美联储降息史

|

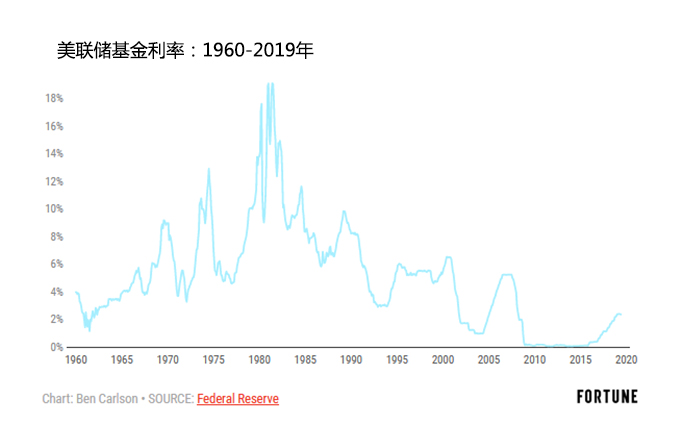

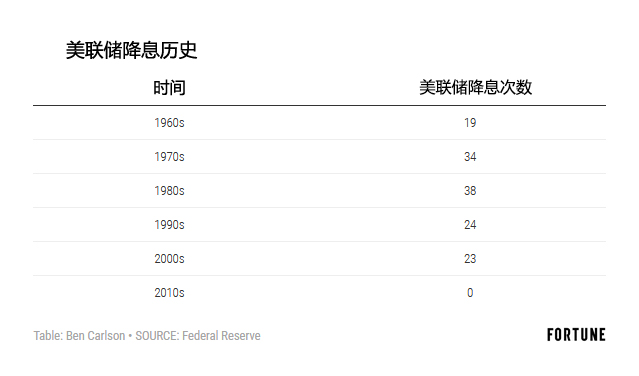

上周在众议院金融服务委员会作证时,美联储主席杰罗姆·鲍威尔暗示该机构可能在本月底再次开会时决定下调短期利率。 历史上下调利率并不新鲜,但美联储上次降息已经是很久以前的事了。1960年以来,美联储将联邦基金利率下调了近140次,每10年大概降息 23次。但2011年至今该机构还没有降低过利率。 |

Testifying before the House Financial Services Committee last week, Fed Chair Jerome Powell hinted that the Federal Reserve may cut short-term interest rates when they meet again later this month. A rate cut wouldn’t be anything new in terms of history but it has been a long time since the Fed last lowered their short-term interest rate. Since 1960, the Federal Reserve has cut the Fed Funds Rate nearly 140 times. That’s good enough for roughly 23 times per decade. But there hasn’t been a single rate cut this decade: |

|

显然,这段时间一直没有降息的最主要原因是全球金融危机过后美国利率一直处于非常低的水平。2008年12月实际利率降至零,直到2015年12月美联储终于将利率上调了0.25个百分点,利率才开始回升。 在过去近60年时间里,美国利率平均降幅为0.5个百分点,但和今天的市场或经济状况类似的历史阶段并不多。目前联邦基金利率为2.5%。2007-2009年爆发金融危机前,美联储将利率降至3%以下的次数屈指可数。 1960年以来的降息行动中,降息前利率高于当前利率的占92%以上,失业率高于目前水平的几乎达到99%,还有近65%的降息出现在通胀率比当前水平高的时候。 为应对1960年至1961年初的轻微经济衰退,美联储主席威廉·麦克切斯尼·马丁曾经10次下调利率,联邦基金利率在差不多两年时间里一直低于3%(在此期间美联储也曾经两次加息)。但受衰退影响,当时的失业率比现在高得多,1961年一度突破7%。 当前美国失业率仅为3.7%,是1969年以来的最低点。实际上,上次美联储在失业率如此之低时下调利率就是在1969年7月,当时的降息幅度为0.25个百分点。但在即将进入70年代时,通胀刚刚开始上行,所以当时的利率远高于目前水平。1969年降息前,联邦基金利率接近9%,而且为了抑制通胀,美联储没过几个月就出现大转折,再次提高了利率。 1960年以来美联储在失业率和联邦基金利率都低于4%时降息的情况只出现过一次,那是在1967年夏天,具体而言是当年7月。但那次降息并未持续很长时间,当年年底前美联储就加息两次。 进入70年代之际,美国通胀率迅速逼近6%,而且有可能在这个10年结束时达到两位数。现在美国通胀率则只有1.6%。通胀率低于2%时美联储降息的情况只在60年代初出现过一次,但如上文所述,当时美国正处于衰退之中。 所以说,当前的局势很特殊。利率、失业率和通胀率都处于历史上很低的水平。这可能是10多年来美联储首次降息。此外,美国股市近几周又一次创下历史新高。 2015年底美联储进入加息周期的唯一原因很可能是让自己随后可以下调利率,目前该机构的策略看来就是这样。短期内,美联储的任何行动都更有可能给市场带来心理上的影响,而不会长久地改变基本面。 市场受到的短期影响一直取决于投资者决定选择怎样的逻辑。有些人会认为降息表明经济滑坡。另一些人则相信美联储降息是为了维持当前的良好形势。 但最终,这些短期解读都必须得到长期基本面的支持,否则就可能被视为欺骗。尽管1960年以来降息近140次,但在这期间美国股市出现了30次两位数回调,美国经济也经历了8次衰退。无论采取怎样的措施,美联储都无法永远杜绝衰退或熊市。(财富中文网) 译者:Charlie 审校:夏林 |

Obviously, the biggest reason there hasn’t been a rate cut this decade is that rates were on the floor for so long following the Great Financial Crisis. Rates were effectively lowered to zero in December 2008 and didn’t rise from the dead until December 2015, when the Fed finally raised rates a quarter of a percent. The average rate cut over the past 60 years or so is 50 basis points but there aren’t many historical scenarios that compare with the current market or economic situation. The Fed Funds rate currently stands at 2.5%. Before the financial crisis of 2007-2009, there have only been a handful of times where the Fed cut rates with yields below 3%. More than 92% of all rate cuts since 1960 have come from higher levels of the Fed Funds Rate. Almost 99% have come when the unemployment rate was higher than the latest reading. And nearly 65% have come when the inflation rate is higher than it currently stands. In response to a minor recession in 1960 which bled into early-1961, Fed Chair William McChesney Martin cut rates ten times while the Fed Funds Rate was below 3% over the course of two years or so (rates were also raised twice during this time). But the unemployment rate was much higher in those days because of the recession, topping out at more than 7% in 1961. The current unemployment rate stands at just 3.7%, the lowest it’s been since 1969. In fact, the last time the Fed cut interest rates with the unemployment rate so low was in July of 1969, when they cut a quarter of a percent. But yields were much higher at that time as inflation was just beginning to take off heading into the 1970s. The Federal Funds Rate was nearly 9% during that rate cut in 1969 and the Fed would actually reverse course and raise rates the very next month in an effort to stave off inflation. There was only one instance since 1960 where both the unemployment rate and the Fed Funds Rate were sub-4% when the Fed cut rates, which occurred in the summer of July 1967. That cut didn't last for long as the Fed raised rates twice before the end of that year. Inflation was fast approaching 6% heading into the 1970s and would reach double-digits by the end of that decade. The latest reading stood at just 1.6%. The only other time we’ve seen the Fed cut rates with inflation below 2% was during the early-1960s, but again that was in the midst of a recession. So the current period is unique. Interest rates, unemployment, and inflation are all low by historical standards. And this would be the first rate cut in over a decade. Plus there’s the fact that stocks have once again been hitting all-time highs in recent weeks. It’s quite possible the only reason the Fed began its hiking cycle in late-2015 is to give themselves the option to then cut rates yet again, which appears to be the current strategy. In the short-term, any Fed actions likely provide more of a psychological impact on the markets than a lasting change in fundamentals. The short-term impact on the markets will always be driven by whichever story investors decide to latch onto. Some will assume a rate cut will signal a weakening economy. Others will assume the Fed will ease in time to keep the party going. Eventually, those short-term narratives have to be backed up by long-term fundamentals or they run the risk of being outed as frauds. Even with nearly 140 rate cuts since 1960, there have been 30 double-digit stock market corrections and 8 recessions in the U.S. over that time. Regardless of what they do, the Fed can't fight off recessions or bear markets forever. |