赚取六位数的薪水是美国许多工作者的梦想,也是辛勤工作可以带来成功和财富的象征。27岁的克莱尔说:“我一直认为赚到10万美元意义重大。因此,当我的薪水达到10万美元时,感觉真的很了不起。”

但是,克莱尔和她的同龄人中的其他五个人认为,现实情况有些不同。赚取六位数的薪水,你依然可能感到手头拮据。他们几人符合“HENRY一族”的特征。这是《财富》杂志在2003年首次开创的一个词,意思是高收入但尚不富裕的人(high-earning but not rich yet)。

年收入突破10万美元大关,就意味着远远超过了美国家庭收入的中位数,但随着生活成本水涨船高,即使是高收入者也发现自己更难实现财务目标。事实上,最近的一项调查发现,在年收入至少10万美元的家庭中,有34%的家庭支出与收入相当。并不是像一些人希望的那样有充分的喘息空间。

当然,赚取的金额达到多少才算足够取决于各种因素,包括你居住的城市,你是否有孩子或其他受抚养人,你高中或大学毕业的年份,以及你追求的理想生活方式。一些“HENRY”千禧一代告诉《财富》杂志,他们过得很安逸,也很自在——但这可能会在瞬间就发生改变,这取决于他们的生活将他们引向何方。

29岁的凯利说:“我意识到我非常幸运,但在财务方面,我仍然感到压力越来越大。我们能勉强过活吗?是的。但我们并非处于领先地位,而且我们错过了许多重要里程碑。”

以下是对这五个年收入至少为六位数的千禧一代家庭每月在不同预算类别上的支出的粗略估计,从高到低进行了排列。(为了平衡起见,我们还加入了一位X世代。)和任何预算一样,预算数字每个月都有波动;有些类别是根据年度总额估算的。这些数字让人们了解高收入千禧一代是如何进行消费和储蓄的,以及他们的工资是否足以支持他们在当今的经济环境下过上舒适生活。

姓氏和其他身份细节已被略去,以便受访者可以自由谈论他们的财务状况和职业。

“手头的钱不多。”

名字:凯利和安德鲁

年龄:29岁和32岁

年总收入:16.6万美元

地点:纽约州北部

每月预算估计:

•活期储蓄:2500美元

•交通费:1370美元

•退休金:1360美元[凯利和安德鲁的401(k)养老计划]

•抵押贷款:1100美元(含财产税)

•可支配费用:1000美元(包括服装、娱乐、旅行等费用)

•食品费:780美元

•学生贷款:400美元(联邦学生贷款支付时间恢复后,这一数字将翻倍)

•水电费:225美元

•宠物费:200美元

•手续费:150美元

•灵活开支账户:85美元

•订阅费用:85美元

虽然这对夫妇似乎存了很多钱,但凯利说,他们是在弥补过去丢失的时间。凯利的年收入约为12.5万美元,还有可能获得10%的年终奖。一年前,她开始在一家科技公司从事目前的工作;在此之前,她的年收入最高约为6.2万美元,因此很难支付基本生活以外的开支。

“手头的钱不多。很多钱都存起来了。”她告诉《财富》杂志。“我本应存款达十年之久,但情况并非如此。”

正因为这样,尽管凯利生活在一个相对经济实惠的城市,但她觉得自己的薪水还不足以支撑她和丈夫的生活开销。她特别担心他们的学生贷款债务,总计约64000美元。如果总统乔·拜登的学生贷款减免计划得到最高法院的支持,其中3万美元将被减免,这将给他们带来喘息空间。但她并不指望这一点。

凯利说:“与过去几代人相比,我感觉12.5万美元已经不够了。我的父母靠这样的薪水养育了四个孩子。我期望,当自己能赚取这样的薪水时,可以过上舒适的生活。”

导致凯利财务焦虑的不仅仅是为退休或新房存钱。她说,考虑到育儿成本,生孩子似乎是“不可能的”,这是千禧一代和Z世代普遍担心的问题。

她说:“当我想到要组建家庭时,我甚至会犹豫是否要这么做,因为学生贷款仍未还清。开始为孩子的学生贷款存钱,同时还在偿还自己的贷款,我不想这么做。”

“我们如此努力地工作,就是为了获得自由。”

名字:罗伯特和盖尔

年龄:38岁和36岁

年总收入:17万美元

地点:堪萨斯城

每月预算估计:

•学生贷款:4800美元(临时,不计息)

•退休金:2272美元[包括401(k)养老计划、养老金、罗斯个人退休账户]

•可支配费用:1525美元(包括房屋装修费、宠物费用和购物费用)

•食品费:约1300美元

•抵押贷款:约800美元

•水电费:500美元

•交通费:175美元(包括汽油和保险)

•会员费:80美元(包括亚马逊Prime会员费和家庭健身房会员费)

毕业后,罗伯特和盖尔就遭遇了大萧条时期,他们终于觉得自己走上了正轨。他们即将偿清全部抵押贷款,并完全拥有属于他们的汽车。他们尽量降低开支,并在退休储蓄和偿还债务方面取得了很大进展。

“我们在金融危机之后毕业,我认为现在的处境很好,但我们花了很长时间才走到这一步。”盖尔说。

盖尔是一名助理教授,罗伯特从事软件开发工作。他们的收入加起来约为17万美元,而罗伯特几个月前从公共部门转到私营部门工作后,目前的收入超过了8.5万美元。

加上加班费,他的薪水从8.6万美元跃升至11万美元;虽然薪水出现了明显变化,但其中大部分都用于家庭储蓄和退休目标,而不是目前的生活方式。

这也让盖尔将她的全部工资都用于偿还学生贷款(财务方面最大的支出之一)。这对夫妇还有大约3.8万美元的联邦贷款未偿清,他们正努力在今年秋天利息再次上涨之前全部还清。

在过去的几个月里,他们能够拿出这么多钱用于偿还学生贷款,部分原因是他们没有让一岁的孩子入托。盖尔这学期少上了几门课(也因此工资减少),以便能够居家办公(能够避免45分钟的通勤)。抽出额外时间照顾孩子改变了他们的生活,但她说,他们需要在秋天把女儿送到日托所——在联邦学生贷款支付时间恢复时,这会产生额外费用。

盖尔说:“我们没有改变生活方式是有原因的。金融风暴即将来临。”

虽然这对夫妇的所有账单都已支付,但他们说没有太多余额用于额外开支。他们曾考虑过存钱买一套新房子,但在目前的市场形势下,再加上他们目前房子的贷款几乎已经全部还清,他们正在重新考虑这个问题。没有房贷会腾出更多资金用于实现其他目标。

罗伯特说:“我们已经非常接近于无债一身轻了,如果不搬家的话,我们可以在未来两年内还清学生贷款和抵押贷款。美国梦是什么,劳役偿债吗? 我们如此努力地工作,就是为了获得自由。”

然后还要为孩子的大学教育做计划。盖尔说,目前,这对夫妇正专注于偿还自己的债务和为退休储蓄。以他们目前的收入,这就是他们所能负担的全部。

“我几乎觉得你必须赚取20万美元,才能在好学区过上舒适的生活。”盖尔说。

“未来我能过上自己感到满意的自在生活吗?”

名字:瑞安

年龄:36岁

年总收入:108000美元

地点:凤凰城

每月预算估计:

•退休金:2400美元[401(k)养老计划和罗斯个人退休账户]

•抵押贷款:1040美元

•手续费:1000美元

•食品费:1000美元(目标是减到每周250美元)

•旅行费:500美元

•医疗储蓄账户:217美元

•水电费:205美元

•交通费:75美元(偶尔使用优步)

•宠物保险:33美元

瑞安是一名保险理赔员,从2023年1月开始赚取六位数的薪水。在此之前,他的年薪从大学毕业后的4万美元左右增加到8万美元左右。与接受采访的许多其他工作者一样,他注意到的最明显的不同之处在于,他可以比以前存更多的钱。

他说:“我过着相当舒适的生活,既不奢华,也不招摇。我努力工作赚钱,我不想轻易放弃这样的生活方式。”

他和女友住在一起,但自己支付了全部抵押贷款。他还负担了大部分食物开销。他们很少外出就餐或去酒吧;两人都很节俭,很少喝酒,并选择骑自行车或其他廉价的约会方式,而不是经常去餐馆就餐。瑞安没有车,他说这是生活在城市地区的一大好处。

在还清了大约3.5万美元的学生贷款债务后,买房是瑞安多年来最大的财务目标。他在2017年左右开始存钱买房,最终在2021年1月购买了公寓。虽然他曾希望能够负担得起一套带院子的独栋住宅(他的狗可以养在院子里),但在目前的市场上,以他的工资水平是无法实现的。

他说:“我在经济上有保障,但再怎么说,我不认为自己富有。我非常认真地做预算,并试图放弃那些不重要的东西。”

年薪六位数曾经似乎是梦想中的薪水;现在他已经实现了,瑞安却感到压力,觉得自己应该赚更多钱。他说:“我只是觉得“享乐跑步机”被放大了。”(尽管生活起伏不定,但人们最终仍然会回到最初的幸福水平上的一种趋势。例如,达成最初的梦想会让你获得一段时间的满足,但你迟早会渴望实现更大的梦想。)他不一定想买一辆新车或华美的衣服。但他在科技等领域工作的朋友的薪水是他的两倍甚至三倍,总有一个新的数字让他向往。他尽量不去攀比,但他说,“这将永远是我们文化中的绊脚石。”

“当我赚取6.5万美元年薪时,我认为我只需要达到70年代的幸福水平就会满足。然后会进一步期望达到80年代的幸福水平和90年代的幸福水平。”他说。“我上周看到一个职位空缺,薪水在15万到20万美元之间。我想,'哇,这样的话,我所有的梦想都会实现。但未来我能过上自己感到满意的自在生活吗?可能不会。”

“能过上自己喜欢的生活,我真的很幸运。”

名字:克莱尔

年龄:27岁

年总收入:11.6万美元

地点:芝加哥

每月预算估计:

•租金:1237.50美元(房租的一半,与室友分摊)

•401(k)养老金计划:1658美元

•交通费:717美元(包括汽车分期付款、保险、汽油费和公共交通费)

•可支配费用:约700美元(包括服装、娱乐、个人护理、旅行费用)

•食品费:615美元(包括男友的餐费)

•活期储蓄:390美元

•停车位费用:200美元

•水电费:105美元

•健身房费用:75美元

•手机通讯费用:50美元

2018年,当克莱尔大学毕业并获得电影制作学位时,她看不到就业前景,也不知道该去哪里找工作。她一直和父母住在一起,直到一位朋友推荐她到他们工作的公司从事教学设计;从那以后,克莱尔就一直在那里工作。这并不是她真正想做的事情,但她对这份工作提供给她的生活条件很满意。她从跑步和弹钢琴等爱好中获得快乐;她最近开始进行飞行员课程学习。

“刚开始工作时,我花了很多精力来忍受痛苦。这些感觉都是可以接受的,但当我意识到无论你从事什么工作,你都不可能拥有一切时,我决定充分享受生活。”她说。“能过上自己喜欢的生活,我真的很幸运。”

自2018年以来,她的工资从5.3万美元左右增加到11.6万美元。她还获得了奖金——以前是每季度一次,现在是每年一次——她用这笔钱偿还了大约7000美元的学生贷款(她在校期间用奖学金和工作收入支付了其余部分),并为婚礼和买房存钱。

克莱尔说,在她的成长过程中,父母并不擅长理财。看到他们经常对自己的财务状况感到焦虑不安,这激励她在找到第一份工作时就尽可能多地学习理财(她的哥哥教会了她基本的理财知识)。她优先考虑的是最大化退休账户,并将她的生活开支保持在她实际上能够承受的范围之内。她试图成为一个有意识的消费者,避免快时尚和冲动消费。

“我很高兴每月都能在401(k)养老计划里存入大量资金,因为这一点非常重要。但在我们所处的文化环境下,我总是感到压力,觉得自己应该多购物或是做更多事情。”她说。

她的薪水对她自己来说绰绰有余,但她也知道情况不会一直如此。她希望尽快结婚,并且比男友挣得多得多。如果她要养育孩子,就不能存下那么多钱,这让她感到害怕。

她说:“仔细想想,我赚的薪水高得离谱。我经常反省自己。我有时确实感到压力很大,但考虑到我的情况,以及我没有很多学生贷款,我觉得自己的处境已经非常好了。”

“如果我在余下的职业生涯中能赚到同样多的钱,我可能会很高兴。”

名字:泰

年龄:38岁

年总收入:12万美元

地点:西雅图郊外

每月预算估计:

•活期储蓄:2000美元

•交通费:1618美元(包括两辆汽车的分期付款、保险、汽油和维修费)

•租金:1100美元(相当于女友抵押贷款的一半)

•可支配费用:860美元(包括服装、捐款、娱乐、礼品和个人护理费用)

•食品费:810美元

•旅行费:625美元

•401(k)养老计划: 600美元(传统账户和Roth账户平分)

•手续费:500美元

•保险费:105美元(包括终身和长期护理政策)

•手机通讯费用:92美元

当泰开始会计生涯时,他的年收入大约是4万美元,为了支付账单和其他费用,他还做了一份兼职。直到他的收入达到六位数,他才有能力放弃第二份工作。

现在,他年薪达到12万美元,已经绰绰有余了。

他说:“在我年轻的时候,钱是优先事项,也是驱动因素,但现在它已经不重要了。如果我在余下的职业生涯中能赚到同样多的钱,我可能会很高兴。我绝对在做我想做的一切。”

虽然房地产经常被吹捧为积累财富的最佳途径,但泰说,太快购房实际上损害了他的利益,至少在短期内是这样。他年轻时拥有一套房子;他几乎负担不起月供,最终亏本出售,在此过程中,他的信用和财务状况都受到损害。现在,再次拥有自己的房子并不是他的优先事项。

他说: “在成长过程中,每个人都说,‘这就是你要做的,上大学,买房子。’我曾经拥有过一套房子,那体验很糟糕。如果你遵从自己的内心,你的真正目标之一是买房,那很好。但如果你想获得体验和做事情,拥有房子可能会阻碍你。”

相反,他会优先考虑旅行和爱好等体验,包括骑山地自行车。由于没有孩子,他能够完全按照自己的意愿进行消费和储蓄。他鼓励其他人认清自己的目标,并尽可能提前计划。

他说:“一旦你不再专注于让别人快乐,而是专注于真正让你快乐的事情,你就可以走出去,做更多更实惠、更令人兴奋的事情,让你收获更多的故事,给你带来更多的快乐。”

他所有经济上的舒适都是来之不易的。泰以前结过婚,他和前妻在财务和目标上意见不一。现在,他和现任女友经常讨论钱的问题,并对他们的未来发展方向达成一致。他希望自己最终能够缩减工作时间。

“我不想把很多钱留给任何人,因为这有什么意义?我想要实现的是:退休储蓄够我在生前花完最后一美元即可。实际上,我已经削减了我的退休储蓄,因为未来的退休金太多了。”

“我终于把一大笔钱存起来了。”

名字:迈克

年龄:50岁

年总收入:21万美元

地点:波士顿

每月预算估计:

•抵押贷款:3200美元

•退休金:2500美元

•食品费:2200美元

•活期储蓄:约1000美元(在他旅行的月份里会减少)

•交通费:690美元

•捐款:约400美元

•健身房会员费:160美元

•水电费:150美元

•宠物费:约100美元

•人寿保险费:90美元

•手机通讯费用:90美元

虽然千禧一代在人生的财富积累阶段遇到了一些挫折,但事情确实变得容易了,至少一位X世代是这样认为的。

自从十年前他和第一任妻子离婚以来,迈克一直在努力恢复他的财务状况。在过去的10年里,他一直在偿还五位数的信用卡欠款,存钱在波士顿市内买了一套新房子,并优先考虑他的退休账户供款。

他说:“我的净资产在40岁时遭受重创,现在我终于把一大笔钱存起来了。”

就在新冠肺炎疫情来袭之前,迈克的工资从14万美元左右跃升至21万美元。当他开始赚取更多收入时,居家意味着他比以往任何时候都能够存更多的钱。现在,随着限制解除,他和妻子尽可能多地旅行。

迈克说,在他收入较少时,他不太会管理自己的财产。但他学到的教训意味着他现在生活得很舒适——非常舒适,以至于他正在考虑是否可以在几年后缩减工作时间(他在一家咨询公司担任经理),这相当于某种形式的提前退休。

“自从疫情结束以来,我们一直在弥过去丢失的时间。我可以经常旅行,而不用担心开销。但我在一个蓝领家庭长大,所以我对待金钱的态度相当务实。我仍然很节俭,但我不是一个吝啬鬼。”

他和妻子住在一起,妻子是一名职业音乐家,收入约为他的四分之一。这对夫妇没有孩子,他说这让他如今的生活方式成为可能;他们喜欢在公寓附近的餐馆就餐、滑雪和旅游。他说:“我把生活质量放在首位,而不是购买东西的数量。”

他在城市生活也很开心,因为这样,他就不需要拥有一辆车(妻子因工作需要拥有一辆车)——即使这意味着要在住房和其他预算项目上支付更多费用。

他说:“如果我以同样的薪水生活在其他地方,我会觉得自己像沃伦•巴菲特(Warren Buffett)。但因为是在波士顿,我仍然在做各种各样的预算,以确保我有足够的退休金。我觉得自己非常幸运,但我不认为自己富有。”(财富中文网)

译者:中慧言-王芳

赚取六位数的薪水是美国许多工作者的梦想,也是辛勤工作可以带来成功和财富的象征。27岁的克莱尔说:“我一直认为赚到10万美元意义重大。因此,当我的薪水达到10万美元时,感觉真的很了不起。”

但是,克莱尔和她的同龄人中的其他五个人认为,现实情况有些不同。赚取六位数的薪水,你依然可能感到手头拮据。他们几人符合“HENRY一族”的特征。这是《财富》杂志在2003年首次开创的一个词,意思是高收入但尚不富裕的人(high-earning but not rich yet)。

年收入突破10万美元大关,就意味着远远超过了美国家庭收入的中位数,但随着生活成本水涨船高,即使是高收入者也发现自己更难实现财务目标。事实上,最近的一项调查发现,在年收入至少10万美元的家庭中,有34%的家庭支出与收入相当。并不是像一些人希望的那样有充分的喘息空间。

当然,赚取的金额达到多少才算足够取决于各种因素,包括你居住的城市,你是否有孩子或其他受抚养人,你高中或大学毕业的年份,以及你追求的理想生活方式。一些“HENRY”千禧一代告诉《财富》杂志,他们过得很安逸,也很自在——但这可能会在瞬间就发生改变,这取决于他们的生活将他们引向何方。

29岁的凯利说:“我意识到我非常幸运,但在财务方面,我仍然感到压力越来越大。我们能勉强过活吗?是的。但我们并非处于领先地位,而且我们错过了许多重要里程碑。”

以下是对这五个年收入至少为六位数的千禧一代家庭每月在不同预算类别上的支出的粗略估计,从高到低进行了排列。(为了平衡起见,我们还加入了一位X世代。)和任何预算一样,预算数字每个月都有波动;有些类别是根据年度总额估算的。这些数字让人们了解高收入千禧一代是如何进行消费和储蓄的,以及他们的工资是否足以支持他们在当今的经济环境下过上舒适生活。

姓氏和其他身份细节已被略去,以便受访者可以自由谈论他们的财务状况和职业。

“手头的钱不多。”

名字:凯利和安德鲁

年龄:29岁和32岁

年总收入:16.6万美元

地点:纽约州北部

每月预算估计:

•活期储蓄:2500美元

•交通费:1370美元

•退休金:1360美元[凯利和安德鲁的401(k)养老计划]

•抵押贷款:1100美元(含财产税)

•可支配费用:1000美元(包括服装、娱乐、旅行等费用)

•食品费:780美元

•学生贷款:400美元(联邦学生贷款支付时间恢复后,这一数字将翻倍)

•水电费:225美元

•宠物费:200美元

•手续费:150美元

•灵活开支账户:85美元

•订阅费用:85美元

虽然这对夫妇似乎存了很多钱,但凯利说,他们是在弥补过去丢失的时间。凯利的年收入约为12.5万美元,还有可能获得10%的年终奖。一年前,她开始在一家科技公司从事目前的工作;在此之前,她的年收入最高约为6.2万美元,因此很难支付基本生活以外的开支。

“手头的钱不多。很多钱都存起来了。”她告诉《财富》杂志。“我本应存款达十年之久,但情况并非如此。”

正因为这样,尽管凯利生活在一个相对经济实惠的城市,但她觉得自己的薪水还不足以支撑她和丈夫的生活开销。她特别担心他们的学生贷款债务,总计约64000美元。如果总统乔·拜登的学生贷款减免计划得到最高法院的支持,其中3万美元将被减免,这将给他们带来喘息空间。但她并不指望这一点。

凯利说:“与过去几代人相比,我感觉12.5万美元已经不够了。我的父母靠这样的薪水养育了四个孩子。我期望,当自己能赚取这样的薪水时,可以过上舒适的生活。”

导致凯利财务焦虑的不仅仅是为退休或新房存钱。她说,考虑到育儿成本,生孩子似乎是“不可能的”,这是千禧一代和Z世代普遍担心的问题。

她说:“当我想到要组建家庭时,我甚至会犹豫是否要这么做,因为学生贷款仍未还清。开始为孩子的学生贷款存钱,同时还在偿还自己的贷款,我不想这么做。”

“我们如此努力地工作,就是为了获得自由。”

名字:罗伯特和盖尔

年龄:38岁和36岁

年总收入:17万美元

地点:堪萨斯城

每月预算估计:

•学生贷款:4800美元(临时,不计息)

•退休金:2272美元[包括401(k)养老计划、养老金、罗斯个人退休账户]

•可支配费用:1525美元(包括房屋装修费、宠物费用和购物费用)

•食品费:约1300美元

•抵押贷款:约800美元

•水电费:500美元

•交通费:175美元(包括汽油和保险)

•会员费:80美元(包括亚马逊Prime会员费和家庭健身房会员费)

毕业后,罗伯特和盖尔就遭遇了大萧条时期,他们终于觉得自己走上了正轨。他们即将偿清全部抵押贷款,并完全拥有属于他们的汽车。他们尽量降低开支,并在退休储蓄和偿还债务方面取得了很大进展。

“我们在金融危机之后毕业,我认为现在的处境很好,但我们花了很长时间才走到这一步。”盖尔说。

盖尔是一名助理教授,罗伯特从事软件开发工作。他们的收入加起来约为17万美元,而罗伯特几个月前从公共部门转到私营部门工作后,目前的收入超过了8.5万美元。

加上加班费,他的薪水从8.6万美元跃升至11万美元;虽然薪水出现了明显变化,但其中大部分都用于家庭储蓄和退休目标,而不是目前的生活方式。

这也让盖尔将她的全部工资都用于偿还学生贷款(财务方面最大的支出之一)。这对夫妇还有大约3.8万美元的联邦贷款未偿清,他们正努力在今年秋天利息再次上涨之前全部还清。

在过去的几个月里,他们能够拿出这么多钱用于偿还学生贷款,部分原因是他们没有让一岁的孩子入托。盖尔这学期少上了几门课(也因此工资减少),以便能够居家办公(能够避免45分钟的通勤)。抽出额外时间照顾孩子改变了他们的生活,但她说,他们需要在秋天把女儿送到日托所——在联邦学生贷款支付时间恢复时,这会产生额外费用。

盖尔说:“我们没有改变生活方式是有原因的。金融风暴即将来临。”

虽然这对夫妇的所有账单都已支付,但他们说没有太多余额用于额外开支。他们曾考虑过存钱买一套新房子,但在目前的市场形势下,再加上他们目前房子的贷款几乎已经全部还清,他们正在重新考虑这个问题。没有房贷会腾出更多资金用于实现其他目标。

罗伯特说:“我们已经非常接近于无债一身轻了,如果不搬家的话,我们可以在未来两年内还清学生贷款和抵押贷款。美国梦是什么,劳役偿债吗? 我们如此努力地工作,就是为了获得自由。”

然后还要为孩子的大学教育做计划。盖尔说,目前,这对夫妇正专注于偿还自己的债务和为退休储蓄。以他们目前的收入,这就是他们所能负担的全部。

“我几乎觉得你必须赚取20万美元,才能在好学区过上舒适的生活。”盖尔说。

“未来我能过上自己感到满意的自在生活吗?”

名字:瑞安

年龄:36岁

年总收入:108000美元

地点:凤凰城

每月预算估计:

•退休金:2400美元[401(k)养老计划和罗斯个人退休账户]

•抵押贷款:1040美元

•手续费:1000美元

•食品费:1000美元(目标是减到每周250美元)

•旅行费:500美元

•医疗储蓄账户:217美元

•水电费:205美元

•交通费:75美元(偶尔使用优步)

•宠物保险:33美元

瑞安是一名保险理赔员,从2023年1月开始赚取六位数的薪水。在此之前,他的年薪从大学毕业后的4万美元左右增加到8万美元左右。与接受采访的许多其他工作者一样,他注意到的最明显的不同之处在于,他可以比以前存更多的钱。

他说:“我过着相当舒适的生活,既不奢华,也不招摇。我努力工作赚钱,我不想轻易放弃这样的生活方式。”

他和女友住在一起,但自己支付了全部抵押贷款。他还负担了大部分食物开销。他们很少外出就餐或去酒吧;两人都很节俭,很少喝酒,并选择骑自行车或其他廉价的约会方式,而不是经常去餐馆就餐。瑞安没有车,他说这是生活在城市地区的一大好处。

在还清了大约3.5万美元的学生贷款债务后,买房是瑞安多年来最大的财务目标。他在2017年左右开始存钱买房,最终在2021年1月购买了公寓。虽然他曾希望能够负担得起一套带院子的独栋住宅(他的狗可以养在院子里),但在目前的市场上,以他的工资水平是无法实现的。

他说:“我在经济上有保障,但再怎么说,我不认为自己富有。我非常认真地做预算,并试图放弃那些不重要的东西。”

年薪六位数曾经似乎是梦想中的薪水;现在他已经实现了,瑞安却感到压力,觉得自己应该赚更多钱。他说:“我只是觉得“享乐跑步机”被放大了。”(尽管生活起伏不定,但人们最终仍然会回到最初的幸福水平上的一种趋势。例如,达成最初的梦想会让你获得一段时间的满足,但你迟早会渴望实现更大的梦想。)他不一定想买一辆新车或华美的衣服。但他在科技等领域工作的朋友的薪水是他的两倍甚至三倍,总有一个新的数字让他向往。他尽量不去攀比,但他说,“这将永远是我们文化中的绊脚石。”

“当我赚取6.5万美元年薪时,我认为我只需要达到70年代的幸福水平就会满足。然后会进一步期望达到80年代的幸福水平和90年代的幸福水平。”他说。“我上周看到一个职位空缺,薪水在15万到20万美元之间。我想,'哇,这样的话,我所有的梦想都会实现。但未来我能过上自己感到满意的自在生活吗?可能不会。”

“能过上自己喜欢的生活,我真的很幸运。”

名字:克莱尔

年龄:27岁

年总收入:11.6万美元

地点:芝加哥

每月预算估计:

•租金:1237.50美元(房租的一半,与室友分摊)

•401(k)养老金计划:1658美元

•交通费:717美元(包括汽车分期付款、保险、汽油费和公共交通费)

•可支配费用:约700美元(包括服装、娱乐、个人护理、旅行费用)

•食品费:615美元(包括男友的餐费)

•活期储蓄:390美元

•停车位费用:200美元

•水电费:105美元

•健身房费用:75美元

•手机通讯费用:50美元

2018年,当克莱尔大学毕业并获得电影制作学位时,她看不到就业前景,也不知道该去哪里找工作。她一直和父母住在一起,直到一位朋友推荐她到他们工作的公司从事教学设计;从那以后,克莱尔就一直在那里工作。这并不是她真正想做的事情,但她对这份工作提供给她的生活条件很满意。她从跑步和弹钢琴等爱好中获得快乐;她最近开始进行飞行员课程学习。

“刚开始工作时,我花了很多精力来忍受痛苦。这些感觉都是可以接受的,但当我意识到无论你从事什么工作,你都不可能拥有一切时,我决定充分享受生活。”她说。“能过上自己喜欢的生活,我真的很幸运。”

自2018年以来,她的工资从5.3万美元左右增加到11.6万美元。她还获得了奖金——以前是每季度一次,现在是每年一次——她用这笔钱偿还了大约7000美元的学生贷款(她在校期间用奖学金和工作收入支付了其余部分),并为婚礼和买房存钱。

克莱尔说,在她的成长过程中,父母并不擅长理财。看到他们经常对自己的财务状况感到焦虑不安,这激励她在找到第一份工作时就尽可能多地学习理财(她的哥哥教会了她基本的理财知识)。她优先考虑的是最大化退休账户,并将她的生活开支保持在她实际上能够承受的范围之内。她试图成为一个有意识的消费者,避免快时尚和冲动消费。

“我很高兴每月都能在401(k)养老计划里存入大量资金,因为这一点非常重要。但在我们所处的文化环境下,我总是感到压力,觉得自己应该多购物或是做更多事情。”她说。

她的薪水对她自己来说绰绰有余,但她也知道情况不会一直如此。她希望尽快结婚,并且比男友挣得多得多。如果她要养育孩子,就不能存下那么多钱,这让她感到害怕。

她说:“仔细想想,我赚的薪水高得离谱。我经常反省自己。我有时确实感到压力很大,但考虑到我的情况,以及我没有很多学生贷款,我觉得自己的处境已经非常好了。”

“如果我在余下的职业生涯中能赚到同样多的钱,我可能会很高兴。”

名字:泰

年龄:38岁

年总收入:12万美元

地点:西雅图郊外

每月预算估计:

•活期储蓄:2000美元

•交通费:1618美元(包括两辆汽车的分期付款、保险、汽油和维修费)

•租金:1100美元(相当于女友抵押贷款的一半)

•可支配费用:860美元(包括服装、捐款、娱乐、礼品和个人护理费用)

•食品费:810美元

•旅行费:625美元

•401(k)养老计划: 600美元(传统账户和Roth账户平分)

•手续费:500美元

•保险费:105美元(包括终身和长期护理政策)

•手机通讯费用:92美元

当泰开始会计生涯时,他的年收入大约是4万美元,为了支付账单和其他费用,他还做了一份兼职。直到他的收入达到六位数,他才有能力放弃第二份工作。

现在,他年薪达到12万美元,已经绰绰有余了。

他说:“在我年轻的时候,钱是优先事项,也是驱动因素,但现在它已经不重要了。如果我在余下的职业生涯中能赚到同样多的钱,我可能会很高兴。我绝对在做我想做的一切。”

虽然房地产经常被吹捧为积累财富的最佳途径,但泰说,太快购房实际上损害了他的利益,至少在短期内是这样。他年轻时拥有一套房子;他几乎负担不起月供,最终亏本出售,在此过程中,他的信用和财务状况都受到损害。现在,再次拥有自己的房子并不是他的优先事项。

他说: “在成长过程中,每个人都说,‘这就是你要做的,上大学,买房子。’我曾经拥有过一套房子,那体验很糟糕。如果你遵从自己的内心,你的真正目标之一是买房,那很好。但如果你想获得体验和做事情,拥有房子可能会阻碍你。”

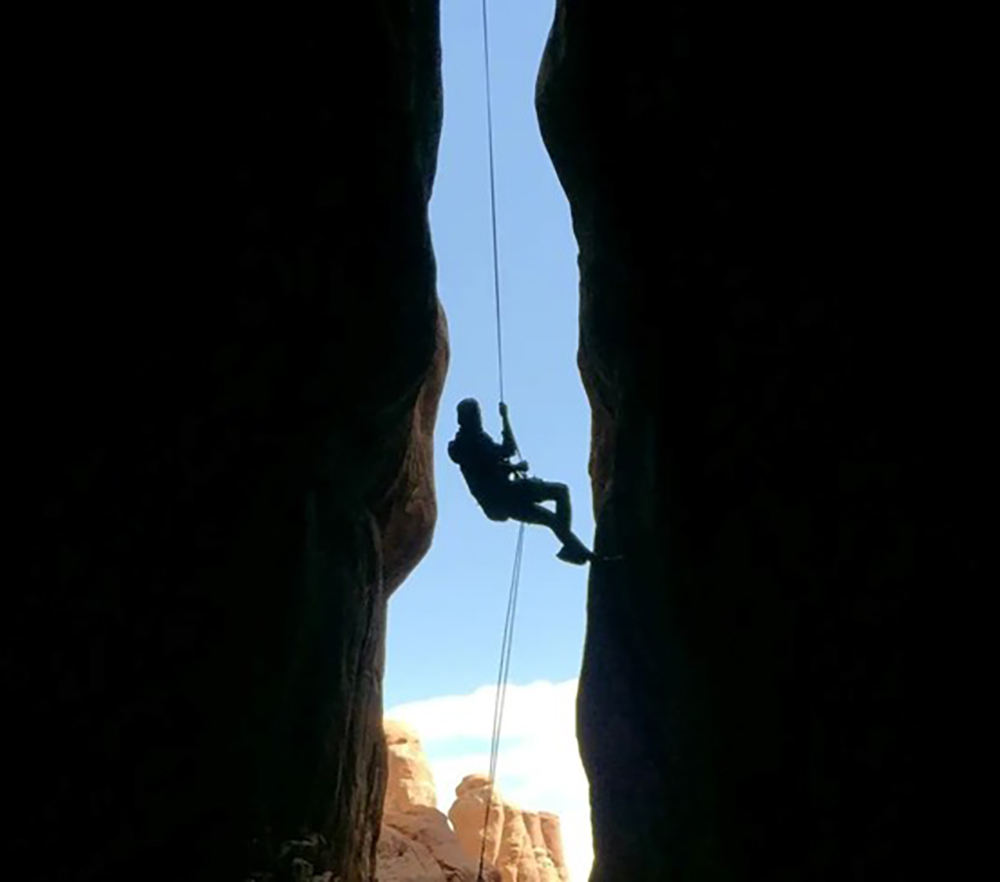

相反,他会优先考虑旅行和爱好等体验,包括骑山地自行车。由于没有孩子,他能够完全按照自己的意愿进行消费和储蓄。他鼓励其他人认清自己的目标,并尽可能提前计划。

他说:“一旦你不再专注于让别人快乐,而是专注于真正让你快乐的事情,你就可以走出去,做更多更实惠、更令人兴奋的事情,让你收获更多的故事,给你带来更多的快乐。”

他所有经济上的舒适都是来之不易的。泰以前结过婚,他和前妻在财务和目标上意见不一。现在,他和现任女友经常讨论钱的问题,并对他们的未来发展方向达成一致。他希望自己最终能够缩减工作时间。

“我不想把很多钱留给任何人,因为这有什么意义?我想要实现的是:退休储蓄够我在生前花完最后一美元即可。实际上,我已经削减了我的退休储蓄,因为未来的退休金太多了。”

“我终于把一大笔钱存起来了。”

名字:迈克

年龄:50岁

年总收入:21万美元

地点:波士顿

每月预算估计:

•抵押贷款:3200美元

•退休金:2500美元

•食品费:2200美元

•活期储蓄:约1000美元(在他旅行的月份里会减少)

•交通费:690美元

•捐款:约400美元

•健身房会员费:160美元

•水电费:150美元

•宠物费:约100美元

•人寿保险费:90美元

•手机通讯费用:90美元

虽然千禧一代在人生的财富积累阶段遇到了一些挫折,但事情确实变得容易了,至少一位X世代是这样认为的。

自从十年前他和第一任妻子离婚以来,迈克一直在努力恢复他的财务状况。在过去的10年里,他一直在偿还五位数的信用卡欠款,存钱在波士顿市内买了一套新房子,并优先考虑他的退休账户供款。

他说:“我的净资产在40岁时遭受重创,现在我终于把一大笔钱存起来了。”

就在新冠肺炎疫情来袭之前,迈克的工资从14万美元左右跃升至21万美元。当他开始赚取更多收入时,居家意味着他比以往任何时候都能够存更多的钱。现在,随着限制解除,他和妻子尽可能多地旅行。

迈克说,在他收入较少时,他不太会管理自己的财产。但他学到的教训意味着他现在生活得很舒适——非常舒适,以至于他正在考虑是否可以在几年后缩减工作时间(他在一家咨询公司担任经理),这相当于某种形式的提前退休。

“自从疫情结束以来,我们一直在弥过去丢失的时间。我可以经常旅行,而不用担心开销。但我在一个蓝领家庭长大,所以我对待金钱的态度相当务实。我仍然很节俭,但我不是一个吝啬鬼。”

他和妻子住在一起,妻子是一名职业音乐家,收入约为他的四分之一。这对夫妇没有孩子,他说这让他如今的生活方式成为可能;他们喜欢在公寓附近的餐馆就餐、滑雪和旅游。他说:“我把生活质量放在首位,而不是购买东西的数量。”

他在城市生活也很开心,因为这样,他就不需要拥有一辆车(妻子因工作需要拥有一辆车)——即使这意味着要在住房和其他预算项目上支付更多费用。

他说:“如果我以同样的薪水生活在其他地方,我会觉得自己像沃伦•巴菲特(Warren Buffett)。但因为是在波士顿,我仍然在做各种各样的预算,以确保我有足够的退休金。我觉得自己非常幸运,但我不认为自己富有。”(财富中文网)

译者:中慧言-王芳

A six-figure salary is a dream for many workers across the U.S., a symbol of the success and prosperity that can come with hard work. “I always thought making $100,000 was significant,” says Claire, 27. “And when I reached it, that felt like a really, really big deal.” But the reality has been, let’s say, a bit different, according to Claire and five other millennials in her cohort, the high-earning but not rich yet (or HENRY) class of Americans that Fortune first identified in 2003. Just because you make six digits doesn’t mean you don’t feel a squeeze.

Breaking the $100,000 mark puts you well above the median U.S. household income, but as the cost of living creeps higher and higher, even high earners are finding it more difficult to reach their financial goals. In fact, a recent survey found 34% of households making at least $100,000 per year are spending as much as they earn. There isn’t as much breathing room as some hoped.

Of course, how much is enough depends on various factors including where you live, if you have children or other dependents, what year you graduated from high school or college, and what type of lifestyle you want to lead. Some of these “HENRY” millennials tell Fortune they are comfortable and content—but that could change in an instant, depending on where their lives lead them.

“I recognize that I’m extremely privileged, but I still feel mounting pressure when it comes to our finances,” says Kelly, 29. “Are we getting by? Yes. But we’re not getting ahead, and we’re missing major milestones along the way.”

Below are rough estimates of what five millennial households across the country earning at least six figures spend on different budget categories each month, from most to least costly. (For balance, we threw in one Gen Xer, too.) Like any budget, the numbers fluctuate month to month; some categories are estimates based on a yearly total. They give an idea of how high-earning millennials are spending and saving—and whether their salaries are enough to live well in today’s economy.

Last names and other identifying details have been omitted so that the subjects could speak freely about their finances and careers.

‘It’s not a lot of money on hand.’

Names: Kelly and Andrew

Ages: 29 and 32

Total Annual Income: $166,000

Location: Upstate New York

Estimated Monthly Budget:

• Liquid Savings: $2,500

• Transportation: $1,370

• Retirement: $1,360 (Kelly and Andrew’s 401(k)s)

• Mortgage: $1,100 (Includes property taxes)

• Discretionary: $1,000 (Includes clothing, entertainment, travel, etc.)

• Food: $780

• Student Loans: $400 (Double this when federal payments resume)

• Utilities: $225

• Pets: $200

• Brokerage: $150

• FSA: $85

• Subscriptions: $85

Though the married couple is seemingly saving a lot of money, Kelly, who earns around $125,000 a year—with the possibility of a 10% annual bonus— says they are making up for lost time. She started working at her current job at a tech company one year ago; before, the most she earned was around $62,000 per year, making it difficult to pay for things beyond the basics.

“It’s not a lot of money on hand. A lot of it is going into savings,” she tells Fortune. “I should have been saving for 10 years and I wasn’t.”

Because of that, Kelly doesn’t feel like her salary is nearly enough for her and her husband, despite living in a relatively affordable city. She’s particularly worried about their student loan debt, which totals around $64,000. If President Joe Biden’s cancelation plan is upheld by the Supreme Court, $30,000 of that would be erased, which would give them breathing room. But she’s not counting on it.

“Compared to past generations, $125,000 doesn’t feel like enough anymore,” says Kelly. “My parents, they raised four children on that. I had this expectation that when you make all this money, you can live a comfortable life.”

It’s not just saving for retirement or a new home that is causing Kelly financial anxiety. She says having children seems “impossible” given the cost of childcare, a common concern among millennials and Gen Z.

“When I think of starting a family, I have hesitation to even wanting to do that with student loans still on the table,” she says. “Starting to save for your kids’ student loans while still paying your own off, that’s something I don’t want to do.”

‘We’ve worked so hard to get free.’

Names: Robert and Gail

Ages: 38 and 36

Total Annual Income: $170,000

Location: Kansas City

Estimated Monthly Budget:

• Student Loans: $4,800 (Temporary while interest is not accruing)

• Retirement: $2,272 (Includes 401(k), pension, Roth IRA)

• Discretionary: $1,525 (Includes home improvement, pet expenses, and shopping)

• Food: ~$1,300

• Mortgage: ~$800

• Utilities: $500

• Transportation: $175 (Includes gas and insurance)

• Memberships: $80 (Includes Amazon Prime and family gym)

After graduating into the Great Recession, Robert and Gail finally feel like they’re on the right track. They are close to paying off their entire mortgage, and own the car they share outright as well. They try to keep their expenses as low as possible, and have made great strides in their retirement savings and debt payoff.

“We graduated right after the financial crisis, and I think we’re in a good position now, but it took us a long time to get here,” says Gail.

Gail is an assistant professor and Robert works in software development. Together, they bring home around $170,000, with Robert currently earning more than half of that after he switched jobs from the public to private sector a few months ago.

His pay jumped from around $86,000 to $110,000, plus over-time; while it’s been a noticeable change, most of it is going toward the family’s savings and retirement goals, rather than current lifestyle spending.

It’s also allowed Gail to put her entire paycheck toward one of the biggest drains on their finances: student loans. The couple has around $38,000 left in federal loans, which they are trying to pay down completely before interest starts accruing again in the fall.

They have been able to put so much toward their student loans over the past few months, in part, by keeping their one-year-old out of daycare. Gail took on fewer classes this semester, and thus a pay cut, to be able to work from home (and avoid the 45-minute commute). The extra time with the baby has been life-changing, but she says they will need to start sending their daughter to daycare in the fall—incurring the additional cost right when federal student loan payments are set to resume.

“There’s a reason we haven’t changed our lifestyle,” says Gail. “There’s this pending financial storm.”

While all the couple’s bills are paid, they say there isn’t much for extras. They’ve considered saving to buy a new house, but in the current market—and with their current home almost completely paid off—they’re rethinking that. Not having a housing payment would free up more money for other goals.

“We’re so close to being debt-free, we could be out from under our student loans and our mortgage in the next two years if we don’t move,” says Robert. “The American Dream is what, debt peonage? We’ve worked so hard to get free.”

And then there’s the baby’s college education to plan for. Gail says that for now, the couple is focusing on repaying their own debt and saving for retirement. On their current income, that’s about all they can afford.

“I almost feel like you have to earn $200,000 to live comfortably in a place with good schools,” says Gail.

‘Will I ever get to a point where I’m satiated, I’m good?’

Name: Ryan

Age: 36

Total Annual Income: $108,000

Location: Phoenix

Estimated Monthly Budget:

• Retirement: $2,400 (401(k) and Roth IRA)

• Mortgage: $1,040

• Brokerage: $1,000

• Food: $1,000 (Aims for $250 per week)

• Travel: $500

• HSA: $217

• Utilities: $205

• Transportation: $75 (Occasional Uber)

• Pet Insurance: $33

Ryan, an insurance claims adjustor, began earning six figures in January 2023. Before that, he worked his way up from earning around $40,000 per year after college to around $80,000. Like many of the other workers interviewed for this story, the biggest difference he’s noticed is that he can save significantly more than he used to.

“I live a pretty comfortable lifestyle. It’s not luxurious or flashy,” he says. “I work hard for my money, I don’t want to give it away easily.”

He lives with his girlfriend, but pays for their entire mortgage himself. He also covers most of the food for the couple. It’s rare that they eat out or go to bars; both are frugal and rarely drink alcohol, and opt for biking or other inexpensive dates instead of frequenting restaurants. Ryan does not own a car, which he says is a benefit of living in an urban area.

After paying off around $35,000 in student loan debt, buying a house was Ryan’s biggest financial goal for many years. He began saving for one around 2017, and was finally able to purchase his condo in January 2021. Though he had hoped to be able to afford a single family home with a yard for his dog, that wasn’t possible in the current market with his salary.

“I’m financially secure, but I don’t consider myself wealthy by any stretch of the imagination,” he says. “I budget really intensely and try to forego things” that aren’t a priority.

Earning six figures a year once seemed like a dream salary; now that he’s achieved it, Ryan feels the pressure to earn more. “The hedonic treadmill, I feel it is only amplified,” he says. He doesn’t necessarily want to buy a new car or fancy clothes. But with friends in fields like tech that earn double or even triple his salary, there’s always a new figure to aspire to. He tries not to give into comparisons, but he says that “will always be a stumbling block in our culture.”

“When I was making $65,000, I thought I’d just need to get to the 70s. And then the 80s and 90s,” he says. “I saw an opening last week where the pay range is $150,000 to $200,000. I’m like, ‘wow all my dreams will come true.’ But will I ever get to a point where I’m satiated, I’m good? I probably won’t.”

‘I feel really lucky to live a life that I enjoy.’

Name: Claire

Age: 27

Total Annual Income: $116,000

Location: Chicago

Estimated Monthly Budget:

• Rent: $1,237.50 (Half of rent, split with a roommate)

• 401(k): $1,658

• Transportation: $717 (Includes car payment, insurance, gas, and public transportation)

• Discretionary: ~$700 (Includes clothing, entertainment, personal care, travel)

• Food: $615 (Includes meals for her boyfriend)

• Liquid Savings: $390

• Parking Spot: $200

• Utilities: $105

• Gym: $75

• Cellphone: $50

When Claire graduated from college in 2018 with a degree in film production, she had no job prospects and little idea of where to look for work. She lived with her parents until a friend recommended her for an instructional design role at the company they worked for; Claire has been there ever since. It’s not exactly what she wanted to do, but she’s happy with the life it affords her. She finds her joy in hobbies like running and playing the piano; she recently started taking pilot lessons.

“When I started working, I spent a lot of energy being miserable. Those were valid feelings, but once I realized you’re probably not going to have it all no matter what you do, I decided to make the most out of my life,” she says. “I feel really lucky to live a life that I enjoy.”

Her salary has increased from around $53,000 to $116,000 since 2018. She also receives bonuses—previously quarterly, now annually—that she has used to pay off around $7,000 in student loan debt (she paid for the rest with scholarships and jobs while in school) and save for a wedding and a house.

Claire says her parents weren’t great with money when she was growing up. Seeing how stressed out they often were about their finances inspired her to learn as much as she could about managing her money when she got her first job (her older brother taught her the basics). She prioritizes maxing out her retirement account and keeping her living expenses lower than she can technically afford. She tries to be as conscious of a consumer as possible, avoiding fast fashion and impulse purchases.

“I’m glad I can put a lot away in my 401(k) each month, because that’s super important. But with the culture we live in, I always feel pressure to buy things or do things,” she says.

Her salary is more than enough for her on her own, but she also knows it won’t always be this way. She hopes to get married soon, and makes significantly more than her boyfriend. If she were to have children, she wouldn’t be able to save nearly as much, which scares her.

“When I really think about it, I make an absurd amount of money,” she says. “I check myself a lot. I do feel stressed out sometimes, but given my situation and that I don’t have a lot of student loans, I feel like I’m in a really good position.”

‘If I made the same amount for the rest of my career, I’d probably be happy.’

Name: Ty

Age: 38

Total Annual Income: $120,000

Location: Outside Seattle

Estimated Monthly Budget:

• Liquid Savings: $2,000

• Transportation: $1,618 (Includes two car payments, insurance, gas, and maintenance)

• Rent: $1,100 (Half of his girlfriend’s mortgage)

• Discretionary: $860 (Includes clothing, donations, entertainment, gifts, and personal care)

• Food: $810

• Travel: $625

• 401(k): $600 (Split between traditional and Roth accounts)

• Brokerage: $500

• Insurance: $105 (Includes life and long term care policies)

• Cellphone: $92

When Ty started his accounting career, he was earning around $40,000 per year and worked a side job to be able to afford his bills and other expenses. It wasn’t until he hit the six-figure income mark that he could afford to give up the second job.

Now, he’s more than comfortable earning $120,000 per year.

“When I was younger, money was a priority, a driving factor, but now it doesn’t matter,” he says. “If I made the same amount for the rest of my career, I’d probably be happy. I’m doing absolutely everything I want to do.”

Though real estate is often touted as the best way to build wealth, Ty says buying too quickly actually hurt him, at least in the short term. He owned a home when he was younger; he could barely afford the payments, and eventually sold it at a loss, destroying his credit and finances in the process. Now, it’s not a priority for him to ever own his home again.

“Growing up, everybody is like, ‘this is what you do, go to college, buy a house.’ I’ve owned a house, it sucks,” he says. “If you look internally and one of your true goals is to buy a house, that’s great. But if you want to have experiences and do things, having a house can hinder that.”

Instead, he prioritizes experiences like traveling and hobbies, including mountain biking. With no kids, he is able to spend and save exactly how he wants to. He encourages others to be as intentional about their goals, and plan ahead as much as possible.

“Once you don’t focus on making other people happy, and you focus on what actually makes you happy, you might be able to go out and do a lot more things that are cheaper, more exciting, give you more stories, and just bring you more joy,” he says.

All of his financial comfort is hard won. Ty was previously married, and he and his ex did not see eye to eye on finances and goals. Now, he and his current girlfriend discuss money often, and are aligned on where their futures are headed. He hopes eventually he will be able to scale back his hours at work.

“I don’t want to pass on a lot of money to anybody, because what’s the point? I want to invest just enough to basically die the same day I spend my last dollar,” he says. “I’ve actually cut back on my retirement savings because it was going to be too much.”

‘I’m finally, really putting big chunks of cash aside.’

Name: Mike

Age: 50

Total Annual Income: $210,000

Location: Boston

Estimated Monthly Budget:

• Mortgage: $3,200

• Retirement: $2,500

• Food: $2,200

• Liquid Savings: ~$1,000 (Less in months he travels)

• Transportation: $690

• Donations: ~$400

• Gym Membership: $160

• Utilities: $150

• Pets: ~$100

• Life Insurance: $90

• Cellphone: $90

While millennials have faced a some set backs in the wealth-building stage of life, things do get easier, at least according to one Gen Xer.

Since he and his first wife divorced a decade ago, Mike has been making an effort to rehabilitate his finances. He’s spent the past 10 years paying off a five-figure credit card balance, saving to buy a new home within the city of Boston, and prioritizing his retirement contributions.

“My net worth took a big hit at the age of 40,” he says. “Now I’m finally, really putting big chunks of cash aside.”

Mike’s salary jumped from around $140,000 to $210,000 just before the COVID-19 pandemic reached the U.S. Staying home right when he started earning significantly more meant he was able to save more than he ever had. Now, with restrictions lifted, he and his wife travel as much as possible.

Mike says he mismanaged his money when he was earning less. But the lessons he learned means he is living comfortably now—so comfortably that he’s considering whether he might be able to cut back on his hours at work (he’s a manager at a consulting firm) in a few years as a sort of early retirement.

“Since the pandemic has ended, we’ve been making up for lost time. I’ve been able to travel a lot without worrying what it will cost,” he says. “But I grew up in a blue collar household, so my relationship with money is pretty pragmatic. I’m still frugal, but I’m not a penny-pincher.”

He lives with his wife, who is a professional musician and earns about a quarter of his salary. The pair do not have children, which he says makes his life possible; they love eating out at the restaurants around their apartment, skiing, and traveling. “I’ve prioritized quality of life over quantity of things I can spend my money on,” he says.

He’s also happy in the city because he doesn’t need to own a car (his wife has one for work) to get by—even if it means paying more for housing and other line items in his budget.

“If I lived anywhere else with the same salary, I would feel like Warren Buffett,” he says. “But because it’s Boston, I’m still doing all different kinds of calculus to make sure I have enough for retirement. I feel extremely fortunate, but I wouldn’t consider myself financially wealthy.”