春天的停工停产沉重打击了美容美发沙龙、日托中心和纹身店的老板们。

在新冠疫情刚开始时,Yelp.com上有140,104家店标注为临时关闭,但到8月,临时关闭的店铺降至65,769家。然而,出现这种变化并不完全是因为经济重启;相反,有许多店铺干脆就彻底关门大吉了。根据Yelp.com的当地经济影响报告,超过97,966家企业在疫情期间永久关闭。

而且情况只会变得更糟。

虽然很多行业已经开始恢复经济活力,但仍有大量小企业在苦苦挣扎,表示需要进一步的经济援助和刺激措施才能够活下来。

事实上,“如果经济继续维持在这种速度,五分之一的企业主预计最早要等到今年年底情况才可以好转。”国家独立企业联盟(National Federation of Independent Business)负责联邦政府关系事务的副主席凯文·库尔曼向《财富》杂志表示,该联盟是一个非营利性的小企业游说组织。

但并不是所有的小企业都受到了同等程度的影响。纽约联邦储备银行(Federal Reserve Bank of New York)8月的一份报告显示,从2月到4月,还开门的黑人小企业主的数量下降了41%(几乎是非黑人企业主数量的两倍),原因是他们中有许多人难以获得薪资保障计划等项目的资源。

然而,新的纾困方案仍悬而未决。尽管美国财政部部长史蒂夫·姆努钦曾经表示,单独通过薪资保障计划将是为小企业提供额外帮助的“最简单”方式(因为有超过1300亿美元的未动用资金),但国会目前仍然因为另外一项计划陷入僵局。

与此同时,通过薪资保障计划获得贷款企业的贷款减免部分即将到期,但仍然有许多银行希望对流程做出更明确的规定,与此同时,一些游说组织则呼吁对小规模贷款实施全额减免。(财富中文网)

译者:Agatha

春天的停工停产沉重打击了美容美发沙龙、日托中心和纹身店的老板们。

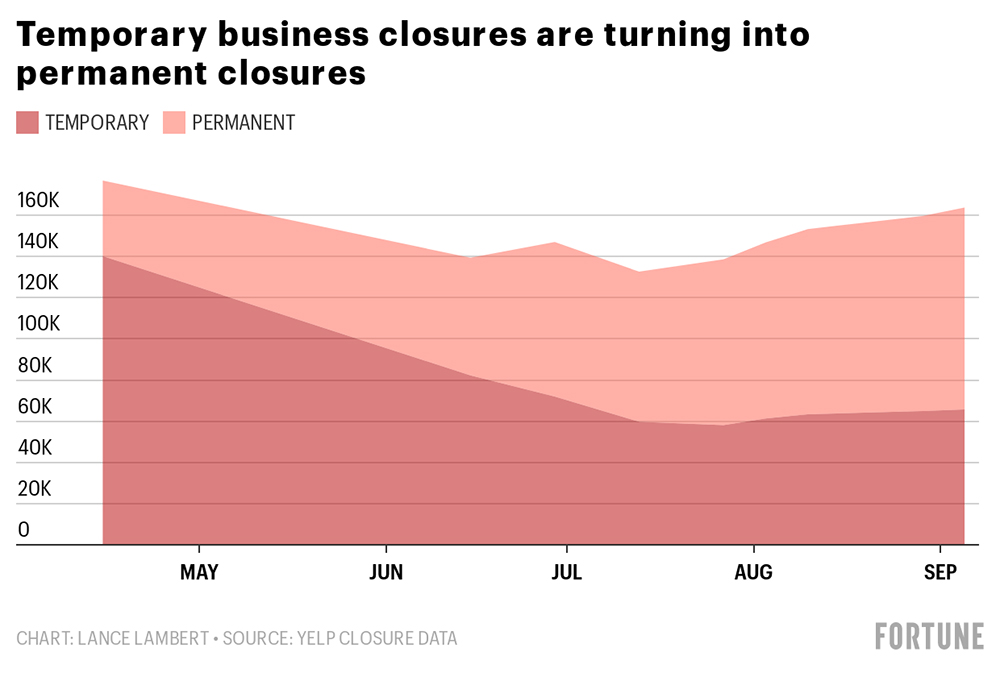

在新冠疫情刚开始时,Yelp.com上有140,104家店标注为临时关闭,但到8月,临时关闭的店铺降至65,769家。然而,出现这种变化并不完全是因为经济重启;相反,有许多店铺干脆就彻底关门大吉了。根据Yelp.com的当地经济影响报告,超过97,966家企业在疫情期间永久关闭。

临时停业变成了永久关门。数据来源:Yelp Closure Data

而且情况只会变得更糟。

虽然很多行业已经开始恢复经济活力,但仍有大量小企业在苦苦挣扎,表示需要进一步的经济援助和刺激措施才能够活下来。

事实上,“如果经济继续维持在这种速度,五分之一的企业主预计最早要等到今年年底情况才可以好转。”国家独立企业联盟(National Federation of Independent Business)负责联邦政府关系事务的副主席凯文·库尔曼向《财富》杂志表示,该联盟是一个非营利性的小企业游说组织。

但并不是所有的小企业都受到了同等程度的影响。纽约联邦储备银行(Federal Reserve Bank of New York)8月的一份报告显示,从2月到4月,还开门的黑人小企业主的数量下降了41%(几乎是非黑人企业主数量的两倍),原因是他们中有许多人难以获得薪资保障计划等项目的资源。

然而,新的纾困方案仍悬而未决。尽管美国财政部部长史蒂夫·姆努钦曾经表示,单独通过薪资保障计划将是为小企业提供额外帮助的“最简单”方式(因为有超过1300亿美元的未动用资金),但国会目前仍然因为另外一项计划陷入僵局。

与此同时,通过薪资保障计划获得贷款企业的贷款减免部分即将到期,但仍然有许多银行希望对流程做出更明确的规定,与此同时,一些游说组织则呼吁对小规模贷款实施全额减免。(财富中文网)

译者:Agatha

The spring shutdowns delivered a gut punch to owners of businesses from salons and daycare centers to tattoo parlors.

At the onset of the pandemic 140,104 were marked temporarily closed on Yelp.com, but by August that had fallen to 65,769. That drop, however, is not entirely driven by businesses reopening; instead, many have simply gone under. More than 97,966 businesses have permanently shut down during the pandemic, according to Yelp.com's Local Economic Impact Report.

And it may only get worse.

While many parts of the economy have begun to hum again, many small businesses are still struggling and report needing further economic aid and stimulus to survive.

In fact, "if economic trends continue at this rate, one in five business owners anticipates they won’t make it until the end of the year," Kevin Kuhlman, the vice president of federal government relations for the National Federation of Independent Business (NFIB), a nonprofit small-business advocacy group, recently told Fortune.

But not all small businesses have been equally affected. According to a Federal Reserve Bank of New York report in August, the number of active Black small-business owners fell 41% from February through April (nearly twice the rate of non-Black-owned businesses), as many struggled to access programs like the Paycheck Protection Program.

More aid, however, is still up in the air. Although Treasury Secretary Steve Mnuchin has said that passing a standalone PPP bill would be the "easiest" way to get additional help to small businesses (as there is over $130 billion in unused funds), Congress has thus far stalled on passing another package.

Meanwhile, the forgiveness portion for businesses who received loans through the PPP is coming due, although many banks still want more clarity on the process, while advocacy groups have asked smaller loans be forgiven altogether.