由于利率持续在零点附近徘徊,加上许多人觉得股市估值过高,部分投资者开始将目光投向艺术品、加密货币以及古董球鞋等另类资产,希望能从中获取收益。

这些所谓的另类投资并不新鲜,多年以来,为从市场赚取更多收益,对冲基金与富豪群体一直在从事此类投资,而近期涌现的各种线上论坛则将此类投资推向了更广阔的公众视野。仅以Yieldstreet和Masterworks为例,前者让普通公众可以对从船舶到诉讼判决在内的各种标的进行投资,后者则使投资者得以购买艺术品的部分所有权。

为给投资者提供一站式投资体验,作为备受欢迎的众筹网站Indiegogo的创始人,斯拉瓦·鲁宾创建了全新的投资平台Vincent,该网站对50个另类投资论坛的产品资源进行了整合,自今夏开始小范围运行。

鲁宾表示,另类投资热度的不断提升让他萌生了创建Vincent的想法,他指出,未来5年,另类投资的市场规模预计将从9万亿美元增长至14万亿美元。

“在当前这种零利率的环境下,另类投资热度空前,俨然已经成为一种宏观趋势,但还有很多人不敢尝试,”鲁宾表示,这也进一步说明了他创建该网站的初衷。

他还补充说,希望Vincent发展成为“投资领域的Zillow”。Zillow是一家倍受欢迎的房产网站。

Vincent为对另类投资感兴趣的用户提供了多种筛选条件,包括投资金额、投资标的类别(包括收藏品、艺术品和房地产)等。在用户设置好筛选条件后,Vincent会从其数十个合作伙伴的网站中提取相应投资选项,并向用户展示。

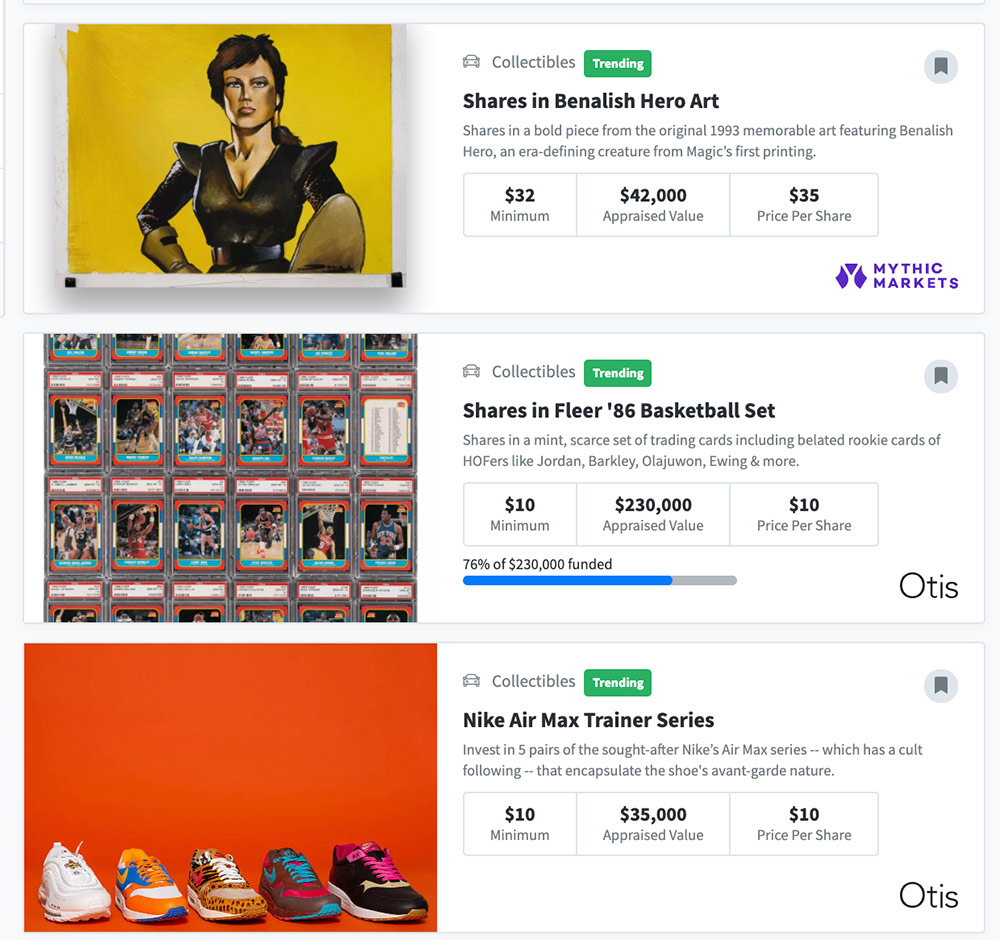

该网站还会询问潜在投资者是否为受信投资人,从而判断其净值,并限定其投资类别。下图是收藏品类别下的可投资标的示例:

获取稀有耐克运动鞋或昂贵画作的少量所有权对许多人来说相当有吸引力,但这也带来了一个问题,即此类投资是否合法。鉴于众筹投资领域过往发生的种种争议,有些所谓“众筹投资”更是已被证明是彻头彻尾的骗局,这一问题必须引起注意。

鲁宾表示,Vincent将借助合作伙伴平台的力量将江湖骗子拒之门外,他还指出,其合作平台均处于SEC等金融监管机构的监管之下。

在介绍网站的盈利方式时,鲁宾表示,投资者使用该网站时无需付费,但Vincent会从合作伙伴处收取一定佣金。为创建该网站,鲁宾共计投入200万美元,其中既有其自有资金,也包括部分天使投资。(财富中文网)

译者:梁宇

审校:夏林

由于利率持续在零点附近徘徊,加上许多人觉得股市估值过高,部分投资者开始将目光投向艺术品、加密货币以及古董球鞋等另类资产,希望能从中获取收益。

这些所谓的另类投资并不新鲜,多年以来,为从市场赚取更多收益,对冲基金与富豪群体一直在从事此类投资,而近期涌现的各种线上论坛则将此类投资推向了更广阔的公众视野。仅以Yieldstreet和Masterworks为例,前者让普通公众可以对从船舶到诉讼判决在内的各种标的进行投资,后者则使投资者得以购买艺术品的部分所有权。

为给投资者提供一站式投资体验,作为备受欢迎的众筹网站Indiegogo的创始人,斯拉瓦·鲁宾创建了全新的投资平台Vincent,该网站对50个另类投资论坛的产品资源进行了整合,自今夏开始小范围运行。

鲁宾表示,另类投资热度的不断提升让他萌生了创建Vincent的想法,他指出,未来5年,另类投资的市场规模预计将从9万亿美元增长至14万亿美元。

“在当前这种零利率的环境下,另类投资热度空前,俨然已经成为一种宏观趋势,但还有很多人不敢尝试,”鲁宾表示,这也进一步说明了他创建该网站的初衷。

他还补充说,希望Vincent发展成为“投资领域的Zillow”。Zillow是一家倍受欢迎的房产网站。

Vincent为对另类投资感兴趣的用户提供了多种筛选条件,包括投资金额、投资标的类别(包括收藏品、艺术品和房地产)等。在用户设置好筛选条件后,Vincent会从其数十个合作伙伴的网站中提取相应投资选项,并向用户展示。

该网站还会询问潜在投资者是否为受信投资人,从而判断其净值,并限定其投资类别。下图是收藏品类别下的可投资标的示例:

获取稀有耐克运动鞋或昂贵画作的少量所有权对许多人来说相当有吸引力,但这也带来了一个问题,即此类投资是否合法。鉴于众筹投资领域过往发生的种种争议,有些所谓“众筹投资”更是已被证明是彻头彻尾的骗局,这一问题必须引起注意。

鲁宾表示,Vincent将借助合作伙伴平台的力量将江湖骗子拒之门外,他还指出,其合作平台均处于SEC等金融监管机构的监管之下。

在介绍网站的盈利方式时,鲁宾表示,投资者使用该网站时无需付费,但Vincent会从合作伙伴处收取一定佣金。为创建该网站,鲁宾共计投入200万美元,其中既有其自有资金,也包括部分天使投资。(财富中文网)

译者:梁宇

审校:夏林

Interest rates continue to hover near zero, and many feel the stock market is overbought. In response, some investors are looking to make money by betting on more exotic assets such as art, cryptocurrency, and vintage sneakers.

These sorts of bets—known as alternative investments—are hardly new. Hedge funds and wealthy individuals have dabbled in them for years in an effort to beat the market. But more recently, a growing number of online forums have sprung up to pitch such investments to a broader public. Examples include Yieldstreet, which lets people invest in everything from ships to the outcome of lawsuits, and Masterworks, which invites investors to purchase shares in fine art.

Now, there is a new platform that lets people peruse over 50 of these forums’ offerings on the same website. The site, which has been operating in stealth since this summer, is called Vincent and is the brainchild of Slava Rubin, who founded the popular crowdfunding site Indiegogo.

Rubin says he was inspired to create Vincent given the growing popularity of alternative investments, which, he notes, are expected to grow from $9 trillion to $14 trillion in the next five years.

“As a macro trend in this zero interest rate environment, alternative investments are hotter than ever. But there’s still a significant amount of people intimidated by them,” says Rubin, further explaining his inspiration for the site.

Rubin adds that Vincent is intended to be “the Zillow of investments,” referring to a popular real estate site.

In practice, those who want to explore alternative investments apply a series of filters, including how much they want to invest and the categories to which they are attracted. (Choices include collectibles, art, and real estate). Vincent then displays a range of options drawn from its dozens of partner sites.

The site also asks whether or not the would-be investor is accredited—a distinction that is determined by a person’s net wealth and that can limit the types of investments they are eligible to make. The screenshot below shows a sample of the investments available in the collectibles category:

The chance to own a small share of a rare Nike sneaker or an expensive painting may appeal to many individuals, but it also raises the question of whether all the investments are legitimate. This is especially the case given past controversies involving crowdfunded investment opportunities, which in some cases have proved to be outright scams.

Rubin says Vincent is relying on its partner platforms to keep charlatans off the site, noting that these platforms are overseen by various financial regulators, including the SEC.

As for how the site makes money, Rubin says that investors can use it for free but that Vincent takes a commission from its partners. Rubin launched the site with a $2 million investment, consisting of his own money and that of a handful of angel investors.