社交外汇交易的诡异新世界:熟人拉新,风险已现

推特、TikTok、Instagram上各种各样的亚文化:从复杂的舞蹈、舒缓的视频,到搞笑的情侣挑战,层出不穷。不过大众可能很难想象,伴随着巨大风险的外汇日间交易也能在社交媒体上兴起并流行起来。

“Forex”(foreign exchange的缩写,意为外汇交易)一词来自华尔街,在这里,资深交易者会对外汇市场的走向进行一场场激动人心地下注。过去几年,Robinhood等线上股票交易平台的兴起给股票交易者带来了更广阔的舞台。但这一投资领域也汇集了两大高风险投资概念:外汇交易与多级分销。与此同时,交易者只需持有一部手机、一个能够追踪市场动态的应用程序即可进行相关交易,而如此低的入场门槛也正是其问题所在。

哈里•布什是一名所谓的“50级主席”,在社交媒体外汇交易界,这一头衔意味着他每个月能够挣到5万美元。布什现年23岁,从两年前开始通过TradeHouse投资集团进行交易,当时他还只是一名想要赚点外快在校大学生。现在,他在一个名为Money Magnets的组织中负责监管自己的团队,手下共有2500多名成员。

TradeHouse等投资集团与在线教育平台IM Mastery Academy建有合作关系,它们会借助该平台的线上课程和网络研讨会对成员进行交易方面的培训。社交外汇交易包含两个侧面:其一是外汇交易,其二是“网络营销”,即参与者可以通过介绍新人开户赚取佣金。

布什解释说:“交易者每月需要支付400美元出头的订阅费,若能介绍两个新客户则可以免交当月的订阅费。也就是说,你可以通过交易赚钱,也能够通过扩充团队、提升影响力来赚钱”。根据IM Mastery Academy的佣金计划,部分特定“等级”成员可以获得佣金奖励,比如,白金150等级的成员每周能够从自己团队成员的身上赚到约40美元佣金,而主席500等级的成员每周则可以赚到12.5万美元。

财务规划信托机构Delphi Advisers的总裁本•赖斯表示,问题不在于外汇交易是否有利可图,而在于这种交易是否适合普通交易者:“大多情况下,这些交易者并不具备预判市场未来走势的能力,他们对此也并不讳言。外汇交易并不是一种适合大众的投资品种,专业交易者和非常熟悉市场的人当然能够参与其中,但真的不适合散户练手。”

虽然在布什眼中,这是一个赚取被动收入的机会,但阿维莉娜•詹姆斯则持有不同看法。她说:“这些人喊着‘分享机会’或者‘加入我们的团队’的口号,感觉好像自己是在帮人实现经济独立一样。”

詹姆斯首次接触外汇交易时正在亚利桑那州立大学读大四,当时她将其视为自己所要寻找的投资机会。她说自己当时已经可以使用“harmonic scanner”这样的高级软件, 这类工具能够检测货币、加密货币以及其他目标的波动模式,从而帮助交易者做出合理的决策。此外,她的投资团队每周都会召开会议,(至少是尝试着去)了解市场状况并解答大家关心的问题。

詹姆斯表示:“当我碰到自己解决不了的问题时,我会去找我的投资团队商量,请大家帮我分析究竟是怎么一回事。但大多时候他们也弄不明白。我也是从那时开始对这件事产生了疑虑。”

而且,当她请交易者们提供赚钱的证据时,通常都会被拒绝。那些交易者会对她说: “你肯定不会问自己的老板要银行对账单吧。”熟人的拉新压力也让她感到困扰。

詹姆斯说:“如果别人不想参与外汇交易,我们不能说‘你这辈子活该受穷’这种话。在我看来,如果你真是想要帮助、培养他们,那你就应该注意自己的方式。”她表示,虽然外汇交易有可能赚钱,但当人们发现实际操作的难度时,很多人就开始转而走上通过拉新赚取被动收入的道路。

Instagram上的招募者

新一代外汇交易者会通过Instagram和推特来分享全美各地的导师讲座、成功经验分享会和本地聚会信息。詹姆斯解释说,你拉到的客户越多,赚到的回报也就越多。

兰迪•“鲁迪”•鲁道夫是TradeHouse投资集团旗下另一个投资团队Market Bullies的创建者,该团队同样在使用IM Mastery Academy的线上平台传授交易策略。鲁道夫表示,并非每个团队都对交易知识分享给予了足够重视,这也是外汇市场名声不好的原因。

“在外汇交易的世界,导师就是一切。如果你的导师重视交易技能培养,那你就能够获得一段不错的经历,但如果你的导师非常贪婪,满脑子想的只是赚取被动收入,那就糟了……在Instagram、Facebook、推特这些平台上,人们看到的往往都是些外汇交易者升级、旅行的内容,而我们真正想要推广的教育内容则很难进入大家的视野。”

鲁道夫建议,在开立真实账户前,交易者可以先通过模拟账户或练习账户使用虚拟货币进行模拟交易。MetaTrader 4(MT4)是一款广受外汇市场散户交易者欢迎的交易应用程序。新人也能够通过IM Mastery Academy学习如何自己分析市场趋势。

鲁道夫表示,为降低(新人投资者的)预期,资深外汇交易者通常会尽量避免在社交媒体上发布有关自己生活方式的贴文。如果他们发布了涉及昂贵手表或游艇的图片,IM Mastery则会要求他们撤下这些图片或对图片进行模糊处理,避免引起美国联邦贸易委员会的注意。2018年,有8家公司被指控违反了保护消费者权益免受欺诈侵害的相关注册规定,其中就包括iMarketsLive。

《财富》杂志在试图联系IM Mastery Academy(此前曾经以iMarketsLive的名义运营)寻求置评时收到了一条信息,称该公司的电子邮件账户已经不再使用,且该公司也不提供电话服务。《财富》杂志试图通过社交媒体联系IM Mastery时收到的自动回复信息则建议联系客服。而在《财富》杂志给其客服团队发送邮件后,每次收到的回复都是“建议登录网站联系客服”。

IM Mastery Academy总部位于纽约,也曾经引起国外监管机构的关注。2018年1月,比利时的一个政府机构便发布了有关该公司的警告信息。

该警告信息写道:“按照该公司(International Markets Live)开出的条件,成员拉新越多,能够获得的好处和佣金也就越多。然而该公司并未获得在比利时提供金融服务与产品的授权,且该公司的体系架构具有传销特征。”

当年晚些时候,英国也发布了类似通知,警告称,如遇变故,向不受监管的企业投资的交易者将不受法律保护。美国商品期货交易委员会(CFTC)曾经发现,有些声称自己在管理客户资金的外汇交易者本身毫无交易经验。2019年,CFTC对一家名为FuturesFX的企业及其创始人西蒙•朱瑟夫提起民事诉讼,指控其“采用欺诈手段诱骗美国及美国以外人士注册加入包含所谓‘实时’外汇交易平台、大宗商品期货线上交易室、教学视频及线上客服等功能的交易系统。”

对于那些希望通过合法途径学习外汇交易的人而言,想做好也并不容易,业余交易者尤其如此。安东尼丝•海托尔是芝加哥的一名教育工作者,她如果想在东京市场进行交易,就需要在美东时间晚上7点到凌晨4点熬夜看盘。

海托尔说:“工作时我也会找机会去看看走势图,但哪怕只有五分钟没看盘,市场下行也会给我造成一定损失。”为了控制风险、避免因糟糕的交易决策造成太大损失,海托尔只在自己的账户里非常谨慎地放了15美元。

在寻找适合自身交易节奏的过程中,她赚过一些小钱,也有过亏损的情况,就这样,第一个月很快就过去了,也到了向所属交易团队支付月度会员费的时候。

海托尔说:“他们想让我在Instagram上发布‘你应该参与其中’的推荐帖,但我做不到,原因是这东西连我自己都不完全看好。”她现在已经将自己对交易的兴趣暂时抛在了脑后。

杠杆是关键的危险信号。外汇市场允许使用高杠杆,有些货币的杠杆可达1比50,也就是说,只要1000美元便可进行价值5万美元的交易。然而如果投资失败,等待着投资者的将是倾家荡产甚至更糟糕的下场。

赖斯表示:“现实是,如果你使用了杠杆,那么你也可能会很快亏掉很多钱。任何人只要说自己靠外汇交易只用几个月的时间就赚到了买车的钱,那么无论真假,都说明他们在交易中承担了很高的风险,而这种风险可以让他们瞬间破产。”

如果希望安全地进行外汇交易,赖斯建议投资者应该去找那种注册经纪商,并了解其佣金收取方式:经纪商的盈利方式能够在很大程度上反映他们的激励机制。作为一名注册投资顾问,赖斯表示,考虑到市场的波动性,他很难向自己的客户证明外汇交易是一种理想的投资选择。

他说:“我必须证明外汇投资可以作为长期投资,能够在为养老准备的投资组合中占有一席之地。但本质上外汇交易是一种投机行为,而不是长期投资。”(财富中文网)

译者:梁宇

审校:夏林

推特、TikTok、Instagram上各种各样的亚文化:从复杂的舞蹈、舒缓的视频,到搞笑的情侣挑战,层出不穷。不过大众可能很难想象,伴随着巨大风险的外汇日间交易也能在社交媒体上兴起并流行起来。

“Forex”(foreign exchange的缩写,意为外汇交易)一词来自华尔街,在这里,资深交易者会对外汇市场的走向进行一场场激动人心地下注。过去几年,Robinhood等线上股票交易平台的兴起给股票交易者带来了更广阔的舞台。但这一投资领域也汇集了两大高风险投资概念:外汇交易与多级分销。与此同时,交易者只需持有一部手机、一个能够追踪市场动态的应用程序即可进行相关交易,而如此低的入场门槛也正是其问题所在。

哈里•布什是一名所谓的“50级主席”,在社交媒体外汇交易界,这一头衔意味着他每个月能够挣到5万美元。布什现年23岁,从两年前开始通过TradeHouse投资集团进行交易,当时他还只是一名想要赚点外快在校大学生。现在,他在一个名为Money Magnets的组织中负责监管自己的团队,手下共有2500多名成员。

纸币上缘曲折的线条模拟了过去一个月间美元指数的走势。

TradeHouse等投资集团与在线教育平台IM Mastery Academy建有合作关系,它们会借助该平台的线上课程和网络研讨会对成员进行交易方面的培训。社交外汇交易包含两个侧面:其一是外汇交易,其二是“网络营销”,即参与者可以通过介绍新人开户赚取佣金。

布什解释说:“交易者每月需要支付400美元出头的订阅费,若能介绍两个新客户则可以免交当月的订阅费。也就是说,你可以通过交易赚钱,也能够通过扩充团队、提升影响力来赚钱”。根据IM Mastery Academy的佣金计划,部分特定“等级”成员可以获得佣金奖励,比如,白金150等级的成员每周能够从自己团队成员的身上赚到约40美元佣金,而主席500等级的成员每周则可以赚到12.5万美元。

(如果你帮我付235美元的入门费我就加入你的外汇交易团队,等我上来后会把钱再还给你,只能这样)

财务规划信托机构Delphi Advisers的总裁本•赖斯表示,问题不在于外汇交易是否有利可图,而在于这种交易是否适合普通交易者:“大多情况下,这些交易者并不具备预判市场未来走势的能力,他们对此也并不讳言。外汇交易并不是一种适合大众的投资品种,专业交易者和非常熟悉市场的人当然能够参与其中,但真的不适合散户练手。”

虽然在布什眼中,这是一个赚取被动收入的机会,但阿维莉娜•詹姆斯则持有不同看法。她说:“这些人喊着‘分享机会’或者‘加入我们的团队’的口号,感觉好像自己是在帮人实现经济独立一样。”

詹姆斯首次接触外汇交易时正在亚利桑那州立大学读大四,当时她将其视为自己所要寻找的投资机会。她说自己当时已经可以使用“harmonic scanner”这样的高级软件, 这类工具能够检测货币、加密货币以及其他目标的波动模式,从而帮助交易者做出合理的决策。此外,她的投资团队每周都会召开会议,(至少是尝试着去)了解市场状况并解答大家关心的问题。

詹姆斯表示:“当我碰到自己解决不了的问题时,我会去找我的投资团队商量,请大家帮我分析究竟是怎么一回事。但大多时候他们也弄不明白。我也是从那时开始对这件事产生了疑虑。”

这哥们约我出来只是为了说服我参与外汇交易

而且,当她请交易者们提供赚钱的证据时,通常都会被拒绝。那些交易者会对她说: “你肯定不会问自己的老板要银行对账单吧。”熟人的拉新压力也让她感到困扰。

詹姆斯说:“如果别人不想参与外汇交易,我们不能说‘你这辈子活该受穷’这种话。在我看来,如果你真是想要帮助、培养他们,那你就应该注意自己的方式。”她表示,虽然外汇交易有可能赚钱,但当人们发现实际操作的难度时,很多人就开始转而走上通过拉新赚取被动收入的道路。

Instagram上的招募者

新一代外汇交易者会通过Instagram和推特来分享全美各地的导师讲座、成功经验分享会和本地聚会信息。詹姆斯解释说,你拉到的客户越多,赚到的回报也就越多。

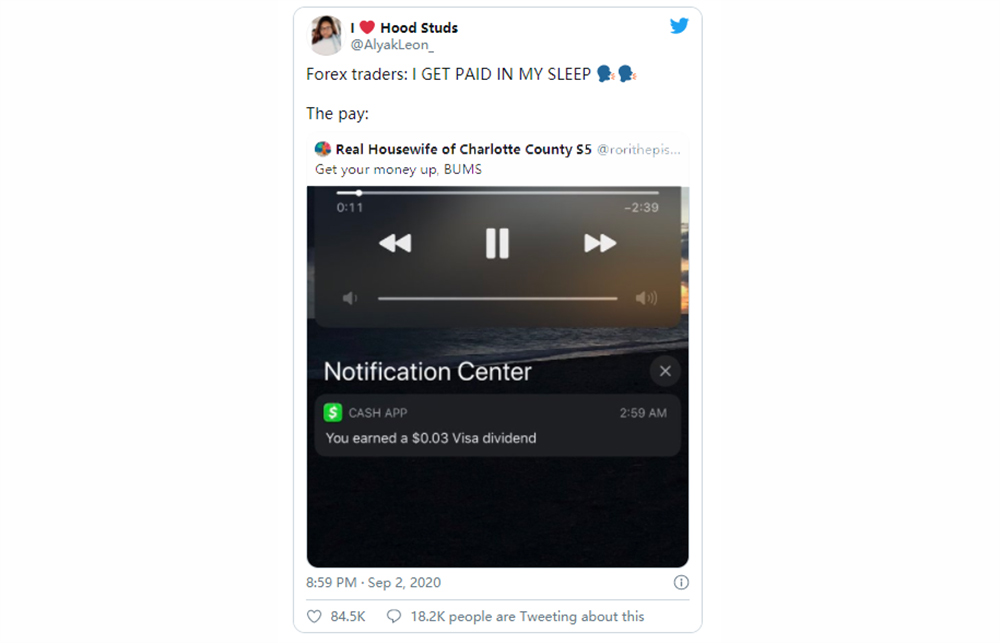

外汇交易者:赚取“睡后收入”

兰迪•“鲁迪”•鲁道夫是TradeHouse投资集团旗下另一个投资团队Market Bullies的创建者,该团队同样在使用IM Mastery Academy的线上平台传授交易策略。鲁道夫表示,并非每个团队都对交易知识分享给予了足够重视,这也是外汇市场名声不好的原因。

“在外汇交易的世界,导师就是一切。如果你的导师重视交易技能培养,那你就能够获得一段不错的经历,但如果你的导师非常贪婪,满脑子想的只是赚取被动收入,那就糟了……在Instagram、Facebook、推特这些平台上,人们看到的往往都是些外汇交易者升级、旅行的内容,而我们真正想要推广的教育内容则很难进入大家的视野。”

鲁道夫建议,在开立真实账户前,交易者可以先通过模拟账户或练习账户使用虚拟货币进行模拟交易。MetaTrader 4(MT4)是一款广受外汇市场散户交易者欢迎的交易应用程序。新人也能够通过IM Mastery Academy学习如何自己分析市场趋势。

鲁道夫表示,为降低(新人投资者的)预期,资深外汇交易者通常会尽量避免在社交媒体上发布有关自己生活方式的贴文。如果他们发布了涉及昂贵手表或游艇的图片,IM Mastery则会要求他们撤下这些图片或对图片进行模糊处理,避免引起美国联邦贸易委员会的注意。2018年,有8家公司被指控违反了保护消费者权益免受欺诈侵害的相关注册规定,其中就包括iMarketsLive。

《财富》杂志在试图联系IM Mastery Academy(此前曾经以iMarketsLive的名义运营)寻求置评时收到了一条信息,称该公司的电子邮件账户已经不再使用,且该公司也不提供电话服务。《财富》杂志试图通过社交媒体联系IM Mastery时收到的自动回复信息则建议联系客服。而在《财富》杂志给其客服团队发送邮件后,每次收到的回复都是“建议登录网站联系客服”。

IM Mastery Academy总部位于纽约,也曾经引起国外监管机构的关注。2018年1月,比利时的一个政府机构便发布了有关该公司的警告信息。

该警告信息写道:“按照该公司(International Markets Live)开出的条件,成员拉新越多,能够获得的好处和佣金也就越多。然而该公司并未获得在比利时提供金融服务与产品的授权,且该公司的体系架构具有传销特征。”

当年晚些时候,英国也发布了类似通知,警告称,如遇变故,向不受监管的企业投资的交易者将不受法律保护。美国商品期货交易委员会(CFTC)曾经发现,有些声称自己在管理客户资金的外汇交易者本身毫无交易经验。2019年,CFTC对一家名为FuturesFX的企业及其创始人西蒙•朱瑟夫提起民事诉讼,指控其“采用欺诈手段诱骗美国及美国以外人士注册加入包含所谓‘实时’外汇交易平台、大宗商品期货线上交易室、教学视频及线上客服等功能的交易系统。”

对于那些希望通过合法途径学习外汇交易的人而言,想做好也并不容易,业余交易者尤其如此。安东尼丝•海托尔是芝加哥的一名教育工作者,她如果想在东京市场进行交易,就需要在美东时间晚上7点到凌晨4点熬夜看盘。

海托尔说:“工作时我也会找机会去看看走势图,但哪怕只有五分钟没看盘,市场下行也会给我造成一定损失。”为了控制风险、避免因糟糕的交易决策造成太大损失,海托尔只在自己的账户里非常谨慎地放了15美元。

在寻找适合自身交易节奏的过程中,她赚过一些小钱,也有过亏损的情况,就这样,第一个月很快就过去了,也到了向所属交易团队支付月度会员费的时候。

海托尔说:“他们想让我在Instagram上发布‘你应该参与其中’的推荐帖,但我做不到,原因是这东西连我自己都不完全看好。”她现在已经将自己对交易的兴趣暂时抛在了脑后。

名叫“外汇交易”的疯人院

——一条线索

杠杆是关键的危险信号。外汇市场允许使用高杠杆,有些货币的杠杆可达1比50,也就是说,只要1000美元便可进行价值5万美元的交易。然而如果投资失败,等待着投资者的将是倾家荡产甚至更糟糕的下场。

赖斯表示:“现实是,如果你使用了杠杆,那么你也可能会很快亏掉很多钱。任何人只要说自己靠外汇交易只用几个月的时间就赚到了买车的钱,那么无论真假,都说明他们在交易中承担了很高的风险,而这种风险可以让他们瞬间破产。”

如果希望安全地进行外汇交易,赖斯建议投资者应该去找那种注册经纪商,并了解其佣金收取方式:经纪商的盈利方式能够在很大程度上反映他们的激励机制。作为一名注册投资顾问,赖斯表示,考虑到市场的波动性,他很难向自己的客户证明外汇交易是一种理想的投资选择。

他说:“我必须证明外汇投资可以作为长期投资,能够在为养老准备的投资组合中占有一席之地。但本质上外汇交易是一种投机行为,而不是长期投资。”(财富中文网)

译者:梁宇

审校:夏林

Complicated dance moves, soothing videos, funny couple challenges…a hive of foreign exchange day traders? Of all the subcultures on Twitter, TikTok, and Instagram, this is one of the most improbable—and riskiest—to emerge. But it’s a real and growing trend.

Slinging “forex” (short for foreign exchange trading) used to be reserved for specialty desks on Wall Street, where experienced traders made nail-biting bets that currencies would move in one direction or another. Over the past several years Robinhood and other online stock trading platforms have broadened the market for equities traders. But in this corner of the investment world, two high-risk concepts are being fused together: foreign exchange trading and multilevel marketing. All you need is a phone and any app that tracks the market—which is exactly the problem, say critics.

Khari Bush is a chairman 50—which, in the social media forex world means he makes $50,000 a month. Bush, 23, started trading with TradeHouse Investment Group two years ago as a college student looking for extra cash. Now he oversees his own team within a group called Money Magnets with over 2,500 members.

TradeHouse and other investment groups partner with online learning platform IM Mastery Academy, using it to teach members how to trade through online classes and webinars. There are two sides to the business: trading currency and then the “network marketing” side where you get paid to bring in new accounts.

“There’s a monthly subscription. In order for you to get that subscription waived, you enroll two people,” Bush explains, adding that the fee is a little over $400. “So you have the money that you make from trading, and you got the money that you make from growing the team and having an impact.” According to IM Mastery Academy’s compensation plan, there are certain “ranks” members are awarded: A platinum 150 can make around $40 a week from his team members. A chairman 500? $125,000 a week.

Ben Lies, president of financial planning fiduciary Delphi Advisers, says it’s not a question of whether trading currency can be profitable but if it’s viable for the average investor: “People don’t even pretend to be able to forecast it in most cases. It’s really not something that a lot of people should be involved in for the most part. Professional traders and people who have a lot of familiarity, sure. But for retail investors, it’s not a great place to cut your teeth.”

And where Bush saw an opportunity to make residual income, Averyanna James saw something else. “They call it ‘teaching somebody about the opportunity’ or ‘joining our team.’ They just feel like they’re helping another person become financially independent,” she says.

James was in her senior year at Arizona State University when she first encountered forex trading, and it seemed like the investment opportunity she was looking for. She had access to fancy software tools like the “harmonic scanner,” which detects patterns in currency fluctuations, cryptocurrency, and more to help traders make informed decisions, she says. And her investment group had weekly meetings to go over the market and answer questions—or at least try to.

“There were times where I would have questions, and I would go to the investment group, and I would ask, ‘Can you explain to me what this is?’ And most of the time they wouldn’t know. And so that’s when my concerns kind of started to form,” James says.

When she asked traders for proof of their success in the market, they were often unwilling to share. “You wouldn’t go to your boss and ask them what their bank statements are,” she says they told her. The pressure to sign up new recruits from among her contacts also troubled her.

“If someone’s not interested in joining, you don’t have to say, ‘Oh, you’re gonna be broke for the rest of your life,’” James says. “I don’t think that’s how you should treat people if you’re really here to help and educate them.” While it’s possible to be successful trading currency, when people realize how difficult it is to learn, she says, they turn to signing people up instead so that they can receive the residual income.

Instagram recruiters

On Instagram and Twitter, the new breed of forex traders share opportunities for mentorships, success stories, and local meetups across the U.S. The more people you can persuade to sign up, James explains, the more money you start to get back.

Randy “Rudy” Rudolph started Market Bullies, another team under TradeHouse Investment Group that uses IM Mastery Academy’s online platform to teach trading strategies. Not every group emphasizes passing along trading knowledge, which is why, Rudolph says, forex gets a bad reputation.

“Mentorship is everything in this opportunity. If your mentor is on it running trainings, then you’re gonna have a good experience,” he says. “If you have people that just are greedy, trying to get residual income, then it’s going to be bad…When people see forex on Instagram, Facebook, Twitter, they see posts about people hitting ranks, and trips they’re taking, and it overshadows the educational piece that we’re really trying to reinforce.”

Rudolph recommends starting with a demo or practice account, and first trading with fake money before opening a real account. A popular app for retail foreign exchange traders is MetaTrader 4 or MT4. From IM Mastery Academy new investors can learn how to analyze market trends for themselves.

Established forex traders try not to post on social media about their lifestyle so as to temper expectations, Rudolph says. If they post images of expensive watches or boats, IM Mastery will ask them to take it down or blur the images to avoid attention from the Federal Trade Commission. In 2018, iMarketsLive was one of eight firms charged with violating registration requirements that safeguard consumers from fraud.

When attempting to reach IM Mastery Academy (which previously operated under the name iMarketsLive) for comment, Fortune received a message that its email account is no longer monitored and that the company does not offer phone support. When Fortune attempted to contact IM Mastery through social media, an automatic reply suggested contacting customer support. Each time Fortune emailed customer support, the response advised logging into the website to contact support that way.

New York–based IM Mastery Academy has also attracted international scrutiny. In Belgium, a government agency issued a warning about the company in January 2018.

“The firm offers its members advantages and compensation that increase the more new members they recruit,” it read. “International Markets Live is not, however, authorized to offer financial services and products in Belgium. Moreover, the system proposed by International Markets Live exhibits features characteristic of a pyramid scheme.”

The U.K. followed with a similar notice later that year, warning that traders who give money to an unregulated firm are not protected by law when things go wrong. In the U.S., the Commodity Futures Trading Commission (CFTC) has seen cases where forex traders claim to manage their clients’ money and, in reality, had no trading experience themselves. In 2019, the CFTC filed a civil lawsuit against a business called FuturesFX and its founder Simon Jousef. Jousef was charged with “fraudulently soliciting people, in the U.S. and abroad, to subscribe to a trading system that included a supposedly ‘live’ foreign exchange (forex) and commodity futures online trading room, educational videos, and online support (trading system).”

For those making a legitimate attempt to learn currency trading, it can be difficult to swing—especially if it’s not your full-time job. Antonise Hightower is an educator in Chicago, and trading in the Tokyo market would require her to work between 7 p.m. and 4 a.m. EST.

“While I was at work, I would try and look at the charts. But even just five minutes could pass and I’ve already lost some money because the chart went down,” says Hightower, who cautiously put $15 in her account to limit the amount of money lost on a bad trade.

After her first month passed with small profits and some losses as she tried to find what worked for her schedule, it was time to pay her monthly membership to her trading group.

“They wanted me to post on Instagram saying, you know, ‘You gotta get out there.’ But I’m not that person to suggest something that I don’t feel completely good about,” says Hightower, who is putting her interest in trading on the back burner for now.

One key red flag is leverage. Forex markets allow high leverage—50 to 1 for some currencies; someone with only $1,000 to trade can trade $50,000 worth of currency. The opposite, losing everything you have, and more, is also true.

“The reality is that when you use leverage, you can also lose a lot of money quickly,” says Lies. “Anybody who says they bought a car—whether it’s true or not––over a couple of months in forex trading took risks that could have bankrupted them.”

To trade currency safely, Lies suggests finding a registered broker and understanding how he or she gets paid; the way that brokers profit says a lot about what their incentive structure is. Lies, who is a registered investment adviser, says it would be hard to justify currency trading to his clients because of the volatility in the markets.

“I would have to prove that it has its place in a long-term, retirement-based portfolio,” he says. “Currency trading by nature is speculation and not long-term investing.”