至少根据房利美(Fannie Mae)在上周发表的一份报告,有关全美房地产市场复苏的说法言过其实。该报告预测住房市场在今年1月和2月的“相对高位”可能是“暂时的”。

房利美的经济学家在最新报告中写道:“尽管乐观情绪似乎已经悄悄潜入房地产行业,但这代表着楼市活动从极低水平上升,如果利率逆转,还有再次下降的风险。”

2023年年初,一系列因素叠加在一起,让低迷的房地产市场稍稍回温。首先,一年中的最初几个月总是有更多的季节性需求。30年期固定利率抵押贷款的平均利率从2022年11月初的7.37%下降到今年2月初的5.99%,以及房屋建筑商目前提供的相当可观的抵押贷款利率折扣,这都推动了今年需求的上升。

然而,我们已经开始看到房地产市场的环境再次恶化。事实上,在过去三周内,30年期固定利率抵押贷款的平均利率从5.99%飙升至6.88%。

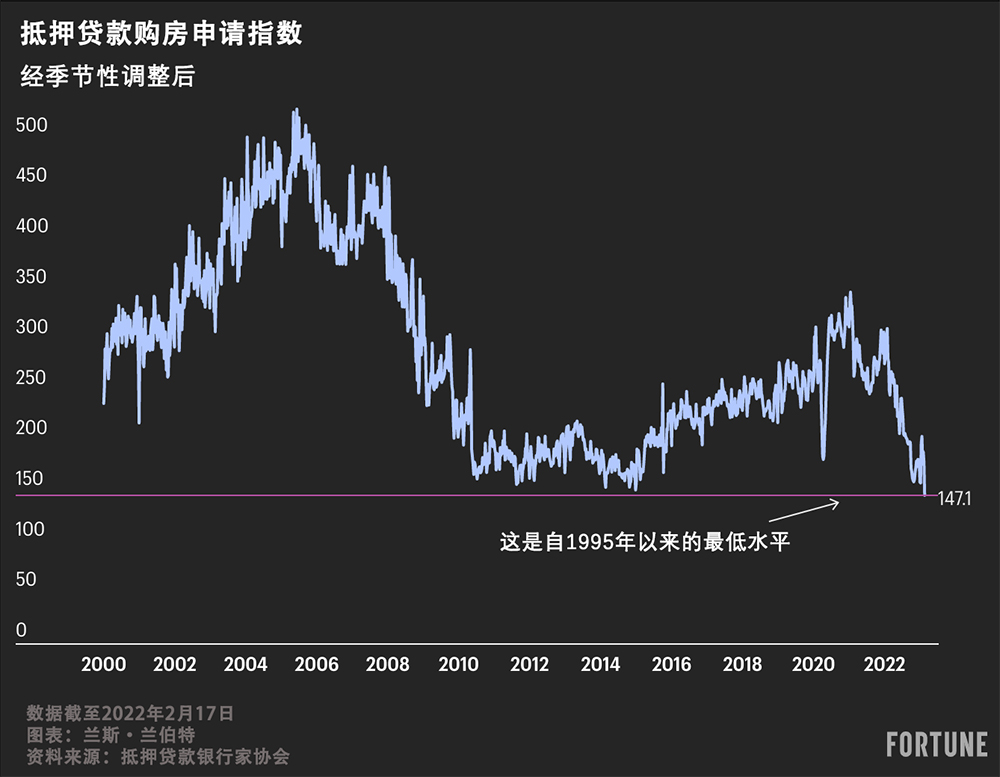

抵押贷款利率的回升已经与上周经季节性调整后的抵押贷款购房申请情况(参见下图)相一致。目前,抵押贷款购房申请已经下降到自1995年以来的最低水平。

房利美预计,2023年全年,新房和现房销量将分别下降5.4%和19.2%。在此之前,2022年新房销售下降16.5%,现房销售下降17.9%。

房利美认为住房市场不会在2023年复苏,主要有以下两个原因。

首先,房利美认为,高企的抵押贷款利率将继续让许多购房者望而却步。

其次,房利美经济学家认为,房屋挂牌出售仍将受到限制,因为很少有卖家急于把3%的固定抵押贷款利率换成6%的抵押贷款利率。当然,房屋销售水平因为库存短缺也难以上升。

房利美的经济学家在最新报告中写道:“负担能力持续受到限制,‘锁定’效应导致大多数目前有抵押贷款的房主不愿意搬家(就财务原因而言,当年他们锁定的抵押贷款利率较低),库存仍然紧张,这些因素预计将继续限制房屋销售……此外,10年期国债近几周大幅上涨,表明抵押贷款利率可能会开始再次上升。”

虽然房利美预计库存水平将继续受到限制,但它表示库存紧张不足以阻止房价回调。

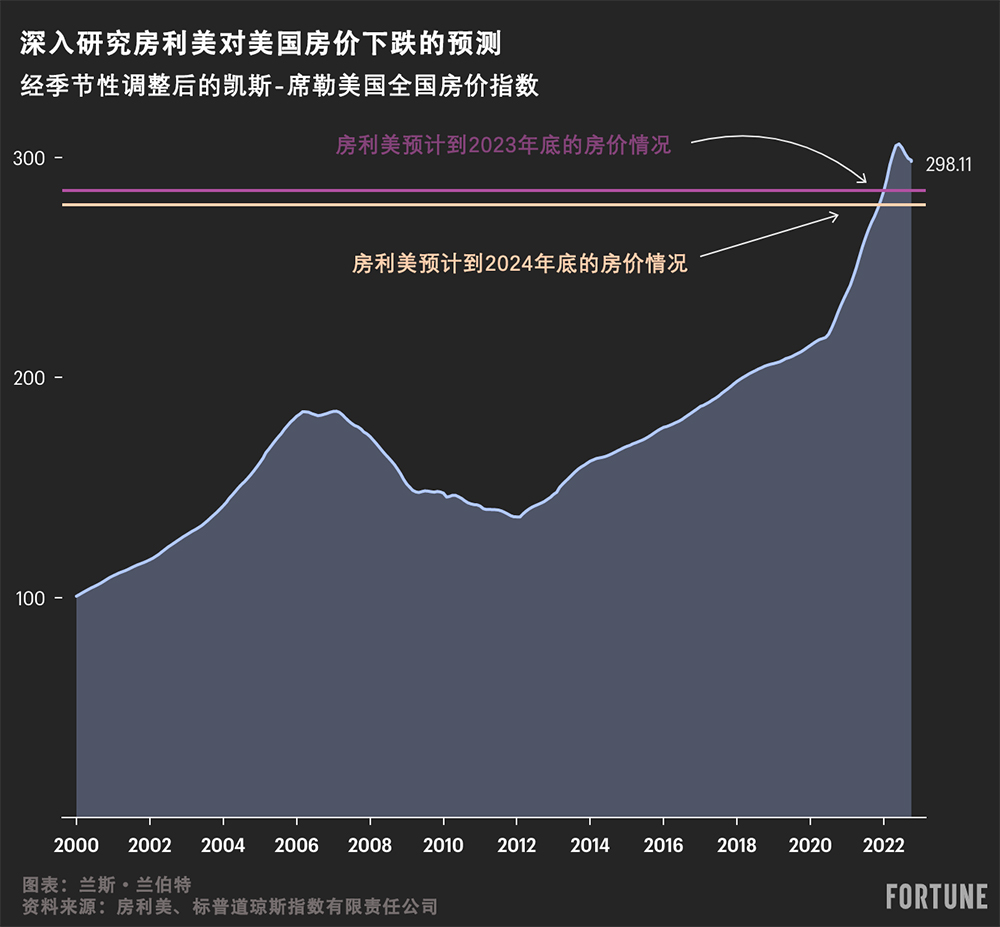

继2022年下半年美国房价下跌2.5%后,房利美预计2023年美国房价将再下跌4.2%。房利美的经济学家预计,2024年美国房价将再下跌2.3%。

如果房利美的预测是正确的,那么这次房市暴跌就将使全美住房市场经历一次温和的房价修正,而不是全面的房价崩盘。毕竟,如果房价真的下跌,全美房价在2024年年底仍将比2020年3月的价格水平高出29%。

要牢记,每当房利美这样的机构讨论美国房价时,讨论的都是全美整体房价。在区域层面上,房价走势各不相同。(财富中文网)

译者:中慧言-王芳

至少根据房利美(Fannie Mae)在上周发表的一份报告,有关全美房地产市场复苏的说法言过其实。该报告预测住房市场在今年1月和2月的“相对高位”可能是“暂时的”。

房利美的经济学家在最新报告中写道:“尽管乐观情绪似乎已经悄悄潜入房地产行业,但这代表着楼市活动从极低水平上升,如果利率逆转,还有再次下降的风险。”

2023年年初,一系列因素叠加在一起,让低迷的房地产市场稍稍回温。首先,一年中的最初几个月总是有更多的季节性需求。30年期固定利率抵押贷款的平均利率从2022年11月初的7.37%下降到今年2月初的5.99%,以及房屋建筑商目前提供的相当可观的抵押贷款利率折扣,这都推动了今年需求的上升。

然而,我们已经开始看到房地产市场的环境再次恶化。事实上,在过去三周内,30年期固定利率抵押贷款的平均利率从5.99%飙升至6.88%。

抵押贷款利率的回升已经与上周经季节性调整后的抵押贷款购房申请情况(参见下图)相一致。目前,抵押贷款购房申请已经下降到自1995年以来的最低水平。

房利美预计,2023年全年,新房和现房销量将分别下降5.4%和19.2%。在此之前,2022年新房销售下降16.5%,现房销售下降17.9%。

房利美认为住房市场不会在2023年复苏,主要有以下两个原因。

首先,房利美认为,高企的抵押贷款利率将继续让许多购房者望而却步。

其次,房利美经济学家认为,房屋挂牌出售仍将受到限制,因为很少有卖家急于把3%的固定抵押贷款利率换成6%的抵押贷款利率。当然,房屋销售水平因为库存短缺也难以上升。

房利美的经济学家在最新报告中写道:“负担能力持续受到限制,‘锁定’效应导致大多数目前有抵押贷款的房主不愿意搬家(就财务原因而言,当年他们锁定的抵押贷款利率较低),库存仍然紧张,这些因素预计将继续限制房屋销售……此外,10年期国债近几周大幅上涨,表明抵押贷款利率可能会开始再次上升。”

虽然房利美预计库存水平将继续受到限制,但它表示库存紧张不足以阻止房价回调。

继2022年下半年美国房价下跌2.5%后,房利美预计2023年美国房价将再下跌4.2%。房利美的经济学家预计,2024年美国房价将再下跌2.3%。

如果房利美的预测是正确的,那么这次房市暴跌就将使全美住房市场经历一次温和的房价修正,而不是全面的房价崩盘。毕竟,如果房价真的下跌,全美房价在2024年年底仍将比2020年3月的价格水平高出29%。

要牢记,每当房利美这样的机构讨论美国房价时,讨论的都是全美整体房价。在区域层面上,房价走势各不相同。(财富中文网)

译者:中慧言-王芳

Talk about a national housing market recovery is overblown. At least that’s according to a Fannie Mae report published last week that predicts the housing market’s “relative high note” in January and February is likely to “prove temporary.”

“While some optimism appears to have crept into the housing sector, it represents an increase from very low levels of activity and is at risk of declining again if rates reverse,” wrote economists at Fannie Mae in their latest report.

In early 2023, a combination of factors came together to make the slumped housing market feel a little warmer. For starters, the early months of the year always see more seasonal demand. That demand uptick this year was aided by the average 30-year fixed mortgage rate slipping from 7.37% in early November to 5.99% by early February, and the fact that homebuilders are now offering substantial mortgage rate buydowns.

However, we’re already starting to see the housing market backdrop sour again. Indeed, over the past three weeks the average 30-year fixed mortgage rate spiked from 5.99% back up to 6.88%.

That resurgence in mortgage rates has already corresponded with seasonally adjusted mortgage purchase applications (see chart below) falling last week to their lowest level since 1995.

For full-year 2023, Fannie Mae expects volumes of both new and existing home sales to fall 5.4% and 19.2%, respectively. That comes after last year’s 16.5% drop in new home sales and the 17.9% drop in existing home sales.

There are two main reasons why Fannie Mae doesn’t think housing will recover in 2023.

First, Fannie Mae thinks high mortgage rates will continue to keep many buyers sidelined.

Second, Fannie Mae economists think home listings will remain constrained as few sellers are eager to trade their fixed 3% mortgage rate for a plus 6% mortgage rate. That lack of inventory, of course, would make it hard for home sales levels to rise.

“Ongoing affordability constraints, the ‘lock-in’ effect creating a financial disincentive for the majority of current homeowners with mortgages to move, and still-tight inventories are expected to continue to limit home sales…Additionally, the 10-year Treasury has increased meaningfully in recent weeks, suggesting that mortgage rates are likely to begin rising again,” wrote Fannie Mae economists in their latest report.

While Fannie Mae expects inventory levels to remain constrained, it says tight inventory alone won’t be enough to stop the home price correction.

Following the 2.5% drop in U.S. home prices in the second half of 2022, Fannie Mae expects U.S. home prices to fall another 4.2% in 2023. Then in 2024, Fannie Mae economists expect U.S. home prices to fall another 2.3%.

If Fannie Mae is right, this housing slump would see the national housing market pass through a mild home price correction—not a full-blown housing price crash. After all, if these price drops do happen, national home prices would end 2024 still up 29% over March 2020 price levels.

Keep in mind, anytime a group like Fannie Mae discusses U.S. home prices, it’s a national aggregate. On a regional level, price movements vary.