罗伯特·艾格(Bob Iger)重返迪士尼(Disney),再次担任首席执行官。图片来源:ANGELA WEISS -AFP - GETTY IMAGES

罗伯特·艾格(Bob Iger)重返迪士尼(Disney),再次担任首席执行官。图片来源:ANGELA WEISS -AFP - GETTY IMAGES本周,维权投资者尼尔森·佩尔茨(Nelson Peltz)与迪士尼董事会之间激烈的代理权之争达到高潮,然而,人们很容易忘记,在扣人心弦的争夺迪士尼控制权的戏剧性场面中,在双方的人身攻击中,代理权之争只不过会导致首席执行官罗伯特·艾格分心,而且相当耗时耗力。在整个传统媒体和娱乐行业受到来自科技巨头及其颠覆性技术的前所未有的竞争威胁之际,罗伯特·艾格负责掌管迪士尼。

就其过去的表现而言,我们已经证明佩尔茨和迪士尼首席执行官罗伯特·艾格是截然不同的。佩尔茨是长期表现最差的维权投资者之一,长期以来一直在董事会中破坏价值,而艾格在两度担任首席执行官期间,其股票表现远超媒体同行,为股东创造了超过1600亿美元的价值,迪士尼是今年道琼斯指数中表现最好的股票。

超越过去的业绩,展望迪士尼的未来,艾格所做的不仅仅是维持迪斯尼的正常运转:他写就了媒体和娱乐业历史上最令人瞩目的扭亏为盈和转型故事。仔细研究罗伯特·艾格为迪斯尼未来十年各业务线增长制定的战略路线图,就会发现,如果说有哪家传统媒体公司能在流媒体时代脱颖而出,获得比传统线性业务和有线电视业务更高的盈利能力,那非迪士尼莫属。

流媒体:由于艾格的先见之明,迪士尼在传统媒体同行中拥有先发优势

十多年前,罗伯特·艾格是最早预见到传统“线性捆绑”即将衰落的媒体高管之一。不熟悉媒体业务的观察人士可能无法理解,线性捆绑对传统媒体公司来说是多么有利可图,因为其在向有线电视用户提供内容而获得“传输费”之外,还从广告商那里获得了意外的广告收入。但随着流媒体的普及以及掐线族的出现,越来越多用户取消了有线电视套餐,这使得许多媒体分析师认为,线性捆绑的商业模式正走向长期衰落。

与一些被颠覆和失衡的媒体业同行不同,艾格力图成为一个颠覆者,主动应变,并为线性业务不再像过去那样强势的世界做好准备,还在早期就投入到有线电视向流媒体的转型中。尽管众多批评者表示迪士尼不可能成功推出流媒体平台,但当艾格在2019年推出旗舰产品Disney+流媒体服务时,仅第一天就有1000万订户,在艾格离任前的前15个月内就有1亿订户。

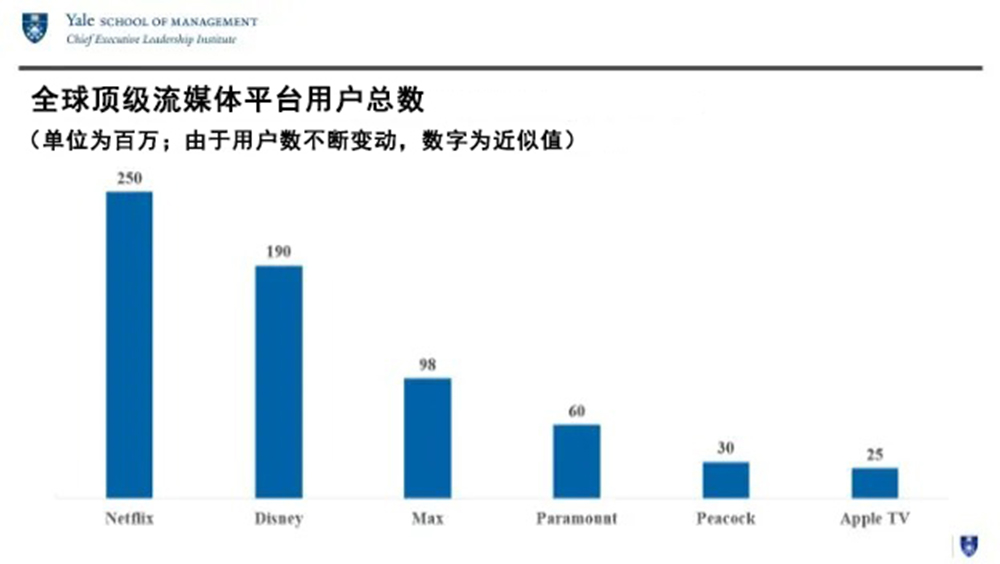

艾格多年来一直在为推出Disney+做准备,他在2017年收购了流媒体技术公司BAMTech的股份。由于艾格的远见卓识和先见之明,迪士尼在实现从线性业务到流媒体的转型方面遥遥领先于传统媒体同行,其流媒体业务带来的收入比传统竞争对手多出数十亿美元。此外,迪士尼流媒体平台的总订户数超过了所有传统媒体同行的总和,迪士尼流媒体平台的全球订户数达到1.9亿(相比之下,华纳兄弟探索频道(Warner Brothers Discovery)运营的Max平台的订户数不到1亿;Paramount+的订户数约为6000万,康卡斯特(Comcast)旗下NBC环球集团(NBC Universal)运营的Peacock的订户数约为3000万;并让大肆宣传的Apple TV相形见绌,其订户数为2500万)。

虽然网飞(Netflix)仍以约2.5亿订户数保持领先地位,但迪士尼正在快速发展,就连网飞也承认“我们两家之间的决斗还将持续很长一段时间”。

尽管股市估值存在巨大差异,但迪斯尼拥有许多网飞所不具备的巨大优势,包括历史悠久的资料库和更多没有时间限制的特许经营项目、在消费品、乐园和度假区之间产生的协同效应,以及真正的规模优势。

迪士尼去年的净收入总额超过了网飞,而收入基数则是网飞的三倍。更不必提及迪士尼的创意引擎,当它全速运转时,仍是无可比拟的:有些人可能会惊讶地发现,在2023年,也就是艾格回归的第一年,美国所有流媒体平台上流量最大的10部电影中,有6部属于迪士尼。

流媒体:未来收入仍有指数级增长潜力

尽管迪斯尼在订户增长方面取得了成功,但许多分析师担心,流媒体时代带来的货币化机会永远赶不上媒体和娱乐公司从传统的线性/有线电视捆绑业务中获得的暴利,而且在利润空间不断缩小的情况下,收入增长将难以为继。但是,现在就敲响媒体和娱乐业盈利能力的丧钟可能还为时过早。显然,流媒体业务仍处于发展的初期阶段。事实上,艾格是第一个承认流媒体业务对迪士尼来说仍是一项“新兴”业务的人,虽然迪士尼进军流媒体只有四年之久,但它仍在进行实时学习,并在军备竞赛中进行相应调整。

艾格已经对迪士尼的流媒体业务进行了重大改进,包括削减开支和适当调整定价结构,以使流媒体平台朝着长期增长和盈利的方向发展。因此,流媒体业务已经从2019年开始时的每年亏损20亿美元,转变为今年的全面盈利。艾格实现了流媒体平台的增长,远远超过了线性业务的衰退速度,没有像他的前任鲍勃·查佩克(Bob Chapek)那样陷入自毁式的流媒体军备竞赛,没有蚕食公司业务,也没有把控制权从创意官员转移到钦点的副手卡里姆·丹尼尔(Kareem Daniel)手中,让Disney+充斥太多无人问津的劣质内容。

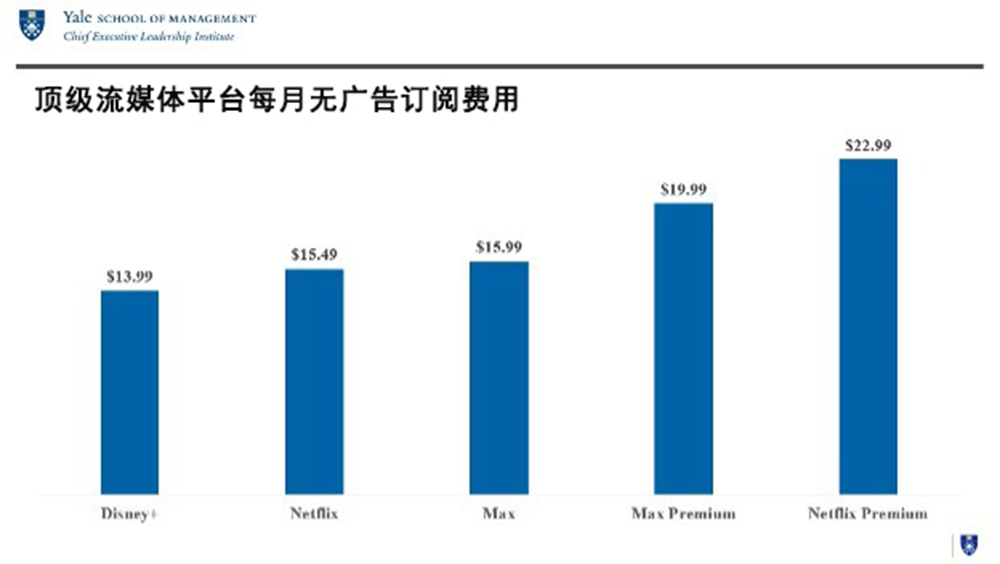

迪斯尼仍有大量尚未开发的机会,不仅可以加速订户增长,还可以加快收入和利润增长。在多次公开采访中,艾格都表示流媒体广告收入具有指数级增长潜力,尤其是更具个性化、更有针对性的数字广告,这对广告商来说比传统的线性电视广告模式更有价值。就像几乎所有竞争对手所做的那样,如果迪斯尼继续拉大无广告和有广告支持的流媒体订阅套餐之间的定价差距,那么流媒体广告收入的增长速度就会进一步加快。令人惊讶的是,迪斯尼仍然拥有竞争对手中最便宜的免广告套餐月费:Disney+的免广告套餐月费13.99美元,比网飞15.49美元的免广告套餐月费便宜,也比Max的15.99美元的免广告套餐月费便宜。同样令人吃惊的是,迪斯尼没有高级版套餐,而竞争对手如网飞和Max,则分别从22.99美元的高级版套餐和19.99美元高级版套餐中赚取利润。至少从纸面上看,迪斯尼有相当大的空间提高无广告订阅套餐的价格。提高价格并不一定会影响可及性和可负担性:Disney+ 7.99美元的广告支持订阅层级对消费者来说仍然非常实惠,对迪斯尼的广告收入也能起到极大的促进作用。

此外,迪士尼还计划在今年晚些时候完成从康卡斯特手中收购Hulu全部股权的协议,将Hulu与迪士尼全资拥有的流媒体平台Disney+和ESPN+全面整合,这也将为迪斯尼带来尚未开发的商机。

迪士尼甚至一开始就拥有Hulu的股份,这证明了艾格的先见之明。如果艾格没有在2018年从鲁伯特·默多克(Rupert Murdoch)手中收购21世纪福克斯,康卡斯特就会收购21世纪福克斯(Hulu是21世纪福克斯的一部分),那么康卡斯特很可能会在今天的流媒体领域领先迪士尼,而不是远远落后,毕竟Peacock只有3000万订户,不到迪士尼订户数的六分之一。对于艾格收购福克斯的交易,最令人信服的批评是,也许他应该从时代华纳(Time Warner)的传奇首席执行官杰夫·比克斯(Jeff Bewkes)手中收购时代华纳,而不是21世纪福克斯,因为时代华纳的资产,包括HBO和华纳兄弟(Warner Bros)的内容库,可能与迪士尼的品牌家族更适配。

另一个被低估的机会来自于新兴流媒体行业的逐渐成熟。2022年,传统媒体公司的流媒体损失总额将超过100亿美元,流媒体军备竞赛的时代很可能在更节制的内容创作和支出中终结。虽然大型科技公司继续大举进军媒体和娱乐业务,但众多流媒体平台却因缺乏获取内容的渠道而难以起步。由于不利的反垄断监管环境,它们很难通过无机并购购买到迫切需要的内容库,这为拥有领先流媒体平台的迪士尼和网飞提供了巨大的竞争优势。

线性:弥合转型差距,削减成本,同时巧妙避免低价销售

艾格成功驾驭了流媒体革命,真正实现了从线性业务的转型,并让线性业务继续蓬勃发展,从而开拓了两全其美的局面。

尽管线性商业模式面临严重压力,但迪士尼旗下的美国广播公司(ABC)和美国广播公司旗下的电视台仍能带来健康收入和利润。如果线性广告市场恢复到更正常的水平,尤其是在今年秋天总统大选(以及相关的广告支出)日益临近的情况下,那么就像许多人预期的那样,收入还有一定的增长潜力。

尽管有大量潜在买家出价,艾格还是巧妙地拒绝以低价出售,同时专注于降低成本,迪士尼节省的75亿美元成本中有很大一部分来自线性成本。艾格还精简了线性业务,将重点放在核心频道上,并削减了经济效益和可行性较差的第三频道。

迪斯尼最近与Charter的谈判为迪斯尼如何继续支持传统的线性商业模式提供了实现双赢的蓝图,同时也能助力其顺利弥合与流媒体业务之间的差距,而迪斯尼则以批发价向Charter客户提供广告支持的Disney+流媒体订阅服务(折扣版),为有线电视客户提供了简单实惠的流媒体选择,以补充其现有的有线电视订阅服务。

制片厂:注重质量,而非数量

在罗伯特·艾格担任首席执行官的第一个任期内,迪士尼制作了有史以来票房最高的前10部电影中的8部,以及前20部电影中的13部,票房收入都超过了10亿美元。相比之下,鲍勃·查佩克制作的电影没有一部票房收入超过10亿美元。

查佩克注重权力集中,用备受瞩目的口水仗疏离创意人才,而艾格与他不同,他明白迪士尼的核心是一家讲故事的公司,而且知道如何拍出好电影。

为此,艾格将质量放在首位,而非数量。他坦率地表示:“数量有时会影响质量。在我们热衷于大幅提高数量的过程中,部分制片厂失去了重点。因此,我们首先采取的措施就是减少数量,尤其是在漫威(Marvel)电影领域。”

迪士尼体验项目(乐园与度假区):全面刷新纪录

迪士尼体验项目(包括其重要乐园和度假区)的营收数字不言而喻:不仅游客人数不断刷新纪录,国内游客人数更是疫情爆发前的两倍,而且2023年的收入、营业收入和营业利润率也创下了历史新高。

更重要的是,艾格认识到乐园和度假区对迪士尼品牌和全球家庭的重要意义,缓和了前任查佩克带来的苛刻而不受欢迎的消费价格上涨。查佩克曾将乐园价格上涨作为弥补流媒体损失的“饼干罐”。

艾格并没有为了资助自己青睐的项目而蚕食迪士尼乐园和度假区的利益,而是投资于增长和可负担性。他计划在未来十年投资600亿美元,以实现持续增长,这反映出在过去十年中,乐园和度假区的投资资本回报率是所有业务线中最高的,也是少数几个不受大型科技公司竞争影响的业务线之一。

体育:在众多选择中屹立不倒

正如艾格喜欢调侃的那样,“体育将继续在娱乐业的众多选择中屹立不倒”,艾格致力于将ESPN打造成唯一领先的数字体育平台,从而实现迪士尼在体育领域的发展。

ESPN Bets等新插件反映了这一愿景,但这只是冰山一角:预计明年推出的沉浸式旗舰产品直接面向消费者的ESPN将包括综合投注、虚拟比赛、购物、统计、定制和个性化等功能,旨在吸引从普通粉丝到铁杆粉丝的所有体育迷。艾格巧妙地拒绝引入增值能力有待商榷的战略合作伙伴,也拒绝廉价出售ESPN。

此外,迪斯尼与福克斯公司和华纳兄弟探索频道新成立的体育合资公司,在任命苹果公司(Apple)资深高管皮特·迪斯塔德(Pete Distad)担任负责人后,开局良好。实现体育内容捆绑不仅能缓解现有用户的不满情绪,还能进军能够实现巨大增长的市场。毕竟,在美国1.25亿户家庭中,超过6000万户家庭不在传统的有线电视捆绑生态系统中,他们迫切希望能在一个平台上观看更多自己喜欢的体育节目。

迪士尼已经发现,只要提供“捆绑”套餐,客户流失率就会大幅下降,因此有理由认为,流媒体服务和有线电视客户将实现深度捆绑,以确保全面减少杂乱无章的客户体验。

游戏等新业务线

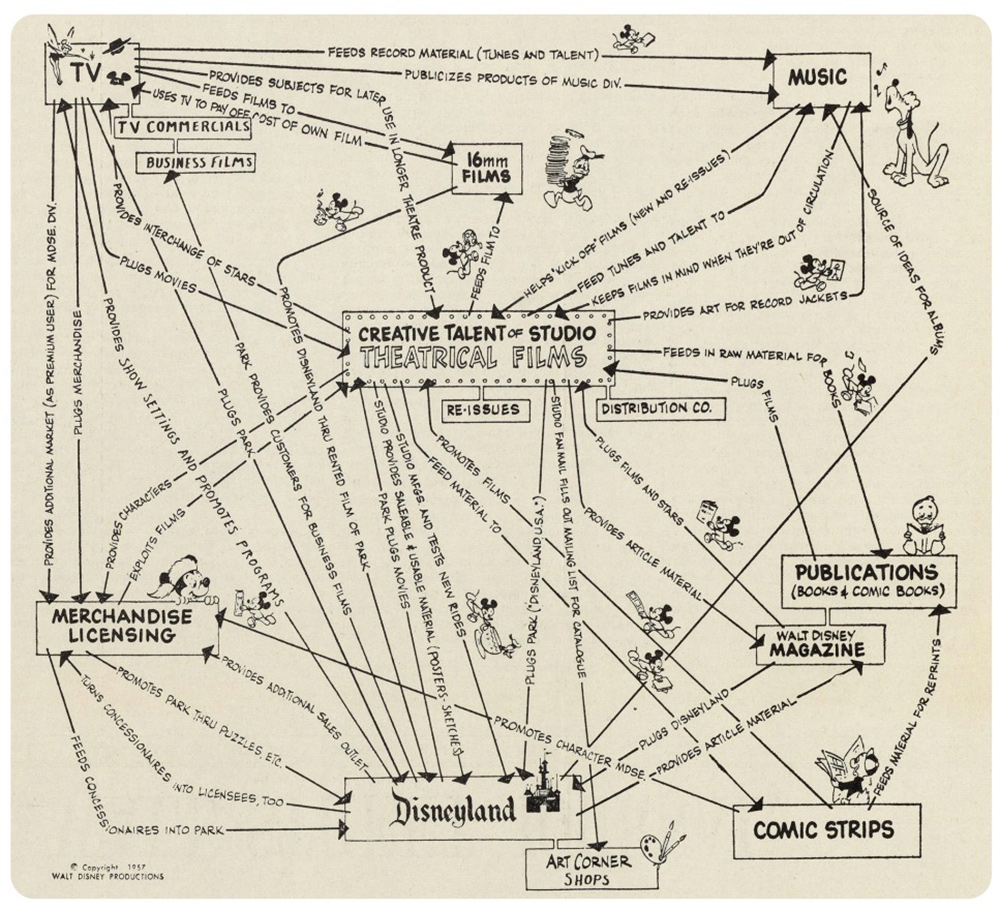

华特·迪士尼 (Walt Disney) 亲自绘制的传奇迪斯尼飞轮正在不断扩张,每一条新业务线都会依托并促进相邻业务线的发展势头。艾格从不惧怕为扩大飞轮而进行大胆飞跃,比如迪斯尼新近斥资15亿美元收购电子游戏制造商Epic Games。千禧一代花在游戏上的时间和看电视或电影的时间一样多,电子游戏对迪斯尼来说不仅是一项高利润的附加业务,而且是提升迪斯尼现有品牌特许经营权(尤其是漫威和星球大战)价值和深度的天然附加产品。

艾格对未来的愿景令人信服,这也是为什么即使是其他维权投资者——比如ValueAct公司精明而富有建设性的梅森·莫菲特(Mason Morfit),他的身价去年增加了46%——也大力支持这位迪士尼首席执行官。

艾格在迪斯尼的业绩不容忽视,但他并没有沉溺于过去。相反,当媒体分析师们在一旁束手无策,抱怨媒体和娱乐公司的黄金时代已经终结,收入增长将一去不复返,或是流媒体永远不会像线性捆绑那样带来利润时,艾格已经为现代娱乐公司构建了全新的愿景和实现创新的蓝图。

影评人罗杰·埃伯特(Roger Ebert)曾经打趣说:“好电影都不会太长,而糟糕电影都不会太短!”罗伯特·艾格精心制定的跨业务线增长计划,将确保神奇王国继续沿着魔毯之路前进,这也是他在未来多年担任迪士尼首席执行官期间重点关注的事项。(财富中文网)

杰弗里·索南费尔德(Jeffrey Sonnenfeld)是莱斯特·克朗管理实践教授、耶鲁大学首席执行官领导力研究所的创始人和总裁。2023年,他被《诗人与量化》杂志(Poets & Quants)评为“年度管理学教授”。

史蒂文·田(Steven Tian)是耶鲁大学首席执行官领导力研究所研究部主任,曾任洛克菲勒家族办公室的量化投资分析师。

译者:中慧言-王芳

本周,维权投资者尼尔森·佩尔茨(Nelson Peltz)与迪士尼董事会之间激烈的代理权之争达到高潮,然而,人们很容易忘记,在扣人心弦的争夺迪士尼控制权的戏剧性场面中,在双方的人身攻击中,代理权之争只不过会导致首席执行官罗伯特·艾格分心,而且相当耗时耗力。在整个传统媒体和娱乐行业受到来自科技巨头及其颠覆性技术的前所未有的竞争威胁之际,罗伯特·艾格负责掌管迪士尼。

就其过去的表现而言,我们已经证明佩尔茨和迪士尼首席执行官罗伯特·艾格是截然不同的。佩尔茨是长期表现最差的维权投资者之一,长期以来一直在董事会中破坏价值,而艾格在两度担任首席执行官期间,其股票表现远超媒体同行,为股东创造了超过1600亿美元的价值,迪士尼是今年道琼斯指数中表现最好的股票。

超越过去的业绩,展望迪士尼的未来,艾格所做的不仅仅是维持迪斯尼的正常运转:他写就了媒体和娱乐业历史上最令人瞩目的扭亏为盈和转型故事。仔细研究罗伯特·艾格为迪斯尼未来十年各业务线增长制定的战略路线图,就会发现,如果说有哪家传统媒体公司能在流媒体时代脱颖而出,获得比传统线性业务和有线电视业务更高的盈利能力,那非迪士尼莫属。

流媒体:由于艾格的先见之明,迪士尼在传统媒体同行中拥有先发优势

十多年前,罗伯特·艾格是最早预见到传统“线性捆绑”即将衰落的媒体高管之一。不熟悉媒体业务的观察人士可能无法理解,线性捆绑对传统媒体公司来说是多么有利可图,因为其在向有线电视用户提供内容而获得“传输费”之外,还从广告商那里获得了意外的广告收入。但随着流媒体的普及以及掐线族的出现,越来越多用户取消了有线电视套餐,这使得许多媒体分析师认为,线性捆绑的商业模式正走向长期衰落。

与一些被颠覆和失衡的媒体业同行不同,艾格力图成为一个颠覆者,主动应变,并为线性业务不再像过去那样强势的世界做好准备,还在早期就投入到有线电视向流媒体的转型中。尽管众多批评者表示迪士尼不可能成功推出流媒体平台,但当艾格在2019年推出旗舰产品Disney+流媒体服务时,仅第一天就有1000万订户,在艾格离任前的前15个月内就有1亿订户。

艾格多年来一直在为推出Disney+做准备,他在2017年收购了流媒体技术公司BAMTech的股份。由于艾格的远见卓识和先见之明,迪士尼在实现从线性业务到流媒体的转型方面遥遥领先于传统媒体同行,其流媒体业务带来的收入比传统竞争对手多出数十亿美元。此外,迪士尼流媒体平台的总订户数超过了所有传统媒体同行的总和,迪士尼流媒体平台的全球订户数达到1.9亿(相比之下,华纳兄弟探索频道(Warner Brothers Discovery)运营的Max平台的订户数不到1亿;Paramount+的订户数约为6000万,康卡斯特(Comcast)旗下NBC环球集团(NBC Universal)运营的Peacock的订户数约为3000万;并让大肆宣传的Apple TV相形见绌,其订户数为2500万)。

虽然网飞(Netflix)仍以约2.5亿订户数保持领先地位,但迪士尼正在快速发展,就连网飞也承认“我们两家之间的决斗还将持续很长一段时间”。

尽管股市估值存在巨大差异,但迪斯尼拥有许多网飞所不具备的巨大优势,包括历史悠久的资料库和更多没有时间限制的特许经营项目、在消费品、乐园和度假区之间产生的协同效应,以及真正的规模优势。

迪士尼去年的净收入总额超过了网飞,而收入基数则是网飞的三倍。更不必提及迪士尼的创意引擎,当它全速运转时,仍是无可比拟的:有些人可能会惊讶地发现,在2023年,也就是艾格回归的第一年,美国所有流媒体平台上流量最大的10部电影中,有6部属于迪士尼。

流媒体:未来收入仍有指数级增长潜力

尽管迪斯尼在订户增长方面取得了成功,但许多分析师担心,流媒体时代带来的货币化机会永远赶不上媒体和娱乐公司从传统的线性/有线电视捆绑业务中获得的暴利,而且在利润空间不断缩小的情况下,收入增长将难以为继。但是,现在就敲响媒体和娱乐业盈利能力的丧钟可能还为时过早。显然,流媒体业务仍处于发展的初期阶段。事实上,艾格是第一个承认流媒体业务对迪士尼来说仍是一项“新兴”业务的人,虽然迪士尼进军流媒体只有四年之久,但它仍在进行实时学习,并在军备竞赛中进行相应调整。

艾格已经对迪士尼的流媒体业务进行了重大改进,包括削减开支和适当调整定价结构,以使流媒体平台朝着长期增长和盈利的方向发展。因此,流媒体业务已经从2019年开始时的每年亏损20亿美元,转变为今年的全面盈利。艾格实现了流媒体平台的增长,远远超过了线性业务的衰退速度,没有像他的前任鲍勃·查佩克(Bob Chapek)那样陷入自毁式的流媒体军备竞赛,没有蚕食公司业务,也没有把控制权从创意官员转移到钦点的副手卡里姆·丹尼尔(Kareem Daniel)手中,让Disney+充斥太多无人问津的劣质内容。

迪斯尼仍有大量尚未开发的机会,不仅可以加速订户增长,还可以加快收入和利润增长。在多次公开采访中,艾格都表示流媒体广告收入具有指数级增长潜力,尤其是更具个性化、更有针对性的数字广告,这对广告商来说比传统的线性电视广告模式更有价值。就像几乎所有竞争对手所做的那样,如果迪斯尼继续拉大无广告和有广告支持的流媒体订阅套餐之间的定价差距,那么流媒体广告收入的增长速度就会进一步加快。令人惊讶的是,迪斯尼仍然拥有竞争对手中最便宜的免广告套餐月费:Disney+的免广告套餐月费13.99美元,比网飞15.49美元的免广告套餐月费便宜,也比Max的15.99美元的免广告套餐月费便宜。同样令人吃惊的是,迪斯尼没有高级版套餐,而竞争对手如网飞和Max,则分别从22.99美元的高级版套餐和19.99美元高级版套餐中赚取利润。至少从纸面上看,迪斯尼有相当大的空间提高无广告订阅套餐的价格。提高价格并不一定会影响可及性和可负担性:Disney+ 7.99美元的广告支持订阅层级对消费者来说仍然非常实惠,对迪斯尼的广告收入也能起到极大的促进作用。

此外,迪士尼还计划在今年晚些时候完成从康卡斯特手中收购Hulu全部股权的协议,将Hulu与迪士尼全资拥有的流媒体平台Disney+和ESPN+全面整合,这也将为迪斯尼带来尚未开发的商机。

迪士尼甚至一开始就拥有Hulu的股份,这证明了艾格的先见之明。如果艾格没有在2018年从鲁伯特·默多克(Rupert Murdoch)手中收购21世纪福克斯,康卡斯特就会收购21世纪福克斯(Hulu是21世纪福克斯的一部分),那么康卡斯特很可能会在今天的流媒体领域领先迪士尼,而不是远远落后,毕竟Peacock只有3000万订户,不到迪士尼订户数的六分之一。对于艾格收购福克斯的交易,最令人信服的批评是,也许他应该从时代华纳(Time Warner)的传奇首席执行官杰夫·比克斯(Jeff Bewkes)手中收购时代华纳,而不是21世纪福克斯,因为时代华纳的资产,包括HBO和华纳兄弟(Warner Bros)的内容库,可能与迪士尼的品牌家族更适配。

另一个被低估的机会来自于新兴流媒体行业的逐渐成熟。2022年,传统媒体公司的流媒体损失总额将超过100亿美元,流媒体军备竞赛的时代很可能在更节制的内容创作和支出中终结。虽然大型科技公司继续大举进军媒体和娱乐业务,但众多流媒体平台却因缺乏获取内容的渠道而难以起步。由于不利的反垄断监管环境,它们很难通过无机并购购买到迫切需要的内容库,这为拥有领先流媒体平台的迪士尼和网飞提供了巨大的竞争优势。

线性:弥合转型差距,削减成本,同时巧妙避免低价销售

艾格成功驾驭了流媒体革命,真正实现了从线性业务的转型,并让线性业务继续蓬勃发展,从而开拓了两全其美的局面。

尽管线性商业模式面临严重压力,但迪士尼旗下的美国广播公司(ABC)和美国广播公司旗下的电视台仍能带来健康收入和利润。如果线性广告市场恢复到更正常的水平,尤其是在今年秋天总统大选(以及相关的广告支出)日益临近的情况下,那么就像许多人预期的那样,收入还有一定的增长潜力。

尽管有大量潜在买家出价,艾格还是巧妙地拒绝以低价出售,同时专注于降低成本,迪士尼节省的75亿美元成本中有很大一部分来自线性成本。艾格还精简了线性业务,将重点放在核心频道上,并削减了经济效益和可行性较差的第三频道。

迪斯尼最近与Charter的谈判为迪斯尼如何继续支持传统的线性商业模式提供了实现双赢的蓝图,同时也能助力其顺利弥合与流媒体业务之间的差距,而迪斯尼则以批发价向Charter客户提供广告支持的Disney+流媒体订阅服务(折扣版),为有线电视客户提供了简单实惠的流媒体选择,以补充其现有的有线电视订阅服务。

制片厂:注重质量,而非数量

在罗伯特·艾格担任首席执行官的第一个任期内,迪士尼制作了有史以来票房最高的前10部电影中的8部,以及前20部电影中的13部,票房收入都超过了10亿美元。相比之下,鲍勃·查佩克制作的电影没有一部票房收入超过10亿美元。

查佩克注重权力集中,用备受瞩目的口水仗疏离创意人才,而艾格与他不同,他明白迪士尼的核心是一家讲故事的公司,而且知道如何拍出好电影。

为此,艾格将质量放在首位,而非数量。他坦率地表示:“数量有时会影响质量。在我们热衷于大幅提高数量的过程中,部分制片厂失去了重点。因此,我们首先采取的措施就是减少数量,尤其是在漫威(Marvel)电影领域。”

迪士尼体验项目(乐园与度假区):全面刷新纪录

迪士尼体验项目(包括其重要乐园和度假区)的营收数字不言而喻:不仅游客人数不断刷新纪录,国内游客人数更是疫情爆发前的两倍,而且2023年的收入、营业收入和营业利润率也创下了历史新高。

更重要的是,艾格认识到乐园和度假区对迪士尼品牌和全球家庭的重要意义,缓和了前任查佩克带来的苛刻而不受欢迎的消费价格上涨。查佩克曾将乐园价格上涨作为弥补流媒体损失的“饼干罐”。

艾格并没有为了资助自己青睐的项目而蚕食迪士尼乐园和度假区的利益,而是投资于增长和可负担性。他计划在未来十年投资600亿美元,以实现持续增长,这反映出在过去十年中,乐园和度假区的投资资本回报率是所有业务线中最高的,也是少数几个不受大型科技公司竞争影响的业务线之一。

体育:在众多选择中屹立不倒

正如艾格喜欢调侃的那样,“体育将继续在娱乐业的众多选择中屹立不倒”,艾格致力于将ESPN打造成唯一领先的数字体育平台,从而实现迪士尼在体育领域的发展。

ESPN Bets等新插件反映了这一愿景,但这只是冰山一角:预计明年推出的沉浸式旗舰产品直接面向消费者的ESPN将包括综合投注、虚拟比赛、购物、统计、定制和个性化等功能,旨在吸引从普通粉丝到铁杆粉丝的所有体育迷。艾格巧妙地拒绝引入增值能力有待商榷的战略合作伙伴,也拒绝廉价出售ESPN。

此外,迪斯尼与福克斯公司和华纳兄弟探索频道新成立的体育合资公司,在任命苹果公司(Apple)资深高管皮特·迪斯塔德(Pete Distad)担任负责人后,开局良好。实现体育内容捆绑不仅能缓解现有用户的不满情绪,还能进军能够实现巨大增长的市场。毕竟,在美国1.25亿户家庭中,超过6000万户家庭不在传统的有线电视捆绑生态系统中,他们迫切希望能在一个平台上观看更多自己喜欢的体育节目。

迪士尼已经发现,只要提供“捆绑”套餐,客户流失率就会大幅下降,因此有理由认为,流媒体服务和有线电视客户将实现深度捆绑,以确保全面减少杂乱无章的客户体验。

游戏等新业务线

华特·迪士尼 (Walt Disney) 亲自绘制的传奇迪斯尼飞轮正在不断扩张,每一条新业务线都会依托并促进相邻业务线的发展势头。艾格从不惧怕为扩大飞轮而进行大胆飞跃,比如迪斯尼新近斥资15亿美元收购电子游戏制造商Epic Games。千禧一代花在游戏上的时间和看电视或电影的时间一样多,电子游戏对迪斯尼来说不仅是一项高利润的附加业务,而且是提升迪斯尼现有品牌特许经营权(尤其是漫威和星球大战)价值和深度的天然附加产品。

艾格对未来的愿景令人信服,这也是为什么即使是其他维权投资者——比如ValueAct公司精明而富有建设性的梅森·莫菲特(Mason Morfit),他的身价去年增加了46%——也大力支持这位迪士尼首席执行官。

艾格在迪斯尼的业绩不容忽视,但他并没有沉溺于过去。相反,当媒体分析师们在一旁束手无策,抱怨媒体和娱乐公司的黄金时代已经终结,收入增长将一去不复返,或是流媒体永远不会像线性捆绑那样带来利润时,艾格已经为现代娱乐公司构建了全新的愿景和实现创新的蓝图。

影评人罗杰·埃伯特(Roger Ebert)曾经打趣说:“好电影都不会太长,而糟糕电影都不会太短!”罗伯特·艾格精心制定的跨业务线增长计划,将确保神奇王国继续沿着魔毯之路前进,这也是他在未来多年担任迪士尼首席执行官期间重点关注的事项。(财富中文网)

杰弗里·索南费尔德(Jeffrey Sonnenfeld)是莱斯特·克朗管理实践教授、耶鲁大学首席执行官领导力研究所的创始人和总裁。2023年,他被《诗人与量化》杂志(Poets & Quants)评为“年度管理学教授”。

史蒂文·田(Steven Tian)是耶鲁大学首席执行官领导力研究所研究部主任,曾任洛克菲勒家族办公室的量化投资分析师。

译者:中慧言-王芳

As the heated proxy fight between activist investor Nelson Peltz and Disney’s board reaches its grand finale this week, it’s easy to forget that amidst the gripping drama of the fight for control of Disney, and a fusillade of personal barbs from both sides, the proxy fight is nothing more than a time-consuming distraction for CEO Bob Iger, who is running Disney at a time when the entire traditional media and entertainment industry is under siege with an unprecedented array of competitive threats from Big Tech and its disruption.

Already, we have shown how, in terms of their past performance, Peltz and Disney CEO Bob Iger could not be more different. While Peltz is one of the chronically poorest-performing activist investors, with a long history of destroying value when he sits on boards, Iger has towered over media peers in stock performance across his two stints as CEO, generating over $160 billion in shareholder value, with Disney being the top-performing stock on the Dow this year.

Looking beyond past performance, and towards the future of Disney, Iger is doing more than keeping the lights on: he is pulling off one of the most remarkable turnaround and transformation stories in media and entertainment history. A close look at Bob Iger’s strategic roadmap for the next decade of growth across business lines at Disney clearly shows that if there is any traditional media company that will emerge from the streaming era with even greater profitability than its traditional linear and cable businesses ever achieved, it will be Disney.

Streaming: Disney was first mover among traditional media peers thanks to Iger’s prescience

Over a decade ago, Bob Iger was one of the first media executives to see the decline of the traditional “linear bundle” coming. Observers not steeped in the media business may not understand just how lucrative the linear bundle was for traditional media companies, as they raked in windfall advertising revenue from advertisers on top of “carriage fees” for providing content to cable customers. But with the popularization of streaming and subsequent cord-cutting, more customers are canceling their cable TV packages, which leads many media analysts to believe that the linear bundle business model is now in secular decline.

Unlike some of his media industry peers who were disrupted and caught off balance, Iger sought to be a disruptor, proactively preparing for a world where the linear business is not as strong as it used to be, and leaning into the cable-to-streaming migration early on. When Iger launched the flagship Disney+ streaming service in 2019, although a chorus of critics said at the time that Disney could never successfully launch a streaming platform, 10 million subscribers signed up on the first day alone, and 100 million within the first 15 months before Iger left office.

Iger had already been preparing for its launch for years, buying a stake in streaming tech company BAMTech in 2017. As a result of Iger’s vision and prescience, Disney is way ahead of traditional media peers in bridging the linear-to-streaming transition, with its streaming business driving billions more in revenue than any of its legacy competitors. Furthermore, Disney’s streaming platforms boast a total subscriber count greater than all its traditional media peers combined, with 190 million global subscribers across the Disney streaming platforms (compared to less than 100 million for Max run by Warner Brothers Discovery; ~60 million on Paramount+, and ~30 million on Peacock, run by Comcast’s NBC Universal; and dwarfing the 25 million subscribers of the much-ballyhooed Apple TV).

While Netflix remains in the lead with ~250 million subscribers, Disney is making fast progress, with even Netflix acknowledging that “it will be….the two of us duking it out for a long time.”

Disney possesses many significant advantages that Netflix does not have, including a deeper historical library and more timeless franchises with synergies across consumer products and parks and resorts, as well as pure scale–despite vastly divergent stock market valuations.

Disney’s total net income surpassed that of Netflix’s last year, with a revenue base three times larger. Not to mention Disney’s creative engine, when working at full force, remains unparalleled: Some may be surprised to know that in 2023, the first full year of Iger’s return, six of the top 10 most streamed movies across all streaming platforms in the U.S. belonged to Disney.

Streaming: Still potential for exponential future revenue growth ahead

Despite Disney’s success in signing up subscribers, many analysts fear that the monetization opportunities from the streaming era will never catch up to the windfall profits historically reaped by media and entertainment companies from the traditional linear/cable bundle–and that revenue growth will be hard to drive moving forward amidst shrinking profit margins. But it may be too early to ring the death knell of media and entertainment profitability. It’s clear that the streaming business is still in its earliest innings of development. Indeed, Iger is the first to acknowledge that streaming is still a “nascent” business for Disney, merely four years old, and that Disney is still learning in real time and making in-game adjustments.

Already, Iger has overseen dramatic improvements in Disney’s streaming business–including reducing expenses and scaling the pricing structure appropriately–to build the streaming platforms toward long-term growth and profitability. As a result, the streaming business has inflected from generating $2 billion a year in losses when it started in 2019 to full profitability this year. Iger has managed the growth of the streaming platforms responsibly, far outpacing the decline of the linear business, without falling into the self-destructive streaming arms-race war that his predecessor Bob Chapek fell into, cannibalizing the rest of the company and wrestling control out of the hands of creative officials into the hands of hand-picked deputy Kareem Daniel to fill Disney+ with too much poor quality content nobody wanted to watch.

However, there are abundant massive untapped opportunities for Disney to accelerate not only subscriber growth but also revenue and margin growth. In many public interviews, Iger has identified streaming advertising revenue as an area where there is potential for exponential growth, especially with more personalized and targeted digital advertising which is far more valuable to advertisers than the old model of generic ads on linear TV. Growth in streaming advertising revenue could really accelerate if Disney continues to widen the pricing gap between its ad-free and ad-supported streaming subscriptions, as virtually all its competitors have done. It is surprising that Disney still has the single cheapest ad-free streaming monthly subscription across its peer competitors, with the $13.99 Disney+ ad-free subscription cheaper than Netflix’s $15.49 ad-free subscription and cheaper than Max’s $15.99 ad-free subscription. It is also surprising that Disney does not have a premium tier, while competitors such as Netflix rake in profits from its $22.99 premium version and Max’s $19.99 premium version. At least on paper, Disney has considerable room to raise prices on its ad-free subscription. Raising prices does not have to hurt accessibility and affordability: The ad-supported subscription tier of Disney+ at $7.99 remains highly affordable for consumers and highly accretive to Disney’s advertising revenue.

There are also untapped opportunities from the planned full integration of Hulu with Disney’s fully-owned streaming platforms, Disney+ and ESPN+, later this year, once Disney closes on its agreement to purchase full ownership in Hulu from Comcast.

That Disney even owns Hulu to begin with is a testament to Iger’s prescience. Had Iger not purchased 21st Century Fox from Rupert Murdoch in 2018, Comcast would have bought Fox, with Hulu as a part of Fox, and Comcast would very likely be leading Disney in streaming today rather than trailing far behind with only ~30 million subscribers on Peacock, less than a sixth of Disney’s subscriber count. Perhaps the most compelling critique of Iger’s Fox deal is that maybe he ought to have pursued an acquisition of Time Warner from its legendary CEO Jeff Bewkes in lieu of 21st Century Fox, as the Time Warner assets including HBO, and the Warner Bros. content library, might have been a better match with Disney’s brand family.

Another underappreciated opportunity arises simply from the gradual maturation of the nascent streaming industry. The days of streaming arms-wars, with streaming losses totaling over $10 billion in 2022 across traditional media companies, are likely over amidst more disciplined content creation and spending. And while Big Tech companies continue to loom large with forays into the media and entertainment business, many of their streaming platforms are hardly getting off the ground, hamstrung by a lack of access to content. Thanks to the unfavorable antitrust regulatory climate, it is hard to see how they will be able to purchase the content libraries they so desperately need through inorganic mergers and acquisitions, providing significant competitive advantages to Disney alongside Netflix with their leading streaming platforms.

Linear: Bridging the transition and cutting costs while smartly avoiding selling at depressed prices

Iger has managed to navigate the streaming revolution in a way that genuinely bridges the transition from linear and allows the linear businesses to continue to flourish, as a best-of-both-worlds scenario.

Although the linear business model is under severe strain, Disney’s ABC and ABC-owned television stations continue to bring in healthy revenues and profits, and there is some revenue growth potential should the market for linear advertising recover to more normalized levels, as many expect it will, especially with a presidential election (and related advertising spending) looming this fall.

Iger has smartly refused to sell at depressed prices, despite an abundance of offers from prospective buyers, while focusing on bringing down costs, with a large chunk of Disney’s $7.5 billion in cost savings coming out of linear. Iger is also streamlining the linear business to focus on core channels, cutting down on tertiary channels with lesser economics and viability moving forward.

Disney’s recent negotiations with Charter provided a win-win blueprint for how Disney can continue to support the traditional linear business model while also bridging the gap to streaming smoothly, with Disney providing discounted ad-supported Disney+ streaming subscriptions to Charter customers at wholesale rates, providing cable customers an easy and affordable streaming option to complement their existing cable subscription.

Studios: Focusing on quality, not quantity

During Bob Iger’s first term as CEO, Disney produced eight of the top 10, and 13 of the top 20, biggest box office openings of all time, all of which crossed $1 billion in box office revenues. In contrast, Bob Chapek produced zero films crossing $1 billion.

Unlike Chapek, who centralized authority and alienated creative talent with high-profile spats, Iger understands that Disney at its core is a storytelling company–and knows how to make good movies.

As a part of that, Iger has prioritized focusing on quality over quantity. As he candidly said, “Volume sometimes can be detrimental to quality. And in our zeal to greatly increase volume, some of our studios lost a little focus. So the first step we’ve taken is we’ve reduced volume. We’ve reduced output, particularly at Marvel”.

Disney Experiences (Parks & Resorts): Setting new records across the board

The top line numbers across Disney Experiences, including its prized parks & resorts, speak for themselves: Not only are new attendance records being set continually, with attendance twice what it was before the pandemic domestically, but 2023 represented all-time records in revenue, operating income, and operating margin.

Even more importantly, Iger recognizes the essential importance of parks and resorts to the Disney brand and to families across the world, moderating the draconian and unpopular consumer price increases seen under his predecessor Chapek, who used price hikes at parks as the cookie jar to backfill streaming losses.

Instead of cannibalizing parks and resorts to fund pet projects, Iger is investing in both growth and affordability, and his plans to invest $60 billion in continued growth over the next decade reflects the fact that parks and resorts have seen some of the highest returns on invested capital across any business line at Disney over the last decade–and is one of the few business lines which are impervious to competition from Big Tech companies.

Sports: Standing tall in a sea of tremendous choice

As Iger likes to quip, “Sports continues to stand tall in a sea of tremendous choice” within entertainment, and Iger has committed to Disney’s future in sports by building out ESPN as the single leading digital sports platform.

New add-ons such as ESPN Bets reflect this vision, but this is only the tip of the iceberg: The launch of the immersive flagship ESPN direct-to-consumer product next year is expected to include integrated betting, fantasy, shopping, statistics, and customization and personalization designed to appeal to every sports fan, from casual followers to die-hards. Iger has smartly resisted bringing in strategic partners with questionable value-add or selling off ESPN on the cheap.

Furthermore, Disney’s new sports joint venture with Fox and Warner Brothers Discovery is off to a strong start with the appointment of veteran Apple executive Pete Distad as its head. The bundling of sports content will not only alleviate existing customer frustrations but also tap into a massive growth market. After all, of 125 million households in America, more than 60 million are not in the traditional bundled cable ecosystem, and desperately searching for a way to watch more of the sports they want, on a single platform.

Disney has already found that churn rates are down significantly wherever “bundled” packages are available, so it stands to reason that further bundling will take place across streaming services and with cable customers to ensure a less confusing customer experience across the board.

New business lines such as gaming

The legendary Disney flywheel–as drawn up by Walt Disney himself–is constantly expanding, with each new business line building off and contributing to the momentum of complimentary adjacent business lines. Iger has never been afraid to take bold leaps to expand the flywheel, with masterstrokes such as Disney’s new $1.5 billion investment in video game maker Epic Games. Millennials spend as much time gaming as they do watching TV or movies, and video games represent not only a high-margin additional business for Disney, they are natural add-ons to enhance the value and depth of Disney’s existing brand-name franchises, in particular Marvel and Star Wars.

Iger’s compelling vision for the future is why even other activist investors–such as the savvy, constructive Mason Morfit of ValueAct, who was up 46% last year–have come out in strong support of the Disney CEO.

Iger’s track record at Disney cannot be ignored–but he is not caught up in the past. Rather, while media analysts wring their hands on the sidelines and complain that the golden days of media and entertainment companies are over, that revenue growth will never return, or that streaming will never bring the profits that the linear bundle once did, Iger has built a thoroughly novel vision and an innovative blueprint for what a modern entertainment company should look like.

Film critic Roger Ebert once quipped, “No good movie is too long and no bad movie is short enough!” Bob Iger’s careful growth plans across business lines will ensure that the Magic Kingdom continues on the magic carpet ride which has defined his tenure as CEO of Disney for many years to come.

Jeffrey Sonnenfeld is the Lester Crown Professor in Management Practice and Founder and President of the Yale Chief Executive Leadership Institute. In 2023, he was named “Management Professor of the Year” by Poets & Quants magazine.

Steven Tian is the director of research at the Yale Chief Executive Leadership Institute and a former quantitative investment analyst with the Rockefeller Family Office.