几十年来,超级碗(Super Bowl)一直是广告领域里的“超级碗”。它是美国最盛大的舞台,是最具分量的品牌,拥有最多的观众,而对于转播超级碗的电视频道来说,这一天是收入最高的一天。

2月共有9,640万人观看了这场比赛,以及中间插播的广告。

但这一数字与接下来的数字相比则相形见绌。

同一时间,弗拉德和尼基•瓦什科托夫在他们的YouTube频道上传了多条视频。身材瘦长、善于表达的8岁男孩弗拉德和天真可爱的5岁弟弟尼基在这些搞笑短视频中做一些小孩子的游戏,比如说服妈妈给他们买一只宠物、搭建一个巨大的乐高房子、玩玩具车等等。

两个男孩在2月最受欢迎的三条视频的累计观看量超过1.7亿,而且这一数字还在不断增加。

“Vlad and Niki”频道在2018年开通。弗拉德在爸爸谢尔盖的帮助下,发布了一条他和玩具狗和一些彩色积木做游戏的四分钟视频。

现在这个频道在英语区YouTube上的订阅用户达到6,800万,使兄弟两人成为YouTube平台上第三大网红“创作者”。(谢尔盖表示,两兄弟在不同语言的平台上共有1.73亿订阅用户。)瓦什科托夫家人拒绝透露他们通过该平台上插播的广告获得的收入分成,而且除此之外,这个频道还给他们带来了赞助合约、商品销售、玩具许可权等。

但关注创作者行业的分析师表示,YouTube上的热门频道每年的收入可能达到3,000万美元至5,000万美元。按照这个水平,他们应该位于金字塔的顶端。

目前约有200万创作者参与了YouTube的广告项目,他们通常可以获得55%的广告收入分成。

现在是YouTube及其创作者蓬勃发展的时期。谷歌在2005年以16.5亿美元的价格收购YouTube。YouTube去年公布的广告收入为200亿美元(分析师表示,除此之外,该公司还有数十亿美元的产品订阅收入,例如YouTube Premium会员等,但YouTube没有披露具体财务数据)。

如果YouTube是一家独立实体,它将是全球第四大数字广告平台,仅次于其母公司Alphabet、Facebook和亚马逊。但真正让华尔街垂涎不已的是它未来的成长空间。YouTube 2020年的收入比2019年增长了31%,而其母公司Alphabet的收入同期仅增长了12.8%。(但有一个事实会给亢奋的分析师泼一盆冷水:我们不清楚不断增长的收入中有多少是利润;从创作者分成到技术成本,YouTube会产生巨额支出。)

推动YouTube广告业务繁荣的一个重要因素是传统广播和有线电视的衰落。市场跟踪机构Convergence Research表示,2012年,付费电视观众约有1.01亿个家庭,达到最高峰,但去年减少到7,600万,预计到2025年将进一步减少一半以上。

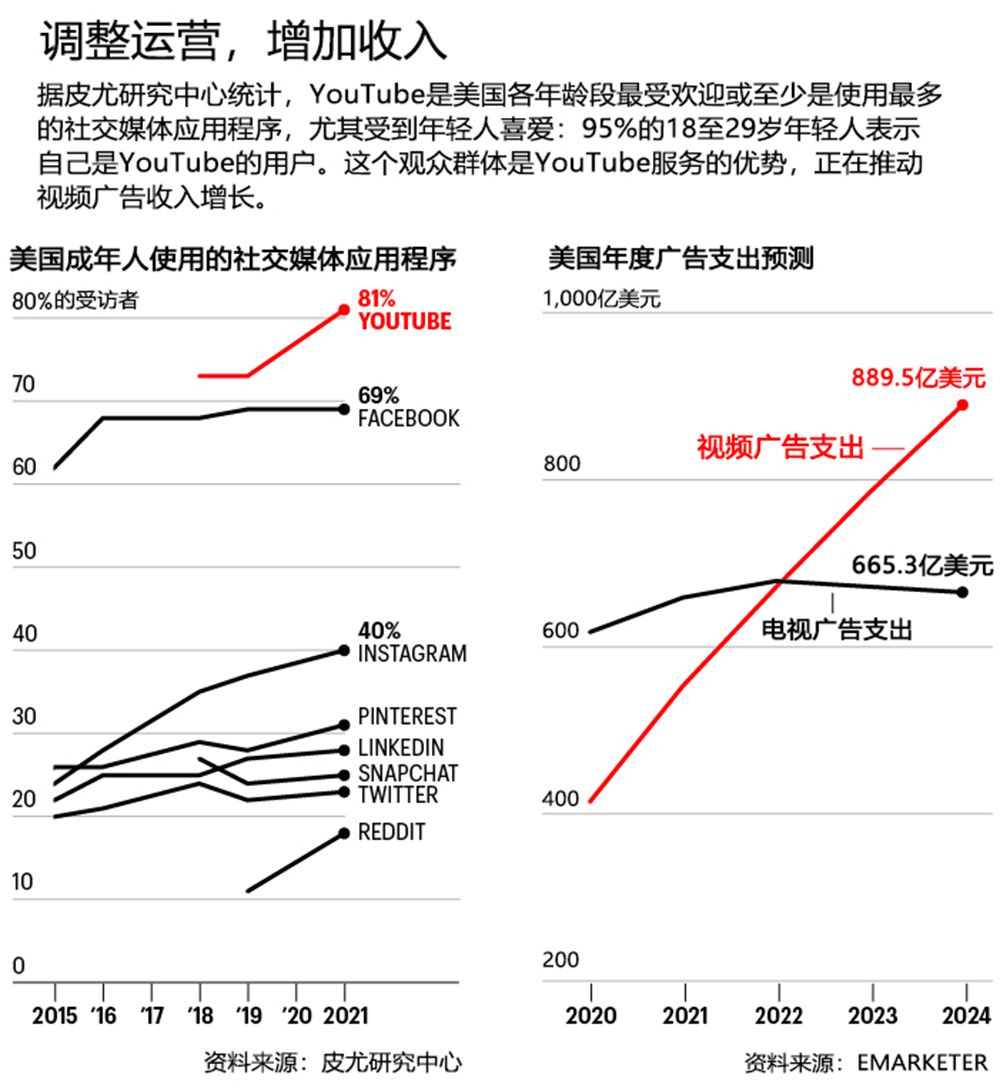

广告支出与观看人数息息相关。去年,电视广告支出减少了12.5%,而视频广告支出增加了30.1%。事实上,eMarketer公司的分析师预测,到2023年,视频广告支出将首次超过电视广告。

大型广告公司GroupM的全球合作负责人基利•泰勒说:“所有人都在为大广告商寻找新的投放广告的机会。”她表示,随着电视观众数量减少,“我们必须寻找其他途径向大众进行宣传。”

而想要找到大量受众,尤其是年轻人,YouTube是理想的选择。

尼尔森最近的一项研究发现,YouTube是深受所有年龄段喜爱的社交平台,50岁以下YouTube用户的数量,始终高于相同年龄段传统电视的观众数量。

4月,皮尤研究中心表示,81%的美国人使用YouTube,而使用第二大热门社交平台Facebook的美国人比例为69%。

所以,瓦什科托夫兄弟、费利克斯•谢尔贝格(网名PewDiePie)和莉莎•科希等YouTube网红受Z世代追捧的程度,不亚于大牌运动员和名人,这不足为奇。

YouTube的主导地位在很大程度上取决于用手机观看视频的数以十亿计的用户。但它也在不断扩大在客厅的影响。在客厅里,更多人观看智能电视或者链接到Roku、Apple TV等机顶盒设备在大屏幕上看YouTube视频。

YouTube表示,12月,美国有1.2亿人通过电视观看YouTube视频,比九个月前增加了20%。而在观看量最高的五种互联网电视服务(Netflix、YouTube、Amazon Prime、Disney+和Hulu)中,只有YouTube和Hulu出售广告。

*****

不断扩张的广告帝国是YouTube的首席执行官苏珊•沃西基主管的领域。她是谷歌的第16位员工,在20世纪90年代加入该公司,从2014年开始负责该视频服务的运营。

沃西基在帕洛阿尔托长大。她的父亲是斯坦福大学的物理系主任,但沃西基坚称她和同样优秀的两个姐妹(安妮创建了一家DNA分析公司23andMe,珍妮特则是一位人类学和流行病学博士),童年时代过得很普通,只是父母很重视她们是否有努力。

众所周知,1998年,苏珊在英特尔公司任职期间,把车库租给了谷歌的联合创始人谢尔盖•布林和拉里•佩奇。她说,当时那样做并不是因为她预感他们会取得成功。

在通过谷歌的Meet应用程序接受虚拟采访时,她回忆道:“我需要租金支付住房按揭贷款。”

沃西基很早就看到了YouTube的潜力;她表示,是她最早力劝布林和佩奇收购刚诞生不久的YouTube平台。沃西基曾经为谷歌创立了庞大的广告业务,因此在收购完成后,她成为运营YouTube的不二之选。

不久,沃西基就发现了用户创作的五花八门的内容和注重品牌形象的大广告商,这两者的组合很不稳定。没有筛选出冒犯性内容的情况在YouTube时有发生,比如在种族主义、恐同和反犹太人视频的旁边投放广告。

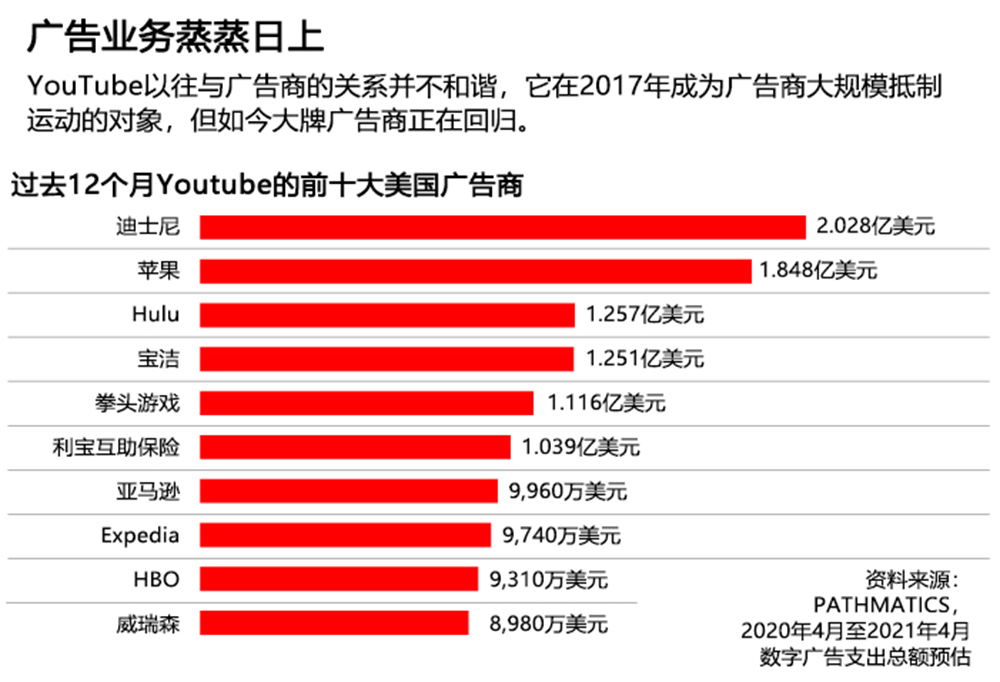

2017年,包括可口可乐、沃尔玛、宝洁和星巴克在内的多家知名美国公司纷纷停止在YouTube投放广告。

损失广告收入、Alphabet股价受挫和公关危机,引起了YouTube的重视。

沃西基说:“我们必须从用户和广告商的角度解决这些问题……这对我们至关重要。”谷歌开始更多利用机器学习人工智能软件来筛查不良内容,并招聘了数千名员工审核和评估可能违反公司服务条款的视频。

最严重的危机已经结束,广告商纷纷回归。

当然,事实上,2017年导致YouTube被广告商抵制的根本问题并没有完全消失(例如QAnon、5G网络阴谋论、疫苗微芯片等言论)。因此,随着YouTube的发展,它必须同步升级其基础设施,继续清理各种有害的内容。

YouTube的策略分为四个部分,其首席产品官尼尔•莫汉将其称为“4个R”。最明显的是“删除”(Removal),即找到并屏蔽最恶劣的内容。其次是“减少”(Reduce):利用YouTube强大的算法将疑似违规的视频降级,以减少观众数量。(莫汉承认这个灰色地带变得日益有挑战性:“有许多内容很难确定是否违规,尤其是在虚假信息方面。”)

第三个R是指“力推”(Raising up)来自可信来源的视频,尤其是与争议话题有关的视频。比如,5月13日,美国疾病预防控制中心(CDC)修改了佩戴口罩指南,当时YouTube的算法发现可能有虚假信息在传播,于是该平台挑选出一批有关这个话题的主流新闻报道,放在美国版页面顶部的显眼位置。最后一部分是“奖励”(Reward),即推广遵守规则的创作者的作品。

保证内容是安全的并且适合广告商,这一点对YouTube变得至关重要,因此公司用于跟踪该策略执行进展的指标,也包含在沃西基和其他高管的年度目标当中[在谷歌内部,这些“目标和关键成果”(OKR)是判断成败的终极指标],并越来越多地被公众采用。

公司网站上的最新数据显示,第一季度的违规观看率从去年同期的0.17%至0.20%下降到0.16%至0.18%。违规观看率用于统计被观看的视频中违反公司政策的比例。(令人意外的是,YouTube不愿意公布该网站上被观看的视频数量,但按照全球观众每天在该网站上花费的超过10亿个小时来计算,即使0.16%的违规视频也代表了较高的观看量。)

大部分广告商对YouTube所做的改进表示满意。工艺品零售连锁Michaels的首席营销官罗恩•斯陶帕说:“我相信在这个平台投放广告是安全的。”Michaels从18个月前开始在YouTube投放广告,广告支出不断增加。

迪克体育用品公司的媒体副总裁帕特里克•戴利称,YouTube的“政策和工具绝大多数情况下都是有效的。”

有些广告商表示,它们会聘请第三方评估其广告是否出现在不恰当的内容旁边。

威瑞森的数字营销副总裁克里斯•保罗说:“我们不会让合作伙伴自我评价。我们必须确保有独立第三方进行验证和核实。”

YouTube对内容的处理策略或许可以让广告商满意,但许多观察机构仍然心存疑虑。反诽谤联盟的副总裁亚当•诺伊菲尔德表示,YouTube“没有采取足够的措施”减少骚扰和极端主义言论传播。

“虽然YouTube公布了许多策略,也采取了一些适当措施,但该平台上仍然存在严重问题。”批评者提到了与新冠疫情有关的虚假信息以及关于选举舞弊的谎言等各种言论,证明YouTube依旧在放纵危险的视频在其平台上传播。

沃西基和她的团队成员都承认,该平台依旧有改进的空间。沃西基说:“我们一直在努力完善。肯定有人总在想方设法滥用平台,所以我们必须始终保持警惕。”

*****

广告商、YouTube及其庞大的内容创作者之间这种独特的三角关系,可能产生争议,也可能带来机会。

去年夏天,乔治•弗洛伊德在明尼苏达州被一名警察谋杀引发全国抗议,当时YouTube上出现了无数视频,人们在视频中提供与这次犯罪有关的信息,或者分享自己遭遇警察暴力的经历。

有黑人创作者承诺将其在YouTube平台上的广告收入捐赠给“黑人的命也是命”(Black Lives Matter)等组织,并鼓励观众点击广告和重复观看,以支持他们的做法。

但广告商不愿意为这些重复点击付费,它们向YouTube投诉,于是后者开始打击这种行为。YouTube方面表示,将代替创作者向种族正义组织捐款,但这种做法已经对有些创作者造成了伤害。

提出这种想法的美妆博主佐伊•阿米拉批评YouTube的决定“令人失望”。她说:“我能够理解它这样做是为了维护与广告商的关系。”但她认为另一方面,“YouTube应该让观众自己决定参与的方式。”

除此之外,YouTube还在尝试利用其对广告商的影响力,鼓励广告商重新评估其策略,在增加广告商业务的同时,可以支持以往被忽视的创作者和内容。

其中一个领域是说唱视频。这个板块在YouTube上很受欢迎,但大牌广告商通常会避免在这个板块投放广告。YouTube试图说服广告商重新审视这类视频,该公司称全世界所有音乐视频的前10名几乎都是说唱艺人,并向广告商承诺最新技术能够过滤歌词或图像不恰当的视频。

YouTube全球视频解决方案副总裁、广告合作事务的负责人黛比•温斯坦称:“如果你是广告商,希望与观众和流行文化产生联结,那么放弃说唱就是一大损失。”

虽然YouTube拒绝透露这方面工作的具体结果,但有迹象表明广告商的态度正在发生改变。

GroupM的泰勒指出,在2020年夏季之前,许多公司将“黑人的命也是命”这个短语列为“禁用词汇”,第三方软件会根据“禁用词汇”列表屏蔽公司的广告,避免其与某一条视频一同出现。但该平台上到处都是谈论“黑人的命也是命”的新闻和社会评论视频,因此有部分广告商同意将其从禁用词汇名单中删除。

泰勒说:“许多跨国品牌的自我反思和成熟令我备受鼓舞。”

*****

虽然所有人都在关注YouTube的内部问题,但它面临的最大威胁可能来自该平台以外。目前,YouTube是少数几个出售广告的流媒体平台之一,但HBO Max已经表示很快将进军这个领域,如果Netflix或迪士尼也跟进,这个领域不久就会变得竞争异常激烈。

在社交平台方面,短视频应用程序TikTok也是YouTube的一大威胁。现在,TikTok是硅谷的“热门新事物”。TikTok和Instagram一直在积极推出新视频功能,并为人们创造更多通过其应用程序变现的途径,它们也是YouTube维持创作者忠诚度面临的主要竞争对手。

为了留住优秀创作者,YouTube一直在努力增加变现方案。现在创作者可以在YouTube网站并通过其支付系统,出售月度会员、在线贴纸等数字商品以及实物商品等。未来YouTube将推出对可能从视频中获得较大价值的观众收取一次性费用的做法,类似于打赏功能。

YouTube分别于去年9月和今年3月先后在印度和美国新推出了不超过60秒的短视频功能Shorts,每天吸引的观看量已经达到65亿。这种短视频功能为创作者提供了一个创作简单视频的平台(而且能够帮助YouTube与TikTok竞争),因为创作者一直抱怨,为了维持顶流创作者的地位他们需要创作足够多的内容,这让他们不堪重负。YouTube一方面拿出1亿美元,用于向短视频创作者付费,同时也在构建支持新格式的广告系统。

YouTube也在进行各种尝试,努力为广告商创造更多价值。例如,不久将大范围推广的一项措施是向广告商开放谷歌商户中心。该功能允许广告商在相关内容中添加产品链接,例如当用户在YouTube搜索“最好的棒球手套”时,他会看到视频上出现一批手套广告。

当然,对任何大型科技公司而言,尤其是在目前,监管才是最大的威胁。各国都在采取措施管制社交媒体,包括有国家提案要求内容托管方对任何危险的帖子或视频承担法律责任。

YouTube的部分批评者认为,这类监管是防止不良内容传播的唯一途径。纽约州立大学布法罗分校专门研究虚假信息的约塔姆•奥菲尔教授表示:“我认为我们不能够指望私人公司拯救世界。我不信任它们……它们当然可以做得更好,只是它们需要这样做的动机。”

沃西基显然不认同这种观点。有些政府提案可能导致非专业人士无法发布视频,或者阻碍YouTube赖以生存的创作者经济的发展。

她说:“我们希望与政府合作,确保他们做出对国民和社区有利的决策。但该计划还没有经过深思熟虑。”

对于可能出现的意想不到的后果,以及在事情没有考虑周全的情况下可能发生的情况,YouTube当然有应对的经验。所以,关于YouTube未来是否会朝着沃西基设想的方向发展,你需要点击“订阅”按钮来一探究竟。(财富中文网)

助理报道:丹尼埃尔•阿布里尔

译者:Biz

几十年来,超级碗(Super Bowl)一直是广告领域里的“超级碗”。它是美国最盛大的舞台,是最具分量的品牌,拥有最多的观众,而对于转播超级碗的电视频道来说,这一天是收入最高的一天。

2月共有9,640万人观看了这场比赛,以及中间插播的广告。

但这一数字与接下来的数字相比则相形见绌。

同一时间,弗拉德和尼基•瓦什科托夫在他们的YouTube频道上传了多条视频。身材瘦长、善于表达的8岁男孩弗拉德和天真可爱的5岁弟弟尼基在这些搞笑短视频中做一些小孩子的游戏,比如说服妈妈给他们买一只宠物、搭建一个巨大的乐高房子、玩玩具车等等。

两个男孩在2月最受欢迎的三条视频的累计观看量超过1.7亿,而且这一数字还在不断增加。

“Vlad and Niki”频道在2018年开通。弗拉德在爸爸谢尔盖的帮助下,发布了一条他和玩具狗和一些彩色积木做游戏的四分钟视频。

现在这个频道在英语区YouTube上的订阅用户达到6,800万,使兄弟两人成为YouTube平台上第三大网红“创作者”。(谢尔盖表示,两兄弟在不同语言的平台上共有1.73亿订阅用户。)瓦什科托夫家人拒绝透露他们通过该平台上插播的广告获得的收入分成,而且除此之外,这个频道还给他们带来了赞助合约、商品销售、玩具许可权等。

但关注创作者行业的分析师表示,YouTube上的热门频道每年的收入可能达到3,000万美元至5,000万美元。按照这个水平,他们应该位于金字塔的顶端。

目前约有200万创作者参与了YouTube的广告项目,他们通常可以获得55%的广告收入分成。

现在是YouTube及其创作者蓬勃发展的时期。谷歌在2005年以16.5亿美元的价格收购YouTube。YouTube去年公布的广告收入为200亿美元(分析师表示,除此之外,该公司还有数十亿美元的产品订阅收入,例如YouTube Premium会员等,但YouTube没有披露具体财务数据)。

如果YouTube是一家独立实体,它将是全球第四大数字广告平台,仅次于其母公司Alphabet、Facebook和亚马逊。但真正让华尔街垂涎不已的是它未来的成长空间。YouTube 2020年的收入比2019年增长了31%,而其母公司Alphabet的收入同期仅增长了12.8%。(但有一个事实会给亢奋的分析师泼一盆冷水:我们不清楚不断增长的收入中有多少是利润;从创作者分成到技术成本,YouTube会产生巨额支出。)

推动YouTube广告业务繁荣的一个重要因素是传统广播和有线电视的衰落。市场跟踪机构Convergence Research表示,2012年,付费电视观众约有1.01亿个家庭,达到最高峰,但去年减少到7,600万,预计到2025年将进一步减少一半以上。

广告支出与观看人数息息相关。去年,电视广告支出减少了12.5%,而视频广告支出增加了30.1%。事实上,eMarketer公司的分析师预测,到2023年,视频广告支出将首次超过电视广告。

大型广告公司GroupM的全球合作负责人基利•泰勒说:“所有人都在为大广告商寻找新的投放广告的机会。”她表示,随着电视观众数量减少,“我们必须寻找其他途径向大众进行宣传。”

而想要找到大量受众,尤其是年轻人,YouTube是理想的选择。

尼尔森最近的一项研究发现,YouTube是深受所有年龄段喜爱的社交平台,50岁以下YouTube用户的数量,始终高于相同年龄段传统电视的观众数量。

4月,皮尤研究中心表示,81%的美国人使用YouTube,而使用第二大热门社交平台Facebook的美国人比例为69%。

所以,瓦什科托夫兄弟、费利克斯•谢尔贝格(网名PewDiePie)和莉莎•科希等YouTube网红受Z世代追捧的程度,不亚于大牌运动员和名人,这不足为奇。

YouTube的主导地位在很大程度上取决于用手机观看视频的数以十亿计的用户。但它也在不断扩大在客厅的影响。在客厅里,更多人观看智能电视或者链接到Roku、Apple TV等机顶盒设备在大屏幕上看YouTube视频。

YouTube表示,12月,美国有1.2亿人通过电视观看YouTube视频,比九个月前增加了20%。而在观看量最高的五种互联网电视服务(Netflix、YouTube、Amazon Prime、Disney+和Hulu)中,只有YouTube和Hulu出售广告。

*****

不断扩张的广告帝国是YouTube的首席执行官苏珊•沃西基主管的领域。她是谷歌的第16位员工,在20世纪90年代加入该公司,从2014年开始负责该视频服务的运营。

沃西基在帕洛阿尔托长大。她的父亲是斯坦福大学的物理系主任,但沃西基坚称她和同样优秀的两个姐妹(安妮创建了一家DNA分析公司23andMe,珍妮特则是一位人类学和流行病学博士),童年时代过得很普通,只是父母很重视她们是否有努力。

众所周知,1998年,苏珊在英特尔公司任职期间,把车库租给了谷歌的联合创始人谢尔盖•布林和拉里•佩奇。她说,当时那样做并不是因为她预感他们会取得成功。

在通过谷歌的Meet应用程序接受虚拟采访时,她回忆道:“我需要租金支付住房按揭贷款。”

沃西基很早就看到了YouTube的潜力;她表示,是她最早力劝布林和佩奇收购刚诞生不久的YouTube平台。沃西基曾经为谷歌创立了庞大的广告业务,因此在收购完成后,她成为运营YouTube的不二之选。

不久,沃西基就发现了用户创作的五花八门的内容和注重品牌形象的大广告商,这两者的组合很不稳定。没有筛选出冒犯性内容的情况在YouTube时有发生,比如在种族主义、恐同和反犹太人视频的旁边投放广告。

2017年,包括可口可乐、沃尔玛、宝洁和星巴克在内的多家知名美国公司纷纷停止在YouTube投放广告。

损失广告收入、Alphabet股价受挫和公关危机,引起了YouTube的重视。

沃西基说:“我们必须从用户和广告商的角度解决这些问题……这对我们至关重要。”谷歌开始更多利用机器学习人工智能软件来筛查不良内容,并招聘了数千名员工审核和评估可能违反公司服务条款的视频。

最严重的危机已经结束,广告商纷纷回归。

当然,事实上,2017年导致YouTube被广告商抵制的根本问题并没有完全消失(例如QAnon、5G网络阴谋论、疫苗微芯片等言论)。因此,随着YouTube的发展,它必须同步升级其基础设施,继续清理各种有害的内容。

YouTube的策略分为四个部分,其首席产品官尼尔•莫汉将其称为“4个R”。最明显的是“删除”(Removal),即找到并屏蔽最恶劣的内容。其次是“减少”(Reduce):利用YouTube强大的算法将疑似违规的视频降级,以减少观众数量。(莫汉承认这个灰色地带变得日益有挑战性:“有许多内容很难确定是否违规,尤其是在虚假信息方面。”)

第三个R是指“力推”(Raising up)来自可信来源的视频,尤其是与争议话题有关的视频。比如,5月13日,美国疾病预防控制中心(CDC)修改了佩戴口罩指南,当时YouTube的算法发现可能有虚假信息在传播,于是该平台挑选出一批有关这个话题的主流新闻报道,放在美国版页面顶部的显眼位置。最后一部分是“奖励”(Reward),即推广遵守规则的创作者的作品。

保证内容是安全的并且适合广告商,这一点对YouTube变得至关重要,因此公司用于跟踪该策略执行进展的指标,也包含在沃西基和其他高管的年度目标当中[在谷歌内部,这些“目标和关键成果”(OKR)是判断成败的终极指标],并越来越多地被公众采用。

公司网站上的最新数据显示,第一季度的违规观看率从去年同期的0.17%至0.20%下降到0.16%至0.18%。违规观看率用于统计被观看的视频中违反公司政策的比例。(令人意外的是,YouTube不愿意公布该网站上被观看的视频数量,但按照全球观众每天在该网站上花费的超过10亿个小时来计算,即使0.16%的违规视频也代表了较高的观看量。)

大部分广告商对YouTube所做的改进表示满意。工艺品零售连锁Michaels的首席营销官罗恩•斯陶帕说:“我相信在这个平台投放广告是安全的。”Michaels从18个月前开始在YouTube投放广告,广告支出不断增加。

迪克体育用品公司的媒体副总裁帕特里克•戴利称,YouTube的“政策和工具绝大多数情况下都是有效的。”

有些广告商表示,它们会聘请第三方评估其广告是否出现在不恰当的内容旁边。

威瑞森的数字营销副总裁克里斯•保罗说:“我们不会让合作伙伴自我评价。我们必须确保有独立第三方进行验证和核实。”

YouTube对内容的处理策略或许可以让广告商满意,但许多观察机构仍然心存疑虑。反诽谤联盟的副总裁亚当•诺伊菲尔德表示,YouTube“没有采取足够的措施”减少骚扰和极端主义言论传播。

“虽然YouTube公布了许多策略,也采取了一些适当措施,但该平台上仍然存在严重问题。”批评者提到了与新冠疫情有关的虚假信息以及关于选举舞弊的谎言等各种言论,证明YouTube依旧在放纵危险的视频在其平台上传播。

沃西基和她的团队成员都承认,该平台依旧有改进的空间。沃西基说:“我们一直在努力完善。肯定有人总在想方设法滥用平台,所以我们必须始终保持警惕。”

*****

广告商、YouTube及其庞大的内容创作者之间这种独特的三角关系,可能产生争议,也可能带来机会。

去年夏天,乔治•弗洛伊德在明尼苏达州被一名警察谋杀引发全国抗议,当时YouTube上出现了无数视频,人们在视频中提供与这次犯罪有关的信息,或者分享自己遭遇警察暴力的经历。

有黑人创作者承诺将其在YouTube平台上的广告收入捐赠给“黑人的命也是命”(Black Lives Matter)等组织,并鼓励观众点击广告和重复观看,以支持他们的做法。

但广告商不愿意为这些重复点击付费,它们向YouTube投诉,于是后者开始打击这种行为。YouTube方面表示,将代替创作者向种族正义组织捐款,但这种做法已经对有些创作者造成了伤害。

提出这种想法的美妆博主佐伊•阿米拉批评YouTube的决定“令人失望”。她说:“我能够理解它这样做是为了维护与广告商的关系。”但她认为另一方面,“YouTube应该让观众自己决定参与的方式。”

除此之外,YouTube还在尝试利用其对广告商的影响力,鼓励广告商重新评估其策略,在增加广告商业务的同时,可以支持以往被忽视的创作者和内容。

其中一个领域是说唱视频。这个板块在YouTube上很受欢迎,但大牌广告商通常会避免在这个板块投放广告。YouTube试图说服广告商重新审视这类视频,该公司称全世界所有音乐视频的前10名几乎都是说唱艺人,并向广告商承诺最新技术能够过滤歌词或图像不恰当的视频。

YouTube全球视频解决方案副总裁、广告合作事务的负责人黛比•温斯坦称:“如果你是广告商,希望与观众和流行文化产生联结,那么放弃说唱就是一大损失。”

虽然YouTube拒绝透露这方面工作的具体结果,但有迹象表明广告商的态度正在发生改变。

GroupM的泰勒指出,在2020年夏季之前,许多公司将“黑人的命也是命”这个短语列为“禁用词汇”,第三方软件会根据“禁用词汇”列表屏蔽公司的广告,避免其与某一条视频一同出现。但该平台上到处都是谈论“黑人的命也是命”的新闻和社会评论视频,因此有部分广告商同意将其从禁用词汇名单中删除。

泰勒说:“许多跨国品牌的自我反思和成熟令我备受鼓舞。”

*****

虽然所有人都在关注YouTube的内部问题,但它面临的最大威胁可能来自该平台以外。目前,YouTube是少数几个出售广告的流媒体平台之一,但HBO Max已经表示很快将进军这个领域,如果Netflix或迪士尼也跟进,这个领域不久就会变得竞争异常激烈。

在社交平台方面,短视频应用程序TikTok也是YouTube的一大威胁。现在,TikTok是硅谷的“热门新事物”。TikTok和Instagram一直在积极推出新视频功能,并为人们创造更多通过其应用程序变现的途径,它们也是YouTube维持创作者忠诚度面临的主要竞争对手。

为了留住优秀创作者,YouTube一直在努力增加变现方案。现在创作者可以在YouTube网站并通过其支付系统,出售月度会员、在线贴纸等数字商品以及实物商品等。未来YouTube将推出对可能从视频中获得较大价值的观众收取一次性费用的做法,类似于打赏功能。

YouTube分别于去年9月和今年3月先后在印度和美国新推出了不超过60秒的短视频功能Shorts,每天吸引的观看量已经达到65亿。这种短视频功能为创作者提供了一个创作简单视频的平台(而且能够帮助YouTube与TikTok竞争),因为创作者一直抱怨,为了维持顶流创作者的地位他们需要创作足够多的内容,这让他们不堪重负。YouTube一方面拿出1亿美元,用于向短视频创作者付费,同时也在构建支持新格式的广告系统。

YouTube也在进行各种尝试,努力为广告商创造更多价值。例如,不久将大范围推广的一项措施是向广告商开放谷歌商户中心。该功能允许广告商在相关内容中添加产品链接,例如当用户在YouTube搜索“最好的棒球手套”时,他会看到视频上出现一批手套广告。

当然,对任何大型科技公司而言,尤其是在目前,监管才是最大的威胁。各国都在采取措施管制社交媒体,包括有国家提案要求内容托管方对任何危险的帖子或视频承担法律责任。

YouTube的部分批评者认为,这类监管是防止不良内容传播的唯一途径。纽约州立大学布法罗分校专门研究虚假信息的约塔姆•奥菲尔教授表示:“我认为我们不能够指望私人公司拯救世界。我不信任它们……它们当然可以做得更好,只是它们需要这样做的动机。”

沃西基显然不认同这种观点。有些政府提案可能导致非专业人士无法发布视频,或者阻碍YouTube赖以生存的创作者经济的发展。

她说:“我们希望与政府合作,确保他们做出对国民和社区有利的决策。但该计划还没有经过深思熟虑。”

对于可能出现的意想不到的后果,以及在事情没有考虑周全的情况下可能发生的情况,YouTube当然有应对的经验。所以,关于YouTube未来是否会朝着沃西基设想的方向发展,你需要点击“订阅”按钮来一探究竟。(财富中文网)

助理报道:丹尼埃尔•阿布里尔

译者:Biz

FOR DECADES, the Super Bowl has been, well, the Super Bowl of the advertising world. The biggest stage, the biggest brands, the biggest audience, and, for the channel that hosts it, the biggest payday. In February, 96.4 million people tuned in to watch the big game and the ads that ran along with it.

Also in February, Vlad and Niki Vashketov posted a handful of videos to their YouTube channel. The short, manic clips show Vlad, a gangly and expressive 8-year-old, and his doeeyed 5-year-old brother, Niki, doing kid stuff: persuading their mom to get them a pet, building a giant Lego house, playing with toy cars. Cumulatively, the boys’ three most popular videos of the month have amassed more than 170 million views—and counting.

The Vlad and Niki channel, which launched in 2018 when Vlad, with the help of his dad, Sergey, posted a four-minute video of Vlad playing with a toy dog and some colored blocks, now has 68 million subscribers on English-language YouTube, making the brothers the third most popular “creators” on the platform. (Globally, Sergey says, the boys have a total of 173 million subscribers in various languages.) The Vashketov family declines to say how much it makes from its share of the revenue from the ads that play against its videos on the platform—not to mention the brand sponsorship deals, merchandise sales, and toy licensing rights the channel has birthed. But analysts who track the creator industry say that, all in, the top channels on YouTube are earning $30 million to $50 million per year. That puts them at the pointy end of the pyramid of some 2 million creators who participate in YouTube’s advertising program and typically get a 55% cut of the ad revenue they generate.

It’s boom times for YouTube and its creators. The Google-owned service, bought for just $1.65 billion in 2005, reported ad revenue of $20 billion last year (plus what analysts say are billions of dollars more from subscriptions to products like YouTube Premium, the financial details of which the company doesn’t disclose). Some context: If YouTube were a stand-alone entity, that would make it the world’s fourth-largest seller of digital ads, after its parent company, Alphabet, Facebook, and Amazon. But what really has Wall Street salivating is the question of just how big it might get. YouTube’s 2020 revenue was up 31% from 2019, compared with a 12.8% increase for its parent, Alphabet. (One note that puts something of a damper on analysts’ exuberance: We still don’t know how much of that growing pool of money is profit; between creator payouts and tech costs, YouTube has significant expenses.)

A big factor driving YouTube’s ad ascendance is the decline of traditional broadcast and cable TV. After peaking at almost 101 million households in 2012, the pay TV audience dropped to 76 million last year and is forecast to shrink to less than half that by 2025, according to market tracking firm Convergence Research. Ad dollars follow the eyeballs. Spending on TV advertising dropped 12.5% last year, while video ads surged 30.1%. Indeed, the analysts at eMarketer are predicting that the amount spent on video advertising will surpass that of TV for the first time by 2023.

“Everyone is looking for new ad opportunities for big advertisers,” says Kieley Taylor, global head of partnerships at mega ad agency GroupM. As the TV audience shrinks, she says, “we have to find other ways to talk to a lot of people.”

If you want to reach a lot of people—and especially young people—YouTube is the place to do it. It’s the most popular social platform among almost all age groups, and the number of people under 50 using YouTube regularly tops the number of people in that same cohort who are watching traditional TV, a recent study by Nielsen concluded. In April, Pew Research said 81% of Americans use YouTube, compared with 69% for Facebook, the second most popular option. It’s no wonder then that for Gen Z, YouTube stars like the Vashketov brothers, Felix Kjellberg (a.k.a. PewDiePie), and Liza Koshy are as recognized and admired as big-name athletes and celebrities.

For most of its life, YouTube’s dominance has depended on billions of mobile phone users watching videos. But it’s increasingly a force in the living room, where more people are watching smart TVs or connecting Roku, Apple TV, and other set-top boxes to watch YouTube on a big screen. YouTube said 120 million people in the U.S. watched via a TV in December, up 20% from nine months earlier. And of the top five most watched services on connected TVs—Netflix, YouTube, Amazon Prime, Disney+, and Hulu—only YouTube and Hulu sell ads.

*****

THIS GROWING ad empire is the domain of YouTube CEO Susan Wojcicki, employee No. 16 at Google back in the 1990s, who has overseen the video service since 2014.

Growing up in Palo Alto, her dad was the chairman of the Stanford University physics department, but Wojcicki insists she and her equally formidable sisters—Anne started DNA analysis company 23andMe, and Janet is a Ph.D. anthropologist and epidemiologist—had a pretty normal childhood, though hard work was highly valued. Later, in 1998, while working at Intel, Susan famously rented her garage to Google cofounders Sergey Brin and Larry Page. It wasn’t because she had a clue they would be so successful, she says. “I wanted the rent because I needed the money to pay my mortgage,” she recalls during a virtual interview held via Google’s Meet app.

Wojcicki saw YouTube’s potential early; she says she was the first person to urge Brin and Page to buy the fledgling platform. And once they did, her background building out Google’s massive ad business made her the obvious candidate to run it.

But it didn’t take long for Wojcicki to discover just how volatile a mix user-generated videos and big-name, image-conscious advertisers could be. YouTube repeatedly failed to filter out offensive content—effectively putting ads against racist, homophobic, and anti-Semitic videos. And in 2017, a who’s who of corporate America, including Coca-Cola, Walmart, Procter & Gamble, and Starbucks, pulled their ad dollars.

The trifecta of lost ad money, a hit to Alphabet’s stock price, and a PR mess got YouTube’s attention.“We needed to work through those issues and to solve them in a way that worked for our users and our advertisers … That was critical for us,” says Wojcicki. Google expanded the use of its machine-learning A.I. software to screen for toxic content and hired thousands of workers to find and assess videos that might violate the company’s terms of service. The worst of the crisis passed, and advertisers trickled back.

The reality, of course, is that the underlying issues that sparked that 2017 boycott have never entirely vanished (see: QAnon, 5G conspiracy theories, vaccine microchips). And so, as YouTube has grown, so has the infrastructure it has created to clean up its sludge-filled gutters. Today the system has four components—which chief product officer Neal Mohan describes as the “Four R’s.” The most visible is “removal”—finding and spiking the most egregious content. Next comes “reduce”: shrinking the audience of borderline videos by downgrading them with YouTube’s all-powerful algorithm. (Mohan admits this gray area is a growing challenge: “There’s a lot of content out there that is very hard to categorize as crossing the line or not, particularly in the realm of misinformation.”) The third R stands for “raising up” videos from trustworthy sources, particularly on controversial topics. For instance, when the CDC issued revised guidance for wearing masks on May 13, YouTube’s algorithms detected a potential for the spread of misinformation and curated a group of mainstream news reports on the topic, which it gave a prominent spot near the top of U.S. feeds. The final plank of the strategy is “reward”—i.e., promote the videos of creators who follow the rules.

Keeping YouTube’s content safe—and therefore advertiser friendly—has become so critical that metrics the company uses to track its progress are included in the annual goals of Wojcicki and her top execs (these “Objectives and Key Results,” or OKRs, are the ultimate arbiters of success and failure inside the Googleplex) and, increasingly, are available to the public online. According to the latest data on the company’s site, the violative view rate—which measures the percentage of watched videos that violated the company’s policies—was between 0.16% to 0.18% in the first quarter, down from 0.17% to 0.20% a year earlier. (YouTube is surprisingly coy about the volume of videos watched on its site, but with more than a billion hours consumed per day, it’s fair to say that even 0.16% represents quite a lot of views.)

For the most part, advertisers say they are impressed with YouTube’s progress. “I’m pretty confident that we are in a safe place,” says Ron Stoupa, chief marketing officer at art-supply chain Michaels, which has been increasing spending with YouTube since it started advertising on the service 18 months ago. YouTube’s“policies and tools work as intended the vast majority of the time,” adds Patrick Daley, vice president of media at Dick’s Sporting Goods.

Some advertisers note that they hire outside companies to assess whether their spots are running alongside inappropriate content.“What we don’t do is allow our partners to check their own homework,” says Chris Paul, vice president of digital marketing at Verizon. “We have to make sure there’s an independent party giving us verification and validation.”

But while ad buyers may be feeling good about YouTube’s handle on its content, many watchdogs remain unconvinced. YouTube “has not taken enough steps” to reduce harassment and the spread of extremism, says Adam Neufeld, vice president of the Anti-Defamation League. “While they’ve announced various efforts and taken modest steps, these are both still massive problems.” Critics point to everything from COVID-19 misinformation to lies about election fraud as evidence that YouTube is still allowing dangerous videos to circulate on its platform.

Wojcicki and members of her team allow that there’s still a way to go. “It’s something we’ll always be working on,” the CEO says. “There will always be the potential of people looking for ways to abuse the platform, and that’s why we need to make sure that we’re vigilant at all times.”

*****

THE UNIQUE three-pronged relationship between advertisers, YouTube, and its vast network of creators can create both controversy and opportunity. Last summer, when the murder of George Floyd by a Minnesota police officer sparked nationwide protests, YouTube was awash in videos providing information about the crime and about the experiences of other victims of police brutality. Some Black creators on the site had pledged to donate their ad profits to organizations like Black Lives Matter and were encouraging viewers to click on their ads and watch them over and over as a way to show their support. Advertisers, unhappy about paying for these repetitive clicks, complained, and YouTube cracked down on the behavior. The company says it replaced the donations with its own contributions to racial justice organizations, but for some creators the damage was already done.

Beauty blogger Zoe Amira, who came up with the idea, calls the decision “disappointing.” “I guess I understood that it was in defense of their relationship with their advertisers,” she says, adding, on the other hand: “It should be left up to the watchers how they engage.”

In other instances, the company has attempted to use its clout with advertisers to encourage them to reassess their strategies in a way that could both boost their business and support creators and content that’s been overlooked in the past. One such area is hip-hop videos, a popular YouTube segment that big advertisers have historically avoided. YouTube pitched advertisers to reexamine the genre, noting that virtually every music video top 10 list around the world is dominated by hip-hop artists and pledging that the latest technology could filter out videos with inappropriate lyrics or images. “If you’re an advertiser and you want to be connecting with audiences and relevant in culture, not being in hip-hop is a big miss,” says Debbie Weinstein, VP of video global solutions at YouTube who oversees ad partnerships.

While YouTube declined to share any details about the results of the effort, there is some suggestion that advertisers are starting to evolve. Until the summer of 2020, many companies included the phrase Black Lives Matter on their list of“banned words”—terms that thirdparty software uses to block their ads from appearing against a video, says GroupM’s Taylor. But as the platform filled with news and social commentary videos citing BLM, some of those advertisers agreed to strike it from their list, she says: “I’m encouraged by the self-reflection and maturation I see with many multinational brands.”

*****

FOR ALL ITS FOCUS on internal issues, perhaps the biggest threats to YouTube’s future come from the world beyond its platform. At the moment, it’s one of the few streamers to accept ads, but HBO Max has said it plans to go that route soon, and if Netflix or Disney ever decide to follow suit, the space could get crowded fast. On the social side, the same could be said of TikTok, the short-form video app that currently wears Silicon Valley’s “hot new thing” mantle. TikTok and Instagram, which has been aggressively rolling out new video features and additional ways for people to make money on the app, are also major risk factors when it comes to maintaining the creators’ loyalty.

To keep the people who make its videos engaged, YouTube has been focused on expanding monetization options. Already, creators can sell monthly memberships, digital goods like online stickers, and merch—all from within their YouTube sites and via YouTube’s payments system. Nextup: a way to collect one-time payments, like a tip jar, for viewers who may derive a lot of value from a video.

YouTube’s new 60-seconds-or-less video feature, Shorts, which debuted in India in September and in the U.S. in March, is already attracting 6.5 billion views per day. The snack-size option gives creators, who have complained that the demands of making enough content to remain a top YouTuber can be exhausting and overwhelming, a forum to create simpler videos (and, yes, helps YouTube challenge TikTok). YouTube set up a $100 million fund to pay creators for making shorts while it gets its ad systems up and running in the new format.

YouTube has also been experimenting with ways to offer more value to advertisers. One such trial soon to be rolled out more broadly is access to the Google Merchant Center. The feature allows advertisers to place links to their products above relevant content, so users who search YouTube for, say, “best baseball glove” will see a bunch of glove ads hovering above the video.

Of course, for any Big Tech player, the ultimate threat, especially right now, is regulation. Efforts are under way around the globe to crack down on social media, including proposals that would hold content-hosting companies legally liable for any dangerous posts or videos.

Some of YouTube’s critics see such regulation as the only way to curb the spread of toxic content. “I don’t think we should expect private companies to save the world,” says University at Buffalo professor Yotam Ophir, who studies misinformation. “I don’t trust them … They can do much better, but they need the incentives to do so.”

Wojcicki obviously disagrees. Some proposals could make it impossible for amateurs to post videos or otherwise handicap the creator economy that underpins her company.

“We want to work with governments to make sure that they’re doing what’s right for citizens and communities,” she says. “But it might not have been thought through.”

YouTube has certainly had its share of experience with unintended consequences and what can happen when things might not have been thought all the way through. So, as to whether its future will follow the path Wojcicki wills, or something quite different—you’ll have to smash that “subscribe” button to find out.

Additional reporting by Danielle Abril