在太阳能行业工作13年后,企业家拉菲·加拉贝迪安深有体会,为所谓的清洁技术初创公司筹资有多难。

清洁技术是跨越不同行业的广泛技术类别,旨在改善环境足迹。十多年前,投资者对可再生能源的兴趣一度高涨,但风险投资家在损失了数十亿美元后逐渐避开这个领域。加拉贝迪安回忆称,此后,很多清洁技术公司筹资荒持续了好几年。

目前,面临亟需解决的气候变化问题,新一代初创企业和投资者正推动着清洁技术行业筹资再次激增,特别是被称为“气候技术”的细分市场。

这一次,投资者环境有所不同:可以获得更多资本,为公司提供生产成品所需的资源;同时,由于政府和企业承诺实现净零排放,带来了更稳定的客户群。

“现在市场上有很多驱动因素,与以往任何时期都截然不同。”早期风投基金Clean Energy Ventures董事总经理丹尼尔•戈德曼在接受《财富》采访时称。

“增长格外强劲”

风投公司Energy Impact Partners合伙人、美国哥伦比亚大学全球能源政策中心非常驻研究员谢尔•坎内称,尽管自从2018年以来清洁技术初创企业投资激增,但今年的增长格外强劲。

“大量资金正在快速流入。”Cleantech Group首席执行官理查德·扬曼指出。

在早些时候的清洁技术热潮期间(2006-2011),投资者向全球清洁技术公司总计投入了约510亿美元资金。研究咨询公司Cleantech Group的数据显示,2021年上半年,清洁技术筹资就已飙升至640亿美元。由此判断,今年清洁技术投资有望达到创纪录的1000亿美元。

加拉贝迪安及其团队于2020年成立新公司Electric Hydrogen后,在今年6月的A轮筹资中顺利筹集到2400万美元,出资最多的是比尔·盖茨投资的公司Breakthrough Energy Ventures。

“如果你是一家尝试解决清洁技术领域重大问题的可靠的初创公司,就会有很多投资方感兴趣。”加拉贝迪安说。他是初创公司Electric Hydrogen的联合创始人兼首席执行官。该公司试图重新设计氢气电解技术,使其从根本上提高成本效益,扩大规模。

“Electric Hydrogen有实力,能兑现如下承诺:氢气可作为经济效益高的清洁能源,成为脱碳行业一部分。”卡迈克尔·罗伯茨说;罗伯茨是Material Impact管理合伙人,也是Breakthrough Energy Ventures(Electric Hydrogen投资方)成员。

气候技术

气候技术,泛指旨在减少温室气体排放的技术,在很大程度上推动了清洁技术投资的激增。

大量注入的资金,既来自综合性风投公司,也来自Breakthrough Energy Ventures、Lowercarbon Capital和Blue Bear Capital等专门致力于应对气候相关挑战的新公司。去年,亚马逊推出了气候承诺基金;这只高达20亿美元的企业风险投资基金,专门投资能够帮助亚马逊实现净零目标的初创企业。微软也有10亿美元的气候创新基金。

在新一轮气候技术浪潮这一特别因素的推动下,2020年代的清洁技术将与2000年代有何不同,目前尚无定论。

行业分析师认为,投资者热情将持续下去,因为新的增长因素在十年前并不存在。

“目前有个现成的买家群,他们迫切想要购买低碳和零碳产品,这些产品在上一个周期没有。”坎内说。许多国家承诺,到2050年实现净零排放,正在制定雄心勃勃的指标来实现这一目标。

坎内同时指出,这一次,“气候科技公司生命周期的所有阶段”都可以获得资金,为初创公司提供技术测试和商业模式所需的资源。

IHS Markit Zoco清洁能源技术总监埃杜尔内·索科指出,在之前的繁荣时期,情况并非如此。上一次清洁技术泡沫破裂的原因是:风险投资家对当时无法筹集到足够资金达到规模效应的企业和技术进行了高风险投资。

清洁技术初创公司筹集大量资金的一种新方式是通过特殊目的收购公司(SPAC)。自从2020年初以来,SPAC收购了32家清洁技术初创公司。尽管对SPAC有明显好处,但分析师已经对过度活跃的SPAC投资者和估值可能过高的公司表示担忧,这会在以后引起麻烦。

随着太阳能、风能和电动汽车的价格持续走低,这一次,许多清洁技术产品更为人熟知。与之前的清洁技术热潮相比,企业家和投资者都吸取了教训,有了更现实的期望。

“我们对气候技术有个基本看法,它不能成为慈善事业。”聚焦绿色技术的风险与成长公司G2 Venture Partners合伙人瓦莱丽•沈表示。

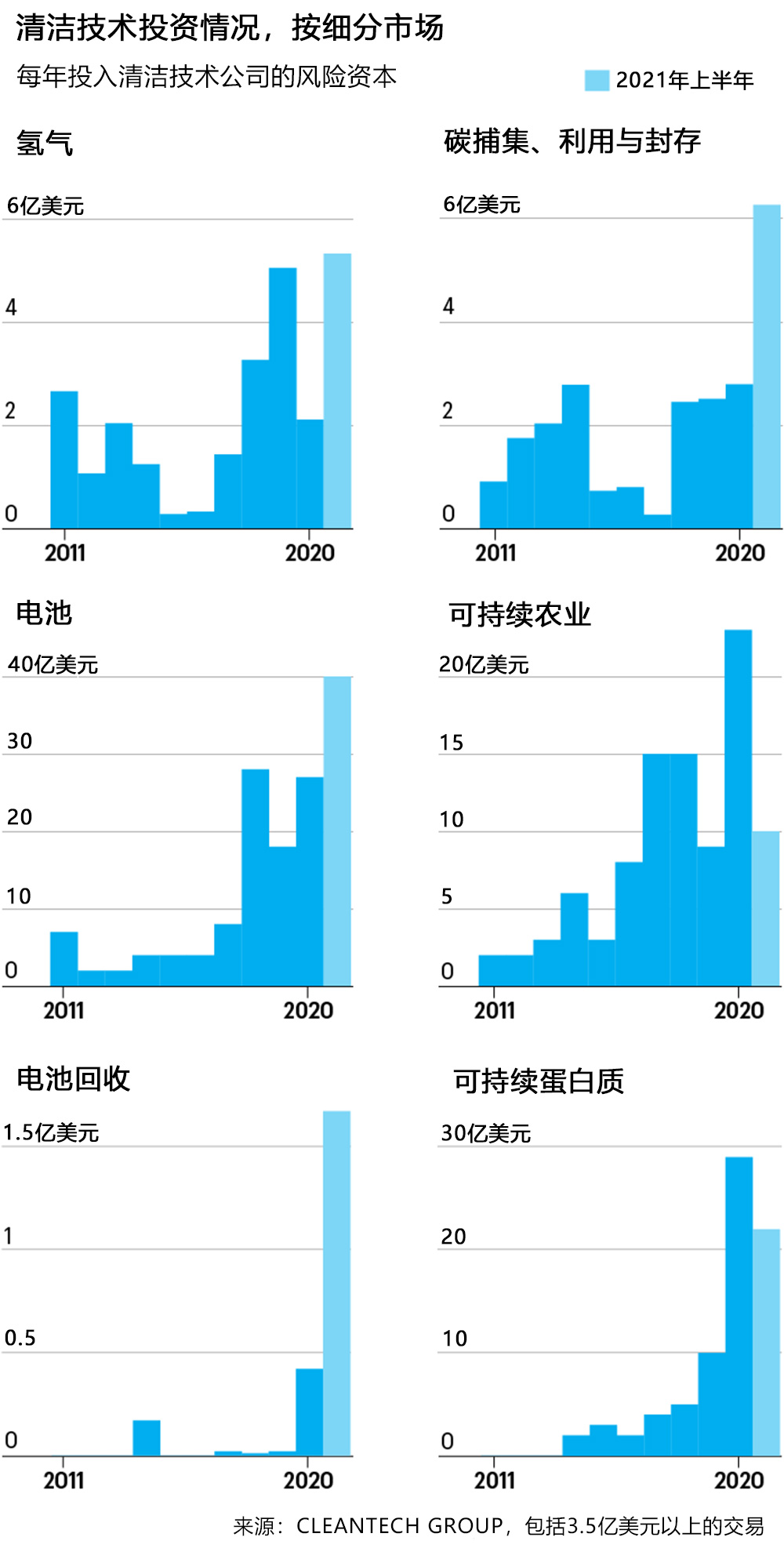

所有这些新驱动因素的一个结果是,清洁技术领域的活动开始蓬勃发展。与在清洁技术1.0时代发挥重要作用的风能、太阳能和生物燃料相比,这些领域一直处于相对休眠状态。很多投资者对气候安全有了更宽泛的定义,把农业和食品技术等行业纳入在内,2000年代的清洁技术还不包括这些行业。

这一次,绿色氢气被视为重型运输和高热工业等行业脱碳的可能方法,因此引起了投资者的更大兴趣。

“公司和政策制定者正在尝试把氢气作为下一波脱碳的促进因素。”索科指出。

同样具有发展潜力的还有碳捕集、利用与封存技术,该技术旨在通过分离二氧化碳排放,将其锁入产品或永久封存在地下,从而达到减排目的。

“该技术还处于早期阶段,但对于遏制全球变暖至关重要。”GreenBiz Group分析师吉姆•贾尔斯称。

电池创新等领域的投资也在增加,企业家正在努力生产性能更好、环境足迹更佳的电池。

需要新的基础设施

初创企业的许多创新本质上是资本密集型,这会给今后的技术规模扩大带来挑战。同时,这些公司也缺乏相关支持性基础设施。在长途货运中用氢气燃料取代汽油,不仅需要大量绿色氢气燃料,还需要基础设施,以便卡车补充燃料。

“让我夜不能寐的是,我们可能在技术上投入的时间太多,在基础设施上投入的时间太少。”美国硅谷银行能源与资源创新董事总经理凯利•贝尔彻说。

扬曼指出,要在如此短的时间内用一种全新的脱碳系统有效取代两百多年前发明的工业系统,是个巨大挑战;仅靠私人投资不足以向净零世界过渡。

“在这个过程中会有失望和公司倒闭,也不会一下子全部实现清洁技术。”扬曼说。

对于加拉贝迪安等企业家来说,有匹配的因素让他感到不同,带给他乐观情绪。但加拉贝迪安和Electric Hydrogen的其他联合创始人并不认为目前的投资状况是新常态。

“虽然不知道什么时候会发生变化,也不知道会发生多大的变化,但我们已经准备就绪。”他说。(财富中文网)

译者:夏晴

在太阳能行业工作13年后,企业家拉菲·加拉贝迪安深有体会,为所谓的清洁技术初创公司筹资有多难。

清洁技术是跨越不同行业的广泛技术类别,旨在改善环境足迹。十多年前,投资者对可再生能源的兴趣一度高涨,但风险投资家在损失了数十亿美元后逐渐避开这个领域。加拉贝迪安回忆称,此后,很多清洁技术公司筹资荒持续了好几年。

目前,面临亟需解决的气候变化问题,新一代初创企业和投资者正推动着清洁技术行业筹资再次激增,特别是被称为“气候技术”的细分市场。

这一次,投资者环境有所不同:可以获得更多资本,为公司提供生产成品所需的资源;同时,由于政府和企业承诺实现净零排放,带来了更稳定的客户群。

“现在市场上有很多驱动因素,与以往任何时期都截然不同。”早期风投基金Clean Energy Ventures董事总经理丹尼尔•戈德曼在接受《财富》采访时称。

“增长格外强劲”

风投公司Energy Impact Partners合伙人、美国哥伦比亚大学全球能源政策中心非常驻研究员谢尔•坎内称,尽管自从2018年以来清洁技术初创企业投资激增,但今年的增长格外强劲。

“大量资金正在快速流入。”Cleantech Group首席执行官理查德·扬曼指出。

在早些时候的清洁技术热潮期间(2006-2011),投资者向全球清洁技术公司总计投入了约510亿美元资金。研究咨询公司Cleantech Group的数据显示,2021年上半年,清洁技术筹资就已飙升至640亿美元。由此判断,今年清洁技术投资有望达到创纪录的1000亿美元。

加拉贝迪安及其团队于2020年成立新公司Electric Hydrogen后,在今年6月的A轮筹资中顺利筹集到2400万美元,出资最多的是比尔·盖茨投资的公司Breakthrough Energy Ventures。

“如果你是一家尝试解决清洁技术领域重大问题的可靠的初创公司,就会有很多投资方感兴趣。”加拉贝迪安说。他是初创公司Electric Hydrogen的联合创始人兼首席执行官。该公司试图重新设计氢气电解技术,使其从根本上提高成本效益,扩大规模。

“Electric Hydrogen有实力,能兑现如下承诺:氢气可作为经济效益高的清洁能源,成为脱碳行业一部分。”卡迈克尔·罗伯茨说;罗伯茨是Material Impact管理合伙人,也是Breakthrough Energy Ventures(Electric Hydrogen投资方)成员。

气候技术

气候技术,泛指旨在减少温室气体排放的技术,在很大程度上推动了清洁技术投资的激增。

大量注入的资金,既来自综合性风投公司,也来自Breakthrough Energy Ventures、Lowercarbon Capital和Blue Bear Capital等专门致力于应对气候相关挑战的新公司。去年,亚马逊推出了气候承诺基金;这只高达20亿美元的企业风险投资基金,专门投资能够帮助亚马逊实现净零目标的初创企业。微软也有10亿美元的气候创新基金。

在新一轮气候技术浪潮这一特别因素的推动下,2020年代的清洁技术将与2000年代有何不同,目前尚无定论。

行业分析师认为,投资者热情将持续下去,因为新的增长因素在十年前并不存在。

“目前有个现成的买家群,他们迫切想要购买低碳和零碳产品,这些产品在上一个周期没有。”坎内说。许多国家承诺,到2050年实现净零排放,正在制定雄心勃勃的指标来实现这一目标。

坎内同时指出,这一次,“气候科技公司生命周期的所有阶段”都可以获得资金,为初创公司提供技术测试和商业模式所需的资源。

IHS Markit Zoco清洁能源技术总监埃杜尔内·索科指出,在之前的繁荣时期,情况并非如此。上一次清洁技术泡沫破裂的原因是:风险投资家对当时无法筹集到足够资金达到规模效应的企业和技术进行了高风险投资。

清洁技术初创公司筹集大量资金的一种新方式是通过特殊目的收购公司(SPAC)。自从2020年初以来,SPAC收购了32家清洁技术初创公司。尽管对SPAC有明显好处,但分析师已经对过度活跃的SPAC投资者和估值可能过高的公司表示担忧,这会在以后引起麻烦。

随着太阳能、风能和电动汽车的价格持续走低,这一次,许多清洁技术产品更为人熟知。与之前的清洁技术热潮相比,企业家和投资者都吸取了教训,有了更现实的期望。

“我们对气候技术有个基本看法,它不能成为慈善事业。”聚焦绿色技术的风险与成长公司G2 Venture Partners合伙人瓦莱丽•沈表示。

所有这些新驱动因素的一个结果是,清洁技术领域的活动开始蓬勃发展。与在清洁技术1.0时代发挥重要作用的风能、太阳能和生物燃料相比,这些领域一直处于相对休眠状态。很多投资者对气候安全有了更宽泛的定义,把农业和食品技术等行业纳入在内,2000年代的清洁技术还不包括这些行业。

这一次,绿色氢气被视为重型运输和高热工业等行业脱碳的可能方法,因此引起了投资者的更大兴趣。

“公司和政策制定者正在尝试把氢气作为下一波脱碳的促进因素。”索科指出。

同样具有发展潜力的还有碳捕集、利用与封存技术,该技术旨在通过分离二氧化碳排放,将其锁入产品或永久封存在地下,从而达到减排目的。

“该技术还处于早期阶段,但对于遏制全球变暖至关重要。”GreenBiz Group分析师吉姆•贾尔斯称。

电池创新等领域的投资也在增加,企业家正在努力生产性能更好、环境足迹更佳的电池。

需要新的基础设施

初创企业的许多创新本质上是资本密集型,这会给今后的技术规模扩大带来挑战。同时,这些公司也缺乏相关支持性基础设施。在长途货运中用氢气燃料取代汽油,不仅需要大量绿色氢气燃料,还需要基础设施,以便卡车补充燃料。

“让我夜不能寐的是,我们可能在技术上投入的时间太多,在基础设施上投入的时间太少。”美国硅谷银行能源与资源创新董事总经理凯利•贝尔彻说。

扬曼指出,要在如此短的时间内用一种全新的脱碳系统有效取代两百多年前发明的工业系统,是个巨大挑战;仅靠私人投资不足以向净零世界过渡。

“在这个过程中会有失望和公司倒闭,也不会一下子全部实现清洁技术。”扬曼说。

对于加拉贝迪安等企业家来说,有匹配的因素让他感到不同,带给他乐观情绪。但加拉贝迪安和Electric Hydrogen的其他联合创始人并不认为目前的投资状况是新常态。

“虽然不知道什么时候会发生变化,也不知道会发生多大的变化,但我们已经准备就绪。”他说。(财富中文网)

译者:夏晴

After 13 years in the solar energy industry, entrepreneur Raffi Garabedian knew exactly how hard it could be to raise funding for the so-called cleantech startups, a wide category of technologies spanning different industries and aiming to improve environmental footprint.

After an initial boom of investor interest in renewable energy over a decade ago, venture capitalists began turning away after losing billions. The funding drought that followed lasted several years for many cleantech companies, Garabedian recalled.

Now, the urgency of climate change and a new generation of startups and investors are fueling another surge of funding into the clean tech space, especially the segment known as climate tech.

This time, the investor environment is different. That includes an increased availability of capital, providing companies the resources they need to bring their products to fruition, as well as a more robust customer base due to an influx of pledges from governments and corporations to achieve net zero emissions.

“There are a lot of drivers in the market that are radically different from any period of the past,” said Daniel Goldman, managing director at Clean Energy Ventures, an early-stage venture capital fund, in an interview with Fortune.

‘Supercharged’

While investment in clean tech startups shot up since 2018, this year it has been “supercharged” according to Shayle Kann, a partner at venture capital firm Energy Impact Partners, who also serves as a non-resident fellow at the Columbia University Center on Global Energy Policy.

There is a “massive amount of capital flowing in fast,” noted Richard Youngman, CEO of Cleantech Group.

During the earlier clean tech boom, considered to have lasted from 2006 to 2011, investors allocated about $51 billion in total funding to clean tech companies globally. While in the first half of 2021, clean tech funding surged to $64 billion, according to data from research and consulting firm Cleantech Group. Based on this data, clean tech investments are on track to reach a record of $100 billion this year.

After founding a new company, Electric Hydrogen, in 2020, Garabedian and his team had no issues raising $24 million in Series A funding this past June, led by Breakthrough Energy Ventures, a Bill Gates investment firm.

“If you are a credible startup trying to solve an important problem in clean tech, there is really a lot of interest,” said Garabedian, a co-founder and CEO of the startup that is trying to redesign hydrogen electrolysis to make it radically more cost effective and larger scale.

“Electric Hydrogen has what it takes to make good on the promise of hydrogen as a clean and economical building block for the decarbonizing industry," said Carmichael Roberts, a managing partner at Material Impact and a member of Breakthrough Energy Ventures that invested in the startup.

Climate Tech to the Rescue

Climate tech, which is broadly defined as technology aimed at reducing greenhouse gas emissions, has fueled much of the surge in clean tech investments.

Funding is pouring in from both generalist venture capital firms, but also newer firms specifically dedicated to addressing climate-related challenges like Breakthrough Energy Ventures, Lowercarbon Capital and Blue Bear Capital. Last year Amazon launched its own $2 billion corporate venture capital fund, the Climate Pledge Fund, dedicated to investing in start-ups that can help it meet its net-zero goals and Microsoft has its own $1 billion Climate Innovation Fund also.

The jury is still out on how the clean tech in the 2020s, particularly buoyed by the new climate tech wave, will prove to be different from the 2000s.

Industry analysts argue that investor enthusiasm will endure because of the new growth factors that were not around a decade ago.

“There is a ready and eager buyer pool for low and zero carbon products that didn’t exist in that last cycle,” says Kann. Many nations have pledged to achieve net zero emissions by 2050 and are setting aggressive targets to meet that goal.

Also, this time around, funding is available “at all stages of a climate tech company’s journey” notes Kann, providing startups with the resources they need to test their technologies and business models.

This wasn’t the case in the previous boom, noted Edurne Zoco, director of clean energy technology at IHS Markit Zoco, noting that the last clean tech bust resulted from venture capitalists making high-risk investments in companies and technologies that then couldn’t raise enough capital to reach scale.

One new way that clean tech startups are raising large amounts of capital is through special purpose acquisition companies (SPACs). Since the start of 2020, 32 clean tech startups were acquired by SPACs. While there are clear benefits to SPACs, analysts are already raising concerns about SPAC investors who are over-exuberant and companies that can be overvalued, leading to trouble down the road.

With solar, wind and electric vehicles getting cheaper, a lot of the clean tech offerings are more familiar this time. Both entrepreneurs and investors have learned lessons and have more realistic expectations compared to the previous clean tech boom.

“One of our fundamental perspectives on climate tech is that it can’t be a charity,” said Valerie Shen, a partner at G2 Venture Partners, a venture and growth firm focused on green technology.

One consequence of all these new drivers is that activity is beginning to thrive in areas of clean tech that have been relatively dormant compared to wind, solar and biofuels, which played a prominent role in Cleantech 1.0. Many investors have a broader definition of what climate security looks like, which includes industries like agriculture and food technology that was absent from clean tech in the 2000s.

Green hydrogen, which is seen as a possible way to decarbonize industries like heavy transportation and high heat industries, is beginning to win more interest from investors this time.

“Companies and policymakers are trying to place hydrogen as the enabler of the next wave of decarbonization,” notes Zoco.

Also with development potential is carbon capture, utilization and storage (CCUS) technology, intended to reduce carbon dioxide emissions by separating them and then either locking them into products or storing them permanently underground.

“It is early stage, but critical if we are to limit global warming,” said Jim Giles, an analyst at the GreenBiz Group.

Investments are also increasing in areas like battery innovation, where entrepreneurs are trying to produce batteries that perform better and have a better environmental footprint.

New Infrastructure Needed

Many of the startups’ innovations are capital-intensive by nature, which will make it challenging to scale their technologies. There is also a dearth of infrastructure to support them. To replace gasoline with hydrogen fuel in long haul trucking not only requires green hydrogen at scale, but the infrastructure so the trucks can refuel.

“What keeps me up at night is the thought that perhaps we're spending too much time investing in technology and too little investing in the infrastructure,” said Kelly Belcher, the managing director of energy and resource innovation at Silicon Valley Bank.

The challenge of effectively replacing an industrial system invented over two centuries ago with a whole new decarbonized one in such a short space of time is immense, noted Youngman, noting that private investment alone will not be sufficient to transition to a net zero world.

“There will be disappointments and company failures along the way, but it won’t be all clean tech in one go,” said Youngman.

For entrepreneurs like Garabedian, there is an alignment of factors that feels different and gives him optimism. Yet he and his co-founders at Electric Hydrogen won’t put their faith in the current investment situation being the new normal.

“We don’t know when or how deeply it is going to shift, but we are prepared for it,” he said.