这个词你大概已经听过一万遍了。它肯定经常出现在你的收件箱里。而且,很可能你自己也不止一次地说过“新常态”。

当然,这个词上口又好记。而且,过去的一年不同寻常,充满了动荡与牺牲,还有许多人被迫隔离。在这样的经历下,这个词触动了每一个人都能感同身受的错位感。但新常态到底意味着什么呢?

“我们讨论新常态时几乎带着宗教般的狂热。”管理咨询公司今日未来研究所(Future Today Institute)的创始人兼首席执行官艾米•韦伯说,“我好奇了好一阵子:到底是什么在驱使我们寻找新常态的答案?我认为答案不是人们想知道未来的样子,从而能为未来做计划。相反,我认为,我们之所以迫切地想要了解新常态,其实是大家都希望未来不再发生这么大的变化。”

经历了过去一年的动荡不安,心理上想让变化慢下来、希望未来能更正常,这是一种完全可以理解的反应。当然,最大的变数是新冠病毒,全球已有约1亿人感染,210多万人因此丧生。新冠肺炎疫情给经济带来了巨大损失,但它也加快了新技术的发展,改变了我们的工作和生活方式,带来了难以预测长期走向的变量。

尽管我们可能想按下“暂停”键,但现实中并没有这个选项。现在比以往任何时候都更迫切需要了解接下来会发生什么,商业、经济和共同抗击新冠肺炎的战斗将何去何从。个中关键或许在于要弄清楚:经历了12个月的动荡后,现在有些事情将永远地“新”下去,有些事情仍然是“常态”,而难的是认识到哪些是哪些并找到正确应对之道。

举个例子,看看乔•拜登总统的当选就知道了。他一生都是中间派,一个有自我认知的传统政客,连他的口罩上可能都会印上“常态”的字样。但是,民主党至少在未来两年将对国会参众两院拥有微弱的领先优势,这无疑是“新”的:这种权力的变动将影响华尔街、全球贸易和中美关系。而这个结果出现在当代最具争议的选举之后——离任的总统传播错误信息,孤注一掷地试图扭转他的绝对败选,无疑增加了我们对“新”时刻的焦虑。

对伊恩•布雷默的客户来说,华盛顿重启绝对是头等大事。他是政治风险咨询公司欧亚集团(Eurasia Group)的创始人兼总裁,他的每个客户都想知道,“拜登有什么不同?他有多少控制权?美国真的面临比我们想象中更严重的结构性风险吗?”

华尔街似乎认为,在拜登的领导下,生活将最大限度地恢复“常态”。从大选日到拜登1月20日就职,标准普尔500指数上涨了14.3%。算起来,拜登对股市的提振力度是四年前特朗普的两倍多,当时标普500指数同期上涨6.2%。目前看来,市场似乎对繁重的新监管规定或加税政策不以为然。与此同时,好像各大银行都在竞相发布最乐观的国内生产总值预测:摩根大通(JPMorgan Chase)预测,2021年美国经济将增长5.8%。摩根士丹利(Morgan Stanley)的预测是6.4%。高盛是6.6%。人们相信存在大量被压抑的需求,消费者行为会“报复性”地恢复“常态”。

当然,信心在很大程度上来自于新冠肺炎疫苗的快速上市,新冠疫苗效果喜人,采用了“新”的研发方式,速度也史无前例。(想了解辉瑞与BioNTech合作成功研发疫苗的故事,请参阅本期的“对话”栏目。)尽管一开始的疫苗接种工作不尽人意,现在美国的疫苗接种速度正在加快,尽管同时病毒已经发生了变异,变得更具传染性。最初拜登总统宣布要在上任100天内接种1亿剂疫苗,到1月底,他承诺,到夏末,美国将拥有足够3亿人使用的疫苗。

在国际关系中,新常态可能与旧常态相似。拜登政府将迅速采取行动,缓和与关键盟友之间的紧张关系。在贸易谈判中,白宫也将重拾不那么具有破坏性的外交风格,重树全球主义思维,这意味着企业喜闻乐见的可预测性。

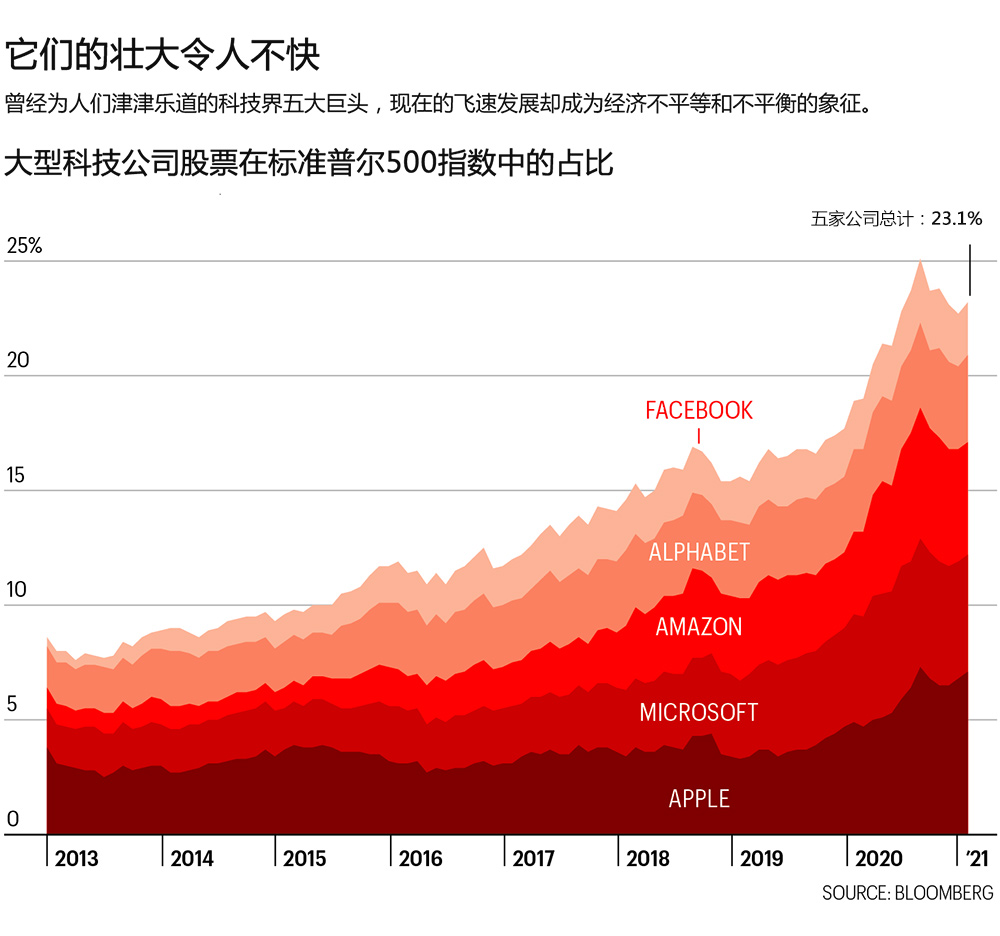

但挑战仍然严峻:疫情的加重突出了美国的收入不平等问题。疫情也进一步破坏了商业生态系统,成千上万的小企业倒闭了,而随着我们对科技巨头的依赖加深,部分大企业飞速崛起。

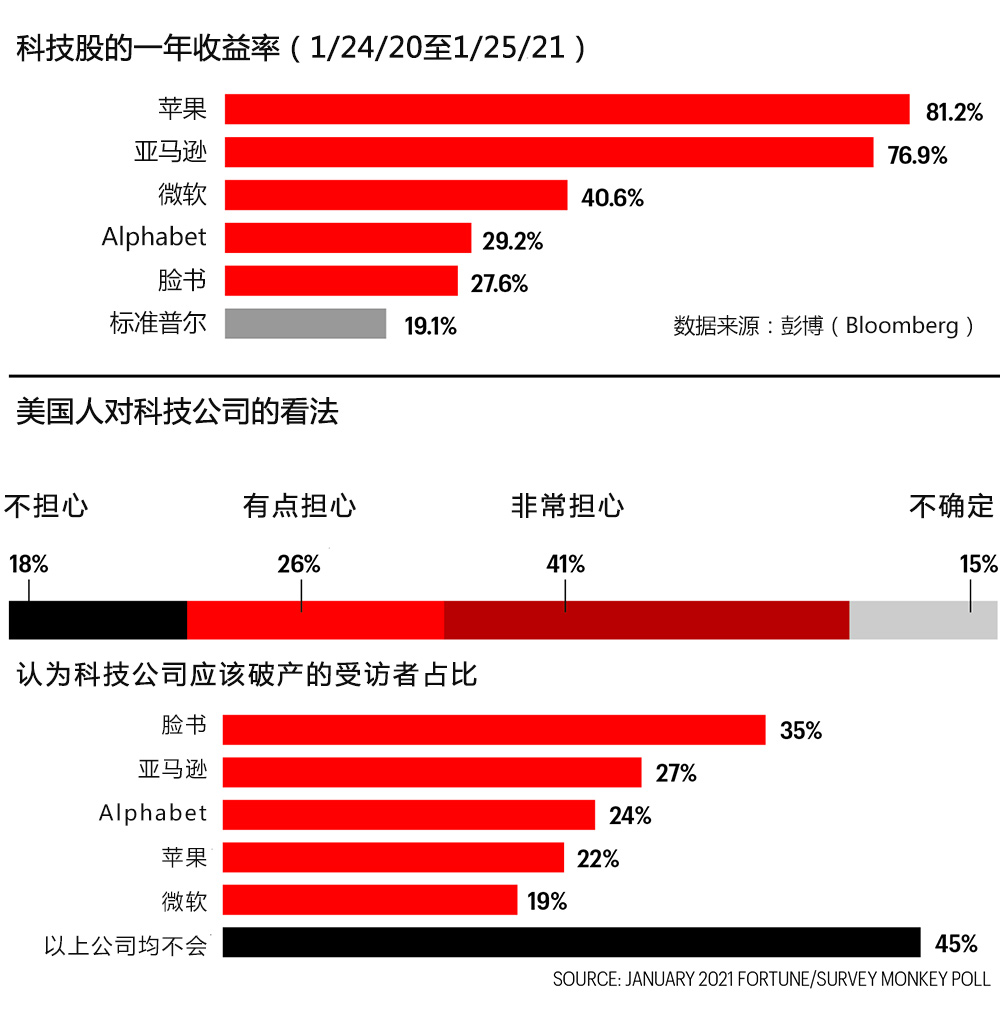

我们在疫情中狼狈前行时,科技公司是我们的救星。在封锁期间,得益于科技公司,我们可以用Zoom开视频工作会、刷剧、在网上买衣服、在隔离中保持社交互动。但对很多人来说,这种“新”情况并不属于“常态”。监管机构、两党当选官员以及消费者都对大型科技公司的影响力感到些许不安。今年1月,《财富》杂志和SurveyMonkey联合进行的一项民调显示,64%的美国成年人希望联邦政府至少对一家大型科技公司进行反垄断调查。(谷歌和Facebook已经在审查中。)

布雷默说,社交媒体公司在特朗普总统任期最后的黑暗时刻对他采取的禁言措施,给这场辩论增加了意想不到的变化。他说,在共和党人眼中,科技监管现在属于党派之争。“不管到底喜不喜欢,科技公司突然全都和民主党站在了一条战线。”布雷默表示,“我不记得还有什么时候,美国经济中最重要的公司曾和一个政党进行过如此激烈的党派斗争。”这可能不是“常态”,但绝对是“新”情况。(财富中文网)

译者:Agatha

这个词你大概已经听过一万遍了。它肯定经常出现在你的收件箱里。而且,很可能你自己也不止一次地说过“新常态”。

当然,这个词上口又好记。而且,过去的一年不同寻常,充满了动荡与牺牲,还有许多人被迫隔离。在这样的经历下,这个词触动了每一个人都能感同身受的错位感。但新常态到底意味着什么呢?

“我们讨论新常态时几乎带着宗教般的狂热。”管理咨询公司今日未来研究所(Future Today Institute)的创始人兼首席执行官艾米•韦伯说,“我好奇了好一阵子:到底是什么在驱使我们寻找新常态的答案?我认为答案不是人们想知道未来的样子,从而能为未来做计划。相反,我认为,我们之所以迫切地想要了解新常态,其实是大家都希望未来不再发生这么大的变化。”

经历了过去一年的动荡不安,心理上想让变化慢下来、希望未来能更正常,这是一种完全可以理解的反应。当然,最大的变数是新冠病毒,全球已有约1亿人感染,210多万人因此丧生。新冠肺炎疫情给经济带来了巨大损失,但它也加快了新技术的发展,改变了我们的工作和生活方式,带来了难以预测长期走向的变量。

尽管我们可能想按下“暂停”键,但现实中并没有这个选项。现在比以往任何时候都更迫切需要了解接下来会发生什么,商业、经济和共同抗击新冠肺炎的战斗将何去何从。个中关键或许在于要弄清楚:经历了12个月的动荡后,现在有些事情将永远地“新”下去,有些事情仍然是“常态”,而难的是认识到哪些是哪些并找到正确应对之道。

举个例子,看看乔•拜登总统的当选就知道了。他一生都是中间派,一个有自我认知的传统政客,连他的口罩上可能都会印上“常态”的字样。但是,民主党至少在未来两年将对国会参众两院拥有微弱的领先优势,这无疑是“新”的:这种权力的变动将影响华尔街、全球贸易和中美关系。而这个结果出现在当代最具争议的选举之后——离任的总统传播错误信息,孤注一掷地试图扭转他的绝对败选,无疑增加了我们对“新”时刻的焦虑。

对伊恩•布雷默的客户来说,华盛顿重启绝对是头等大事。他是政治风险咨询公司欧亚集团(Eurasia Group)的创始人兼总裁,他的每个客户都想知道,“拜登有什么不同?他有多少控制权?美国真的面临比我们想象中更严重的结构性风险吗?”

华尔街似乎认为,在拜登的领导下,生活将最大限度地恢复“常态”。从大选日到拜登1月20日就职,标准普尔500指数上涨了14.3%。算起来,拜登对股市的提振力度是四年前特朗普的两倍多,当时标普500指数同期上涨6.2%。目前看来,市场似乎对繁重的新监管规定或加税政策不以为然。与此同时,好像各大银行都在竞相发布最乐观的国内生产总值预测:摩根大通(JPMorgan Chase)预测,2021年美国经济将增长5.8%。摩根士丹利(Morgan Stanley)的预测是6.4%。高盛是6.6%。人们相信存在大量被压抑的需求,消费者行为会“报复性”地恢复“常态”。

当然,信心在很大程度上来自于新冠肺炎疫苗的快速上市,新冠疫苗效果喜人,采用了“新”的研发方式,速度也史无前例。(想了解辉瑞与BioNTech合作成功研发疫苗的故事,请参阅本期的“对话”栏目。)尽管一开始的疫苗接种工作不尽人意,现在美国的疫苗接种速度正在加快,尽管同时病毒已经发生了变异,变得更具传染性。最初拜登总统宣布要在上任100天内接种1亿剂疫苗,到1月底,他承诺,到夏末,美国将拥有足够3亿人使用的疫苗。

在国际关系中,新常态可能与旧常态相似。拜登政府将迅速采取行动,缓和与关键盟友之间的紧张关系。在贸易谈判中,白宫也将重拾不那么具有破坏性的外交风格,重树全球主义思维,这意味着企业喜闻乐见的可预测性。

但挑战仍然严峻:疫情的加重突出了美国的收入不平等问题。疫情也进一步破坏了商业生态系统,成千上万的小企业倒闭了,而随着我们对科技巨头的依赖加深,部分大企业飞速崛起。

我们在疫情中狼狈前行时,科技公司是我们的救星。在封锁期间,得益于科技公司,我们可以用Zoom开视频工作会、刷剧、在网上买衣服、在隔离中保持社交互动。但对很多人来说,这种“新”情况并不属于“常态”。监管机构、两党当选官员以及消费者都对大型科技公司的影响力感到些许不安。今年1月,《财富》杂志和SurveyMonkey联合进行的一项民调显示,64%的美国成年人希望联邦政府至少对一家大型科技公司进行反垄断调查。(谷歌和Facebook已经在审查中。)

布雷默说,社交媒体公司在特朗普总统任期最后的黑暗时刻对他采取的禁言措施,给这场辩论增加了意想不到的变化。他说,在共和党人眼中,科技监管现在属于党派之争。“不管到底喜不喜欢,科技公司突然全都和民主党站在了一条战线。”布雷默表示,“我不记得还有什么时候,美国经济中最重要的公司曾和一个政党进行过如此激烈的党派斗争。”这可能不是“常态”,但绝对是“新”情况。(财富中文网)

译者:Agatha

You’ve heard the phrase roughly 10,000 times by now. There’s no doubt the expression has been popping up in your inbox regularly. It’s very likely, in fact, that you’ve said it yourself more than once: “The New Normal.”

Sure, it’s catchy and alliterative. And it taps into the sense of dislocation that we all feel after a year of uncommon upheaval, sacrifice, and, for many, forced isolation. But what, exactly, does it mean?

“There is this almost religious fervor with which we talk about the new normal,” says Amy Webb, the founder and CEO of the Future Today Institute, a management consulting firm. “And I’ve been curious for a while now: What is driving us to seek that out? And I don’t actually think the answer is that people want to know what the future is so they can plan for it. I think, instead, that desire to know the new normal is really our collective desire to have things stop changing so much.”

The psychological imperative to slow down and normalize the path forward is a perfectly understandable response to the jarring turbulence of the past year. Most disruptive of all, of course, has been the SARS-CoV-2 virus, which has already infected some 100 million people around the world and taken the lives of more than 2.1 million. The pandemic has exacted an enormous economic toll, but it has also accelerated the development of new technologies and transformed the dynamics of how we work and live, introducing variables that are hard to predict long term.

As much as we might like to hit “pause,” however, it’s not really an option. If anything, the need to understand what comes next—for business, the economy, and our collective battle against COVID-19—is more urgent than ever. And the key to understanding may lie in this insight: After the turmoil of the past 12 months, some things are now permanently New; some things are still Normal; and the challenge is to recognize and navigate between the two.

For a case in point, look no further than the election of President Joe Biden. He’s a lifelong centrist, a self-consciously traditional pol who might as well have “Normal” silk-screened on his hygienic face masks. But the fact that the Democrats now have narrow control of both houses of Congress for at least the next two years is undoubtedly New: It’s a power shift with ramifications for Wall Street, global trade, and our relationship with China. That it follows the most contentious election in contemporary times, marked by the outgoing President’s desperate attempt, through misinformation, to reverse the results of an election he lost definitively, only adds to our anxiety about this New moment.

The reboot in Washington is absolutely top of mind for Ian Bremmer’s clients. The founder and president of the Eurasia Group, a political risk consulting firm, says that every customer wants to know, “How different is Biden? How much can he govern? Is the U.S. actually facing some structural challenges that are deeper than we thought?”

Wall Street appears to be betting that life under Biden will be the best kind of Normal. From Election Day through Biden’s inauguration on Jan. 20, the S&P 500 rose 14.3%. In fact, the Biden boost was more than twice as strong as the Trump bump from four years ago, when the S&P rose 6.2% in the same span. For now, it seems the market is shrugging off any concerns about onerous new regulation or tax increases. Meanwhile, it almost appears as if the big banks are competing to issue the most bullish GDP forecast: JPMorgan Chase predicts the U.S. economy will grow 5.8% in 2021. Morgan Stanley sees 6.4%. And Goldman Sachs is forecasting 6.6%. That’s a lot of pent-up demand, a belief that consumers will get Normal with a vengeance.

Much of the confidence, of course, stems from the early rollout of highly effective vaccines—developed, in a New way, at record speed—to counter COVID-19. (For insight into Pfizer’s successful effort, in partnership with BioNTech, see “The Conversation” in this issue.) After a bumpy start, the vaccination distribution effort in the U.S. is picking up speed, even as the virus mutates and becomes more infectious. President Biden first announced a goal of distributing 100 million doses of vaccine in his first 100 days in office; by late January, he was pledging the U.S. would have enough doses for 300 million Americans by the end of summer.

In international relations, the New Normal may in fact resemble the Old Normal. The Biden administration will move quickly to smooth over ruffled relationships with key allies. A return to a less disruptive style of diplomacy in trade negotiations and the restoration of a globalist mindset in the White House add up to a predictability that business can embrace.

Still, there are stiff challenges ahead: The pandemic has only deepened and highlighted the problem of income inequality in the U.S. And it has further disrupted the ecosystem of business, as thousands of small enterprises have closed even as corporate behemoths, particularly the tech giants on which we’re increasingly dependent, have surged.

Technology has been our salvation as we’ve muddled our way through the pandemic. During lockdowns, it has allowed us to Zoom with colleagues, to binge-watch, to shop our looks online, and to socialize in isolation. But to many, this New doesn’t feel Normal. Regulators, elected officials of both parties, and consumers are getting a little uncomfortable with Big Tech’s heft and sway. In January, a Fortune and SurveyMonkey poll found that 64% of U.S. adults would like to see the federal government investigate at least one large tech company for antitrust violations. (Google and Facebook are already on the docket.)

Bremmer believes that the actions of the social media companies to “deplatform” President Trump in his final, dark days in office add an unexpected dynamic to the debate. In the eyes of Republicans, he says, tech regulation is now a partisan battle. “The tech companies are suddenly all in on the Democratic side, whether they like it or not,” says Bremmer. “I can’t remember a time when the most important companies in the U.S. economy were going to be in such a partisan battle with one political party.” It may not be Normal, but it’s definitely New.