本周,对衰退的担心席卷华尔街,股票、债券和加密货币大跌,投资者纷纷寻找避险之处。

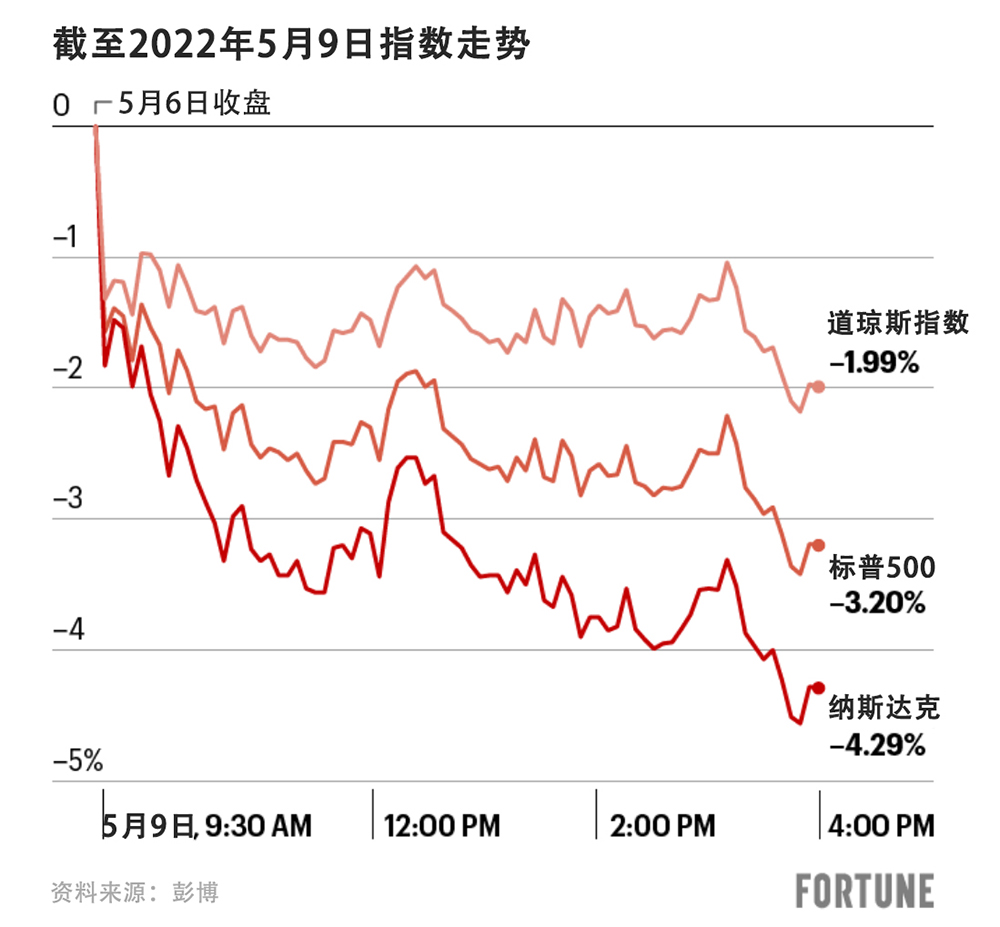

道琼斯指数下跌1.9%,标准普尔500指数和以科技股为主的纳斯达克综合指数分别下跌3.2%和4.3%。

“周一下跌部分原因在于,市场担心美联储(Fed)为抑制通胀可能最终导致衰退,”Bay Street Capital Holdings首席投资官威廉·休斯顿对《财富》表示,“经济衰退期间,企业收益往往受到影响,这正是股市担心所在。”

波音(Boeing)领跌道琼斯指数,下跌10.5%,阿根廷电商巨头Mercado Libre则是纳斯达克跌幅最大的股票,下跌16.9%。

周一科技股尤其承压,巨头亚马逊(Amazon)和苹果(Apple)分别下跌5.2%和3.3%。

人工智能热门公司Palantir Technologies之前高歌猛进,然而季度盈利报告公布的前景展望令人失望,股价暴跌超过21.3%。报道称,福特(Ford)已卖出800万股电动车初创公司Rivian的股票,摩根大通(JPMorgan)计划为匿名卖家再抛售1300万至1500万股。第二天,Rivian股价下跌了20.9%。

“美联储加息、通货膨胀、地缘政治持续紧张且市场充满对经济衰退的担心情绪,种种负面消息酿成了庞大的风暴,投资者无处躲藏,”Wedbush Securities的丹·艾夫斯对《财富》表示。“随着资金涌向安全资产,科技股遭到重创,市场进入熊市心态,科技投资者对痛苦的承受极限正经受考验。”

债市也相当惨淡,标准普尔500债券指数( S&P 500 Bond Index )下跌近1%,今年迄今跌幅已经超过11%。

加密货币也没给投资者喘息的机会,周一加密货币总市值下跌超过10%,降至1.5万亿美元以下。主要数字资产比特币暴跌约8%,至3.1万美元左右,以太币也紧随其后,当日下跌11%,至2300美元以下。

对于多样化投资者来说,这是华尔街黑暗一日,以往的避险资产未发挥任何作用。周一,黄金价格下跌超过1.5%至每盎司1850美元左右,大宗商品价格也全面崩溃。

由于欧盟放弃阻止油轮运输俄罗斯石油,国际油价基准布伦特原油价格下跌6.4%,至每桶105美元。

小麦和玉米价格也分别下跌1.65%和1.56%,木材期货下跌2%,价格约为每千板英尺815美元。(财富中文网)

译者:梁宇

审校:夏林

本周,对衰退的担心席卷华尔街,股票、债券和加密货币大跌,投资者纷纷寻找避险之处。

道琼斯指数下跌1.9%,标准普尔500指数和以科技股为主的纳斯达克综合指数分别下跌3.2%和4.3%。

“周一下跌部分原因在于,市场担心美联储(Fed)为抑制通胀可能最终导致衰退,”Bay Street Capital Holdings首席投资官威廉·休斯顿对《财富》表示,“经济衰退期间,企业收益往往受到影响,这正是股市担心所在。”

波音(Boeing)领跌道琼斯指数,下跌10.5%,阿根廷电商巨头Mercado Libre则是纳斯达克跌幅最大的股票,下跌16.9%。

周一科技股尤其承压,巨头亚马逊(Amazon)和苹果(Apple)分别下跌5.2%和3.3%。

人工智能热门公司Palantir Technologies之前高歌猛进,然而季度盈利报告公布的前景展望令人失望,股价暴跌超过21.3%。报道称,福特(Ford)已卖出800万股电动车初创公司Rivian的股票,摩根大通(JPMorgan)计划为匿名卖家再抛售1300万至1500万股。第二天,Rivian股价下跌了20.9%。

“美联储加息、通货膨胀、地缘政治持续紧张且市场充满对经济衰退的担心情绪,种种负面消息酿成了庞大的风暴,投资者无处躲藏,”Wedbush Securities的丹·艾夫斯对《财富》表示。“随着资金涌向安全资产,科技股遭到重创,市场进入熊市心态,科技投资者对痛苦的承受极限正经受考验。”

债市也相当惨淡,标准普尔500债券指数( S&P 500 Bond Index )下跌近1%,今年迄今跌幅已经超过11%。

加密货币也没给投资者喘息的机会,周一加密货币总市值下跌超过10%,降至1.5万亿美元以下。主要数字资产比特币暴跌约8%,至3.1万美元左右,以太币也紧随其后,当日下跌11%,至2300美元以下。

对于多样化投资者来说,这是华尔街黑暗一日,以往的避险资产未发挥任何作用。周一,黄金价格下跌超过1.5%至每盎司1850美元左右,大宗商品价格也全面崩溃。

由于欧盟放弃阻止油轮运输俄罗斯石油,国际油价基准布伦特原油价格下跌6.4%,至每桶105美元。

小麦和玉米价格也分别下跌1.65%和1.56%,木材期货下跌2%,价格约为每千板英尺815美元。(财富中文网)

译者:梁宇

审校:夏林

Recession fears hit Wall Street on Monday, leading to a broad rout in stocks, bonds, and cryptocurrencies as investors searched for somewhere to hide.

The Dow Jones industrial average dropped 1.9%, while the S&P 500 and tech-heavy Nasdaq Composite sank 3.2% and 4.3%, respectively.

“Monday’s declines are being driven in part by fears that the Fed’s efforts to tame inflation may end up causing a recession,” William Huston, the chief investment officer of Bay Street Capital Holdings, told Fortune. “Corporate earnings tend to suffer during recessions, and that’s what the stock market is worried about.”

Boeing led the Dow lower, falling 10.5%, while the Argentinian e-commerce leader Mercado Libre proved the biggest loser in the Nasdaq, sinking 16.9%.

Tech stocks were under particular pressure on Monday, with stalwarts like Amazon and Apple sinking 5.2% and 3.3%, respectively.

The once high-flying A.I. darling Palantir Technologies saw its stock crater more than 21.3% after posting a disappointing growth outlook in its quarterly earnings report. Shares of Rivian sank 20.9% the day after reports revealed that Ford had unloaded 8 million shares of the EV startup and that JPMorgan planned to sell an additional 13 million to 15 million shares for an unknown seller.

“It’s a perfect storm for investors with nowhere to hide as Fed hikes, inflation, geopolitical issues, and worries about a recession abound,” Wedbush Securities’ Dan Ives told Fortune. “Tech stocks are getting crushed on this flight to safety, and it’s a bear market mentality with the pain threshold being tested for tech investors.”

Bonds also had an off day, with the S&P 500 Bond Index sinking almost 1%, capping off a more than 11% drop year to date.

Cryptocurrencies didn’t offer any respite for investors either as the total crypto market cap sank over 10% to below $1.5 trillion on Monday. The leading digital asset, Bitcoin, plummeted roughly 8% to around $31,000, and Ether followed suit, falling 11% to under $2,300 on the day.

For the diversified investor, it was a dark day on Wall Street and typical safe-haven assets didn’t provide any help. Gold prices fell over 1.5% on Monday to around $1,850 per ounce in a broad rout for commodities.

Brent Crude oil prices, the international benchmark, fell 6.4% to $105 per barrel as the EU dropped its plan to stop oil tankers from transporting Russian supplies.

Wheat and corn prices also dipped 1.65% and 1.56%, respectively, while lumber futures fell 2% to trade at roughly $815 per thousand board feet.