通货膨胀率可能已经从去年夏天令人晕眩的高位回落,但这并不意味着物价在下降。物价只是不再像以前那样快速攀升。

虽然许多美国人可能会在购买食品杂货上削减一些预算,或者推迟购买昂贵的汽车来控制预算,但要调整住房、水电和保险等月度开支则要困难得多。

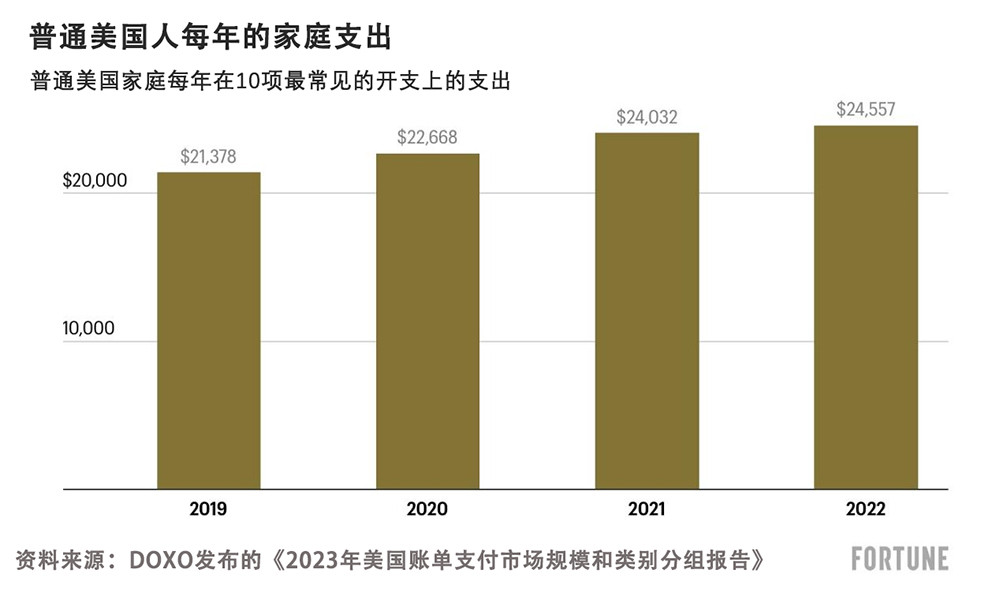

遗憾的是,这些成本也在上升。Doxo发布的《2023年美国账单支付市场规模和类别分组报告》显示,在10项最常见的月度家庭支出中,包括住房、公用事业费、汽车贷款、有线电视费、网络费、手机服务费、安保和保险费用,去年的成本平均上涨了近4%。

根据账单支付服务提供商Doxo的数据,总体而言,美国家庭每年的总支出约为3.87万亿美元,其中3.22万亿美元支出属于10种基本开支支付类别,占美国消费者月度经常性支出的近四分之三。

Doxo发现,细分来看,普通美国家庭每年在基本的家庭开支上的总支出为29459美元。2021年美国家庭实际收入中位数达到70784美元(档案中的最新数据),这意味着美国人正用约42%的工资来支付生活必需品开支。

住房仍然是许多家庭每月最大的开支。根据Doxo的分析,美国人平均每年在抵押贷款上的支出为6341美元,每年在房租上的支出为4716美元。这一分析是基于美国全境97%的消费者的实际账单进行的。当然,支付房租的消费者通常不会同时支付抵押贷款,因此大多数家庭只需专注于支付这些大额支出中的一项。

实际上,人寿保险和公用事业费的月度成本同比增幅最大。人寿保险费用同比上涨了约9%,而包括包括电费、煤气费、水费和污水处理费以及垃圾回收费在内的公用事业费同比上涨8%。

虽然一些月度支出比较稳定——一些州的公用事业费受到更严格的监管,许多美国人有固定利率的抵押贷款——但租金和汽车支出方面的变化更大。因此,虽然总体支出没有大幅增长,但也无法保证它们未来会保持稳定。

对于许多美国人来说,这意味着要密切关注账单,以确保自己能够发现并理解利率的增长或变化。当这种情况发生时,许多专家建议尽可能通过打电话给提供商来尝试协商降低费用。此外,如果你有稳定收入,并密切管理财务,那么如果你设置了自动付款,一些提供商还会提供折扣,这可能更方便。(财富中文网)

译者:中慧言-王芳

通货膨胀率可能已经从去年夏天令人晕眩的高位回落,但这并不意味着物价在下降。物价只是不再像以前那样快速攀升。

虽然许多美国人可能会在购买食品杂货上削减一些预算,或者推迟购买昂贵的汽车来控制预算,但要调整住房、水电和保险等月度开支则要困难得多。

遗憾的是,这些成本也在上升。Doxo发布的《2023年美国账单支付市场规模和类别分组报告》显示,在10项最常见的月度家庭支出中,包括住房、公用事业费、汽车贷款、有线电视费、网络费、手机服务费、安保和保险费用,去年的成本平均上涨了近4%。

根据账单支付服务提供商Doxo的数据,总体而言,美国家庭每年的总支出约为3.87万亿美元,其中3.22万亿美元支出属于10种基本开支支付类别,占美国消费者月度经常性支出的近四分之三。

Doxo发现,细分来看,普通美国家庭每年在基本的家庭开支上的总支出为29459美元。2021年美国家庭实际收入中位数达到70784美元(档案中的最新数据),这意味着美国人正用约42%的工资来支付生活必需品开支。

住房仍然是许多家庭每月最大的开支。根据Doxo的分析,美国人平均每年在抵押贷款上的支出为6341美元,每年在房租上的支出为4716美元。这一分析是基于美国全境97%的消费者的实际账单进行的。当然,支付房租的消费者通常不会同时支付抵押贷款,因此大多数家庭只需专注于支付这些大额支出中的一项。

实际上,人寿保险和公用事业费的月度成本同比增幅最大。人寿保险费用同比上涨了约9%,而包括包括电费、煤气费、水费和污水处理费以及垃圾回收费在内的公用事业费同比上涨8%。

虽然一些月度支出比较稳定——一些州的公用事业费受到更严格的监管,许多美国人有固定利率的抵押贷款——但租金和汽车支出方面的变化更大。因此,虽然总体支出没有大幅增长,但也无法保证它们未来会保持稳定。

对于许多美国人来说,这意味着要密切关注账单,以确保自己能够发现并理解利率的增长或变化。当这种情况发生时,许多专家建议尽可能通过打电话给提供商来尝试协商降低费用。此外,如果你有稳定收入,并密切管理财务,那么如果你设置了自动付款,一些提供商还会提供折扣,这可能更方便。(财富中文网)

译者:中慧言-王芳

Americans are getting hit with rising costs from all sides.

ANDRESR/GETTY IMAGES

Inflation rates may be down from the dizzying heights seen last summer, but that doesn’t mean prices are falling. They’re just no longer climbing as quickly.

And while many Americans may be able to trim their budgets a bit when it comes to the types of groceries they buy or put off expensive car purchases to keep their budgets in check, it’s much more difficult to adjust monthly expenses like housing, utilities, and insurance.

Unfortunately, those costs are going up, too. Across the 10 most common monthly household bills—including housing, utilities, auto loans, cable, internet, cell service, security, and insurance expenses—costs rose an average of nearly 4% last year, according to Doxo’s 2023 U.S. Bill Pay Market Size and Category Breakout Report.

Overall, U.S. households spend about $3.87 trillion per year on bills—$3.22 trillion of which falls within the 10 essential bill payment categories that makes up nearly three-quarters of all U.S. consumer spending on recurring monthly expenses, according to Doxo, a bill pay service provider.

Breaking it down, the average U.S. household spends $29,459 per year on all household bills, Doxo finds. Real median U.S. household income hit $70,784 in 2021 (the latest data on file), which means Americans are using about 42% of their paychecks just to cover the essentials.

Housing continues to be the biggest monthly expense for many families. Americans spend an average $6,341 on mortgage payments per year and $4,716 annually on rent, according to Doxo’s analysis that is based on actual bill payments from consumers located across 97% of U.S. zip codes. Of course, consumers who pay rent typically are not also paying a mortgage, so most households have to focus on paying only one of these big-ticket expenses.

It was actually the monthly cost of life insurance and utilities that saw the biggest year-over-year percentage increases. Life insurance costs jumped by about 9%, while utility bills—which include electric, gas, water and sewer, and waste and recycling fees—rose 8% year over year.

While some monthly costs are more stable—utility fees are more regulated in some states, and many Americans have fixed-rate mortgages—rent and auto expenses are more variable. So while expenses didn’t overall jump dramatically, there’s no guarantee that they will remain steady.

For many Americans, that means keeping a close eye on their bills to ensure that they catch and understand rate increases or changes. And when those do happen, many experts recommend trying to negotiate down cost increases when possible by calling the provider. Additionally, some providers will offer discounts if you automate payments, which can come in handy if you have a steady income and manage your finances closely.