通货膨胀正在消退,但通胀率下降幅度在各商品和服务中表现并不均衡。

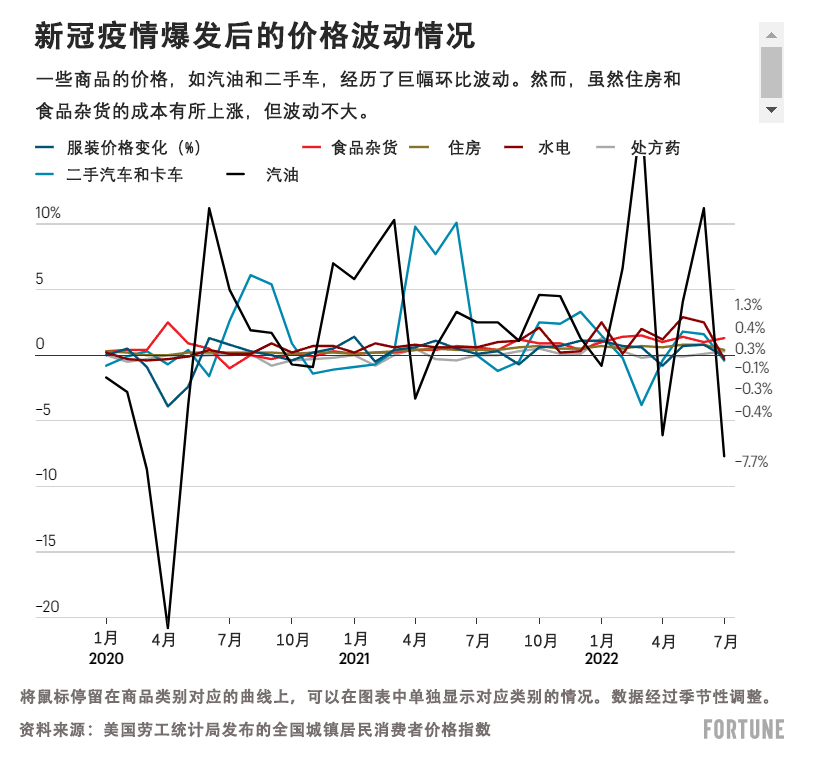

7月份,通货膨胀率环比增长0%。年通货膨胀率甚至从6月份的9.1%下降到7月份的8.5%。专家很快表示,该数据变化表明美联储(Federal Reserve)稳定消费价格的举措初见成效。但现在宣布胜利可能还为时尚早,因为汽油、汽车等商品的价格每个月仍在剧烈波动。

消费者价格指数(CPI)是一个平均衡量标准,在很多方面并不完美。它本质上是对数百种不同商品的价格进行计算,各类商品被赋予了不同的权重。例如,房价所占权重比能源成本要高得多。此外,该指数并没有跟踪农村地区居民的消费模式,也没有涵盖美国军人或监狱、精神病院人员的消费模式。

虽然7月份通货膨胀总体上有所消退,但通胀率下降幅度在各类商品中的表现并不均衡。上个月整体通货膨胀率的下降很大程度上是由于汽油价格的下跌。继6月份汽油价格环比上涨11.2%之后,7月份CPI汽油指数下跌7.7%。美国经济顾问委员会(Council of Economic Advisors)的数据显示,7月份总体能源价格下降4.6%,使上个月的月度通胀率下降了约41个基点。

这的确是个好消息,但能源只占CPI计算权重的7.5%左右。美国经济顾问委员会指出,由于俄乌冲突持续,能源价格可能在未来几个月继续波动。

另一方面,食品价格和房价没有出现同样的剧烈涨跌,而是一直在稳步上涨。消费者价格指数数据显示,7月份食品价格整体上涨1.1%,其中食品杂货支出上涨1.3%。食品价格的上涨使月度通胀率增加了约15个基点。

如果这种上涨势头持续下去,可能对消费者造成长期困扰。食品和住房在该指数中的权重最大,约占CPI这一通胀指标的46%。特别是,房价往往比汽油或汽车成本更具粘性。

美国经济与政策研究中心(Center for Economic and Policy Research)的高级经济学家迪恩•贝克写道:“7月份的消费者价格指数数据好坏参半。汽油价格的暴跌意味着人们的口袋里有钱,但食品价格仍在迅速上涨。”

大多数消费者可能不会看到物价上涨后的大幅回落,但专家预计,通胀率下降将有助于放慢美联储加息的步伐。PNC金融服务公司的高级经济学家库尔特•兰金表示:“与通胀的斗争尚未结束,但7月份的数据表明,政府正在采取正确的措施。”

“尽管日用必需品的价格继续上涨,但这类商品价格的上涨速度已经放缓,能源成本当月大幅回落。未来几个月,其他消费品和服务将面临较弱的价格压力,”兰金补充道。(财富中文网)

译者:郝秀

审校:汪皓

通货膨胀正在消退,但通胀率下降幅度在各商品和服务中表现并不均衡。

7月份,通货膨胀率环比增长0%。年通货膨胀率甚至从6月份的9.1%下降到7月份的8.5%。专家很快表示,该数据变化表明美联储(Federal Reserve)稳定消费价格的举措初见成效。但现在宣布胜利可能还为时尚早,因为汽油、汽车等商品的价格每个月仍在剧烈波动。

消费者价格指数(CPI)是一个平均衡量标准,在很多方面并不完美。它本质上是对数百种不同商品的价格进行计算,各类商品被赋予了不同的权重。例如,房价所占权重比能源成本要高得多。此外,该指数并没有跟踪农村地区居民的消费模式,也没有涵盖美国军人或监狱、精神病院人员的消费模式。

虽然7月份通货膨胀总体上有所消退,但通胀率下降幅度在各类商品中的表现并不均衡。上个月整体通货膨胀率的下降很大程度上是由于汽油价格的下跌。继6月份汽油价格环比上涨11.2%之后,7月份CPI汽油指数下跌7.7%。美国经济顾问委员会(Council of Economic Advisors)的数据显示,7月份总体能源价格下降4.6%,使上个月的月度通胀率下降了约41个基点。

这的确是个好消息,但能源只占CPI计算权重的7.5%左右。美国经济顾问委员会指出,由于俄乌冲突持续,能源价格可能在未来几个月继续波动。

另一方面,食品价格和房价没有出现同样的剧烈涨跌,而是一直在稳步上涨。消费者价格指数数据显示,7月份食品价格整体上涨1.1%,其中食品杂货支出上涨1.3%。食品价格的上涨使月度通胀率增加了约15个基点。

如果这种上涨势头持续下去,可能对消费者造成长期困扰。食品和住房在该指数中的权重最大,约占CPI这一通胀指标的46%。特别是,房价往往比汽油或汽车成本更具粘性。

美国经济与政策研究中心(Center for Economic and Policy Research)的高级经济学家迪恩•贝克写道:“7月份的消费者价格指数数据好坏参半。汽油价格的暴跌意味着人们的口袋里有钱,但食品价格仍在迅速上涨。”

大多数消费者可能不会看到物价上涨后的大幅回落,但专家预计,通胀率下降将有助于放慢美联储加息的步伐。PNC金融服务公司的高级经济学家库尔特•兰金表示:“与通胀的斗争尚未结束,但7月份的数据表明,政府正在采取正确的措施。”

“尽管日用必需品的价格继续上涨,但这类商品价格的上涨速度已经放缓,能源成本当月大幅回落。未来几个月,其他消费品和服务将面临较弱的价格压力,”兰金补充道。(财富中文网)

译者:郝秀

审校:汪皓

Inflation is falling, but it’s not happening evenly across all goods and services.

On a month-to-month basis, there was a 0% increase in inflation in July. The annual inflation rate even dropped from 9.1% in June to 8.5% in July. Pundits were quick to argue this shows the Federal Reserve is seeing some early success in its actions to stabilize the prices of consumer goods. But it’s probably too soon to declare victory, since the cost of things like gas and cars are still swinging wildly from month to month.

The Consumer Price Index (CPI) is an average measure, and it’s imperfect in many ways. It’s essentially a calculation of prices across hundreds of different categories—and not all are weighted equally. Housing prices, for example, count for a lot more than energy costs. And the CPI doesn’t track spending patterns of those living in rural areas, for example, nor Americans in the armed forces or those living in institutions such as prisons or mental health hospitals.

While overall inflation fell in July, it’s not consistent across all types of goods. Last month’s decline in overall inflation was driven, in large part, by falling gas prices. The CPI logged a 7.7% drop in July gasoline costs after jumping 11.2% month-over-month in June. Overall energy prices dropped by 4.6% in July, subtracting about 41 basis points from the total monthly inflation last month, according to the Council of Economic Advisors.

This is good news, but energy only makes up about 7.5% of the total CPI calculation. And it's likely energy prices will continue to be volatile in coming months thanks to Russia’s ongoing invasion of Ukraine, the Council noted.

Food and housing prices, on the other hand, haven’t seen the same wild spikes and troughs—instead these expenses have been steadily on the rise. Overall food prices rose 1.1% in July, with grocery expenses specifically hitting 1.3%, according to the CPI. That bump in food prices added about 15 basis points.

If that upward momentum continues, it could be problematic for consumers long-term. Together, food and housing carry the most weight in the index, making up about 46% of the overall CPI inflation measure. And housing prices, in particular, tend to be stickier than gas or car costs.

“The July Consumer Price Index data are a mixed picture. The plunge in gas prices means money in people’s pockets, but food prices are still rising rapidly,” wrote Dean Baker, senior economist with the Center for Economic and Policy Research.

Most consumers likely won’t see a major break from rising prices, but experts predict the drop in inflation will help moderate the Fed’s pace of rising interest rates. “The fight against inflation is not over, but July’s results suggest that steps in the right direction are being taken,” says Kurt Rankin, PNC senior economist.

“Although prices continue to rise for everyday necessities, the pace of gains for such items slowed, and energy costs fell back sharply for the month which should flow through to weaker price pressure on other consumer goods and services in the months to come," Rankin added.