7月,美国新增就业180万人,是史上单月就业增长幅度最高的月份之一,总就业人数达到1.396亿人。虽然这与4月的1.303亿就业人口相比进步显著,但依旧远低于2月的1.525亿人。

简而言之:就业市场正在好转,但形势依旧非常糟糕。

而且就业市场的恢复速度注定会放缓。过去几个月,招聘数量增加主要源自各州美甲店和牙科诊所等商户的复工,这些商户不会吸引大量人群聚集。但除非我们找到抑制病毒的方法,否则无法完全复工的公司,比如游乐园、游艇公司和酒吧等,会拖累经济的全面复苏。

美国经济还面临着一系列障碍:美国近3,000万失业人口领取的每周600美元联邦疫情补助到期,将导致消费者支出(占美国经济的三分之二)减少,而即将到来的企业和家庭破产会引发金融危机。与3月份通过2.2万亿美元《冠状病毒援助、救济和经济安全法案》(CARES Act)时不同,这一次,民主党和共和党的领导人都不愿意在有关更多经济刺激措施的交锋中让步。

为了帮助《财富》杂志的读者更好地了解美国经济的现状和未来趋势,我们根据一直在密切跟踪的疫情期间的经济数据,制作了9张数据图:

失业率

在3月停工之后,美国遭遇了史上最大幅度的经济收缩:失业率从2月的3.5%(50年最低)到激增到4月的14.7%,达到1940年以来的最高水平。

之后就业市场开始复苏,恢复的速度超过了许多经济学家的预期。失业率从6月的11.1%到下降到7月的10.2%。这超出了国会预算办公室(Congressional Budget Office)在5月的预期。当时,该办公室预测失业率在2021年底将达到9.5%。

但进入夏季之后,就业增长幅度有所放缓。美国6月新增480万个就业岗位,但7月只增加了180万个。

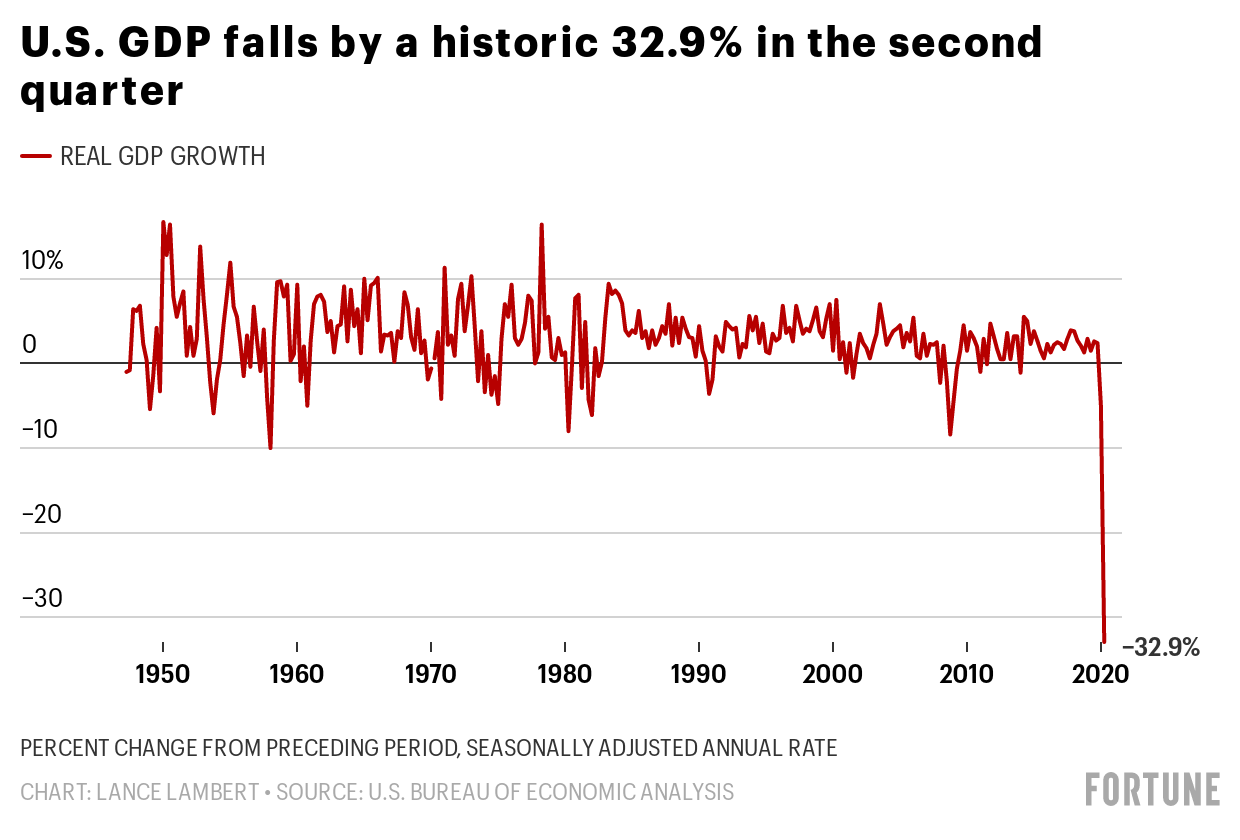

国内生产总值

据美国经济分析局(U.S. Bureau of Economic Analysis)统计,从4月至6月,美国第二季度的实际GDP较前一季度下跌32.9%。这是自1947年以来美国GDP单季度最大降幅,也意味着美国经济产出因为新冠疫情已经损失了超过1万亿美元。

在此之前,美国第一季度的GDP已经下跌了5%。第一季度在最后几周才爆发了新冠疫情。但经济学家认为最糟糕的情况远没有结束。事实上,高盛(Goldman Sachs)预测随着各州纷纷复工,第三季度的GDP涨幅将达到创纪录的25%。即便如此,今年美国GDP的跌幅将依旧高达4.6%。

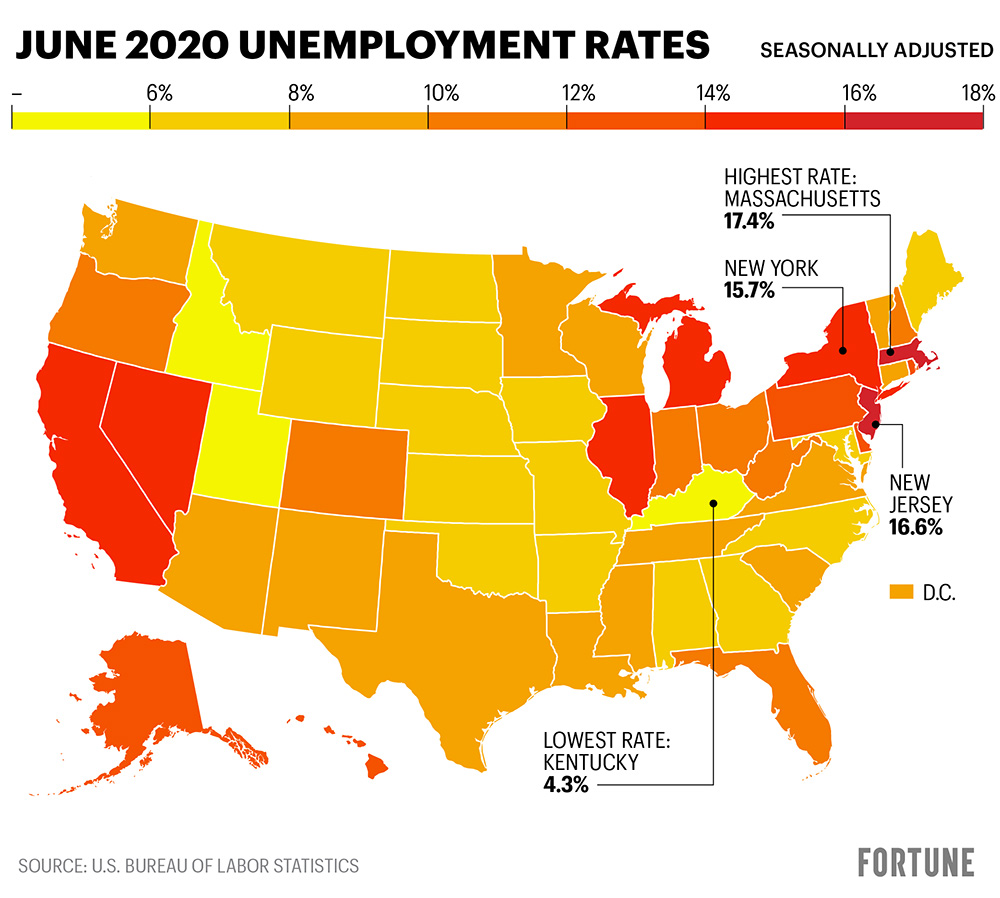

各州失业率

部分州的经济已经开始呈V字型复苏,但有些州的失业率仍然处在大萧条时期的水平。

据美国劳工统计局统计,肯塔基州的季节调整后失业率从2月的4.2%迅速升高到4月的16.6%。但随着该州州长安德鲁•贝希尔宣布“蓝草州”经济重启,该州6月的失业率降至4.3%,为美国最低。

犹他州(5.1%)、爱达荷州(5.6%)和北达科他州(6.1%)等较偏远州的失业率,也表现出V字型复苏的趋势。包括肯塔基州在内,这些州并不过度依赖惨遭疫情破坏的休闲餐旅行业。而且这些州有更多经济部门已经复工。

也有一些地区丝毫没有复苏的迹象。新泽西州4月的失业率为16.3%,到6月提高到了16.6%。纽约州和新泽西州等东北部各州是早期的疫情震中,这些州的经济重启速度更加缓慢。

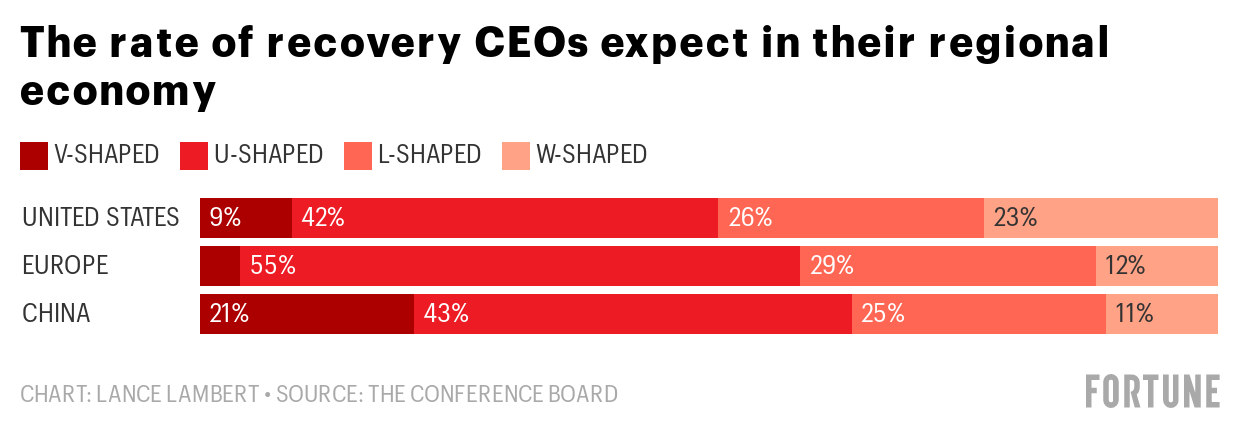

CEO的展望

42%的美国CEO预测经济将出现U字型复苏,即更加温和的反弹,26%预测会出现可怕的L字型复苏,23%认为美国经济将经历W字型复苏或者二次探底。美国经济咨商会(Conference Board)近期的CEO调查显示,只有9%的美国CEO预测美国经济反弹的速度将与萎缩的速度相当,即会出现V字型反弹。

消极的经济展望意味着CEO们不太可能开展商业投资,这将放缓经济复苏的速度。

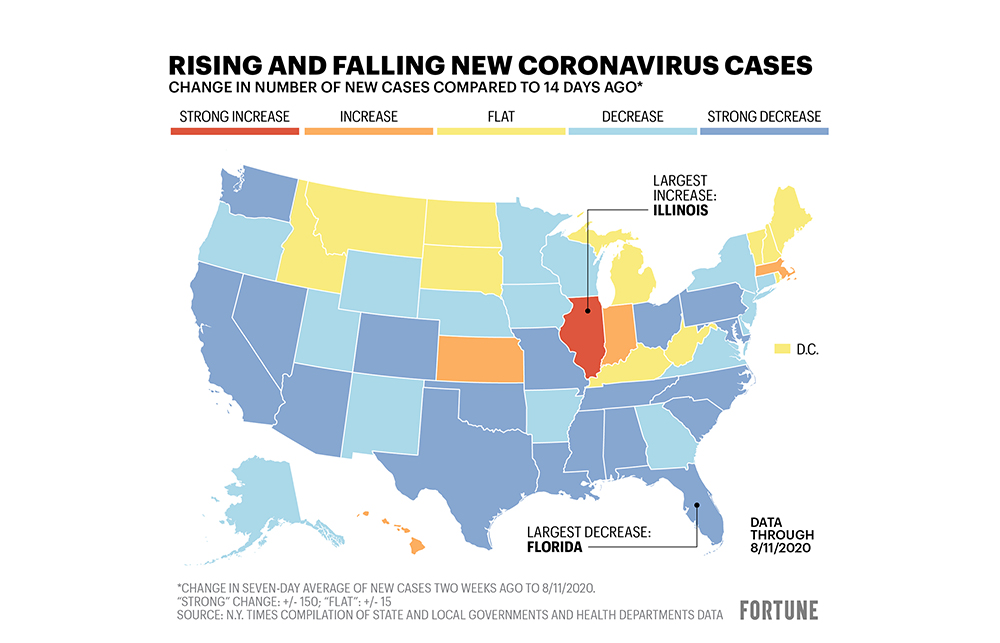

新冠肺炎确诊病例

过去几周,美国南部、西部和中西部的新冠肺炎病例迅速增加。但《财富》杂志分析《纽约时报》本周的数据发现,与两周前相比,18个州连续七天的平均每日新增病例至少减少了150例。病例减少幅度最大的是佛罗里达州和亚利桑那州。

新冠肺炎病例减少让我们看到了希望,代表美国不会因为最近的疫情再次陷入经济衰退。

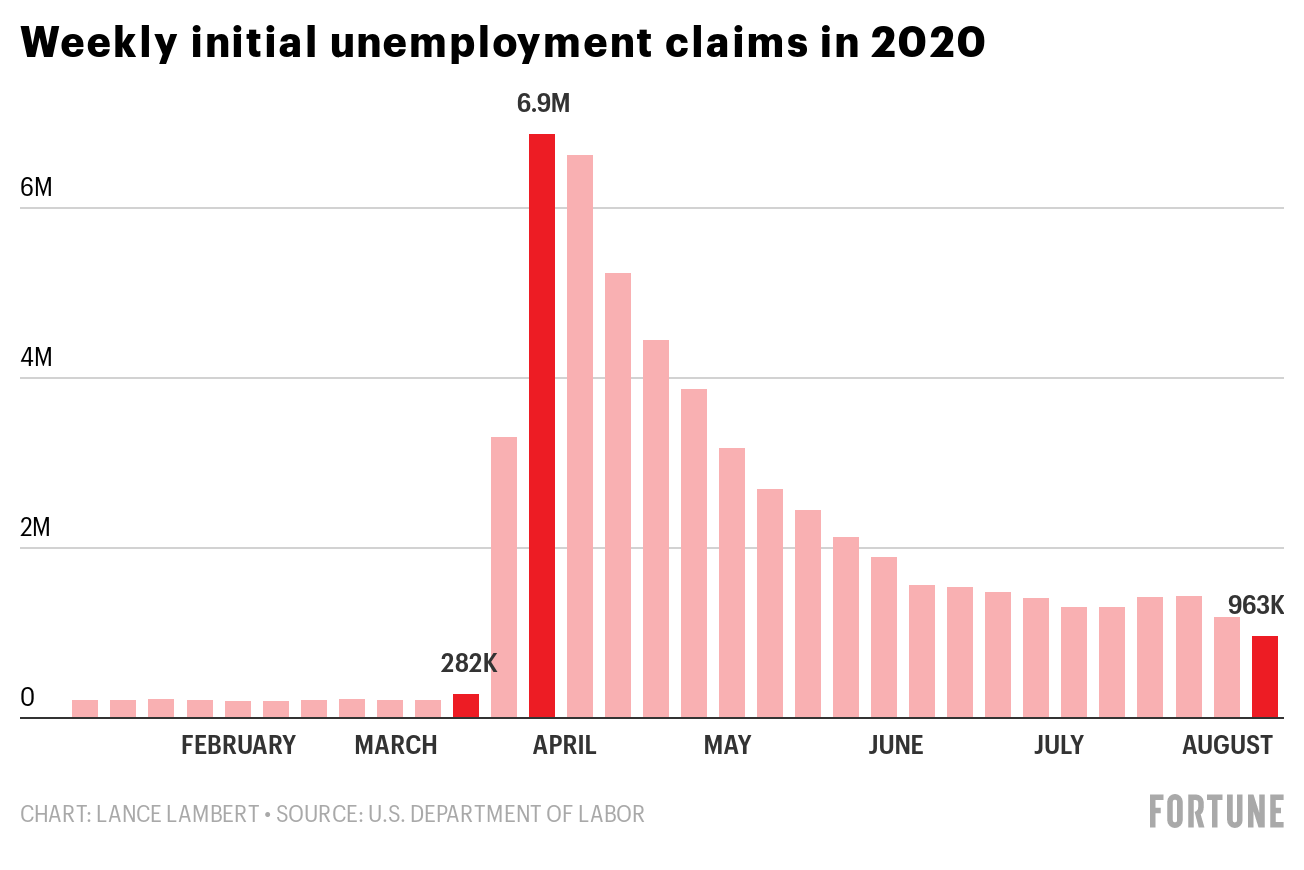

首次申领失业补助金的人数

、

、我们在周四获悉,单周首次申领失业补助金的人数自疫情爆发以来第一次低于100万人。但96.3万首次申领失业补助的人数,依旧是疫情爆发之前的三倍以上。

这意味着尽管经济持续复苏,但雇主依旧在裁员。与封城期间的春季裁员或临时解雇不同,这些裁员通常是被永久性解雇。

美国领取失业补助金的人数

截至8月1日的一周内,美国目前申领失业补助金或持续申领失业补助的总人数为1,550万人。这与截至5月9日的一周内的最高峰2,490万人相比已经大幅减少,但与3月初的180万失业人口相比仍有巨大差距。

坦白的说,美国目前处在大规模失业阶段,要走出困境可能需要几年时间。

从7月25日开始,这1,550万美国失业人口以及领取疫情失业援助救济或疫情紧急失业补助的1,190万人,不能再额外领取600美元失业补助金。美国总统唐纳德•特朗普上周签署了一份备忘录,提出向领取州失业补助的人员每周额外发放300美元补贴,但我们并不知道这笔资金从什么时候开始发放以及他的行政命令是否合法。

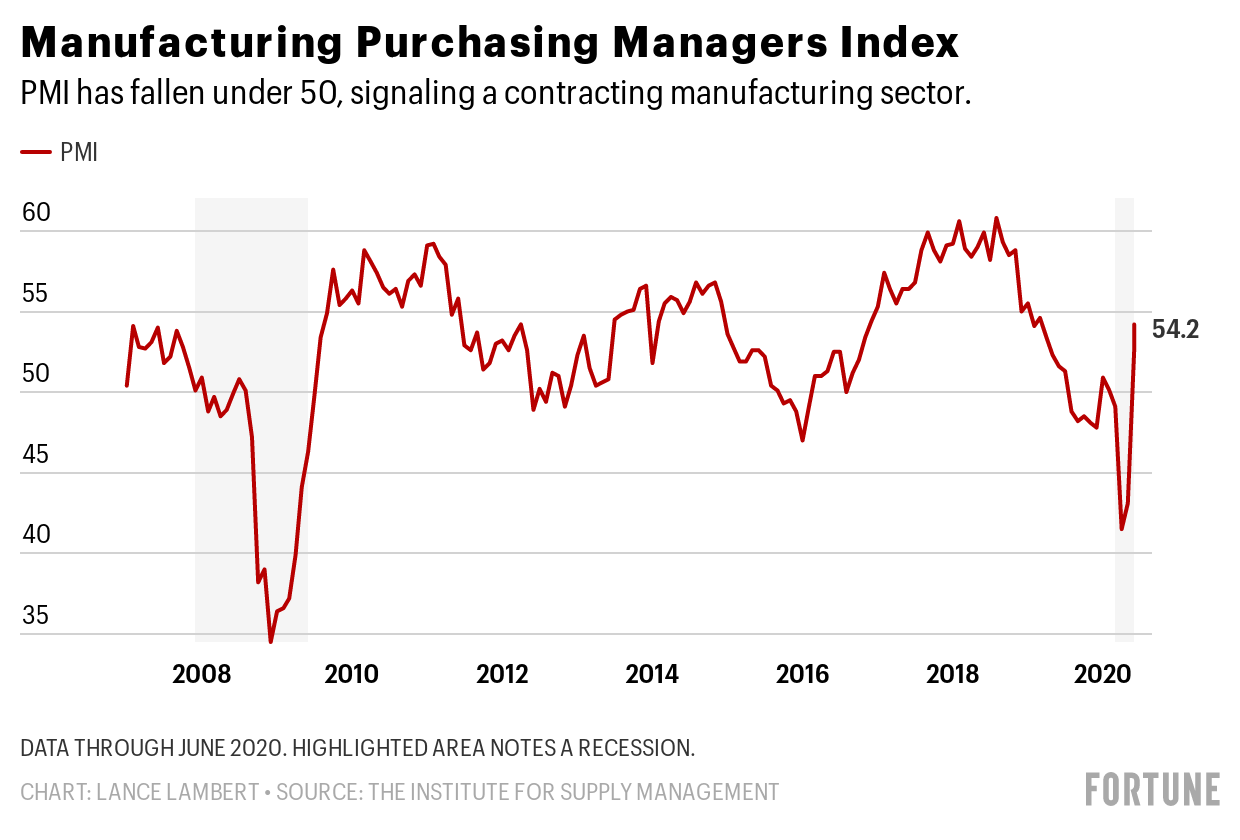

制造业

大衰退令建筑业和制造业遭遇重创。但这一次,仍然处在竞价战当中的房地产行业和制造业成为经济中的亮点。6月,供应管理协会(Institute for Supply Management)的采购经理人指数(PMI)从4月的41.5和5月的52.6提高到54.2。由于PMI指数低于50才意味着制造业正在萎缩,因此这表明美国制造业正在恢复增长。

春季的工厂停工造成汽车、木材、硬币、胡椒博士(Dr Pepper)饮品等各种物资短缺。近期内,制造商将忙于填补这些空缺。

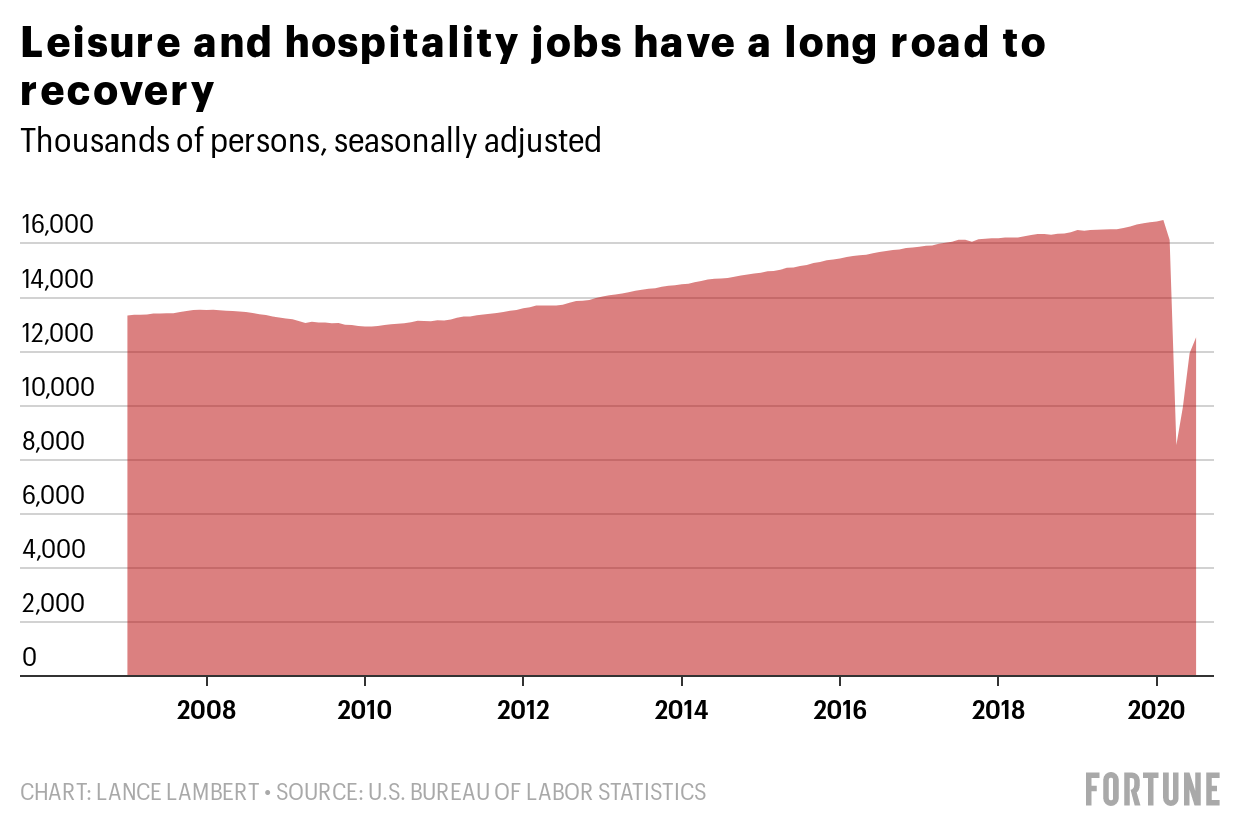

休闲餐旅行业的就业

新冠疫情使旅游业和服务业的就业损失惨重。事实上,美国休闲餐旅业的就业岗位从2月的1,690万个减少到4月的850万个,已经低于该行业1989年的就业人数(900万人)。

虽然休闲餐旅业的就业岗位已经恢复到1,250万个,但仍然无法达到2020年2月的水平,甚至还有很大差距,除非病毒得到抑制,并且全国恢复正常出行。

综合来看,这9张图告诉了我们哪些信息?显然,在5月各州经济重启之后,经济进入了复苏轨道,但经济复苏的速度正在放缓。而经济复苏速度放缓是由于财政刺激措施到期,企业破产数量开始增加。

穆迪分析(Moody’s Analytics)的首席经济学家马克•扎蒂告诉《财富》杂志:“美国的经济状况开始日益糟糕……没有600美元额外失业补助,没有更多薪资保护计划,没有各州和地方政府的帮助,我们将跌入财务悬崖。我认为有效的疫苗是经济恢复运行的必要条件,疫苗上市的时间越长,我们就越有可能重新陷入衰退,甚至出现大萧条这样更糟糕的情况。”(财富中文网)

译者:Biz

7月,美国新增就业180万人,是史上单月就业增长幅度最高的月份之一,总就业人数达到1.396亿人。虽然这与4月的1.303亿就业人口相比进步显著,但依旧远低于2月的1.525亿人。

简而言之:就业市场正在好转,但形势依旧非常糟糕。

而且就业市场的恢复速度注定会放缓。过去几个月,招聘数量增加主要源自各州美甲店和牙科诊所等商户的复工,这些商户不会吸引大量人群聚集。但除非我们找到抑制病毒的方法,否则无法完全复工的公司,比如游乐园、游艇公司和酒吧等,会拖累经济的全面复苏。

美国经济还面临着一系列障碍:美国近3,000万失业人口领取的每周600美元联邦疫情补助到期,将导致消费者支出(占美国经济的三分之二)减少,而即将到来的企业和家庭破产会引发金融危机。与3月份通过2.2万亿美元《冠状病毒援助、救济和经济安全法案》(CARES Act)时不同,这一次,民主党和共和党的领导人都不愿意在有关更多经济刺激措施的交锋中让步。

为了帮助《财富》杂志的读者更好地了解美国经济的现状和未来趋势,我们根据一直在密切跟踪的疫情期间的经济数据,制作了9张数据图:

失业率

在3月停工之后,美国遭遇了史上最大幅度的经济收缩:失业率从2月的3.5%(50年最低)到激增到4月的14.7%,达到1940年以来的最高水平。

之后就业市场开始复苏,恢复的速度超过了许多经济学家的预期。失业率从6月的11.1%到下降到7月的10.2%。这超出了国会预算办公室(Congressional Budget Office)在5月的预期。当时,该办公室预测失业率在2021年底将达到9.5%。

但进入夏季之后,就业增长幅度有所放缓。美国6月新增480万个就业岗位,但7月只增加了180万个。

国内生产总值

据美国经济分析局(U.S. Bureau of Economic Analysis)统计,从4月至6月,美国第二季度的实际GDP较前一季度下跌32.9%。这是自1947年以来美国GDP单季度最大降幅,也意味着美国经济产出因为新冠疫情已经损失了超过1万亿美元。

在此之前,美国第一季度的GDP已经下跌了5%。第一季度在最后几周才爆发了新冠疫情。但经济学家认为最糟糕的情况远没有结束。事实上,高盛(Goldman Sachs)预测随着各州纷纷复工,第三季度的GDP涨幅将达到创纪录的25%。即便如此,今年美国GDP的跌幅将依旧高达4.6%。

各州失业率

部分州的经济已经开始呈V字型复苏,但有些州的失业率仍然处在大萧条时期的水平。

据美国劳工统计局统计,肯塔基州的季节调整后失业率从2月的4.2%迅速升高到4月的16.6%。但随着该州州长安德鲁•贝希尔宣布“蓝草州”经济重启,该州6月的失业率降至4.3%,为美国最低。

犹他州(5.1%)、爱达荷州(5.6%)和北达科他州(6.1%)等较偏远州的失业率,也表现出V字型复苏的趋势。包括肯塔基州在内,这些州并不过度依赖惨遭疫情破坏的休闲餐旅行业。而且这些州有更多经济部门已经复工。

也有一些地区丝毫没有复苏的迹象。新泽西州4月的失业率为16.3%,到6月提高到了16.6%。纽约州和新泽西州等东北部各州是早期的疫情震中,这些州的经济重启速度更加缓慢。

CEO的展望

42%的美国CEO预测经济将出现U字型复苏,即更加温和的反弹,26%预测会出现可怕的L字型复苏,23%认为美国经济将经历W字型复苏或者二次探底。美国经济咨商会(Conference Board)近期的CEO调查显示,只有9%的美国CEO预测美国经济反弹的速度将与萎缩的速度相当,即会出现V字型反弹。

消极的经济展望意味着CEO们不太可能开展商业投资,这将放缓经济复苏的速度。

新冠肺炎确诊病例

过去几周,美国南部、西部和中西部的新冠肺炎病例迅速增加。但《财富》杂志分析《纽约时报》本周的数据发现,与两周前相比,18个州连续七天的平均每日新增病例至少减少了150例。病例减少幅度最大的是佛罗里达州和亚利桑那州。

新冠肺炎病例减少让我们看到了希望,代表美国不会因为最近的疫情再次陷入经济衰退。

首次申领失业补助金的人数

我们在周四获悉,单周首次申领失业补助金的人数自疫情爆发以来第一次低于100万人。但96.3万首次申领失业补助的人数,依旧是疫情爆发之前的三倍以上。

这意味着尽管经济持续复苏,但雇主依旧在裁员。与封城期间的春季裁员或临时解雇不同,这些裁员通常是被永久性解雇。

美国领取失业补助金的人数

截至8月1日的一周内,美国目前申领失业补助金或持续申领失业补助的总人数为1,550万人。这与截至5月9日的一周内的最高峰2,490万人相比已经大幅减少,但与3月初的180万失业人口相比仍有巨大差距。

坦白的说,美国目前处在大规模失业阶段,要走出困境可能需要几年时间。

从7月25日开始,这1,550万美国失业人口以及领取疫情失业援助救济或疫情紧急失业补助的1,190万人,不能再额外领取600美元失业补助金。美国总统唐纳德•特朗普上周签署了一份备忘录,提出向领取州失业补助的人员每周额外发放300美元补贴,但我们并不知道这笔资金从什么时候开始发放以及他的行政命令是否合法。

制造业

大衰退令建筑业和制造业遭遇重创。但这一次,仍然处在竞价战当中的房地产行业和制造业成为经济中的亮点。6月,供应管理协会(Institute for Supply Management)的采购经理人指数(PMI)从4月的41.5和5月的52.6提高到54.2。由于PMI指数低于50才意味着制造业正在萎缩,因此这表明美国制造业正在恢复增长。

春季的工厂停工造成汽车、木材、硬币、胡椒博士(Dr Pepper)饮品等各种物资短缺。近期内,制造商将忙于填补这些空缺。

休闲餐旅行业的就业

新冠疫情使旅游业和服务业的就业损失惨重。事实上,美国休闲餐旅业的就业岗位从2月的1,690万个减少到4月的850万个,已经低于该行业1989年的就业人数(900万人)。

虽然休闲餐旅业的就业岗位已经恢复到1,250万个,但仍然无法达到2020年2月的水平,甚至还有很大差距,除非病毒得到抑制,并且全国恢复正常出行。

综合来看,这9张图告诉了我们哪些信息?显然,在5月各州经济重启之后,经济进入了复苏轨道,但经济复苏的速度正在放缓。而经济复苏速度放缓是由于财政刺激措施到期,企业破产数量开始增加。

穆迪分析(Moody’s Analytics)的首席经济学家马克•扎蒂告诉《财富》杂志:“美国的经济状况开始日益糟糕……没有600美元额外失业补助,没有更多薪资保护计划,没有各州和地方政府的帮助,我们将跌入财务悬崖。我认为有效的疫苗是经济恢复运行的必要条件,疫苗上市的时间越长,我们就越有可能重新陷入衰退,甚至出现大萧条这样更糟糕的情况。”(财富中文网)

译者:Biz

The U.S. economy added 1.8 million jobs in July, one of the highest one-month jumps on record, bringing total employment to 139.6 million. While that is substantial progress compared to April, when only 130.3 million were employed, it's still significantly less that the 152.5 million people who made up the U.S. paid workforce in February.

Simply put: Employment is improving, but it's still really bad.

And that rate of recovery is destined to slow. Over the past few months hiring was driven by states reopening businesses, like nail salons and dental offices, which don't attract huge crowds. But unless the virus is tamed, businesses that do and are therefore not able to fully reopen—including amusement parks, cruise lines, and bars—will hold back a broader recovery.

The economy also faces a series of headwinds: Expired $600 weekly federal pandemic assistance for around 30 million unemployed Americans threatens to drag down consumer spending—two-thirds of the economy—and looming business failures and household bankruptcies could cause a financial crisis. And unlike in March when the $2.2 trillion CARES Act was passed, this go-around Democratic and Republican leaders have thus far been unwilling to compromise on more economic stimulus.

To give Fortune readers a better understanding of where the economy is and where it’s heading, we rounded up nine charts of economic data we’ve been tracking throughout the crisis:

Jobless rate

The economic contraction following the March shutdowns was the sharpest in U.S. history: The jobless rate jumped from 3.5% in February—a 50-year low—to 14.7% in April——the highest level since 1940.

We've since shifted into a recovery that is moving faster than many economists expected. The unemployment rate dropped from 11.1% in June to 10.2% in July. That beats the timeline the Congressional Budget Office projected in May, when it forecasted a 9.5% unemployment rate at the end of 2021.

But the pace of job growth slowed during the summer. In June the economy added 4.8 million jobs, followed by 1.8 million in July.

Gross domestic product

Second quarter real GDP, in the period from April to June, declined by 32.9% from the preceding quarter, according to the U.S. Bureau of Economic Analysis. That's the largest single quarterly decline on record for data going back to 1947 and represents more than $1 trillion in economic output wiped out by the coronavirus pandemic.

That 32.9% decline follows a 5% decline in the first quarter, which only included the first few weeks of the pandemic. But economists believe the worst is over. Indeed, Goldman Sachs projects third-quarter GDP will jump a record 25%, as the economy benefits from those states that were able to reopen. But even with that rebound, GDP would still end the year down 4.6%.

State-by-state unemployment rate

The economies of some state are already seeing a V-shaped recovery, but others remain at Great Depression–era unemployment levels.

In Kentucky, the seasonally adjusted jobless rate soared from 4.2% in February to 16.6% in April, according to the U.S. Bureau of Labor Statistics. But as Gov. Andrew Beshear reopened the Bluegrass State's economy, the jobless rate sunk to 4.3% by June—the lowest in the nation.

Other more rural states like Utah (5.1%), Idaho (5.6%), and North Dakota (6.1%) have jobless rates that also indicate V-shaped recoveries. These states, including Kentucky, don'y rely heavily on industries like leisure and hospitality that were decimated by the pandemic. And they've reopened more segments of their economy.

Then there are places that have seen little to no recovery. The jobless rate in New Jersey was 16.3% in April, but by June had climbed to 16.6%. Northeast states like New York and New Jersey, were among the early epicenters of the virus and are reopening their economies at much slower rates.

CEO outlook

Among U.S. CEOs, 42% foresee a U-shaped recovery—that is, a more moderate rebound—while 26% expect the dreaded L-shaped recovery, and 23% a W-shaped recovery, or a double-dip recession. Only 9% of U.S. CEOs predict a V-shaped recovery when an economy rebounds nearly as quickly as it contracted, according to a recent CEO survey conducted by the Conference Board.

A sour economic outlook can mean CEOs are less likely to pull the trigger on the business investments, which could translate into a slower recovery.

Confirmed COVID-19 cases

Over the past few weeks COVID-19 cases spiked across the South, West, and Midwest. But according to a Fortune analysis of New York Times data this week, 18 states have seen a seven-day moving average daily decrease of at least 150 cases when compared with two weeks ago. The largest declines were in Florida and Arizona.

Receding coronavirus cases is a hopeful sign that the recent outbreaks alone can't pull us back into recession.

Initial unemployment claims

On Thursday we learned initial weekly jobless claims dropped under 1 million for the first time since the start of the crisis. But that 963,000 jobless claims is still more than three times the level typically seen before the crisis.

This means that even as the economy continues to recover, employers are still turning to layoffs. And unlike the spring layoffs or furloughs during the shutdowns, these job cuts are usually permanent.

Americans receiving unemployment benefits

The total number of Americans currently receiving unemployment benefits—called continued claims—came in at 15.5 million in the week ended August 1. That is down substantially since the peak of 24.9 million the week ending May 9, but a far cry from the 1.8 million on the unemployment rolls back in early March.

Frankly, we're in period of mass joblessness, and getting out of this hole could take years.

And as of the week ending July 25, those 15.5 million jobless Americans—along with another 11.9 million jobless on Pandemic Unemployment Assistance or Pandemic Emergency Unemployment Compensation—are no longer receiving the $600 enhanced unemployment benefits. President Donald Trump signed a memorandum last week to extend $300 per week enhanced benefits to those on state unemployment rolls, however, it's unclear when those funds will start to get dispersed or if the executive order is even legal.

Manufacturing

The Great Recession hammered construction and manufacturing. But this time housing—which is still seeing bidding wars—and manufacturing are among our bright spots. The Institute for Supply Management’s Purchasing Managers Index (PMI) came in at 54.2 in June, up from 41.5 in April and 52.6 in May. A PMI below 50 signals a contracting manufacturing sector. So that means U.S. manufacturers are growing again.

The factory shutdowns in the spring have caused shortages in everything from cars, lumber, coins, to Dr Pepper. In the immediate future, manufacturers will be busy making up for those shortfalls.

Employment in hospitality and leisure industries

The pandemic was a gut punch to tourism and service jobs. In fact, the number of U.S. leisure and hospitality jobs fell from 16.9 million in February to 8.5 million by April—fewer than the 9 million employed in the sector back in 1989.

Leisure and hospitality jobs have recovered to 12.5 million, however, those jobs simply can't reach Feb 2020 levels—or anything close to it—until the virus is tamed and travel is back to normal.

Big picture, what do these nine charts tell us? The economy clearly moved into recovery sometime in May as states reopened; however, the pace of that recovery is now slowing. And that slowdown comes as fiscal stimulus runs out and business bankruptcies are starting to rise.

"The economy is starting to go sideways ... without extra $600 unemployment insurance, more PPP, and help for state and local governments we're going to go off a fiscal cliff," Mark Zandi, chief economist at Moody's Analytics, tells Fortune. "I think an effective vaccine is the necessary condition for getting the economy going again, the longer it takes the more likely we're going back into recession or even worse: A depression."