联合国(United Nations)在上周发布的第六次评估报告与以往没有区别:未来20年,地球气温将(至少)升高1.5摄氏度,而人类是罪魁祸首。作为地球的居民,这意味着我们必须开始做好准备,迎接更多的火灾、洪水、干旱、粮食短缺和动物灭绝。

但这份报告以及气候变化的广泛影响,对于投资者也有重要的意义。气候债券倡议组织(Climate Bonds Initiative)的首席执行官肖恩•基德尼说:“我们确实有资本,这一点毋庸置疑,但我们必须快速调整策略。”气候债券倡议组织是一家鼓励低碳投资的国际机构,提供绿色债券认证。

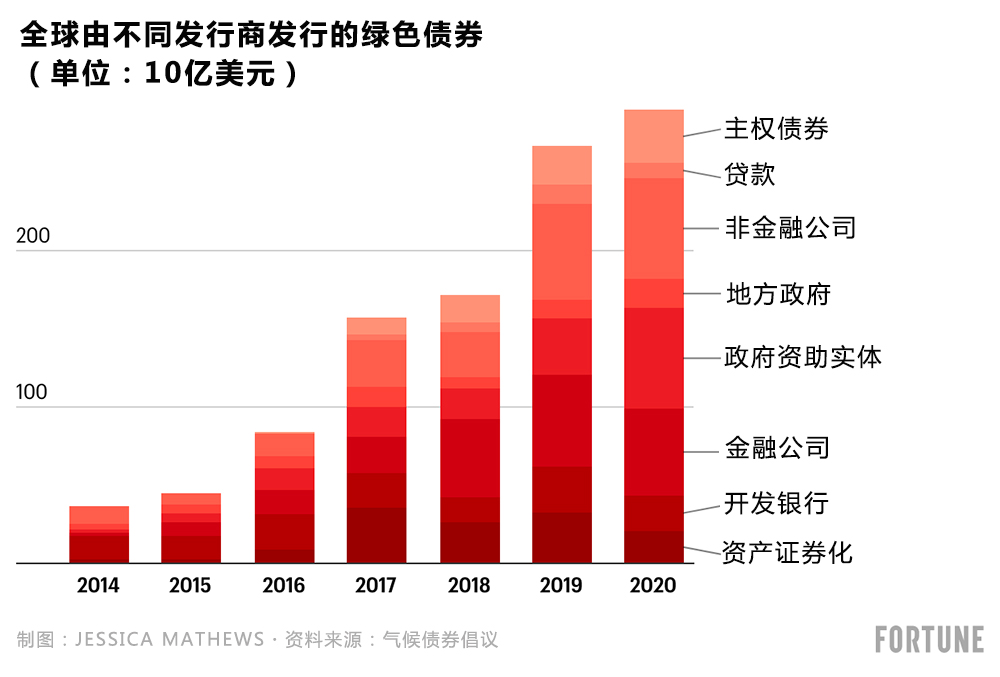

这意味着,绿色债券将成为关注的焦点。据晨星(Morningstar)统计,去年债券市场的资产规模超过1万亿美元,其中2020年发行的绿色债券价值为2,900亿美元。2021年,预计绿色债券发行量将达到5,000亿美元。这在全球债券市场中所占的比例确实相对较小(约为1%),但该领域正在快速扩张。晨星从事固定收益投资研究的乔斯•加西亚-扎拉特表示,在债券市场里,“绿色债券可能是增长速度最快的领域之一。”目前全球有128家资产管理公司承诺将帮助实现最晚在2050年之前达到温室气体净零排放的目标,这些公司管理的资产规模达到43万亿美元。截至6月底,投资者在可持续共同基金和交易所交易基金(ETF)共投资约2.24万亿美元,这比三个月前增加了12%。

绿色债券不仅为企业、资产管理公司和市政府资助可持续发展项目提供了一种可行的途径,投资者也可以通过绿色债券,在获得投资收益的同时通过投资发挥其资金的影响力。以下是投资者需要了解的信息。

什么是绿色债券?

绿色债券就是,绿色的债务。绿色债券的结构与传统固定收益证券相同,但专为能够为减少碳足迹做出明显贡献的项目发行(比如水项目、能效建筑或电动汽车等)。

绿色债券的运作原理是:绿色债券投资者向企业、市政府或政府部门提供贷款,用于资助一项业务或一个项目。债券有规定的结束日期,即“到期日”,发行方必须在到期日将资金返还给投资者。在债券有效期内,企业或政府部门向投资者支付利息。

绿色债券的结构与非绿色债券相同,因此理论上它们的信用结构也是相同的。基德尼表示:“绿色债券的理念是一种……与任何其他债券具有相同风险和收益特征的债券,但它有一种额外功能”,可以通过投资解决气候变化。“就是这样。绿色债券并不复杂。”

规模达数万亿美元的部门

2007年,欧洲投资银行(European Investment Bank)首次发行绿色债券,专注于可再生能源效率。直到2013年,法国电力集团(EDF)、美银美林(Bank of America Merrill Lynch )和Vasakronan等公司率先发行绿色债券,这种新产品才开始日益增多。截至2013年年底,绿色债券市场的资产规模达到110亿美元,规模扩大了两倍。

威瑞森(Verizon)在2019年为可再生能源项目及其设施节能照明升级等发行绿色债券,融资约10亿美元;苹果(Apple)在2020年投资了17个绿色债券项目,其中一些投资属于其在2030年之前实现碳中和计划的一部分。尤其是在新冠肺炎疫情期间,各地方政府纷纷利用市政债券为资本项目以及越来越多的绿色项目融资。标普全球评级(S&P Global Ratings)在今年年初发布的一份报告,统计了2020年以来的176家绿色市政债券发行商,其中109家首次发行绿色债券。报告预测,到今年年底,美国市政绿色债券将占市政债券发行量总额的约4.1%。

总体而言,可持续资金和投资需求旺盛,目前绿色债券仍然处于供不应求。基德尼指出:“每一个绿色债券都会出现超购现象:超购达到3至10倍。”

如何投资

目前,退休基金、保险公司或对冲基金等机构投资者大量集中于私人债券市场,无论是否属于绿色债券。二级市场(投资者向其他投资者购买债券,而不是直接从发行商处购买)的规模也在持续壮大,但依旧属于小众市场。

有些倡议项目为普通人直接参与绿色债券投资提供了便利。英国最近宣布,将特别针对散户投资者发行一系列绿色债券,但到目前为止尚未公布详细信息。气候债券倡议组织的研究显示,美国购买绿色、社会或可持续市政债券的主要是国内的散户投资者或个人投资者。去年,北得克萨斯或西雅图有面向散户投资者的市政债券投资。散户投资者能够通过债券交易商、经纪商或银行,或者通过理财顾问,购买市政债券。交易过程可能较为复杂,并且收取的费用高低不一。

散户投资者投资绿色债券还有一种更多样化的方式,那就是通过联合投资工具,例如共同基金或交易所交易基金等。据晨星统计,截至2021年5月,全球共有76只绿色债券基金,资产规模达到约250亿美元,其中65只位于欧洲。下列基金可供投资者选择:位于爱尔兰的iShares Green Bond Index Fund(IE)是规模最大的绿色债券基金,资产规模为34亿美元。除此之外,还有Lyxor Green Bond (DR) UCITS ETF、VanEck Green Bond ETF(GRNB)和TIAA-CREF Green Bond Fund等。

没有固定收益替代品

投资者在为了拯救地球放弃传统债券并且希望维持相同收益水平以前,他们应该清楚他们的想法目前是不现实的。

绿色债券市场的风险权重不同,因为大部分绿色债券是在欧洲和美国发行,尤其是由企业发行。据晨星估计,如果投资者将iShares Global Aggregate Bond ETF替换成绿色基金交易所交易基金,其对欧元区债券的风险敞口将从23.6%提高到68%,对美国债券的风险敞口将从42%下降到20.7%。

由于绿色债券基金的权重不同,因此其表现也会有所差异。例如,到7月底,iShares Global Green Bond ETF的1年期总收益率为1.12%。更传统的债券iShares Core Global Aggregate Bond UCITS ETF的1年期总收益率为0.63%。

当绿色债券相对较新的时候,我们很难对基金进行对比(几乎所有绿色债券的发行时间都不超过三年),尤其是美国和欧洲的债券收益率在新冠肺炎疫情期间始终在史上最低水平徘徊。晨星认为,即使更多的企业和政府发行绿色债券,绿色债券基金未来也不会在欧元区获得较高的权重。

除了这些因素以外,到目前为止,有一些基金取得了不错的长期收益,包括2018年成立的NuShares ESG U.S. Aggregate Bond ETF(NUBD),其三年期总收益率为5.34%。从1月到7月底,该基金下跌了0.88%。VanEck Vectors Green Bond ETF(GRNB)在7月底的三年期总收益率为3.82%,但与1月相比下跌了0.45%。作为最受欢迎的传统债券交易所交易基金之一,Vanguard Total Bond Market ETF(BND)过去三年的表现均胜过了这两只基金,其在7月底的总收益率为5.83%。从1月到7月底下跌了0.63%。

投资者还需要注意其他几个问题。首先是费用。绿色债券基金的收费往往更高:美国两只绿色债券交易所交易基金每年的成本为0.25%。相比之下,晨星表示普通债券交易所交易基金的成本只有0.08%或0.09%。总体而言,环境、社会和治理(ESG)投资有时候无法产生其他投资的规模经济效益,并且可能会有额外成本,例如股东倡议开支等。其他影响因素包括:绿色债券的平均持续时间更长,但到期时的平均收益低于标准债券。绿色债券基金往往更容易受到BBB级债券(通常追求更高收益)的影响,这意味着他们面临更高的信用风险和久期风险。

投资者还应该坚持开展尽职调查:首先分析债券所资助的项目。Ceres投资者网络(Ceres Investor Network)的高级总监彼得•埃尔斯沃思在一封电子邮件中写道,随着更多公司发行绿色债券,“投资者需要小心谨慎,不能只看品牌。”Ceres投资者网络是一家致力于可持续发展的非营利机构,主要与资本市场的领先企业合作。埃尔斯沃思建议投资者考虑投资收益是否符合现有标准,比如欧洲绿色债券标准或气候债券倡议等,并且投资者应该审查发行商对于低碳未来的广泛承诺。

最重要的是什么?晨星认为,目前绿色债券最适合作为投资组合的补充,而不是取代普通债券。(财富中文网)

翻译:刘进龙

审校:汪皓

联合国(United Nations)在上周发布的第六次评估报告与以往没有区别:未来20年,地球气温将(至少)升高1.5摄氏度,而人类是罪魁祸首。作为地球的居民,这意味着我们必须开始做好准备,迎接更多的火灾、洪水、干旱、粮食短缺和动物灭绝。

但这份报告以及气候变化的广泛影响,对于投资者也有重要的意义。气候债券倡议组织(Climate Bonds Initiative)的首席执行官肖恩•基德尼说:“我们确实有资本,这一点毋庸置疑,但我们必须快速调整策略。”气候债券倡议组织是一家鼓励低碳投资的国际机构,提供绿色债券认证。

这意味着,绿色债券将成为关注的焦点。据晨星(Morningstar)统计,去年债券市场的资产规模超过1万亿美元,其中2020年发行的绿色债券价值为2,900亿美元。2021年,预计绿色债券发行量将达到5,000亿美元。这在全球债券市场中所占的比例确实相对较小(约为1%),但该领域正在快速扩张。晨星从事固定收益投资研究的乔斯•加西亚-扎拉特表示,在债券市场里,“绿色债券可能是增长速度最快的领域之一。”目前全球有128家资产管理公司承诺将帮助实现最晚在2050年之前达到温室气体净零排放的目标,这些公司管理的资产规模达到43万亿美元。截至6月底,投资者在可持续共同基金和交易所交易基金(ETF)共投资约2.24万亿美元,这比三个月前增加了12%。

绿色债券不仅为企业、资产管理公司和市政府资助可持续发展项目提供了一种可行的途径,投资者也可以通过绿色债券,在获得投资收益的同时通过投资发挥其资金的影响力。以下是投资者需要了解的信息。

什么是绿色债券?

绿色债券就是,绿色的债务。绿色债券的结构与传统固定收益证券相同,但专为能够为减少碳足迹做出明显贡献的项目发行(比如水项目、能效建筑或电动汽车等)。

绿色债券的运作原理是:绿色债券投资者向企业、市政府或政府部门提供贷款,用于资助一项业务或一个项目。债券有规定的结束日期,即“到期日”,发行方必须在到期日将资金返还给投资者。在债券有效期内,企业或政府部门向投资者支付利息。

绿色债券的结构与非绿色债券相同,因此理论上它们的信用结构也是相同的。基德尼表示:“绿色债券的理念是一种……与任何其他债券具有相同风险和收益特征的债券,但它有一种额外功能”,可以通过投资解决气候变化。“就是这样。绿色债券并不复杂。”

规模达数万亿美元的部门

2007年,欧洲投资银行(European Investment Bank)首次发行绿色债券,专注于可再生能源效率。直到2013年,法国电力集团(EDF)、美银美林(Bank of America Merrill Lynch )和Vasakronan等公司率先发行绿色债券,这种新产品才开始日益增多。截至2013年年底,绿色债券市场的资产规模达到110亿美元,规模扩大了两倍。

威瑞森(Verizon)在2019年为可再生能源项目及其设施节能照明升级等发行绿色债券,融资约10亿美元;苹果(Apple)在2020年投资了17个绿色债券项目,其中一些投资属于其在2030年之前实现碳中和计划的一部分。尤其是在新冠肺炎疫情期间,各地方政府纷纷利用市政债券为资本项目以及越来越多的绿色项目融资。标普全球评级(S&P Global Ratings)在今年年初发布的一份报告,统计了2020年以来的176家绿色市政债券发行商,其中109家首次发行绿色债券。报告预测,到今年年底,美国市政绿色债券将占市政债券发行量总额的约4.1%。

总体而言,可持续资金和投资需求旺盛,目前绿色债券仍然处于供不应求。基德尼指出:“每一个绿色债券都会出现超购现象:超购达到3至10倍。”

如何投资

目前,退休基金、保险公司或对冲基金等机构投资者大量集中于私人债券市场,无论是否属于绿色债券。二级市场(投资者向其他投资者购买债券,而不是直接从发行商处购买)的规模也在持续壮大,但依旧属于小众市场。

有些倡议项目为普通人直接参与绿色债券投资提供了便利。英国最近宣布,将特别针对散户投资者发行一系列绿色债券,但到目前为止尚未公布详细信息。气候债券倡议组织的研究显示,美国购买绿色、社会或可持续市政债券的主要是国内的散户投资者或个人投资者。去年,北得克萨斯或西雅图有面向散户投资者的市政债券投资。散户投资者能够通过债券交易商、经纪商或银行,或者通过理财顾问,购买市政债券。交易过程可能较为复杂,并且收取的费用高低不一。

散户投资者投资绿色债券还有一种更多样化的方式,那就是通过联合投资工具,例如共同基金或交易所交易基金等。据晨星统计,截至2021年5月,全球共有76只绿色债券基金,资产规模达到约250亿美元,其中65只位于欧洲。下列基金可供投资者选择:位于爱尔兰的iShares Green Bond Index Fund(IE)是规模最大的绿色债券基金,资产规模为34亿美元。除此之外,还有Lyxor Green Bond (DR) UCITS ETF、VanEck Green Bond ETF(GRNB)和TIAA-CREF Green Bond Fund等。

没有固定收益替代品

投资者在为了拯救地球放弃传统债券并且希望维持相同收益水平以前,他们应该清楚他们的想法目前是不现实的。

绿色债券市场的风险权重不同,因为大部分绿色债券是在欧洲和美国发行,尤其是由企业发行。据晨星估计,如果投资者将iShares Global Aggregate Bond ETF替换成绿色基金交易所交易基金,其对欧元区债券的风险敞口将从23.6%提高到68%,对美国债券的风险敞口将从42%下降到20.7%。

由于绿色债券基金的权重不同,因此其表现也会有所差异。例如,到7月底,iShares Global Green Bond ETF的1年期总收益率为1.12%。更传统的债券iShares Core Global Aggregate Bond UCITS ETF的1年期总收益率为0.63%。

当绿色债券相对较新的时候,我们很难对基金进行对比(几乎所有绿色债券的发行时间都不超过三年),尤其是美国和欧洲的债券收益率在新冠肺炎疫情期间始终在史上最低水平徘徊。晨星认为,即使更多的企业和政府发行绿色债券,绿色债券基金未来也不会在欧元区获得较高的权重。

除了这些因素以外,到目前为止,有一些基金取得了不错的长期收益,包括2018年成立的NuShares ESG U.S. Aggregate Bond ETF(NUBD),其三年期总收益率为5.34%。从1月到7月底,该基金下跌了0.88%。VanEck Vectors Green Bond ETF(GRNB)在7月底的三年期总收益率为3.82%,但与1月相比下跌了0.45%。作为最受欢迎的传统债券交易所交易基金之一,Vanguard Total Bond Market ETF(BND)过去三年的表现均胜过了这两只基金,其在7月底的总收益率为5.83%。从1月到7月底下跌了0.63%。

投资者还需要注意其他几个问题。首先是费用。绿色债券基金的收费往往更高:美国两只绿色债券交易所交易基金每年的成本为0.25%。相比之下,晨星表示普通债券交易所交易基金的成本只有0.08%或0.09%。总体而言,环境、社会和治理(ESG)投资有时候无法产生其他投资的规模经济效益,并且可能会有额外成本,例如股东倡议开支等。其他影响因素包括:绿色债券的平均持续时间更长,但到期时的平均收益低于标准债券。绿色债券基金往往更容易受到BBB级债券(通常追求更高收益)的影响,这意味着他们面临更高的信用风险和久期风险。

投资者还应该坚持开展尽职调查:首先分析债券所资助的项目。Ceres投资者网络(Ceres Investor Network)的高级总监彼得•埃尔斯沃思在一封电子邮件中写道,随着更多公司发行绿色债券,“投资者需要小心谨慎,不能只看品牌。”Ceres投资者网络是一家致力于可持续发展的非营利机构,主要与资本市场的领先企业合作。埃尔斯沃思建议投资者考虑投资收益是否符合现有标准,比如欧洲绿色债券标准或气候债券倡议等,并且投资者应该审查发行商对于低碳未来的广泛承诺。

最重要的是什么?晨星认为,目前绿色债券最适合作为投资组合的补充,而不是取代普通债券。(财富中文网)

翻译:刘进龙

审校:汪皓

There were no subtleties within the United Nations sixth assessment report released at last week: The Earth is on track to get (at least) 1.5 degrees hotter in the next 20 years, and humans are to blame for it. As residents that means we can start readying ourselves for more fires, flooding, droughts, food shortages, and animal extinctions.

But the report—and the ramifications of climate change—have some powerful implications for investors as well. “We do have the capital resources—there’s no doubt about that—but we have to change things quite quickly,” says Sean Kidney, CEO of the Climate Bonds Initiative, an international organization promoting low-carbon investments that certifies green bonds.

All this is to say, green bonds are having a moment in the spotlight. The market surpassed $1 trillion in assets last year, with $290 billion in green bonds issued in 2020, according to Morningstar. In 2021, issuance is projected to hit $500 billion. To be sure, it’s a relatively small slice of the global bond market (about 1% to be exact), but it’s expanding quickly. “This is probably one of the fastest growing areas” in the bond market, says Jose Garcia-Zarate, who researches fixed income at Morningstar. There are 128 global asset managers representing $43 trillion in assets that have committed to helping hit the goal of net zero greenhouse gas emissions by at least 2050. Investors have invested some $2.24 trillion in sustainable mutual funds and ETFs by the end of June. That’s 12% more than there were only three months prior.

Not only are green bonds a tangible way corporations, asset managers and municipalities are funding sustainable projects—they're also a way for investors to pinpoint the impact of the dollars they've investing while also generating a return. Here's what investors should know.

What’s a green bond?

Green bonds are debt that is … well … green. They’re structured the same as traditional fixed income securities, but earmarked for projects explicitly contributing to reducing the carbon footprint (think water projects, energy-efficient buildings or electric vehicles).

A reminder of how bonds work: It’s effectively a loan made by an investor to a corporation, municipality or government agency to fund operations or a project. Bonds have specific end dates, called “maturity dates,” where the issuer must return money to the investor. The company or agency pays an investor interest throughout the duration of the bond.

Green bonds have the same structure as their non-green counterparts, so they theoretically carry the same credit structure. “The idea was simply a bond that could … have the same risk and yield characteristics of any other bond but have a bonus feature” where the investments would address climate change. “That's it. Nothing more complicated than that,” Kidney says.

A trillion-dollar sector

The first green bond was issued by the European Investment Bank in 2007, focused on renewable energy efficiency. It wasn’t until 2013, when the first corporations—EDF, Bank of America Merrill Lynch and Vasakronan—issued green bonds that the new products started taking off. By the end of that year, the green bond market had reached $11 billion in assets, tripling in size.

Verizon raised nearly $1 billion in an issuance in 2019 for things like renewable energy projects and upgrading its facilities to energy-efficient lighting across its facilities; and Apple funded 17 green bond projects in 2020, some of which are part of its effort to go carbon neutral by 2030. Particularly during the pandemic, local governments have been using municipal bonds to fund capital projects—and increasingly green ones. S&P Global Ratings identified 176 unique issuers of green muni bonds from 2020 in a report earlier this year, and 109 of those were first-time issuers. It predicts that the U.S. municipal green-labeled debt sector will make up about 4.1% of all municipal issuance by the end of this year.

There’s a flood of demand for sustainable funds and investments in general, and there aren’t enough bonds to keep up with it. “Every green bond that comes out is oversubscribed: anywhere between three and 10 times,” Kidney says.

How to invest

Right now, the primary bond market—green or not—is heavily saturated with institutional investors like pension funds, insurance companies or hedge funds. The secondary market (where investors are purchasing bonds from other investors, rather than the issuers themselves) is growing, too, although that’s still niche as well.

Some initiatives are making it easier for everyday individuals to gain direct access. The U.K. recently said it was issuing a suite of green bonds particularly targeted at retail investors, although details are limited thus far. Green, social or sustainable muni debt in the U.S. is largely bought by domestic retail or individual investors, according to Climate Bond Initiative research. Some municipal bond investments available to retail investors last year were in North Texas or Seattle. Retail investors can purchase individual muni bonds through a bond dealer, brokerage or bank, or through a financial advisor. It can be complex, and there may be high fees or minimums.

A more diversified way for retail investors to gain exposure to green bonds is through pooled investment vehicles, such as mutual funds or ETFs. As of May 2021, there were 76 green bond funds globally with around $25 billion in assets, according to Morningstar, with 65 of them being housed in Europe. Here are a few of the funds available: The iShares Green Bond Index Fund (IE), which is domiciled in Ireland, is the largest green bond fund with some $3.4 billion in assets. There’s also the Lyxor Green Bond (DR) UCITS ETF, the VanEck Green Bond ETF (GRNB) and the TIAA-CREF Green Bond Fund, just to name a few.

Not a fixed income substitute

Before anyone rids themselves of the traditional bonds in a portfolio in favor of saving the Earth and making the same returns, just know that, as of right now, that doesn’t really work.

The green bond market is weighted differently, as most of this debt is being issued in Europe and—in the U.S.—specifically by corporations. If an investor were to swap out the iShares Global Aggregate Bond ETF for its green bond ETF, exposure to the euro would increase to 68% from 23.6%, and exposure to U.S. bonds would lower to 20.7% from 42%, according to Morningstar.

Due to green bond funds being weighted differently, they will perform differently, too. The iShares Global Green Bond ETF, for example, had a 1-year total return of 1.12% at the end of July. A more-traditional bond counterpart, the iShares Core Global Aggregate Bond UCITS ETF, had a lower 1-year total return , at 0.63%.

It can be difficult to adequately compare the funds when green bonds are so relatively new in comparison (nearly all of them around for less than three years), and particularly when the yields for bonds are at all-time lows in the U.S. and Europe during the coronavirus pandemic. As more companies and governments issue green bonds, it's also likely that green bond funds won't be as heavily weighted in the euro in the future, according to Morningstar.

These factors aside, some of the funds have experienced promising returns in the long-run thus far, including the NuShares ESG U.S. Aggregate Bond ETF (NUBD), which launched in 2018 and has a 3-year total return of 5.34%. It was down -0.88% from the end of July from January. The VanEck Vectors Green Bond ETF (GRNB) had a 3-year total return of 3.82% at the end of July, but was down -0.45% from January. One of the most popular traditional bond ETFs, the Vanguard Total Bond Market ETF (BND), performed better than both these funds over the last three years, with a total return of 5.83% at the end of July. It was down -0.63% at the end of July from January.

There are a few other things investors should keep in mind. For one, fees. Green bond funds do tend to be more expensive: The two U.S.-domiciled green bond ETFs cost 0.25% per year. That's compared with 0.08% or 0.09% for a more general bond ETF, according to Morningstar. ESG investments, in general, sometimes don't benefit from the same economies of scale as their counterparts, and they can have extra costs for things like shareholder advocacy. Other key differentiators: Green bonds have a higher average duration, but a lower average yield to maturity than standard bonds. Green debt funds tend to have more exposure to BBB rated bonds (which typically corresponds to a search for a higher yield)—meaning they have higher exposure to credit and duration risk.

Investors should always do their own due diligence, too: Start by looking into the projects the bonds intend to fund. “Investors will need to carefully look beyond the label,” as more companies issue this debt, Peter Ellsworth, senior director of the Ceres Investor Network, a sustainability-focused non-profit organization that works with capital markets leaders, wrote in an email. Ellsworth suggests investors consider whether the proceeds align with established criteria, such as the European Green Bond Standard or Climate Bonds Initiative, and that an investor examines the issuer’s broader commitment to a low-carbon future.

The bottom line? Right now, Morningstar says green bonds are best used as a complement to a portfolio, rather than a substitute, for regular bonds.