1998年,关于微策略公司(MicroStrategy)创始人迈克尔·塞勒,有一件流传甚广的轶事。据说在1998年,就在微策略公司还有几个小时就要敲钟上市的时候,迈克尔·塞勒既没有做什么表态去安抚大股东,也没有给出什么预测数字,甚至没有往冰桶里放一瓶香槟。

当时他住在曼哈顿皇宫酒店里的一间三层的套房里,据说它的房费是1万美元一晚,不过他的注意力完全被另一件东西吸引了——那就是这间套房里的私人电梯。据媒体报道,这个年轻的创业者对这个电梯十分着迷,以至于大清早坐着这个电梯上上下下玩了几个小时。

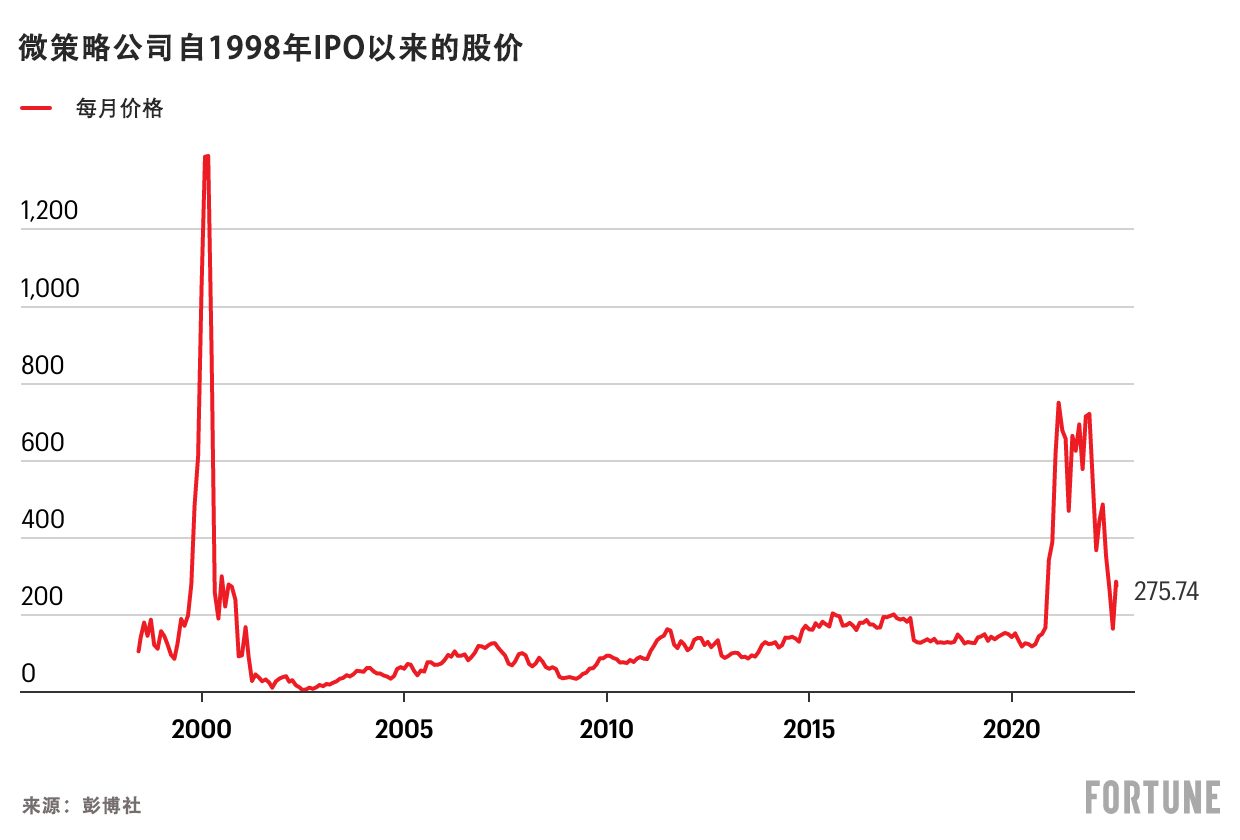

回顾迈克尔·塞勒33年的创业生涯,我们发现,他或许就是喜欢这种忽上忽下的感觉,甚至喜欢主动追逐这种感觉。在微策略公司成功登陆纳斯达克的当天,它的股价就在发行价基础上爆涨100%,单日估值猛增近10亿美元。到了当天收盘时,塞勒所持的股份已价值5.4亿美元。

几年后,微策略公司陷入了一起会计丑闻,股价在一天内暴跌62%,塞勒一下损失了60亿美元的个人财富。他甚至因此而成了益智游戏《猜谜大挑战》里的一个问题的答案:“谁在一天里损失的钱最多?”

不管怎样,这位创业者还是挺住了那次风浪。后来,他向Facebook提供了一款很有前途的新产品,将他打造的一款云软件平台卖了1亿多美元,又写了一本畅想移动技术的未来的畅销书,还成了一个游艇收藏家,他的一艘游艇还在HBO喜剧《明星伙伴》里亮过相。

不过,塞勒最大胆的赌注还并不是这些,而是在过去两年的时间里,将年收入约5亿美元的微策略公司全部押宝在了比特币上。8月2日,微策略宣布已掌舵公司30年的塞勒将卸任CEO一职,转任公司的执行董事长。塞勒在一份声明中表示,这份新工作能让他“专注于比特币的收购策略和相关的比特币倡议。”(由于塞勒控制着投票权,加上他将留任公司执董,那么这次职务调整肯定是塞勒本人的决定。我们数次联系微策略公司,请求采访塞勒本人,但一直未获回应。)离奇的是,虽然微策略公司宣布减记9.18亿美元的比特币资产,但在消息传出次日,它的股价竟然还上涨了15%,达到321美元,市值增长超4亿美元。

微策略股价的这次离奇猛涨,让围绕在塞勒身上的神秘色彩又浓了一些。考虑到微策略公司本质上是一家软件业务公司,华尔街的这次反应,到底是觉得公司没有了执迷于比特币的塞勒会好得多,还是觉得让他一门心思搞比特币,微策略公司会更有前途呢?

备受争议的创业之路:一个没有商业才能的“小马斯克”

2020年8月11日,塞勒的一则推文一石激起千层浪。他宣布,微策略公司“启动了比特币战略”,已斥资2.5亿美元购买了21454枚比特币,当时比特币的单价还不到12000美元。但是在2013年的时候,塞勒还曾批判比特币“所剩的日子屈指可数”。不过在疫情爆发初期,塞勒突然顿悟了。当时微策略公司手上有大笔现金,而塞勒则担心美联储的宽松货币政策会加剧通胀,导致他手里的现金严重贬值。

当时,他在一次接受采访时表示:“我们突然意识到,我们是坐在一座5亿美元的冰山上。”塞勒赞同比特币之父中本聪的观点,即央行会不可避免地促使法定货币贬值,而数字加密货币以其供应量的有限性,可以成为一种可靠且无法被侵蚀的“储值工具”,甚至“优于现金”。塞勒在微策略公司举办了研讨会,试图让管理团队相信比特币拥有改变世界的潜能,并且“愉快地给他们布置了家庭作业和练习题,让他们学习比特币相关知识”。

到了2021年2月,也就是他首次购买比特币6个月后,塞勒宣布,微策略公司购买比特币将不仅仅是为了给软件销售收入保值,而是要顺势转型,既不放弃传统软件业务,同时也要成立专门的比特币部门,因为塞勒相信,比特币的价值将随着时间的推移而大幅上升。而利用软件销售收入和借款来购买比特币,也能比投资核心业务、股票回购和收购等措施更快地提振股价。

到目前为止,微策略公司已经借款24亿美元用于购买比特币,该公司持有的比特币也达到129699枚,以当前市价约合31亿美元。在决定下注的时候,微策略公司相当于借入了相当于全部股东权益3倍的资金。现在,这家公司可以说已经成了一个专注于炒币的公司了,而且它还专门成立了一个比特币分析部门。虽然塞勒目前只持有微策略公司五分之一的股份,但这些股份却控制了64%的投票权,所以在决策上还是他说了算。

不过据《财富》了解,这种赌注的风险也是很高的。微策略公司甚至没有办法给公司的董事和高管买全部保险,理由是风险太高,商业保险公司在财务上无法接受。就这个问题,该公司的第二季度财报显示,公司与塞勒个人达成了一项协议,对公司董事和高管因股东诉讼导致的损失,由塞勒个人予以补偿。商业保险公司最高可以提供3000万美元的董事及高管责任险(简称D&O保险),但塞勒可以在此基础上再补偿1000万美元。另外在这项保险新政6月生效前,他还愿意以个人名义为董事和高管们提供4000万美元的D&O保险。为此,微策略公司每年还得向塞勒个人支付120万美元的“保费”。

简而言之,由于保险公司认为微策略公司的风险太高,塞勒只得自己充当起保险公司的角色,一旦哪天公司的董事会、高管以及他本人遭到股东诉讼,他就得自己掏钱来赔。

不少批评人士认为,塞勒的赌注将以失败收场。研究公司New Constructs的创始人、会计专家大卫·特雷纳就笑称:“说起疯狂程度,塞勒可以说是‘小马斯克’,只不过没有马斯克的商业天赋。”特雷纳还表示:“他严重错配了投资者的资本,市场会在短期内会奖励这种行为,但是他和股东们最终将以一种痛苦的方式达成和解。”

塞勒的创业故事:高中全班第一,24岁创办微策略

从很早的时候开始,塞勒身上就融合了聪明和疯狂这两种特质。塞勒的父亲是美国空军的一名军士长,母亲是一个乡村歌手的女儿。他的少年时代是在俄亥俄州代顿市的莱特帕特森基地附近度过的。他高中就学会了开滑翔机,并且以全班第一名的成绩从高中毕业。后来他获得了美国后备军官训练计划(ROTC)奖学金,进入麻省理工学院学习科技史和航空航天学。他的论文研究的是意大利文艺复兴时期的城邦的数学模型。但是由于体检发现了心脏杂音,他只得放弃了成为飞行员或宇航员的念头。在杜邦公司当了一段时间的计算机模拟规划师后,1989年,24岁的塞勒与两名MIT的校友共同创办了一家咨询公司,也就是现在的微策略公司。

当时塞勒意识到,互联网具有强大的数据分析能力,可以帮助企业分析关于产品和市场的海量数据。很快,客户们开始每年向微策略公司支付几十万美元的费用,用于创建直观的图表,来显示一些直观的消费趋势,比如哪些消费者喜欢特定的饮料或者保险产品。微策略公司还与麦当劳签订了1000万美元的合同,用于开发应用,以评估促销措施的效果。这份合同对微策略公司的早期发展起了重要的推动作用。

到了1998年,塞勒为了IPO进行为期11天的路演时,他的表现已经非常出色了。当时他还邀请了一名《华盛顿邮报》的记者记录整个过程。塞勒的销售风格靠的是激情、舞台技巧和宏大叙事,而不是数字。他天花乱缀的介绍要比PPT吸引人得多。他曾说过:“什么是聚焦,我们聚焦到可以把天花板烧出一个洞!”

这种以个人魅力开路的方法起到了奇效。华尔街普遍认为,塞勒虽然傲慢,但确实很有煽动力。从当时的新闻报道看,塞勒对数据分析技术报有极大热情,而且对这项技术的未来描绘了一幅令人信服的路线图,投资人几乎都是凭借对他的信心签约的。华尔街有一位软件投资人,每次开会的时候都爱把软件行业的CEO们的鄙视一番,认为他们“都是垃圾”,但是塞勒却凭借三寸不烂之舌,硬生生地让他签了字。在贝尔斯登公司,塞勒只花了20分钟,就让这家公司的老板认购了10%的股份。全球最大基金公司富达集团被称为业界最难攻破的后场,但用塞勒的话说,他攻破这家公司“就像扣篮一样”摧枯拉朽。

在1998年6月挂牌上市后,微策略公司迅速成了华尔街的宠儿。到2000年3月,它的股价已经达到发行价的16倍,市值近180亿美元。

微策略公司也是企业数据分析技术的先行者。这项技术可以通过数据分析软件,让零售公司、制药巨头、银行、保险公司和政府机构从大量数据中发现一些重要的趋势。凭借这手绝活,微策略公司拿下了300多个长期客户,其中包括肯德基、辉瑞、迪士尼、安联、劳氏和美国广播公司等巨头。以某家咖啡连锁店为例,在使用了微策略公司的技术后,它就可以深度研究会员卡数据,看哪一类顾客喜欢哪些品,这样他们就可以向特定顾客推送新产品,或者发送优惠信息。零售商使用微策略公司的技术后,可以优化客户服务,缩短客服电话时长。保险公司则可以发现和提醒那些没有按时服药的患者。

当然,微策略公司并不是科技界的“超级巨星”。20多年来,这家公司多多少少有些“工匠精神”,基本上做的都是幕后工作。它的两大竞争对手Salesforce和微软智能云虽然起步较晚,但增长速度都很快。目前,微策略公司的年销售额稳定在5亿美元区间,但它的生命力还是很旺盛的。

2000年3月20日,微策略公司宣布了一条令市场震动的消息——它的审计公司普华永道要求它重报前两年的收入和利润。在重新审计之后,该公司1998年和1999年的业绩从2800万美元盈利,变成了3700万美元亏损。作为公司的联合创始人和前财务总监,塞勒以及另一位创始人和公司的财务总监选择向证监会缴纳1100万美元罚款以了结相关指控,作为CEO,塞勒本人掏了830万。但塞勒和其他卷入这桩丑闻的人都不承认有任何不当行为。

到2002年的年中,微策略公司的市值已狂跌至4000万美元左右,较最高时下降了98%。

不过这时,塞勒又有了一个点子,正是这个点子导致了微策略公司的再度崛起。他预见到移动设备会出现爆发式增长,因此,他认为可以开发一些程序来帮助客户分析从用户的iPhone和笔记本电脑中收集的海量数据。在2009年前后,塞勒将他的软件免费提供给了脸书的新任运营总监谢丽尔·桑德伯格。2012年的一篇《财富》文章指出,微策略公司的技术对于脸书十分重要,它能让销售人员知道每个产品能带来多少收入。脸书最终成为了微策略公司的一个稳定客户,每年能给它带来几百万美元的收入,而塞勒也借助移动化的东风实现了持续盈利。

虽然生意做得不算特别大,但塞勒的个人生活却堪称奢华。他在迈阿密海滩有一幢别墅,里面有13间卧室和12间浴室。他还有一架价值4700万美元的庞巴迪飞机和两艘游艇。其中一艘游艇名叫“哈尔号”,是为了纪念1736年将他的祖先从荷兰鹿特丹带到费城的那艘船。船上有电子版的莫奈、梵高和毕加索的画作,顶层甲板还有一个巨大的浴缸。他的备用游艇“亚瑟号”也装饰得极为豪华,且拥有波利尼西亚风格的房间,船上还有两台玛格丽特酒机。据2012年的那篇《财富》文章报道,一直未婚的塞勒据传曾与约旦的努尔王后约会过。他还有自己的私人管家。

他还是一个派对达人。2010年他在华盛顿的W酒店给自己过生日,特地组织了一个野生动物主题的派对,还把一条缅甸白蟒蛇挂在脖子上拍照。每年感恩节前,他还会在曼哈顿SoHo举办摇滚节,让宾客们打扮成摇滚明星的样子。

寻找大创意

在接受《财富》采访时,塞勒的前同事们表示,除了华丽的社交生活,塞勒还渴望在科技界拥有广泛的影响力。他很想成为一名著名的思想领袖。用一名离职员工的话说,就是“成为一个被万众仰慕的思想巨人”。

不过事实证明,他是很擅长观察大趋势的。他在2012年出版了一本畅销书《移动化浪潮:移动智能将如何改变一切》。书中预见了移动设备将如何引发从零售到银行的方方面面的革命。

塞勒在微策略公司内部至少打造了两项引人注目的新业务。一位塞勒的前同事曾这样评价他:“他有预见未来的能力。”在2000年代末,他开发了一个监控平台,让家庭和企业可以通过一个网站(alarm.com)监测自家的安全系统。2008年,他将这项业务以2800万美元卖给了私募投资者。现在,Alarm.com已经是一家欣欣向荣的上市公司了,市值达到了35亿美元。在2010年代初期,塞勒为呼叫中心开发了第一批基于云服务的自动语音应答系统,名将其命名为“天使”(Angel)。2013年,Genesys公司以1.1亿美元收购了“天使”。根据Prescient & Strategic Intelligence公司的研究,呼叫中心软件市场目前的规模为240亿美元,预计未来十年将以18%的速度增长。而“天使”技术则帮助Genesys成为了该市场的一个重要参与者。

他很善于培养人才,也很善于经营企业。一位已经离职的经理表示:“他会给每个和他共事过的人留下深刻印象。”据说,塞勒总能一种“疯狂的天才”的形象激励人,让人们觉得如果他的这些疯狂的实验能够成功,那么他们应该也能做到。与他共事过的人有他的MIT校友乔·佩恩,2013年他将自己创办的软件Eloqua以近10亿美元卖给了甲骨文。他的联合创始人桑珠·班萨尔与CEO雷吉·阿加瓦尔共同创办了Cvent公司,它的软件可以帮助用户策划线下线下会议和其他活动。该公司去年12月进行了IPO,目前市值为28亿美元。

不过,据塞勒的前同事称,塞勒是一个喜怒无常、管理上事无巨细的人。有人说他“管理太严了”。塞勒是一个极度自信的人,因此他觉得自己什么事情都能亲历亲为,因此他也不愿意过多赋权给手下的人。

他的前同事表示:“他不允许人们按照自己的方式做事,然而没有这种做事的自由度,人们就无法成长。当然,我认为这还是利大于弊的。想想看,如果你每一步都跟着他投资,先是互联网,再是移动技术和云计算!”

塞勒这种情绪化和阴晴不定的风格也给管理层带来了很大压力,一定程度上阻碍了公司的发展。从2018年起,他已经换了3个营销总监,一个财务总监才干了一年就离职了。塞勒留不住优秀人才,这也解释了他为什么没有把“天使”技术和Alarm.com这样优秀的创意做大做强,而是卖给了其他公司。

微策略公司的股东架构,一定程度上助长了塞勒的控制狂倾向,使他的权力远远超过了他的所有权比例。该公司一共发行了两种股票,A股只有1票的投票权,而B股有10票投票权,塞勒持有大量B股,因此即便他只占有五分之一的股份,却控制了64%的投票权,因此他几乎可以在公司为所欲为。这样无疑是有风险的,塞勒将公司的大量资产拿去炒币,同时耽搁了原本盈利的核心业务,这样一来显然使股东承受了重大风险。对于一家80%的股份由散户投资者持有的公司而言,塞勒的自由裁量权显然是过大了。

比特币的最大推手

在将微策略公司的命运绑在比特币身上的同时,塞勒本人几乎成了全球头号的比特币推手。据报道,去年正是塞勒说服伊隆·马斯克买了15亿美元的比特币,马斯克的背书极大提振了比特币的价格和声誉。(不过特斯拉已经在第二季度出售了大部分所持的比特币,只保留了原始购买量的四分之一左右。)

从去年年底到今年6月份,比特币的币值一下子从将近7万美元暴跌至不到2万美元。这段时间,塞勒几乎每天都要上电视,鼓吹比特币是金融的未来,最近的下跌正是入手的好时机。不过他很少提及比特币的实际用途,比如买房买车买菜等等,也不提它有抗通胀的作用,而是以他标志性的危言耸听的语气,称全世界已经处在经济大灾难的边缘,比特币才是一个稳定的避风港。他在接受CNN采访时说:“比特币是一艘救生艇,它在狂风暴雨的海面上颠簸,为所有需要从沉船上逃生的人提供了希望。”塞勒还在推特上放了一张“激光眼”的照片,以表明他有意使比特币成为一种新的经济赋权工具。(一位批评人士揶揄道:“他把自己当成宙斯了。”)

塞勒认为,比特币的币值几年内就会达到50万美元,人们应该“把要留给孙子的钱换成比特币。”

出人意料的是,虽然近期比特币崩盘了,但微策略公司的市值却不跌反涨。从2020年8月到现在,虽然微策略公司的股价几经大起大落,但截至8月3日,已经达到323美元每股,几乎翻了三番。显然是有看好区块链的交易员将这家公司看作了比特币的化身。

问题是,微策略公司的股市表现与它软弱的基本面是相悖的。它的股价的涨幅远远超过了所持比特币的升值部分。比如6月16日,比特币的售价是20300美元,而微策略公司的股价是161美元,其市值为18亿美元。到8月3日,比特币的价格回弹15%,达到23300美元,相当于微策略公司持有的比特币增值了4亿美元。虽然该公司的基本业务在衰退,但在那周的时间里,它的股价却几乎翻了一番,达到312美元。这相当于它的市值一下子增加了18亿美元,是它持有的比特币增值部分的4倍多。

这种现象说明微策略公司有一种“塞勒效应”,这位CEO能凭借天花乱缀的话术,让大批投资者相信他的看法。业界有6位分析师对微策略公司的股价做了12个月的预测,其中两位持悲观态度,认为其股价会跌至180至250美元区间,两位认为当前300多美元的股价已经到顶了,但还有两位认为它还有巨大的增值空间。比如BTIG研究公司认为,它的股价有望涨到950美元。很多人也认为微策略公司的股价与它的炒币收益不成比例,因此纷纷买空微策略公司。目前该公司大约有一半的股票被做空,这也创下了长期做空的纪录。

有批评人士认为,塞勒的激进转向导致了公司基础的软件业务受损,而他恰恰需要软件业务的现金流来支持买比特币所借的几十亿债务。正在做空微策略公司的Bireme Capital公司分析师瑞安·巴伦廷表示:“比特币的不确定性很高,我想象不来持有大量比特币对它的基础业务有什么好处。如果你是客户的话,你可能也会担心这其中的风险,那么找它合作还不如找微软。”

另一方面,塞勒给微策略公司加的杠杆太重了,如果比特币价格下跌,公司很可能将没有足够现金,来偿还最早在2025年就要到期的巨额债务。

塞勒是从2020年8月开始购买比特币的,到目前为止,他已经借了24亿巨债用来炒币,其中涉及3种债务和1种保证金贷款。他还动用了公司账上的大量现金,包括所有自由现金流,全部用来炒比特币。

2021年2月,他还发行了10亿美元新股,并将收入全部投入到比特币上。当时,微策略公司的股价一度从2020年8月的124美元飙升至770美元。Bireme Capital公司的分析师巴伦廷表示:“在融资方面,塞勒是很聪明的,他在股价最高时卖掉了他的股份。但如果他用这些高价股票来买比特币,效果还会好得多。但他却选择了举借巨额债务来购买币值极不稳定的比特币,届时他的比特币价值很可能远远低于他的债务。”

不管怎样,塞勒已经斥资40亿美元购买了129699个比特币,平均购价为31320美元。但是目前,比特币的价格已跌至23300美元,也就是比他的入手价低了26%,他手中的比特币目前只值30亿美元,也就是缩水了10亿美元。在微策略公司豪赌比特币之前,该公司几乎没有任何债务,因此也没有利息支出。但现在它却欠了债权人和对冲基金24亿美元。它每年还要为这些借款支付4600万美元的利息。

因此,现在的微策略公司面临着四大威胁。首先,它的利息支出几乎耗光了软件业务的自由现金流。如果它的基本业务继续缩水,那微策略公司就没有犯错的空间了,但这种可能性是存在的。正如巴伦廷所指的那样,如果微策略公司损失了大量业务,除了被迫卖掉比特币,它毫无其他办法支付利息。虽然塞勒发誓称这种情况永远不会发生。

第二,微策略公司苛刻的融资条件也是一个风险隐患。它是以“超长期投资”的名义搞到的借款,还款周期是3到6年。它还发行了5亿美元的优先担保票据,到期时间是2028年。此外它还发行了6.5亿美元的可转换债券,到期时间是2025年。但2028年到期的那笔债券规定,如果到了2025年,微策略公司没有足够现金偿还那笔6.5亿的债务,则这5亿美元的还款期将被提前到2025年,而且要优先偿还。而要还清这两笔债务,该公司至少需要准备10.5亿美元的流动资产。

要知道,目前微策略公司持有的比特币价值仅比它的债务高出7亿美元左右,而且公司几乎没有多余的现金了,因为大家都知道它把所有的钱都花在了炒币上。而由于利息支出大幅增加,它的软件业务也无法产生可观的现金流。当然,到2025年,比特币也不见得会跌到让它还不上债的水平。但如果比特币价值稳定在2万美元以下,届时它的债务就会超过所持比特币的价值,使公司面临资不抵债的风险。这还是建立在软件收入一直能够支付利息支出的前提下,这样塞勒就不必卖币来支付利息了。

第三,如果微策略公司继续维持当前的处境,又会发生什么?如果比特币一直维持在2万多美元的水平,它又能产生足够现金来支付利息,那么最有可能的结果,就是它的股价回归其基本价值。巴伦廷认为:“如果微策略公司继续维持现状,炒币带来的股市溢价就会消退,因为它的核心业务在支付完利息后已经不剩什么钱了。”剩下的只是比特币账户与债务之间的价差,而目前这一数字已经达到7亿美元左右。这就是巴伦廷眼中微策略公司所剩的价值。如果巴伦廷的预测是正确的,那么该公司目前36亿美元的市值还存在80%的水份。如果真按照他的剧本走,一旦塞勒的“忽悠”不灵了,微策略公司的股价就将大幅跳水。

再来说说最后一个风险因素。作为一家原本优秀的软件公司,如果其股价跌破了传统价值,那么它的领导层很可能会遭到一系列违反受信业务的诉讼,如前所述,塞勒本人对此已经提供了相当一部分保险。但股东们如果起诉的话,理由也是很充分的,因为塞勒把股东的钱拿去投资了一种最不稳定、最有争议性的资产,但同时却让一家本可以继续赚取相当利润的企业陷入了危机。

毕竟,塞勒之所以闻名于世,就是因为他对未来科技的预测经常是准确的。虽然他的创业史起起伏伏,但他有时也确实是正确的。但不管怎样,他将自己和比特币绑在了一起,就是将公司的未来押在了一个极不稳定的投机工具上。

至于这部“电梯”会将他带向顶楼还是地下室,我们现在还无法判断。(财富中文网)

译者:朴成奎

1998年,关于微策略公司(MicroStrategy)创始人迈克尔·塞勒,有一件流传甚广的轶事。据说在1998年,就在微策略公司还有几个小时就要敲钟上市的时候,迈克尔·塞勒既没有做什么表态去安抚大股东,也没有给出什么预测数字,甚至没有往冰桶里放一瓶香槟。

当时他住在曼哈顿皇宫酒店里的一间三层的套房里,据说它的房费是1万美元一晚,不过他的注意力完全被另一件东西吸引了——那就是这间套房里的私人电梯。据媒体报道,这个年轻的创业者对这个电梯十分着迷,以至于大清早坐着这个电梯上上下下玩了几个小时。

回顾迈克尔·塞勒33年的创业生涯,我们发现,他或许就是喜欢这种忽上忽下的感觉,甚至喜欢主动追逐这种感觉。在微策略公司成功登陆纳斯达克的当天,它的股价就在发行价基础上爆涨100%,单日估值猛增近10亿美元。到了当天收盘时,塞勒所持的股份已价值5.4亿美元。

几年后,微策略公司陷入了一起会计丑闻,股价在一天内暴跌62%,塞勒一下损失了60亿美元的个人财富。他甚至因此而成了益智游戏《猜谜大挑战》里的一个问题的答案:“谁在一天里损失的钱最多?”

不管怎样,这位创业者还是挺住了那次风浪。后来,他向Facebook提供了一款很有前途的新产品,将他打造的一款云软件平台卖了1亿多美元,又写了一本畅想移动技术的未来的畅销书,还成了一个游艇收藏家,他的一艘游艇还在HBO喜剧《明星伙伴》里亮过相。

不过,塞勒最大胆的赌注还并不是这些,而是在过去两年的时间里,将年收入约5亿美元的微策略公司全部押宝在了比特币上。8月2日,微策略宣布已掌舵公司30年的塞勒将卸任CEO一职,转任公司的执行董事长。塞勒在一份声明中表示,这份新工作能让他“专注于比特币的收购策略和相关的比特币倡议。”(由于塞勒控制着投票权,加上他将留任公司执董,那么这次职务调整肯定是塞勒本人的决定。我们数次联系微策略公司,请求采访塞勒本人,但一直未获回应。)离奇的是,虽然微策略公司宣布减记9.18亿美元的比特币资产,但在消息传出次日,它的股价竟然还上涨了15%,达到321美元,市值增长超4亿美元。

微策略股价的这次离奇猛涨,让围绕在塞勒身上的神秘色彩又浓了一些。考虑到微策略公司本质上是一家软件业务公司,华尔街的这次反应,到底是觉得公司没有了执迷于比特币的塞勒会好得多,还是觉得让他一门心思搞比特币,微策略公司会更有前途呢?

备受争议的创业之路:一个没有商业才能的“小马斯克”

2020年8月11日,塞勒的一则推文一石激起千层浪。他宣布,微策略公司“启动了比特币战略”,已斥资2.5亿美元购买了21454枚比特币,当时比特币的单价还不到12000美元。但是在2013年的时候,塞勒还曾批判比特币“所剩的日子屈指可数”。不过在疫情爆发初期,塞勒突然顿悟了。当时微策略公司手上有大笔现金,而塞勒则担心美联储的宽松货币政策会加剧通胀,导致他手里的现金严重贬值。

当时,他在一次接受采访时表示:“我们突然意识到,我们是坐在一座5亿美元的冰山上。”塞勒赞同比特币之父中本聪的观点,即央行会不可避免地促使法定货币贬值,而数字加密货币以其供应量的有限性,可以成为一种可靠且无法被侵蚀的“储值工具”,甚至“优于现金”。塞勒在微策略公司举办了研讨会,试图让管理团队相信比特币拥有改变世界的潜能,并且“愉快地给他们布置了家庭作业和练习题,让他们学习比特币相关知识”。

到了2021年2月,也就是他首次购买比特币6个月后,塞勒宣布,微策略公司购买比特币将不仅仅是为了给软件销售收入保值,而是要顺势转型,既不放弃传统软件业务,同时也要成立专门的比特币部门,因为塞勒相信,比特币的价值将随着时间的推移而大幅上升。而利用软件销售收入和借款来购买比特币,也能比投资核心业务、股票回购和收购等措施更快地提振股价。

到目前为止,微策略公司已经借款24亿美元用于购买比特币,该公司持有的比特币也达到129699枚,以当前市价约合31亿美元。在决定下注的时候,微策略公司相当于借入了相当于全部股东权益3倍的资金。现在,这家公司可以说已经成了一个专注于炒币的公司了,而且它还专门成立了一个比特币分析部门。虽然塞勒目前只持有微策略公司五分之一的股份,但这些股份却控制了64%的投票权,所以在决策上还是他说了算。

不过据《财富》了解,这种赌注的风险也是很高的。微策略公司甚至没有办法给公司的董事和高管买全部保险,理由是风险太高,商业保险公司在财务上无法接受。就这个问题,该公司的第二季度财报显示,公司与塞勒个人达成了一项协议,对公司董事和高管因股东诉讼导致的损失,由塞勒个人予以补偿。商业保险公司最高可以提供3000万美元的董事及高管责任险(简称D&O保险),但塞勒可以在此基础上再补偿1000万美元。另外在这项保险新政6月生效前,他还愿意以个人名义为董事和高管们提供4000万美元的D&O保险。为此,微策略公司每年还得向塞勒个人支付120万美元的“保费”。

简而言之,由于保险公司认为微策略公司的风险太高,塞勒只得自己充当起保险公司的角色,一旦哪天公司的董事会、高管以及他本人遭到股东诉讼,他就得自己掏钱来赔。

不少批评人士认为,塞勒的赌注将以失败收场。研究公司New Constructs的创始人、会计专家大卫·特雷纳就笑称:“说起疯狂程度,塞勒可以说是‘小马斯克’,只不过没有马斯克的商业天赋。”特雷纳还表示:“他严重错配了投资者的资本,市场会在短期内会奖励这种行为,但是他和股东们最终将以一种痛苦的方式达成和解。”

塞勒的创业故事:高中全班第一,24岁创办微策略

从很早的时候开始,塞勒身上就融合了聪明和疯狂这两种特质。塞勒的父亲是美国空军的一名军士长,母亲是一个乡村歌手的女儿。他的少年时代是在俄亥俄州代顿市的莱特帕特森基地附近度过的。他高中就学会了开滑翔机,并且以全班第一名的成绩从高中毕业。后来他获得了美国后备军官训练计划(ROTC)奖学金,进入麻省理工学院学习科技史和航空航天学。他的论文研究的是意大利文艺复兴时期的城邦的数学模型。但是由于体检发现了心脏杂音,他只得放弃了成为飞行员或宇航员的念头。在杜邦公司当了一段时间的计算机模拟规划师后,1989年,24岁的塞勒与两名MIT的校友共同创办了一家咨询公司,也就是现在的微策略公司。

当时塞勒意识到,互联网具有强大的数据分析能力,可以帮助企业分析关于产品和市场的海量数据。很快,客户们开始每年向微策略公司支付几十万美元的费用,用于创建直观的图表,来显示一些直观的消费趋势,比如哪些消费者喜欢特定的饮料或者保险产品。微策略公司还与麦当劳签订了1000万美元的合同,用于开发应用,以评估促销措施的效果。这份合同对微策略公司的早期发展起了重要的推动作用。

到了1998年,塞勒为了IPO进行为期11天的路演时,他的表现已经非常出色了。当时他还邀请了一名《华盛顿邮报》的记者记录整个过程。塞勒的销售风格靠的是激情、舞台技巧和宏大叙事,而不是数字。他天花乱缀的介绍要比PPT吸引人得多。他曾说过:“什么是聚焦,我们聚焦到可以把天花板烧出一个洞!”

这种以个人魅力开路的方法起到了奇效。华尔街普遍认为,塞勒虽然傲慢,但确实很有煽动力。从当时的新闻报道看,塞勒对数据分析技术报有极大热情,而且对这项技术的未来描绘了一幅令人信服的路线图,投资人几乎都是凭借对他的信心签约的。华尔街有一位软件投资人,每次开会的时候都爱把软件行业的CEO们的鄙视一番,认为他们“都是垃圾”,但是塞勒却凭借三寸不烂之舌,硬生生地让他签了字。在贝尔斯登公司,塞勒只花了20分钟,就让这家公司的老板认购了10%的股份。全球最大基金公司富达集团被称为业界最难攻破的后场,但用塞勒的话说,他攻破这家公司“就像扣篮一样”摧枯拉朽。

在1998年6月挂牌上市后,微策略公司迅速成了华尔街的宠儿。到2000年3月,它的股价已经达到发行价的16倍,市值近180亿美元。

微策略公司也是企业数据分析技术的先行者。这项技术可以通过数据分析软件,让零售公司、制药巨头、银行、保险公司和政府机构从大量数据中发现一些重要的趋势。凭借这手绝活,微策略公司拿下了300多个长期客户,其中包括肯德基、辉瑞、迪士尼、安联、劳氏和美国广播公司等巨头。以某家咖啡连锁店为例,在使用了微策略公司的技术后,它就可以深度研究会员卡数据,看哪一类顾客喜欢哪些品,这样他们就可以向特定顾客推送新产品,或者发送优惠信息。零售商使用微策略公司的技术后,可以优化客户服务,缩短客服电话时长。保险公司则可以发现和提醒那些没有按时服药的患者。

当然,微策略公司并不是科技界的“超级巨星”。20多年来,这家公司多多少少有些“工匠精神”,基本上做的都是幕后工作。它的两大竞争对手Salesforce和微软智能云虽然起步较晚,但增长速度都很快。目前,微策略公司的年销售额稳定在5亿美元区间,但它的生命力还是很旺盛的。

2000年3月20日,微策略公司宣布了一条令市场震动的消息——它的审计公司普华永道要求它重报前两年的收入和利润。在重新审计之后,该公司1998年和1999年的业绩从2800万美元盈利,变成了3700万美元亏损。作为公司的联合创始人和前财务总监,塞勒以及另一位创始人和公司的财务总监选择向证监会缴纳1100万美元罚款以了结相关指控,作为CEO,塞勒本人掏了830万。但塞勒和其他卷入这桩丑闻的人都不承认有任何不当行为。

到2002年的年中,微策略公司的市值已狂跌至4000万美元左右,较最高时下降了98%。

不过这时,塞勒又有了一个点子,正是这个点子导致了微策略公司的再度崛起。他预见到移动设备会出现爆发式增长,因此,他认为可以开发一些程序来帮助客户分析从用户的iPhone和笔记本电脑中收集的海量数据。在2009年前后,塞勒将他的软件免费提供给了脸书的新任运营总监谢丽尔·桑德伯格。2012年的一篇《财富》文章指出,微策略公司的技术对于脸书十分重要,它能让销售人员知道每个产品能带来多少收入。脸书最终成为了微策略公司的一个稳定客户,每年能给它带来几百万美元的收入,而塞勒也借助移动化的东风实现了持续盈利。

虽然生意做得不算特别大,但塞勒的个人生活却堪称奢华。他在迈阿密海滩有一幢别墅,里面有13间卧室和12间浴室。他还有一架价值4700万美元的庞巴迪飞机和两艘游艇。其中一艘游艇名叫“哈尔号”,是为了纪念1736年将他的祖先从荷兰鹿特丹带到费城的那艘船。船上有电子版的莫奈、梵高和毕加索的画作,顶层甲板还有一个巨大的浴缸。他的备用游艇“亚瑟号”也装饰得极为豪华,且拥有波利尼西亚风格的房间,船上还有两台玛格丽特酒机。据2012年的那篇《财富》文章报道,一直未婚的塞勒据传曾与约旦的努尔王后约会过。他还有自己的私人管家。

他还是一个派对达人。2010年他在华盛顿的W酒店给自己过生日,特地组织了一个野生动物主题的派对,还把一条缅甸白蟒蛇挂在脖子上拍照。每年感恩节前,他还会在曼哈顿SoHo举办摇滚节,让宾客们打扮成摇滚明星的样子。

寻找大创意

在接受《财富》采访时,塞勒的前同事们表示,除了华丽的社交生活,塞勒还渴望在科技界拥有广泛的影响力。他很想成为一名著名的思想领袖。用一名离职员工的话说,就是“成为一个被万众仰慕的思想巨人”。

不过事实证明,他是很擅长观察大趋势的。他在2012年出版了一本畅销书《移动化浪潮:移动智能将如何改变一切》。书中预见了移动设备将如何引发从零售到银行的方方面面的革命。

塞勒在微策略公司内部至少打造了两项引人注目的新业务。一位塞勒的前同事曾这样评价他:“他有预见未来的能力。”在2000年代末,他开发了一个监控平台,让家庭和企业可以通过一个网站(alarm.com)监测自家的安全系统。2008年,他将这项业务以2800万美元卖给了私募投资者。现在,Alarm.com已经是一家欣欣向荣的上市公司了,市值达到了35亿美元。在2010年代初期,塞勒为呼叫中心开发了第一批基于云服务的自动语音应答系统,名将其命名为“天使”(Angel)。2013年,Genesys公司以1.1亿美元收购了“天使”。根据Prescient & Strategic Intelligence公司的研究,呼叫中心软件市场目前的规模为240亿美元,预计未来十年将以18%的速度增长。而“天使”技术则帮助Genesys成为了该市场的一个重要参与者。

他很善于培养人才,也很善于经营企业。一位已经离职的经理表示:“他会给每个和他共事过的人留下深刻印象。”据说,塞勒总能一种“疯狂的天才”的形象激励人,让人们觉得如果他的这些疯狂的实验能够成功,那么他们应该也能做到。与他共事过的人有他的MIT校友乔·佩恩,2013年他将自己创办的软件Eloqua以近10亿美元卖给了甲骨文。他的联合创始人桑珠·班萨尔与CEO雷吉·阿加瓦尔共同创办了Cvent公司,它的软件可以帮助用户策划线下线下会议和其他活动。该公司去年12月进行了IPO,目前市值为28亿美元。

不过,据塞勒的前同事称,塞勒是一个喜怒无常、管理上事无巨细的人。有人说他“管理太严了”。塞勒是一个极度自信的人,因此他觉得自己什么事情都能亲历亲为,因此他也不愿意过多赋权给手下的人。

他的前同事表示:“他不允许人们按照自己的方式做事,然而没有这种做事的自由度,人们就无法成长。当然,我认为这还是利大于弊的。想想看,如果你每一步都跟着他投资,先是互联网,再是移动技术和云计算!”

塞勒这种情绪化和阴晴不定的风格也给管理层带来了很大压力,一定程度上阻碍了公司的发展。从2018年起,他已经换了3个营销总监,一个财务总监才干了一年就离职了。塞勒留不住优秀人才,这也解释了他为什么没有把“天使”技术和Alarm.com这样优秀的创意做大做强,而是卖给了其他公司。

微策略公司的股东架构,一定程度上助长了塞勒的控制狂倾向,使他的权力远远超过了他的所有权比例。该公司一共发行了两种股票,A股只有1票的投票权,而B股有10票投票权,塞勒持有大量B股,因此即便他只占有五分之一的股份,却控制了64%的投票权,因此他几乎可以在公司为所欲为。这样无疑是有风险的,塞勒将公司的大量资产拿去炒币,同时耽搁了原本盈利的核心业务,这样一来显然使股东承受了重大风险。对于一家80%的股份由散户投资者持有的公司而言,塞勒的自由裁量权显然是过大了。

比特币的最大推手

在将微策略公司的命运绑在比特币身上的同时,塞勒本人几乎成了全球头号的比特币推手。据报道,去年正是塞勒说服伊隆·马斯克买了15亿美元的比特币,马斯克的背书极大提振了比特币的价格和声誉。(不过特斯拉已经在第二季度出售了大部分所持的比特币,只保留了原始购买量的四分之一左右。)

从去年年底到今年6月份,比特币的币值一下子从将近7万美元暴跌至不到2万美元。这段时间,塞勒几乎每天都要上电视,鼓吹比特币是金融的未来,最近的下跌正是入手的好时机。不过他很少提及比特币的实际用途,比如买房买车买菜等等,也不提它有抗通胀的作用,而是以他标志性的危言耸听的语气,称全世界已经处在经济大灾难的边缘,比特币才是一个稳定的避风港。他在接受CNN采访时说:“比特币是一艘救生艇,它在狂风暴雨的海面上颠簸,为所有需要从沉船上逃生的人提供了希望。”塞勒还在推特上放了一张“激光眼”的照片,以表明他有意使比特币成为一种新的经济赋权工具。(一位批评人士揶揄道:“他把自己当成宙斯了。”)

塞勒认为,比特币的币值几年内就会达到50万美元,人们应该“把要留给孙子的钱换成比特币。”

出人意料的是,虽然近期比特币崩盘了,但微策略公司的市值却不跌反涨。从2020年8月到现在,虽然微策略公司的股价几经大起大落,但截至8月3日,已经达到323美元每股,几乎翻了三番。显然是有看好区块链的交易员将这家公司看作了比特币的化身。

问题是,微策略公司的股市表现与它软弱的基本面是相悖的。它的股价的涨幅远远超过了所持比特币的升值部分。比如6月16日,比特币的售价是20300美元,而微策略公司的股价是161美元,其市值为18亿美元。到8月3日,比特币的价格回弹15%,达到23300美元,相当于微策略公司持有的比特币增值了4亿美元。虽然该公司的基本业务在衰退,但在那周的时间里,它的股价却几乎翻了一番,达到312美元。这相当于它的市值一下子增加了18亿美元,是它持有的比特币增值部分的4倍多。

这种现象说明微策略公司有一种“塞勒效应”,这位CEO能凭借天花乱缀的话术,让大批投资者相信他的看法。业界有6位分析师对微策略公司的股价做了12个月的预测,其中两位持悲观态度,认为其股价会跌至180至250美元区间,两位认为当前300多美元的股价已经到顶了,但还有两位认为它还有巨大的增值空间。比如BTIG研究公司认为,它的股价有望涨到950美元。很多人也认为微策略公司的股价与它的炒币收益不成比例,因此纷纷买空微策略公司。目前该公司大约有一半的股票被做空,这也创下了长期做空的纪录。

有批评人士认为,塞勒的激进转向导致了公司基础的软件业务受损,而他恰恰需要软件业务的现金流来支持买比特币所借的几十亿债务。正在做空微策略公司的Bireme Capital公司分析师瑞安·巴伦廷表示:“比特币的不确定性很高,我想象不来持有大量比特币对它的基础业务有什么好处。如果你是客户的话,你可能也会担心这其中的风险,那么找它合作还不如找微软。”

另一方面,塞勒给微策略公司加的杠杆太重了,如果比特币价格下跌,公司很可能将没有足够现金,来偿还最早在2025年就要到期的巨额债务。

塞勒是从2020年8月开始购买比特币的,到目前为止,他已经借了24亿巨债用来炒币,其中涉及3种债务和1种保证金贷款。他还动用了公司账上的大量现金,包括所有自由现金流,全部用来炒比特币。

2021年2月,他还发行了10亿美元新股,并将收入全部投入到比特币上。当时,微策略公司的股价一度从2020年8月的124美元飙升至770美元。Bireme Capital公司的分析师巴伦廷表示:“在融资方面,塞勒是很聪明的,他在股价最高时卖掉了他的股份。但如果他用这些高价股票来买比特币,效果还会好得多。但他却选择了举借巨额债务来购买币值极不稳定的比特币,届时他的比特币价值很可能远远低于他的债务。”

不管怎样,塞勒已经斥资40亿美元购买了129699个比特币,平均购价为31320美元。但是目前,比特币的价格已跌至23300美元,也就是比他的入手价低了26%,他手中的比特币目前只值30亿美元,也就是缩水了10亿美元。在微策略公司豪赌比特币之前,该公司几乎没有任何债务,因此也没有利息支出。但现在它却欠了债权人和对冲基金24亿美元。它每年还要为这些借款支付4600万美元的利息。

因此,现在的微策略公司面临着四大威胁。首先,它的利息支出几乎耗光了软件业务的自由现金流。如果它的基本业务继续缩水,那微策略公司就没有犯错的空间了,但这种可能性是存在的。正如巴伦廷所指的那样,如果微策略公司损失了大量业务,除了被迫卖掉比特币,它毫无其他办法支付利息。虽然塞勒发誓称这种情况永远不会发生。

第二,微策略公司苛刻的融资条件也是一个风险隐患。它是以“超长期投资”的名义搞到的借款,还款周期是3到6年。它还发行了5亿美元的优先担保票据,到期时间是2028年。此外它还发行了6.5亿美元的可转换债券,到期时间是2025年。但2028年到期的那笔债券规定,如果到了2025年,微策略公司没有足够现金偿还那笔6.5亿的债务,则这5亿美元的还款期将被提前到2025年,而且要优先偿还。而要还清这两笔债务,该公司至少需要准备10.5亿美元的流动资产。

要知道,目前微策略公司持有的比特币价值仅比它的债务高出7亿美元左右,而且公司几乎没有多余的现金了,因为大家都知道它把所有的钱都花在了炒币上。而由于利息支出大幅增加,它的软件业务也无法产生可观的现金流。当然,到2025年,比特币也不见得会跌到让它还不上债的水平。但如果比特币价值稳定在2万美元以下,届时它的债务就会超过所持比特币的价值,使公司面临资不抵债的风险。这还是建立在软件收入一直能够支付利息支出的前提下,这样塞勒就不必卖币来支付利息了。

第三,如果微策略公司继续维持当前的处境,又会发生什么?如果比特币一直维持在2万多美元的水平,它又能产生足够现金来支付利息,那么最有可能的结果,就是它的股价回归其基本价值。巴伦廷认为:“如果微策略公司继续维持现状,炒币带来的股市溢价就会消退,因为它的核心业务在支付完利息后已经不剩什么钱了。”剩下的只是比特币账户与债务之间的价差,而目前这一数字已经达到7亿美元左右。这就是巴伦廷眼中微策略公司所剩的价值。如果巴伦廷的预测是正确的,那么该公司目前36亿美元的市值还存在80%的水份。如果真按照他的剧本走,一旦塞勒的“忽悠”不灵了,微策略公司的股价就将大幅跳水。

再来说说最后一个风险因素。作为一家原本优秀的软件公司,如果其股价跌破了传统价值,那么它的领导层很可能会遭到一系列违反受信业务的诉讼,如前所述,塞勒本人对此已经提供了相当一部分保险。但股东们如果起诉的话,理由也是很充分的,因为塞勒把股东的钱拿去投资了一种最不稳定、最有争议性的资产,但同时却让一家本可以继续赚取相当利润的企业陷入了危机。

毕竟,塞勒之所以闻名于世,就是因为他对未来科技的预测经常是准确的。虽然他的创业史起起伏伏,但他有时也确实是正确的。但不管怎样,他将自己和比特币绑在了一起,就是将公司的未来押在了一个极不稳定的投机工具上。

至于这部“电梯”会将他带向顶楼还是地下室,我们现在还无法判断。(财富中文网)

译者:朴成奎

It was the early hours before MicroStrategy’s IPO in 1998, but founder Michael Saylor wasn’t assuaging big investors or running through projections, or even putting champagne on ice.

Ensconced in a $10,000-a-night three-story rooftop suite at Manhattan’s Palace Hotel, he found his attention captured by something else entirely: the suite’s private elevator. He was so enthralled by the opulent toy that, according to a press account at the time, the young founder spent the early morning hours obsessively riding it up and down.

Indeed, when looking at Michael Saylor’s 33-year career, one gets the sense that the wild ups and downs don’t faze him at all. In fact, he may even be chasing them. At the NASDAQ later that morning, MicroStrategy’s stock popped 100% from the offering price to garner an almost $1 billion valuation. By the close, Saylor’s stake reached $540 million.

Years later, MicroStrategy would become ensnared in an accounting scandal that sent the stock plunging 62% in one day; Saylor lost $6 billion in personal wealth. His swift financial decline even turned him into an answer to the Trivial Pursuit question: “Who has lost the most money in a single day?”

Still, the entrepreneur persisted. He went on to offer a promising new product to Facebook, sell a cloud-based software platform he’d built in-house for over $100 million, pen a prophet bestseller on the mobile future, and collect multiple yachts, one of which starred in the wild party scene of an Entourage movie.

But Saylor’s most outrageous swing of all is one that’s playing out right now at MicroStrategy. Over the past two years he has essentially bet his entire $500 million revenue company on the future of Bitcoin. On August 2, the company announced Saylor would step down as CEO after three decades at the helm to take the role of executive chairman. In a statement, Saylor attested that the new job will enable him to focus “on our Bitcoin acquisition strategy and related Bitcoin advocacy initiatives.” (Given that Saylor controls the voting stock, and will stay on executive chairman, it’s certain the decision was his, though the company did not respond to several requests for interviews with Saylor.) In a surreal twist, though the company announced a gigantic writedown of $918 million on its Bitcoin holdings, MicroStrategy’s stock soared the day after the news hit, rising 15% to $321 and gaining over $400 million in market cap.

The jump deepens the mysterious mythology of Michael Saylor. Did Wall Street cheer because the bedrock software business will fare far better when Saylor, distracted by Bitcoin, isn’t running things day-to-day? Or does having him as a full-time crypto evangelist actually lift Bitcoin’s prospects and hence brighten MicroStrategy’s future?

Saylor’s journey from entrepreneur to evangelist has been controversial: “An Elon Junior without the business talent”

It all started with an innocuous tweet. On Aug. 11, 2020, Saylor reinvented himself and MicroStrategy overnight by grabbing the kind of earth-changing mega-idea he’d long been chasing: He announced on Twitter that MicroStrategy had “embarked on its Bitcoin strategy” by spending $250 million to buy 21,454 Bitcoin at less than $12,000 each. Back in 2013, Saylor had trashed Bitcoin, tweeting that “its days are numbered.” But during the early days of the pandemic, Saylor experienced an epiphany. MicroStrategy was accumulating tons of cash—and Saylor fretted that the Fed’s easy-money policies would severely erode his war chest’s value by eventually stoking inflation.

“We just had the awful realization we were sitting on top of an $500 million ice cube,” he recalled in an interview at the time. Saylor shared Bitcoin creator Satoshi Nakamoto’s view that central banks will inevitably debase fiat currencies. For Saylor, crypto’s limited supply made it a reliable, incorruptible “store of value” that was “superior to cash.” Saylor held seminars at MicroStrategy to convince his lieutenants of Bitcoin’s world-changing advances, and “cheerfully assigned them homework and learning exercises.”

By February of 2021, six months from his original purchase, Saylor announced that MicroStrategy wasn’t just deploying Bitcoin to preserve cash earned from selling software. It would henceforth reinvent itself as a hybrid that combined its traditional franchise and an arm that specializes in accumulating Bitcoin as a business, based on the conviction that its value will rise substantially over time, and that using the software cash flows and borrowing to buy Bitcoin could boost MicroStrategy’s stock much faster than reinvesting in the core business, buying back stock, or making acquisitions.

At this point MicroStrategy has borrowed a staggering $2.4 billion to buy Bitcoin, of which it now owns 129,699 at a current market value of $3.1 billion. To build its cache, MicroStrategy has borrowed the equivalent of three times its entire base of shareholders’ equity when the adventure began. It’s now primarily a vehicle for speculating in the lead crypto—as it runs an enterprise analytics arm on the side. And though he owns just one-fifth of MicroStrategy’s shares, those shares control 64% of the votes, hence he calls the shots.

But this wild experiment has proved so risky that, Fortune has learned, MicroStrategy was unable to obtain full insurance for its directors and officers (D&O) policies from commercial insurers on terms it deemed financially acceptable. As a result, as detailed in its Q2 10Q, it reached an agreement with Saylor in which the founder and CEO indemnified the board members and C-suite for damages incurred in suits by shareholders. Private carriers are now providing D&O protection for up to $30 million in damages. But Saylor is personally indemnifying the directors and officers for another $10 million over and above claims paid by the carriers. He’s also providing D&O coverage for up to $40 million in claims for policies instituted before the new commercial policies were secured in June. The company is paying Saylor “premiums” of $1.2 million on an annualized basis to provide the coverage.

Put simply, Saylor is insuring himself, his board, and his executives against shareholder suits because the carriers who usually provide comprehensive coverage consider it too risky.

There are no shortage of critics predicting Saylor’s experiment will end in grief. David Trainer, an accounting expert and founder of research firm New Constructs quips that “in terms of madmen, Saylor is ‘Elon Junior,’ without the business talent.” Adds Trainer, “He’s massively misallocating his investors’ capital because the market rewarded that behavior in the short-term. It will reconcile in a painful way for himself and his shareholders.”

Saylor’s origin story: From the top of his high school class to founding MicroStrategy at age 24

From his early days, Saylor has been an unusual blend of a deep intellectual and a carnival barker. His father was a U.S. Air Force master sergeant, his mother the daughter of a country singer. As a teenager growing up near the Wright-Patterson base in Dayton, Ohio, Saylor learned to fly gliders and finished first in his high school class. He went to MIT on an ROTC scholarship, studying the history of technology, aeronautics, and astronautics. His thesis presented a mathematical model for an Italian Renaissance city-state. A benign heart murmur grounded his ambitions to become a pilot or astronaut, and after a brief spell as a computer simulation planner at DuPont, Saylor at age 24 cofounded MicroStrategy in 1989 as a consulting firm with two friends from MIT.

The group recognized the internet’s power for the parsing troves of data that companies collected on their products and markets. Soon clients were paying MicroStrategy hundreds of thousands a year to create easy-to-read charts and grids showing key trends in the types of consumers who preferred different soft drinks or insurance products. Winning a $10 million contract from McDonald’s to develop applications for analyzing the effectiveness of its promotions furnished an early boost.

By the time the 11-day 1998 IPO road show rolled around, Saylor had hit his stride, inviting a Washington Post reporter along to chronicle the process. Saylor’s selling style relied on passion, stagecraft, and a lofty vision, not numbers. His rah-rah intro to the official presentation got more buzz than the slideshow: “We’re so focused, we’ll burn a hole in the ceiling!” he’d proclaim.

The I-fill-a-room approach worked big-time. The Wall Street crowd viewed Saylor as arrogant but persuasive. According to the rollicking account, Saylor showed so much passion, and presented such a compelling road map for the future of data analytics, that bankers signed on virtually as a leap of faith. An ultra-arrogant software investor started the meeting by raging about how much he despised most of the industry’s CEOs. But somehow Saylor’s grand vision, his argument that his products would “purge ignorance from the planet,” got the investor to sign on. At Bear Stearns, it took Saylor just 20 minutes before his host scribbled “10%” on the prospectus, signaling his firm would take that chunk of the offering, and walked out. So impressed were the notoriously tough gatekeepers from Fidelity, the world’s largest fund purveyor, that winning their commitment, in Saylor’s words, amounted to “a slam dunk.”

Following the IPO in June 1998, MicroStrategy dazzled Wall Street to shine as a darling of the dotcom frenzy. By March of 2000, its shares had soared 16-fold from the offering price, ballooning its market cap to almost $18 billion.

The company was a pioneer in an important new field: enterprise analytics, software programs that enable retailers, pharma giants, banks, insurers, and government agencies to spot key trends by parsing vast streams of data. It would eventually boast a roster of over 300 mainly longstanding clients, including KFC, Pfizer, Disney, Allianz, Lowe’s, and ABC. Using MicroStrategy’s technology, a coffee chain can dive deep into loyalty card data to identify which flavors different types of customers prefer, so they can target the best candidates for a new offering by sending special offers to their mobile devices. Retailers deploy MicroStrategy’s analytics to find the responses reps use at contact centers that best help customers and shorten calls. Insurers summon its programs to spot and nudge patients suffering from chronic conditions who aren’t taking their medication on schedule.

To be sure, MicroStrategy never achieved tech superstardom. For two decades, Saylor ran his brainchild in a workmanlike fashion, more or less from the shadows. MicroStrategy bumped along as a reliable plodder. Its two main rivals in the field, Salesforce.com and Microsoft’s Intelligent Cloud business, home of its Azure product, started later but grew fast, while MicroStrategy flatlined at annual sales in the $500 million range. Still, it remained a durable survivor.

But on Mar. 20, 2000, MicroStrategy rocked the markets by announcing that its auditors, PriceWaterhouseCoopers, required their client to radically restate revenues and profits for the previous two years. The restatements for 1998 and 1999 took MicroStrategy from a previously reported $28 million gain from operations to a $37 million loss. Saylor, a cofounder, and the former CFO paid the SEC $11 million to settle the charges, the CEO surrendering $8.3 million. Neither Saylor nor the others implicated in the scandal admitted wrongdoing.

By mid-2002, MicroStrategy’s valuation had dropped to around $40 million, down some 98% from its peak.

But Saylor had an idea—one that would lead to an astounding comeback. Anticipating the explosion in mobile devices, he foresaw a niche in providing the programs that enable clients to analyze the vast troves of customer data collected over iPhones or laptops. Around 2009, Saylor offered his software to Facebook’s new COO, Sheryl Sandberg—for free. MicroStrategy became central to the social network’s infrastructure, providing such functions as informing salespeople how much revenue each produces, according to a 2012 Fortune story by David Caplan. Facebook eventually proved a multimillion-dollar-a-year customer, and Saylor rode the mobile wave to achieve a trajectory of moderate but consistent profitability.

But if the business was less than flashy, Saylor’s personal life was anything but. Among his holdings: Villa Vecchia in Miami Beach, an opulent mansion built for the president of F.W. Woolworth that has 13 bedrooms and 12 baths. He also has a $47 million Bombardier jet and two yachts. The 147-foot Harle, reportedly named after the ship that brought his ancestors from Rotterdam in the Netherlands to Philadelphia in 1736, features artwork databases that display digital versions of Monets, Van Goghs, and Picassos, not to mention a giant hot tub on the top deck. His backup party vessel, the similarly sized Usher, welcomes guests to art deco and Polynesian-themed staterooms, and offers two on-board margarita machines. According to the 2012 Fortune piece, the never-married Saylor was rumored to have dated Queen Noor of Jordan, and had his own private butler.

His host-with-the-most parties are legendary. At his birthday celebration at Washington’s W Hotel in 2010, Saylor organized a safari-themed affair festooned with exotic animals—draping an albino Burmese python around his own neck for photos. Each year just before Thanksgiving, Saylor holds his renowned Rocktoberfest gala in Manhattan’s SoHo and assorted venues, where the guests dress as rock stars.

Looking for his big idea

Flamboyant social life aside, what Saylor really craves is widespread influence in the tech world, former associates interviewed by Fortune say. According to those sources, Saylor yearns to be a renowned thought leader—“to be widely admired as an intellectual powerhouse,” in the words of one departed employee.

Indeed, he’s been prescient at spotting trends: His 2012 book—briefly a bestseller—The Mobile Wave: How Mobile Intelligence Will Change Everything foresaw the revolution that mobile devices would unleash on everything from retailing to banking.

Saylor created at least two remarkable new businesses inside MicroStrategy. “He’s got the ability to see the future,” says a former associate. In the late aughts, he developed a pioneering platform that enabled homes and businesses to monitor security systems over the web called alarm.com. He sold it to private equity investors in 2008 for $28 million. Today, Alarm.com is a thriving publicly traded enterprise valued at $3.5 billion. In the early 2010s, Saylor developed one of the first automated voice response systems for contact centers, a cloud-based service called Angel. Genesys bought Angel in 2013 for $110 million. According to a study by Prescient & Strategic Intelligence, the contact center software market is now a $24 billion business forecast to grow at 18% over the next decade—and the Angel deal helped make Genesys a major player in the field.

He’s good at incubating talent as well as businesses. “He leaves a mark on anyone who works with him,” says a departed manager. By all accounts, Saylor inspires people with a kind of mad-genius daring that makes them believe that if he can make these crazy experiments work, they can too. Among his successful alums are Joe Payne, who in 2013 sold software startup Eloqua to Oracle for almost $1 billion; and his cofounder, Sanju Bansal, who together with CEO Reggie Aggarwal launched Cvent, which provides software for planners of in-person and mobile conferences and other events. It IPO’d last December, and now carries a market cap of $2.8 billion.

Still, former associates say that Saylor is a highly temperamental micromanager who, as one source puts it, “controls too tightly.” Saylor’s supreme self-confidence made him believe that he could run everything himself, and made him reluctant to delegate strong operating roles to lieutenants, according to ex-employees.

“He doesn’t allow people to do things their own way, and over time,” the source continues. “And that freedom [is what] creates more growth over time. Still, there’s more good here than bad. Imagine if you’d invested in his theses over time, in the web, mobile technology, the cloud!”

Saylor’s emotional, mercurial style ignites heavy churn in the C-suite, hindering MicroStrategy’s growth. Since 2018, he’s had three chief marketing officers, and a CFO left in 2020 after just one year. His problem keeping good people may also explain why he didn’t fully build such promising ideas as Angel and Alarm.com but instead sold the technology.

Enabling Saylor’s controlling tendencies is MicroStrategy’s shareholder structure, which awards him power far in excess of his ownership position. The company has two classes of stock, and Saylor’s ownership of B shares that carry 10 votes versus one for the class A give him 64% of the votes, though he owns just one-fifth of the total shares. In effect, Saylor can do whatever he wants at MicroStrategy. The danger is that by putting its assets in harm’s way, and undermining its formerly profitable core business, he destroys immense value for his shareholders. Saylor has already taken extraordinary, possibly quixotic liberties with a business that’s 80% owned by public shareholders.

Bitcoin’s biggest booster

At the same time he wildly shifted MicroStrategy’s fortunes into Bitcoin, Saylor emerged as arguably the world’s leading promoter for the cryptocurrency. According to press reports, it was Saylor who helped convince Elon Musk to buy $1.5 billion in Bitcoin early last year, an endorsement that greatly boosted its price and reputation. (Tesla sold most of its Bitcoin holdings in Q2, and retains just one-quarter of its original purchases.)

Bitcoin’s steep drop from almost $70,000 in late 2021 to under $20,000 in June 2022 rallied Saylor to appear almost daily on TV arguing that Bitcoin is the future of finance, and that the selloff makes it an even more fantastic buy. On CNBC, CNN, Fox’s Tucker Carlson Tonight or CoinDesk’s webcast, Saylor typically appears clad in an open-collared black shirt, sporting a shaggy mop of gray hair, seated before a fireplace at his penthouse apartment on the Georgetown waterfront in Washington, D.C. He seldom specifies practical uses for Bitcoin, such as its potential as a currency for buying and selling cars and groceries, or as a hedge against inflation. Instead, in his trademark high-pitched delivery, Saylor argues that the world is on the verge of an economic cataclysm, and that Bitcoin represents a haven of stability. “Bitcoin is a lifeboat, tossed on a stormy sea, offering hope to anyone that needs to get off the sinking ship,” he intoned on CNN. Saylor’s Twitter feed features his image emitting smoke through flashing “laser eyes” that “signal intent to make Bitcoin an instrument of economic empowerment.” (“He thinks he’s Zeus,” snaps one critic.)

Saylor argues that Bitcoin will reach $500,000 within a few years, and that folks should “take the money they were going to give their grandchildren and convert it to Bitcoin.”

The crazy thing is, despite the Bitcoin crash, amazingly, MicroStrategy is worth far more now than when Saylor started his adventure: Since August 2020, despite huge spikes and deep drops along the way, MicroStrategy’s stock has almost tripled to $323 as of August 3. Crypto-loving traders clearly see MicroStrategy as a proxy for Bitcoin.

The problem? MicroStrategy’s performance is defying its weak fundamentals. Its stock consistently posts increases that far outstrip the dollar gains for the Bitcoin holdings: On June 16, with Bitcoin selling at around $20,300, MicroStrategy’s shares traded at $161, and its market cap stood at $1.8 billion. By August 3, Bitcoin had rebounded by 15% to $23,300, raising the value of MicroStrategy’s strongbox by around $400 million. But even though its basic business was fading, its shares over those six weeks almost doubled to $312. That moonshot added $1.8 billion to its market cap, more than four times the amount the Bitcoin on its books swelled in value.

This phenomenon suggests a “Saylor premium”: that the CEO’s charismatic salesmanship is converting hordes of believer-shareholders to his vision. Of the six analysts providing 12-month price forecasts for MicroStrategy, two are pessimistic, predicting a drop to between $180 and $250; two reckon the stock have maxed out that the current $300-plus; and two see room for big increases, with BTIG Research expecting a jump to $950. The view that the leap in the stock price is far out of proportion to its gains on Bitcoin has prompted short-sellers to pour into MicroStrategy. Around half of its shares are currently sold short, a record for this longstanding target for shorts.

According to critics, Saylor’s big switch is hurting its bedrock software franchise, and he needs big cash flows from that business to support the new billions in debt. “I can’t imagine that the uncertainty of holding all that Bitcoin can be good for the underlying business,” says Ryan Ballentine of Bireme Capital, who’s shorting MicroStrategy shares. “If you’re a client and worry it could cause big problems, why not go to a competitor like Microsoft?”

Saylor has also leveraged MicroStrategy so heavily that if the price of Bitcoin drops, it will lack the cash to repay big chunks of debt that could come due as early as 2025.

Since Saylor started buying Bitcoin in August 2020, he’s borrowed a staggering $2.4 billion to purchase coins, using three separate bond offerings and a margin loan. He’s also tapped most of the company’s pre-Bitcoin cash, and all of its free cash flow, to buy more.

In addition, he floated a $1 billion equity offering in February of 2021, and plowed all the proceeds into Bitcoin. At the time, MicroStrategy shares had jumped from $124 in August of 2020 to $770. “On the financing side, Saylor was smart to sell his shares at such an overpriced number,” says short-seller Ballentine of Bireme Capital. “He would have been a lot better off buying all of his Bitcoin with overpriced stock. Instead, he’s stuck with loads of debt that bought super-volatile Bitcoin that could become worth a lot less than the debt.”

The rub is that Saylor has spent $4 billion to accumulate 129,699 Bitcoin at an average price of around $31,320. But today, with Bitcoin selling at roughly $23,300 or 26% less, his holdings are worth $3 billion, or $1 billion less than he paid. Before the Bitcoin adventure, MicroStrategy held virtually no debt and hence carried no interest expense. But today, it owes $2.4 billion to bondholders and hedge funds. It’s also paying $46 million a year in interest on those borrowings.

Hence, MicroStrategy faces four big threats. First, its interest costs wipe out the free cash flow from the software business, after subtracting the cost of options grants. MicroStrategy has no margin for error if profits from the basic business shrink. And that’s a strong possibility. As short-seller Ballentine points out, clients know that if MicroStrategy loses any substantial amount of business, it won’t be able to cover its interest payments without selling Bitcoin, something Saylor swears will never happen.

Second, the tight conditions of MicroStategy’s financings also raise red flags. It’s borrowing on terms of under three to six years for financing what it bills as an ultra-long-term investment. It issued $500 million on senior secured notes officially due in 2028, and also floated a $650 million convertible bond offering payable in 2025. But the covenants on the 2028 senior notes stipulate that if the company doesn’t have the full $650 million in cash available to pay off the 2025 offering when it comes due, the maturity on the $500 bond jumps to 2025, and is payable ahead of the $650 million bond. So as early as 2025, if MicroStrategy doesn’t have the $650 million in cash, it will need to pay the $500 million and, after satisfying that debt, retire the original 2025 issue for $650 million in cash. To make both payments, MicroStrategy would need $1.05 billion in liquidity.

Keep in mind that right now, its Bitcoin strongbox is worth just $700 million or so more than its debt. And MicroStrategy holds little extra cash. It’s famously spending everything on Bitcoin. Nor is the software business generating any significant cash, due to the big jump in interest expense. It’s unlikely that the price of Bitcoin will drop so low that MicroStrategy won’t be able to repay the debt as the bonds and margin loan come due through 2025. But if the price settles at below $20,000, by that point it could owe more than the value of the coins on its books. The company risks being effectively insolvent. And that’s assuming the software business generates the cash to cover its current interest so that Saylor doesn’t have to start dumping coins to keep the payments current.

Third, what happens if MicroStrategy just bumps along much as it’s doing now? Bitcoin’s price stays in the low to mid-$20,000s, and it produces enough cash to pay its interest. The most likely outcome is that the shares revert to their fundamental value. “If MicroStrategy muddles along, the crypto-insanity premium goes away,” says Ballentine. “The core business is making no money after interest payments.” What’s left is the difference between the Bitcoin holdings, and the debt incurred to build the stockpile. Right now, that number is around $700 million. And that’s the underlying worth Ballentine is placing on all of MicroStrategy. If he’s right, the company right now, at a market cap of $3.6 billion, is overpriced by around 80%. In the muddling scenario, the math takes precedence, Saylor’s Pied Piper appeal evaporates, and MicroStrategy’s stock takes a deep dive.

Which brings us back to the final risk factor. If the stock dives below its traditional value as a sound software franchise, MicroStrategy is likely to see a rash of suits against its leaders for breach of fiduciary duty, and as previously stated, it’s Saylor himself who is providing a big part of the coverage at this point. The suing shareholders could have a strong case. Saylor has loaded his creation with gigantic debt to amass the most volatile and controversial of assets, while endangering a stalwart that could have kept minting modest profits for years to come.

In the end, Michael Saylor is famous for his outrageously self-confident predictions about the technological future. Despite the violent ups and downs, he’s been right some of the time. But by hitching himself to Bitcoin, he’s staked his company’s future on a wildly volatile speculative vehicle.

It’s impossible to tell whether this elevator is heading for the penthouse or the sub-basement.