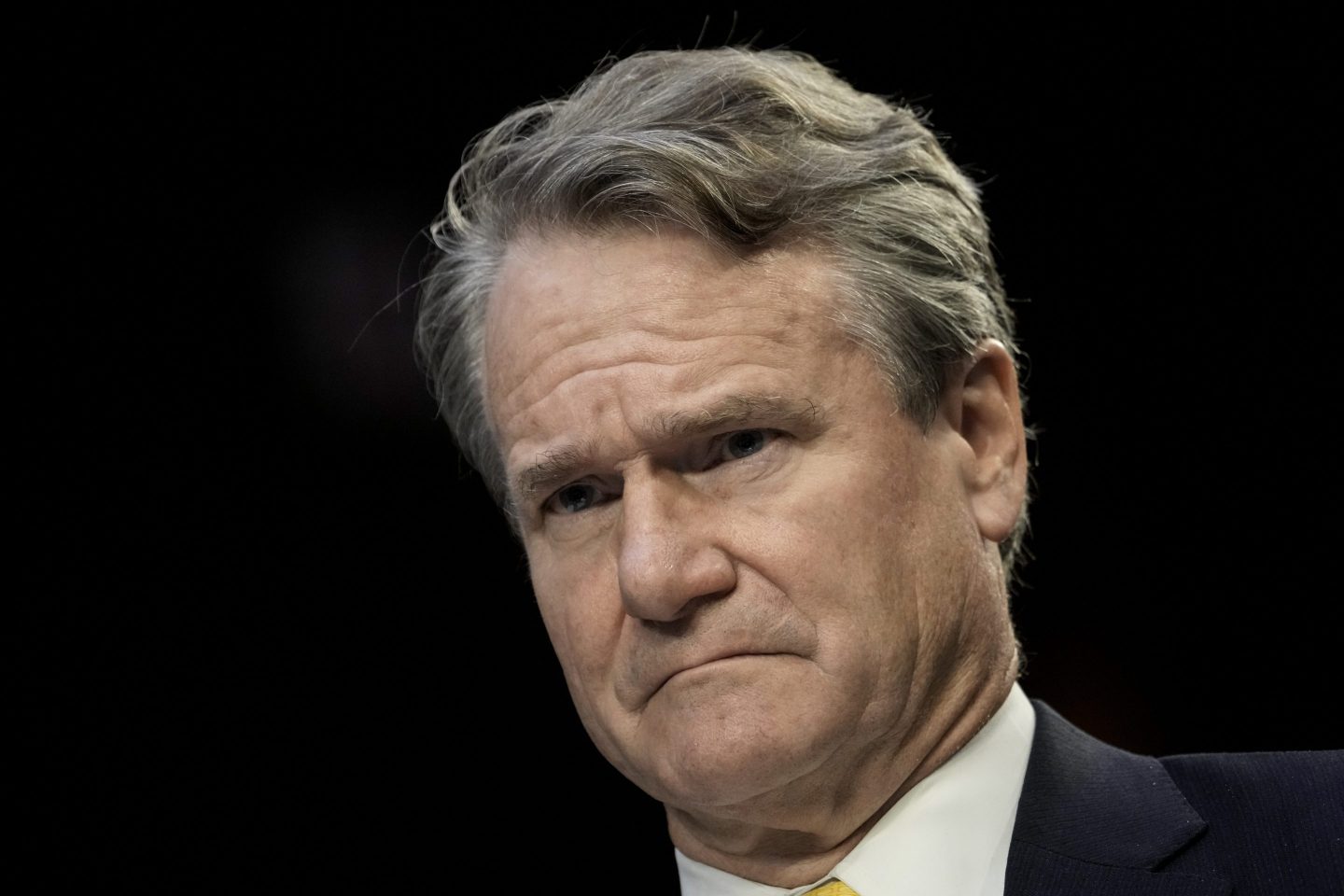

十多年前,曾有多位银行家致信美国国会,警告国会议员美国国家债务违约的严重后果,美国银行(Bank of America)CEO布莱恩·莫伊尼汉就是其中之一。十二年后,莫伊尼汉表示,他和美国乃至全世界的公司领导者都必须做好准备,迎接终究会发生的美国债务违约。这种情况极有可能发生。

莫伊尼汉在CNN《今晨》(This Morning)节目中表示,虽然他希望一直以来所担心的问题不会真得发生,但希望“不是一种策略”。

在此之前,美国政府债务在1月19日达到31.4万亿美元的上限,国会为此连续数周争吵不休。为了减少贷款违约的风险,政客们通常会寻求提高债务上限。然而,随着共和党人最近掌管众议院,并要求削减开支,提高债务上限的过程似乎将被拖得更长,并且可能导致故意违约。

美国财政部部长珍妮特·耶伦曾警告美国“自己造成的违约灾难”会影响全球经济,以及将提高债务上限与削减支出挂钩的危害。

也有经济学家认为,债务上限是“可笑的”,对于真正减少支出的作用无异于杯水车薪。亿万富翁投资者、大型投资管理公司桥水联合基金(Bridgewater Associates)的创始人雷·达里奥在LinkedIn上撰文称,债务上限“就像是一群酒鬼在起草强制限制饮酒的法律,只要达到规定的限制,他们就会进行荒唐的谈判,临时取消限制,让他们可以再酗酒狂欢,直到达到新的限制,然后他们又会故技重施,继续酗酒。”

在被问到债务上限是否“有必要”时,美国银行的莫伊尼汉表示,在宪法的范围内,债务上限会继续发挥作用。他说道:“这是一个政治进程,作为一个国家,我们必须就如何做到量入为出展开讨论,而且这场讨论会继续下去。国会掌控了财政大权。我对于修改美国宪法持谨慎的态度。美国宪法已经存在了约250年时间,我们认为应该顺其自然,并保证它正常运行。”

这位银行老板并没有批评导致达到债务上限的决策,他表示:“过去两年,为了克服疫情对经济的拖累,我们不得不背负大量债务。在某种情况下,我们必须弄清楚这种做法未来如何发挥作用,但目前,我们必须解决调整技术结构的问题。”

更乐观的前景

虽然国会仍在就债务上限问题争执不休,但从多个重要经济指标来看,目前的经济前景似乎好于预期。虽然投资银行、经济学家和亿万富翁投资者都预测经济前景暗淡,但美国劳工统计局(Bureau of Labor Statistics)本月公布的劳动力市场数据却显示,美国失业率降至3.4%,为53年最低水平。耶伦表示,这个确切的信号表明美国经济“强劲且有弹性”。

莫伊尼汉也对这则消息感到振奋。他说道,就业是“美联储面临的挑战”之一,但尽管美联储加息,失业率却依旧较低,这表明美联储的政策已经发挥了预期效果,并没有对经济造成伤害。

虽然他依旧预测美国将陷入“适度衰退”,但他认为发生经济衰退的可能性变得越来越低。他还对中美之间的贸易紧张表示乐观。他表示,对中美发生冲突的负面影响的担忧,将是促使双方“回到会议室”,通过谈判缓解紧张局面的关键。(财富中文网)

译者:刘进龙

审校:汪皓

十多年前,曾有多位银行家致信美国国会,警告国会议员美国国家债务违约的严重后果,美国银行(Bank of America)CEO布莱恩·莫伊尼汉就是其中之一。十二年后,莫伊尼汉表示,他和美国乃至全世界的公司领导者都必须做好准备,迎接终究会发生的美国债务违约。这种情况极有可能发生。

莫伊尼汉在CNN《今晨》(This Morning)节目中表示,虽然他希望一直以来所担心的问题不会真得发生,但希望“不是一种策略”。

在此之前,美国政府债务在1月19日达到31.4万亿美元的上限,国会为此连续数周争吵不休。为了减少贷款违约的风险,政客们通常会寻求提高债务上限。然而,随着共和党人最近掌管众议院,并要求削减开支,提高债务上限的过程似乎将被拖得更长,并且可能导致故意违约。

美国财政部部长珍妮特·耶伦曾警告美国“自己造成的违约灾难”会影响全球经济,以及将提高债务上限与削减支出挂钩的危害。

也有经济学家认为,债务上限是“可笑的”,对于真正减少支出的作用无异于杯水车薪。亿万富翁投资者、大型投资管理公司桥水联合基金(Bridgewater Associates)的创始人雷·达里奥在LinkedIn上撰文称,债务上限“就像是一群酒鬼在起草强制限制饮酒的法律,只要达到规定的限制,他们就会进行荒唐的谈判,临时取消限制,让他们可以再酗酒狂欢,直到达到新的限制,然后他们又会故技重施,继续酗酒。”

在被问到债务上限是否“有必要”时,美国银行的莫伊尼汉表示,在宪法的范围内,债务上限会继续发挥作用。他说道:“这是一个政治进程,作为一个国家,我们必须就如何做到量入为出展开讨论,而且这场讨论会继续下去。国会掌控了财政大权。我对于修改美国宪法持谨慎的态度。美国宪法已经存在了约250年时间,我们认为应该顺其自然,并保证它正常运行。”

这位银行老板并没有批评导致达到债务上限的决策,他表示:“过去两年,为了克服疫情对经济的拖累,我们不得不背负大量债务。在某种情况下,我们必须弄清楚这种做法未来如何发挥作用,但目前,我们必须解决调整技术结构的问题。”

更乐观的前景

虽然国会仍在就债务上限问题争执不休,但从多个重要经济指标来看,目前的经济前景似乎好于预期。虽然投资银行、经济学家和亿万富翁投资者都预测经济前景暗淡,但美国劳工统计局(Bureau of Labor Statistics)本月公布的劳动力市场数据却显示,美国失业率降至3.4%,为53年最低水平。耶伦表示,这个确切的信号表明美国经济“强劲且有弹性”。

莫伊尼汉也对这则消息感到振奋。他说道,就业是“美联储面临的挑战”之一,但尽管美联储加息,失业率却依旧较低,这表明美联储的政策已经发挥了预期效果,并没有对经济造成伤害。

虽然他依旧预测美国将陷入“适度衰退”,但他认为发生经济衰退的可能性变得越来越低。他还对中美之间的贸易紧张表示乐观。他表示,对中美发生冲突的负面影响的担忧,将是促使双方“回到会议室”,通过谈判缓解紧张局面的关键。(财富中文网)

译者:刘进龙

审校:汪皓

More than a decade ago, Bank of America CEO Brian Moynihan was one of a handful of bankers to write to Congress warning lawmakers how terrible it would be to default on the country’s debt. Twelve years on and Moynihan has said that both he and corporate leaders across America and around the world must be prepared for the real possibility that it could finally happen.

Speaking on CNN This Morning, Moynihan said that although he is hoping his long-held fears won’t come true, hope simply “isn’t a strategy.”

Moynihan’s words come following weeks of congressional bickering after the U.S. government hit its debt ceiling of $31.4 trillion on Jan. 19. Typically politicians will seek to raise this ceiling to alleviate the risk of defaulting on loans. However, with the Republicans recently taking control of the House of Representatives—and demanding spending cuts—it seems that the process will take longer than usual and could lead to an intentional default.

Treasury Secretary Janet Yellen has warned of the “self-inflicted calamity” a default would inflict on the global economy, and of the dangers of linking an increase in the debt ceiling to cuts.

Other economists believe the debt ceiling is a “farce” that has little teeth to actually curb spending. Ray Dalio, billionaire investor and founder of the investment management giant Bridgewater Associates, wrote on LinkedIn that the cap is “like a bunch of alcoholics who write laws to enforce drinking limits, and when a limit is reached, they do a farcical negotiation that temporarily eliminates the limit which allows them to have the next drinking binge until they reach the next limit at which time they go through the next farcical negotiation and continue to binge.”

When asked whether or not the limit is “worth it,” Bank of America’s Moynihan voiced his belief in continuing to work within the parameters of the Constitution. “It’s a political process and there’s got to be an argument about how we make sure we live within our means as a country, and that argument’s going to go on,” he said. “Congress has the purse strings. I would be careful about trying to restructure the U.S. Constitution. It’s been around for 250 years almost, I think we should leave it alone and make sure it operates correctly.”

The banking boss wasn’t critical of the decisions that led to the ceiling being reached, adding, “We had to put on a lot of debt over the past couple of years to overcome the pandemic drag on the economy. At some point we’ve got to figure out how that works in the future, but right now we’ve got to get past the issues of just getting through the technical structure.”

Rosier outlook

As the debt ceiling bickering continues in Congress, the current economic outlook appears rosier than expected by several key economic measures. Despite ongoing doom and gloom predictions from investment banks, economists, and billionaire investors, labor market data from the Bureau of Labor Statistics released this month showed the unemployment rate fell to a 53-year low of 3.4%. A sure sign, Yellen added, that the economy is “strong and resilient.”

Moynihan was also buoyed by the news. Employment is one of the “challenges for the Fed,” he said, but the fact that unemployment had remained low despite the central bank raising rates was a sign the policy has had its desired effects without being detrimental to the economy.

And although the CEO is still predicting a “mild recession,” he added that the prospect of one is growing more distant. He was also sanguine about trade tensions with China, saying that the fear of a negative impact from a falling out between China and the U.S. would be key to getting people “back in a room” to ease tensions through negotiations.