随着世界各国央行继续对抗不断上升的通胀率,美元对大多数主要货币升值,其在整个2022年的走势令人难以置信。

仅今年一年,美元兑日元汇率就上涨了15%,兑英镑汇率上涨了10%,兑人民币汇率上涨了5%。衡量美元兑其他16种主要货币汇率的《华尔街日报》美元指数(Dollar Index)今年上半年的表现是2010年以来最好的,年初至今涨幅超过10%。

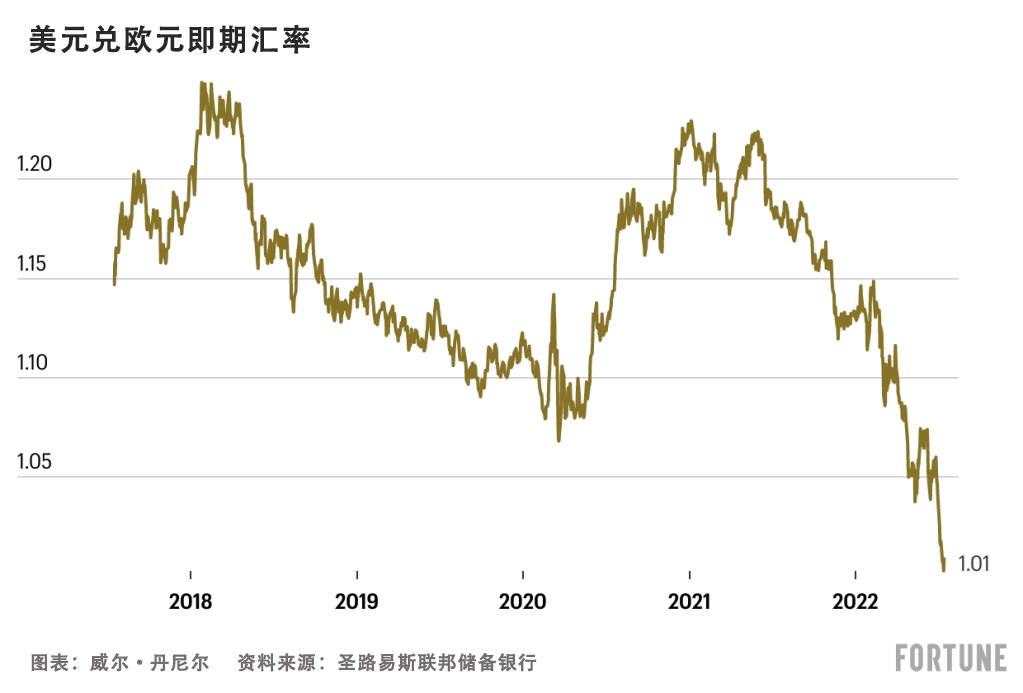

对于那些能够买到廉价机票(带着所有的行李通关)去欧洲的幸运的美国人来说,本月初,美元甚至在20年来第一次与欧元平起平坐。

美元升值意味着美国人可以享受特价国际旅行。虽然消费者价格继续上涨,但美元走强可能有助于减少美国通胀率飙升带来的影响。

但美元走强也给世界各国带来一些毁灭性的影响,对今年剩余时间在海外开展业务的美国公司来说,这可能是一大阻力。

对许多投资者和消费者来说,仍有两个亟待解决的问题:美元今年为何如此强势,以及美元将何去何从?

多位华尔街首席投资官和策略师告诉《财富》杂志,一种推动美元走强的新趋势已经出现,但大多数人认为,美元将在年底前开始下跌。以下是他们的看法。

美元为何如此强势?

从历史上看,汇率变动在很大程度上与相对利率和经济实力有关。要想了解美元,专家们告诉《财富》杂志,只要看看美联储就知道了。美联储目前正以上世纪90年代以来前所未有的速度加息。

财富和投资管理公司Bailard的首席投资官埃里克·莱夫(Eric Leve)告诉《财富》杂志:“美元走强是因为美联储实施的货币紧缩政策是全球主要央行中最激进的。”

莱夫指出,美联储的加息已将政府债券的实际收益率(或债券投资者扣除通胀因素后的利息收益)推高至正值区域,这是多年来的首次。这使得美国债券对全球投资者更具吸引力,从而提高了美元的相对价值。

莱夫还认为,在通胀和衰退风险方面,美联储的加息使美国的经济状况比许多其他国家更好。

由于美联储,美国在很多方面都是“最干净的脏衬衫”。

——BAILARD首席信息官埃里克·莱夫

美联储的举措还有助于降低通胀预期(消费者和投资者的通胀预期),这使得美国对担心消费者价格上涨的全球投资者来说更具吸引力。

投资研究公司CFRA research的首席投资策略师萨姆·斯托瓦尔(Sam Stovall)告诉《财富》杂志,美元的强势得益于这种相对吸引力。他说,在担忧全球经济衰退的情况下,这对外国投资者来说是一种“避险”。

但在新冠肺炎疫情和俄乌冲突之后,也出现了一种影响全球货币相对强势的新动态——自给自足。

当新冠肺炎疫情在2020年肆虐时,它引发了一场全球供应链的噩梦,加剧了从半导体到卫生纸等所有产品的短缺,并将大宗商品价格推至新高。标准普尔高盛综合商品指数(S&P GSCI Index)是衡量全球原材料价格的广泛指标,疫情以来,该指数已飙升了180%以上。

因此,世界上许多国家对其商品供应的保护力度加大,新一轮逆全球化浪潮已经大行其道。由于美国在能源和其他大宗商品供应方面相对自给自足,这种大宗商品保护主义导致美元升值。

俄乌冲突加剧了这一趋势,因为欧洲的天然气供应立即受到严重影响,导致天然气价格在过去一年飙升了400%以上。这使得欧盟各国争相满足其能源需求,但迄今为止,计划未能奏效。国际能源署(IEA)本周甚至警告说,欧盟需要立即削减天然气需求,否则将面临“漫长而艰难的冬天”。

欧洲能源危机和缺乏自给自足的最终结果是,在大宗商品价格居高不下的情况下,出口下降,进口增加。

宏观数据分析公司Quant Insight的分析主管休•罗伯茨(Huw Roberts)告诉《财富》杂志,这相当于“贸易比率冲击”,即进口价格相对于出口价格飙升。

他说:“如果你是能源进口国,那么这将造成严重的损害。但如果你是能源出口国,那么实际上你会受益。”

美国等能源出口较多、大宗商品供应更能实现自给自足的国家本币升值,而欧盟等大宗商品无法实现自给自足的国家和地区本币贬值。

强势美元会带来什么影响?

对于美国消费者而言,强势美元不仅让国际旅行更便宜;它还有助于降低通货膨胀。

“在边际上,美元走强在一定程度上限制了 [美国] 通胀,”Bailard的莱夫说。“由于美元走强,从国外购买商品,就像美国消费者倾向于做的那样,变得便宜得多。所以我们实际上是在引入通货紧缩。”

一些美国企业也受益于强势美元,强势美元降低了大宗商品价格。

Quant Insights的罗伯茨说:“因此,如果就制造业企业而言,他们购买的原材料以美元计价,而大宗商品价格正在下跌,那么强势美元实际上对他们有利。”

然而,这些企业是例外。对大多数美国公司来说,美元走强是一种不受欢迎的逆风。

莱夫指出:“如果你想在海外销售商品,那么强势美元会让你的商品更加昂贵,从而给美国企业的营收带来负担。”

此外,Northwestern Mutual Wealth Management Company的首席投资策略师布伦特·舒特(Brent Schutte)告诉《财富》杂志,当美国公司试图将其海外收益汇回国内时,强势美元意味着他们的收益比往年要少。

“当然,如果你在海外有很多以其他货币计值的获利,当你将它们转换回来时,可能会造成获利亏损。”舒特说。国际商用机器公司(IBM)、强生公司(Johnson and Johnson)和奈飞公司(Netflix)等公司的季度财务业绩在本财报季已经受到冲击。

eToro全球市场策略师本·莱德勒(Ben Laidler)上周对《纽约时报》表示,美元升值可能会使拥有大型国际业务的标准普尔500指数成份股公司今年收益减少多达1000亿美元。不过,舒特指出,这些“损失”更像是一种“会计惯例”。

他说:“我通常认为,投资者,尤其是长期投资者,会识破这一点。”

强势美元在美国以外带来严重影响,这使得低收入国家(国债以美元计价)几乎不可能偿还债权人或购买足够的基本商品。斯里兰卡已经上演了这样痛苦的现实,今年5月,由于货币贬值,该国被迫拖欠债务。

这个东南亚国家现在已经没有美元可以用来支付关键的进口商品,由于民众面临饥饿和排长队等待燃料,导致了大规模抗议活动,

世界银行宏观经济、贸易和投资全球主任马塞洛·埃斯特万(Marcello Estevão)本周对《华尔街日报》表示:“每个以美元计价的国家都需要承担巨额债务,这都令人担忧。”

美元将何去何从?

尽管到目前为止,美元在2022年经历了历史上最好的年份之一,但大多数专家认为,它正接近峰值。

"美元很昂贵,相对于其他货币被高估了。" Northwestern Mutual的舒特称。“如果回顾2001年发生的情况,你会发现,相对于其他货币,美元被高估的程度与2001年类似。这确实引发了美元在国际市场上长达10年的优异表现,而这在很大程度上是由美元实际下跌推动的。”

舒特指出,购买力平价——或者说从长远来看,一篮子商品在全球范围内应该恢复到大致相同的价格——是美元可能“被高估”的一个关键指标。

Bailard的埃里克·莱夫说:“最好的衡量标准之一是《经济学人》的巨无霸指数,你可以查看面包、特制酱料、馅饼和其他所有东西的价格,并在全球范围内对其进行评估。考虑到巨无霸的所有组成部分基本上都是全球性的,这是我们可以说一种货币对美元来说太便宜的方式之一。”

最新的巨无霸指数于周四发布,它显示“几乎所有货币兑美元的汇率都被低估了”。

《财富》杂志采访的大多数专家认为,这表明美元可能会在今年年底前贬值。

Northwestern Mutual的舒特指出,其他央行正在“追赶”美联储的加息步伐,并且有一些迹象表明美国通胀可能正在悄然回落,包括近期大宗商品价格回落和华尔街通胀预期下降。这可能导致美联储未来加息力度减弱,从而减缓美元的升值步伐。

对投资者来说,这意味着非美股市可能会在年底前开始变得有吸引力。

“最近,强势美元使得非美股票投资变得相当痛苦。”莱夫说。“但我认为,展望未来……我们将看到美元从对非美股票投资的不利因素,变成有利因素。”

然而,并非所有专家都认为美元正接近峰值。CFRA Research的萨姆·斯托瓦尔表示,其研究机构的经济学家预测,美元将在今年全年和2023年持续走强。

他说:“随着美联储继续以与其他央行行长相同或更快的速度加息,那么我认为这可能会继续吸引外国投资者到美国来。此外,由于经济衰退的威胁仍然非常严重。我认为这将导致投资者希望继续将美元作为避风港。”(财富中文网)

译者:中慧言-王芳

随着世界各国央行继续对抗不断上升的通胀率,美元对大多数主要货币升值,其在整个2022年的走势令人难以置信。

仅今年一年,美元兑日元汇率就上涨了15%,兑英镑汇率上涨了10%,兑人民币汇率上涨了5%。衡量美元兑其他16种主要货币汇率的《华尔街日报》美元指数(Dollar Index)今年上半年的表现是2010年以来最好的,年初至今涨幅超过10%。

对于那些能够买到廉价机票(带着所有的行李通关)去欧洲的幸运的美国人来说,本月初,美元甚至在20年来第一次与欧元平起平坐。

美元升值意味着美国人可以享受特价国际旅行。虽然消费者价格继续上涨,但美元走强可能有助于减少美国通胀率飙升带来的影响。

但美元走强也给世界各国带来一些毁灭性的影响,对今年剩余时间在海外开展业务的美国公司来说,这可能是一大阻力。

对许多投资者和消费者来说,仍有两个亟待解决的问题:美元今年为何如此强势,以及美元将何去何从?

多位华尔街首席投资官和策略师告诉《财富》杂志,一种推动美元走强的新趋势已经出现,但大多数人认为,美元将在年底前开始下跌。以下是他们的看法。

美元为何如此强势?

从历史上看,汇率变动在很大程度上与相对利率和经济实力有关。要想了解美元,专家们告诉《财富》杂志,只要看看美联储就知道了。美联储目前正以上世纪90年代以来前所未有的速度加息。

财富和投资管理公司Bailard的首席投资官埃里克·莱夫(Eric Leve)告诉《财富》杂志:“美元走强是因为美联储实施的货币紧缩政策是全球主要央行中最激进的。”

莱夫指出,美联储的加息已将政府债券的实际收益率(或债券投资者扣除通胀因素后的利息收益)推高至正值区域,这是多年来的首次。这使得美国债券对全球投资者更具吸引力,从而提高了美元的相对价值。

莱夫还认为,在通胀和衰退风险方面,美联储的加息使美国的经济状况比许多其他国家更好。

由于美联储,美国在很多方面都是“最干净的脏衬衫”。

——BAILARD首席信息官埃里克·莱夫

美联储的举措还有助于降低通胀预期(消费者和投资者的通胀预期),这使得美国对担心消费者价格上涨的全球投资者来说更具吸引力。

投资研究公司CFRA research的首席投资策略师萨姆·斯托瓦尔(Sam Stovall)告诉《财富》杂志,美元的强势得益于这种相对吸引力。他说,在担忧全球经济衰退的情况下,这对外国投资者来说是一种“避险”。

但在新冠肺炎疫情和俄乌冲突之后,也出现了一种影响全球货币相对强势的新动态——自给自足。

当新冠肺炎疫情在2020年肆虐时,它引发了一场全球供应链的噩梦,加剧了从半导体到卫生纸等所有产品的短缺,并将大宗商品价格推至新高。标准普尔高盛综合商品指数(S&P GSCI Index)是衡量全球原材料价格的广泛指标,疫情以来,该指数已飙升了180%以上。

因此,世界上许多国家对其商品供应的保护力度加大,新一轮逆全球化浪潮已经大行其道。由于美国在能源和其他大宗商品供应方面相对自给自足,这种大宗商品保护主义导致美元升值。

俄乌冲突加剧了这一趋势,因为欧洲的天然气供应立即受到严重影响,导致天然气价格在过去一年飙升了400%以上。这使得欧盟各国争相满足其能源需求,但迄今为止,计划未能奏效。国际能源署(IEA)本周甚至警告说,欧盟需要立即削减天然气需求,否则将面临“漫长而艰难的冬天”。

欧洲能源危机和缺乏自给自足的最终结果是,在大宗商品价格居高不下的情况下,出口下降,进口增加。

宏观数据分析公司Quant Insight的分析主管休•罗伯茨(Huw Roberts)告诉《财富》杂志,这相当于“贸易比率冲击”,即进口价格相对于出口价格飙升。

他说:“如果你是能源进口国,那么这将造成严重的损害。但如果你是能源出口国,那么实际上你会受益。”

美国等能源出口较多、大宗商品供应更能实现自给自足的国家本币升值,而欧盟等大宗商品无法实现自给自足的国家和地区本币贬值。

强势美元会带来什么影响?

对于美国消费者而言,强势美元不仅让国际旅行更便宜;它还有助于降低通货膨胀。

“在边际上,美元走强在一定程度上限制了 [美国] 通胀,”Bailard的莱夫说。“由于美元走强,从国外购买商品,就像美国消费者倾向于做的那样,变得便宜得多。所以我们实际上是在引入通货紧缩。”

一些美国企业也受益于强势美元,强势美元降低了大宗商品价格。

Quant Insights的罗伯茨说:“因此,如果就制造业企业而言,他们购买的原材料以美元计价,而大宗商品价格正在下跌,那么强势美元实际上对他们有利。”

然而,这些企业是例外。对大多数美国公司来说,美元走强是一种不受欢迎的逆风。

莱夫指出:“如果你想在海外销售商品,那么强势美元会让你的商品更加昂贵,从而给美国企业的营收带来负担。”

此外,Northwestern Mutual Wealth Management Company的首席投资策略师布伦特·舒特(Brent Schutte)告诉《财富》杂志,当美国公司试图将其海外收益汇回国内时,强势美元意味着他们的收益比往年要少。

“当然,如果你在海外有很多以其他货币计值的获利,当你将它们转换回来时,可能会造成获利亏损。”舒特说。国际商用机器公司(IBM)、强生公司(Johnson and Johnson)和奈飞公司(Netflix)等公司的季度财务业绩在本财报季已经受到冲击。

eToro全球市场策略师本·莱德勒(Ben Laidler)上周对《纽约时报》表示,美元升值可能会使拥有大型国际业务的标准普尔500指数成份股公司今年收益减少多达1000亿美元。不过,舒特指出,这些“损失”更像是一种“会计惯例”。

他说:“我通常认为,投资者,尤其是长期投资者,会识破这一点。”

强势美元在美国以外带来严重影响,这使得低收入国家(国债以美元计价)几乎不可能偿还债权人或购买足够的基本商品。斯里兰卡已经上演了这样痛苦的现实,今年5月,由于货币贬值,该国被迫拖欠债务。

这个东南亚国家现在已经没有美元可以用来支付关键的进口商品,由于民众面临饥饿和排长队等待燃料,导致了大规模抗议活动,

世界银行宏观经济、贸易和投资全球主任马塞洛·埃斯特万(Marcello Estevão)本周对《华尔街日报》表示:“每个以美元计价的国家都需要承担巨额债务,这都令人担忧。”

美元将何去何从?

尽管到目前为止,美元在2022年经历了历史上最好的年份之一,但大多数专家认为,它正接近峰值。

"美元很昂贵,相对于其他货币被高估了。" Northwestern Mutual的舒特称。“如果回顾2001年发生的情况,你会发现,相对于其他货币,美元被高估的程度与2001年类似。这确实引发了美元在国际市场上长达10年的优异表现,而这在很大程度上是由美元实际下跌推动的。”

舒特指出,购买力平价——或者说从长远来看,一篮子商品在全球范围内应该恢复到大致相同的价格——是美元可能“被高估”的一个关键指标。

Bailard的埃里克·莱夫说:“最好的衡量标准之一是《经济学人》的巨无霸指数,你可以查看面包、特制酱料、馅饼和其他所有东西的价格,并在全球范围内对其进行评估。考虑到巨无霸的所有组成部分基本上都是全球性的,这是我们可以说一种货币对美元来说太便宜的方式之一。”

最新的巨无霸指数于周四发布,它显示“几乎所有货币兑美元的汇率都被低估了”。

《财富》杂志采访的大多数专家认为,这表明美元可能会在今年年底前贬值。

Northwestern Mutual的舒特指出,其他央行正在“追赶”美联储的加息步伐,并且有一些迹象表明美国通胀可能正在悄然回落,包括近期大宗商品价格回落和华尔街通胀预期下降。这可能导致美联储未来加息力度减弱,从而减缓美元的升值步伐。

对投资者来说,这意味着非美股市可能会在年底前开始变得有吸引力。

“最近,强势美元使得非美股票投资变得相当痛苦。”莱夫说。“但我认为,展望未来……我们将看到美元从对非美股票投资的不利因素,变成有利因素。”

然而,并非所有专家都认为美元正接近峰值。CFRA Research的萨姆·斯托瓦尔表示,其研究机构的经济学家预测,美元将在今年全年和2023年持续走强。

他说:“随着美联储继续以与其他央行行长相同或更快的速度加息,那么我认为这可能会继续吸引外国投资者到美国来。此外,由于经济衰退的威胁仍然非常严重。我认为这将导致投资者希望继续将美元作为避风港。”(财富中文网)

译者:中慧言-王芳

The U.S. dollar has had an incredible run throughout 2022, appreciating against most major currencies as the world’s central banks continue to combat rising inflation.

This year alone, the dollar is up 15% against the Japanese yen, 10% against the British pound, and 5% compared to China’s renminbi. The Wall Street Journal’s Dollar Index, which measures the dollar against 16 other major currencies, has also had its best first half performance since 2010 this year, rising more than 10% year-to-date.

And for the lucky Americans who could find cheap airfare to Europe (and made it through with all their luggage), the dollar even reached equal standing with the euro for the first time in two decades earlier this month.

The dollar’s gains mean international travel is on sale for Americans. And while consumer prices continue to rise, a stronger dollar could help reduce the impact of rising inflation in the U.S.

But the dollar’s strength has also led to some devastating outcomes for countries around the world, and it’s likely to be a major headwind for U.S. companies with operations overseas through the rest of the year.

For many investors and consumers, there are still two burning questions: why has the U.S. dollar been so strong this year, and where is it headed next?

Multiple top Wall Street chief investment officers and strategists told Fortune that a new trend has emerged and is driving the dollar’s strength, but most argue the greenback will begin to drop by the end of the year. Here’s what they had to say.

Why is the dollar so strong?

Historically, currency movements have largely been related to relative interest rates and economic strength. To understand the dollar, experts told Fortune to look no further than the Federal Reserve, which is currently jacking up interest rates at a pace unseen since the 1990s.

“The dollar is strong because the Fed is in the midst of the most aggressive monetary tightening policy among major central banks in the world,” Eric Leve, the chief investment officer at the wealth and investment management firm Bailard, told Fortune.

Leve noted that the Fed’s rate increases have pushed real yields on government bonds (or bond investors’ returns from interest payments after accounting for inflation) into positive territory for the first time in years. This makes U.S. bonds more attractive for investors around the world, thereby increasing the relative value of the dollar.

Leve also argued that the Fed’s rate increases have left the U.S. economy in a better place than many of its peers when it comes to inflation and recession risk.

The U.S., because of the Fed, is in many ways the cleanest dirty shirt.

—BAILARD'S CIO ERIC LEVE

The Fed’s actions also help to reduce inflation expectations (consumers' and investors' inflation outlook), which makes the U.S. more appealing to global investors that fear rising consumer prices.

Sam Stovall, the chief investment strategist at the investment research firm CFRA Research, told Fortune that the dollar’s strength has been helped by this relative attractiveness. It’s a “flight to safety” for foreign investors amid global recession fears, he said.

But after the COVID-19 pandemic and Russia’s invasion of Ukraine, a new dynamic has also emerged affecting the relative strength of currencies around the world—self-sufficiency.

When COVID-19 took hold in 2020, it led to a global supply chain nightmare, fueling shortages in everything from semiconductors to toilet paper, and pushing commodity prices to new heights. The S&P GSCI Index, a broad measure of the price of raw materials worldwide, has soared by more than 180% in the years since.

As a result, many nations around the world have become more protective of their commodity supplies, and a new wave of deglobalization has taken hold. Because of the U.S.’ relative self-sufficiency when it comes to energy and other commodity supplies, this commodity protectionism has led the dollar to appreciate.

The Ukraine war only exacerbated the trend as Europe’s natural gas supplies were immediately and dramatically affected, leading prices to soar more than 400% in the past year. This has left the bloc scrambling to meet its energy needs, and so far it’s failed. The International Energy Agency (IEA) even warned this week that the EU will need to cut its natural gas consumption immediately or face a "long, hard winter."

The end result of Europe’s energy crisis and lack of self-sufficiency is falling exports and rising imports at a time when commodity prices remain elevated.

Huw Roberts, the head of analytics at the macro data analytics firm Quant Insight, told Fortune that this amounts to a “terms of trade shock,” where import prices have soared relative to export prices.

“If you are an energy importer, then this is hugely hurtful,” he said. “But if you're an energy exporter, then actually you stand to benefit.”

Countries that export more energy and have more self-sufficiency in their commodity supply, like the U.S., have seen their currencies appreciate, while countries and regions without commodity self-sufficiency, like the E.U., have watched their currencies drop.

What are the effects of the strong dollar?

For U.S. consumers, the strong dollar not only makes international travel much cheaper; it also helps to reduce inflation.

“At the margin, the stronger dollar is putting a bit of a limiter on [U.S.] inflation,” Bailard’s Leve said. “By having a strong dollar, purchasing goods from abroad, as U.S. consumers tend to do, becomes much cheaper. And so we're essentially importing deflation.”

Some U.S. businesses also benefit from a strong dollar, which acts to lower commodity prices.

“So, if it's maybe more of a manufacturing company, and they're buying raw materials that are priced in dollars and commodities are coming lower, then a strong dollar actually helps them,” said Quant Insights’ Roberts.

Those businesses are the exception, however. For most U.S.-based corporations, the strong dollar is an unwelcome headwind.

“If you're trying to sell goods overseas, that strong dollar makes your goods all the more expensive, putting a burden on top line revenue for US companies,” Leve noted.

On top of that, Brent Schutte, the chief investment strategist at Northwestern Mutual Wealth Management Company, told Fortune that when U.S. companies attempt to repatriate their foreign earnings, the strong dollar means they are getting less back than they have in previous years.

“Certainly if you have a lot of earnings across the ocean, and in other currencies, when you convert them back, it could cause earnings misses,” Schutte said. IBM, Johnson and Johnson, and Netflix are among the companies whose quarterly financial results have already taken a hit this earnings season.

Ben Laidler, a global markets strategist for eToro, told the New York Times last week that the dollar's rise could cut the earnings of S&P 500 companies with large international operations by up to $100 billion this year. Still, Schutte noted that these “losses” are more of an “accounting convention.”

“I generally do think that investors, especially longer-term ones, would look through that,” he said.

The most harmful effects of a strong dollar occur outside the US, making it nearly impossible for lower-income countries—with national debts denominated in dollars—to pay back their creditors or buy enough basic goods. That painful reality has been on display in Sri Lanka, which was forced to default on its debts in May as its currency depreciated.

The South East Asian nation has now run out of U.S. dollars to pay for critical imports, leading to mass protests as citizens face starvation and wait in long lines for fuel.

“Every country that has large liability in dollars is a cause for concern,” Marcello Estevão, the World Bank’s global director for macroeconomics, trade, and investment, told the Wall Street Journal this week.

Where is the dollar headed from here?

While the dollar has had one of its best years in history so far in 2022, most experts believe it is nearing its peak.

“The dollar is expensive, it's overvalued relative to its peers,” Northwestern Mutual’s Schutte said. “If you look back to 2001, you're at similar levels of the dollar being overvalued, relative to other currencies, which did launch a 10-year time period of international outperformance that was largely driven by the dollar actually falling.”

Schutte pointed to purchasing power parity—or the idea that a given basket of goods should revert to a somewhat equal price around the world over the long run—as a key indicator that the dollar may be “overvalued.”

“One of the best measures of that is the Economists’ Big Mac Index, where you look at the price of that bun, that special sauce, the patties and everything else, and evaluate it around the world,” Bailard’s Eric Leve said. “It’s one of those ways that we can state that a currency is too cheap versus the dollar, given that all the components of a Big Mac are essentially global.”

The latest Big Mac Index was released on Thursday, and it showed that “nearly all currencies are undervalued against the dollar.”

Most experts that Fortune interviewed argued this shows that the dollar will likely see its value wane by the end of the year.

Northwestern Mutual’s Schutte noted that other central banks are “catching up” to the Fed with interest rate hikes, and there are some signs that U.S. inflation may be quietly coming down, including a recent commodity price retreat and falling inflation expectations on Wall Street. That could lead the Fed to less aggressive interest rate increases moving forward, slowing the dollar’s rise.

For investors, that means that non-U.S. equities may begin to look attractive by the end of the year.

“The strong dollar has made investing in non-U.S. equities pretty painful recently,” Leve said. “But I think as we look forward…we will see the dollar move from being a headwind to non-US equity investing to a tailwind.”

Not every expert sees the dollar nearing its peak, however. CFRA Research’s Sam Stovall said his economists have forecasted a strengthening dollar throughout the year and into 2023.

“As the Fed continues to raise rates, and at a pace that is equal to or greater than other central bankers, then I would say that that could continue to attract foreign investors to the U.S,” he said. “And also, as the threat of recession remains paramount. I think that would cause investors to want to continue to search for the dollar as a safe haven.”