也许大家会觉得凭自己的收入可以偶尔挥霍一下,但个人经济生活远比眼前的情况更复杂。重点在于要了解自己的财务状况,以便调整支出、储蓄和投资习惯,进而确保自己顺利迈向更稳定的未来。要更好地了解自己的财务健康情况,途径之一就是计算自己的净值并学习有助于净值增长的方法。

什么是净值?

个人净值就是你的资产减去负债。

知道自己的净值可以帮助你从另一个角度来了解自己的财务状况。你的收入很重要,而且确实影响你的整体净值,但更重要的是知道怎样不断增加储蓄,以及如何用这些钱来偿还贷款并积累长期财富。

Wealth Enhancement Group高级财务规划师达斯汀·罗宾斯说:“资产包括你拥有的一切,如银行账户、投资账户以及不动产、汽车和个人财产的公允市值。负债包括按揭、车贷、学贷、信用卡以及其他个人贷款或债务。”

了解自己的净值有以下几大作用:

评估自己的财务状况。收入足够支付每月的账单并不意味着你在积累长期财富。净值将告诉你自己的资产价值是否随着时间推移而呈正增长以及哪些因素可能是阻碍。

分析有问题的财务区域。以净值为起点有助于你做出所有和钱有关的大大小小的选择。它可以成为警示信号,告诉你自己在某个领域可能投入过多,或在另一方面投资不足。如果所处的情况不理想,或许就意味着需要重新评估自己的债务管理方法或投资策略了。

实现财务目标。如果你想买房或早点儿退休,那么净值正是反映你能否顺利实现这些目标,或者要跟上理想进度是否需要调整自身财务习惯的明确指标。根据经验,许多专家都建议每年计算一次个人净值。不过,某些情况下也许应该更频繁地重新进行计算,比如花了一大笔钱或者做了一大笔投资以之后。

各年龄段美国人净值

美联储(Federal Reserve)2019年消费者财务状况调查结果显示,2016至2019年美国所有家庭的净值中位数和平均值双双上升,分别达到121,760美元和748,800美元。这是可以查到的最近一次的数据,而新数据将在2023年公布。

衡量美国人净值通常有两种方法,分别是平均净值和净值中位数。平均净值是所有美国人净值的平均数。这个数字或许不能那么准确地体现美国人净值的平均水平,原因是它可能受到个别极高或极低净值的干扰。净值中位数是所有美国人净值的中点。

美联储的调查结果显示年龄和净值正相关,大多数美国人的净值都随着年龄的增长而上升,这是因为他们的收入增多,而且有更多时间来存钱和投资。

美国人在各个年龄段的平均净值如下:

到了退休年龄并开始靠储蓄和投资生活之后,美国人的净值就可能见顶或下滑。

可能影响个人净值的四项因素

虽然净值和年龄正相关,但在个人财务决策影响下,个人净值随时都可能上升或下降。

罗宾斯说:“个人能够控制的影响净值的两个最主要因素是开支和储蓄。举例来说,决定为买房花多少钱以及用多少按揭会对个人能存下多少钱产生重大影响。”

可能提升或压低个人净值的常见因素包括:

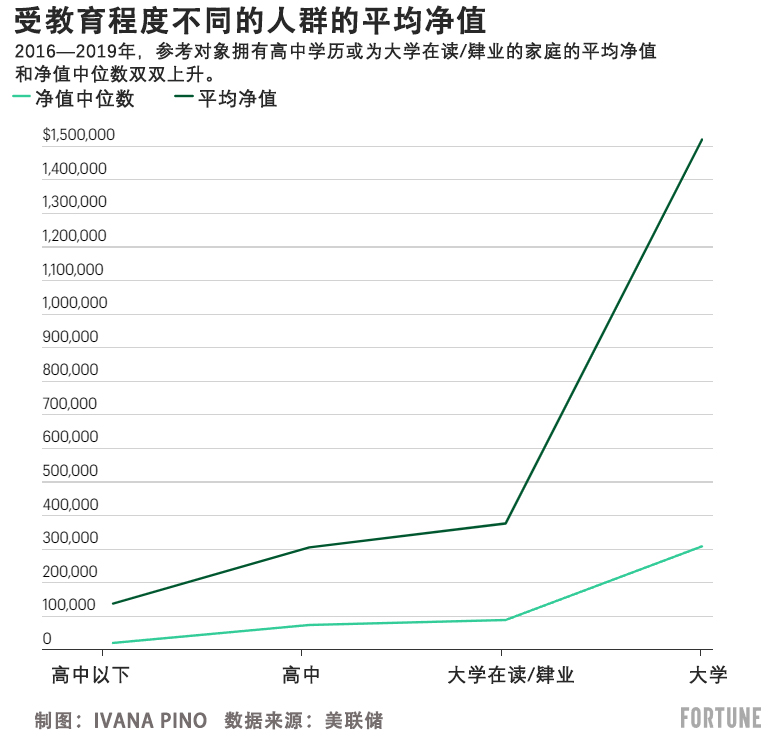

受教育程度:根据美联储的数据,净值和受教育程度正相关。每拿到一个学位,个人净值都有可能上升。

每月支出:每个月要承担的开支(住房、食品、出行、保险等)将决定你能剩下多少钱用于储备应急资金、投资或偿还债务。

个人资产状态:这包括个人银行账户余额和个人投资的价值。

个人负债状态:一直顺利偿还每个月的按揭、学贷、车贷或信用卡债务也会对个人净值产生影响。

提高个人净值的五点建议

一些影响个人净值的因素不受个人控制,比如股市表现,本地房市状况以及个人负债的利率。不过,在个人生活和职业生涯中仍有一些方法可以推动个人净值上升。

1. 偿还债务

要增加个人净值,首先就要摆脱可能拖垮你的债务,比如信用卡、学贷、车贷等等。不过,也要为偿还债务的潜在不利影响做好准备。将一项或多项贷款清零时个人信用评分往往会暂时下降。

2. 建立应急储蓄

无法偿付意外开支时,为生活中的意外情况存下的钱将有助于避免借贷或动用信用卡。你最终可能会因为利息或费用而花更多的钱,这取决于你需要的贷款金额和你能拿到的利率。

国际金融理财师、Blue Ocean Global Wealth首席执行官玛格丽塔‧程说:“采取措施来保护、增加、管理和转移财富很重要。债务过多或者信用评分很低可能影响偿债成本。这可能有损个人净值,因为它会提高借贷成本。”

多出来的钱可用于购买或投资于可以逐步升值的资产,从而提高个人净值。

3. 寻找增加个人收入的方法

收入越多,可用于投资和提高净值的资金就越多。那么怎样才能做到这一点呢?增收方法之一是开设自己的公司,寻找新工作或者要求加薪,甚至做兼职。

另一条增收途径是更换工作。皮尤研究中心(Pew Research Center )的数据显示,“大辞职”(Great Resignation)参与者的收入都增多了。在2021年4月到2022年3月之间更换工作的打工族中,半数人的收入上升了9.7%或更多,而没换工作的人的中位数收入下降了1.7%。

4. 提高养老缴存金额

原则上,专家建议将年收入的10%-15%存入养老金。就算刚开始存入的金额较少,较早地着手并逐步提高缴存额将确保存款利息有机会利生利,这样到了晚年开始依赖养老存款时个人净值就不会骤然缩水。

5. 投资

通过投资股票、债券、ETF和/或公募基金来为自己的资金注入增长动力是让这些资金为自己出力的方法之一。但要注意,股市总是起伏不定,而这会影响你的投资。尽管如此,专家仍建议进行长期投资,而且在股市动荡时不要动自己的投资。

罗宾斯说:“随着积累资产和偿还债务,个人净值会逐步发生改变。增加储蓄,削减生活消费和偿还贷款将对个人长期净值产生显著的积极影响。”(财富中文网)

编者按:本文中的建议、意见或排名,仅代表Fortune Recommends™编辑团队的意见。本文未经过我们的联盟合作伙伴或任何第三方的评审或背书。

译者:梁宇

审校:夏林

也许大家会觉得凭自己的收入可以偶尔挥霍一下,但个人经济生活远比眼前的情况更复杂。重点在于要了解自己的财务状况,以便调整支出、储蓄和投资习惯,进而确保自己顺利迈向更稳定的未来。要更好地了解自己的财务健康情况,途径之一就是计算自己的净值并学习有助于净值增长的方法。

什么是净值?

个人净值就是你的资产减去负债。

知道自己的净值可以帮助你从另一个角度来了解自己的财务状况。你的收入很重要,而且确实影响你的整体净值,但更重要的是知道怎样不断增加储蓄,以及如何用这些钱来偿还贷款并积累长期财富。

Wealth Enhancement Group高级财务规划师达斯汀·罗宾斯说:“资产包括你拥有的一切,如银行账户、投资账户以及不动产、汽车和个人财产的公允市值。负债包括按揭、车贷、学贷、信用卡以及其他个人贷款或债务。”

了解自己的净值有以下几大作用:

评估自己的财务状况。收入足够支付每月的账单并不意味着你在积累长期财富。净值将告诉你自己的资产价值是否随着时间推移而呈正增长以及哪些因素可能是阻碍。

分析有问题的财务区域。以净值为起点有助于你做出所有和钱有关的大大小小的选择。它可以成为警示信号,告诉你自己在某个领域可能投入过多,或在另一方面投资不足。如果所处的情况不理想,或许就意味着需要重新评估自己的债务管理方法或投资策略了。

实现财务目标。如果你想买房或早点儿退休,那么净值正是反映你能否顺利实现这些目标,或者要跟上理想进度是否需要调整自身财务习惯的明确指标。根据经验,许多专家都建议每年计算一次个人净值。不过,某些情况下也许应该更频繁地重新进行计算,比如花了一大笔钱或者做了一大笔投资以之后。

各年龄段美国人净值

美联储(Federal Reserve)2019年消费者财务状况调查结果显示,2016至2019年美国所有家庭的净值中位数和平均值双双上升,分别达到121,760美元和748,800美元。这是可以查到的最近一次的数据,而新数据将在2023年公布。

衡量美国人净值通常有两种方法,分别是平均净值和净值中位数。平均净值是所有美国人净值的平均数。这个数字或许不能那么准确地体现美国人净值的平均水平,原因是它可能受到个别极高或极低净值的干扰。净值中位数是所有美国人净值的中点。

美联储的调查结果显示年龄和净值正相关,大多数美国人的净值都随着年龄的增长而上升,这是因为他们的收入增多,而且有更多时间来存钱和投资。

美国人在各个年龄段的平均净值如下:

到了退休年龄并开始靠储蓄和投资生活之后,美国人的净值就可能见顶或下滑。

可能影响个人净值的四项因素

虽然净值和年龄正相关,但在个人财务决策影响下,个人净值随时都可能上升或下降。

罗宾斯说:“个人能够控制的影响净值的两个最主要因素是开支和储蓄。举例来说,决定为买房花多少钱以及用多少按揭会对个人能存下多少钱产生重大影响。”

可能提升或压低个人净值的常见因素包括:

受教育程度:根据美联储的数据,净值和受教育程度正相关。每拿到一个学位,个人净值都有可能上升。

每月支出:每个月要承担的开支(住房、食品、出行、保险等)将决定你能剩下多少钱用于储备应急资金、投资或偿还债务。

个人资产状态:这包括个人银行账户余额和个人投资的价值。

个人负债状态:一直顺利偿还每个月的按揭、学贷、车贷或信用卡债务也会对个人净值产生影响。

提高个人净值的五点建议

一些影响个人净值的因素不受个人控制,比如股市表现,本地房市状况以及个人负债的利率。不过,在个人生活和职业生涯中仍有一些方法可以推动个人净值上升。

1. 偿还债务

要增加个人净值,首先就要摆脱可能拖垮你的债务,比如信用卡、学贷、车贷等等。不过,也要为偿还债务的潜在不利影响做好准备。将一项或多项贷款清零时个人信用评分往往会暂时下降。

2. 建立应急储蓄

无法偿付意外开支时,为生活中的意外情况存下的钱将有助于避免借贷或动用信用卡。你最终可能会因为利息或费用而花更多的钱,这取决于你需要的贷款金额和你能拿到的利率。

国际金融理财师、Blue Ocean Global Wealth首席执行官玛格丽塔‧程说:“采取措施来保护、增加、管理和转移财富很重要。债务过多或者信用评分很低可能影响偿债成本。这可能有损个人净值,因为它会提高借贷成本。”

多出来的钱可用于购买或投资于可以逐步升值的资产,从而提高个人净值。

3. 寻找增加个人收入的方法

收入越多,可用于投资和提高净值的资金就越多。那么怎样才能做到这一点呢?增收方法之一是开设自己的公司,寻找新工作或者要求加薪,甚至做兼职。

另一条增收途径是更换工作。皮尤研究中心(Pew Research Center )的数据显示,“大辞职”(Great Resignation)参与者的收入都增多了。在2021年4月到2022年3月之间更换工作的打工族中,半数人的收入上升了9.7%或更多,而没换工作的人的中位数收入下降了1.7%。

4. 提高养老缴存金额

原则上,专家建议将年收入的10%-15%存入养老金。就算刚开始存入的金额较少,较早地着手并逐步提高缴存额将确保存款利息有机会利生利,这样到了晚年开始依赖养老存款时个人净值就不会骤然缩水。

5. 投资

通过投资股票、债券、ETF和/或公募基金来为自己的资金注入增长动力是让这些资金为自己出力的方法之一。但要注意,股市总是起伏不定,而这会影响你的投资。尽管如此,专家仍建议进行长期投资,而且在股市动荡时不要动自己的投资。

罗宾斯说:“随着积累资产和偿还债务,个人净值会逐步发生改变。增加储蓄,削减生活消费和偿还贷款将对个人长期净值产生显著的积极影响。”(财富中文网)

编者按:本文中的建议、意见或排名,仅代表Fortune Recommends™编辑团队的意见。本文未经过我们的联盟合作伙伴或任何第三方的评审或背书。

译者:梁宇

审校:夏林

While it might feel like your paycheck allows you to make the occasional splurge, there’s more to your financial life than the present moment. It’s important to check in on your finances so that you can adjust your spending, saving, and investing habits to make sure you’re on track for a more stable future. One way to better understand your financial health: Learn about your net worth and what you can do now to help it grow.

What is net worth?

Your net worth is the value of what you own, minus what you owe.

Knowing your net worth can help you understand your finances through a different lens. Your income matters and does factor into your overall net worth, but what matters even more is how you’re growing your savings—and using those funds to pay down debt and build long-term wealth.

“Your assets are everything you own including bank accounts, investment accounts, and the fair market value of real estate, automobiles, and personal property,” says Dustin Robbins, senior financial planner at Wealth Enhancement Group. “Liabilities include mortgages, automobile loans, student loans, credit cards and any other personal loans or debts.”

Understanding your net worth serves a few key purposes:

Evaluating where you stand financially. Making enough income to cover your monthly bills doesn’t mean that you’re building long-term wealth. Your net worth will tell you whether the value of what you own is moving in a positive direction over time and the factors that could be holding you back.

Diagnosing financial problem areas. Your net worth a helpful starting point for all your money-related choices, big or small. It can serve as a warning sign that you may be overextended in one area or underinvesting in another. If you aren’t where you want to be, that may indicate that it’s time to re-evaluate your debt management or investing strategy.

Achieving financial goals. Maybe you’re hoping to purchase a home or retire early. Your net worth is a good indicator of whether you’re on track to hit those goals, or if you need to make any changes to your financial habits to meet your ideal timeline. As a rule of thumb, many experts recommend calculating your net worth annually. Although, there may be cases when it makes sense to re-calculate more frequently—like after you’ve made a large purchase or investment.

The average American net worth by age

The median and mean net worth for all American families saw an increase between 2016 and 2019, standing at $121,760 and $748,800, respectively, according to the Federal Reserve’s 2019 Survey of Consumer Finances. This is the latest data available, and we’ll see new numbers in 2023.

Net worth is often measured in one of two ways: mean net worth and median net worth. The mean is the average net worth of all Americans. This figure may be a less accurate representation of the average American’s net worth because it can be skewed by extremely high or low outliers. The median net worth is the middle point between all Americans.

The Fed’s findings demonstrate a positive correlation between age and net worth, with most Americans seeing an increase in their net worth as they get older, earn more money, and have more time to save and invest.

Here’s how the average American’s net worth changes throughout their lifetime:

Once you’ve reached retirement age and begin to live off your savings and investments, you’ll likely see your net worth hit a plateau or decrease.

4 factors that can impact your net worth

Despite the positive correlation between net worth and age, your net worth can rise or fall at any point in your life based on your financial decisions.

“The two biggest factors you can control that will have an impact on your net worth are your spending and saving,” says Robbins. “For example, deciding how much to spend on a home and the amount you finance with a mortgage can have a substantial impact on how much money you are able to save.”

A few common factors that can help or hurt your net worth include:

Educational level: According to the Federal Reserve’s data, there is a positive trend between net worth and higher levels of education. Your net worth will likely increase with each degree you earn.

Monthly expenses: The amount you pay to cover your costs (housing, food, transportation, insurance, etc.) each month will impact how much money you have leftover to put in your emergency fund, invest, or pay off debt.

The state of your assets: This includes your bank account balances and the value of your investments.

The state of your liabilities: Remaining in good standing with your monthly mortgage, student loan, car, or credit card payments will also contribute to your net worth.

5 Tips to boost your net worth

Some factors that contribute to your net worth are out of your control, such as the performance of the stock markets, the housing market where you live, and interest rates on your debts. Still, there are moves you can make within your personal and professional life to grow your net worth.

1. Pay down debt

Increasing your net worth starts with eliminating financial obligations that could be dragging you down. Think: credit card debt, student loan debt, car loans, and more. However, you should be prepared for the potential downsides of paying off debt. It’s common to see a temporary drop in your credit score when you hit a zero balance on one or more of your loans.

2. Build your emergency savings

Saving for life’s curveballs can help you avoid taking out a loan or putting the charge on a credit card when you’re unable to pay for an unexpected expense. Depending on how much you need to borrow and what interest rate you qualify for, you can end up paying more through interest or fees.

“It’s important to take steps to protect, grow, manage, and transfer wealth,” says Marguerita Cheng, CFP professional and CEO at Blue Ocean Global Wealth. “Too much debt or a poor credit score can affect the cost you pay to service your debt. These can hurt your net worth because it costs you more to borrow money.”

That extra money can be used to buy or invest in assets that can appreciate over time, increasing your net worth.

3. Look for ways to increase your income

The more you earn, the more capital you have to invest and grow your net worth. So how can do that? One way is to increase your income by starting your own business, looking for a new job—or asking for a raise at your current one—or even picking up a side hustle.

Another way to boost your income is by switching jobs. Data from the Pew Research Center revealed that those who joined the Great Resignation saw their income increase; Half of the workers who changed jobs from April 2021 to March 2022 increased their income 9.7% or more, while the median worker who remained in the same job experienced a loss of 1.7%.

4. Increase your retirement contributions

As a rule, experts suggest saving 10% to 15% of your annual income for retirement. Even if you have to start small, saving early and increasing your contributions over time will ensure that interest earned on your savings has a chance to compound and that your net worth won’t plummet in your later years once you start dipping into those savings.

5. Invest

Giving your money the power to grow by investing in stocks, bonds, ETFs, and/or mutual funds is one way to make your money work for you. Fair warning: The stock market constantly fluctuates, and this can impact your investments. Even so, experts recommend playing the long game and leaving your investments alone when this happens.

“Your net worth changes over time as you accumulate assets and pay down debt,” says Robbins. “By increasing your savings, trimming your lifestyle spending and paying off debt, you will have a significantly positive impact on your net worth over time.”

EDITORIAL DISCLOSURE: The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.