加利福尼亚州山景城海岸线露天剧场,谷歌母公司Alphabet首席执行官桑达尔·皮查伊面前观众座无虚席。他正尽最大努力扮演史蒂夫·乔布斯和比尔·盖茨开创的新派科技公司掌门人角色:有点像流行偶像,又有点像教会传教士传达神之旨意,只是方法不再是歌曲或布道,而是软件和硅。可惜说话温和,性格内向的皮查伊天生不太适合这一角色。不知何故,他演讲的氛围更像是高中音乐剧,没有好莱坞剧场的热烈氛围。

早在2016年,皮查伊就宣布谷歌推行“人工智能优先”战略。如今人工智能发展正处于重要时刻,然而谷歌的竞争对手吸引了所有注意力。去年11月ChatGPT亮相让谷歌措手不及,过去六个月里,谷歌忙着推出产品,与ChatGPT研发方OpenAI以及其合作伙伴兼支持者微软竞争。

5月举办的公司年度I/O开发者大会上,皮查伊希望展示过去六个月里谷歌的努力。他介绍了名为“帮我写作”的Gmail新功能,可根据文本提示自动起草整封邮件;谷歌地图里人工智能支持的沉浸式视图,可以构建用户路线的逼真3D预览;生成式人工智能照片编辑工具等等。他谈到了强大的PaLM 2大型语言模型(LLM),正是该技术支持了种种新功能,包括谷歌用来对标ChatGPT的Bard。他还提到正在开发的强大人工智能模型家族,名为Gemini,可能大幅拓展人工智能的影响,也会放大其中风险。

不过现场和观看直播的观众们最希望听到的话题,皮查伊却避而不谈,即谷歌到底有什么计划?毕竟,搜索是谷歌的核心产品,去年收入超过1600亿美元,约占Alphabet总收入的60%。如今人工智能聊天机器人可以从全网络搜集信息回答用户,不再以链接列表形式而是以对话形式提供,对谷歌这台利润机器有何影响?

皮查伊对此闪烁其词。“我们正以大胆和负责任的方式重新构想所有核心产品,包括搜索,”皮查伊说。如此介绍关系公司命运,与他自身将来也息息相关的产品,实在低调得有些奇怪。之后皮查伊的演讲中,从每一轮不温不火的礼节性掌声中就能感受到观众的不耐烦。

然而皮查伊再没触及关键话题。他选择让谷歌搜索副总裁凯茜·爱德华兹介绍名字有些尴尬的“搜索生成体验”(SGE)。该功能结合了搜索和生成式人工智能,用户搜索时可提供单独一份摘要“快照”答案,以及证实答案的网站链接。用户可以继续提问,就像使用聊天机器人一样。

新产品有可能成为强大的答案生成器。但能带来收入吗?这正是谷歌面临的创新者困境核心。

Alphabet表示,SGE属于“实验”。不过皮查伊明确表示,SGE或同类产品将在未来的搜索领域发挥关键作用。6月,皮查伊对彭博社(Bloomberg)表示,“类似产品将成为主流搜索体验的一部分”。这项新技术显然还未达到预期目标。SGE速度相对较慢,而且跟其他生成式人工智能一样,容易出现计算机科学家所谓的“幻觉”,即自信地提供虚假信息。皮查伊也承认,在搜索引擎中这一问题可能存在危险。他告诉彭博,如果父母在谷歌上搜索儿童应服用泰诺的剂量,“完全不能出错。”

从SGE的推出,能看出在人工智能军备竞赛中谷歌的反应速度。该技术借鉴了谷歌在人工智能和搜索领域数十年的经验,充分展示了Alphabet的火力。不过也暴露了大变革之际Alphabet的脆弱性。聊天机器人的信息收集可能蚕食谷歌的传统搜索业务,及其利润丰厚的广告驱动商业模式。不幸的是,比起熟悉的谷歌链接列表,很多人更喜欢ChatGPT的答案。“现在人们熟知的搜索行将消失,”研究公司Forrester的分析师杰伊·帕蒂萨尔如此预测。

因此,皮查伊和Alphabet不能弄错的不仅仅是泰诺剂量。谷歌拥有强大的人工智能工具,却未制定与Alphabet身为全球第17大公司的广告收入相匹配的战略。如何应对转变,将决定未来十年里谷歌不管作为动词还是一家公司能否继续生存。

****

ChatGPT推出时,一些评论家认为意义接近iPhone或个人电脑问世;还有些人更为激进,认为聊天机器人堪比电动机或印刷机。但在很多高管、资金经理和技术人员看来,有件事从一开始就很明显:ChatGPT是直指Alphabet心脏的匕首。ChatGPT刚亮相几个小时,使用该聊天机器人的用户就称之为“谷歌杀手”。

尽管ChatGPT无法访问互联网,不过观察人士准确地猜到,让人工智能驱动的聊天机器人访问搜索引擎以提供答案相对容易。处理多重查询时,ChatGPT统一响应似乎比必须通过多个链接拼凑信息要方便。此外,聊天机器人还能编写代码、创作俳句、写高中历史论文、制定营销计划和提供生活指导。这些谷歌搜索都做不到。

到目前为止,微软已向OpenAI投资130亿美元,而且迅速宣布将OpenAI的技术集成到搜索引擎必应中,之前必应的市场份额从未超过3%。评论人士认为,本次整合可能是必应彻底击垮谷歌搜索的最佳机会。微软首席执行官萨蒂亚·纳德拉打趣道,谷歌是搜索领域的“无敌巨人”,然后补充说,“我想让人们知道,我们能让巨人起舞。”

比起一些认为谷歌太过官僚主义、迟钝得无法起舞的评论人士,纳德拉对谷歌的“舞蹈技巧”信心还要强一些。长期以来,谷歌世界级的人工智能团队一直是科技界羡慕的对象。2017年,谷歌研究人员发明了支撑生成式人工智能热潮的基本算法,称为transformer的人工神经网络。(ChatGPT中的T就是“transformer”。)然而Alphabet似乎搞不清如何才能将研究转化为能激发公众想象力的产品。2021年谷歌还创建了名为LaMDA的聊天机器人,功能相当强大。LaMDA的对话技巧堪称一流。但就像其他大语言模型一样,这款机器人的反应可能不准确,存在偏见,有时只是奇怪和令人不安。由于问题并未解决,而且人工智能社区想解决确实很难,谷歌担心急着发布不负责任,会对声誉造成风险。

或许还有一点同样重要,聊天机器人并不太符合谷歌的主要商业模式——广告。与谷歌搜索相比,总结式答案或对话流提供的广告投放或赞助链接机会似乎少得多。

在很多人看来,此次冲突暴露出更深层次的文化障碍。一些前员工称,谷歌对市场主导地位太舒服且过于自满和官僚主义,无法应对迅速的转变,就像2020年谷歌收购生成式人工智能企业家普拉文·塞沙德里的初创公司AppSheet时一样。今年早些时候,他离职后不久写了一篇博客,称谷歌存在四大核心问题:没有使命、没有紧迫感、特殊主义妄想和管理不善。他说,所有问题都源于“拥有名为‘广告’印钞机,保持逐年增长,却掩盖了其他错误。”

还有四位过去两年离开谷歌的前员工也有类似描述。(由于担心违反离职协议或损害职业发展,他们接受《财富》杂志采访时要求匿名。)“仅仅想改进现有功能,就得忍受大量繁琐程序,更不用说研发新产品,令人难以置信,”其中一人表示。另一位前员工表示,谷歌经常把庞大用户群和收入当做借口,不接受新想法。“他们把影响的标准定得太高,几乎没什么办法绕过,”另一位说。

类似的内部不满情绪只会助长更广泛的说法:谷歌麻烦大了。从ChatGPT发布到元旦的五个星期里,Alphabet公司的股价下跌了12%。

到去年12月中旬,谷歌内部出现了恐慌迹象。《纽约时报》(New York Times)报道称,Alphabet为赶上OpenAI和微软拉响了“红色警报”。2019年谷歌联合创始人拉里·佩奇和谢尔盖·布林已经辞去日常职责,只通过超级投票权股份控制公司。现在两人突然返回,有报道称布林卷起袖子帮忙编写代码。

联合创始人突然回归,很难说是对皮查伊领导能力的支持。不过谷歌高管认为,佩奇和布林的返回,以及最近的争夺背后都是热情而非恐慌。“必须记住,拉里和谢尔盖都是计算机科学家,”Alphabet全球事务总裁肯特·沃尔克表示。“两人都对未来的可能性很兴奋。”后来皮查伊在接受《纽约时报》播客采访时表示,从未发布“红色警报”。不过他承认“要求团队紧急行动”,寻找办法将生成式人工智能变成“深刻、有意义的体验”。

外部刺激显然产生了效果。今年2月,谷歌宣布推出与ChatGPT正面竞争的Bard。到3月,谷歌介绍了Workspace写作助手功能,以及Vertex人工智能环境,该环境可以帮助云客户利用自己的数据训练并运行生成式人工智能应用。在5月的I/O开发者大会上,谷歌几乎每款产品都闪耀着新一代人工智能光辉。一些投资者对此印象深刻。I/O大会后,摩根士丹利(Morgan Stanley)分析师立即写道,该公司的“创新速度和推向市场节奏提升”。ChatGPT推出后谷歌股票一度跌至每股88美元,等到皮查伊在山景城登台时,股价已超过122美元。

疑云仍未消散。“谷歌有很多内在优势,”股票研究公司Arete research的创始人理查德·克莱默表示,毕竟谷歌拥有无可匹敌的人工智能研究成果,还能访问全世界一些最先进数据中心。“谷歌只是在商业上没有尽全力推进,”他补充道,谷歌各部门和产品团队过于孤立,很难在公司层面展开合作。(到目前为止,人工智能冲击下谷歌对组织架构最明显的调整是将两项领先的人工智能研究项目,即总部位于山景城的谷歌大脑和总部位于伦敦的DeepMind合并为名为GoogleDeepMind的实体。)

除了Arete分析师,也有其他人认为谷歌并未实现潜力。摩根士丹利指出,尽管最近Alphabet有所复苏,但仍存在“估值差距”。之前其股价一直高于苹果、Meta和微软等其他科技巨头,但截至7月谷歌市盈率比竞争对手低约23%。在很多人看来,这说明市场认为谷歌无力摆脱人工智能的困境。

****

38岁的杰克·克劳奇克是谷歌的“二进宫”员工。他在20多岁时加入谷歌,2011年离开去一家初创公司,后来在流媒体广播服务Pandora和WeWork。2020年,他返回公司开发谷歌助手,用来应对苹果的Siri和亚马逊的Alexa。

谷歌的LaMDA聊天机器人让克劳奇克很感兴趣,他想知道聊天机器人能否改进智能助手的功能。“2022年大部分时间里,可能还要加上2021年,我一直在说这件事,”克劳奇克表示。面临的阻碍是可靠性,即持续存在的“幻觉”问题。用户能接受很自信然而事实错误的答案吗?

“我们一直在期待宣布‘准备好展开极其说服力的互动’ 那一刻,” 克劳奇克说。去年秋天,“我们开始发现一些信号”,他说,有些不好意思地略过了ChatGPT大受欢迎一事。

如今,克劳奇克是Bard团队高级产品总监。尽管该产品借鉴了谷歌多年来的研究,不过Bard确实在ChatGPT推出后很快就完成开发。2月6日,谷歌发布新款聊天机器人,几天后微软推出必应聊天。谷歌不愿透露该项目有多少员工参与。不过从一些迹象可看出,公司正面临压力。

ChatGPT反应流畅的秘密之一是,通过被称为人类反馈强化学习(RLHF)的过程进行微调。具体想法是让人类给聊天机器人的反应评分,人工智能逐渐学会调整答案努力接近高分版。一家公司可训练的对话越多,聊天机器人表现可能就越好。

短短两个月ChatGPT获得1亿用户,OpenAI通过大量对话实现遥遥领先。为了迎头赶上,谷歌雇佣了合同评估人员。一些为外包公司Appen工作的合同人员后来向美国国家劳动关系委员会(National Labor Relations Board)提出投诉,称因公开谈论收入过低和截止时限不合理被解雇。其中一人告诉《华盛顿邮报》(Washington Post),哪怕是Bard对内战起源等复杂话题的长文回答,评分员只有五分钟时间打分。合同人员担心,时间压力会导致评分有缺陷,影响Bard的安全性。谷歌表示,问题主要出在Appen与员工之间,评分只是用于培训和测试Bard的众多数据点中的一块;训练仍在快速进行。另有报道称,谷歌尝试使用竞争对手ChatGPT的答案培训Bard,因为之前不少用户将对话发布在ShareGPT网站上。谷歌否认利用相关数据。

与新款必应不同,Bard尽管可以提供相关网站链接,却不是搜索工具。克劳奇克说,Bard的目的是成为“创意合作者”。据他介绍,Bard的主要作用是从用户自己的大脑中找回想法。“获取脑海中的关键信息,抽象概念,然后扩展,”他说。“最终是增强想象力。”克劳奇克说,谷歌搜索就像望远镜,而Bard像面镜子。

到底人们在Bard的镜子里看到了什么,现在还很难说。聊天机器人的首次亮相很不稳定:在发布Bard的博客中,其输出的截图中存在错误说法,即2021年发射的詹姆斯·韦伯太空望远镜拍摄到太阳系外行星的第一张照片。(事实上是由2004年一台地球上的望远镜拍摄。)事实证明,这一错误价值1000亿美元:记者报道该错误后的48小时内Alphabet缩水的市值。与此同时,谷歌警告员工不要过于相信Bard:谷歌在6月发布了一份备忘录,提醒员工如果未仔细核查,不要依赖Bard或其他聊天机器人在代码方面的建议。

Bard首次亮相以来,谷歌已将聊天机器人的人工智能升级为PaLM 2 LLM。根据谷歌发布的测试,PaLM 2在推理、数学和翻译一些领域的基准方面优于OpenAI的顶级模型GPT-4。(一些独立评估者并未得出相同结果。)谷歌还做了一些调整,极大改善了Bard对数学和编码查询的反应。克劳奇克说,其中一些调整降低了Bard产生幻觉的可能,不过问题远未解决。“没有能产生‘x,’的最佳实践, ” 他说。“这就是Bard仍是试运行的原因。”

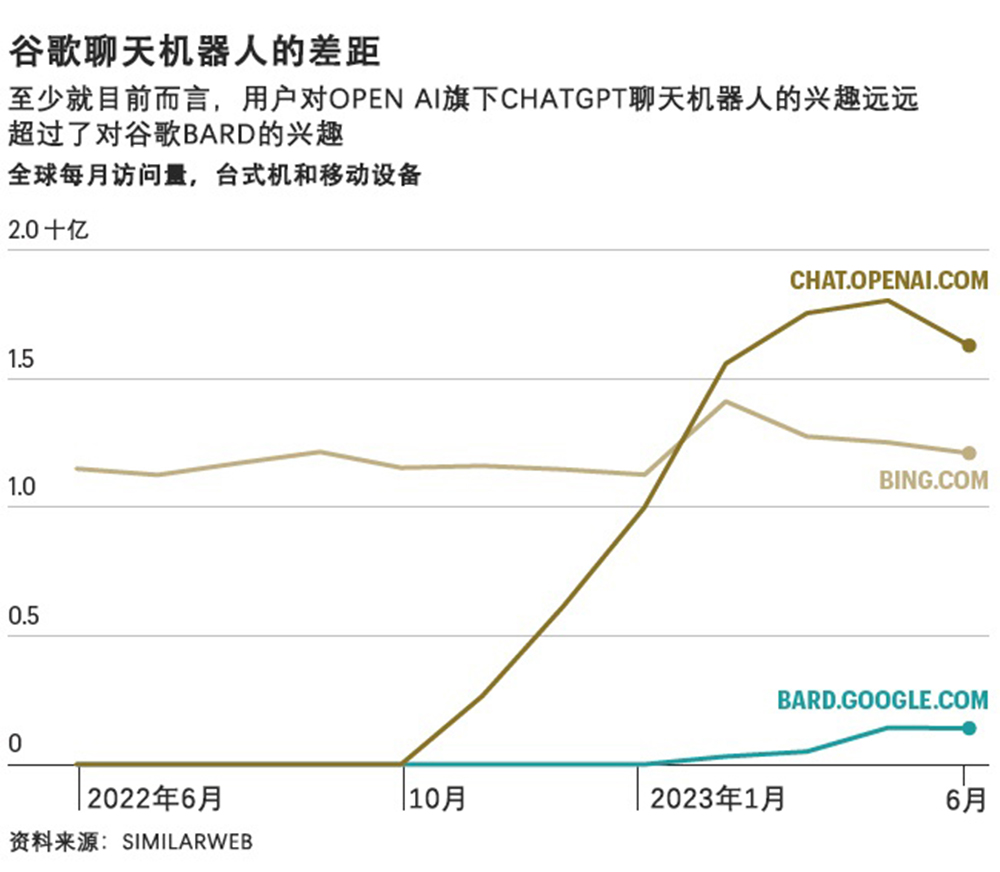

谷歌拒绝透露Bard用户数量。不过从第三方数据可看出迹象:Similarweb数据显示,Bard网站访问量从4月的约5000万增加到6月的1.426亿,远远落后于同月ChatGPT的18亿次访问量。(7月,谷歌将Bard推广到欧盟和巴西,将回答的语言范围增加了35种,包括中文、印地语和西班牙语。)相关数字与谷歌主要搜索引擎相比相形见绌,搜索引擎每月访问量为880亿次,日搜索量85亿次。根据StatCounter的数据,必应聊天推出以来,谷歌的搜索市场份额略有增加,达到93.1%,而必应在搜索市场占有率基本保持不变,为2.8%。

****

必应显然不是人工智能对搜索的最大威胁。5月,彭博行业研究(Bloomberg Intelligence)对美国650人进行的一项调查显示,在16岁至34岁的人群中,60%的人表示更喜欢向ChatGPT提问,而不是用谷歌搜索。“年轻群体可能推动在线搜索方式彻底转变,”彭博行业研究高级技术分析师曼蒂普·辛格表示。

这正是SGE的用武之地。谷歌搜索业务副总裁伊丽莎白·里德表示,谷歌新款生成式人工智能工具可以向用户提供比传统谷歌搜索更复杂的多步骤查询答案。

仍有很多问题需要解决,尤其是在速度方面。谷歌搜索能立即返回结果,然而用户想看到SGE返回的快照必须等待几秒钟,体验不佳。“技术的乐趣之一是处理延迟,”里德在I/O大会之前一次演示中苦笑地告诉我。随后一次采访中,她表示谷歌在速度方面取得了进展,并指出用户使用SGE有可能容忍获得明确答案之前存在短暂延迟,毕竟不必再花10分钟点击多个链接自行寻找答案。

用户还发现SGE存在抄袭行为,即从网站逐字逐句地提取答案,还不提供原始来源链接。这反映了生成式人工智能特有的问题。“这项技术有一点本质上很棘手,因为经常不知道其信息来源,”里德说。谷歌表示,将继续了解SGE的优势和劣势并做出改进。

最大的问题是,谷歌不知道生成式人工智能内容广告的利润能否比得上传统搜索。“我们正继续试验广告,”里德说。其中包括在SGE页面不同位置放置广告,以及里德提到的在快照答案中内置“原生”广告,不过谷歌必须明确告知用户哪些部分为广告。里德还表示,谷歌正考虑如何在SGE页面中添加额外“出口”,向用户提供更多链接到第三方网站的机会。

对依赖谷歌搜索结果提升网站流量的出版商和广告商来说,如何解决“退出”问题至关重要,这些人已然很紧张。有了快照答案,人们点击链接的可能性可能大大降低。新闻出版商尤为愤怒:按照目前LLM运行方式,谷歌基本上是无偿从新闻网站上抓取信息,然后利用相关数据建立人工智能,此举可能彻底击垮新闻报道业务。多家大型新闻机构已开展谈判,要求谷歌每年支付数百万美元才允许其访问内容。7月,美联社(Associated Press)成为第一家与OpenAI签署协议的新闻机构,具体财务条款没有披露。(7月,微软搜索主管乔迪·里巴斯在《财富》科技头脑风暴会议上告诉观众,公司内部数据显示,必应聊天用户比传统必应搜索的用户点击链接可能性更高。)

当然,如果人们不点击链接,同样会对Alphabet构成生存威胁。占谷歌80%收入的广告商业模式是否最适合聊天机器人和助手,目前还不好判断。例如,OpenAI为ChatGPT Plus服务选择了订阅模式,每月向用户收取20美元。Alphabet旗下有诸多订阅业务,从YouTube Premium到Fitbit可穿戴设备的各种功能。但利润都比不上广告。

而且广告以外业务增长乏力。2022年,谷歌非广告收入(不包括其云服务和“其他押注”公司)增长率仅3.5%,为290亿美元,而广告收入增速为两倍,达到2240亿美元。谷歌是否能将大量习惯于免费互联网搜索的人转变为付费用户,这一点尚不清楚。彭博行业研究人工智能调研中另一个不太妙的发现是,各年龄段的多数人(93%)表示,不接受人工智能聊天机器人每月费用超过10美元。

****

如果生成式人工智能确实成为搜索杀手,谷歌还能从哪寻找增长点?云业务可能受益。长期以来谷歌一直将人工智能能力融入云服务中,分析人士表示,这一趋势激发了客户兴趣。过去一年中谷歌是唯一市场份额增长的大型云提供商,市场份额上升至11%。2023年一季度谷歌云也首次实现盈利。

Arete Research的克莱默指出,尽管实现增长,谷歌要赶上竞争对手还有很长的路。亚马逊和微软的云产品规模都远超谷歌,利润也高得多。此外,与人工智能相关的竞争也很激烈:ChatGPT热潮导致很多商业客户通过微软的Azure Cloud使用OpenAI的LLM技术。

更广泛地说,迄今为止谷歌的生成式人工智能举措大多是应对OpenAI和微软攻击的防御性策略。为赢得下一步竞争,谷歌必须主动进攻。多位专家一致认为,接下来的重点是人工智能系统,不仅可以生成内容还能在互联网上行动,代表用户操作软件。未来的人工智能将是“数字代理人”,能订购食品杂货、预订酒店房间,还能搜索页面之外管理生活——例如通过Alexa或Siri提醒服用类固醇。

“无论哪家公司赢得个人代理战争,都是大事,因为用户再也不会去搜索网站,再也不会上生产力网站,再不会去亚马逊了,”比尔·盖茨5月表示。他说,如果微软不尝试开发代理会很失望。他还投资了DeepMind联合创始人穆斯塔法·苏莱曼创办的初创公司Inflection,该公司表示目标是培养个人人工智能“大管家”。

谷歌调侃了即将成立名为Gemini的更强大人工智能模型家族。皮查伊表示,Gemini将“在工具和API集成方面效率很高”,明确暗示Gemini可以助力数字代理。另一个信号是,2022年底谷歌DeepMind发表了名为Gato的人工智能研究,专家们认为这可能是Gemini的前身。

Bard团队的克劳奇克承认数字代理让人兴奋,但他也指出,从助理转变到代理需要谨慎,才能在谷歌限制的范围内“负责任”。毕竟,能在现实世界中行动的代理比单纯的文本生成器可能造成的伤害更大。而且有一点让问题更加复杂,即人们往往不善于下指令。“人们的指令往往提供的背景不足,”克劳奇克说。“我们希望这些工具能读懂我们的想法。然而实际上做不到。”

正是出于类似担忧,谷歌的未来将取决于监管态度。7月底,白宫宣布,包括谷歌在内七家顶级人工智能公司自愿承诺围绕人工智能模型的公开透明、安全测试和安全性采取几项措施。不过国会和拜登政府很可能额外设置障碍。在欧盟,一项即将通过的人工智能法案要求人工智能培训数据透明且严格遵守数据隐私法,可能给Alphabet带来挑战。谷歌全球事务主管沃尔克肩负着闯过重重关卡的艰巨任务。“各国应该努力推出最合适的人工智能监管规定,而不是抢先出台规定,”他说,暗示前路漫漫。

沃尔克是莎士比亚粉丝,在准备采访他的时候,我问Bard莎翁作品中有没有类似Alphabet当前面临的创新者困境。Bard提出了《暴风雨》(The Tempest)中的普洛斯彼罗。和Alphabet一样,普洛斯彼罗一直是岛上的主导力量,利用魔法统治,就像Alphabet利用在搜索和早期人工智能领域的霸主地位统治一样。普洛斯彼罗的魔法召唤出一场风暴,将对手冲上了岛屿,随后他的世界被颠覆。事实上,这一比喻相当恰当。

然而当我向沃尔克问起莎翁作品与当下的相似之处时,他引用了《麦克白》(Macbeth)中的一句话,班柯对三个女巫说:“要是你们能够洞察时间所播的种子,/知道哪一颗会长成,哪一颗不会长成,/那么请对我说吧;我既不乞讨你们的恩遇,/也不惧怕你们的憎恨。”

“人工智能就是这么做的,”沃克说。“先观察一百万颗种子,了解哪些种子可能长成,哪些种子可能不会长成。因此,人工智能是协助预测可能发生事情的工具。”

不过人工智能无法告诉沃尔克或皮查伊,谷歌有没有找到解决传统搜索面临终结的方法。就目前来看,不管是莎翁还是Bard都无法回答这一问题。 (财富中文网)

本文发表于2023年8月/9月的《财富》杂志,标题为《桑达尔·皮查伊和谷歌面临1600亿美元困境。》(Sundar Pichai and Google face their $160 billion dilemma)

译者:梁宇

审校:夏林

加利福尼亚州山景城海岸线露天剧场,谷歌母公司Alphabet首席执行官桑达尔·皮查伊面前观众座无虚席。他正尽最大努力扮演史蒂夫·乔布斯和比尔·盖茨开创的新派科技公司掌门人角色:有点像流行偶像,又有点像教会传教士传达神之旨意,只是方法不再是歌曲或布道,而是软件和硅。可惜说话温和,性格内向的皮查伊天生不太适合这一角色。不知何故,他演讲的氛围更像是高中音乐剧,没有好莱坞剧场的热烈氛围。

早在2016年,皮查伊就宣布谷歌推行“人工智能优先”战略。如今人工智能发展正处于重要时刻,然而谷歌的竞争对手吸引了所有注意力。去年11月ChatGPT亮相让谷歌措手不及,过去六个月里,谷歌忙着推出产品,与ChatGPT研发方OpenAI以及其合作伙伴兼支持者微软竞争。

5月举办的公司年度I/O开发者大会上,皮查伊希望展示过去六个月里谷歌的努力。他介绍了名为“帮我写作”的Gmail新功能,可根据文本提示自动起草整封邮件;谷歌地图里人工智能支持的沉浸式视图,可以构建用户路线的逼真3D预览;生成式人工智能照片编辑工具等等。他谈到了强大的PaLM 2大型语言模型(LLM),正是该技术支持了种种新功能,包括谷歌用来对标ChatGPT的Bard。他还提到正在开发的强大人工智能模型家族,名为Gemini,可能大幅拓展人工智能的影响,也会放大其中风险。

不过现场和观看直播的观众们最希望听到的话题,皮查伊却避而不谈,即谷歌到底有什么计划?毕竟,搜索是谷歌的核心产品,去年收入超过1600亿美元,约占Alphabet总收入的60%。如今人工智能聊天机器人可以从全网络搜集信息回答用户,不再以链接列表形式而是以对话形式提供,对谷歌这台利润机器有何影响?

皮查伊对此闪烁其词。“我们正以大胆和负责任的方式重新构想所有核心产品,包括搜索,”皮查伊说。如此介绍关系公司命运,与他自身将来也息息相关的产品,实在低调得有些奇怪。之后皮查伊的演讲中,从每一轮不温不火的礼节性掌声中就能感受到观众的不耐烦。

然而皮查伊再没触及关键话题。他选择让谷歌搜索副总裁凯茜·爱德华兹介绍名字有些尴尬的“搜索生成体验”(SGE)。该功能结合了搜索和生成式人工智能,用户搜索时可提供单独一份摘要“快照”答案,以及证实答案的网站链接。用户可以继续提问,就像使用聊天机器人一样。

新产品有可能成为强大的答案生成器。但能带来收入吗?这正是谷歌面临的创新者困境核心。

Alphabet表示,SGE属于“实验”。不过皮查伊明确表示,SGE或同类产品将在未来的搜索领域发挥关键作用。6月,皮查伊对彭博社(Bloomberg)表示,“类似产品将成为主流搜索体验的一部分”。这项新技术显然还未达到预期目标。SGE速度相对较慢,而且跟其他生成式人工智能一样,容易出现计算机科学家所谓的“幻觉”,即自信地提供虚假信息。皮查伊也承认,在搜索引擎中这一问题可能存在危险。他告诉彭博,如果父母在谷歌上搜索儿童应服用泰诺的剂量,“完全不能出错。”

从SGE的推出,能看出在人工智能军备竞赛中谷歌的反应速度。该技术借鉴了谷歌在人工智能和搜索领域数十年的经验,充分展示了Alphabet的火力。不过也暴露了大变革之际Alphabet的脆弱性。聊天机器人的信息收集可能蚕食谷歌的传统搜索业务,及其利润丰厚的广告驱动商业模式。不幸的是,比起熟悉的谷歌链接列表,很多人更喜欢ChatGPT的答案。“现在人们熟知的搜索行将消失,”研究公司Forrester的分析师杰伊·帕蒂萨尔如此预测。

因此,皮查伊和Alphabet不能弄错的不仅仅是泰诺剂量。谷歌拥有强大的人工智能工具,却未制定与Alphabet身为全球第17大公司的广告收入相匹配的战略。如何应对转变,将决定未来十年里谷歌不管作为动词还是一家公司能否继续生存。

ChatGPT推出时,一些评论家认为意义接近iPhone或个人电脑问世;还有些人更为激进,认为聊天机器人堪比电动机或印刷机。但在很多高管、资金经理和技术人员看来,有件事从一开始就很明显:ChatGPT是直指Alphabet心脏的匕首。ChatGPT刚亮相几个小时,使用该聊天机器人的用户就称之为“谷歌杀手”。

尽管ChatGPT无法访问互联网,不过观察人士准确地猜到,让人工智能驱动的聊天机器人访问搜索引擎以提供答案相对容易。处理多重查询时,ChatGPT统一响应似乎比必须通过多个链接拼凑信息要方便。此外,聊天机器人还能编写代码、创作俳句、写高中历史论文、制定营销计划和提供生活指导。这些谷歌搜索都做不到。

到目前为止,微软已向OpenAI投资130亿美元,而且迅速宣布将OpenAI的技术集成到搜索引擎必应中,之前必应的市场份额从未超过3%。评论人士认为,本次整合可能是必应彻底击垮谷歌搜索的最佳机会。微软首席执行官萨蒂亚·纳德拉打趣道,谷歌是搜索领域的“无敌巨人”,然后补充说,“我想让人们知道,我们能让巨人起舞。”

比起一些认为谷歌太过官僚主义、迟钝得无法起舞的评论人士,纳德拉对谷歌的“舞蹈技巧”信心还要强一些。长期以来,谷歌世界级的人工智能团队一直是科技界羡慕的对象。2017年,谷歌研究人员发明了支撑生成式人工智能热潮的基本算法,称为transformer的人工神经网络。(ChatGPT中的T就是“transformer”。)然而Alphabet似乎搞不清如何才能将研究转化为能激发公众想象力的产品。2021年谷歌还创建了名为LaMDA的聊天机器人,功能相当强大。LaMDA的对话技巧堪称一流。但就像其他大语言模型一样,这款机器人的反应可能不准确,存在偏见,有时只是奇怪和令人不安。由于问题并未解决,而且人工智能社区想解决确实很难,谷歌担心急着发布不负责任,会对声誉造成风险。

或许还有一点同样重要,聊天机器人并不太符合谷歌的主要商业模式——广告。与谷歌搜索相比,总结式答案或对话流提供的广告投放或赞助链接机会似乎少得多。

在很多人看来,此次冲突暴露出更深层次的文化障碍。一些前员工称,谷歌对市场主导地位太舒服且过于自满和官僚主义,无法应对迅速的转变,就像2020年谷歌收购生成式人工智能企业家普拉文·塞沙德里的初创公司AppSheet时一样。今年早些时候,他离职后不久写了一篇博客,称谷歌存在四大核心问题:没有使命、没有紧迫感、特殊主义妄想和管理不善。他说,所有问题都源于“拥有名为‘广告’印钞机,保持逐年增长,却掩盖了其他错误。”

还有四位过去两年离开谷歌的前员工也有类似描述。(由于担心违反离职协议或损害职业发展,他们接受《财富》杂志采访时要求匿名。)“仅仅想改进现有功能,就得忍受大量繁琐程序,更不用说研发新产品,令人难以置信,”其中一人表示。另一位前员工表示,谷歌经常把庞大用户群和收入当做借口,不接受新想法。“他们把影响的标准定得太高,几乎没什么办法绕过,”另一位说。

类似的内部不满情绪只会助长更广泛的说法:谷歌麻烦大了。从ChatGPT发布到元旦的五个星期里,Alphabet公司的股价下跌了12%。

到去年12月中旬,谷歌内部出现了恐慌迹象。《纽约时报》(New York Times)报道称,Alphabet为赶上OpenAI和微软拉响了“红色警报”。2019年谷歌联合创始人拉里·佩奇和谢尔盖·布林已经辞去日常职责,只通过超级投票权股份控制公司。现在两人突然返回,有报道称布林卷起袖子帮忙编写代码。

联合创始人突然回归,很难说是对皮查伊领导能力的支持。不过谷歌高管认为,佩奇和布林的返回,以及最近的争夺背后都是热情而非恐慌。“必须记住,拉里和谢尔盖都是计算机科学家,”Alphabet全球事务总裁肯特·沃尔克表示。“两人都对未来的可能性很兴奋。”后来皮查伊在接受《纽约时报》播客采访时表示,从未发布“红色警报”。不过他承认“要求团队紧急行动”,寻找办法将生成式人工智能变成“深刻、有意义的体验”。

外部刺激显然产生了效果。今年2月,谷歌宣布推出与ChatGPT正面竞争的Bard。到3月,谷歌介绍了Workspace写作助手功能,以及Vertex人工智能环境,该环境可以帮助云客户利用自己的数据训练并运行生成式人工智能应用。在5月的I/O开发者大会上,谷歌几乎每款产品都闪耀着新一代人工智能光辉。一些投资者对此印象深刻。I/O大会后,摩根士丹利(Morgan Stanley)分析师立即写道,该公司的“创新速度和推向市场节奏提升”。ChatGPT推出后谷歌股票一度跌至每股88美元,等到皮查伊在山景城登台时,股价已超过122美元。

疑云仍未消散。“谷歌有很多内在优势,”股票研究公司Arete research的创始人理查德·克莱默表示,毕竟谷歌拥有无可匹敌的人工智能研究成果,还能访问全世界一些最先进数据中心。“谷歌只是在商业上没有尽全力推进,”他补充道,谷歌各部门和产品团队过于孤立,很难在公司层面展开合作。(到目前为止,人工智能冲击下谷歌对组织架构最明显的调整是将两项领先的人工智能研究项目,即总部位于山景城的谷歌大脑和总部位于伦敦的DeepMind合并为名为GoogleDeepMind的实体。)

除了Arete分析师,也有其他人认为谷歌并未实现潜力。摩根士丹利指出,尽管最近Alphabet有所复苏,但仍存在“估值差距”。之前其股价一直高于苹果、Meta和微软等其他科技巨头,但截至7月谷歌市盈率比竞争对手低约23%。在很多人看来,这说明市场认为谷歌无力摆脱人工智能的困境。

38岁的杰克·克劳奇克是谷歌的“二进宫”员工。他在20多岁时加入谷歌,2011年离开去一家初创公司,后来在流媒体广播服务Pandora和WeWork。2020年,他返回公司开发谷歌助手,用来应对苹果的Siri和亚马逊的Alexa。

谷歌的LaMDA聊天机器人让克劳奇克很感兴趣,他想知道聊天机器人能否改进智能助手的功能。“2022年大部分时间里,可能还要加上2021年,我一直在说这件事,”克劳奇克表示。面临的阻碍是可靠性,即持续存在的“幻觉”问题。用户能接受很自信然而事实错误的答案吗?

“我们一直在期待宣布‘准备好展开极其说服力的互动’ 那一刻,” 克劳奇克说。去年秋天,“我们开始发现一些信号”,他说,有些不好意思地略过了ChatGPT大受欢迎一事。

如今,克劳奇克是Bard团队高级产品总监。尽管该产品借鉴了谷歌多年来的研究,不过Bard确实在ChatGPT推出后很快就完成开发。2月6日,谷歌发布新款聊天机器人,几天后微软推出必应聊天。谷歌不愿透露该项目有多少员工参与。不过从一些迹象可看出,公司正面临压力。

ChatGPT反应流畅的秘密之一是,通过被称为人类反馈强化学习(RLHF)的过程进行微调。具体想法是让人类给聊天机器人的反应评分,人工智能逐渐学会调整答案努力接近高分版。一家公司可训练的对话越多,聊天机器人表现可能就越好。

短短两个月ChatGPT获得1亿用户,OpenAI通过大量对话实现遥遥领先。为了迎头赶上,谷歌雇佣了合同评估人员。一些为外包公司Appen工作的合同人员后来向美国国家劳动关系委员会(National Labor Relations Board)提出投诉,称因公开谈论收入过低和截止时限不合理被解雇。其中一人告诉《华盛顿邮报》(Washington Post),哪怕是Bard对内战起源等复杂话题的长文回答,评分员只有五分钟时间打分。合同人员担心,时间压力会导致评分有缺陷,影响Bard的安全性。谷歌表示,问题主要出在Appen与员工之间,评分只是用于培训和测试Bard的众多数据点中的一块;训练仍在快速进行。另有报道称,谷歌尝试使用竞争对手ChatGPT的答案培训Bard,因为之前不少用户将对话发布在ShareGPT网站上。谷歌否认利用相关数据。

与新款必应不同,Bard尽管可以提供相关网站链接,却不是搜索工具。克劳奇克说,Bard的目的是成为“创意合作者”。据他介绍,Bard的主要作用是从用户自己的大脑中找回想法。“获取脑海中的关键信息,抽象概念,然后扩展,”他说。“最终是增强想象力。”克劳奇克说,谷歌搜索就像望远镜,而Bard像面镜子。

到底人们在Bard的镜子里看到了什么,现在还很难说。聊天机器人的首次亮相很不稳定:在发布Bard的博客中,其输出的截图中存在错误说法,即2021年发射的詹姆斯·韦伯太空望远镜拍摄到太阳系外行星的第一张照片。(事实上是由2004年一台地球上的望远镜拍摄。)事实证明,这一错误价值1000亿美元:记者报道该错误后的48小时内Alphabet缩水的市值。与此同时,谷歌警告员工不要过于相信Bard:谷歌在6月发布了一份备忘录,提醒员工如果未仔细核查,不要依赖Bard或其他聊天机器人在代码方面的建议。

Bard首次亮相以来,谷歌已将聊天机器人的人工智能升级为PaLM 2 LLM。根据谷歌发布的测试,PaLM 2在推理、数学和翻译一些领域的基准方面优于OpenAI的顶级模型GPT-4。(一些独立评估者并未得出相同结果。)谷歌还做了一些调整,极大改善了Bard对数学和编码查询的反应。克劳奇克说,其中一些调整降低了Bard产生幻觉的可能,不过问题远未解决。“没有能产生‘x,’的最佳实践, ” 他说。“这就是Bard仍是试运行的原因。”

谷歌拒绝透露Bard用户数量。不过从第三方数据可看出迹象:Similarweb数据显示,Bard网站访问量从4月的约5000万增加到6月的1.426亿,远远落后于同月ChatGPT的18亿次访问量。(7月,谷歌将Bard推广到欧盟和巴西,将回答的语言范围增加了35种,包括中文、印地语和西班牙语。)相关数字与谷歌主要搜索引擎相比相形见绌,搜索引擎每月访问量为880亿次,日搜索量85亿次。根据StatCounter的数据,必应聊天推出以来,谷歌的搜索市场份额略有增加,达到93.1%,而必应在搜索市场占有率基本保持不变,为2.8%。

必应显然不是人工智能对搜索的最大威胁。5月,彭博行业研究(Bloomberg Intelligence)对美国650人进行的一项调查显示,在16岁至34岁的人群中,60%的人表示更喜欢向ChatGPT提问,而不是用谷歌搜索。“年轻群体可能推动在线搜索方式彻底转变,”彭博行业研究高级技术分析师曼蒂普·辛格表示。

这正是SGE的用武之地。谷歌搜索业务副总裁伊丽莎白·里德表示,谷歌新款生成式人工智能工具可以向用户提供比传统谷歌搜索更复杂的多步骤查询答案。

仍有很多问题需要解决,尤其是在速度方面。谷歌搜索能立即返回结果,然而用户想看到SGE返回的快照必须等待几秒钟,体验不佳。“技术的乐趣之一是处理延迟,”里德在I/O大会之前一次演示中苦笑地告诉我。随后一次采访中,她表示谷歌在速度方面取得了进展,并指出用户使用SGE有可能容忍获得明确答案之前存在短暂延迟,毕竟不必再花10分钟点击多个链接自行寻找答案。

用户还发现SGE存在抄袭行为,即从网站逐字逐句地提取答案,还不提供原始来源链接。这反映了生成式人工智能特有的问题。“这项技术有一点本质上很棘手,因为经常不知道其信息来源,”里德说。谷歌表示,将继续了解SGE的优势和劣势并做出改进。

最大的问题是,谷歌不知道生成式人工智能内容广告的利润能否比得上传统搜索。“我们正继续试验广告,”里德说。其中包括在SGE页面不同位置放置广告,以及里德提到的在快照答案中内置“原生”广告,不过谷歌必须明确告知用户哪些部分为广告。里德还表示,谷歌正考虑如何在SGE页面中添加额外“出口”,向用户提供更多链接到第三方网站的机会。

对依赖谷歌搜索结果提升网站流量的出版商和广告商来说,如何解决“退出”问题至关重要,这些人已然很紧张。有了快照答案,人们点击链接的可能性可能大大降低。新闻出版商尤为愤怒:按照目前LLM运行方式,谷歌基本上是无偿从新闻网站上抓取信息,然后利用相关数据建立人工智能,此举可能彻底击垮新闻报道业务。多家大型新闻机构已开展谈判,要求谷歌每年支付数百万美元才允许其访问内容。7月,美联社(Associated Press)成为第一家与OpenAI签署协议的新闻机构,具体财务条款没有披露。(7月,微软搜索主管乔迪·里巴斯在《财富》科技头脑风暴会议上告诉观众,公司内部数据显示,必应聊天用户比传统必应搜索的用户点击链接可能性更高。)

当然,如果人们不点击链接,同样会对Alphabet构成生存威胁。占谷歌80%收入的广告商业模式是否最适合聊天机器人和助手,目前还不好判断。例如,OpenAI为ChatGPT Plus服务选择了订阅模式,每月向用户收取20美元。Alphabet旗下有诸多订阅业务,从YouTube Premium到Fitbit可穿戴设备的各种功能。但利润都比不上广告。

而且广告以外业务增长乏力。2022年,谷歌非广告收入(不包括其云服务和“其他押注”公司)增长率仅3.5%,为290亿美元,而广告收入增速为两倍,达到2240亿美元。谷歌是否能将大量习惯于免费互联网搜索的人转变为付费用户,这一点尚不清楚。彭博行业研究人工智能调研中另一个不太妙的发现是,各年龄段的多数人(93%)表示,不接受人工智能聊天机器人每月费用超过10美元。

如果生成式人工智能确实成为搜索杀手,谷歌还能从哪寻找增长点?云业务可能受益。长期以来谷歌一直将人工智能能力融入云服务中,分析人士表示,这一趋势激发了客户兴趣。过去一年中谷歌是唯一市场份额增长的大型云提供商,市场份额上升至11%。2023年一季度谷歌云也首次实现盈利。

Arete Research的克莱默指出,尽管实现增长,谷歌要赶上竞争对手还有很长的路。亚马逊和微软的云产品规模都远超谷歌,利润也高得多。此外,与人工智能相关的竞争也很激烈:ChatGPT热潮导致很多商业客户通过微软的Azure Cloud使用OpenAI的LLM技术。

更广泛地说,迄今为止谷歌的生成式人工智能举措大多是应对OpenAI和微软攻击的防御性策略。为赢得下一步竞争,谷歌必须主动进攻。多位专家一致认为,接下来的重点是人工智能系统,不仅可以生成内容还能在互联网上行动,代表用户操作软件。未来的人工智能将是“数字代理人”,能订购食品杂货、预订酒店房间,还能搜索页面之外管理生活——例如通过Alexa或Siri提醒服用类固醇。

“无论哪家公司赢得个人代理战争,都是大事,因为用户再也不会去搜索网站,再也不会上生产力网站,再不会去亚马逊了,”比尔·盖茨5月表示。他说,如果微软不尝试开发代理会很失望。他还投资了DeepMind联合创始人穆斯塔法·苏莱曼创办的初创公司Inflection,该公司表示目标是培养个人人工智能“大管家”。

谷歌调侃了即将成立名为Gemini的更强大人工智能模型家族。皮查伊表示,Gemini将“在工具和API集成方面效率很高”,明确暗示Gemini可以助力数字代理。另一个信号是,2022年底谷歌DeepMind发表了名为Gato的人工智能研究,专家们认为这可能是Gemini的前身。

Bard团队的克劳奇克承认数字代理让人兴奋,但他也指出,从助理转变到代理需要谨慎,才能在谷歌限制的范围内“负责任”。毕竟,能在现实世界中行动的代理比单纯的文本生成器可能造成的伤害更大。而且有一点让问题更加复杂,即人们往往不善于下指令。“人们的指令往往提供的背景不足,”克劳奇克说。“我们希望这些工具能读懂我们的想法。然而实际上做不到。”

正是出于类似担忧,谷歌的未来将取决于监管态度。7月底,白宫宣布,包括谷歌在内七家顶级人工智能公司自愿承诺围绕人工智能模型的公开透明、安全测试和安全性采取几项措施。不过国会和拜登政府很可能额外设置障碍。在欧盟,一项即将通过的人工智能法案要求人工智能培训数据透明且严格遵守数据隐私法,可能给Alphabet带来挑战。谷歌全球事务主管沃尔克肩负着闯过重重关卡的艰巨任务。“各国应该努力推出最合适的人工智能监管规定,而不是抢先出台规定,”他说,暗示前路漫漫。

沃尔克是莎士比亚粉丝,在准备采访他的时候,我问Bard莎翁作品中有没有类似Alphabet当前面临的创新者困境。Bard提出了《暴风雨》(The Tempest)中的普洛斯彼罗。和Alphabet一样,普洛斯彼罗一直是岛上的主导力量,利用魔法统治,就像Alphabet利用在搜索和早期人工智能领域的霸主地位统治一样。普洛斯彼罗的魔法召唤出一场风暴,将对手冲上了岛屿,随后他的世界被颠覆。事实上,这一比喻相当恰当。

然而当我向沃尔克问起莎翁作品与当下的相似之处时,他引用了《麦克白》(Macbeth)中的一句话,班柯对三个女巫说:“要是你们能够洞察时间所播的种子,/知道哪一颗会长成,哪一颗不会长成,/那么请对我说吧;我既不乞讨你们的恩遇,/也不惧怕你们的憎恨。”

“人工智能就是这么做的,”沃克说。“先观察一百万颗种子,了解哪些种子可能长成,哪些种子可能不会长成。因此,人工智能是协助预测可能发生事情的工具。”

不过人工智能无法告诉沃尔克或皮查伊,谷歌有没有找到解决传统搜索面临终结的方法。就目前来看,不管是莎翁还是Bard都无法回答这一问题。 (财富中文网)

本文发表于2023年8月/9月的《财富》杂志,标题为《桑达尔·皮查伊和谷歌面临1600亿美元困境。》(Sundar Pichai and Google face their $160 billion dilemma)

译者:梁宇

审校:夏林

Sundar Pichai, CEO of Alphabet, parent company of Google, stands onstage in front of a packed house at the Shoreline Amphitheatre in Mountain View, Calif. He’s doing his best interpretation of a role pioneered by Steve Jobs and Bill Gates: the tech CEO as part pop idol, part tent-revival preacher, deliverer of divine revelation, not in song or sermon but in software and silicon. Except the soft-spoken, introverted Pichai is not a natural for the role: Somehow his vibe is more high school musical than Hollywood Bowl.

Pichai declared Google to be an “A.I.-first” company way back in 2016. Now A.I. is having a major moment—but a Google rival is grabbing all the attention. The November debut of ChatGPT caught Google off guard, setting off a frantic six months in which it scrambled to match the generative A.I. offerings being rolled out by ChatGPT creator OpenAI and its partner and backer, Microsoft.

Here, at the company’s huge annual I/O developer conference in May, Pichai wants to show off what Google built in those six months. He reveals a new Gmail feature called Help Me Write, which automatically drafts whole emails based on a text prompt; an A.I.-powered immersive view in Google Maps that builds a realistic 3D preview of a user’s route; generative A.I. photo editing tools; and much more. He talks about the powerful PaLM 2 large language model (LLM) that underpins much of this technology—including Bard, Google’s ChatGPT competitor. And he mentions a powerful family of A.I. models under development, called Gemini, that could immensely expand A.I.’s impact—and its risks.

But Pichai dances around the topic that so many in the audience, and watching from around the world on a livestream, most want to hear about: What’s the plan for Search? Search, after all, is Google’s first and foremost product, driving more than $160 billion in revenue last year—about 60% of Alphabet’s total. Now that A.I. chatbots can deliver information from across the internet, not as a list of links but in conversational prose, what happens to this profit machine?

The CEO barely flicks at the issue at the top of his keynote. “With a bold and responsible approach, we are reimagining all our core products, including Search,” Pichai says. It’s an oddly muted way to introduce the product on which the fate of his company—and his legacy—may depend. You can sense the audience’s impatience to hear more in every round of tepid, polite applause Pichai receives for the rest of his address.

But Pichai never returns to the topic. Instead, he leaves it to Cathy Edwards, Google’s vice president of Search, to explain what the company calls, awkwardly, “search generative experience,” or SGE. A combination of search and generative A.I., it returns a single, summarized “snapshot” answer to a user’s search, along with links to websites that corroborate it. Users can ask follow-up questions, much as they would with a chatbot.

It’s a potentially impressive answer generator. But will it generate revenue? That question is at the heart of Google’s innovator’s dilemma.

Alphabet says SGE is “an experiment.” But Pichai has made clear that SGE or something a lot like it will play a key role in Search’s future. “These are going to be part of the mainstream search experience,” the CEO told Bloomberg in June. The technology is certainly not there yet. SGE is relatively slow, and like all generative A.I., it’s prone to a phenomenon computer scientists call “hallucination,” confidently delivering invented information. That can be dangerous in a search engine, as Pichai readily acknowledges. If a parent googles Tylenol dosage for their child, as he told Bloomberg, “there’s no room to get that wrong.”

SGE’s arrival is an indication of just how quickly Google has bounced back in the A.I. arms race. The tech draws on Google’s decades of experience in A.I. and search, demonstrating how much firepower Alphabet can bring to bear. But it also exposes Alphabet’s vulnerability in this moment of profound change. Chatbot-style information gathering threatens to cannibalize Google’s traditional Search and its incredibly lucrative advertising-driven business model. Ominously, many people prefer ChatGPT’s answers to Google’s familiar list of links. “Search as we know it will disappear,” predicts Jay Pattisall, an analyst at research firm Forrester.

So it’s not just Tylenol doses that Pichai and Alphabet can’t afford to botch. Google has the tools to be great at A.I.; what it doesn’t have, yet, is a strategy that comes anywhere near matching the ad revenue that turned Alphabet into the world’s 17th-biggest company. How Google plays this transition will determine whether it will survive, as both a verb and a company, well into the next decade.

****

When ChatGPT arrived, some commentators compared its significance to the debut of the iPhone or the personal computer; others took bigger swings and placed the chatbot alongside electric motors or the printing press. But to many executives, money managers, and technologists, one thing was obvious from the start: ChatGPT is a dagger pointed straight at Alphabet’s heart. Within hours of ChatGPT’s debut, users playing with the new chatbot declared it “a Google killer.”

Although ChatGPT itself did not have access to the internet, many observers correctly speculated that it would be relatively easy to give A.I.-powered chatbots access to a search engine to help inform their responses. For many queries, ChatGPT’s unified response seemed better than having to wade through multiple links to cobble together information. Plus, the chatbot could write code, compose haikus, craft high school history papers, create marketing plans, and offer life coaching. A Google search can’t do that.

Microsoft—which has invested $13 billion into OpenAI so far—almost immediately moved to integrate OpenAI’s technology into its also-ran search engine, Bing, which had never achieved more than 3% market share. The integration, commentators thought, might give Bing its best shot at knocking Google Search from its pedestal. Satya Nadella, Microsoft’s CEO, quipped that Google was “the 800-pound gorilla” of search, adding, “I want people to know that we made them dance.”

Nadella actually had more faith in his competitor’s dancing skills than some commentators, who seemed to think Google was too bureaucratic and sluggish to boogie. Google’s world-class A.I. team had long been the envy of the tech community. Indeed, in 2017, Google researchers had invented the basic algorithmic design underpinning the entire generative A.I. boom, a kind of artificial neural network called a transformer. (The T in ChatGPT stands for “transformer.”) But Alphabet didn’t seem to know how to turn that research into products that fired the public imagination. Google had actually created a powerful chatbot called LaMDA in 2021. LaMDA’s dialogue skills were superlative. But its responses, like those from any LLM, can be inaccurate, exhibit bias, or just be bizarre and disturbing. Until those issues were resolved—and the A.I. community is far from resolving them—Google feared that releasing it would be irresponsible and pose a reputational risk.

Perhaps as important, there was no obvious way that a chatbot fit with Google’s primary business model—advertising. Compared with Google Search, a summarized answer or a dialogue thread seemed to provide far less opportunity for advertising placement or sponsored links.

To many, that conflict exposed deeper cultural impediments. Google, according to some former employees, has grown too comfortable with its market dominance, too complacent and bureaucratic, to respond to as fast-moving a shift as generative A.I. Entrepreneur Praveen Seshadri joined Google after the company acquired his startup AppSheet in 2020. Shortly after leaving earlier this year, he wrote a blog post in which he said that the company had four core problems: no mission, no urgency, delusions of exceptionalism, and mismanagement. All of these, he said, were “the natural consequences of having a money-printing machine called ‘Ads’ that has kept growing relentlessly every year, hiding all other sins.”

Four other former employees who have left Google in the past two years characterized the culture similarly. (They spoke to Fortune on the condition their names not be used, for fear of violating separation agreements or damaging their career prospects.) “The amount of red tape you would have to wade through just to improve an existing feature, let alone a new product, was mind-boggling,” one said. Another said Google often used the massive scale of its user base and revenues as an excuse not to embrace new ideas. “They set the bar so high in terms of impact that almost nothing could ever clear it,” another said.

Such insider discontent only fueled the broader narrative: Google was toast. In the five weeks between ChatGPT’s release and New Year’s Day, Alphabet’s stock dropped 12%.

By mid-December, there were signs of panic inside the Googleplex. The New York Times reported that Alphabet had declared “a code red” to catch OpenAI and Microsoft. Google’s cofounders, Larry Page and Sergey Brin, who stepped away from day-to-day responsibilities in 2019—but exercise majority control over the company’s shares through a super-voting class of stock—were suddenly back, with Brin reportedly rolling up his sleeves and helping to write code.

It was hard to interpret the cofounders’ return as a ringing endorsement of Pichai’s leadership. But Google executives frame Page and Brin’s renewed presence—and indeed the whole recent scramble—as driven by enthusiasm rather than alarm. “You have to remember, both Larry and Sergey are computer scientists,” says Kent Walker, Alphabet’s president of global affairs, who oversees the company’s content policies and its responsible innovation team, among other duties. “Larry and Sergey are excited about the possibility.” For his part, Pichai later told a Times podcast that he never instituted a “code red.” He did, however, say he was “asking teams to move with urgency” to figure out how to translate generative A.I. into “deep, meaningful experiences.”

Those urgings clearly had an effect. In February, Google announced Bard, its ChatGPT competitor. By March, it had previewed the writing assistant functions for Workspace, as well as its Vertex A.I. environment, which helps its cloud customers train and run generative A.I. applications on their own data. At I/O in May, it seemed almost every Google product was getting a shiny new generative-A.I. gloss. Some investors were impressed. The company’s “speed of innovation and go-to-market motion are improving,” Morgan Stanley analysts wrote immediately after I/O. Google’s stock, which sank as low as $88 per share in the wake of ChatGPT’s release, was trading above $122 by the time Pichai hit the stage in Mountain View.

But doubts persist. “Google has a lot of embedded advantages,” says Richard Kramer, founder of equity research firm Arete Research, noting its unrivaled A.I. research output and access to some of the world’s most advanced data centers. “They’re just not pursuing them as aggressively commercially as they could be.” Its divisions and product teams are too siloed, he adds, making it difficult to collaborate across the company. (So far, the most visible change to Google’s organizational structure that Pichai has made amid the A.I. upheaval has been merging the company’s two advanced A.I. efforts, Mountain View–based Google Brain and London-based DeepMind, into an entity called Google DeepMind.)

Arete analysts aren’t the only ones who think Google is falling short of its potential. Morgan Stanley noted that, despite the recent recovery, Alphabet suffers from “a valuation gap.” Its shares have historically traded at a premium to other Big Tech companies such as Apple, Meta, and Microsoft, but as of July, they were trading at a price/earnings multiple about 23% below those rivals. To many, that’s a clue that the market doesn’t believe Google can shrug off its A.I. malaise.

****

Jack Krawczyk, 38, is a boomerang Googler. He joined the company in his twenties, then left in 2011 to work at a startup and, later, at streaming radio service Pandora and WeWork. He came back in 2020 to work on Google Assistant, Google’s answer to Apple’s Siri and Amazon’s Alexa.

Google’s LaMDA chatbot fascinated Krawczyk, who wondered if it could improve Assistant’s functionality. “I know I couldn’t shut up about it for most of 2022, if not 2021,” he says. What held the idea back, Krawczyk tells me, was reliability—that persistent problem of “hallucination.” Would users be okay with answers that sounded confident but were wrong?

“We were waiting for a moment where we got a signal to say, ‘I’m ready for an interaction that feels very convincing,’ ” says Krawczyk. “We started to see those signals” last fall, he says, coyly not mentioning that they included the giant flashing billboard of ChatGPT’s popularity.

Today Krawczyk is senior director of product on the Bard team. Although it drew on research Google had been developing for years, Bard was built fast following ChatGPT’s launch. The new chatbot was unveiled on Feb. 6, just days ahead of Microsoft’s debut of Bing Chat. The company won’t reveal how many people worked on the project. But some indications of the pressure the company was under have emerged.

One of the secrets to ChatGPT’s fluent responses is that they’re fine-tuned via a process called reinforcement learning through human feedback (RLHF). The idea is that humans rate a chatbot’s responses and the A.I. learns to tailor its output to better resemble the responses that get the best ratings. The more dialogues a company can train on, the better the chatbot is likely to be.

With ChatGPT having reached 100 million users in just two months, OpenAI had a big head start in those dialogues. To play catch-up, Google employed contract evaluators. Some of these contractors, who worked for outsourcing firm Appen, later filed a complaint with the National Labor Relations Board, saying they had been fired for speaking out about low pay and unreasonable deadlines. One told the Washington Post that raters were given as little as five minutes to evaluate detailed answers from Bard on such complex topics as the origins of the Civil War. The contractors said they feared the time pressure would lead to flawed ratings and make Bard unsafe. Google has said the matter is between Appen and its employees and that the ratings are just one data point among many used to train and test Bard; the training continues apace. Other reports have claimed that Google tried to bootstrap Bard’s training by using answers from its rival, ChatGPT, that users had posted to a website called ShareGPT. Google denies using such data for training.

Unlike the new Bing, Bard was not designed to be a search tool, even though it can provide links to relevant internet sites. Bard’s purpose, Krawczyk says, is to serve as “a creative collaborator.” In his telling, Bard is primarily about retrieving ideas from your own mind. “It’s about taking that piece of information, that sort of abstract concept that you have in your head, and expanding it,” he says. “It’s about augmenting your imagination.” Google Search, Krawczyk says, is like a telescope; Bard is like a mirror.

Exactly what people are seeing in Bard’s mirror is hard to say. The chatbot’s debut was rocky: In the blog post announcing Bard, an accompanying screenshot of its output included an erroneous statement that the James Webb Space Telescope, launched in 2021, took the first pictures of a planet outside our solar system. (In fact, an Earth-based telescope achieved that feat in 2004.) It turned out to be a $100 billion mistake: That’s how much market value Alphabet lost in the 48 hours after journalists reported the error. Meanwhile, Google has warned its own staff not to put too much faith in Bard: In June it issued a memo reminding employees not to rely on coding suggestions from Bard or other chatbots without careful review.

Since Bard’s debut, Google has upgraded the A.I. powering the chatbot to its PaLM 2 LLM. According to testing Google has published, PaLM 2 outperforms OpenAI’s top model, GPT-4, on some reasoning, mathematical, and translation benchmarks. (Some independent evaluators have not been able to replicate those results.) Google also made changes that greatly improved Bard’s responses to math and coding queries. Krawczyk says that some of these changes have reduced Bard’s tendency to hallucinate, but that hallucination is far from solved. “There’s no best practice that is going to yield ‘x,’ ” he says. “It’s why Bard launched as an experiment.”

Google declined to reveal how many users Bard has. But third-party data offers signs of progress: Bard website visits increased from about 50 million in April to 142.6 million in June, according to Similarweb. That trails far behind ChatGPT’s 1.8 billion visits the same month. (In July, Google rolled Bard out to the European Union and Brazil and expanded its responses to cover 35 additional languages, including Chinese, Hindi, and Spanish.) Those numbers in turn pale beside those for Google’s main search engine, with 88 billion monthly visits and 8.5 billion daily search queries. Since the launch of Bing Chat, Google’s search market share has increased slightly, to 93.1%, while Bing’s is essentially unchanged at 2.8%, per data from StatCounter.

****

Bing is far from the biggest threat A.I. poses to search. In a survey of 650 people in the U.S. in May, conducted by Bloomberg Intelligence, 60% of those between ages 16 and 34 said they preferred asking ChatGPT questions to using Google Search. “The younger age group may help drive a permanent shift in how search is used online,” says Mandeep Singh, senior technology analyst at Bloomberg Intelligence.

That’s where SGE comes in. Google’s new generative A.I. tool allows users to find answers to more complex, multistep queries than they might have been able to with a traditional Google Search, according to Elizabeth Reid, Google’s vice president of Search.

There are plenty of kinks to work out—especially around speed. While Google Search returns results instantly, users have to wait frustratingly long seconds for SGE’s snapshot. “Part of the technology fun is working on the latency,” Reid told me, sardonically, during a demo before I/O. In a later interview, she said Google had made progress on speed, and noted that users might tolerate a brief delay before getting a clear answer from SGE, rather than spending 10 minutes clicking through multiple links to puzzle out an answer on their own.

Users have also caught SGE engaging in plagiarism—lifting answers verbatim from websites, and then not providing a link to the original source. That reflects a problem endemic to generative A.I. “What’s inherently tricky about the technology is it doesn’t actually always know where it knows things from,” Reid says. Google says it’s continuing to learn about SGE’s strengths and weaknesses, and to make improvements.

The biggest issue is that Google doesn’t know if it can make as much money from ads around generative A.I. content as it has from traditional Search. “We are continuing to experiment with ads,” Reid says. This includes placing ads in different positions around the SGE page, as well as what Reid calls opportunities for “native” ads built into the snapshot answer—although Google will have to figure out how to make clear to users that a given portion of a response is paid for. Reid also said Google was thinking about how to add additional “exits” throughout the SGE page, providing more opportunities for people to link out to third-party websites.

The solution to that “exit” problem is of vital interest to publishers and advertisers who depend on Google’s search results to drive traffic to their sites—and who are already freaking out. With snapshot answers, people may be far less likely to click through on links. News publishers are particularly incensed: With its current LLM approach, Google essentially scrapes information from their sites, without compensation, and uses that data to build A.I. that may destroy their business. Many large news organizations have begun negotiations, seeking millions of dollars per year to grant Google access to their content. In July, the Associated Press became the first news organization to sign a deal of this kind with OpenAI, although financial terms were not disclosed. (Jordi Ribas, Microsoft’s head of search, told the audience at the Fortune Brainstorm Tech conference in July that the company’s own data shows that users of Bing Chat are more likely to click on links than users of a traditional Bing search.)

Of course, if people don’t click through on links, that also poses an existential threat to Alphabet itself. It remains far from clear that the business model that drives 80% of Google’s revenues—advertising—is the best fit for chatbots and assistants. OpenAI, for example, has chosen a subscription model for its ChatGPT Plus service, charging users $20 per month. Alphabet has many subscription businesses, from YouTube Premium to various features in its Fitbit wearables. But none are anywhere near as lucrative as advertising.

Nor has the company grown any of them as quickly. Google’s non-advertising revenue, excluding its Cloud service and “other bets” companies, grew just 3.5% in 2022, to $29 billion, while ad revenue leaped ahead at twice that rate, to $224 billion. It’s also not clear that Google could convert a meaningful mass of people accustomed to free internet searches to become paying subscribers. Another ominous finding of Bloomberg Intelligence’s A.I. survey is that most people of all ages, 93%, said they would not want to pay more than $10 per month for access to an A.I. chatbot.

****

If generative A.I. becomes a Search killer, where can Google look for growth? Its cloud business, for one, is likely to benefit. Google has long built its A.I. prowess into its cloud services, and analysts say the boom is perking up customer interest. Google was the only major cloud provider to gain market share in the past year, edging up to 11%. Google Cloud also turned a profit for the first time in the first quarter of 2023.

Still, Kramer of Arete Research notes that Google has a long way to go to catch its competitors. Amazon’s and Microsoft’s cloud offerings are both far bigger than Google’s and far more profitable. Plus, the A.I.-related competition is stiff: The ChatGPT buzz has led many business customers to seek out OpenAI’s LLM tech through Microsoft’s Azure Cloud.

More broadly, the generative A.I. moves Google has made so far have been mostly defensive, parries to the thrusts from OpenAI and Microsoft. To win the race for what comes next, Google will have to play offense. And many experts agree that what comes next is A.I. systems that don’t just generate content but take actions across the internet and operate software on behalf of a user. They will be “digital agents,” able to order groceries, book hotel rooms, and otherwise manage your life beyond the search page—Alexa or Siri on steroids.

“Whoever wins the personal agent, that’s the big thing, because you will never go to a search site again, you will never go to a productivity site, you’ll never go to Amazon again,” Bill Gates said in May. Gates said he’d be disappointed if Microsoft did not try to build an agent. He is also an investor in Inflection, a startup launched by DeepMind cofounder Mustafa Suleyman that says it aims to build everyone’s personal A.I. “chief of staff.”

Google has teased a forthcoming family of more powerful A.I. models called Gemini. Pichai has said Gemini will be “highly efficient at tool and API integrations,” a strong suggestion that it could power a digital agent. In another signal, Google’s DeepMind published research late in 2022 about an A.I. called Gato that experts see as a likely precursor to Gemini.

Krawczyk, from the Bard team, acknowledges the excitement around digital agents, but he notes that the assistant-to-agent transformation will require caution to manage within Google’s mandate to be “responsible.” After all, an agent that acts in the real world can cause more harm than a mere text generator. Compounding the problem, people tend to be poor at giving instructions. “We often don’t provide enough context,” Krawczyk says. “We want these things to be able to read our minds. But they can’t.”

Precisely because of such concerns, regulation will shape Google’s future. In late July, the White House announced that seven top A.I. companies, including Google, were voluntarily committing to several steps around public transparency, safety testing, and security of their A.I. models. But Congress and the Biden administration may well impose additional guardrails. In the E.U., an A.I. Act nearing completion may pose challenges for Alphabet, by requiring transparency around A.I. training data and compliance with strict data privacy laws. Walker, Google’s global affairs chief, has the unenviable task of navigating these currents. “The race should be for the best A.I. regulation, not the first A.I. regulation,” he says, hinting at the long slog ahead.

Walker is a fan of Shakespeare, and in preparing to interview him, I asked Bard whether there were analogies from the work of that other bard that might encapsulate Alphabet’s current innovator’s dilemma. Bard suggested Prospero, from The Tempest. Like Alphabet, Prospero had been the dominant force on his island, using magic to rule, much as Alphabet had used its supremacy in search and earlier forms of A.I. to dominate its realm. Then Prospero’s magic summoned a storm that washed rivals onto his island—and his world was upended. A pretty apt analogy, actually.

But when I ask Walker about Shakespearean parallels for the current moment, he instead quotes a line from Macbeth in which Banquo says to the three witches, “If you can look into the seeds of time,/And say which grain will grow and which will not,/Speak then to me, who neither beg nor fear/Your favors nor your hate.”

“That’s what A.I. does,” Walker says. “By looking at a million seeds, it can understand which ones are likely to grow and which ones are likely to not. So it’s a tool for helping us anticipate what might happen.”

But A.I. won’t be able to tell Walker or Pichai if Google has found a solution to the end of Search as we know it. For now, neither the bard nor Bard can answer that question.

This article appears in the August/September 2023 issue of Fortune with the headline, “Sundar Pichai and Google face their $160 billion dilemma.”