2021年12月初,众筹初创公司Kickstarter员工突然听说一笔意外之财:一家投资机构想买入公司股票。这一消息令人吃惊。多年来员工是攒下了公司不少股份,但很多人早就放弃卖出的念头。

彼时的Kickstarter跟2009年爆火的初创公司已截然不同,2009年公司推出了“反人类纸牌”和动感单车Peloton等热门项目。有一段时间,Kickstarter广受企业家和公众欢迎,甚至取得了最让人艳羡的创业成就:公司名称成了专门名词,人们用Kickstarter代指互联网众筹活动。

创业初期,公司的反企业倾向和草根精神吸引了不少名人投资,也推动塑造了纽约科技界的格局。从电影首映到屋顶音乐节,以及疯狂传播的筹款活动,公司推出的种种活动都证明有创意的商业理念在硅谷以外也能获得成功和资金,艺术家可以向粉丝寻求支持。

然而Kickstarter成立十几年后早已风光不再,首席执行官也走马灯一般轮转。2021年的Kickstarter除了令人头疼,对潜在投资者来说几乎毫无价值。公司增长停滞不前,平台上每当有项目达到资金门槛就从中抽取佣金,经历激烈的工会运动之后,曾经感觉良好的文化也逐渐变味。新股东接手的是很多人认为已过时的品牌。

对于Kickstarter的员工和早期投资者来说,这笔意外投资就像是回到正轨的机会。毕竟,投资金额是惊人的1亿美元(公司估值约为4亿美元)。当然存在陷阱。获得投资的同时,Kickstarter要转向区块链,因为新投资方是Andreessen Horowitz旗下加密货币基金,主要希望利用新的炒作周期。

这笔意外之财原本能推动公司重整旗鼓回到正轨。然而,转投区块链后,公司依赖的创作者和粉丝群体反应激烈,不仅重大项目出现损失,尚未恢复的声誉又遭打击。种种动荡显示,即便是最有前途的初创公司也会迷失方向,凸显了在风险投资基础上追求行善面临的挑战。

天堂里的麻烦

2009年Kickstarter成立时,曾带动纽约Etsy或Foursquare等一众初创企业。相较于谷歌(Google)和Facebook等重视技术开发的湾区公司,纽约的初创公司更侧重艺术和文化。

Kickstarter的创意是艺术家或创作者从公众筹集新专辑、棋盘游戏或漫画书的资金,这一想法最早由曾经当过DJ的陈彬睿(Perry Chen)提出,他在新奥尔良爵士音乐节期间艰难筹集资金举办演唱会后创办了公司。项目吸引的风投支持者当中最知名的包括投过早期Tumblr和Twitter的弗雷德·威尔逊,他带领的Union Square Ventures可能是纽约最具标志性的风投公司。

起初Kickstarter办公地尚在曼哈顿下东区一间装有铁皮天花板的阁楼,前门都是涂鸦,还有一张写着“吃屎”的贴纸。公司经常组织用户参加活动,2010年在布鲁克林戈瓦努斯的老美国罐头厂屋顶上举办了第一届电影节。屏幕上播放着平台资助项目的视频,包括模仿濒危动植物物种的舞蹈,来宾排队购买众筹食品项目提供的馅饼和手工苏打水,Kickstarter资助的铜管乐队在一旁演奏。

早期员工还记得,公司非常重视创造力和社会意识,不像硅谷初创公司不惜一切代价追求增长。这家布鲁克林初创公司不像其他同行为实现突破式增长陷入亏损,而是第二年就实现盈利,主要通过从成功筹资的项目中收取5%的佣金和手续费。

这一模式下确实出现了爆款和突破,包括后来荣获艾美奖由菲比·沃勒-布里奇主演的BBC喜剧《伦敦生活》,还有VR头戴式显示器Oculus Rift(Facebook以20亿美元将其收购)。2013年,《美眉校探》(Veronica Mars)制片人罗伯·托马斯在这部小众电视剧被Hulu取消后,在Kickstarter筹集了570万美元。这是Kickstarter项目中金额最高的一次,也充分证明了将权威交回创作者的使命。

“为了艺术而艺术非常重要,”一位前员工告诉《财富》杂志。“项目最终能否执行,不应该仅看项目能为投资者带来多少盈利。”

Kickstarter很早就明确表示并不追求发财致富,投资者还是投入了大量资金,包括2011年的1000万美元融资。早期支持者包括Kickstarter在创意行业的同行,如Meetup的联合创始人斯科特·海弗曼和Vimeo联合创始人扎克·克莱因,还有《发展受阻》(Arrested Development)演员大卫·克罗斯。后来负责Andreessen旗下a16z crypto的克里斯·迪克森也选择加入,当时他刚开始从事天使投资。

似乎所有人都清楚,Kickstarter的目标不是巨额回报。2013年一篇博客文章中,威尔逊特别指出Kickstarter不需要风投的帮助(尽管风投确实有贡献):“公司不需要外部资金,也没怎么强化盈利能力,”威尔逊写道。另一位早期投资者告诉《财富》杂志,之所以选择投资只是因为“喜欢公司的理念”,并不相信会带来经济回报。

然而,Kickstarter早期的感觉良好很快变成另一种情绪——无处不在的混乱感。2014年,Kickstarter联合创始人扬西·斯楚克勒接替陈彬睿,之后几年陈彬睿继续担任管理职务,首席执行官走马灯式轮换开始了。

2015年,Kickstarter迈出了不寻常的一步变身公益公司,营利性公司同意满足社会和环境标准即可转型。一个员工在播客中表示,公益公司是可以确保投资者或董事无法退出或出售Kickstarter的法律架构。“转型为公益公司模糊了个人和公司价值观之间的界限,”一名员工在播客中表示。“创始人经常说,在公益公司架构下,公司的追求可以超越盈利。”

2017年陈彬睿重新担任首席执行官时强化了这一信息,重申Kickstarter永远不会上市或被收购。公司故作姿态以及业务重心突变开始让员工感到愤怒。“我确实感到极度疲惫和倦怠,我觉得员工们对陈彬睿没什么信心,”一位员工表示。

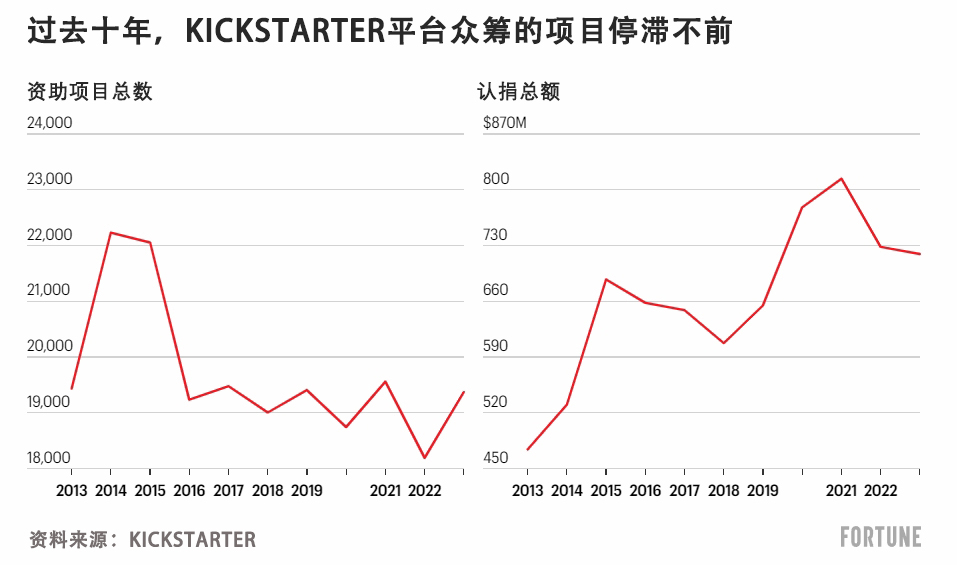

尽管Kickstarter很早就实现盈利,公司业务似乎永远没法实现腾飞。2016年,项目数量稳定在每年19000个左右,没有增长的迹象。Kickstarter赖以收取佣金的平台众筹资金额逐年波动,疫情期间达到近8.14亿美元峰值。

一位早期投资者告诉《财富》杂志,在追求增长与坚守对社会有价值但昂贵或困难的义务之间,Kickstarter从未找到平衡。尽管使命崇高,但由于公司发展重点相互竞争导致混乱,员工很难找到职业发展的道路或发挥主动性。

2012年,Kickstarter斥资750万美元在时尚的布鲁克林Greenpoint社区买下一栋铅笔公司名下的大楼,很快成了2010年代中期科技公司办公室的翻版。有必不可少的屋顶花园、日光浴室和电影院。周六深夜员工带朋友一同前去也能发现有人在公司玩。松弛氛围的另一面是工作文化毫无约束,项目停滞不前,有些员工每天只工作几个小时。

与此同时,该公司在增长战略方面仍举步维艰。面对快速增长的众筹平台Patreon竞争, Kickstarter于2016年收购了名叫Drip的初创公司结果没什么水花,Kicksstarter应付不断崛起的竞争对手的计划也彻底搁置。

“要找到与公司使命不冲突的业务并不容易,”一位投资者表示。“有几年确实感觉公司发展停滞。”

员工当中不满情绪开始涌现,当初很多人加入公司是因为热爱其使命,有人称之为“梦幻般,又有些崇高的氛围”。他们当时就知道,由于陈彬睿承诺永远不出售公司,自己手中的股权不会有多大价值。

2019年3月,Kickstarter企业文化中的紧张局势终于爆发,具体形式是工会运动。当时,对科技公司全职员工来说工会还是新鲜事物。接替陈彬睿的新任首席执行官阿齐兹·哈桑回应称,公司不会主动承认工会。Kickstarter解雇了两名领导工会运动的员工。两人转头就指控公司采取非法报复手段。

Kickstarter应对工会运动的失误打破了人们的幻想,原来这家初创公司并无与众不同之处。此事招致曾让Kickstarter出名的创作者谴责,其中包括演员大卫·克罗斯,他在Twitter上呼吁粉丝支持工会。Current Affairs杂志等曾通过平台支持进步项目的机构威胁要撤回资金。公司后来承认了工会,但不久便裁掉140名员工中的18%,哈桑表示平台上新项目有所减少。

2020年初,疫情导致Kickstarter的员工离开Greenpoint总部远程办公。期间由于困在家里的人们想方设法支持创作者,平台出现了短暂增长。与此同时风投资金涌入其他初创公司,不管是金额还是估值都创下记录。加密货币价格飙升至历史新高,2021年11月比特币达到6.9万美元。仅一个月之后,Kickstarter的区块链公告以及1亿美元的收购要约公诸于世。

豪赌区块链

Kickstarter能吸引新兴风投资本家克里斯·迪克森注意,实在毫不奇怪。2010年代初迪克森曾经营名为Hunch的推荐初创公司,他经常在博客上称应该回到更平等的网络时代,读者甚多。正如迪克森在2009年写道,他和纽约科技创始人创办的小型风险基金Founder Collective同行支持了一家叫20×200的公司,该公司通过与艺术家分享收入“实现艺术民主化”,坚决“不讨好纽约上东区社交名流”。

2011年,迪克森和Hunch联合创始人卡特琳娜·法克都投资了Kickstarter,也推动公司成为纽约科技界宠儿。不久后,迪克森加入了Andreessen Horowitz,对区块链产生浓厚兴趣,他认为区块链技术能让互联网回到最初的开源。2018年 Andreessen Horowitz推出单独的a16z crypto业务,专门投资区块链。

迪克森担任a16z crypto负责人期间,第三只基金募得22亿美元巨额资金,跟陈彬睿的联系也未中断。一位知情人士透露,2021年夏天陈彬睿等Kickstarter董事会成员跟迪克森接触,商讨了Kickstarter新一轮投资事宜,还提出以区块链为支点推进交易。对迪克森来说,带领Kickstarter这样的知名公司进入充满希望的Web3领域实在太诱人,他没有拒绝的理由。

该交易并非向Kickstarter注资买入新股权,而是以要约收购形式进行,意味着新现金都用于购买其他股东持有的流通股,不会直接流入Kickstarter。也就是说,员工和早期投资人可借此套现。

据知情人士透露,该轮隐形融资总金额为1亿美元。a16z crypto领投,其他一些小投资人也加入其中,包括主投早期项目的Yes VC,公司负责人是曾担任迪克森联合创始人的法克,法克还联合创立过照片网站Flickr。

虽然对于收入微薄的公司来说这是一笔巨额投资,但对a16z crypto来说算不上特别。迪克森为了实现加密货币运营网络的愿景还下了其他大胆赌注,比如2018年对名叫Dfinity的初创公司联合主导了两笔总额超过1.6亿美元的交易,该公司正搭建基于区块链的互联网。(然而该公司的代币推出不久便暴跌95%,随后陷入争议。)

为了回报16z慷慨投资,Kickstarter尝试转型为Web3公司。该计划要求将整个平台转移到名为Celo的区块链上,也是16z投资公司,执行起来宏大而艰巨。平台将作为开源协议(类似于http或比特币)运行,不像大多数科技公司一样使用专有代码模型。

用户将可围绕动漫等小众兴趣自行创建迷你平台,从而吸引更多人并通过Kickstarter分享利润。这一架构类似Farcaster等项目,不要求捐赠者使用加密货币支付,Kickstarter要在区块链里上线现有软件的开源新版本,而区块链从未经过大规模消费者应用测试。

加密货币行业很少有人将Celo视为顶级区块链项目,不过该项目确实拥有“负碳”足迹,如此一来Kickstarter也能遵守其环保使命声明。2022年8月Celo联合创始人塞潘达·大卫·卡姆瓦加入Kickstarter董事会。

这笔交易并未要求Kickstarter转型。尽管如此,Kickstarter一位员工表示,公司内部沟通时明确表示a16z参与其中,而风投巨头之所以投资Kickstarter就是因为公司愿意进军Web3。也就是说Kickstarter是完美的试验品。

2021年12月8日,Kickstarter公布进军区块链的同一天,员工收件箱里收到了报价。他们可以以7.41美元出售高达32.49%的股份,比员工买入价格大幅上涨,如果其他人不参与还可以选择出售更多。Kickstarter甚至会支付相关费用。“(公司)热情似乎非常高,”一位前员工表示。

对于一些员工来说,经历了多年动荡之后,这笔收购是一份意外的礼物。“这是千载难逢的机会,”一名员工回忆起收到报价后的想法。

被解雇的工会组织者之一泰勒·摩尔对这一消息深感不安。

“Kickstarter的领导层,包括陈彬睿还有其他一些马屁精都是典型的‘皇帝的新衣’,跟其他人完全脱节,”他告诉《财富》杂志。“而真正认真工作的人……都知道这一想法很愚蠢。”

陈彬睿对区块链表现得很热情,宣布的声明中却几乎没有具体内容,而且设定的转型时间不到一年。因此Kickstarter社区担心,在加密货币市场的炒作中,该计划会把平台变成快速致富的骗局。一些用户则担心转型区块链对环境造成的影响,尽管Kickstarter考虑到保护气候选择了Celo,区块链还是可能产生巨大的碳足迹。此时距山姆·班克曼-弗里德的FTX离崩溃还有几个月,加密货币行业丑闻层出不穷已让人心生警惕。

“大家都见识过……加密货币领域几乎到处是猖獗的欺诈、盗窃和财务崩溃,”2022年6月一家流行桌面游戏公司创始人艾萨克·柴尔德里斯在一份通讯中写道。他宣布未来为项目众筹会选择其他平台。

社区当中最愤怒的还是员工,群聊中员工表示怀疑,相互交换嘲讽Kickstarter NFT的笑话。由于公司决定找外部顾问宣布转型区块链的消息,很多员工对突然涌来的用户谩骂毫无准备。再加上Kickstarter以往推出新项目屡试屡败的历史,人们对其能否实现重大技术转型表示怀疑。“简直没法想象,”一名员工说。

转向区块链的计划似乎前景渺茫,事实也很快证明。几个月内,高管们就不再提及,平台也完全没调整为在区块链运行。“感觉就像 Drip,”一位前员工说,Drip是众筹网站Patreon命运多舛的竞争对手。“宣布一下,然后就放弃。”

2022年,Kickstarter聘请了另一位首席执行官埃弗雷特·泰勒,也是公司十年里第五次换掌门人。他接手是在工会运动和转型区块链之后,当时公司已裁掉约40%员工。Kickstarter一位发言人表示,陈彬睿悄悄辞去了董事会主席职务,去年开始了彻底离开董事会的过渡计划。

泰勒很快就明确表示,区块链不再是公司发展重点,上任一周后的2022年10月4日告诉TechCrunch,“我们承诺Kickstarter不会转型区块链或者从事区块链相关业务。”

迪克森和a16z crypto拒绝对本文发表评论,不过迪克森在新书《读、写、拥有》(Read Write Own)新闻发布会上明确表示,尽管公众明显不喜欢区块链技术,但区块链是长期趋势。Kickstarter也未完全放弃。2021年宣布转型后,该公司分拆出名为创意众筹协议的独立公益公司,调派了两名员工,其中包括Kickstarter的前运营经理。现在新公司网站发布了两个软件工程师招聘需求,地点在孟加拉国,Celo仍将Kickstarter称为“生态系统合作伙伴”。

转向没有影响到Kickstarter,a16z的资金无疑有利于获得员工和投资者的好感。但员工表示,这是公司很难摆脱低迷状态的另一因素。区块链转型崩溃最终让用户和员工寒心,人们普遍认为Kickstarter大势已去。

2022年末,Kickstarter首席运营官肖恩·里奥在Celo接受采访时坚称,公司仍然相信区块链。采访者问里奥距离愿景实现有多远时,他回答说:“目前还差95%。”

Kickstarter拒绝让里奥、泰勒和其他高管接受采访。

仍在寻找

Kickstarter确实获得了创业公司罕见的殊荣,成为了专有名词,然而光芒早已不在。“每当我说这Kickstarter工作,别人第一反应都是,‘哦,那家公司还在呢?’”一位2022年入职的前员工说。

如今,埃弗雷特·泰勒继续寻找新的收入来源,推出举措帮助创作者解决航运物流和税收问题等等。他还接受杂志采访和出席论坛,努力向公众重新介绍Kickstarter,强调自己黑人首席执行官的角色以及公司对高管多元化的承诺。

泰勒加盟一年后,Kickstarter聘请了新首席财务官帮助提高收入。根据公司数据以及首席财务官发送的一封内部邮件,2019年以来尽管筹款总额有所增长,收入却有所下降。“他们总在谈论这件事,”一位前员工说。"感觉每次召开全员大会都是紧急事件。"一位发言人拒绝提供Kickstarter的收入数据。

到最后,新产品并没解决Kickstarter的根本问题:过去十年中,每年平台资助的项目数量大致相同。公司原本内部口号是“去他的单一文化”,泰勒采取的手段则更为企业化,五位接受《财富》杂志采访的前员工均对此表示不满。2023年初,泰勒成为雪佛兰(Chevrolet)广告活动代言人,2月又加入一家在线奢侈品市场上市公司的董事会。

“很多人看到首席执行官做赞助内容很生气,”其中一人表示。“感觉是背叛了公司的价值观。”

平台上欺诈横行也一直让人担心。过去三年里,美国商业促进局(Better Business Bureau)收到了100多起与该公司相关的投诉,其中多起涉及欺诈或用户从未收到支持的产品。去年,俄亥俄州总检察长宣布Kickstarter一名用户达成和解,该用户涉嫌为海龟保护慈善机构筹集资金,后来却投向加密货币。诈骗者同意给受骗的捐赠者退款,且五年内不在俄亥俄州开展众筹活动。

根据Kickstarter的机制,项目哪怕不打算启动也能获得全额资金,Kickstarter可从中获得佣金。一些用户还在平台上小额认捐测试信用卡是否被盗刷。据《财富》杂志了解,内部估算显示欺诈项目收入高达18%,之前各州总检察长和联邦贸易委员会在调查中也曾针对Kickstarter平台欺诈行为采取行动。(Kickstarter公司尚未在诉讼或投诉中受到指控。)一位发言人不认可相关估算,表示公司已采取新检测软件和流程等“大量措施”解决欺诈问题。

由于价格飙升,加密货币重新流行,开源协议仍然可以解决Kickstarter棘手的问题。2022年末里奥的采访中提到,区块链不可篡改记账以及可追踪地址和交易历史的特性,有助于解决平台在欺诈和信任方面的困难。

然而,Kickstarter最大的问题可能是时机已过。“我觉得在文化层面,这家公司已经被抛弃了,”一位前员工告诉《财富》杂志。“既然现在(筹集资金)有更方便的方式,比如当TikTok网红,还有什么理由去Kickstarter?”

不过,如果有独立创作者想制作说明内容冗长的棋盘游戏,或是用人工智能每分钟写一首新诗的时钟,Kickstarter还是能填补空白。

“2009年推出以来,Kickstarter上创意项目的认捐金额达到了80亿美元,”公司发言人在一份声明中表示。“展望未来,我们将继续以社区为中心做好每件事。”

发言人表示,在创作者经济中公司的地位与TikTok等平台不同。他们提到最近社交媒体意见领袖资助的项目,还有Kickstarter资助在圣丹斯放映的电影。

然而在区块链丑闻后,BackerKit等竞争对手吸引了一些不满的用户,顶级创作者持续流失。今年2月,奇幻作家布兰登·桑德森宣布下一个项目将选择BackerKit。桑德森曾发起Kickstarter历史上规模最大的活动。

到最后,Kickstarter从未重塑投资和社区支持的规则,每次想跃上新台阶时都会被自身理想主义绊倒。

“公司渴望将平台打造得更像市场,重新成为家喻户晓的品牌,”一位最近离职的员工表示。“我觉得公司声誉每况愈下,发展停滞不前。”

疫情过后,公司再也没搬回3.3万平方英尺的Greenpoint总部,而是以2950万美元出售房产。经过数月寻找,Kickstarter正在与一家潜在买家谈判,对方是为社交媒体意见领袖服务的人才经纪公司。(财富中文网)

译者:梁宇

审校:夏林

2021年12月初,众筹初创公司Kickstarter员工突然听说一笔意外之财:一家投资机构想买入公司股票。这一消息令人吃惊。多年来员工是攒下了公司不少股份,但很多人早就放弃卖出的念头。

彼时的Kickstarter跟2009年爆火的初创公司已截然不同,2009年公司推出了“反人类纸牌”和动感单车Peloton等热门项目。有一段时间,Kickstarter广受企业家和公众欢迎,甚至取得了最让人艳羡的创业成就:公司名称成了专门名词,人们用Kickstarter代指互联网众筹活动。

创业初期,公司的反企业倾向和草根精神吸引了不少名人投资,也推动塑造了纽约科技界的格局。从电影首映到屋顶音乐节,以及疯狂传播的筹款活动,公司推出的种种活动都证明有创意的商业理念在硅谷以外也能获得成功和资金,艺术家可以向粉丝寻求支持。

然而Kickstarter成立十几年后早已风光不再,首席执行官也走马灯一般轮转。2021年的Kickstarter除了令人头疼,对潜在投资者来说几乎毫无价值。公司增长停滞不前,平台上每当有项目达到资金门槛就从中抽取佣金,经历激烈的工会运动之后,曾经感觉良好的文化也逐渐变味。新股东接手的是很多人认为已过时的品牌。

对于Kickstarter的员工和早期投资者来说,这笔意外投资就像是回到正轨的机会。毕竟,投资金额是惊人的1亿美元(公司估值约为4亿美元)。当然存在陷阱。获得投资的同时,Kickstarter要转向区块链,因为新投资方是Andreessen Horowitz旗下加密货币基金,主要希望利用新的炒作周期。

这笔意外之财原本能推动公司重整旗鼓回到正轨。然而,转投区块链后,公司依赖的创作者和粉丝群体反应激烈,不仅重大项目出现损失,尚未恢复的声誉又遭打击。种种动荡显示,即便是最有前途的初创公司也会迷失方向,凸显了在风险投资基础上追求行善面临的挑战。

天堂里的麻烦

2009年Kickstarter成立时,曾带动纽约Etsy或Foursquare等一众初创企业。相较于谷歌(Google)和Facebook等重视技术开发的湾区公司,纽约的初创公司更侧重艺术和文化。

Kickstarter的创意是艺术家或创作者从公众筹集新专辑、棋盘游戏或漫画书的资金,这一想法最早由曾经当过DJ的陈彬睿(Perry Chen)提出,他在新奥尔良爵士音乐节期间艰难筹集资金举办演唱会后创办了公司。项目吸引的风投支持者当中最知名的包括投过早期Tumblr和Twitter的弗雷德·威尔逊,他带领的Union Square Ventures可能是纽约最具标志性的风投公司。

起初Kickstarter办公地尚在曼哈顿下东区一间装有铁皮天花板的阁楼,前门都是涂鸦,还有一张写着“吃屎”的贴纸。公司经常组织用户参加活动,2010年在布鲁克林戈瓦努斯的老美国罐头厂屋顶上举办了第一届电影节。屏幕上播放着平台资助项目的视频,包括模仿濒危动植物物种的舞蹈,来宾排队购买众筹食品项目提供的馅饼和手工苏打水,Kickstarter资助的铜管乐队在一旁演奏。

早期员工还记得,公司非常重视创造力和社会意识,不像硅谷初创公司不惜一切代价追求增长。这家布鲁克林初创公司不像其他同行为实现突破式增长陷入亏损,而是第二年就实现盈利,主要通过从成功筹资的项目中收取5%的佣金和手续费。

这一模式下确实出现了爆款和突破,包括后来荣获艾美奖由菲比·沃勒-布里奇主演的BBC喜剧《伦敦生活》,还有VR头戴式显示器Oculus Rift(Facebook以20亿美元将其收购)。2013年,《美眉校探》(Veronica Mars)制片人罗伯·托马斯在这部小众电视剧被Hulu取消后,在Kickstarter筹集了570万美元。这是Kickstarter项目中金额最高的一次,也充分证明了将权威交回创作者的使命。

“为了艺术而艺术非常重要,”一位前员工告诉《财富》杂志。“项目最终能否执行,不应该仅看项目能为投资者带来多少盈利。”

Kickstarter很早就明确表示并不追求发财致富,投资者还是投入了大量资金,包括2011年的1000万美元融资。早期支持者包括Kickstarter在创意行业的同行,如Meetup的联合创始人斯科特·海弗曼和Vimeo联合创始人扎克·克莱因,还有《发展受阻》(Arrested Development)演员大卫·克罗斯。后来负责Andreessen旗下a16z crypto的克里斯·迪克森也选择加入,当时他刚开始从事天使投资。

似乎所有人都清楚,Kickstarter的目标不是巨额回报。2013年一篇博客文章中,威尔逊特别指出Kickstarter不需要风投的帮助(尽管风投确实有贡献):“公司不需要外部资金,也没怎么强化盈利能力,”威尔逊写道。另一位早期投资者告诉《财富》杂志,之所以选择投资只是因为“喜欢公司的理念”,并不相信会带来经济回报。

然而,Kickstarter早期的感觉良好很快变成另一种情绪——无处不在的混乱感。2014年,Kickstarter联合创始人扬西·斯楚克勒接替陈彬睿,之后几年陈彬睿继续担任管理职务,首席执行官走马灯式轮换开始了。

2015年,Kickstarter迈出了不寻常的一步变身公益公司,营利性公司同意满足社会和环境标准即可转型。一个员工在播客中表示,公益公司是可以确保投资者或董事无法退出或出售Kickstarter的法律架构。“转型为公益公司模糊了个人和公司价值观之间的界限,”一名员工在播客中表示。“创始人经常说,在公益公司架构下,公司的追求可以超越盈利。”

2017年陈彬睿重新担任首席执行官时强化了这一信息,重申Kickstarter永远不会上市或被收购。公司故作姿态以及业务重心突变开始让员工感到愤怒。“我确实感到极度疲惫和倦怠,我觉得员工们对陈彬睿没什么信心,”一位员工表示。

尽管Kickstarter很早就实现盈利,公司业务似乎永远没法实现腾飞。2016年,项目数量稳定在每年19000个左右,没有增长的迹象。Kickstarter赖以收取佣金的平台众筹资金额逐年波动,疫情期间达到近8.14亿美元峰值。

一位早期投资者告诉《财富》杂志,在追求增长与坚守对社会有价值但昂贵或困难的义务之间,Kickstarter从未找到平衡。尽管使命崇高,但由于公司发展重点相互竞争导致混乱,员工很难找到职业发展的道路或发挥主动性。

2012年,Kickstarter斥资750万美元在时尚的布鲁克林Greenpoint社区买下一栋铅笔公司名下的大楼,很快成了2010年代中期科技公司办公室的翻版。有必不可少的屋顶花园、日光浴室和电影院。周六深夜员工带朋友一同前去也能发现有人在公司玩。松弛氛围的另一面是工作文化毫无约束,项目停滞不前,有些员工每天只工作几个小时。

与此同时,该公司在增长战略方面仍举步维艰。面对快速增长的众筹平台Patreon竞争, Kickstarter于2016年收购了名叫Drip的初创公司结果没什么水花,Kicksstarter应付不断崛起的竞争对手的计划也彻底搁置。

“要找到与公司使命不冲突的业务并不容易,”一位投资者表示。“有几年确实感觉公司发展停滞。”

员工当中不满情绪开始涌现,当初很多人加入公司是因为热爱其使命,有人称之为“梦幻般,又有些崇高的氛围”。他们当时就知道,由于陈彬睿承诺永远不出售公司,自己手中的股权不会有多大价值。

2019年3月,Kickstarter企业文化中的紧张局势终于爆发,具体形式是工会运动。当时,对科技公司全职员工来说工会还是新鲜事物。接替陈彬睿的新任首席执行官阿齐兹·哈桑回应称,公司不会主动承认工会。Kickstarter解雇了两名领导工会运动的员工。两人转头就指控公司采取非法报复手段。

Kickstarter应对工会运动的失误打破了人们的幻想,原来这家初创公司并无与众不同之处。此事招致曾让Kickstarter出名的创作者谴责,其中包括演员大卫·克罗斯,他在Twitter上呼吁粉丝支持工会。Current Affairs杂志等曾通过平台支持进步项目的机构威胁要撤回资金。公司后来承认了工会,但不久便裁掉140名员工中的18%,哈桑表示平台上新项目有所减少。

2020年初,疫情导致Kickstarter的员工离开Greenpoint总部远程办公。期间由于困在家里的人们想方设法支持创作者,平台出现了短暂增长。与此同时风投资金涌入其他初创公司,不管是金额还是估值都创下记录。加密货币价格飙升至历史新高,2021年11月比特币达到6.9万美元。仅一个月之后,Kickstarter的区块链公告以及1亿美元的收购要约公诸于世。

豪赌区块链

Kickstarter能吸引新兴风投资本家克里斯·迪克森注意,实在毫不奇怪。2010年代初迪克森曾经营名为Hunch的推荐初创公司,他经常在博客上称应该回到更平等的网络时代,读者甚多。正如迪克森在2009年写道,他和纽约科技创始人创办的小型风险基金Founder Collective同行支持了一家叫20×200的公司,该公司通过与艺术家分享收入“实现艺术民主化”,坚决“不讨好纽约上东区社交名流”。

2011年,迪克森和Hunch联合创始人卡特琳娜·法克都投资了Kickstarter,也推动公司成为纽约科技界宠儿。不久后,迪克森加入了Andreessen Horowitz,对区块链产生浓厚兴趣,他认为区块链技术能让互联网回到最初的开源。2018年 Andreessen Horowitz推出单独的a16z crypto业务,专门投资区块链。

迪克森担任a16z crypto负责人期间,第三只基金募得22亿美元巨额资金,跟陈彬睿的联系也未中断。一位知情人士透露,2021年夏天陈彬睿等Kickstarter董事会成员跟迪克森接触,商讨了Kickstarter新一轮投资事宜,还提出以区块链为支点推进交易。对迪克森来说,带领Kickstarter这样的知名公司进入充满希望的Web3领域实在太诱人,他没有拒绝的理由。

该交易并非向Kickstarter注资买入新股权,而是以要约收购形式进行,意味着新现金都用于购买其他股东持有的流通股,不会直接流入Kickstarter。也就是说,员工和早期投资人可借此套现。

据知情人士透露,该轮隐形融资总金额为1亿美元。a16z crypto领投,其他一些小投资人也加入其中,包括主投早期项目的Yes VC,公司负责人是曾担任迪克森联合创始人的法克,法克还联合创立过照片网站Flickr。

虽然对于收入微薄的公司来说这是一笔巨额投资,但对a16z crypto来说算不上特别。迪克森为了实现加密货币运营网络的愿景还下了其他大胆赌注,比如2018年对名叫Dfinity的初创公司联合主导了两笔总额超过1.6亿美元的交易,该公司正搭建基于区块链的互联网。(然而该公司的代币推出不久便暴跌95%,随后陷入争议。)

为了回报16z慷慨投资,Kickstarter尝试转型为Web3公司。该计划要求将整个平台转移到名为Celo的区块链上,也是16z投资公司,执行起来宏大而艰巨。平台将作为开源协议(类似于http或比特币)运行,不像大多数科技公司一样使用专有代码模型。

用户将可围绕动漫等小众兴趣自行创建迷你平台,从而吸引更多人并通过Kickstarter分享利润。这一架构类似Farcaster等项目,不要求捐赠者使用加密货币支付,Kickstarter要在区块链里上线现有软件的开源新版本,而区块链从未经过大规模消费者应用测试。

加密货币行业很少有人将Celo视为顶级区块链项目,不过该项目确实拥有“负碳”足迹,如此一来Kickstarter也能遵守其环保使命声明。2022年8月Celo联合创始人塞潘达·大卫·卡姆瓦加入Kickstarter董事会。

这笔交易并未要求Kickstarter转型。尽管如此,Kickstarter一位员工表示,公司内部沟通时明确表示a16z参与其中,而风投巨头之所以投资Kickstarter就是因为公司愿意进军Web3。也就是说Kickstarter是完美的试验品。

2021年12月8日,Kickstarter公布进军区块链的同一天,员工收件箱里收到了报价。他们可以以7.41美元出售高达32.49%的股份,比员工买入价格大幅上涨,如果其他人不参与还可以选择出售更多。Kickstarter甚至会支付相关费用。“(公司)热情似乎非常高,”一位前员工表示。

对于一些员工来说,经历了多年动荡之后,这笔收购是一份意外的礼物。“这是千载难逢的机会,”一名员工回忆起收到报价后的想法。

被解雇的工会组织者之一泰勒·摩尔对这一消息深感不安。

“Kickstarter的领导层,包括陈彬睿还有其他一些马屁精都是典型的‘皇帝的新衣’,跟其他人完全脱节,”他告诉《财富》杂志。“而真正认真工作的人……都知道这一想法很愚蠢。”

陈彬睿对区块链表现得很热情,宣布的声明中却几乎没有具体内容,而且设定的转型时间不到一年。因此Kickstarter社区担心,在加密货币市场的炒作中,该计划会把平台变成快速致富的骗局。一些用户则担心转型区块链对环境造成的影响,尽管Kickstarter考虑到保护气候选择了Celo,区块链还是可能产生巨大的碳足迹。此时距山姆·班克曼-弗里德的FTX离崩溃还有几个月,加密货币行业丑闻层出不穷已让人心生警惕。

“大家都见识过……加密货币领域几乎到处是猖獗的欺诈、盗窃和财务崩溃,”2022年6月一家流行桌面游戏公司创始人艾萨克·柴尔德里斯在一份通讯中写道。他宣布未来为项目众筹会选择其他平台。

社区当中最愤怒的还是员工,群聊中员工表示怀疑,相互交换嘲讽Kickstarter NFT的笑话。由于公司决定找外部顾问宣布转型区块链的消息,很多员工对突然涌来的用户谩骂毫无准备。再加上Kickstarter以往推出新项目屡试屡败的历史,人们对其能否实现重大技术转型表示怀疑。“简直没法想象,”一名员工说。

转向区块链的计划似乎前景渺茫,事实也很快证明。几个月内,高管们就不再提及,平台也完全没调整为在区块链运行。“感觉就像 Drip,”一位前员工说,Drip是众筹网站Patreon命运多舛的竞争对手。“宣布一下,然后就放弃。”

2022年,Kickstarter聘请了另一位首席执行官埃弗雷特·泰勒,也是公司十年里第五次换掌门人。他接手是在工会运动和转型区块链之后,当时公司已裁掉约40%员工。Kickstarter一位发言人表示,陈彬睿悄悄辞去了董事会主席职务,去年开始了彻底离开董事会的过渡计划。

泰勒很快就明确表示,区块链不再是公司发展重点,上任一周后的2022年10月4日告诉TechCrunch,“我们承诺Kickstarter不会转型区块链或者从事区块链相关业务。”

迪克森和a16z crypto拒绝对本文发表评论,不过迪克森在新书《读、写、拥有》(Read Write Own)新闻发布会上明确表示,尽管公众明显不喜欢区块链技术,但区块链是长期趋势。Kickstarter也未完全放弃。2021年宣布转型后,该公司分拆出名为创意众筹协议的独立公益公司,调派了两名员工,其中包括Kickstarter的前运营经理。现在新公司网站发布了两个软件工程师招聘需求,地点在孟加拉国,Celo仍将Kickstarter称为“生态系统合作伙伴”。

转向没有影响到Kickstarter,a16z的资金无疑有利于获得员工和投资者的好感。但员工表示,这是公司很难摆脱低迷状态的另一因素。区块链转型崩溃最终让用户和员工寒心,人们普遍认为Kickstarter大势已去。

2022年末,Kickstarter首席运营官肖恩·里奥在Celo接受采访时坚称,公司仍然相信区块链。采访者问里奥距离愿景实现有多远时,他回答说:“目前还差95%。”

Kickstarter拒绝让里奥、泰勒和其他高管接受采访。

仍在寻找

Kickstarter确实获得了创业公司罕见的殊荣,成为了专有名词,然而光芒早已不在。“每当我说这Kickstarter工作,别人第一反应都是,‘哦,那家公司还在呢?’”一位2022年入职的前员工说。

如今,埃弗雷特·泰勒继续寻找新的收入来源,推出举措帮助创作者解决航运物流和税收问题等等。他还接受杂志采访和出席论坛,努力向公众重新介绍Kickstarter,强调自己黑人首席执行官的角色以及公司对高管多元化的承诺。

泰勒加盟一年后,Kickstarter聘请了新首席财务官帮助提高收入。根据公司数据以及首席财务官发送的一封内部邮件,2019年以来尽管筹款总额有所增长,收入却有所下降。“他们总在谈论这件事,”一位前员工说。"感觉每次召开全员大会都是紧急事件。"一位发言人拒绝提供Kickstarter的收入数据。

到最后,新产品并没解决Kickstarter的根本问题:过去十年中,每年平台资助的项目数量大致相同。公司原本内部口号是“去他的单一文化”,泰勒采取的手段则更为企业化,五位接受《财富》杂志采访的前员工均对此表示不满。2023年初,泰勒成为雪佛兰(Chevrolet)广告活动代言人,2月又加入一家在线奢侈品市场上市公司的董事会。

“很多人看到首席执行官做赞助内容很生气,”其中一人表示。“感觉是背叛了公司的价值观。”

平台上欺诈横行也一直让人担心。过去三年里,美国商业促进局(Better Business Bureau)收到了100多起与该公司相关的投诉,其中多起涉及欺诈或用户从未收到支持的产品。去年,俄亥俄州总检察长宣布Kickstarter一名用户达成和解,该用户涉嫌为海龟保护慈善机构筹集资金,后来却投向加密货币。诈骗者同意给受骗的捐赠者退款,且五年内不在俄亥俄州开展众筹活动。

根据Kickstarter的机制,项目哪怕不打算启动也能获得全额资金,Kickstarter可从中获得佣金。一些用户还在平台上小额认捐测试信用卡是否被盗刷。据《财富》杂志了解,内部估算显示欺诈项目收入高达18%,之前各州总检察长和联邦贸易委员会在调查中也曾针对Kickstarter平台欺诈行为采取行动。(Kickstarter公司尚未在诉讼或投诉中受到指控。)一位发言人不认可相关估算,表示公司已采取新检测软件和流程等“大量措施”解决欺诈问题。

由于价格飙升,加密货币重新流行,开源协议仍然可以解决Kickstarter棘手的问题。2022年末里奥的采访中提到,区块链不可篡改记账以及可追踪地址和交易历史的特性,有助于解决平台在欺诈和信任方面的困难。

然而,Kickstarter最大的问题可能是时机已过。“我觉得在文化层面,这家公司已经被抛弃了,”一位前员工告诉《财富》杂志。“既然现在(筹集资金)有更方便的方式,比如当TikTok网红,还有什么理由去Kickstarter?”

不过,如果有独立创作者想制作说明内容冗长的棋盘游戏,或是用人工智能每分钟写一首新诗的时钟,Kickstarter还是能填补空白。

“2009年推出以来,Kickstarter上创意项目的认捐金额达到了80亿美元,”公司发言人在一份声明中表示。“展望未来,我们将继续以社区为中心做好每件事。”

发言人表示,在创作者经济中公司的地位与TikTok等平台不同。他们提到最近社交媒体意见领袖资助的项目,还有Kickstarter资助在圣丹斯放映的电影。

然而在区块链丑闻后,BackerKit等竞争对手吸引了一些不满的用户,顶级创作者持续流失。今年2月,奇幻作家布兰登·桑德森宣布下一个项目将选择BackerKit。桑德森曾发起Kickstarter历史上规模最大的活动。

到最后,Kickstarter从未重塑投资和社区支持的规则,每次想跃上新台阶时都会被自身理想主义绊倒。

“公司渴望将平台打造得更像市场,重新成为家喻户晓的品牌,”一位最近离职的员工表示。“我觉得公司声誉每况愈下,发展停滞不前。”

疫情过后,公司再也没搬回3.3万平方英尺的Greenpoint总部,而是以2950万美元出售房产。经过数月寻找,Kickstarter正在与一家潜在买家谈判,对方是为社交媒体意见领袖服务的人才经纪公司。(财富中文网)

译者:梁宇

审校:夏林

In early December 2021, employees at the crowdfunding startup Kickstarter got news of a windfall: An investor group wanted to buy some of their shares. The news came as a surprise. While the workers had amassed equity in the firm for years, many had given up hope of ever selling it.

The Kickstarter they now worked for was a very different place than the red-hot startup of 2009 that had launched viral projects like Cards Against Humanity and Peloton. For a while, Kickstarter was the toast of entrepreneurs and the public alike, and even achieved the most coveted startup achievement: Its name became a noun as people used “Kickstarter” synonymously with internet crowdfunding campaigns.

Back then, the company’s anti-corporate slant and grassroots spirit had lured celebrity investors and helped shape the early New York tech scene. Its events, from film premieres to rooftop festivals, and its viral money-raising campaigns had helped prove that creative business ideas could find success—and funding—outside of Silicon Valley, and that artists could find support from their fans.

But a dozen years after its launch, Kickstarter had lost its cachet of cool and churned through CEOs. The Kickstarter of 2021 had little to offer would-be investors but headaches. Growth had flatlined at the startup, which made its money by taking a small cut when a project on its platform met a funding threshold, and its onetime feel-good culture had become toxic in the wake of a bitter unionization drive. New shareholders would be inheriting ownership of a brand that many felt had turned stale.

For Kickstarter’s employees and early investors, the surprise investment felt like an opportunity to make things right. After all, this was no small top-up to keep the lights on, but a staggering $100 million investment that valued the startup at around $400 million. But there was a catch. The investment came with the expectation that Kickstarter would attempt a pivot to blockchain as its new benefactor—the crypto fund of venture behemoth Andreessen Horowitz—sought to capitalize on the latest hype cycle.

The windfall could have been the boost the company needed to help it reset and get back on a path toward relevance. Instead, the blockchain pivot triggered a vitriolic response from the community of creators and fans on which the company relied, leading to the loss of major projects and a reputational hit from which Kickstarter has yet to recover. The turmoil shows how even the most promising startups can lose their way, but also underscores the challenge of pursuing a do-gooder mission atop a foundation of venture capital.

Trouble in paradise

When it launched in 2009, Kickstarter was at the vanguard of a cohort of New York startups—think Etsy or Foursquare—that would challenge their West Coast counterparts by leaning into arts and culture versus the developer-first sensibilities of Bay Area projects like Google and Facebook.

The idea for Kickstarter—where artists or creators turned to the public to fund their new album, board game, or comic book—came from Perry Chen, a former DJ who launched the company after he struggled to raise money to throw a concert during New Orleans’ Jazz Fest. Its highest-profile venture backer was Fred Wilson, who made early bets on the likes of Tumblr and Twitter, and whose Union Square Ventures is perhaps New York’s most iconic venture shop.

Kickstarter started out in a loft with tin ceilings on the trendy Lower East Side of Manhattan—its front door was painted with graffiti and a sticker that read “Eat Shit.” The company rallied its users around events, throwing its first annual film festival in 2010 on the rooftop of the Old American Can Factory in Gowanus, Brooklyn. A screen streamed footage of projects funded by the platform—including a choreographed dance that mimicked endangered plant and animal species—while a Kickstarter-backed brass band performed for guests who lined up for pies and artisanal sodas from crowdfunded food projects.

Early employees remember a company that valued creativity and a socially conscious ethos over the growth-at-all-costs mentality that typically defined Silicon Valley startups. Rather than pursuing the usual venture path of going into the red to achieve hockey stick growth, the Brooklyn startup notched a profit in its second year through the 5% cut and processing fees it took from successfully funded projects.

The model produced internet virality and breakout hits, including Fleabag, the Phoebe Waller-Bridge BBC comedy that would go on to win Emmys, and the VR headset Oculus Rift, which would later sell for $2 billion to Facebook. In 2013, Veronica Mars showrunner Rob Thomas turned to Kickstarter to raise $5.7 million for a movie after the cult-favorite television series was canceled by Hulu. It was the most that had ever been pledged to a Kickstarter project—and a testament to its mission to put authority back into the hands of creators.

“Art for art’s sake was really important,” one former employee told Fortune. “It shouldn’t be just how much money a project can turn around for investors that should dictate its being allowed to get made.”

Kickstarter made it clear early on that it wasn’t pursuing a path to riches, but investors poured in money all the same, including a $10 million round announced in 2011. Early backers included Kickstarter’s fellow creative travelers like Scott Heiferman, the cofounder of Meetup, and Zach Klein, the cofounder of Vimeo, as well as Arrested Development actor David Cross. Chris Dixon, the future head of Andreessen spinoff a16z crypto who was getting his start as an angel investor, also came on board.

All seemed to understand that Kickstarter was not built to deliver outsize returns. In a 2013 blog post, Wilson specifically pointed out that Kickstarter didn’t need help from VCs (even though they contributed nonetheless): “It has never needed to take outside money, and it has not done much to optimize its profitability,” Wilson wrote. Another early investor told Fortune that they put money in because they “just loved the concept” and never believed it would lead to a financial payoff.

Those feel-good early days at Kickstarter, however, would soon give way to another sentiment—a pervasive sense of chaos. A CEO carousel began at the company as Kickstarter cofounder Yancey Strickler took over from Chen in 2014, although the latter would retain a management role for years to come.

Then in 2015, Kickstarter took the rare step of becoming a public benefit corporation, a type of classification where for-profit companies agree to meet social and environmental standards. An employee-produced podcast described the public benefit corporation as a legal structure that could protect Kickstarter from attempts by investors or directors to exit or sell the company. “Restructuring as a PBC blurs the line between personal and company values,” one employee said on the podcast. “Our founders would regularly describe the PBC as a structure that allows the company to operate more like a person driven by more than just profit.”

Chen reinforced the message when he returned as CEO in 2017 and restated earlier proclamations that Kickstarter would never go public or be acquired. The posturing and whiplash of company priorities had begun to grate on employees. “I definitely felt that there was an extreme level of exhaustion and burnout, and I don’t think staff had a lot of faith in Perry,” said one.

Even though Kickstarter figured out early on how to make a profit, the company could never seem to take off. The number of projects plateaued in 2016 at around 19,000 per year—with no signs of growth. Dollars raised on the platform, where Kickstarter got its cut, would fluctuate year-to-year and peaked during the pandemic at nearly $814 million.

An early investor told Fortune that Kickstarter was never able to find an equilibrium between growth and staying true to its new charter, which committed it to socially worthy but expensive or difficult obligations. Despite the noble mission, employees struggled to find paths for career growth or advance their own initiatives as the company’s competing priorities bred dysfunction.

In 2012, Kickstarter spent $7.5 million on a building owned by a pencil company in the modish Brooklyn neighborhood of Greenpoint—which soon became a parody of a mid-2010s tech office. There was the obligatory rooftop garden, solarium, and movie theater. Employees would stop by with their friends late on a Saturday night and still find people hanging out. The flip side was a tetherless haze of a work culture, where projects languished and some employees only worked a few hours each day.

Meanwhile, the company continued to flail when it came to growth strategies. It acquired a startup called Drip in 2016 as a response to the quickly growing crowdfunding subscription platform Patreon, but the move didn’t pan out, and Kickstarter’s planned answer to its rising competitor was shut down altogether.

“It’s not the easiest task to come up with something that doesn’t start conflicting with some of their mission,” one of the investors said. “It felt like things really just kind of plateaued for quite a few years.”

Discontent began bubbling up among employees, many of whom had joined the company because of its mission, which one described as a “dreamy, sort of lofty vibe.” They knew their equity in the startup would never amount to much, thanks to Chen’s pledge to never sell.

In March 2019, the tensions in Kickstarter’s workplace culture boiled over in the form of a union drive—at the time, an unprecedented step for full-time workers at a tech company. New CEO Aziz Hasan—yet another leader who had taken over for Chen—responded by calling an all-hands to say the company would not voluntarily recognize the union. Kickstarter fired two of the employees leading the labor drive. The pair promptly turned around and filed a complaint accusing the startup of illegal retaliation.

Kickstarter’s bungling of the union drive punctured illusions that it was a different kind of startup. The move drew condemnation from the same creators who had catapulted Kickstarter to popularity, including David Cross, who urged followers to support the union on Twitter. Backers of progressive projects funded through the platform, like the magazine Current Affairs, threatened to pull their funding. The company laid off 18% of its 140-person workforce shortly after recognizing the union, with Hasan citing a drop-off in new projects on the platform.

In early 2020, the pandemic drove Kickstarter’s employees out of their Greenpoint headquarters into remote work. During this time, the platform saw a brief uptick in growth as people stuck at home looked for ways to support creators. Meanwhile, venture funding flowed into other startups at record levels and valuations, while crypto prices soared to all-time highs with Bitcoin scraping $69,000 in November 2021. Kickstarter’s blockchain announcement—and the $100 million tender offer—came just a month later.

The blockchain gamble

Kickstarter was exactly the kind of company you might expect to captivate the attention of up-and-coming venture capitalist Chris Dixon. Dixon—who, in the early 2010s, ran a recommendation startup called Hunch—wrote regularly on his widely read blog about the need to harken back to the more egalitarian era of the web. He and his peers at Founder Collective, a small venture fund started by New York tech founders, had already backed another company at the time called 20×200, which was aimed at “democratizing art” by splitting revenue with artists to avoid any “groveling to Upper East Side socialites,” as Dixon wrote in 2009.

Dixon and his Hunch cofounder Caterina Fake both invested in Kickstarter in 2011—helping to anoint the startup as a darling in New York tech circles. Soon after, Dixon joined Andreessen Horowitz, where he became enamored with blockchain, viewing the technology as a way to bring the internet back to its open-source roots. The firm would spin out a separate operation—a16z crypto—dedicated to blockchain investments in 2018.

In his new role as head of a16z crypto—and bearing a whopping $2.2 billion from its third fund—Dixon stayed in touch with Chen. According to a person familiar with the deal, members of the Kickstarter board, including Chen, approached Dixon in the summer of 2021 about a new investment in Kickstarter, with the proposed blockchain pivot offered as the impetus for the deal. For Dixon, the prospect of shepherding a familiar name like Kickstarter into the promised land of Web3 proved too enticing to pass up.

Rather than injecting capital into Kickstarter to buy new equity, the deal came in the form of a tender offer, meaning all of the new cash went to buy up outstanding shares owned by other shareholders—none would go directly to Kickstarter. Instead, it allowed employees and early investors to cash out.

The stealth round totaled $100 million, according to people familiar with the deal. It was led by a16z crypto and included a handful of other smaller investors, including Yes VC, the early-stage investment firm headed by Dixon’s onetime cofounder Fake, who had also cofounded photo site Flickr.

While this was a massive check for a company that pulled in slim revenue figures, the deal was not out of the ordinary for a16z crypto. Dixon had placed other moonshot bets to enact his vision of a crypto-run web, such as co-leading two deals in 2018 totaling over $160 million for a startup called Dfinity that was building a blockchain-based version of the internet. (The company, instead, became mired in controversy after its token crashed 95% shortly after launching.)

In return for the a16z largesse, Kickstarter would take its own crack at becoming a Web3 company. The grand but improbable plan called for shifting its entire platform onto a blockchain called Celo, another a16z portfolio company, where it would operate as an open-source protocol—akin to http or Bitcoin—rather than rely on the proprietary code model used by most tech firms.

Users, meanwhile, would be able to create mini platforms of their own around niche interests like anime, bringing in more people and splitting any profits with Kickstarter. This structure, which would echo other initiatives like Farcaster, did not require donors to pay with cryptocurrencies but would entail Kickstarter’s creating an entirely new, open-source version of its existing software built atop a blockchain that had never been tested by a massive consumer application.

Few in the crypto industry have ever regarded Celo as a top-tier blockchain project, but it did boast a “carbon negative” footprint that would also allow Kickstarter to abide by its environmentally conscious mission statement. Celo’s cofounder, Sepandar David Kamvar, joined Kickstarter’s board in August 2022.

The deal didn’t require Kickstarter to follow through on the pivot. Still, one employee who worked at Kickstarter at the time of the tender offer said that the company made clear through internal communications that a16z was involved and that the venture giant was investing in Kickstarter because the company was willing to move into Web3. The company represented the perfect guinea pig.

The tender offer arrived in employees’ inboxes on Dec. 8, 2021, the same day that Kickstarter revealed its blockchain ambitions. They could sell up to 32.49% of their shares at a price of $7.41, a steep markup from the employees’ purchase price, with the option of selling even more if others did not take part. Kickstarter would even cover the associated fees. “[The company] seemed very enthusiastic,” said one former employee.

For some employees, the buyout represented an unexpected gift after years of turmoil. “This is a once-in-a-lifetime opportunity,” one employee remembered thinking after getting the tender offer.

Taylor Moore, one of the fired union organizers, viewed the announcement with trepidation.

“Kickstarter’s leadership, talking about Perry Chen and some of his other sycophants, are a classic story of The Emperor’s New Clothes, just completely out of touch,” he told Fortune. “Whereas the people who actually work…they know that it’s a stupid idea.”

Despite Chen’s newfound enthusiasm about blockchain, the announcement came with few specifics, and the timeline set out for the pivot was less than a year—raising fears among the Kickstarter community that, amid the hype of the crypto market, the plan would transform their beloved platform into a scammy get-rich-quick scheme. Some users expressed concern over the environmental impact of moving over to blockchain, which can have a massive carbon footprint, even though Kickstarter had chosen Celo because of its climate-friendly approach. And even though Sam Bankman-Fried’s FTX was months away from imploding, the scandals piling up in the crypto industry made everyone wary.

“Pretty much all we have seen…from the crypto space is rampant fraud, theft, and financial ruin,” wrote Isaac Childres, the founder of a popular tabletop game company, in a June 2022 newsletter announcing he would turn to other platforms to crowdfund future projects.

Most of the community outrage fell upon employees, who expressed their disbelief in group chats and swapped sardonic jokes about Kickstarter NFTs. Meanwhile, the company’s decision to use an outside consultant to announce the blockchain news meant that many staffers were ill-prepared for the sudden torrent of vitriol from users. And given Kickstarter’s checkered history of launching new initiatives, doubt spread about its capacity to pull off a major technology pivot. “It was inconceivable,” said one employee.

The blockchain plan seemed impossible—and that would soon prove to be the case. Within months, executives stopped bringing it up at all, and no section of the platform was ever converted to run on a blockchain. “It felt like Drip,” said one former employee, referring to the ill-fated Patreon competitor. “Announcing this thing, and then just abandoning it.”

In 2022, Kickstarter hired yet another CEO, Everette Taylor—the company’s fifth change in a decade—who started after the union organization, blockchain rollout, and after the company had parted ways with approximately 40% of its employees. Chen quietly stepped down as chair of the board, and last year began a transition plan to leave the board altogether, according to a Kickstarter spokesperson.

Taylor immediately made clear that blockchain was no longer a priority for the company, telling TechCrunch on Oct. 4, 2022—a week after he started—that “we’re not committed to moving Kickstarter to the blockchain or doing anything specific there.”

Though Dixon and a16z crypto declined to comment for the article, Dixon made clear on a recent press tour for his new book, Read Write Own, that blockchain is a long-term play, despite the public’s apparent distaste for the technology. Meanwhile, Kickstarter hasn’t turned its back on it altogether. After the 2021 announcement, it spun out a separate public benefit corporation called the Creative Crowdfunding Protocol and staffed it with two employees, including Kickstarter’s former manager of operations. Today, its website lists two job openings for software engineers in Bangladesh, and Celo still refers to Kickstarter as an “ecosystem partner.”

The pivot didn’t hurt Kickstarter—and the money from a16z certainly helped build some goodwill with staffers and investors. But employees say it was yet another distraction that kept the company from pulling out of its doldrums. And by ultimately alienating users and employees, the blockchain debacle contributed to the overall perception that Kickstarter’s best days were behind it.

In an interview hosted at Celo in late 2022, Kickstarter COO Sean Leow insisted that the company continued to believe in the protocol. The interviewer asked whether he saw any gaps in the vision. “I would say 95% of it is gaps at this point,” Leow replied.

Kickstarter declined to make Leow, Taylor, and other executives available for an interview.

Still searching

Kickstarter may have achieved the rare startup distinction of becoming a noun, but the company has lost its gleam. “Everybody’s gut reaction when I said that I worked at Kickstarter was, ‘Oh, that’s still a company?’” said one former employee, who joined in 2022.

Today, Everette Taylor continues to hunt for fresh revenue streams, launching initiatives such as a plan to help creators with shipping logistics and taxes. The CEO is also attempting to reintroduce Kickstarter to the public, including through magazine interviews and conference appearances that highlight his role as a Black CEO and the company’s commitment to diversity within the C-suite.

A year after Taylor joined, Kickstarter brought on a new CFO to help improve revenue. Even as fundraising totals have grown, revenue has declined since 2019, according to company data as well as an internal email sent by the CFO. “They talk about it all the time,” said one former employee. “It feels like every all-hands is an emergency event.” A spokesperson declined to provide Kickstarter’s revenue figures.

Ultimately, the new products do not address Kickstarter’s fundamental problem: The platform has funded roughly the same number of projects each year for the past decade. And Taylor’s more corporate approach to a company whose internal motto was once “Fuck the monoculture” has drawn criticism from five former employees who spoke with Fortune. In early 2023, Taylor was the face of an advertising campaign for Chevrolet, and he joined the board of a publicly traded online luxury marketplace in February.

“A lot of people were dismayed to see the CEO doing sponsored content,” said one. “It felt like a betrayal of the values of the company.”

The prevalence of fraud on the platform is another persistent anxiety. The company has notched more than 100 complaints with the Better Business Bureau in the past three years, many of which revolve around allegations of scams or users never getting products they backed. Last year, Ohio’s attorney general settled with a Kickstarter user for allegedly raising money for turtle conservation charities only to turn around and blow it on crypto. The scammer agreed to pay back the defrauded donors and refrain from crowdfunding campaigns in Ohio for five years.

Because of Kickstarter’s mechanics, projects can achieve full funding—and Kickstarter will receive its cut—with no intention of ever launching. Some users will also make small pledges on the platform to test out stolen credit cards. As Fortune learned, one internal estimate puts the amount of revenue that comes from fraudulent projects as high as 18%—a concern echoed by past actions from different states’ attorneys general and the Federal Trade Commission, who have targeted Kickstarter scams in their investigations. (Kickstarter itself has not been charged in these lawsuits or complaints.) A spokesperson denied the estimate and said the company has implemented “extensive measures” to address fraud, including new detection software and processes.

Crypto is creeping back into vogue thanks to skyrocketing prices, and an open-source protocol could still present a solution to Kickstarter’s nagging issues. The immutable ledger of the blockchain, with its traceable addresses and transaction history, could help solve the platform’s difficulties with fraud and trust, as Leow brought up in his late 2022 interview.

The biggest problem for Kickstarter, though, may be that time has simply passed it by. “I feel like they just were left in the dust culturally,” one former employee told Fortune. “What’s the argument for someone to go to Kickstarter when there’s all these other ways [to raise money] that are more viable, like being a TikTok influencer?”

Kickstarter still does fill a niche for indie creators who want to create a board game with a verbose set of instructions, or a clock that uses AI to write a new poem every minute.

“Since our launch in 2009, $8 billion has been pledged to creative projects on Kickstarter,” the spokesperson said in a statement. “As we look to the future, we’ll continue to center our community in everything we do.”

The spokesperson said that the company sits in a different position within the creator economy than platforms like TikTok. They pointed to recently funded projects from social media influencers, as well as recent Kickstarter-funded films showcased at Sundance.

Competitors like BackerKit, however, hoovered up disaffected users after the blockchain scandal, and Kickstarter continues to bleed top creators. In February, the fantasy author Brandon Sanderson—who launched the largest campaign in Kickstarter’s history—announced his next project would be on BackerKit.

Ultimately, Kickstarter was never able to reinvent the rules of investing and community support, instead tripping over its own idealism whenever it sought to leap to the next level.

“There is this desire to become more of a marketplace and be a household name again,” said one staffer who left recently. “I feel like we’re stagnating because our reputation is getting worse and worse.”

The company never moved back into its 33,000-square-foot brick headquarters in Greenpoint after the pandemic, instead opting to put the property up for sale to the tune of $29.5 million. After months of searching, Kickstarter is in talks with a potential buyer: a talent agency for social media influencers.