’s a different firm to manage. It’s a different culture, too.” Blankfein is human, so on some level he is, of course, covetous of JPMorgan Chase’s ability to produce $25 billion in annual net income year after year. But he is more focused on the return on equity that can be achieved from Goldman’s mix of businesses, and less on the absolute dollar amount of Goldman’s profitability. In a low-growth environment, such as we’ve seen the past few years, Blankfein says that having a huge loan portfolio such as Chase’s can be stabilizing: “But there have been huge swaths of time—in fact, the predominant amount of time—where our returns were always much higher. And had we had that business, it would’ve pulled down our returns. So it depends on what part of the cycle you’re in.” At the moment, he laments, Goldman’s return on equity is 10%—below where he’d like it to be, certainly, and more in keeping with what the bigger commercial banks should be delivering to investors. One way to goose Goldman’s ROE, Blankfein points out, would be to reduce the capital that big banks are required to have. And—spoiler alert!—he thinks capital requirements are too high. “If we ran the same business with 25% less capital, we’d have a third higher ROE,” he says. The departure in April of Daniel Tarullo, the Federal Reserve governor who was Wall Street’s de facto regulator-in-chief for the past six years, gives Blankfein some hope that those rules might be changing. Tarullo was the leading advocate of stricter capital rules on banks in the wake of the financial crisis. The consensus on the Street is that whoever President Trump appoints to succeed Tarullo will be much more understanding of the banks’ point of view. That’s the bet that Steve Eisman is making. The veteran investor, a character in Michael Lewis’s The Big Short who was memorably portrayed by Steve Carell in the movie version, is bullish on financials, including Goldman. Under Trump, he believes that the regulators will grade the banks’ safety net “on a different curve,” and the Volcker Rule will be relaxed. Banks will be able to buy back more stock and ease back into risk. “They’ll have more leverage so the ROE will go up a lot,” he says. “Goldman will benefit enormously from that.” A lot of Blankfein’s focus today is on establishing his new leadership team. Cohn’s departure necessitated a major restructuring. David Solomon and Harvey Schwartz, the new copresidents and co–chief operating officers, were selected to replace Cohn. Gregg Lemkau and Marc Nachmann have been named the new coheads of investment banking, moving up to replace Solomon. And R. Martin Chavez, an openly gay Latino man with Japanese tattoos on his arm, replaced Schwartz as chief financial officer. Chavez’s appointment is as much a sign as any that Goldman is evolving with the times. Blankfein says he doesn’t think Trump chose Cohn, Mnuchin, and Powell just because they once worked at Goldman Sachs, although he takes it as a compliment. “I find it validating,” he says. “It makes me feel good that he sees in those people the same thing I see in those people.” In a claim that will draw eye-rolling from some of his fellow Democrats, Blankfein says there’s actually a downside for Goldman to having its alumni in Washington. “It was a lot easier for me to call Jack Lew [the former Treasury secretary] than it is to call Steve Mnuchin,” he says. “It’s in my head to be careful about it and to limit it.” It was one thing during the financial crisis to be able to pick up the phone and talk to Paulson, which he did often, but now, “I’m much more sensitized that people are keeping score.” From a management standpoint, losing Cohn and Powell “makes some things harder and some things easier,” he says. “Because every day we had people under Gary that wanted a shot. I wasn’t dying to have [him leave], and I’m close to Gary and a lot of life here was organized around Gary’s strengths and what he was good at and what he liked to do and his long-term relationships. All that has to be reoriented and replaced.” |

|

但他的主要责任是考虑高盛的未来领导力,他表示随着寇恩的离职,这项任务变得稍微容易了一些。他说道:“你可以让一个人多留两年,但你可能会失去一个会多给你10年时间的人。这是一种事后的合理化解释。” 布兰克芬会如何安排自己在高盛的未来?是否可以说,他会继续留任两年,付出的代价是牺牲下一个将要领导高盛10年的人?(值得一提的是,华尔街似乎认为,经过更多年的历练之后,鲜有人知的前首席财务官哈维·施瓦茨将成为高盛的下一位CEO。) 布兰克芬告诉我:“不必感到震惊。我不可能一直干下去。从我上任的第一天开始,人们就在对我的继任者问题设置障碍。虽然成功执行继任计划可能是我的职责,而且在合适的情况下,董事会可能就会让我下台,但任何人都不应该贸然提前终止自己的工作。所以我在等待他们认为合适的时机。如果有人跟我说我应该离开了,我能理解。” 但现在他还得坚持下去,因为“还没有人要解雇我。” 事实上,整体上来说,布兰克芬最近一段时间感觉很乐观。他说,曾经他会用98%的时间担心概率只有2%的事情,现在他已经变得更加乐观。 “我现在看待事情的态度有所改观,所以现在我会用99%的时间去担心概率只有1%的事情。” 本文一个版本发表于2017年6月15日的《财富》杂志上,标题为《高盛还是华尔街的No. 1吗?》。(财富中文网) 译者:刘进龙/汪皓 |

But his chief responsibility is to think about the firm’s future leadership, and Blankfein says that became marginally easier with Cohn’s departure. “You can keep somebody an extra two years,” he says, “but you might lose somebody who was otherwise going to give you 10 more years. It’s an ex post facto rationalization.” What about Blankfein’s own future at Goldman? Couldn’t it be argued that he is hanging on for a couple extra years, at the expense of the next person who will lead Goldman for another 10? (For what it’s worth, the betting on the Street seems to be that after a few more years of seasoning, Harvey Schwartz, the little-known former chief financial officer, will be Goldman’s next CEO.) “Don’t be shocked,” Blankfein tells me. “I’m probably not going to stay forever. People have been handicapping my succession since my first day. But it’s not anybody’s job to leave their job prematurely, even though it might be my job to manage that succession, and it might be the board’s job to manage me out, if it suits them. So I’ll wait until it suits them. If somebody said to me that it’s time to leave, I would understand that.” For now he might as well keep at it, though, because “nobody’s fired me yet.” Indeed, all things considered, Blankfein is feeling pretty sanguine these days. He says that where once upon a time he spent 98% of his time worrying about things with a 2% probability, he’s more optimistic now. “I’m feeling much better about things, so now it’s 99% and 1%.” A version of this article appears in the June 15, 2017 issue of Fortune with the headline "Is Goldman Sachs Still No. 1 on Wall Street?". |