从新冠疫情封锁的第一天起,富人就在纷纷逃离他们的城市,搬到阿斯彭、汉普顿等地的大豪宅。这让全美各地的二手房市场掀起了抢购狂潮和竞价战。

在汉普顿,二手房的价格平均上涨了15.3%。这涨幅显然不小了。但事实上,涨幅最让人瞠目结舌的并不是知名的豪宅飞地。真正的飙涨反而发生在不那么为人知晓的豪宅市场和新兴的豪宅社区。这就是《财富》杂志在查阅房地产信息网站realtor.com的价格数据,了解疫情期间涨得最凶的豪宅市场时发现的情况。

除了发现这些蓬勃发展的豪宅市场,《财富》杂志还调查了这些市场是否能够保持增长态势。毕竟,对于投资,买入时机与卖出时机一样重要。

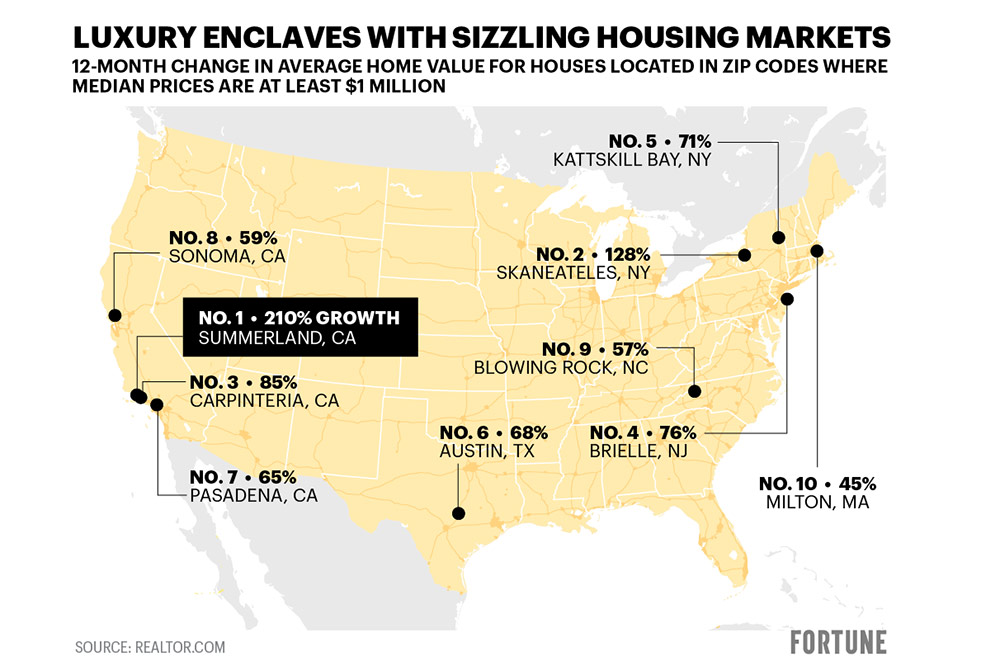

疫情期间美国涨得最凶的十大豪宅市场(按房屋中位价至少达100万美元的地区12个月均价涨幅排名)

1. 加州萨默兰,涨210%

2. 纽约州斯卡尼阿特勒斯,涨128%

3. 加州卡平特里亚,涨85%

4. 新泽西州布里勒,涨76%

5. 纽约州卡茨基尔湾,涨71%

6. 得州奥斯汀,涨68%

7. 加州帕萨迪纳,涨65%

8. 加州索诺玛,涨59%

9. 北卡罗来纳州布洛英罗克,涨57%

10. 马萨诸塞州密尔顿,涨45%

洛杉矶可能是美国住房最短缺的一个地方。即便是该市的富裕阶层,也很难找到心仪的住宅。这就解释了为什么在疫情爆发后,会有那么多的居民逃离城市——引爆了周边的豪宅市场。

其中,最疯狂的是加州的萨默兰。该沿海社区的豪宅中位价已经飙升210%,达到1980万美元,在《财富》杂志的排行榜上高居榜首。它位于圣巴巴拉以西5英里处——圣巴巴拉市场也出现飙涨——距离洛杉矶89英里。随着那些富人纷纷搬来,原本的富人居民瞬间相形见绌。从萨莫兰目前在售的最价格不菲的一处房屋便可见一斑,那是一座地中海风格的豪宅,占地4.3万平方英尺(约合4000平方米),标价高达5500万美元。

“萨默兰豪宅的中位价涨幅是全美最高,主要原因包括库存少、占地面积大(包含大牧场)、靠近海滩以及给人一种小城镇般的感觉。”顶级房屋中介机构Engel & Völkers圣巴巴拉的许可合伙人保罗·本森向《财富》杂志说道,“这似乎不是人们返回城市后会发生改变的事情。一旦你体验过这种生活质量,你会舍不得离开,很难想象会有许多买家想要离开。”

加州卡平特里亚和帕萨迪纳市场也因为洛杉矶人的逃离而出现豪宅抢购热潮。这些市场的豪宅挂牌价中位数涨幅分别达到85%和65%,在《财富》杂志的排行榜上分列第三和第七。当然,类似的现象也发生在纽约人经常光顾的二手房市场。比如排在榜单第五位的纽约州卡茨基尔湾,当地的房价上涨了71%。

二手房市场相当火爆,尤其是海滩或湖泊小镇。但也有其他赢家:高速发展城市的高档郊区。最明显不过的例子是,排在榜单第六位的得州奥斯汀斯坦纳牧场。当地以顶尖学校林立而闻名,在过去的一年里其豪宅中位价飞涨了68%。自疫情爆发以来,多家公司从湾区迁移到奥斯汀。其中规模最大的是甲骨文公司(Oracle),它在去年12月宣布迁往奥斯汀。随这些公司而来的是腰缠万贯的新居民,他们在物色得州的大房子。斯坦纳牧场正好符合他们的需求。

“我们从来没有见过当前的火爆行情,如此盛况远远甚于过往任何时候。从未见过如此紧张的库存和如此高涨的需求同时出现。”AustinRealEstate.com的房地产经纪人杰森·伯恩克诺夫指出。

但是,这些豪宅市场能够保持火箭般的飙涨吗?美国备受青睐的豪宅经纪人多莉·伦兹告诉《财富》杂志,情况即将发生翻转:郊区豪宅价格将呈现增长放缓或下降,而城市豪宅市场——包括目前“折价”的曼哈顿——则将迎来大幅反弹。有例外的地方吗?她说,像汉普顿这样的海滨城镇,即将迎来大批国外购房者的涌入——这部分购房者在疫情出现以后一直难以进入市场。

伦兹说:“豪宅市场整体上已经显示出反转和回撤的迹象……人们的生活正在开始逐渐恢复到以前的正常状态。”(财富中文网)

译者:万志文

一从新冠疫情封锁的第一天起,富人就在纷纷逃离他们的城市,搬到阿斯彭、汉普顿等地的大豪宅。这让全美各地的二手房市场掀起了抢购狂潮和竞价战。

在汉普顿,二手房的价格平均上涨了15.3%。这涨幅显然不小了。但事实上,涨幅最让人瞠目结舌的并不是知名的豪宅飞地。真正的飙涨反而发生在不那么为人知晓的豪宅市场和新兴的豪宅社区。这就是《财富》杂志在查阅房地产信息网站realtor.com的价格数据,了解疫情期间涨得最凶的豪宅市场时发现的情况。

除了发现这些蓬勃发展的豪宅市场,《财富》杂志还调查了这些市场是否能够保持增长态势。毕竟,对于投资,买入时机与卖出时机一样重要。

疫情期间美国涨得最凶的十大豪宅市场(按房屋中位价至少达100万美元的地区12个月均价涨幅排名)

1. 加州萨默兰,涨210%

2. 纽约州斯卡尼阿特勒斯,涨128%

3. 加州卡平特里亚,涨85%

4. 新泽西州布里勒,涨76%

5. 纽约州卡茨基尔湾,涨71%

6. 得州奥斯汀,涨68%

7. 加州帕萨迪纳,涨65%

8. 加州索诺玛,涨59%

9. 北卡罗来纳州布洛英罗克,涨57%

10. 马萨诸塞州密尔顿,涨45%

洛杉矶可能是美国住房最短缺的一个地方。即便是该市的富裕阶层,也很难找到心仪的住宅。这就解释了为什么在疫情爆发后,会有那么多的居民逃离城市——引爆了周边的豪宅市场。

其中,最疯狂的是加州的萨默兰。该沿海社区的豪宅中位价已经飙升210%,达到1980万美元,在《财富》杂志的排行榜上高居榜首。它位于圣巴巴拉以西5英里处——圣巴巴拉市场也出现飙涨——距离洛杉矶89英里。随着那些富人纷纷搬来,原本的富人居民瞬间相形见绌。从萨莫兰目前在售的最价格不菲的一处房屋便可见一斑,那是一座地中海风格的豪宅,占地4.3万平方英尺(约合4000平方米),标价高达5500万美元。

“萨默兰豪宅的中位价涨幅是全美最高,主要原因包括库存少、占地面积大(包含大牧场)、靠近海滩以及给人一种小城镇般的感觉。”顶级房屋中介机构Engel & Völkers圣巴巴拉的许可合伙人保罗·本森向《财富》杂志说道,“这似乎不是人们返回城市后会发生改变的事情。一旦你体验过这种生活质量,你会舍不得离开,很难想象会有许多买家想要离开。”

加州卡平特里亚和帕萨迪纳市场也因为洛杉矶人的逃离而出现豪宅抢购热潮。这些市场的豪宅挂牌价中位数涨幅分别达到85%和65%,在《财富》杂志的排行榜上分列第三和第七。当然,类似的现象也发生在纽约人经常光顾的二手房市场。比如排在榜单第五位的纽约州卡茨基尔湾,当地的房价上涨了71%。

二手房市场相当火爆,尤其是海滩或湖泊小镇。但也有其他赢家:高速发展城市的高档郊区。最明显不过的例子是,排在榜单第六位的得州奥斯汀斯坦纳牧场。当地以顶尖学校林立而闻名,在过去的一年里其豪宅中位价飞涨了68%。自疫情爆发以来,多家公司从湾区迁移到奥斯汀。其中规模最大的是甲骨文公司(Oracle),它在去年12月宣布迁往奥斯汀。随这些公司而来的是腰缠万贯的新居民,他们在物色得州的大房子。斯坦纳牧场正好符合他们的需求。

“我们从来没有见过当前的火爆行情,如此盛况远远甚于过往任何时候。从未见过如此紧张的库存和如此高涨的需求同时出现。”AustinRealEstate.com的房地产经纪人杰森·伯恩克诺夫指出。

但是,这些豪宅市场能够保持火箭般的飙涨吗?美国备受青睐的豪宅经纪人多莉·伦兹告诉《财富》杂志,情况即将发生翻转:郊区豪宅价格将呈现增长放缓或下降,而城市豪宅市场——包括目前“折价”的曼哈顿——则将迎来大幅反弹。有例外的地方吗?她说,像汉普顿这样的海滨城镇,即将迎来大批国外购房者的涌入——这部分购房者在疫情出现以后一直难以进入市场。

伦兹说:“豪宅市场整体上已经显示出反转和回撤的迹象……人们的生活正在开始逐渐恢复到以前的正常状态。”(财富中文网)

译者:万志文

From day one of the lockdowns, the rich were fleeing their city cribs for spacious abodes in places like Aspen and the Hamptons. That set off buying sprees and bidding wars in second-home markets across the nation.

In the Hamptons that translated into a 15.3% average price jump. Undoubtedly, a solid gain. But it turns out the most earth-shattering numbers weren't posted in big-name ritzy enclaves. The real run-ups were instead happening in less publicized high-end markets and up-and-coming luxury neighborhoods. That's what Fortune found when we looked at realtor.com price data to find the luxury markets with the most price appreciation during the pandemic.

In addition to finding these booming luxury markets, Fortune also looked into whether these markets can hold on to the gains. After all, investing is just as much about knowing when to buy as when to sell.

Arguably, Los Angeles has the worst housing shortage in America. Even the city's affluent and wealthy struggle to find what they want in the city. That explains why when the pandemic struck so many residents decamped—setting off a real estate explosion for outlying luxury markets.

The top benefactor is Summerland, Calif. (93067 zip code), a coastal community that has seen its median list price soar 210% to $19.8 million—putting it No. 1 on Fortune’s ranking. It's five miles west of Santa Barbara—which is seeing its own price boom—and 89 miles from Los Angeles. The rich people moving here make some other rich people look poor. Just look at the most expensive home currently for sale in Summerland: a 43,000-square-foot Mediterranean-style mansion listed at $55 million.

"Summerland has seen the highest median price growth in the nation, thanks to a combination of low inventory, large properties including ranches, proximity to the beach, and that small-town feel," Paul Benson, license partner of Engel & Völkers Santa Barbara, told Fortune. "This does not seem to be something that will change when people return to cities. Once you get a taste of this quality of life it is hard to imagine that many of these buyers will want to leave."

The market in Carpinteria, Calif. (93013 zip code), and Pasadena (91103 zip code) have seen similar luxury booms from fleeing Angelenos. The median list price in those markets are up 85% and 65%, putting the zip codes as No. 3 and No. 7 on the list. Of course, a similar phenomenon is happening in the second-home markets frequented by New Yorkers. Look no farther than No. 5, Kattskill Bay, N.Y. (12844 zip code), where home prices are up 71%.

Second-home markets, especially beach or lake towns, dominate the list. There are other winners, too, however: high-end suburbs in fast-growing cities. The clearest example is No. 6, Steiner Ranch (78732 zip code) in Austin. The median list price in that zip code—known for its top-ranked schools—soared 68% over the past year. Since the onset of the pandemic, a wave of companies have relocated from the Bay Area to Austin. The biggest is Oracle, which announced the move to Austin in December. These companies bring with them deep-pocketed new arrivals who are looking for big Texas homes. Steiner Ranch fits the bill.

"We've never seen anything like this—nothing even comes close. Never seen this little inventory and this much demand all at once," says Jason Bernknopf, a real estate agent at AustinRealEstate.com.

But can these luxury markets hold on to their astronomic gains? Dolly Lenz, one of the most sought-after luxury real estate brokers in America, told Fortune that the script is about to flip: Suburban luxury markets will see prices slow or fall, while luxury urban markets—including currently "discounted" Manhattan—will see a big rebound. The one exception? Beach towns like the Hamptons, which are about to see an influx of international homebuyers—a segment of buyers that disappeared when the pandemic hit, she says.

"It is already showing signs of reversing and pulling back…They're starting to see their lives go back to the old normal," Lenz says.