传奇投资者瑞·达利欧周三表示,由于债务危机和迫在眉睫的资产负债表衰退,美国经济问题“将变得更糟”。

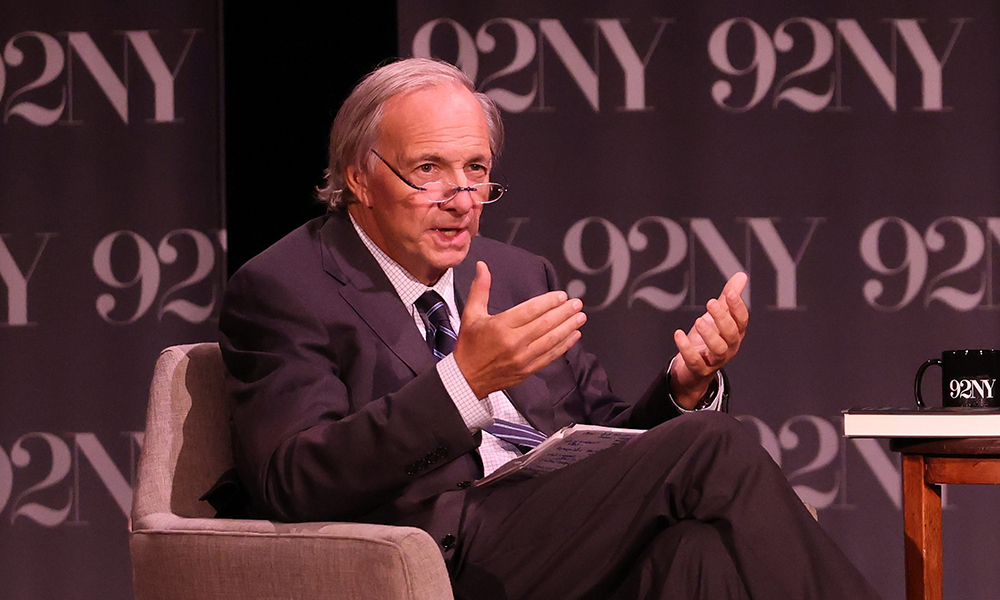

在纽约举行的彭博投资大会(Bloomberg Invest conference)上,达利欧警告称,美国经济正面临“危险局面”。达利欧于1975年创立了桥水联合基金(Bridgewater Associates),并将其打造成全球最大的对冲基金之一。

达利欧告诉彭博社的大卫·威斯汀(David Westin),他的担忧之一是,可能没有足够的买家购买市场上涌入的政府债务。预计到2023年底,美国财政部将发行超过1万亿美元的国库券,因为在最后一刻达成提高债务上限协议后,美国政府希望建立现金储备。

“在我看来,我们正处于一场非常典型的晚期大周期债务危机的开端,届时会产生过多的债务,却缺少买家。”达利欧说。

“现在的情况是,我们必须出售所有这些债务,然后就会出现[这样的问题],‘有足够的买家吗?世界各地的大型投资机构在美国国债上损失了资金,如今它们持有的美国国债量发生了变化,然后地缘政治变化也在产生影响。”

根据达利欧的说法,债券市场正处于确定是否有足够的买家来购买即将涌入的美国国债的“边缘”,这位资深投资者认为,供需情况将在“未来一两年”变得更加清晰。

达利欧周三表示:“必须有买家来购买大量债务,必须保证足够高的利率。(但)如果我们继续沿着这条路走下去,就未来5年、10年可能出现的情况而言,我们就会陷入这样的境地:实现平衡变得非常困难。”

政治方面的担忧

达利欧还表示,美国的政治分裂造成经济风险,他认为,对政治制度和经济来说,唯一的理想情况是建立“强大的”中间立场,即使 “极端主义”和“分裂主义”在共和党和民主党中持续增长。

他说:“无论是偏右还是偏左,任何一个极端都不可能占主导地位。因此,我们看到社会出现分裂。从地理上看,你会看到人们迁往不同地区……因为价值观的差异,你就会看到这种隔离现象。”

他问道:“我认为,在接下来的两年里,问题是我们能否建立一个强大的中间派,还是会出现那种社会分裂问题?”

这位净资产估计为165亿美元的桥水公司(Bridgewater)创始人接着说,经济将在一段时间内处于紧张状态,因为目前的利率水平“可能会维持”一段时间。

他说:“这样做的后果将是未来经济走弱。由于家庭部门的原因,经济不一定会出现严重的衰退,但这是一场资产负债表衰退。我认为经济形势会变得更糟;在发生内部冲突的同时,还存在金融问题,所以我认为这将引发危险局面。”

一段时间以来,达利欧一直在对美国经济发出警告,他在2022年底警告说,“荒谬愚蠢”的经济政策使美国走向经济阵痛的“完美风暴”。

他并不是唯一一个对美国经济感到担忧的市场观察人士,尽管一些投资者对经济前景感到更加乐观,因为有迹象表明美国经济出现了反弹。

本周早些时候,德意志银行(Deutsche Bank)警告称,美国正走向“政策主导的”经济衰退,而亿万富翁投资者斯坦·德鲁肯米勒(Stan Druckenmiller)上月表示,美国正处于经济衰退的边缘,并预测将出现“硬着陆”。(财富中文网)

译者:中慧言-王芳

传奇投资者瑞·达利欧周三表示,由于债务危机和迫在眉睫的资产负债表衰退,美国经济问题“将变得更糟”。

在纽约举行的彭博投资大会(Bloomberg Invest conference)上,达利欧警告称,美国经济正面临“危险局面”。达利欧于1975年创立了桥水联合基金(Bridgewater Associates),并将其打造成全球最大的对冲基金之一。

达利欧告诉彭博社的大卫·威斯汀(David Westin),他的担忧之一是,可能没有足够的买家购买市场上涌入的政府债务。预计到2023年底,美国财政部将发行超过1万亿美元的国库券,因为在最后一刻达成提高债务上限协议后,美国政府希望建立现金储备。

“在我看来,我们正处于一场非常典型的晚期大周期债务危机的开端,届时会产生过多的债务,却缺少买家。”达利欧说。

“现在的情况是,我们必须出售所有这些债务,然后就会出现[这样的问题],‘有足够的买家吗?世界各地的大型投资机构在美国国债上损失了资金,如今它们持有的美国国债量发生了变化,然后地缘政治变化也在产生影响。”

根据达利欧的说法,债券市场正处于确定是否有足够的买家来购买即将涌入的美国国债的“边缘”,这位资深投资者认为,供需情况将在“未来一两年”变得更加清晰。

达利欧周三表示:“必须有买家来购买大量债务,必须保证足够高的利率。(但)如果我们继续沿着这条路走下去,就未来5年、10年可能出现的情况而言,我们就会陷入这样的境地:实现平衡变得非常困难。”

政治方面的担忧

达利欧还表示,美国的政治分裂造成经济风险,他认为,对政治制度和经济来说,唯一的理想情况是建立“强大的”中间立场,即使 “极端主义”和“分裂主义”在共和党和民主党中持续增长。

他说:“无论是偏右还是偏左,任何一个极端都不可能占主导地位。因此,我们看到社会出现分裂。从地理上看,你会看到人们迁往不同地区……因为价值观的差异,你就会看到这种隔离现象。”

他问道:“我认为,在接下来的两年里,问题是我们能否建立一个强大的中间派,还是会出现那种社会分裂问题?”

这位净资产估计为165亿美元的桥水公司(Bridgewater)创始人接着说,经济将在一段时间内处于紧张状态,因为目前的利率水平“可能会维持”一段时间。

他说:“这样做的后果将是未来经济走弱。由于家庭部门的原因,经济不一定会出现严重的衰退,但这是一场资产负债表衰退。我认为经济形势会变得更糟;在发生内部冲突的同时,还存在金融问题,所以我认为这将引发危险局面。”

一段时间以来,达利欧一直在对美国经济发出警告,他在2022年底警告说,“荒谬愚蠢”的经济政策使美国走向经济阵痛的“完美风暴”。

他并不是唯一一个对美国经济感到担忧的市场观察人士,尽管一些投资者对经济前景感到更加乐观,因为有迹象表明美国经济出现了反弹。

本周早些时候,德意志银行(Deutsche Bank)警告称,美国正走向“政策主导的”经济衰退,而亿万富翁投资者斯坦·德鲁肯米勒(Stan Druckenmiller)上月表示,美国正处于经济衰退的边缘,并预测将出现“硬着陆”。(财富中文网)

译者:中慧言-王芳

America’s economic troubles are “going to get worse” thanks to a debt crisis and looming balance sheet recession, legendary investor Ray Dalio said Wednesday.

Speaking at the Bloomberg Invest conference in New York, Dalio—who in 1975 founded Bridgewater Associates and built it into one of the world’s biggest hedge funds—issued a warning that the U.S. economy was facing a “risky situation.”

Dalio told Bloomberg’s David Westin one of his concerns was that there may not be enough buyers for an influx of government debt on the market. The U.S. Treasury is expected to issue more than $1 trillion in T-bills by the end of 2023, as the government looks to build its cash reserves following a last-minute deal to raise the debt ceiling.

“In my opinion, we are at the beginning of a very classic late, big-cycle debt crisis when you are producing too much debt and have also a shortage of buyers,” Dalio said.

“What’s happening now is we have to sell all this debt, [and] we then have [the question of] ‘Do you have enough buyers?’ There are changes now in terms of the quantities that are being held by large investors around the world who have lost money in these Treasury bonds, and then there are geopolitical changes which are having an effect.”

According to Dalio, the debt market is “at the brink” of finding out whether it will have sufficient buyers for an impending influx of Treasury bonds, with the veteran investor arguing that the supply and demand picture will become clearer “over the next year or two.”

“There’s a lot of debt, it has to be bought, it has to have a high enough interest rate,” Dalio said on Wednesday. “[But] if we continue down this path, in terms of what’s likely over the next five, 10 years, you reach the point where that balancing act becomes very difficult.”

Political concerns

Dalio also said that political division in America was creating economic risks, arguing that the only good outcome for the political system and the economy was for a “strong” middle ground to be established even as “extremism” and a “split” was growing in both the Republican and Democratic parties.

“Either of the extremes is not going to be able to be dominant, either the small Right or the small Left,” he said. “And as a result, we’re seeing a fragmentation. Geographically you’re seeing people move to different areas…because of differences in values, and so you’re seeing this separation.”

“I think over the next two years, the question is can we have a strong bipartisan middle, or are we going to have that kind of fragmentation?” he questioned.

The Bridgewater founder, who has an estimated net worth of $16.5 billion, went on to argue that the economy would be strained for some time because interest rates were now at a level that “they’re probably going to stay at” for a while.

“The consequences of that are going to be a weaker economy going forward,” he said. “It doesn’t have to be a big downturn because of the household sector, but it is a balance sheet kind of recession. I think things are going to get worse in the economy; there’s a financial issue at the same time as you have this internal conflict, so I think that’s going to make for a risky situation.”

Dalio has been sounding the alarm on the U.S. economy for some time, warning in late 2022 that “ridiculously stupid” economic policies had the country headed toward a “perfect storm” of economic pain.

He isn’t the only market watcher to be concerned about the U.S. economy, even as some investors are feeling more optimistic about the economic outlook amid signs of resilience.

Earlier this week, Deutsche Bank warned that America was headed for a “policy-led” recession, while billionaire investor Stan Druckenmiller said last month that the U.S. was on the brink of a recession and predicted a “hard landing.”