在受到新冠疫情影响而搬到新泽西郊区后,丽贝卡·戈德堡·布罗德斯基迫不及待地想回到布鲁克林。作为一名室内设计师,她怀念纽约市的蓬勃生机,以及她在那里生活时建立的人脉资源。

戈德堡·布罗德斯基和她的丈夫在布鲁克林社区找了六个月的房子,但约40万美元的预算让他们无功而返。她说,所以他们决定“孤注一掷”,转移资产,这样他们就能够大幅增加支出。最终,他们在公园坡找到了一套三层公寓——它位于曾经的教堂里,售价110万美元——并于2021年9月入住。

戈德堡·布罗德斯基对可以住在一个有良好的公立学校和繁华社区的地方感到欣喜若狂,她愿意忽略旧地板、含铅油漆和令人目眩的高昂价格。直到她的“新”冰箱坏了——一位灭虫员发现公寓里老鼠横行。

戈德堡·布罗德斯基说:“这比我们预期的要贵得多。”她估计他们在厨房装修上花了大约3万美元。“我们在很多方面都很幸运,因为我们在新冠疫情期间确实赚得更多,我们能够联手实现这一目标。”

很快,把装修预算用在新油漆和地板上的梦想破灭了。戈德堡·布罗德斯基和她的丈夫不得不花费数万美元在他们新家的墙壁上安装金属网和更换旧窗户,以防止害虫入侵。

他们远非个例。在今天的房地产市场上,即便是超过100万美元的价格也不可以保证购买者在某些地区就能够拥有豪华住宅。事实上,许多人发现他们不得不在购买后花费更多的钱——可能是数万美元——让他们的新家更宜居。

当然,许多新房主出于审美需求,想要更新厨房橱柜或者改变卧室的油漆颜色,像戈德堡·布罗德斯基和她的丈夫打算做的那样。但在过去一年火爆的房地产市场中,许多买家会买下任何他们可以买到的房子,房价呈指数级上涨,花费七位数往往只是理财之旅的开始。

戈德堡·布罗德斯基表示:“只要经济能够维持下去,而且不会变成一场灾难性事件,那么我在心理上就可以接受。我希望五年后、十年后我能够说这是值得的。”

房子越来越小,越来越老

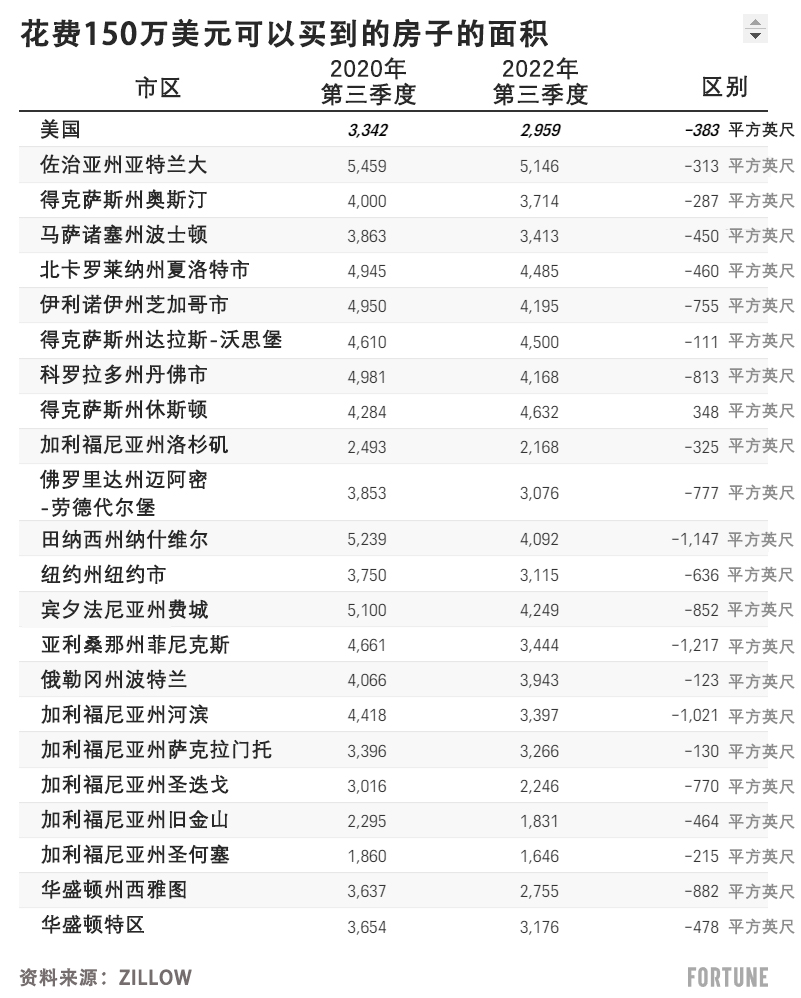

根据Zillow的数据,在达拉斯、菲尼克斯、旧金山(及其周边地区)、西雅图和其他繁荣的房地产市场,房屋每平方英尺的成本在上升,因此售价100万美元的房子的面积越来越小。在2022年第三季度,售出的150万美元的普通住宅面积为2,959平方英尺(约合274.9平方米),而2020年第三季度,售出的150万美元的普通住宅面积为3,342平方英尺(约合310.5平方米)。

Zillow的高级经济学家杰夫·塔克称,这些房子也不太可能是全新的交钥匙建筑。售出的150万美元的房屋的房龄中值也大幅提高:从2020年第三季度的28年上升到2022年第三季度的35年。

塔克说:“售价150万美元的房子的大小和质量都下降了,因为过去几年整体房价水平推得太高了。那些看起来异乎寻常的普通住宅,现在正以这个相当惊人的价位出售。”

老房子并不一定意味着它的状况不好。但它确实增加了需要进行某些更新以使其符合现代生活规范的可能性。塔克表示,尤其是在房价高昂的西海岸市场,150万美元可能只够买一套“待修房屋”。

塔克指出:“人们可能花费那么多钱买了一套房子,却发现供暖系统或者电力系统已经有几十年的历史了。他们不仅在房子上花费了150万美元,还需要在主要系统维修上花费数万美元。”

塔克称,几年前,在西雅图等地最昂贵的社区,一套房子只在有什么独特之处或者定制的情况下,才会定价150万美元或以上。如今,整个社区的房价都在这个水平。

去年,阿曼达·麦卡维纳和她的丈夫花了两倍多的价钱——350万美元在布鲁克林买了一栋联排别墅。和戈德堡·布罗德斯基一样,麦卡维纳在搬进来时也不得不重新装修厨房。

“他们将房子挂牌时展示的照片处理得至臻至美,但是……甚至连基本的生活所需都没有,炉子几乎不能用。”麦卡维纳说。搬进来后,她和丈夫很快就不得不更换涂有铅漆的橱柜、主水管和家里的所有窗户。

时年36岁的麦卡维纳表示,这令人失望,尤其是她和丈夫从20岁出头就开始攒钱买新房。

“没有家庭支持,也没有赠与。”麦卡维纳说。“我们把所有的积蓄都投入其中,我们得到的却是粉红色的浴室。我们的热水箱马上就坏了。这当然不是令人向往的房子。”

话虽如此,麦卡维纳却相信他们总有一天会收回投资。他们计划在这所房子里住20年到30年,在这里抚养孩子,并享受社区提供的一切。

戈德堡·布罗德斯基也不后悔。她觉得自己和周围的社区有很深的联系,无法想象在除了纽约市以外的其他地方生活。她说她的生意很兴隆。

“我们已经尽全力了,我们也与自己达成了和解。不管怎样,我们都留下了回忆。如果有什么不同的话,未来只会更加光明。”(财富中文网)

译者:中慧言-王芳

在受到新冠疫情影响而搬到新泽西郊区后,丽贝卡·戈德堡·布罗德斯基迫不及待地想回到布鲁克林。作为一名室内设计师,她怀念纽约市的蓬勃生机,以及她在那里生活时建立的人脉资源。

戈德堡·布罗德斯基和她的丈夫在布鲁克林社区找了六个月的房子,但约40万美元的预算让他们无功而返。她说,所以他们决定“孤注一掷”,转移资产,这样他们就能够大幅增加支出。最终,他们在公园坡找到了一套三层公寓——它位于曾经的教堂里,售价110万美元——并于2021年9月入住。

戈德堡·布罗德斯基对可以住在一个有良好的公立学校和繁华社区的地方感到欣喜若狂,她愿意忽略旧地板、含铅油漆和令人目眩的高昂价格。直到她的“新”冰箱坏了——一位灭虫员发现公寓里老鼠横行。

戈德堡·布罗德斯基说:“这比我们预期的要贵得多。”她估计他们在厨房装修上花了大约3万美元。“我们在很多方面都很幸运,因为我们在新冠疫情期间确实赚得更多,我们能够联手实现这一目标。”

很快,把装修预算用在新油漆和地板上的梦想破灭了。戈德堡·布罗德斯基和她的丈夫不得不花费数万美元在他们新家的墙壁上安装金属网和更换旧窗户,以防止害虫入侵。

他们远非个例。在今天的房地产市场上,即便是超过100万美元的价格也不可以保证购买者在某些地区就能够拥有豪华住宅。事实上,许多人发现他们不得不在购买后花费更多的钱——可能是数万美元——让他们的新家更宜居。

当然,许多新房主出于审美需求,想要更新厨房橱柜或者改变卧室的油漆颜色,像戈德堡·布罗德斯基和她的丈夫打算做的那样。但在过去一年火爆的房地产市场中,许多买家会买下任何他们可以买到的房子,房价呈指数级上涨,花费七位数往往只是理财之旅的开始。

戈德堡·布罗德斯基表示:“只要经济能够维持下去,而且不会变成一场灾难性事件,那么我在心理上就可以接受。我希望五年后、十年后我能够说这是值得的。”

房子越来越小,越来越老

根据Zillow的数据,在达拉斯、菲尼克斯、旧金山(及其周边地区)、西雅图和其他繁荣的房地产市场,房屋每平方英尺的成本在上升,因此售价100万美元的房子的面积越来越小。在2022年第三季度,售出的150万美元的普通住宅面积为2,959平方英尺(约合274.9平方米),而2020年第三季度,售出的150万美元的普通住宅面积为3,342平方英尺(约合310.5平方米)。

Zillow的高级经济学家杰夫·塔克称,这些房子也不太可能是全新的交钥匙建筑。售出的150万美元的房屋的房龄中值也大幅提高:从2020年第三季度的28年上升到2022年第三季度的35年。

塔克说:“售价150万美元的房子的大小和质量都下降了,因为过去几年整体房价水平推得太高了。那些看起来异乎寻常的普通住宅,现在正以这个相当惊人的价位出售。”

老房子并不一定意味着它的状况不好。但它确实增加了需要进行某些更新以使其符合现代生活规范的可能性。塔克表示,尤其是在房价高昂的西海岸市场,150万美元可能只够买一套“待修房屋”。

塔克指出:“人们可能花费那么多钱买了一套房子,却发现供暖系统或者电力系统已经有几十年的历史了。他们不仅在房子上花费了150万美元,还需要在主要系统维修上花费数万美元。”

塔克称,几年前,在西雅图等地最昂贵的社区,一套房子只在有什么独特之处或者定制的情况下,才会定价150万美元或以上。如今,整个社区的房价都在这个水平。

去年,阿曼达·麦卡维纳和她的丈夫花了两倍多的价钱——350万美元在布鲁克林买了一栋联排别墅。和戈德堡·布罗德斯基一样,麦卡维纳在搬进来时也不得不重新装修厨房。

“他们将房子挂牌时展示的照片处理得至臻至美,但是……甚至连基本的生活所需都没有,炉子几乎不能用。”麦卡维纳说。搬进来后,她和丈夫很快就不得不更换涂有铅漆的橱柜、主水管和家里的所有窗户。

时年36岁的麦卡维纳表示,这令人失望,尤其是她和丈夫从20岁出头就开始攒钱买新房。

“没有家庭支持,也没有赠与。”麦卡维纳说。“我们把所有的积蓄都投入其中,我们得到的却是粉红色的浴室。我们的热水箱马上就坏了。这当然不是令人向往的房子。”

话虽如此,麦卡维纳却相信他们总有一天会收回投资。他们计划在这所房子里住20年到30年,在这里抚养孩子,并享受社区提供的一切。

戈德堡·布罗德斯基也不后悔。她觉得自己和周围的社区有很深的联系,无法想象在除了纽约市以外的其他地方生活。她说她的生意很兴隆。

“我们已经尽全力了,我们也与自己达成了和解。不管怎样,我们都留下了回忆。如果有什么不同的话,未来只会更加光明。”(财富中文网)

译者:中慧言-王芳

After a pandemic-inspired move to the New Jersey suburbs, Rebecca Goldberg Brodsky was itching to get back to Brooklyn. An interior designer, she missed the vibrancy of New York City, and the connections she made while living there.

Goldberg Brodsky and her husband searched Brooklyn neighborhoods for six months, but had no success with their budget of around $400,000. So they decided to “go all in,” she says, moving around their assets so they could spend significantly more. Eventually, they found a three-floor apartment—it is located in what used to be a church—for $1.1 million in Park Slope and moved in in Sept. 2021.

Ecstatic to live somewhere with good public schools and a bustling community, Goldberg Brodsky was willing to overlook the old flooring, lead paint, and the dizzyingly-high price tag. That is, until her “new” refrigerator didn’t work—and an exterminator found the apartment was infested with mice.

“It was a lot more expensive than we expected to be,” says Goldberg Brodsky, estimating they spent around $30,000 on the kitchen renovation. “We’re very fortunate in many ways in that we did make more money during COVID, and we could band together to make this work.”

Soon, dreams of using their renovation budget on new paint and floors dissipated; Goldberg Brodsky and her husband instead had to spend tens of thousands of dollars vermin-proofing their new home by putting metal mesh in the walls and replacing old windows.

They’re far from alone. In today’s housing market, even a price tag of over $1 million doesn’t guarantee buyers a luxury home in some areas. In fact, many are finding they have to shell out more after the purchase—potentially tens of thousand of dollars—to make their new homes livable.

Of course many new homeowners want to update kitchen cabinets or change the bedroom paint color for aesthetic reasons, as Goldberg Brodsky and her husband intended to do. But during the hot housing market of the past year, with many buyers taking whatever home they could get and price rising exponentially, spending seven figures was often just the start of the financial journey.

“I’m okay with it mentally as long as this economy holds up, and it doesn’t turn out to be a catastrophic event,” says Goldberg Brodsky. “My hope is five, 10 years from now I can say it was worth it.”

Houses are getting smaller—and older

In booming markets like Dallas, Phoenix, San Francisco (and surrounding areas), Seattle, and others, the cost per square foot is going up, according to data from Zillow and so million-dollar homes are getting smaller. The typical $1.5 million home sold in the third quarter of 2022 was 2,959 square feet, compared to 3,342 square feet in the third quarter of 2020.

They’re also less likely to be pristine, turn-key builds, says Jeff Tucker, senior economist at Zillow. The median age of a $1.5 million home being sold is also substantially older: up from 28 years in the third quarter of 2020 to 35 years in the third quarter of 2022.

“The caliber or the size and quality of homes that will sell for $1.5 million have all really fallen because the overall price levels have pushed so very high in the past couple years,” says Tucker. “Homes that look surprisingly normal rather than lavish mansions are now selling at this pretty extraordinary price point.”

An older home doesn’t necessarily mean it’s in bad shape. But it does increase the chances of needing certain updates to bring it up to modern code. Especially in pricey West Coast markets, $1.5 million “can be just enough to buy a bit of a fixer-upper,” says Tucker.

“People might be paying that much for a home and finding decades-old heating systems or electrical systems,” says Tucker. “Not only have they spent $1.5 million on the home, they need to turn around and shell out tens of thousands of dollars on major system repairs.”

A few years ago, a home in the most expensive neighborhoods in a place like Seattle would have only been priced at or above $1.5 million if there was something truly unique or custom about it, says Tucker. Now, whole neighborhoods are priced at that level.

Amanda McAvena and her husband spent more than double that—$3.5 million—for a townhouse in Brooklyn last year that's had to undergo its fair share of renovations. Like Goldberg Brodsky, McAvena also had to redo the kitchen when she moved in.

"The listing photos, they did a pretty good job, but...there wasn't even basic things to live with, the stove barely worked," McAvena says. Upon moving in, she and her husband soon had to replace cabinets covered in lead paint, the main water pipe, and the windows throughout their home.

It's disappointing, the 36-year-old says, especially since she and her husband saved since their early 20s to buy their new home.

"There was no family support network, there was no gifting," she says. "We put all of that savings into this, and we have pink bathrooms. Our hot water tank went out right away. It certainly is not a glamorous house."

That said, McAvena is confident they will recoup their investment one day. They plan to live in the home for 20 to 30 years, raising their children there and enjoying everything the neighborhood has to offer.

Goldberg Brodsky also has no regrets. She feels a deep connection to her neighborhood and couldn't imagine living anywhere else but NYC; she says her business is thriving.

"We’ve made peace with what we can do. We’ve made memories regardless," she says. "If anything, it can only go up from here."