在看好房地产市场的人们眼里,美国房地产市场已经趋于稳定。激进的建筑商激励将购房人重新拉回市场,新房销量再次上涨。与此同时,抵押贷款利率跌回至7%以下,而且房地产市场进入了更加热闹的春季,因此许多区域房地产市场从回调模式进入了增长模式。事实上,在Zillow跟踪的区域房地产市场中,只有16%的市场在今年3月至4月期间房价下跌。

但房地产市场最糟糕的情况即将来临。或者已经来临?

房地产市场衰退并未结束,而且随着市场进入夏季和秋季等季节性增速放缓的月份,市场可能恢复下跌的势头。至少房利美(Fannie Mae)刚刚公布的修订后预测是这样认为。

2023年第一季度,从私人住宅固定投资(即房地产业GDP的核心)来看,美国房地产市场的名义投资金额连续四个季度呈下降趋势。而且市场可能进一步收缩。房利美预测,2023年第二季度(-5.9%)、第三季度(-9.1%)、第四季度(-6.4%)和2024年第一季度(-1%),住宅固定投资将持续下降。

房利美的经济学家在5月19日发布的报告中表示:“目前在建多户住宅数量创新高,这些住宅将于今年晚些时候和2024年上市。此外建筑贷款信贷收紧,很快新建项目数量增长将会放缓,我们预计今年晚些时候,美国房地产市场会大幅下滑。”

房利美的预测称,多户住宅价格下跌,将使在单户住宅领域的任何经济刺激措施失效。今年春季,建筑商提供的买低抵押贷款利率等激励措施,刺激了单户住宅市场的发展。

过去一年,房地产市场是美国少数几个陷入衰退的经济领域。这种情况可能很快发生变化:房利美的预测模型认为,美国房地产市场衰退将产生溢出效应,让美国经济陷入衰退。事实上,房利美预测2023年第三季度(-1.2%)、第四季度(-1.7%)和2024年第一季度(-0.5%),美国的GDP都将处于下降趋势。

房利美的经济学家写道:“如果与工资相关的通胀压力没有消失,美联储(Federal Reserve)可能就会在更长时间内延续更紧缩的政策,这最有可能导致的结果是美国经济陷入适度衰退,但衰退发生时间依旧是一个巨大的未知数。”

虽然房利美的预测模型认为,美国房地产市场将把美国经济拉入衰退,但其经济学家也认为,房地产市场将是抵御严重经济衰退的缓冲。

他们在5月19日称:“我们认为住宅建设和汽车行业的状况,更有可能成为抵御严重经济衰退的缓冲,它们可能成为最终刺激经济复苏的驱动力,而不是防止经济衰退的工具。”

这对房价意味着什么?

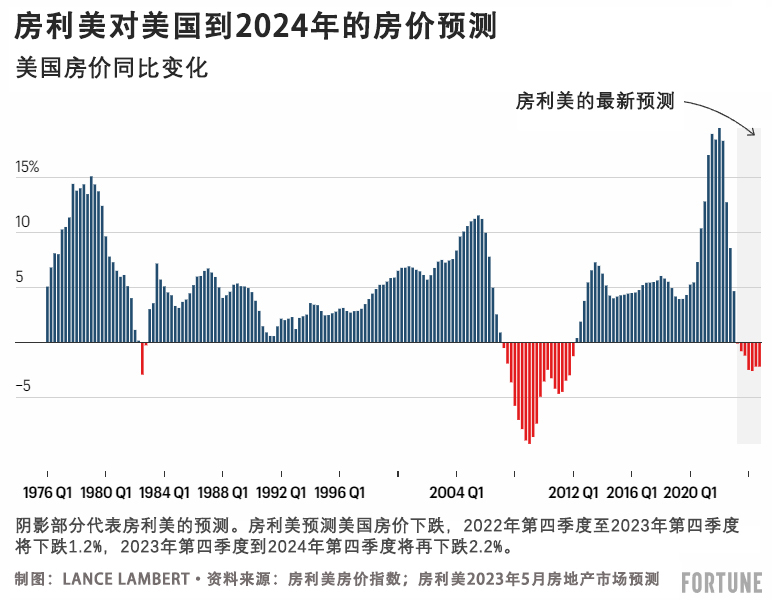

Zillow和CoreLogic等均预测未来一年,美国房价将小幅上涨,但房利美认为房价可能很快恢复下降的势头。房利美的预测模型根据房利美房价指数(Fannie Mae Home Price Index),认为美国房价在2022年第四季度至2023年第四季度将下跌1.2%,2023年第四季度到2024年第四季度将再下跌2.2%。如果房利美的预测成真,这就将是自2012年以来,房利美房价指数评估的首次房价同比下跌。

房利美预测,到2024年第四季度,全美房价将跌至最低点,从2022年第二季度的最高点下跌5.28%。各区域的房价存在巨大差异。

房利美的预测结果是适度回调,而不是房地产市场崩溃。

房利美表示,全美房价下跌的原因不太可能归咎于缺少转售库存。事实上,有效库存依旧比新冠疫情之前的水平低40%。

房利美的首席经济学家道格·邓肯在最近的报告中写道:“虽然抵押贷款利率依旧高于前几年的水平,但房地产供应严重不足将有助于维持房价。当然,待售房屋短缺目前因为所谓的‘锁定效应’而进一步加剧,这会继续令大批享受低抵押贷款利率的家庭放弃将房子挂牌出售。”(财富中文网)

译者:刘进龙

审校:汪皓

在看好房地产市场的人们眼里,美国房地产市场已经趋于稳定。激进的建筑商激励将购房人重新拉回市场,新房销量再次上涨。与此同时,抵押贷款利率跌回至7%以下,而且房地产市场进入了更加热闹的春季,因此许多区域房地产市场从回调模式进入了增长模式。事实上,在Zillow跟踪的区域房地产市场中,只有16%的市场在今年3月至4月期间房价下跌。

但房地产市场最糟糕的情况即将来临。或者已经来临?

房地产市场衰退并未结束,而且随着市场进入夏季和秋季等季节性增速放缓的月份,市场可能恢复下跌的势头。至少房利美(Fannie Mae)刚刚公布的修订后预测是这样认为。

2023年第一季度,从私人住宅固定投资(即房地产业GDP的核心)来看,美国房地产市场的名义投资金额连续四个季度呈下降趋势。而且市场可能进一步收缩。房利美预测,2023年第二季度(-5.9%)、第三季度(-9.1%)、第四季度(-6.4%)和2024年第一季度(-1%),住宅固定投资将持续下降。

房利美的经济学家在5月19日发布的报告中表示:“目前在建多户住宅数量创新高,这些住宅将于今年晚些时候和2024年上市。此外建筑贷款信贷收紧,很快新建项目数量增长将会放缓,我们预计今年晚些时候,美国房地产市场会大幅下滑。”

房利美的预测称,多户住宅价格下跌,将使在单户住宅领域的任何经济刺激措施失效。今年春季,建筑商提供的买低抵押贷款利率等激励措施,刺激了单户住宅市场的发展。

过去一年,房地产市场是美国少数几个陷入衰退的经济领域。这种情况可能很快发生变化:房利美的预测模型认为,美国房地产市场衰退将产生溢出效应,让美国经济陷入衰退。事实上,房利美预测2023年第三季度(-1.2%)、第四季度(-1.7%)和2024年第一季度(-0.5%),美国的GDP都将处于下降趋势。

房利美的经济学家写道:“如果与工资相关的通胀压力没有消失,美联储(Federal Reserve)可能就会在更长时间内延续更紧缩的政策,这最有可能导致的结果是美国经济陷入适度衰退,但衰退发生时间依旧是一个巨大的未知数。”

虽然房利美的预测模型认为,美国房地产市场将把美国经济拉入衰退,但其经济学家也认为,房地产市场将是抵御严重经济衰退的缓冲。

他们在5月19日称:“我们认为住宅建设和汽车行业的状况,更有可能成为抵御严重经济衰退的缓冲,它们可能成为最终刺激经济复苏的驱动力,而不是防止经济衰退的工具。”

这对房价意味着什么?

Zillow和CoreLogic等均预测未来一年,美国房价将小幅上涨,但房利美认为房价可能很快恢复下降的势头。房利美的预测模型根据房利美房价指数(Fannie Mae Home Price Index),认为美国房价在2022年第四季度至2023年第四季度将下跌1.2%,2023年第四季度到2024年第四季度将再下跌2.2%。如果房利美的预测成真,这就将是自2012年以来,房利美房价指数评估的首次房价同比下跌。

房利美预测,到2024年第四季度,全美房价将跌至最低点,从2022年第二季度的最高点下跌5.28%。各区域的房价存在巨大差异。

房利美的预测结果是适度回调,而不是房地产市场崩溃。

房利美表示,全美房价下跌的原因不太可能归咎于缺少转售库存。事实上,有效库存依旧比新冠疫情之前的水平低40%。

房利美的首席经济学家道格·邓肯在最近的报告中写道:“虽然抵押贷款利率依旧高于前几年的水平,但房地产供应严重不足将有助于维持房价。当然,待售房屋短缺目前因为所谓的‘锁定效应’而进一步加剧,这会继续令大批享受低抵押贷款利率的家庭放弃将房子挂牌出售。”(财富中文网)

译者:刘进龙

审校:汪皓

The U.S. housing market, in the telling of housing bulls, has stabilized. New home sales are rising again, as aggressive builder incentives pull buyers back into the market. Meanwhile, mortgage rates falling back under 7%, combined with the housing market entering into the busier spring season, has seen many regional housing markets flip from correction mode to growth mode. In fact, only 16% of regional housing markets tracked by Zillow saw a home price decline between March and April.

When it comes to housing, the worst is behind us. Or is it?

The housing market recession isn’t over just yet—and it could regain momentum as the market moves into the seasonally slower summer and fall months. At least that’s according to a revised forecast just put out by Fannie Mae.

Through the first quarter of 2023, U.S. housing market activity as measured by private residential fixed investment (i.e. the core of housing GDP) has declined, on a nominal basis, for four straight quarters. And more contractions could be on the horizon. Indeed, Fannie Mae expects residential fixed investment to fall in Q2 2023 (-5.9%), Q3 2023 (-9.1%), Q4 2023 (-6.4%), and Q1 2024 (-1%).

“There is a record number of multifamily units currently under construction, which are scheduled to come online later this year and into 2024. Combined with tightening credit for construction lending, which we expect will soon be realized by a slower new project pipeline, we are expecting a significant slowdown in starts later this year,” wrote Fannie Mae economists in their report published on May 19.

The pullback on the multifamily side, according to the Fannie Mae forecast, will negate any economic boosts created on the single-family side, which has benefited this spring from builder incentives like mortgage rate buydowns.

Over the past year, the housing market has been one of the few areas of the economy stuck in recession. That could soon change: Fannie Mae’s forecast model thinks declines in the U.S. housing market will spill over and help to push the U.S. economy into a recession. Indeed, Fannie Mae is forecasting U.S. GDP declines in Q3 2023 (-1.2%), Q4 2023 (-1.7%), and Q1 2024 (-0.5%).

“A modest recession is the likeliest outcome—and that its timing remains the principal outstanding question—as the Fed is likely to maintain tighter policy for longer if wage-related inflationary pressures do not subside,” wrote Fannie Mae economists.

While Fannie Mae’s forecast model predicts that the U.S. housing market will help to drag the economy into recession, Fannie Mae economists also believe that the U.S. housing market will be a buffer against a deep recession.

“We see the conditions in the housing construction and auto sectors as likely being more of a buffer to the severity of a recession by being potential drivers of eventual recovery than a means to prevent one,” wrote Fannie Mae economists on May 19.

What does this mean for home prices?

Unlike Zillow and CoreLogic, which are forecasting slight home price gains over the next year, Fannie Mae thinks the home price correction will soon regain momentum. Fannie Mae's forecast model has U.S. home prices, as measured by the Fannie Mae Home Price Index, falling 1.2% between Q4 2022 and Q4 2023, and then another 2.2% decline between Q4 2023 and Q4 2024. If those declines come to fruition, it'd mark the first year-over-year declines measured by the Fannie Mae Home Price Index since 2012.

By the time national home prices bottom in Q4 2024, Fannie Mae predicts U.S. home prices will be 5.28% lower than the peak in Q2 2022. Regionally speaking, the outcomes are likely to vary—a lot.

That forecast is a mild correction—not a housing crash.

The reason Fannie Mae says a national home price crash is unlikely boils down to the lack of resale inventory. In fact, active inventory is still 40% below pre-pandemic levels.

"Even though mortgage rates remain elevated compared to the previous few years, the acute lack of housing supply remains supportive of home prices. Of course, the shortage of homes for sale is currently being exacerbated by the so-called ‘lock-in effect,’ which continues to disincentivize huge numbers of households with low mortgage rates from listing their homes," wrote Fannie Mae chief economist Doug Duncan in a recent report.