婴儿潮一代也退休了,令美国通胀雪上加霜

如今人们可能会看到,在快餐店端盘子的美国老年人以及在当地百货店干兼职的老年人越来越少。

这些消失的员工不仅仅让店面迟迟无法撤掉“需要人手”的招工启事,同时也让居高不下的通胀水平变得越发难以管控。

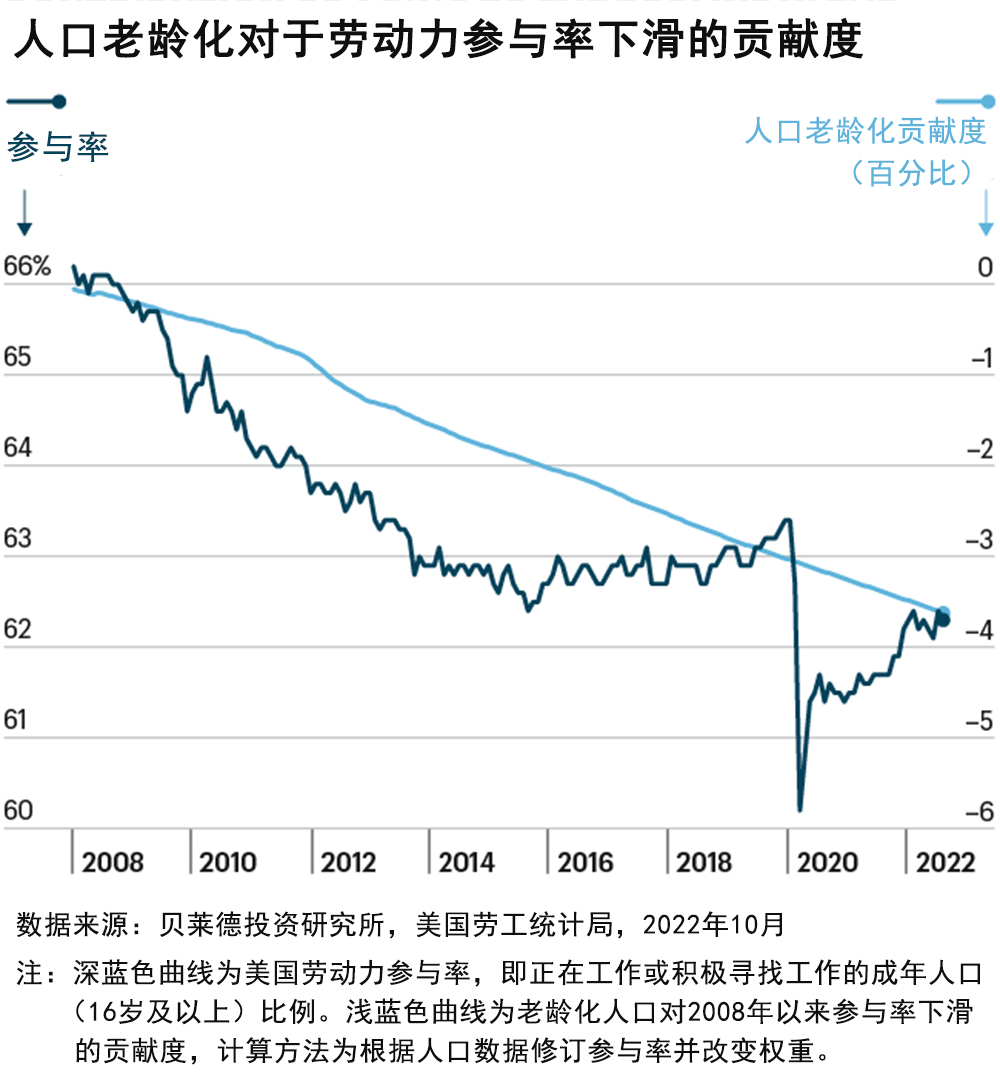

最近贝莱德(BlackRock)发布报告称,美国65岁以上老年人的数量在不断增长而且达到了退休年龄,此外,这些老年人不再回归工作的比例已经达到了疫情前水平。这一现象会给劳动力短缺以及薪酬和雇员利用等问题带来重大影响,同时还会波及当前和未来的通胀水平。

贝莱德分析师称:“老龄化加剧了劳动力的短缺,推高了控制通胀的成本。”

毕马威(KPMG)首席经济师戴安娜∙斯旺克对《财富》杂志说,从1995年到2020年2月,65岁以上人群劳动力参与率实际上在不断增长。然而,当疫情爆发后,他们的参与率因一系列原因出现了下滑,包括该人群更容易受到病毒感染等,斯旺克说道。

尽管劳动力参与率较新冠疫情初期的暴跌有所恢复,但劳动力短缺的问题依然存在。其中很大一部分源于老年人不再回归劳动力市场。贝莱德的报告显示,截至2022年10月,常规退休已经让130万美国人(64岁以上)脱离了劳动力大军,还有63万人因提前退休而脱离。

11月30日,美联储主席杰罗姆∙鲍威尔在布鲁金斯学会发表讲话时表示,当前的劳动力参与率缺口大多归咎于“超量退休”,也就是退休人群数量超过了人们对老龄化人口退休的预期。在350万的劳动力缺口中,超量退休贡献的缺口超过了200万人。

鲍威尔称:“老年人的退休率仍在上升,而且他们在退休后回归劳动力市场的比例也不够大,无法有效减少过量退休人员的总数。”

斯旺克说,虽然这可能不是个大问题,但事实在于,当前没有足够多的年轻员工来完全替代即将退休并永久退出劳动力大军的婴儿潮人群。

“这些事件都碰到一块了,人口老龄化,再加上疫情的催化,进一步破坏了我们增加适龄劳动力数量的能力,” 斯旺克说。“如果不实施重大改革,我们无法填补这些变化造成的劳动力空洞。”

就在上述缺口导致劳动力紧缺的同时,雇主为了吸引和留住所需的雇员一直在调高薪资,并直接放弃了其所期望的用工标准。贝莱德分析师还预测,仅靠美联储的加息也不大可能解决劳动力短缺这类窘境。

分析师写道:“有鉴于人口的不断老龄化,美国经济将难以在不出现长期通胀的情况下实现增长。经济活动将需要在更低水平运行,才能避免持续的薪资和价格通胀,尤其是劳动力密集的服务行业。”

尽管美联储在疫情初期称,供应链问题和疫情相关因素(并非薪资)是价格高涨的推手,但鲍威尔在11月30日表示,这一现象随着通胀的持续发生了改变。“不过这是一个时间的问题,通胀如今已经波及经济的各个方面。尽管我依然认为,我们当前经历的通胀与薪资没有太大的关系,然而在未来,薪资增长很有可能成为通胀非常重要的推手。”

老龄化的婴儿潮人群还存在额外成本,包括生活成本调整,例如社保将于明年实施的生活费调整。斯旺克指出,最终,6600多万美国民众将迎来8.7%的收入增幅。她说:“此举为已然在负重前行的美联储增添了新的担子。”她还表示,此举可能会转化为对需求的大幅提振,而美联储却在努力压低这一需求。

不幸的是,在应对人口结构问题带来的劳动力参与率挑战方面,没有多少可在短期内发挥作用的简单解决方案。最大的革命性解决方案就是移民改革,然而,联邦层面对于通过修改美国移民政策来提供更多的劳动力没有多少兴趣。合法移民在2020年-2021年出现了断崖式下跌,尽管目前有所回升,但依然是杯水车薪。

斯旺克说:“从我们面临的紧张地缘政治局势到气候变化,再到极端天气事件以及老龄化的人口结构和管控更加严格的移民政策,就算[美联储]成功消灭了这一次的通胀,但所有这一切都将让这个世界成为通胀滋生的沃土。这也就意味着,我们不会回到21世纪10年代那个受到抑制、不愠不火、努力走出金融危机阴影的世界,而是通往一个大起大落、充满通胀和加息的世界。”(财富中文网)

译者:冯丰

审校:夏林

如今人们可能会看到,在快餐店端盘子的美国老年人以及在当地百货店干兼职的老年人越来越少。

这些消失的员工不仅仅让店面迟迟无法撤掉“需要人手”的招工启事,同时也让居高不下的通胀水平变得越发难以管控。

最近贝莱德(BlackRock)发布报告称,美国65岁以上老年人的数量在不断增长而且达到了退休年龄,此外,这些老年人不再回归工作的比例已经达到了疫情前水平。这一现象会给劳动力短缺以及薪酬和雇员利用等问题带来重大影响,同时还会波及当前和未来的通胀水平。

贝莱德分析师称:“老龄化加剧了劳动力的短缺,推高了控制通胀的成本。”

毕马威(KPMG)首席经济师戴安娜∙斯旺克对《财富》杂志说,从1995年到2020年2月,65岁以上人群劳动力参与率实际上在不断增长。然而,当疫情爆发后,他们的参与率因一系列原因出现了下滑,包括该人群更容易受到病毒感染等,斯旺克说道。

尽管劳动力参与率较新冠疫情初期的暴跌有所恢复,但劳动力短缺的问题依然存在。其中很大一部分源于老年人不再回归劳动力市场。贝莱德的报告显示,截至2022年10月,常规退休已经让130万美国人(64岁以上)脱离了劳动力大军,还有63万人因提前退休而脱离。

11月30日,美联储主席杰罗姆∙鲍威尔在布鲁金斯学会发表讲话时表示,当前的劳动力参与率缺口大多归咎于“超量退休”,也就是退休人群数量超过了人们对老龄化人口退休的预期。在350万的劳动力缺口中,超量退休贡献的缺口超过了200万人。

鲍威尔称:“老年人的退休率仍在上升,而且他们在退休后回归劳动力市场的比例也不够大,无法有效减少过量退休人员的总数。”

斯旺克说,虽然这可能不是个大问题,但事实在于,当前没有足够多的年轻员工来完全替代即将退休并永久退出劳动力大军的婴儿潮人群。

“这些事件都碰到一块了,人口老龄化,再加上疫情的催化,进一步破坏了我们增加适龄劳动力数量的能力,” 斯旺克说。“如果不实施重大改革,我们无法填补这些变化造成的劳动力空洞。”

就在上述缺口导致劳动力紧缺的同时,雇主为了吸引和留住所需的雇员一直在调高薪资,并直接放弃了其所期望的用工标准。贝莱德分析师还预测,仅靠美联储的加息也不大可能解决劳动力短缺这类窘境。

分析师写道:“有鉴于人口的不断老龄化,美国经济将难以在不出现长期通胀的情况下实现增长。经济活动将需要在更低水平运行,才能避免持续的薪资和价格通胀,尤其是劳动力密集的服务行业。”

尽管美联储在疫情初期称,供应链问题和疫情相关因素(并非薪资)是价格高涨的推手,但鲍威尔在11月30日表示,这一现象随着通胀的持续发生了改变。“不过这是一个时间的问题,通胀如今已经波及经济的各个方面。尽管我依然认为,我们当前经历的通胀与薪资没有太大的关系,然而在未来,薪资增长很有可能成为通胀非常重要的推手。”

老龄化的婴儿潮人群还存在额外成本,包括生活成本调整,例如社保将于明年实施的生活费调整。斯旺克指出,最终,6600多万美国民众将迎来8.7%的收入增幅。她说:“此举为已然在负重前行的美联储增添了新的担子。”她还表示,此举可能会转化为对需求的大幅提振,而美联储却在努力压低这一需求。

不幸的是,在应对人口结构问题带来的劳动力参与率挑战方面,没有多少可在短期内发挥作用的简单解决方案。最大的革命性解决方案就是移民改革,然而,联邦层面对于通过修改美国移民政策来提供更多的劳动力没有多少兴趣。合法移民在2020年-2021年出现了断崖式下跌,尽管目前有所回升,但依然是杯水车薪。

斯旺克说:“从我们面临的紧张地缘政治局势到气候变化,再到极端天气事件以及老龄化的人口结构和管控更加严格的移民政策,就算[美联储]成功消灭了这一次的通胀,但所有这一切都将让这个世界成为通胀滋生的沃土。这也就意味着,我们不会回到21世纪10年代那个受到抑制、不愠不火、努力走出金融危机阴影的世界,而是通往一个大起大落、充满通胀和加息的世界。”(财富中文网)

译者:冯丰

审校:夏林

These days, you’re likely to see fewer older Americans handing over your fast food order or working part-time at the local grocery store.

Those missing workers are not just causing the “help wanted” signs to linger, but are actually making it harder to tame sky-high inflation levels.

The number of older Americans over the age of 65 is not only growing and hitting their retirement age, they’re also not coming back to the workforce in the numbers seen prior to the COVID-19 pandemic. That has major implications—not only for issues like worker shortages and compensation and employee leverage, but also for current and future inflation levels, according to a recent BlackRock report.

“Aging has worsened labor shortages, raising the cost of taming inflation,” BlackRock analysts report.

From 1995 to February 2020, the labor force participation rate among those over age 65 had actually been growing, Diane Swonk, chief economist for KPMG, tells Fortune. But when the pandemic hit, their participation rate dropped owing to a variety of reasons—including that this demographic was more vulnerable to the virus, Swonk says.

Although the labor force participation rate has recovered from the nosedive it took early in the COVID-19 pandemic, there’s still a lingering shortfall of workers. And a good portion of that stems from older workers not returning to the workforce. Routine retirements have taken 1.3 million Americans (age 64 and older) out of the workforce as of October 2022, BlackRock reports. Another 630,000 have left because of early retirement.

The current labor force participation rate gap is mostly the result of “excess retirements,” or exits above and beyond what would have been expected from aging alone, Fed Chair Jay Powell noted during an appearance on Wednesday. Those excess retirements are estimated to account for more than 2 million of the 3.5 million–person shortfall in the labor force.

“Older workers are still retiring at higher rates, and retirees do not appear to be returning to the labor force in sufficient numbers to meaningfully reduce the total number of excess retirees,” Powell said.

That perhaps wouldn’t be an issue, except for the fact that there aren’t enough younger workers to fully replace the sheer number of baby boomers who are retiring and permanently exiting the workforce, Swonk says.

“You really have this sort of collision of events of aging demographics that has been accelerated by the pandemic further undermining our ability to grow the prime-age labor force,” Swonk says. “Without major reforms, we’re just not going to be able to fill the hole that was left by those shifts.”

That shortfall makes for a tighter workforce where employers have been upping wages to attract and retain the employees they need, as well as simply forgoing the desired staffing levels. And the Federal Reserve’s interest rate hikes alone are unlikely to cure constraints like labor shortages, BlackRock’s analysts predict.

“An aging population will hurt the U.S. economy’s ability to grow without creating inflation longer term,” the analysts write. “Economic activity will need to run at a lower level to avoid persistent wage and price inflation, especially in the labor-heavy services sector.”

While the Fed reported early in the pandemic that supply-chain issues and pandemic-related conditions—not wages—were contributing to rising prices, that has shifted as inflation has persisted, Powell said Wednesday. “Over time though, inflation has now spread broadly through the economy. And while I would still say that the inflation we’re seeing now is not principally related to wages, we think that wage increases are probably going to be a very important part of the story going forward.”

There are additional costs tied to aging baby boomers, including cost of living adjustments like the one Social Security is set to implement next year. Essentially, over 66 million people are going to get an 8.7% raise, Swonk notes. “It ups the ante on the Fed at a time when they’re already challenged,” she says, adding that this likely translates to a pretty significant boost to demand when the Fed is trying to cool it.

Unfortunately, there aren’t a lot of easy or short-term solutions that address the demographic challenges to the labor force participation rate. The biggest game-changing solution is immigration reform, but there’s been little appetite at the federal level to overhaul U.S. immigration policy to provide more workers. Legal immigration fell off a cliff in 2020 and 2021, and while it’s picking up again, it’s still not enough.

“From the geopolitical tensions we face to climate change to extreme weather events to the aging demographics and harsher borders—all of that makes for a more inflation-prone world even after [the Fed] slays this one inflation dragon. Which means we’re moving not back to the subdued, tepid, trying-to-recover-from-a-financial-crisis world that we were in during the 2010s, but to a much more boom-bust cycle punctuated by inflation and interest rate hikes,” Swonk says.