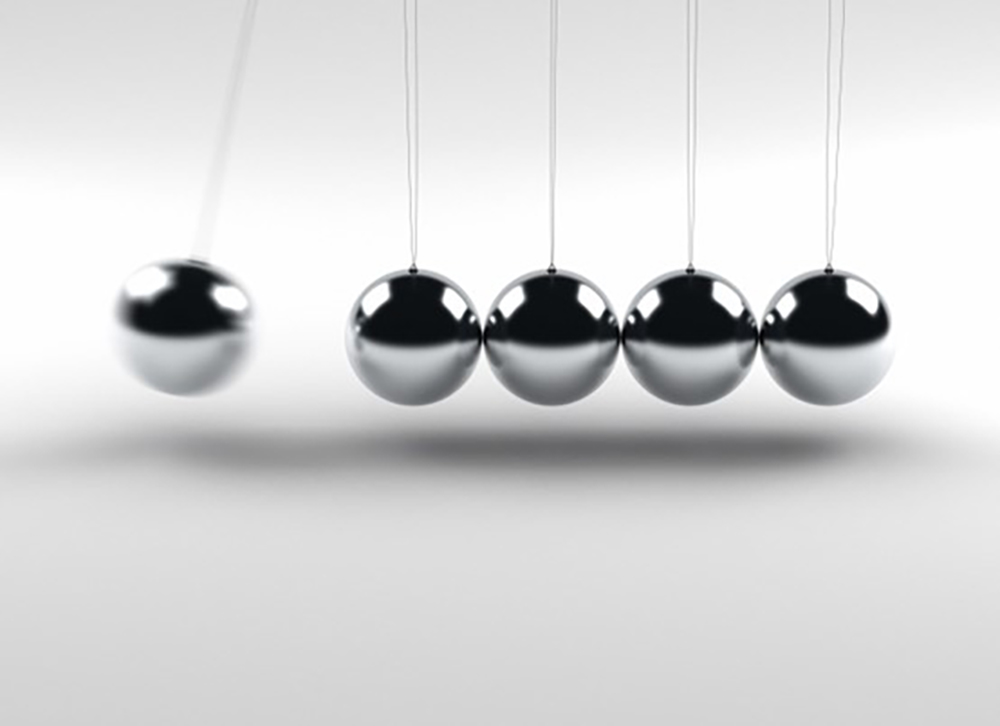

我一直觉得牛顿摆是一个有趣的装置。你知道的,就是那个装置:金属球朝着相反的方向摆动,在撞击中间的静止球时回摆。

这个小小的桌面玩具展示了动量和能量的重要原理。但问题是:要让它长时间摆动,你需要合适的材料。金属球必须有很高的弹性,这样才能够保存更多的能量。而且球的密度需要相同。我这么说吧:规格很重要。

把私人市场看作牛顿摆是很有趣的。这是一种过度简化的说法,但资金从一端进入种子阶段的公司,该公司就会扩大规模、不断成长、不断创新,如果一切顺利的话,首次公开募股就会在另一端实现。在这一过程中被搁置的回报被交还给有限合伙人,然后可以重新投入到这一系统中。在一个理想化的世界里,你会得到高价值的、追求创新的公司,这些公司提高了雇佣率,让世界变得更美好,人们在整个过程中也能够赚钱。

但正如2022年的情况那样,显而易见的是,有一系列的外部指标严重影响了这些金属球是否可以保持动量并不断回摆——或者它们是否会停下来,整个系统被堵塞。比如利率、贴现率、监管、公开市场表现、经济增长、通货膨胀等。所有这些因素都对首次公开募股市场的可行性产生了实质上的影响。而首次公开募股市场反过来也会对有意上市的公司的发展轨迹产生实质上的影响。

2022年,美国首次公开募股市场基本上死气沉沉。当然,各处也有几家公司上市了,但人们并没有从中赚到多少钱。安永(EY)的《2022年全球首次公开募股趋势报告》(Global IPO Trends Report 2022)显示,在美洲,2022年上市公司的收益比2021年减少了95%。2022年美洲地区的上市公司数量比前一年减少了76%。

那么,这一切何时会恢复?又有哪些公司被关在笼子里,等待笼门打开呢?

虽然没有人能够准确指明首次公开募股市场将在什么时候重新开放,但经营二级经纪公司Rainmaker Securities的格伦·安德森和格雷格·马丁猜测,首次公开募股市场将在今年第三季度重新开放。在正式流动性事件之外,投资者可以在Rainmaker Securities购买私人公司股票。

“显然,我认为这取决于利率的稳定性。”马丁说,随后补充道。“只要我们处在一个不断加息的环境中,我认为市场就将继续关闭,我们的股市仍将十分动荡。”

马丁表示,如果美联储(Federal Reserve)在第二季度的某个时候停止加息,那么首次公开募股市场可能就会在第三季度开始重新开放。“市场正在寻求稳定性。”

纽约证券交易所的美国资本市场主管邦妮·贤解释了为什么美联储的决策对首次公开募股有如此重大的影响:她解释道,利率与贴现率直接相关,贴现率被用来计算一家公司未来现金流的现值。当利率上升时,贴现率也会上升,这可能会导致公司估值降低。

邦妮·贤说:“我认为,2021年,当你确实看到没有收入或收入有限的公司上市时,那么该公司是基于未来现金流概念上市的。我认为整个市场情绪已经改变了。”

利率也会影响有限合伙人在风险投资领域的兴趣,因为低风险资产类别在高利率环境下会变得更有吸引力。

如果今年首次公开募股市场重新开放,哪些公司就将率先上市?马丁和安德森告诉我,投资者继续对SpaceX、Stripe、Rubrik、Klarna、字节跳动和Databricks等蓝筹初创公司的股票表现出相当大的兴趣,以及其他进入后期融资轮的科技股——如果这些公司决定上市,它们就会成为有价值的候选对象。

然而,这并不意味着投资者愿意为上市公司支付与上一轮融资所显示的价格相同的价格。根据Rainmaker的数据,2021年11月中旬,投资者在二级市场上以每股83美元的价格抢购Stripe的股票。2022年年底,这家二级经纪公司购买的股票都在每股29美元至35美元之间。据报道,Stripe和Instacart等几家公司都在经济低迷时期对自己的估值进行了下调,而Klarna则是在正式融资轮中这样做的。

除了贴现率等因素外,进入后期融资轮的公司股价下跌的部分原因是需求下降。马丁说,2022年,随着首次公开募股市场关闭,家族办公室、高净值个人、对冲基金和共同基金纷纷退出市场。现在,这些投资者开始慢慢回流。(马丁和安德森表示,私募股权投资者和风投公司仍然在继续投资。)

在市场波动和新发现的盈利能力偏好的影响下,一些公司似乎不再像去年这个时候那样准备好上市了。马丁指出,2021年有数百家公司在二级市场获得了投资者的青睐。

马丁称:“现在更像是30家、40家、50家这样的公司,它们要么被视为表现较好,要么在估值方面下跌了很多,代表着逢低买入的机会。”安德森表示,像Discord、Epic Games、Kraken、OpenSea、Udacity和Automation anywhere这样的初创公司——去年都是二级市场上备受关注的公司——但在Rainmaker的二级交易活动中不再获得同样的关注。(截至本文发稿时,这些公司的发言人尚未回复置评请求。)

马丁说:“我认为,损失肯定会是估值倍数大幅下降。公司最好有可预测的收入,有盈利能力,有良好的单位经济效益,而且在任何承销商要助力你上市之前,你大致需要有非常稳定的15亿美元至20亿美元的市值。你甚至可能需要有更高的市值。”(财富中文网)

译者:中慧言-王芳

我一直觉得牛顿摆是一个有趣的装置。你知道的,就是那个装置:金属球朝着相反的方向摆动,在撞击中间的静止球时回摆。

这个小小的桌面玩具展示了动量和能量的重要原理。但问题是:要让它长时间摆动,你需要合适的材料。金属球必须有很高的弹性,这样才能够保存更多的能量。而且球的密度需要相同。我这么说吧:规格很重要。

把私人市场看作牛顿摆是很有趣的。这是一种过度简化的说法,但资金从一端进入种子阶段的公司,该公司就会扩大规模、不断成长、不断创新,如果一切顺利的话,首次公开募股就会在另一端实现。在这一过程中被搁置的回报被交还给有限合伙人,然后可以重新投入到这一系统中。在一个理想化的世界里,你会得到高价值的、追求创新的公司,这些公司提高了雇佣率,让世界变得更美好,人们在整个过程中也能够赚钱。

但正如2022年的情况那样,显而易见的是,有一系列的外部指标严重影响了这些金属球是否可以保持动量并不断回摆——或者它们是否会停下来,整个系统被堵塞。比如利率、贴现率、监管、公开市场表现、经济增长、通货膨胀等。所有这些因素都对首次公开募股市场的可行性产生了实质上的影响。而首次公开募股市场反过来也会对有意上市的公司的发展轨迹产生实质上的影响。

2022年,美国首次公开募股市场基本上死气沉沉。当然,各处也有几家公司上市了,但人们并没有从中赚到多少钱。安永(EY)的《2022年全球首次公开募股趋势报告》(Global IPO Trends Report 2022)显示,在美洲,2022年上市公司的收益比2021年减少了95%。2022年美洲地区的上市公司数量比前一年减少了76%。

那么,这一切何时会恢复?又有哪些公司被关在笼子里,等待笼门打开呢?

虽然没有人能够准确指明首次公开募股市场将在什么时候重新开放,但经营二级经纪公司Rainmaker Securities的格伦·安德森和格雷格·马丁猜测,首次公开募股市场将在今年第三季度重新开放。在正式流动性事件之外,投资者可以在Rainmaker Securities购买私人公司股票。

“显然,我认为这取决于利率的稳定性。”马丁说,随后补充道。“只要我们处在一个不断加息的环境中,我认为市场就将继续关闭,我们的股市仍将十分动荡。”

马丁表示,如果美联储(Federal Reserve)在第二季度的某个时候停止加息,那么首次公开募股市场可能就会在第三季度开始重新开放。“市场正在寻求稳定性。”

纽约证券交易所的美国资本市场主管邦妮·贤解释了为什么美联储的决策对首次公开募股有如此重大的影响:她解释道,利率与贴现率直接相关,贴现率被用来计算一家公司未来现金流的现值。当利率上升时,贴现率也会上升,这可能会导致公司估值降低。

邦妮·贤说:“我认为,2021年,当你确实看到没有收入或收入有限的公司上市时,那么该公司是基于未来现金流概念上市的。我认为整个市场情绪已经改变了。”

利率也会影响有限合伙人在风险投资领域的兴趣,因为低风险资产类别在高利率环境下会变得更有吸引力。

如果今年首次公开募股市场重新开放,哪些公司就将率先上市?马丁和安德森告诉我,投资者继续对SpaceX、Stripe、Rubrik、Klarna、字节跳动和Databricks等蓝筹初创公司的股票表现出相当大的兴趣,以及其他进入后期融资轮的科技股——如果这些公司决定上市,它们就会成为有价值的候选对象。

然而,这并不意味着投资者愿意为上市公司支付与上一轮融资所显示的价格相同的价格。根据Rainmaker的数据,2021年11月中旬,投资者在二级市场上以每股83美元的价格抢购Stripe的股票。2022年年底,这家二级经纪公司购买的股票都在每股29美元至35美元之间。据报道,Stripe和Instacart等几家公司都在经济低迷时期对自己的估值进行了下调,而Klarna则是在正式融资轮中这样做的。

除了贴现率等因素外,进入后期融资轮的公司股价下跌的部分原因是需求下降。马丁说,2022年,随着首次公开募股市场关闭,家族办公室、高净值个人、对冲基金和共同基金纷纷退出市场。现在,这些投资者开始慢慢回流。(马丁和安德森表示,私募股权投资者和风投公司仍然在继续投资。)

在市场波动和新发现的盈利能力偏好的影响下,一些公司似乎不再像去年这个时候那样准备好上市了。马丁指出,2021年有数百家公司在二级市场获得了投资者的青睐。

马丁称:“现在更像是30家、40家、50家这样的公司,它们要么被视为表现较好,要么在估值方面下跌了很多,代表着逢低买入的机会。”安德森表示,像Discord、Epic Games、Kraken、OpenSea、Udacity和Automation anywhere这样的初创公司——去年都是二级市场上备受关注的公司——但在Rainmaker的二级交易活动中不再获得同样的关注。(截至本文发稿时,这些公司的发言人尚未回复置评请求。)

马丁说:“我认为,损失肯定会是估值倍数大幅下降。公司最好有可预测的收入,有盈利能力,有良好的单位经济效益,而且在任何承销商要助力你上市之前,你大致需要有非常稳定的15亿美元至20亿美元的市值。你甚至可能需要有更高的市值。”(财富中文网)

译者:中慧言-王芳

I always found Newton’s cradle to be a fun contraption. You know the one: The metal balls that swing in opposite directions, going back and forth as they hit the stationary balls in the middle.

This little desk toy demonstrates powerful principles of momentum and energy. But here’s the thing: To make it work for long periods of time, you need the right materials. The balls need to be highly elastic, so they conserve more energy. And the density of the balls needs to be the same. Let me put it this way: The specifications matter.

It’s fun to think of the private markets as Newton’s cradle. This is an oversimplification, but money goes in one side into a seed-stage company, it scales, grows, innovates, and—if all goes well—IPOs come out the other end. Returns that were held up during the process are handed back to LPs, then can be reinvested back into the system. In an ideal world, you get worthy, innovative companies that improve hiring rates and make the world a better place, and people make money throughout the process, too.

But as 2022 has made it abundantly clear, there’s a series of external indicators that heavily influence whether those balls maintain their momentum and keep snapping back and forth—or whether they come to a halt and the whole system gets clogged up. There are things like interest rates, discount rates, regulation, public market performance, economic growth, inflation, etc. All those things have a very real impact on the viability of the IPO market. And the IPO market, in turn, has a very real impact on the trajectory of companies that are aiming for it.

The American IPO market was basically dead in 2022. Sure, there were a few IPOs here and there, but people weren’t really making much money from them. EY’s 2022 Global IPO Trends Report revealed that, in the Americas, there was a 95% reduction in proceeds from companies that went public in 2022 versus 2021. 95%. There were 76% fewer IPOs in 2022 in the Americas than the year before.

So when will all this pick back up? And which companies are in the cages, waiting for the gates to open?

While no one can pinpoint exactly when the IPO market will reopen, Glen Anderson and Greg Martin, who run the secondary brokerage Rainmaker Securities, where investors can buy shares of private companies outside of formal liquidity events, guess it will be in the third quarter of this year.

“Obviously, I think it relies upon the stabilization of interest rates,” Martin says, adding later. “As long as we’re in an increasing interest rate environment, which we still are right now, I think the markets are going to remain closed, and we’re going to still have very choppy equity markets.”

If the Federal Reserve stops raising rates sometime in the second quarter, then the IPO market could start to open back up in the third quarter, Martin says. “The market is looking for stability.”

Bonnie Hyun, U.S. head of capital markets at the New York Stock Exchange, helped explain why the Fed’s decision-making is so influential to IPOs: Interest rates are directly correlated to discount rates, which are used to calculate the present-day value of future cash flow of a company, she explains. When interest rates go up, so do discount rates, which can contribute to a lower valuation of a company.

“I think that in 2021 when you did see companies that had no revenue or limited revenue go public, that was based on the notion of future cash flows,” Hyun says. “I think that whole sentiment has changed.”

Interest rates can also impact LP interest in the venture capital sector, as less-risky asset classes can become more appealing in high-interest-rate environments.

If the IPO market does reopen this year, which companies will go public first? Martin and Anderson tell me that investors continue to show sizable interest in shares for bluechip startups like SpaceX, Stripe, Rubrik, Klarna, Bytedance, and Databricks, among other late-stage tech stocks—making these companies worthy candidates if they decide to go public.

This doesn’t mean that investors are willing to pay the same prices for companies as their last funding rounds may indicate, however. In mid-November of 2021, investors were scooping up shares of Stripe on the secondary market for as much as $83 per share, according to Rainmaker data. At the end of 2022, the secondary brokerage was placing orders for between $29-35 per share. Stripe is one of several companies, such as Instacart, to reportedly dock its own valuation amidst the downturn, while Klarna did so as part of a formal fundraising round.

Besides factors like discount rates, part of the reason that shares of late-stage companies have fallen in price is demand. In 2022, family offices, high-net-worth individuals, hedge funds, and mutual funds retreated from the market as the IPO market closed, Martin says. Now those investors are starting to trickle back in. (Private equity investors and VCs have continued to invest, Martin and Anderson say.)

Amid the market volatility and newfound preferences for profitability, some companies no longer appear to be as poised for an IPO as they might have been this time last year. Martin says that there were hundreds of companies getting secondary market traction from investors in 2021.

“Now it’s more like 30, 40, 50 that are seen as either a little bit higher quality, or they’ve come down so much in terms of valuation, they represent bargain opportunities,” Martin says. Anderson pointed out that startups like Discord, Epic Games, Kraken, OpenSea, Udacity and Automation Anywhere—all high-interest companies on the secondary market last year—are no longer garnering the same level of interest in terms of secondary trading activity at Rainmaker. (Spokespersons at those companies had not responded to requests for comment by the time of publication.)

“I think the damage is definitely going to be substantially reduced valuation multiples,” Martin says. “You better have predictable revenue, be profitable, and have great unit economics, and probably a very secure $1.5-$2 billion market cap before any underwriter is going to take you public. And probably more.”