从某种意义上来说,过高的木材价格意味着树木确实变成了“摇钱树”。因此,伐木工们正在加紧砍伐更多的南方黄松,这个树种在美国南方腹地分布广泛,数量繁多。周二,来自不列颠哥伦比亚省的木材业巨头Canfor宣布,计划投资1.6亿美元在路易斯安那州建设首家锯木厂。在此之前,同样来自不列颠哥伦比亚省的West Fraser Timber曾在五月宣布,将投资1.5亿美元在美国南方扩建五家锯木厂。来自该省的另外一家木材生产商Interfor也在扩大其位于乔治亚州多家锯木厂的产能。

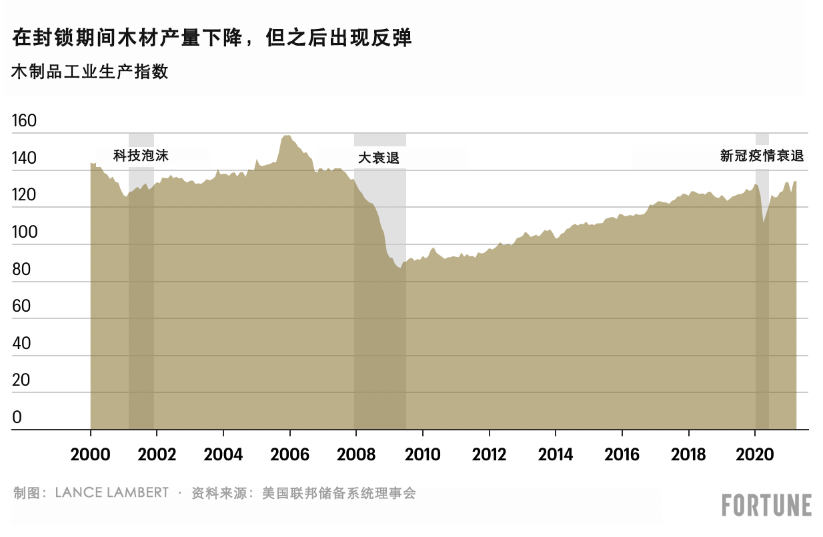

虽然新建锯木厂不会很快生产出两英寸厚四英寸宽的板材,但现有锯木厂的产量增加,已经使美国的木材产量达到近13年新高。4月,美国工业用木材产量指数达到134.2点,为自2007年12月以来的最高点。2007年12月,该指数一度达到135.3点,当时是美国陷入大衰退的第一个月,此后房屋建设和木材产量突然陷入了停滞。

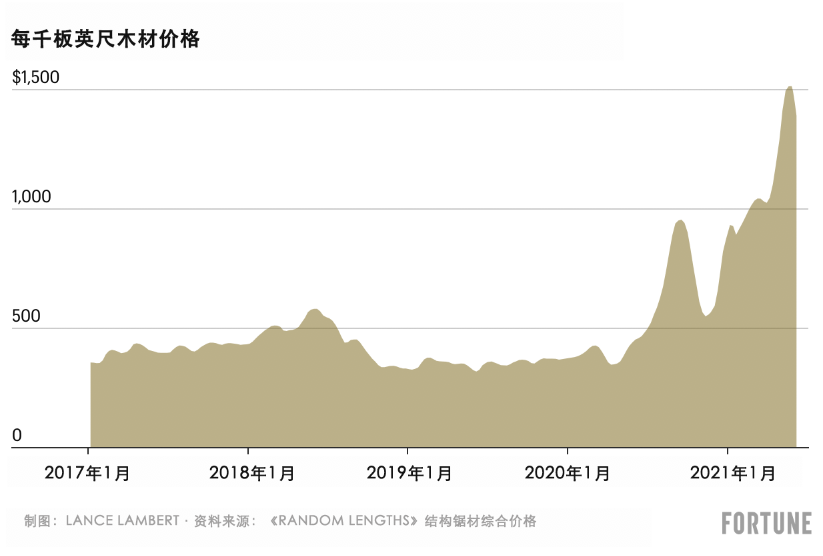

木材产量增加的背后似乎有简单的经济学原理:随着木材价格屡创历史新高,木材生产商有增加供应的动机,而当价格达到较高水平时,购买者采购木材时会再三斟酌。但此次木材产量增加的同时,木材价格却没有下降到疫情之前的水平。据行业期刊《Random Lengths》统计,周二,每千板英尺的现货价格为1,391美元。虽然这与5月28日的历史最高价格1,515美元相比有小幅下降,但自2020年4月以来的涨幅依旧达到惊人的288%。在疫情爆发之前,木材价格通常会上涨350美元至500美元。

既然木材产量创13年新高,为什么木材价格没有快速下跌?简而言之,木材需求依旧旺盛。4月,新房建设量较2021年3月创下的14年新高减少了8%;然而,这与2020年4月和2019年4月的水平相比依旧分别增加了67%和22%。房屋建设市场依旧火热。此外,DIY房屋改造的热度并没有下降:4月,家居装饰销售创历史新高,较疫情之前增长了31%。

大宗商品交易平台Mickey Group的交易与增长总监奇普·泽茨尔表示:“我们积攒了大量的订单。许多地方都急需木材。无论是来自加勒比地区还是中国的客户,所有人都在要求增加木材供应。每家公司都供应紧张。”

《财富》杂志之前曾经分析过,疫情期间的各种因素造成了这种史无前例的木材短缺。2020年春季新冠疫情爆发之后,由于担心房地产行业崩溃,锯木厂开始削减产量并减少库存。但崩溃并未到来,反而出现了截然相反的局面。美国民众纷纷涌入家得宝(Home Depot)和劳氏公司(Lowe’s)为DIY项目采购材料,而经济衰退导致的低利率也刺激了房地产市场繁荣。大批千禧一代开始购房,数量达到了最高峰,这进一步推动了市场繁荣,使房地产存量快速减少,因此购房人只能寻找新建住房。住房装修和建设需要大量木材,而锯木厂的产量难以满足需求。

虽然近几周木材短缺状况有所缓解,但宏观市场动态依旧没有变化。旺盛的需求意味着贮木场无法积攒库存,而且整个供应链依旧面临压力。

Fastmarkets RISI主要研究木材市场的高级经济学家达斯丁·贾尔伯特告诉《财富》杂志:“库存修正需要时间:锯木厂不仅要满足建筑和制造业当前的需求,还要填补我们在2020年因为供不应求造成的库存缺口。所以,即使买方意识到市场正在转变为买方市场,他们也无法随心所欲地大肆采购,因为建筑商和承包商的需求依旧旺盛,尽管增长速度有小幅放缓,但这仍迫使他们不断下订单来满足眼前的需求。”

仅靠国内木材产量增长无法帮助美国摆脱木材短缺的困境。据Fastmarkets统计,美国消费的木材约30%来自加拿大。最受美国房屋建筑商欢迎的加拿大软木的供应量,还没有快速恢复。加拿大因为自身的原因导致木材供应受限,包括发生在不列颠哥伦比亚的森林大火、甲虫入侵和云杉树增长速度缓慢等。

加拿大本地木材供应受限,也是Canfor、Interfor和West Fraser Timber等该国林业巨头纷纷前往美国南部扩大生产的原因。

Sherwood Lumber公司CEO安迪·古德曼告诉《财富》杂志:“北美木材供应链正在重新平衡的过程当中,加拿大供应量减少,美国供应量增加。过去50年,美国人建造房屋使用的木材大部分来自美国太平洋西北地区或加拿大,而不是美国南部。美国南部有地球上最茂盛的森林和成本最低的木材。一直以来,该地区生产的木材主要供应东部、东南部和墨西哥湾等地的处理木材市场,并没有广泛应用于住宅建筑市场。随着住宅市场的需求增长,传统产地的供应停滞或下降,需要由产自美国南部的南方黄松填补供应缺口。”

业内人士表示,美国南方的供应增加是木材行业的利好迹象。但对于DIY房屋改造用户而言,这意味着木材价格不会回落到疫情之前的水平。泽茨尔表示,每千板英尺的长期价格可能在600美元至1,000美元之间徘徊。归根结底,人口结构变化和可售住房量存量不足,将维持房屋建设市场的繁荣。

2008年房地产市场的崩溃和随之而来的止赎危机令房屋建筑商和锯木厂遭遇重创。这样说可能有些轻描淡写。当年的危机造成的金融和心理伤害,导致尽管住房需求反弹,建筑商和锯木厂却依旧小心谨慎,不愿意承担过多风险。十年来房屋建筑行业保守的态度,解释了美国为什么目前会出现房屋供应不足,而且锯木厂认为这种情况在短期内不会有变化。因此他们才会敢于扩大生产。

West Fraser Timber宣布扩大美国锯木厂生产规模之后不久便召开了最近一次营收报告会议。该公司在会议上表示:“低按揭利率、低可供转售的房屋存量、有利的人口结构、日益提高的远程办公接受度和多年来房屋建设不足导致的供应缺口,似乎将对北美地区的新住房需求产生积极影响。住宅老化和维修与翻新支出增加,也会继续刺激木材、胶合板和定向刨花板等产品的需求。”(财富中文网)

翻译:刘进龙

审校:汪皓

从某种意义上来说,过高的木材价格意味着树木确实变成了“摇钱树”。因此,伐木工们正在加紧砍伐更多的南方黄松,这个树种在美国南方腹地分布广泛,数量繁多。周二,来自不列颠哥伦比亚省的木材业巨头Canfor宣布,计划投资1.6亿美元在路易斯安那州建设首家锯木厂。在此之前,同样来自不列颠哥伦比亚省的West Fraser Timber曾在五月宣布,将投资1.5亿美元在美国南方扩建五家锯木厂。来自该省的另外一家木材生产商Interfor也在扩大其位于乔治亚州多家锯木厂的产能。

虽然新建锯木厂不会很快生产出两英寸厚四英寸宽的板材,但现有锯木厂的产量增加,已经使美国的木材产量达到近13年新高。4月,美国工业用木材产量指数达到134.2点,为自2007年12月以来的最高点。2007年12月,该指数一度达到135.3点,当时是美国陷入大衰退的第一个月,此后房屋建设和木材产量突然陷入了停滞。

木材产量增加的背后似乎有简单的经济学原理:随着木材价格屡创历史新高,木材生产商有增加供应的动机,而当价格达到较高水平时,购买者采购木材时会再三斟酌。但此次木材产量增加的同时,木材价格却没有下降到疫情之前的水平。据行业期刊《Random Lengths》统计,周二,每千板英尺的现货价格为1,391美元。虽然这与5月28日的历史最高价格1,515美元相比有小幅下降,但自2020年4月以来的涨幅依旧达到惊人的288%。在疫情爆发之前,木材价格通常会上涨350美元至500美元。

既然木材产量创13年新高,为什么木材价格没有快速下跌?简而言之,木材需求依旧旺盛。4月,新房建设量较2021年3月创下的14年新高减少了8%;然而,这与2020年4月和2019年4月的水平相比依旧分别增加了67%和22%。房屋建设市场依旧火热。此外,DIY房屋改造的热度并没有下降:4月,家居装饰销售创历史新高,较疫情之前增长了31%。

大宗商品交易平台Mickey Group的交易与增长总监奇普·泽茨尔表示:“我们积攒了大量的订单。许多地方都急需木材。无论是来自加勒比地区还是中国的客户,所有人都在要求增加木材供应。每家公司都供应紧张。”

《财富》杂志之前曾经分析过,疫情期间的各种因素造成了这种史无前例的木材短缺。2020年春季新冠疫情爆发之后,由于担心房地产行业崩溃,锯木厂开始削减产量并减少库存。但崩溃并未到来,反而出现了截然相反的局面。美国民众纷纷涌入家得宝(Home Depot)和劳氏公司(Lowe’s)为DIY项目采购材料,而经济衰退导致的低利率也刺激了房地产市场繁荣。大批千禧一代开始购房,数量达到了最高峰,这进一步推动了市场繁荣,使房地产存量快速减少,因此购房人只能寻找新建住房。住房装修和建设需要大量木材,而锯木厂的产量难以满足需求。

虽然近几周木材短缺状况有所缓解,但宏观市场动态依旧没有变化。旺盛的需求意味着贮木场无法积攒库存,而且整个供应链依旧面临压力。

Fastmarkets RISI主要研究木材市场的高级经济学家达斯丁·贾尔伯特告诉《财富》杂志:“库存修正需要时间:锯木厂不仅要满足建筑和制造业当前的需求,还要填补我们在2020年因为供不应求造成的库存缺口。所以,即使买方意识到市场正在转变为买方市场,他们也无法随心所欲地大肆采购,因为建筑商和承包商的需求依旧旺盛,尽管增长速度有小幅放缓,但这仍迫使他们不断下订单来满足眼前的需求。”

仅靠国内木材产量增长无法帮助美国摆脱木材短缺的困境。据Fastmarkets统计,美国消费的木材约30%来自加拿大。最受美国房屋建筑商欢迎的加拿大软木的供应量,还没有快速恢复。加拿大因为自身的原因导致木材供应受限,包括发生在不列颠哥伦比亚的森林大火、甲虫入侵和云杉树增长速度缓慢等。

加拿大本地木材供应受限,也是Canfor、Interfor和West Fraser Timber等该国林业巨头纷纷前往美国南部扩大生产的原因。

Sherwood Lumber公司CEO安迪·古德曼告诉《财富》杂志:“北美木材供应链正在重新平衡的过程当中,加拿大供应量减少,美国供应量增加。过去50年,美国人建造房屋使用的木材大部分来自美国太平洋西北地区或加拿大,而不是美国南部。美国南部有地球上最茂盛的森林和成本最低的木材。一直以来,该地区生产的木材主要供应东部、东南部和墨西哥湾等地的处理木材市场,并没有广泛应用于住宅建筑市场。随着住宅市场的需求增长,传统产地的供应停滞或下降,需要由产自美国南部的南方黄松填补供应缺口。”

业内人士表示,美国南方的供应增加是木材行业的利好迹象。但对于DIY房屋改造用户而言,这意味着木材价格不会回落到疫情之前的水平。泽茨尔表示,每千板英尺的长期价格可能在600美元至1,000美元之间徘徊。归根结底,人口结构变化和可售住房量存量不足,将维持房屋建设市场的繁荣。

2008年房地产市场的崩溃和随之而来的止赎危机令房屋建筑商和锯木厂遭遇重创。这样说可能有些轻描淡写。当年的危机造成的金融和心理伤害,导致尽管住房需求反弹,建筑商和锯木厂却依旧小心谨慎,不愿意承担过多风险。十年来房屋建筑行业保守的态度,解释了美国为什么目前会出现房屋供应不足,而且锯木厂认为这种情况在短期内不会有变化。因此他们才会敢于扩大生产。

West Fraser Timber宣布扩大美国锯木厂生产规模之后不久便召开了最近一次营收报告会议。该公司在会议上表示:“低按揭利率、低可供转售的房屋存量、有利的人口结构、日益提高的远程办公接受度和多年来房屋建设不足导致的供应缺口,似乎将对北美地区的新住房需求产生积极影响。住宅老化和维修与翻新支出增加,也会继续刺激木材、胶合板和定向刨花板等产品的需求。”(财富中文网)

翻译:刘进龙

审校:汪皓

Exorbitant lumber prices mean money, in a sense, does grow on trees. It’s why loggers are racing to cut down more Southern yellow pine—a plentiful species that dots the Deep South. On Tuesday, British Columbia–based lumber giant Canfor announced its plan to invest $160 million to build its first-ever sawmill in Louisiana. That comes after BC-based West Fraser Timber announced in May that it will spend $150 million to expand five sawmills in the South. Interfor, another BC-based lumber producer, is also in the midst of expanding some of its Georgia sawmills.

While new sawmills won’t churn out two-by-fours anytime soon, increased production at existing mills is already pushing wood production in the U.S. to a 13-year high. In April, the U.S. industrial wood production index hit 134.2, its highest level since the 135.3 struck in December 2007—the first month of the Great Recession, after which homebuilding and lumber production screeched to a halt.

This increase in wood production looks like simple economics at work: With lumber at historic prices, producers should be incentivized to boost supply while buyers presumably would rethink purchasing at those levels. Except this uptick in wood production hasn’t coincided with a reversal to pre-pandemic lumber prices. On Tuesday, the cash price per thousand board feet of lumber was at $1,391, according to industry trade publication Random Lengths. While that’s down a bit from its $1,515 all-time high set on May 28, it’s up a staggering 288% since April 2020. Prior to the pandemic, the price usually floated between $350 and $500.

So if wood production is at a 13-year high, why aren’t lumber prices falling faster? Simply put, demand is still through the roof. In April, new housing starts backed off 8% from a 14-year high set in March 2021; however, that level of construction is up 67% from its bottom in April 2020 and up 22% from April 2019. Home construction remains red-hot. Additionally, do-it-yourselfers aren’t slowing down: In April, home improvement sales hit an all-time high—up 31% from pre-pandemic levels.

“The backlog is just too strong. There are too many places to put wood,” says Chip Setzer, director of trading and growth for Mickey Group, a commodity trading platform. “I got customers in the Caribbean screaming for more; I got China customers screaming for more. Everybody is under a squeeze.”

As Fortune has previously explained, this historic lumber shortage was spurred by a perfect storm of factors set off during the pandemic. When COVID-19 broke out in spring 2020, sawmills cut production and unloaded inventory in fears of a looming housing crash. The crash didn’t happen—instead, the opposite occurred. Americans rushed to Home Depot and Lowe’s to buy up materials for do-it-yourself projects, while recession-induced interest rates helped spur a housing boom. That boom, which was exacerbated by a large cohort of millennials starting to hit their peak homebuying years, dried up housing inventory and sent buyers in search of new construction. Home improvements and construction require a lot of lumber, and mills couldn’t keep up.

While the shortage has improved in recent weeks, the bigger macro dynamic still remains. That high demand means that lumberyards still can’t build up inventory, and the entire supply chain remains under stress.

“That inventory correction is going to take time to sort out: Mills are not only producing to meet existing demand from construction and manufacturing, but also to fill that inventory hole that we dug in 2020 as demand outpaced production,” Dustin Jalbert, a senior economist at Fastmarkets RISI, where he covers the lumber market, tells Fortune. “So even though buyers sense the market turning in their favor, they cannot throttle buying as much as they’d like to, as demand from builders and contractors is still there, even if slowing a bit, and so it forces them to keep placing orders to meet immediate needs.”

Rising domestic wood production alone can’t dig the country out of the lumber shortage. According to Fastmarkets, around 30% of lumber consumed in the U.S. comes from Canada. Supply of Canadian softwood, a favorite among U.S. homebuilders, hasn’t recovered as quickly. Canadian timber supply is limited by its own perfect storm: British Columbia’s forest fires, beetle infestations, and the slow growth rate of spruce trees.

That limited Canadian timber supply is also why Canadian forestry giants like Canfor, Interfor, and West Fraser Timber are upping production in the U.S. South.

“The North American lumber supply chain is in the middle of a rebalancing act, with Canadian supply declining and U.S. supply increasing,” Andy Goodman, CEO of Sherwood Lumber, tells Fortune. “For the last 50 years, the majority of the lumber that has been used to build a home in the U.S. was shipped from the U.S. Pacific Northwest or Canada, not from the U.S. South, where the most bountiful forests and the cheapest fiber in the world is located. Lumber produced in the U.S. South has been heavily used to supply the treated lumber markets for the Eastern, Southeastern, and Gulf Coast markets and not expansively used for residential construction. With demand increasing, and legacy supply static or decreasing, Southern yellow pine from the U.S. South has to fill that supply gap.”

This expansion in the U.S. South, industry insiders say, is a bullish sign for the lumber industry. Unfortunately for DIYers, it suggests we aren’t going back to pre-coronavirus lumber prices. Setzer says the price per thousand board feet is more likely to hover in the $600 to $1,000 range long term. It boils down to the fact that demographics and the lack of available homes for sale should keep builders busy.

The 2008 housing crash and subsequent foreclosure crisis dealt homebuilders and sawmills a blow. That’s putting it mildly. The financial and psychological damage caused by those rough years is why even as housing demand rebounded, builders and sawmills were careful to not overextend themselves. That decade-long period of conservative building explains our current nationwide housing shortage—something sawmills don’t see going away anytime soon. It’s why they’re expanding.

“Low mortgage rates, low volumes of homes available for resale, favorable demographics, increasing acceptance of remote working, and the underlying housing construction deficit due to several years of under-building appear to be positively influencing the demand for new housing in North America,” West Fraser Timber wrote in its latest earnings report soon after announcing its U.S. sawmill expansion. “An aging housing stock and increased repair and renovation spending should also continue to drive strong lumber, plywood, and OSB demand.”