新冠肺炎疫情带来的挫折可能让美国支付公司Square一直觉得如鲠在喉。这家公司成立于2009年,创始人包括首席执行官杰克·多尔西,当然他还是著名的推特公司(Twitter)的联合创始人及首席执行官。Square最为人知的可能是它与众不同的白色信用卡读卡器,小公司可以轻松地用它在智能手机或平板电脑上完成支付。进入2020年时,Square势头强劲,此前一年的销售额增速高达43%。但随着新冠疫情在美国肆虐,从去年3月开始的封城措施给Square的核心客户,也就是那些夫妻店式的小公司带来了毁灭性的打击。

在一条业务线面临致命威胁之际,多尔西及其团队又适时地拿出了另外一项创新,那就是支付服务Cash App。

Cash App旨在和PayPal、PayPal旗下的Venmo以及Apple Pay等应用程序展开竞争,由于具备其他数字钱包无法比拟的能力,这款产品一炮而红。它有直接存钱功能,因此许多用户直接把经济刺激支票转入了自己的Cash App账户。同时,用户还能够通过这款数字钱包交易比特币和零碎股,这就意味着Cash App处于绝佳的位置,可以在加密货币价格以及股价飙升时套现。截至去年12月,Cash App的月活跃用户人数已经超过3600万人,在一年中增长了50%。

Cash App的成功为Square的销售带来了爆炸性的增长,也首次为这家公司在《财富》美国500强中挣得一席之地,名列第323位。2020年,该公司的收入增幅略高于100%,达到95亿美元。这使其市值从2020年3月的200亿美元增至2020年年底的1000亿美元。

当然,在今年的《财富》美国500强名单上,并非所有公司的表现都能够与Square匹敌。大多数公司甚至都望尘莫及。但Square的故事对经历了2020年的《财富》美国500强来说很有整体代表性,这有两大体现:首先,全世界的数字化水平都在上升,而且速度很快;其次,新技术突然取得突破并实现了庞大的规模。

对可以在规则改写后的世界中快速适应下来的公司来说,多种趋势的共同作用带来了大量新机遇。就让我们称之为大重塑吧。

从日常所见到罕有之物,这方面的事例不一而足。大家可以想想宠物食品电商Chewy(最近从零售商PetSmart中拆分了出来)。居家办公的宠物主人通过电话订购宠物尿垫,这让Chewy去年的销售额增长了47%,进而首次跻身《财富》美国500强,居第403位。还有排名第77的辉瑞(Pfizer),它和德国的生物科技公司BioNTech合作,以创纪录的时间开发出了新冠疫苗。这要归功于辉瑞使用了革命性的方法——用信使核糖核酸(mRNA)来诱发免疫反应,这为合成生物带来了无尽可能。

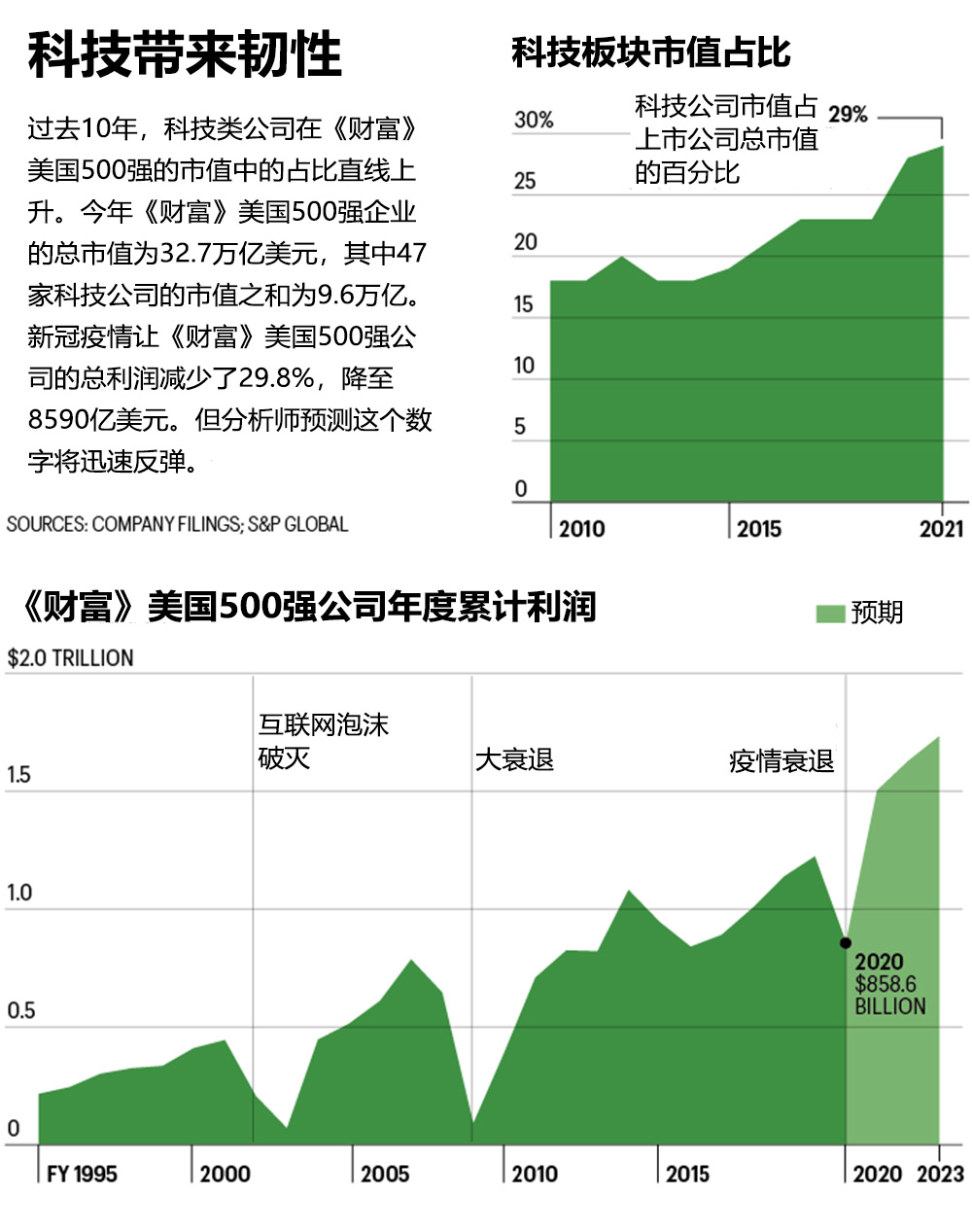

这并不是说去年的经济损失还不够多。在今年的《财富》美国500强企业中,有108家公司共亏损了2240亿美元,创大衰退(Great Recession)以来的新高。能源、酒店、航空及餐饮行业均遭重创。但科技类公司表现强劲,收入上升940亿美元,成为增长点。整体而言,《财富》美国500强的公司销售额下降3.1%至13.8万亿美元,但仍然是本榜单创立以来的历史第二高水平。2021年第一季度美国经济增速高达6.4%,这可能意味着《财富》美国500强公司最快明年就能够创出新高。

打算借这样的增长来实现发展的公司都普遍认识到,用疫情前的方式来对待数字化转型将无法成功。它们对此认识深刻,原因是消费者突然改变了购买方式,而且迅速迷上了崭新的技术。

安永会计师事务所(EY)的全球首席创新官杰夫·王(音译)说:“首席执行官们突然意识到,对于这项此前已经计划但还没有怎么实施的转型,他们需要加速推进。我觉得现在的情况是,随着我们摆脱新冠疫情,转型的速度确实正在加快。”

在此要介绍一下,安永最近对300多位大公司首席执行官的调查显示,65%的受访者计划为今后三年的转型投入的资金超过此前三年,68%的受访者还表示他们打算在数据科技方面进行重大投资。

Square的增长速度当然没有放慢。2021年前三个月,该公司销售同比上升266%。它还为Cash App增添了新功能,包括用户可以免费将比特币发送给朋友或家人。在一、两年前,轻松完成这样的交易似乎还是无法想象的事情,而目前已经是今非昔比。(财富中文网)

译者:Charlie

新冠肺炎疫情带来的挫折可能让美国支付公司Square一直觉得如鲠在喉。这家公司成立于2009年,创始人包括首席执行官杰克·多尔西,当然他还是著名的推特公司(Twitter)的联合创始人及首席执行官。Square最为人知的可能是它与众不同的白色信用卡读卡器,小公司可以轻松地用它在智能手机或平板电脑上完成支付。进入2020年时,Square势头强劲,此前一年的销售额增速高达43%。但随着新冠疫情在美国肆虐,从去年3月开始的封城措施给Square的核心客户,也就是那些夫妻店式的小公司带来了毁灭性的打击。

在一条业务线面临致命威胁之际,多尔西及其团队又适时地拿出了另外一项创新,那就是支付服务Cash App。

Cash App旨在和PayPal、PayPal旗下的Venmo以及Apple Pay等应用程序展开竞争,由于具备其他数字钱包无法比拟的能力,这款产品一炮而红。它有直接存钱功能,因此许多用户直接把经济刺激支票转入了自己的Cash App账户。同时,用户还能够通过这款数字钱包交易比特币和零碎股,这就意味着Cash App处于绝佳的位置,可以在加密货币价格以及股价飙升时套现。截至去年12月,Cash App的月活跃用户人数已经超过3600万人,在一年中增长了50%。

Cash App的成功为Square的销售带来了爆炸性的增长,也首次为这家公司在《财富》美国500强中挣得一席之地,名列第323位。2020年,该公司的收入增幅略高于100%,达到95亿美元。这使其市值从2020年3月的200亿美元增至2020年年底的1000亿美元。

当然,在今年的《财富》美国500强名单上,并非所有公司的表现都能够与Square匹敌。大多数公司甚至都望尘莫及。但Square的故事对经历了2020年的《财富》美国500强来说很有整体代表性,这有两大体现:首先,全世界的数字化水平都在上升,而且速度很快;其次,新技术突然取得突破并实现了庞大的规模。

对可以在规则改写后的世界中快速适应下来的公司来说,多种趋势的共同作用带来了大量新机遇。就让我们称之为大重塑吧。

从日常所见到罕有之物,这方面的事例不一而足。大家可以想想宠物食品电商Chewy(最近从零售商PetSmart中拆分了出来)。居家办公的宠物主人通过电话订购宠物尿垫,这让Chewy去年的销售额增长了47%,进而首次跻身《财富》美国500强,居第403位。还有排名第77的辉瑞(Pfizer),它和德国的生物科技公司BioNTech合作,以创纪录的时间开发出了新冠疫苗。这要归功于辉瑞使用了革命性的方法——用信使核糖核酸(mRNA)来诱发免疫反应,这为合成生物带来了无尽可能。

这并不是说去年的经济损失还不够多。在今年的《财富》美国500强企业中,有108家公司共亏损了2240亿美元,创大衰退(Great Recession)以来的新高。能源、酒店、航空及餐饮行业均遭重创。但科技类公司表现强劲,收入上升940亿美元,成为增长点。整体而言,《财富》美国500强的公司销售额下降3.1%至13.8万亿美元,但仍然是本榜单创立以来的历史第二高水平。2021年第一季度美国经济增速高达6.4%,这可能意味着《财富》美国500强公司最快明年就能够创出新高。

打算借这样的增长来实现发展的公司都普遍认识到,用疫情前的方式来对待数字化转型将无法成功。它们对此认识深刻,原因是消费者突然改变了购买方式,而且迅速迷上了崭新的技术。

安永会计师事务所(EY)的全球首席创新官杰夫·王(音译)说:“首席执行官们突然意识到,对于这项此前已经计划但还没有怎么实施的转型,他们需要加速推进。我觉得现在的情况是,随着我们摆脱新冠疫情,转型的速度确实正在加快。”

在此要介绍一下,安永最近对300多位大公司首席执行官的调查显示,65%的受访者计划为今后三年的转型投入的资金超过此前三年,68%的受访者还表示他们打算在数据科技方面进行重大投资。

Square的增长速度当然没有放慢。2021年前三个月,该公司销售同比上升266%。它还为Cash App增添了新功能,包括用户可以免费将比特币发送给朋友或家人。在一、两年前,轻松完成这样的交易似乎还是无法想象的事情,而目前已经是今非昔比。(财富中文网)

译者:Charlie

THE PANDEMIC could have been a jarring setback for Square. Cofounded in 2009 by CEO Jack Dorsey—also, of course, famously the cofounder and CEO of Twitter—the company is perhaps best known for its distinctive, white credit-card readers that make it easy for small businesses to process payments from a smartphone or tablet. Square barreled into 2020 with powerful momentum, with its sales having soared 43% in the previous 12 months. But the lockdowns that began last March as COVID-19 spread across the U.S. dealt a devastating blow to Square’s core customers: mom-and-pop businesses.

With one business line under mortal threat, Dorsey and his team had another innovation ready that was made for the moment—the Cash App payment service.

Created to compete with the likes of PayPal, PayPal-owned Venmo, and Apple Pay, among others, Cash App exploded in popularity thanks to capabilities that other digital wallets couldn’t match. Because Cash App allows direct deposits, many users had their stimulus checks sent straight to their Cash App accounts. And the fact that the digital wallet allows users to trade Bitcoin and fractional shares of stocks meant that Cash App was in a perfect position to, ahem, cash in when cryptocurrency prices and day trading took off. By December, Cash App had more than 36 million active monthly users, or a 50% gain in one year.

Square rode Cash App’s success to explosive sales growth—and its first-ever spot on the Fortune 500, at No. 323. For the year, its revenue jumped by just over 100%, to $9.5 billion. And its shareholders were rewarded with a nearly 250% return for 2020. That propelled its market value from $20 billion last March to $100 billion by year’s end.

Not every company on this year’s Fortune 500 can match Square’s performance, of course. Most can’t come close. But in a couple of significant ways, the story of Square is emblematic of the 500 in 2020 overall: First, the world became even more digital—and fast. And second, new technologies suddenly broke through and achieved tremendous scale.

That potent combination of trends has opened up vast new opportunities for businesses that can quickly adapt to a world of rewritten rules. Call it the Great Reimagining.

The examples range from the everyday to the extraordinary. Think of Chewy, the online pet supply business (recently split off from retailer PetSmart) which grew sales 47% last year to join the list for the first time at No. 403, as homebound puppy owners ordered pee pads from their phones. Or Pfizer, No. 77, which partnered with German biotechnology company BioNTech to develop a vaccine for COVID-19 in record time, thanks to its revolutionary approach of using messenger RNA to create an immune response—opening up endless possibilities for synthetic biology.

That’s not to say that there wasn’t plenty of economic pain last year. A total of 108 companies on this year’s 500 list lost a combined $224 billion—the biggest loss since the Great Recession. Energy, hotels, airlines, and restaurants were all hit hard. But the strength of tech—sector revenue grew by $94 billion—served as a buoy. Overall, the Fortune 500’s sales fell by 3.1% to $13.8 trillion, which was still the second biggest total in the history of the list. And the U.S. economy’s booming 6.4% growth in the first quarter of 2021 suggests that the 500 could be reaching new highs as soon as next year.

*****

FOR COMPANIES seeking to lean into that growth and build on it, there is widespread understanding that returning to a pre-pandemic approach to digital transformation won’t cut it. That lesson was driven home as consumers changed over- night how, where, and why they buy things, and plunged headlong into using brand-new technologies.

“What CEOs suddenly realized,” says Jeff Wong, global chief innovation officer at EY, “is that they need to accelerate all that transformation that they had planned on from before but hadn’t quite executed against.” Continues Wong: “I think what we’re seeing is that it’s actually accelerating as we come out of this pandemic.”

Consider that a recent survey of more than 300 CEOs of big companies conducted by EY found that 65% of them plan to spend more investing in transformation over the next three years than they did in the past three. And 68% say they’re planning a major investment in data technology.

Square is certainly not slowing down. Over the first three months of 2021, sales at Dorsey’s company were 266% higher than those from the same quarter last year. Square also introduced new features to Cash App, including the capability for users to send Bitcoin to friends or family for free. A year or two ago, making that kind of transaction happen so easily might have seemed unimaginable. Not anymore