2017全球经济形态将由这五大趋势决定

|

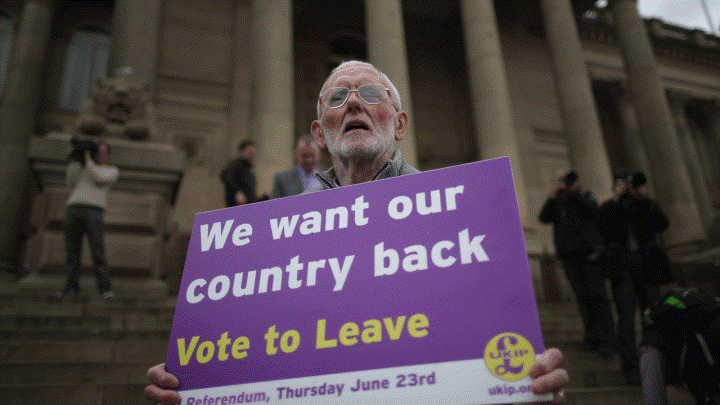

每年,在我们措手不及的情况下,都会有一系列的事件震动全球经济。很少有预言者预测到英国会在2016年公投脱欧,而在未来几年,这一决定可能会对全球贸易产生重要影响。而且多数民调和专家均未能预测唐纳德·特朗普会在美国总统大选中胜出,这已经是众所周知的事情。 尽管如此,细心的观察者未来还是会发现许多影响人类世界的经济趋势。比如在特朗普执政期间,美国将重新采取财政刺激政策,或美联储加快加息的步伐等。下面是今年值得关注的五个趋势。 1. 欧洲继续分裂 |

Every year brings its share of events that take us by surprise and shake up the global economy. Few prognosticators saw Britain voting to leave the European Union in 2016, though the decision will likely have important implications for global trade in the coming years. And it almost goes without saying that most polls and pundits failed to anticipate Donald Trump's election victory in the U.S. That said, many of the economic trends that shape our world can be spotted ahead of time by careful observers. Whether it's the return of fiscal stimulus under a Trump administration, or the Federal Reserve's plans to accelerate the pace of interest rate hikes, here are 5 trends to focus on this year. Europe Continues to Unwind |

意大利五星运动党创建者毕普·格里罗在一次公众集会上发表演说。

|

假如出人意料的英国脱欧公投结果是欧盟唯一的问题,那么欧洲的决策者和欧洲经济的利益相关者可以高枕无忧了。但高频经济(High Frequency Economics)的首席经济学家卡尔·温伯格却认为,事实上,英国脱离欧盟可能是欧洲最不必担心的问题。他指出,意大利最近的公投结果,再次确认了民粹主义的崛起和反欧洲情绪的出现,显示出整个欧洲项目的脆弱。 目前尚不确定意大利将在何时举行下一次大选(最晚将在2018年2月举行),但公投结果表明,意大利支持统一欧洲的主流政党正在迅速丧失选民的支持。温伯格在最近的一篇分析报告中写道:“如果意大利退出欧元区甚至脱离欧盟,所产生的经济和金融影响将使欧洲经济陷入衰退。”他认为,解除意大利银行对欧盟其他国家的义务,将引发金融恐慌。 2.中国增长速度持续放缓 |

If the surprising Brexit vote were E only problem, European policy makers and stakeholders in the continent's economy could rest easy. But Britain's exit from the EU could be the least of its worries, according to Carl Weinberg, chief economist with High Frequency Economics. He argues that a recent referendum in Italy reaffirmed the appeal of populism and anti-European sentiment, showing just how fragile the entire European project is. It's not clear when Italy's next elections will be held (the latest would be February 2018), but the referendum results suggest that mainstream parties that favor a unified Europe are losing support fast. "If Italy moves out of the Euro Zone and away from the European Union, the economic and financial implications will throw European economies into recession," he writes in a recent analyst note, arguing that the process of unwinding Italian banks' obligations to the rest of the EU could spark a financial panic. China Continues to Slow |

|

2017年,中国国家主席习近平将开始其首个任期的最后一年,而作为世界第二大经济体的管理者,他将面临诸多挑战。中国政府为未来五年制定的增长目标为6.5%,但近期的实践证明,除非坚持可持续的发展方式,否则实现甚至超过这一目标,也无法给中国带来稳定的经济。 自金融危机以来,中国的决策者们通过为企业部门提供低息贷款,投资基础设施和中国强大的出口部门,支撑了国内经济增长。但这些贷款逐渐集中到了低生产率投资,导致总体债务大幅增加。据国际货币基金组织(International Monetary Fund)最近的分析披露,“中国总体信贷的年均增长率达到了约20%,远高于名义GDP增长率。”这并非实现未来经济增长的可持续战略,在新的一年,习近平主席必须进一步推动经济再平衡,向消费者支出领域转型,只有这样,中国经济才能继续作为全球经济增长的发动机。 3. 美国进入特朗普经济时代。 |

President Xi Jinping will begin the final year of his first term in 2017, and the challenges he faces managing the world's second largest economy are manifold. China's government is aiming for growth rates of 6.5% over the next five years, but recent experience has shown that reaching or even exceeding these goals will not lead to a stable Chinese economy unless those targets are hit in a sustainable manner. Since the financial crisis, policymakers have propped up growth by supporting the corporate sector with cheap credit to invest in infrastructure and China's formidable export sector. But that credit has been increasingly funnelled into less productive investments, leading overall debt to soar. According to a recent analysis by the International Monetary Fund, "overall credit growth has been averaging around 20% per year, much higher than nominal GDP growth." That's not a sustainable strategy for future economic growth, and President Xi must do more to rebalance the economy towards consumer spending in the coming year if the Chinese economy is going to continue to power global growth going forward. It's Trump's Economy Now |

|

在地球的另一端,美国新任总统唐纳德·特朗普,将开始推行其实质性的改革项目。这些改革包括减税和增加基础设施支出等,独立分析师们认为,这些措施将使医保和社会保障等政府福利支出大幅增长,与此同时,也将导致美国联邦政府的赤字迅速增加。 基于新政府设计基础设施投资结构的方式,这些支出有可能给未来经济增长带来福音,而且考虑到当前的低利率,甚至可以以较低的成本来获得增长。然而,这些决策不止基于经济基本面,同样存在政治方面的考虑。国会山的共和党领导人与白宫主人之间的权力之争,将是经济预测者们密切关注的焦点,因为最终结果将决定共和党传统的“小政府”的观点和减税主张,能否胜过特朗普的民粹主义冲动。 4. 2017年也将是珍妮特·耶伦的经济时代 |

Halfway around the world the new American president, Donald Trump, will be embarking on his own substantial reform projects. One such effort will be a program of tax cuts and infrastructure spending, which independent analysts say will balloon the federal government's deficit at the same time that spending on entitlements like Medicare and Social Security is on course to soar. Depending on how the new administration structures its infrastructure investments, that spending could be a boon to growth going forward, and one that could be bought cheaply given today's low interest rates. These decisions, however, will be made based on politics as much as economic fundamentals. The power struggle between Republican leaders on Capitol Hill and the White House will be one that economic forecasters follow closely, as it will determine whether a traditional Republican vision of small government and tax cuts wins out over Trump's populist impulses. But Also Janet Yellen's |

|

尚未被共和党控制的一家政府机构是美联储(Federal Reserve)。该独立中央银行的任务,将是针对新的财政政策,管理货币供应。美联储主席珍妮特·耶伦早已预测将加快加息步伐,而如果美国政府慷慨的财政支出导致就业市场过热,使通胀率显著高于该央行2%的年度目标,耶伦加息的速度还要进一步加快。 5. 贸易仍将是核心问题 |

The one governmental institution that the Republican Party doesn't control is the Federal Reserve. The independent central bank will be tasked with managing the money supply in reaction to new fiscal policies. Already predicting an acceleration in the pace of interest rate increases, Fed Chair Janet Yellen may be forced to move faster in that regard if generous fiscal spending overheats the labor market and leads to inflation significantly above the central bank's 2% annual target. Trade Will Remain at the Fore |

|

过去70年来,最稳定的全球政策立场是稳步推动贸易自由化。然而,那些容易实现的清除贸易壁垒的目标早已被实现。2016年向世人证明,富有国家的选民们认为,有些政策正在逐渐削弱他们的收入增长潜力,所得到的却是并未感觉更廉价的商品,而少数精英们的薪酬却在日益增长。他们将不再忍受这些政策。 全世界都将关注美国当选总统特朗普会为全球贸易定下怎样的基调。他会退出北美自由贸易协定(NAFTA),还是会致力于重塑与中国的贸易,为此甚至不惜与世界贸易组织(World Trade Organization)的规则发生碰撞?特朗普甚至有可能在上文所述的欧元区巨变中插上一脚,因为他已经表示,愿意尽快与英国谈判贸易协定,这将使欧盟成员国将脱离欧盟视为更有吸引力的选择。(财富中文网) 译者:刘进龙/汪皓 |

The most stable global policy stance of the past 70 years has been the steady march toward ever-freer trade. But the low-hanging fruit of removing trade barriers has long since been picked. And 2016 showed us that the electorates in the wealthy world are no longer going to brook policies that they feel sap their potential income growth in return for imperceptibly cheaper products and much higher pay for a select few. All eyes will be on President-elect Trump as he sets the tone for global trade. Will he move to pull out of NAFTA, or will he set his sights on reshaping trade with China, possibly running afoul of World Trade Organization rules? Trump may even play a role in the aforementioned Eurozone drama, as he has indicated his willingness to quickly negotiate a trade deal with Britain, making the option of leaving the EU a more enticing ones for states that continue to be members. |