网红股票大幅上涨。TikTok里有数不尽的股票解说员。“山姆大叔”的“stimmies”(经济刺激支票)变成了“tendies”(巨额投资回报)。

华尔街老将对家里蹲投资者的异军突起感到困惑,这股投资势力不知道源自何方,似乎从天而降。我们知道,这股投资势力能够把GameStop和AMC娱乐(AMC Entertainment)等受到新冠肺炎疫情冲击的企业股票推上历史新高,再让它们从高处跌落,也可以推动加密货币实现一轮又一轮的上涨,却不知道他们的动机是什么。

为了找到答案,Betterment访问了1500名投资者,包括大批使用该公司热门投资和个人理财APP的投资者。我们能够透过调查结果来了解这些散户投资者的投资策略,看看刺激支票和资本利得税的作用,预判一下他们在疫情结束后会否继续保持对交易的热情。

散户交易的增长确实令人瞩目。某项指标显示,现在散户的交易量几乎相当于共同基金和对冲基金的日交易量之和。

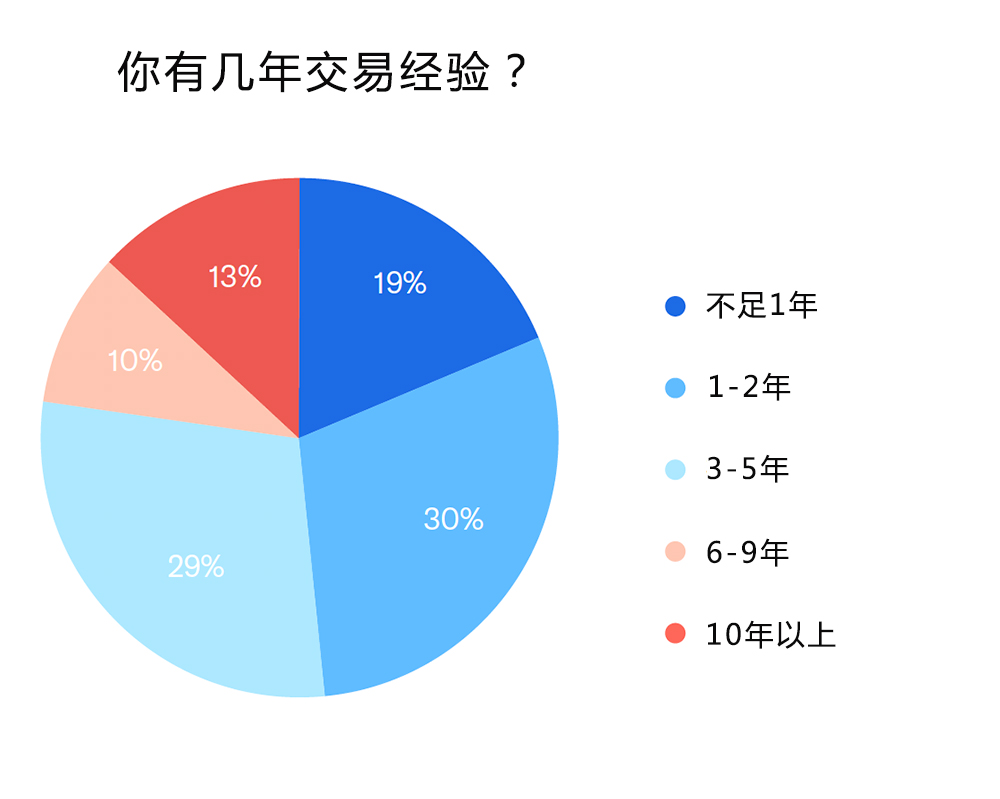

从Betterment的调查来看,这是一个充满新手投资者的市场。近一半(49%)的受访者表示,他们的投资经验还不足两年。

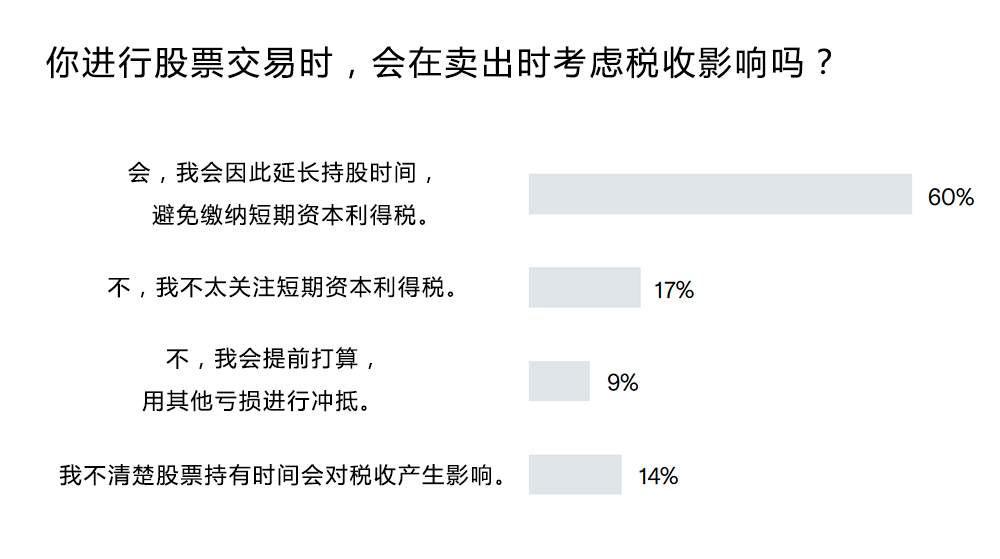

毋庸置疑,交易股票和其他资产都需要应付各种不熟悉的繁文缛节,比如税收。大约七分之一(14%)的受访者表示,不知道有短期资本利得税这种东西。值得称赞的是,60%的人说,他们知道这些讨人厌的税收会影响投资利润,也确实会因此调整持股时间。

至于怎么找、在哪里找股票投资消息的问题,他们主要依靠平常在推特(Twitter)、TikTok和WallStreetBets等Reddit论坛上冲浪时听到看到的信息。

调查结果显示,社交媒体渠道是这个群体获得投资建议的第三大沃土。它们的排名仅次于财经新闻网站(《财富》杂志的财经和市场记者应当为此感到高兴)。

Betterment报告的作者对这些调查结果发出了警告。

“超过一半的受访者表示,他们的择股依据是因为熟悉这个公司的名字。这曾经出现过问题,比如‘股票代码不匹配’,即人们交易的股票代码不是想交易的公司。”报告作者指出,“比如,埃隆•马斯克发过一条关于Signal公司(一个非营利性的即时通讯应用程序)的推特,另一家公司的股价却因此飙升了3092%。”

其他调查结果还包括:

• 接受调查的散户中67%把自己的刺激支票资金用于投资。

• 97%的受访者表示,他们将继续投资GameStop、黑莓(BlackBerry)和AMC娱乐等网红股票。

• 34%的受访者表示,投资是他们主要储蓄方式,超过了支票账户(32%)和高收益储蓄账户(30%)。

尽管这份报告针对这一大家知之甚少的细分市场提供了某种程度上细致微妙的调查数据,但作者们仍然不确定,这种现象在未来几年将以何种形式出现。

他们写道:“在Betterment,我们经常把日内交易比作去拉斯维加斯——玩得开心,玩得尽兴,但要做好准备,你带回家的可能是变薄的钱包,还有宿醉。”

“这份报告总结的趋势似乎表明,越来越多的人开始涉足投资领域,而且(目前为止)没有什么人准备退出。”他们指出,“这一趋势是否会持续,会给人们的财务、健康、压力带来什么样的长期影响,仍然有待观察。”(财富中文网)

译者:Agatha

网红股票大幅上涨。TikTok里有数不尽的股票解说员。“山姆大叔”的“stimmies”(经济刺激支票)变成了“tendies”(巨额投资回报)。

华尔街老将对家里蹲投资者的异军突起感到困惑,这股投资势力不知道源自何方,似乎从天而降。我们知道,这股投资势力能够把GameStop和AMC娱乐(AMC Entertainment)等受到新冠肺炎疫情冲击的企业股票推上历史新高,再让它们从高处跌落,也可以推动加密货币实现一轮又一轮的上涨,却不知道他们的动机是什么。

为了找到答案,Betterment访问了1500名投资者,包括大批使用该公司热门投资和个人理财APP的投资者。我们能够透过调查结果来了解这些散户投资者的投资策略,看看刺激支票和资本利得税的作用,预判一下他们在疫情结束后会否继续保持对交易的热情。

散户交易的增长确实令人瞩目。某项指标显示,现在散户的交易量几乎相当于共同基金和对冲基金的日交易量之和。

从Betterment的调查来看,这是一个充满新手投资者的市场。近一半(49%)的受访者表示,他们的投资经验还不足两年。

毋庸置疑,交易股票和其他资产都需要应付各种不熟悉的繁文缛节,比如税收。大约七分之一(14%)的受访者表示,不知道有短期资本利得税这种东西。值得称赞的是,60%的人说,他们知道这些讨人厌的税收会影响投资利润,也确实会因此调整持股时间。

至于怎么找、在哪里找股票投资消息的问题,他们主要依靠平常在推特(Twitter)、TikTok和WallStreetBets等Reddit论坛上冲浪时听到看到的信息。

调查结果显示,社交媒体渠道是这个群体获得投资建议的第三大沃土。它们的排名仅次于财经新闻网站(《财富》杂志的财经和市场记者应当为此感到高兴)。

Betterment报告的作者对这些调查结果发出了警告。

“超过一半的受访者表示,他们的择股依据是因为熟悉这个公司的名字。这曾经出现过问题,比如‘股票代码不匹配’,即人们交易的股票代码不是想交易的公司。”报告作者指出,“比如,埃隆•马斯克发过一条关于Signal公司(一个非营利性的即时通讯应用程序)的推特,另一家公司的股价却因此飙升了3092%。”

其他调查结果还包括:

• 接受调查的散户中67%把自己的刺激支票资金用于投资。

• 97%的受访者表示,他们将继续投资GameStop、黑莓(BlackBerry)和AMC娱乐等网红股票。

• 34%的受访者表示,投资是他们主要储蓄方式,超过了支票账户(32%)和高收益储蓄账户(30%)。

尽管这份报告针对这一大家知之甚少的细分市场提供了某种程度上细致微妙的调查数据,但作者们仍然不确定,这种现象在未来几年将以何种形式出现。

他们写道:“在Betterment,我们经常把日内交易比作去拉斯维加斯——玩得开心,玩得尽兴,但要做好准备,你带回家的可能是变薄的钱包,还有宿醉。”

“这份报告总结的趋势似乎表明,越来越多的人开始涉足投资领域,而且(目前为止)没有什么人准备退出。”他们指出,“这一趋势是否会持续,会给人们的财务、健康、压力带来什么样的长期影响,仍然有待观察。”(财富中文网)

译者:Agatha

Meme-fueled rallies. TikTok stock tippers. Uncle Sam’s “stimmies” (stimulus checks) converted into “tendies” (big investment returns).

Wall Street veterans continue to puzzle over the ascendance of the stuck-at-home retail trader, an investing force that arose seemingly out of nowhere. We know what these traders are capable of—pushing COVID-battered businesses like GameStop and AMC Entertainment to new heights and back again, fueling rally after rally in cryptocurrencies—but not so much about their motivations.

Betterment sought to find out, surveying 1,500 investors, including a number who use its popular investing and personal finance app. The findings offer a glimpse into the retail trader’s investment strategy; a look at the role that stimulus checks and capital gains taxes play; and a take on whether this group will maintain its appetite for continued day trading post-pandemic.

The growth of retail trading has been truly remarkable. By one measure, retail trading flow is nearly equal to the daily trading volume of mutual funds and hedge funds combined.

From the looks of the Betterment survey, it’s a segment full of newbie investors. Nearly half the respondents (49%) say they have been trading for less than two years.

Unsurprisingly, trading stocks and other assets means all kinds of unfamiliar red tape to contend with—like taxes. Roughly one in seven (14%) respondents said they weren’t aware of such a thing as short-term capital gains tax. To their credit, 60% said they were aware of those pesky hits on investment profits, and that these taxes do factor into how long they hold on to a stock.

As for how and where they find their stock tips, this generation of traders is highly influenced by the daily chatter they pick up on Twitter, TikTok, and Reddit forums like WallStreetBets.

Social media channels, it turns out, are the third most fertile ground for investment tips among this crowd. They rank just behind financial news websites (which should cheer up Fortune’s finance and markets reporters).

The Betterment report authors waved a warning flag at these particular findings.

“More than half of respondents suggested they buy stocks based on company names they’re familiar with. But we’ve seen this lead to issues in the past—with ‘ticker mismatches,’ where people trade the ticker of a stock that isn’t the correct company,” the authors noted. “For example, after a tweet from Elon Musk about Signal [a nonprofit messaging app], a different company’s stock was sent soaring 3,092%.”

Among other findings…

• 67% of the day traders surveyed invested their stimulus-check money.

• 97% said they would continue to invest in meme stocks such as GameStop, BlackBerry, and AMC Entertainment.

• 34% said investing is the primary way they save money for the future, beating checking accounts (32%) and high-yield savings accounts (30%).

Though the report delivers a certain level of nuanced survey data for a poorly understood segment of the markets, the authors still wonder what shape this phenomenon will take in the years to come.

“At Betterment we have often compared day trading to going to Vegas—have a great time, enjoy yourself, but be prepared to come back home with fewer dollars in your wallet and a hangover,” they wrote.

“The trends outlined in this report seem to indicate that more people are dipping their toe into the investing pool, and (so far) few have decided to walk away,” they noted. “Whether this trend will continue—and the long-term impact it will have on people’s finances, health, stress, etc.—remains to be seen.”