波音的卫星工厂位于洛杉矶国际机场附近的工业区,长期以来一直是美国航空和航天工业的中心。工厂建于20世纪40年代,当初是为老纳什汽车公司(Nash Motors)建造,后来工厂装配线推出了标志性的“漫步者”(Rambler)。20世纪50年代,航空业传奇巨头霍华德·休斯(Howard Hughes)同名的航空航天公司收购了这块地,并很快建造了全球最早的商业卫星。

2000年波音公司收购休斯的太空业务时,将该工厂收入囊中。如今,波音卫星系统公司(Boeing Satellite Systems)是全球最大的卫星制造商之一,隶属于国防、空间和安全部门。今年上半年,该部门为波音创造了140亿美元的销售额,占总收入的43%以上。

如今,波音在快速增长的航天领域面临着激烈竞争。随着宽带互联网服务需求增加,埃隆·马斯克的SpaceX等新贵纷纷发射重量更轻、更精简、技术也更先进的卫星。大量资金史无前例地投入到“太空科技”领域,去年以太空业务为主的初创公司筹集资金超过70亿美元。现在波音发现,反而是自己要为现代太空竞赛中保持领先地位而奋斗。

“技术不断改变,现在流行小卫星组成大星座,要关注保守派将如何与之竞争。”美国银行(Bank of America)的航空航天和国防股票分析师罗纳德·爱泼斯坦说。

“保守派”波音要跟上所谓的新空间经济,关键战场是位于洛杉矶国际机场附近100万平方英尺(约92903.04平方米)的巨大卫星工厂。主厂房就像巨大的白色盒子,30多米高的天花板上明亮的荧光灯散发着光芒。波音团队正在为公司最大的商业客户之一、位于卢森堡的卫星运营商SES研发最先进的卫星。

波音从20世纪90年代初就开始为SES制造卫星,当时卫星部门仍然属于休斯航天通信公司(Hughes Space and Communications)。现在波音和SES合作开发了11颗通信卫星组成的星座,运行高度为中轨道,距离地球大约5000英里(约8046.72千米)。该星座称为O3bmPower,目标是为云计算提供商、电信公司、航运公司、邮轮和航空公司等客户提供宽带互联网和数据连接。

新卫星将更新SES运营的星座,原本的20颗卫星由波音竞争对手泰雷兹阿莱尼亚宇航公司(Thales Alenia Space)制造,8年前发射。至于第二代卫星,波音要帮助SES提升原有网络的能力,方法是设计一组体积较小、运行更快更灵活的卫星,新型O3b mPower卫星尺寸仅为前代一半,数据容量则增加到10倍多。最初的O3b卫星配备了多达10个模拟“宽波束”,类似于将信号发射到地球的小型卫星天线。新版本完全实现数字化,可操纵波束多达5000个,能够更精确地重定向和调整,显著提高了为SES客户提供服务的速度、范围和精度。

“就好比从iPhone一步升级到iPhone 12。”SES的首席执行官史蒂夫·科勒说,他站在波音工厂里,跟其他人一样穿着白罩衫,戴着发网和透明护目镜。他旁边站着波音的空间和发射部门的高级副总裁吉姆·奇尔顿。他指出,流线型、数字化的新型卫星使用的硬件组件比起老款也少得多。

SES的新卫星发射到中地球轨道后,预计运行轨道将更接近地球,从而减少宽带通信延迟,且能够覆盖全球96%的人口。摩根士丹利(Morgan Stanley)的研究显示,新卫星可以帮助运营商满足人们对更快速、更廉价宽带数据日益增长的需求,未来20年内将推动全球航天业70%的增长。

“卫星的超级能力就是触达。”科勒指出。尽管长期以来,在地球上空22000英里(约35405.57千米)轨道运行的地球同步卫星能够实现触达,但由于距离远,一直存在延迟问题。“这就是让卫星离地球更近,利用卫星传送互联网的革命性想法源头所在。”他补充道。

虽然第一颗O3b mPower卫星要等到今年晚些时候才可以发射,但已经吸引了法国电信公司Orange和邮轮运营商嘉年华(Carnival)等客户。云计算公司也是很关键且不断增长的市场。SES最近吸引了亚马逊(Amazon)的AWS和微软(Microsoft)的Azure等云供应商,之前云供应商一直在寻求中轨道卫星支持其宽带连接,减少自身云网络的延迟。

SES并不是唯一一家向云供应商推销新卫星技术潜力的公司。去年宣布与SES建立合作关系时,微软也与SpaceX达成了新合作,其中包括接入埃隆·马斯克领导的Starlink宽带卫星网络。Starlink计划最终将数万颗小卫星送入距地表不到1000英里(约1609.34千米)的低地球轨道,目标是提升宽带互联网访问速度。(SES和SpaceX在卫星开发方面是竞争对手,也有密切的业务关系;SES是SpaceX的第一个商业客户,SES新款卫星将利用SpaceX的猎鹰9号火箭发射。)

尽管科勒注意到低地球轨道发射卫星的成本高企,而且技术更复杂,但他还是表示SES将追求“多轨道战略”,最终可能效仿SpaceX推出自己的低轨道项目。虽然SpaceX的出现威胁到波音和SES等长期的主导地位,他却还是赞扬SpaceX协助降低成本,为航天领域新加入者和现有各方创造了更多的创新空间。

奇尔顿指出,波音已经制定多轨道战略,也就是说将更关注SES中轨道系统等新卫星技术提供的“数字未来”。作为制造商,波音希望与“努力改变行业的顶端人士合作,”奇尔顿说,与此同时将逐渐淘汰过去几年的模拟地球同步技术。“我们赌下了全部身家,将携新技术闯进新世界。”

科勒补充说,新技术的最终结果是,在地球上随时随地都可以轻松选择上网。他指出,几年前曾经与皇家加勒比邮轮公司(Royal Carbitra)的高管交流,当时邮轮公司认为船上需要的数据不超过0.5Gb。然而随着时间推移,越来越多乘客抱怨邮轮上缺少Wi-Fi。按照科勒的说法,现在皇家加勒比为邮轮上每位乘客提供的数据超过了1Gb,而且均通过SES的卫星传送。

“现在这一行业非常激动人心。”科勒说,“对于熟悉航天未来发展的老牌玩家来说,可以抓住很多机会提供全新的服务。”(财富中文网)

译者:梁宇

审校:夏林

波音的卫星工厂位于洛杉矶国际机场附近的工业区,长期以来一直是美国航空和航天工业的中心。工厂建于20世纪40年代,当初是为老纳什汽车公司(Nash Motors)建造,后来工厂装配线推出了标志性的“漫步者”(Rambler)。20世纪50年代,航空业传奇巨头霍华德·休斯(Howard Hughes)同名的航空航天公司收购了这块地,并很快建造了全球最早的商业卫星。

2000年波音公司收购休斯的太空业务时,将该工厂收入囊中。如今,波音卫星系统公司(Boeing Satellite Systems)是全球最大的卫星制造商之一,隶属于国防、空间和安全部门。今年上半年,该部门为波音创造了140亿美元的销售额,占总收入的43%以上。

如今,波音在快速增长的航天领域面临着激烈竞争。随着宽带互联网服务需求增加,埃隆·马斯克的SpaceX等新贵纷纷发射重量更轻、更精简、技术也更先进的卫星。大量资金史无前例地投入到“太空科技”领域,去年以太空业务为主的初创公司筹集资金超过70亿美元。现在波音发现,反而是自己要为现代太空竞赛中保持领先地位而奋斗。

“技术不断改变,现在流行小卫星组成大星座,要关注保守派将如何与之竞争。”美国银行(Bank of America)的航空航天和国防股票分析师罗纳德·爱泼斯坦说。

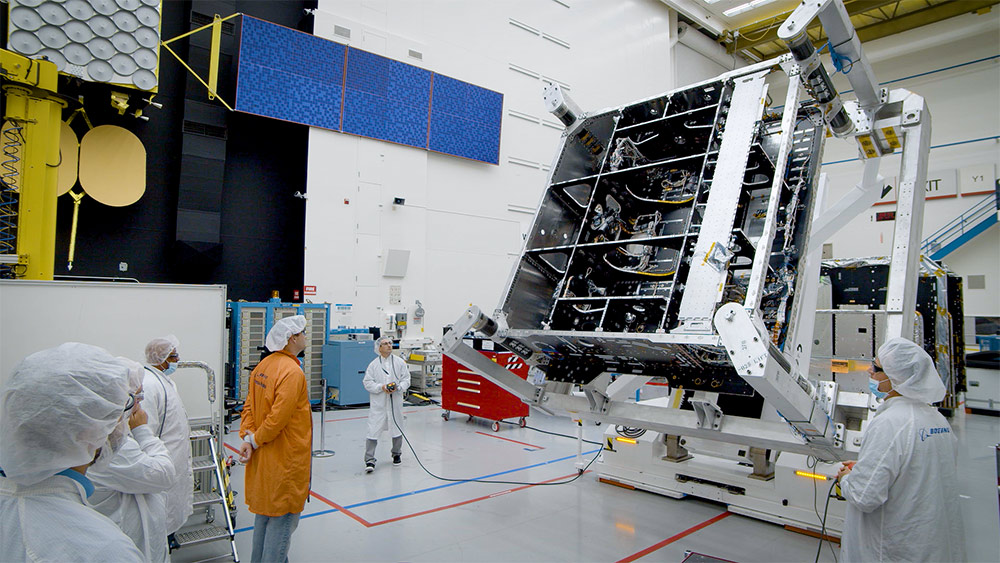

位于加州埃尔塞贡多的波音卫星系统公司的工厂正在检查O3b mPower卫星硬件。新卫星是为卫星运营商SES建造,目标是显著减少组件和重量,同时增加数据容量。

“保守派”波音要跟上所谓的新空间经济,关键战场是位于洛杉矶国际机场附近100万平方英尺(约92903.04平方米)的巨大卫星工厂。主厂房就像巨大的白色盒子,30多米高的天花板上明亮的荧光灯散发着光芒。波音团队正在为公司最大的商业客户之一、位于卢森堡的卫星运营商SES研发最先进的卫星。

波音从20世纪90年代初就开始为SES制造卫星,当时卫星部门仍然属于休斯航天通信公司(Hughes Space and Communications)。现在波音和SES合作开发了11颗通信卫星组成的星座,运行高度为中轨道,距离地球大约5000英里(约8046.72千米)。该星座称为O3bmPower,目标是为云计算提供商、电信公司、航运公司、邮轮和航空公司等客户提供宽带互联网和数据连接。

新卫星将更新SES运营的星座,原本的20颗卫星由波音竞争对手泰雷兹阿莱尼亚宇航公司(Thales Alenia Space)制造,8年前发射。至于第二代卫星,波音要帮助SES提升原有网络的能力,方法是设计一组体积较小、运行更快更灵活的卫星,新型O3b mPower卫星尺寸仅为前代一半,数据容量则增加到10倍多。最初的O3b卫星配备了多达10个模拟“宽波束”,类似于将信号发射到地球的小型卫星天线。新版本完全实现数字化,可操纵波束多达5000个,能够更精确地重定向和调整,显著提高了为SES客户提供服务的速度、范围和精度。

“就好比从iPhone一步升级到iPhone 12。”SES的首席执行官史蒂夫·科勒说,他站在波音工厂里,跟其他人一样穿着白罩衫,戴着发网和透明护目镜。他旁边站着波音的空间和发射部门的高级副总裁吉姆·奇尔顿。他指出,流线型、数字化的新型卫星使用的硬件组件比起老款也少得多。

加州埃尔塞贡多的波音卫星系统工厂,O3b mPower卫星硬件详细图。与上一代O3b卫星相比,波音设计的新卫星更小、更轻、完全数字化,数据容量更大,信号也更灵活。

SES的新卫星发射到中地球轨道后,预计运行轨道将更接近地球,从而减少宽带通信延迟,且能够覆盖全球96%的人口。摩根士丹利(Morgan Stanley)的研究显示,新卫星可以帮助运营商满足人们对更快速、更廉价宽带数据日益增长的需求,未来20年内将推动全球航天业70%的增长。

“卫星的超级能力就是触达。”科勒指出。尽管长期以来,在地球上空22000英里(约35405.57千米)轨道运行的地球同步卫星能够实现触达,但由于距离远,一直存在延迟问题。“这就是让卫星离地球更近,利用卫星传送互联网的革命性想法源头所在。”他补充道。

虽然第一颗O3b mPower卫星要等到今年晚些时候才可以发射,但已经吸引了法国电信公司Orange和邮轮运营商嘉年华(Carnival)等客户。云计算公司也是很关键且不断增长的市场。SES最近吸引了亚马逊(Amazon)的AWS和微软(Microsoft)的Azure等云供应商,之前云供应商一直在寻求中轨道卫星支持其宽带连接,减少自身云网络的延迟。

SES并不是唯一一家向云供应商推销新卫星技术潜力的公司。去年宣布与SES建立合作关系时,微软也与SpaceX达成了新合作,其中包括接入埃隆·马斯克领导的Starlink宽带卫星网络。Starlink计划最终将数万颗小卫星送入距地表不到1000英里(约1609.34千米)的低地球轨道,目标是提升宽带互联网访问速度。(SES和SpaceX在卫星开发方面是竞争对手,也有密切的业务关系;SES是SpaceX的第一个商业客户,SES新款卫星将利用SpaceX的猎鹰9号火箭发射。)

尽管科勒注意到低地球轨道发射卫星的成本高企,而且技术更复杂,但他还是表示SES将追求“多轨道战略”,最终可能效仿SpaceX推出自己的低轨道项目。虽然SpaceX的出现威胁到波音和SES等长期的主导地位,他却还是赞扬SpaceX协助降低成本,为航天领域新加入者和现有各方创造了更多的创新空间。

奇尔顿指出,波音已经制定多轨道战略,也就是说将更关注SES中轨道系统等新卫星技术提供的“数字未来”。作为制造商,波音希望与“努力改变行业的顶端人士合作,”奇尔顿说,与此同时将逐渐淘汰过去几年的模拟地球同步技术。“我们赌下了全部身家,将携新技术闯进新世界。”

科勒补充说,新技术的最终结果是,在地球上随时随地都可以轻松选择上网。他指出,几年前曾经与皇家加勒比邮轮公司(Royal Carbitra)的高管交流,当时邮轮公司认为船上需要的数据不超过0.5Gb。然而随着时间推移,越来越多乘客抱怨邮轮上缺少Wi-Fi。按照科勒的说法,现在皇家加勒比为邮轮上每位乘客提供的数据超过了1Gb,而且均通过SES的卫星传送。

“现在这一行业非常激动人心。”科勒说,“对于熟悉航天未来发展的老牌玩家来说,可以抓住很多机会提供全新的服务。”(财富中文网)

译者:梁宇

审校:夏林

Boeing's satellite factory sits in the sprawling industrial zone surrounding Los Angeles International Airport, long an epicenter for the American aviation and aerospace industries. The facility was built in the 1940s for the old Nash Motors, which rolled its iconic Rambler off the plant's assembly line. In the 1950s, legendary aviation mogul Howard Hughes’s eponymous aerospace company acquired the property and soon built some of the world’s earliest commercial satellites there.

Boeing inherited the facility when it bought Hughes’s space business in 2000. Today it houses Boeing Satellite Systems—one of the largest satellite manufacturers in the world and part of a Defense, Space & Security division that generated $14 billion in sales for Boeing in the first half of this year, or more than 43% of the company's overall revenues.

These days, Boeing faces intense competition in a rapidly growing space sector. Amid heightened demand for broadband Internet service, upstarts like Elon Musk’s SpaceX are launching lighter, leaner, and more technologically advanced satellites. Unprecedented amounts of money have poured into “space-tech,” with space-focused startups raising more than $7 billion in funding last year. Boeing, in turn, now finds itself fighting to maintain its frontrunner status in what has become a modern-day space race.

"Technology’s changing—you’re getting smaller satellites with big constellations, and how the old guard are going to compete against that is something we have to watch,” says Bank of America aerospace and defense equity analyst Ronald Epstein.

As an “old guard” company looking to keep up with the so-called new space economy, the key battleground for Boeing is its enormous, 1-million-square-foot satellite facility near LAX. The main factory floor resembles a cavernous white box, with bright fluorescent lighting beaming down from ceilings a hundred feet above. Here, Boeing’s teams are working on state-of-the-art satellites for one of the company’s largest commercial customers, Luxembourg-based satellite operator SES.

Boeing has been making satellites for SES since the early 1990s, when its satellite division was still a part of Hughes Space and Communications. Now Boeing and SES have teamed up to develop a constellation of 11 communications satellites that will operate in medium orbit, about 5,000 miles above Earth. The goal of the constellation, known as O3b mPower, is to provide broadband Internet and data connections to customers including cloud-computing providers, telecom companies, shipping lines, cruise ships, and airlines.

The satellites will update a constellation of 20 satellites operated by SES that were built by Boeing rival Thales Alenia Space and launched eight years ago. For this second generation, Boeing is helping SES expand the original network’s capabilities by designing a fleet of smaller satellites that promise to function in a faster, more flexible, and farther-reaching fashion. The new O3b mPower satellites will be nearly half the size of their predecessors but will offer more than 10 times the data capacity. The original O3b satellites came equipped with up to 10 analog “wide beams,” resembling small satellite dishes, which beamed signals down to Earth. The new versions are fully digitized and feature up to 5,000 steerable beams that can more precisely be redirected and adjusted—significantly improving their speed, reach, and accuracy for SES’s clients.

“It’s like we’re going from the iPhone to iPhone 12 in one step,” SES CEO Steve Collar says on Boeing's factory floor—draped, like everyone in the room, in a white smock, hairnet, and clear protective goggles. Next to him stands Jim Chilton, senior vice president of Boeing’s Space and Launch division, who notes that the streamlined, digitally enabled new satellites feature only a fraction of the hardware components that their predecessors did.

With their launch into medium Earth orbit, SES’s new satellites are supposed to reduce the latency, or lag, of broadband communications by orbiting closer to Earth, while still being far enough to reach 96% of the world’s population. They will help the satellite operator meet rising demand for faster and cheaper access to broadband data, which could drive up to 70% of the global space industry's overall growth over the next two decades, according to Morgan Stanley Research.

“Satellites have this amazing superpower, which is reach," Collar notes. But while traditional geostationary satellites, which orbit 22,000 miles above Earth, have long enabled that reach, latency has always been an issue given their distance. “That was where this revolutionary idea of bringing the satellites closer to the Earth, and using that to deliver the Internet, came from,” he adds.

Though the first O3b mPower satellites aren't launching until later this year, they have already attracted customers including French telecom company Orange and cruise operator Carnival. Cloud-computing companies are also a key, growing market; SES has recently lured cloud providers like Amazon's AWS and Microsoft Azure, which have looked to the medium-orbit satellites to bolster their broadband connectivity and reduce the latency of their own cloud networks.

SES isn’t the only company marketing the potential of new satellite technologies to cloud providers. In announcing its partnership with SES last year, Microsoft also rolled out a new relationship with SpaceX that includes access to the Elon Musk-led firm’s Starlink broadband satellite network. Starlink aims to eventually deploy tens of thousands of small satellites into low Earth orbit, less than 1,000 miles above the Earth’s surface, with designs on making broadband Internet more widely accessible. (As well as being rivals in satellite development, SES and SpaceX also have a close business relationship; SES was SpaceX’s first commercial customer, and the new SES satellites will launch on SpaceX’s Falcon 9 rockets.)

While noting the prohibitive cost and technical complexity of launching satellites in low Earth orbit, Collar says SES will pursue a “multi-orbit strategy” that could eventually see it follow SpaceX’s lead with low-orbit projects of its own. He also credits SpaceX for helping drive down costs and for creating more room for new and existing players in the space sector to innovate—even as SpaceX’s emergence threatens the long-term dominance of incumbents like Boeing and SES.

Boeing has targeted a multi-orbit strategy of its own, according to Chilton—one that will see the aerospace manufacturer focus more on the “digital future” being offered by new satellite technologies like SES’s medium-orbit systems. As a manufacturer, Boeing is looking to partner with “leading edge, aggressive people who are trying to change the business,” Chilton says, while gradually moving away from the analog, geostationary technology of years past. “We have kind of bet the farm that we’re going to jump into this new world with new technology.”

The end result of that new technology, Collar adds, is a world where having Internet access anywhere you please is a choice. He notes conversations with Royal Caribbean executives several years ago in which the cruise line didn’t believe it would need more than 0.5 gigabits of data for its ships. Yet as the years went by, passengers increasingly complained about the lack of Wi-Fi during cruises. Now, according to Collar, Royal Caribbean ships each offer more than 1 gigabit of data per passenger, beamed to them from SES’s satellites.

“It’s a very exciting industry to be in right now,” says Collar. “There’s a lot of opportunity for established players who understand what space is about to go deliver a whole bunch of new services.”