基于经济复苏的情况似乎好于预期,高盛(Goldman Sachs)于近日给出了一个相当乐观的估计:美国第三季度GDP增幅将达35%。

这一估计远高于普遍预期的21%。高盛的经济学家在9月10日的一份报告中写道,这一大胆的预测是基于“远强于预期的就业报告,以及更为坚实和普遍化的夏季数据”。

实际上,高盛和许多华尔街经济学家一样,都对近期的经济数据感到惊喜,尤其是对8月的最新失业报告。失业报告显示,当月失业率为8.4%,低于7月的10.2%,也好于高盛自己估计的9.8%。当月,美国总共增加了140万个就业岗位。

考虑到美国6月和7月新冠肺炎疫情的反弹,最近经济快速复苏的情况让不少人感到惊讶。600美元的增额失业救济、经济刺激计划、旨在提振小型企业的薪资保障计划到期,在当时曾经引发了不少经济将再度下行的担忧,(但现在看来,这种担忧似乎并无必要)。

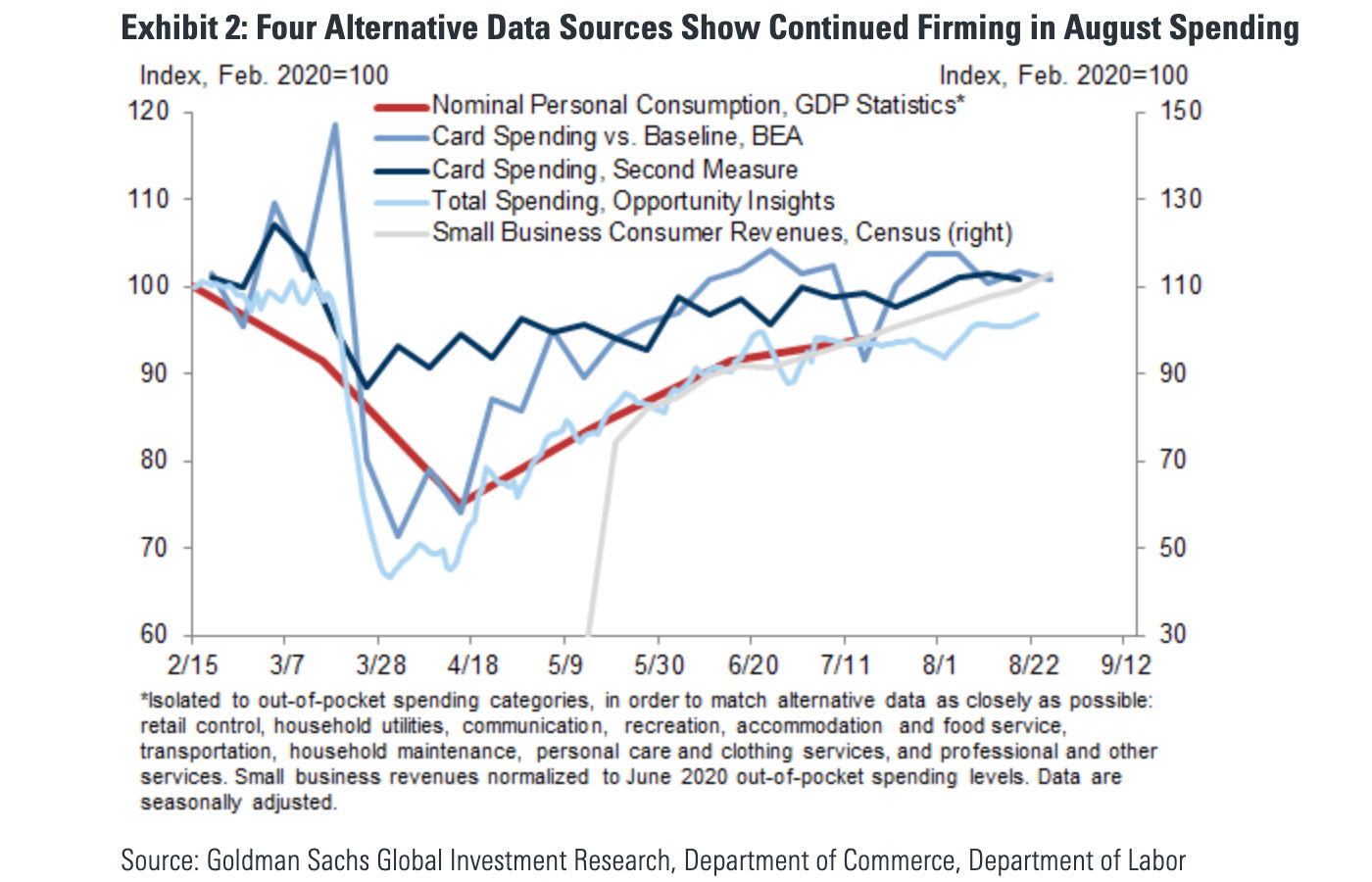

一些经济学家担心消费者支出会锐减,但高盛认为,恰恰相反,“7月支出强劲增长,而且高频指标显示,8月实际支出又进一步增加了1%至2%”。高盛将8月消费者支出增加的1.25%纳入了GDP预测中。高盛指出,即便是那些领取了增额失业救济的人,支出下降幅度也比他们之前预期的更为缓和。

高盛表示,失业救济金领取者、低收入地区民众的夏末支出速度也远高于第二季度的水平。其预计,随着新一轮失业救济补助的发放,9月底前消费者支出将迎来反弹。高盛指出,8月支出数据大致表明消费趋于稳定或上行。当然,服装行业除外,因为学生返校搁置,服装销售受到了不利影响。

这些消费者数据是经济学家衡量经济复苏速度及其成功程度的关键。德意志银行(Deutsche Bank)的美国资深经济学家布雷特•瑞恩近日对《财富》杂志说:“事实上,我最没有把握的就是消费者支出数据,而这恰好占到了美国经济的70%。”

除了消费者支出方面,高盛还对制造业和库存的“V型复苏”持乐观态度。正如其经济学家指出的那样,“工业产值自4月以来增长了10%,而名义商业库存在7月已经实现了自去年12月以来的首次增长”。

而GDP则在艰难中缓慢回升。美国GDP在第二季度下降了32.9%,仅略好于一些最悲观的估计值。而现在,高盛的估计要比亚特兰大联邦储备委员会(Atlanta Federal Reserve)截至9月10日的GDP Now预测模型估计的30.8%更为乐观。

但显然,经济还没有完全摆脱困境。美国国会在一项旨在提振各州、失业者及小型企业的刺激法案上陷入僵局,此外,共和党提出的一项成本较低的提案也未能在9月10日的参议院投票中获得通过。Moody’s Analytics公司的马克•赞迪在8月下旬曾经对《财富》杂志表示,尽管经济数据有所改善,但“如果认为美国经济已经开始正常运转,失业者等群体不再需要额外的支持,那绝对是一个严重的错误”。

但总的来说,高盛指出,市场预期远比实际情况要来得糟糕。他们相信,第三季度经济数据的连续强劲,也将预示着第四季度以及之后的好兆头。(财富中文网)

编译:杨二一

基于经济复苏的情况似乎好于预期,高盛(Goldman Sachs)于近日给出了一个相当乐观的估计:美国第三季度GDP增幅将达35%。

这一估计远高于普遍预期的21%。高盛的经济学家在9月10日的一份报告中写道,这一大胆的预测是基于“远强于预期的就业报告,以及更为坚实和普遍化的夏季数据”。

实际上,高盛和许多华尔街经济学家一样,都对近期的经济数据感到惊喜,尤其是对8月的最新失业报告。失业报告显示,当月失业率为8.4%,低于7月的10.2%,也好于高盛自己估计的9.8%。当月,美国总共增加了140万个就业岗位。

考虑到美国6月和7月新冠肺炎疫情的反弹,最近经济快速复苏的情况让不少人感到惊讶。600美元的增额失业救济、经济刺激计划、旨在提振小型企业的薪资保障计划到期,在当时曾经引发了不少经济将再度下行的担忧,(但现在看来,这种担忧似乎并无必要)。

一些经济学家担心消费者支出会锐减,但高盛认为,恰恰相反,“7月支出强劲增长,而且高频指标显示,8月实际支出又进一步增加了1%至2%”。高盛将8月消费者支出增加的1.25%纳入了GDP预测中。高盛指出,即便是那些领取了增额失业救济的人,支出下降幅度也比他们之前预期的更为缓和。

高盛表示,失业救济金领取者、低收入地区民众的夏末支出速度也远高于第二季度的水平。其预计,随着新一轮失业救济补助的发放,9月底前消费者支出将迎来反弹。高盛指出,8月支出数据大致表明消费趋于稳定或上行。当然,服装行业除外,因为学生返校搁置,服装销售受到了不利影响。

这些消费者数据是经济学家衡量经济复苏速度及其成功程度的关键。德意志银行(Deutsche Bank)的美国资深经济学家布雷特•瑞恩近日对《财富》杂志说:“事实上,我最没有把握的就是消费者支出数据,而这恰好占到了美国经济的70%。”

除了消费者支出方面,高盛还对制造业和库存的“V型复苏”持乐观态度。正如其经济学家指出的那样,“工业产值自4月以来增长了10%,而名义商业库存在7月已经实现了自去年12月以来的首次增长”。

而GDP则在艰难中缓慢回升。美国GDP在第二季度下降了32.9%,仅略好于一些最悲观的估计值。而现在,高盛的估计要比亚特兰大联邦储备委员会(Atlanta Federal Reserve)截至9月10日的GDP Now预测模型估计的30.8%更为乐观。

但显然,经济还没有完全摆脱困境。美国国会在一项旨在提振各州、失业者及小型企业的刺激法案上陷入僵局,此外,共和党提出的一项成本较低的提案也未能在9月10日的参议院投票中获得通过。Moody’s Analytics公司的马克•赞迪在8月下旬曾经对《财富》杂志表示,尽管经济数据有所改善,但“如果认为美国经济已经开始正常运转,失业者等群体不再需要额外的支持,那绝对是一个严重的错误”。

但总的来说,高盛指出,市场预期远比实际情况要来得糟糕。他们相信,第三季度经济数据的连续强劲,也将预示着第四季度以及之后的好兆头。(财富中文网)

编译:杨二一

It appears the recovery may be going better than expected, and Goldman Sachs isn't afraid to put a bullish estimate out there: 35% GDP growth for the 3rd quarter.

That estimate is far above consensus at around 21% growth for Q3, per Bloomberg—But economists at the firm write the new bold call is born out of a "much stronger-than-expected jobs report (and solid summer data more generally)," economists at Goldman Sachs wrote in a report on September 10.

Indeed, the firm, like many on Wall Street, says it's happily surprised by some of the recent data, notably the latest unemployment report for August, which came in at 8.4%—down from 10.2% in July with 1.4 million jobs added, and handily beating Goldman's own estimate of 9.8%.

To be sure, the rebound in most economic data of late is perhaps surprising given the resurgence in coronavirus cases throughout the U.S. in June and July—and the expiration of the $600 enhanced unemployment benefits, stimulus checks, and the Paycheck Protection Program, designed to buoy small businesses during the crisis, had many worried the data may start looking worse again.

While some economists have been concerned consumer spending has been tapering off, economists at Goldman argue that, on the contrary, "spending instead rose strongly in July, and ... high-frequency measures indicate a further 1-2% increase in real spending in August." That's prompted the firm to "pencil in" a 1.25% increase in consumption for August (concealing, however, a "decline among unemployment benefit recipients," the firm notes). But even for those who received enhanced unemployment checks, Goldman notes the "spending decline is more moderate than we had previously expected.

The end-of-summer spending pace for unemployment benefit recipients and for lower-income zip codes more generally is also well above Q2 levels—and we expect it to rebound by late September as retroactive top-up checks arrive." Indeed, economists at the firm note "most information on August spending indicates stable or higher consumption"—apart from clothing, which may be impacted due to slower back-to-school sales.

Those consumer numbers have been key for economists to gauge the pace and success of the recovery thus far. Indeed, "It's the consumer spending data I’m most uncertain about, and that happens to be 70% of the economy," Brett Ryan, senior U.S. economist at Deutsche Bank, told Fortune recently.

Apart from the consumer, Goldman is also optimistic there has been a V-shaped recovery in manufacturing and inventories, as economists note "industrial production has risen 10% since April (not annualized)," while nominal business inventories rose in July for the first time since December.

But GDP is clawing its way back from some pretty grisly numbers earlier this year. GDP for the second quarter fell -32.9%, slightly better than some of the more gruesome projections. Now, Goldman's estimate is more bullish than the Atlanta Federal Reserve's GDPNow estimate at 30.8 as of Sept. 10.

Still, the economy is by no means out of the woods yet. Congress has stalled on compromising on another stimulus bill to help boost states, the unemployed, and small businesses, and a less expensive proposal by Republicans failed to pass a vote in the Senate on September 10. Despite the improving data, for some economists, "It would be a grievous mistake to conclude this economy is off and running and they don’t need to provide additional support," Moody's Analytics' Mark Zandi remarked to Fortune in late August.

But all told, economists at Goldman note the markets have been expecting a far worse case scenario than we're likely to get—and they believe "the sequential strength in the data in Q3 also bodes well for Q4 and beyond."